As

filed with the Securities and Exchange Commission on July 29, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

VIVOPOWER

INTERNATIONAL PLC

(Exact

name of registrant as specified in its charter)

| England

and Wales |

Not

applicable |

(State

or other jurisdiction of

incorporation

or organization) |

(I.R.S.

Employer

Identification

No.) |

The

Scalpel, 18th Floor, 52 Lime Street

London

EC3M 7AF

United Kingdom

Telephone:

+44 203 667 5158

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

VivoPower International PLC 2017 Omnibus Equity Incentive Plan

(Full title of the plan)

Corporation

Service Company

251

Little Falls Drive Wilmington, DE 19808

United

States

+1 302 636 5400

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY

NOTE

On

July 6, 2023, the shareholders of VivoPower International PLC (the “Registrant”) approved an amendment to the VivoPower International

PLC 2017 Omnibus Incentive Plan (“OIP”) allowing the number of ordinary shares, nominal value $0.12 per share (the “Ordinary

Shares”), reserved under the OIP to automatically increase each July 1, beginning on July 1, 2023, and ending on July 2, 2032,

by 5.0% of the outstanding number of Ordinary Shares of the Registrant on the immediately preceding June 30, or such lesser amount as

determined by the Registrant’s Remuneration Committee (the “Evergreen Provision”).

This

Registration Statement on Form S-8 (the “Registration Statement”) is being filed to register an additional 221,987 Ordinary

Shares of the Registrant to be issued pursuant to the Registrant’s OIP as a result of the Evergreen Provision. This Registration

Statement registers additional securities of the same class as other securities for which the registration statements filed on Form S-8

on July 28, 2023, December 8, 2022, December 21, 2020 and October 12, 2018 (File Nos. 333-273520, 333-268720, 333-227810 and 333-251546)

are effective (collectively, the “Previous Registration Statements”). The information contained in the Previous Registration

Statements is hereby incorporated by reference pursuant to General Instruction E of Form S-8.

In

accordance with the instructional Note to Part I of Form S-8 as promulgated by the Securities and Exchange Commission, the information

specified by Part I of Form S-8 has been omitted from this Registration Statement on Form S-8 with respect to the Ordinary Shares.

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item

8. Exhibits.

+

Denotes management contract or compensatory plan or arrangement

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of London, United Kingdom, on July 29, 2024.

| |

VIVOPOWER

INTERNATIONAL PLC |

| |

|

| |

By: |

/s/

Kevin Chin |

| |

|

Kevin

Chin

Chief

Executive Officer, Executive Chairman and Director |

KNOW

ALL BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Kevin Chin and Gary Challinor,

and each or any one of them, his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution,

for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective

amendments) to this Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith,

with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority

to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and

purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any

of them, or their or his or her substitutes or substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities

and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Kevin Chin |

|

Chief

Executive Officer, Executive Chairman and Director |

|

July

29, 2024 |

| Kevin

Chin |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Gary Challinor |

|

Chief

Financial Officer |

|

July

29, 2024 |

| Gary

Challinor |

|

(Principal

Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/

Michael Hui |

|

Director |

|

July

29, 2024 |

| Michael

Hui |

|

|

|

|

| |

|

|

|

|

| /s/

Peter Jeavons |

|

Director |

|

July

29, 2024 |

| Peter

Jeavons |

|

|

|

|

| |

|

|

|

|

| /s/

William Langdon |

|

Director |

|

July

29, 2024 |

| William

Langdon |

|

|

|

|

SIGNATURE

OF AUTHORIZED U.S. REPRESENTATIVE OF THE REGISTRANT

Pursuant

to the Securities Act of 1933, the undersigned, the duly authorized representative in the United States of VivoPower International PLC

has signed this registration statement on July 29, 2024.

| |

VIVOPOWER INTERNATIONAL PLC |

| |

|

|

| |

By: |

/s/

William Langdon |

| |

Name: |

William Langdon |

| |

Title: |

Director |

Exhibit

5.1

| VivoPower

International PLC |

|

| The

Scalpel |

|

| 18th

Floor |

|

| 52

Lime Street |

|

| London |

|

| EC3M

7AF |

|

| |

|

|

| Our

Ref |

ATP/M-00908237 |

|

| Date |

29

July 2024 |

|

Dear

Sirs

VivoPower

International PLC Registration Statement on Form S-8

We

have acted as counsel to VivoPower International PLC (company number 09978410) (“Company”), a public limited company

incorporated in England and Wales, in connection with the matters set out below.

For

the purposes of our opinion, we have examined and relied upon such documents, records, certificates and other instruments as we, in our

professional judgment, have deemed necessary or appropriate as a basis for the opinions and statements below.

| 1.1 | The

opinions given in this Opinion Letter (the “Opinions”) are given only

with respect to English law as published and applied by the courts of England and Wales at

the date of this Opinion Letter. |

| 1.2 | We

express no opinion on the laws of any other jurisdiction. No opinion is expressed as to any

provision of the Documents (as defined below) that refers to specific laws or regulations

of any jurisdiction other than England and Wales. To the extent that the laws of the United

States of America or any other jurisdiction may be relevant to the subject matter of the

Opinions, we have made no independent investigation of them and our opinion is subject to

the effect of such laws. We express no opinion on the validity of such matters. |

| 1.3 | The

Opinions are given only with respect to the matters expressly set out in paragraph 4.1 and

shall not be construed as opinions as to any other matter. The Opinions do not cover the

matters set out in paragraph 6.1. |

| 1.4 | The

Opinions are given on the basis of the assumptions set out in paragraph 5. We have not taken

any steps to investigate whether they are correct except as may be specified in paragraph

5. |

| 1.5 | The

Opinions are subject to the qualifications listed in paragraph 6 and to any matters not disclosed

to us. |

| 1.6 | By

providing you with this Opinion Letter, we do not assume any obligation to notify you of

future changes in law which may affect the Opinions or to otherwise update this Opinion Letter

in any respect. |

| 2.1 | We

have acted as English legal advisers to VivoPower International PLC, a public limited company

incorporated in England and Wales, in connection with the registration statement on Form

S-8 which is attached to this Opinion Letter as an exhibit (the “Registration Statement”)

filed with the United States Securities and Exchange Commission (the “SEC”)

pursuant to the United States Securities Act of 1933, as amended (the “Securities

Act”). |

| 2.2 | The

Registration Statement relates to an increase of 221,987 shares available for issuance by

the Company from time to time of ordinary shares each having a nominal value of $0.12 pursuant

to the Company’s 2017 Omnibus Equity Incentive Plan (the “Plan”)

which was implemented in a general meeting of the Company held on 5 September 2017 (the “New

Shares”). |

| 2.3 | We

understand that none of the New Shares are, and are not intended to be, admitted to trading

on any market or exchange, or otherwise listed, in the United Kingdom. |

| 3 | Examination

of documents and searches |

| 3.1 | For

the purpose of giving this Opinion Letter, we have examined the following documents (the

“Documents”, each a “Document”): |

| 3.1.1 | the

final copy Registration Statement; |

| 3.1.2 | copy

of the Company’s certificate of incorporation dated 1 February 2016 and copy current

articles of association adopted pursuant to a special resolution of the Company’s shareholders

passed on 20 August 2018; |

| 3.1.3 | a

minute of the general meeting of the Company held on 5 September 2017 at which certain shareholder

resolutions were passed, including the resolution to approve the Plan and the resolution

providing a general authority to allot shares in the Company and disapplying statutory pre-emption

rights in respect of such allotment of shares or the grant of rights to subscribe for or

convert into shares up to an aggregate nominal value of $1,560.00; |

| 3.1.4 | the

final copy registration statement on Form S-8 dated 12 October 2018 which registered 1,355,736

ordinary shares of $0.012 pursuant to the Plan; |

| 3.1.5 | the

final copy registration statement on Form S-8 dated 21 December 2020 which registered 338,237

ordinary shares of $0.012 pursuant to the Plan; |

| 3.1.6 | the

final copy registration statement on Form S-8 dated 8 December 2022 which registered 958,421

ordinary shares of $0.012 pursuant to the Plan; |

| 3.1.7 | written

resolutions of the board of directors passed on 9 October 2020 which resolved to approve

the allotment of ordinary shares of $0.012 each up to an aggregate subscription amount of

$34,500,000; |

| 3.1.8 | written

resolutions of the board of directions passed on 14 October 2020 which resolved to approve

the allotment of ordinary shares of $0.012 each up to an aggregate offering price of $5,750,000; |

| 3.1.9 | a

minute of the general meeting of the Company held on 6 October 2020 at which certain shareholder

resolutions were passed, including the resolutions providing a general authority to allot

shares in the Company and disapplying statutory pre-emption rights in respect of such allotment

of shares or the grant of rights to subscribe for or convert into shares up to an aggregate

nominal value of $180,000; |

| 3.1.10 | resolutions

of the general meeting of the Company held on 10 November 2022 at which certain shareholder

resolutions were passed, including the resolutions providing a general authority to allot

shares in the Company and disapplying statutory pre-emption rights in respect of such allotment

of shares or the grant of rights to subscribe for or convert into shares up to an aggregate

nominal value of $180,000; |

| 3.1.11 | a

minute of the general meeting of the Company held on 18 December 2020 at which certain shareholder

resolutions were passed, including the resolutions providing a general authority to allot

ordinary shares in the Company and disapplying statutory pre-emption rights in respect of

such allotment of ordinary shares or the grant of rights to subscribe for or convert into

ordinary shares up to an aggregate nominal value of $180,000; |

| 3.1.12 | written

resolutions of the board of directors of the Company passed on 12 November 2021 which resolved

to approve the filing of the Prospectus Supplement (as defined in the Equity Distribution

Agreement) with the Commission (as defined in the Equity Distribution Agreement), and written

resolutions of the board of directors passed on 12 November 2021 which resolved to approve

the allotment and disapplying statutory pre-emption rights in respect of the allotment of

ordinary shares up to a subscription amount of $80,000,000; |

| 3.1.13 | a

director’s certificate dated 12 November 2021 in which the directors confirmed no resolutions

have been passed which render any part of this Opinion Letter untrue or invalid, and that

no resolutions of the board or shareholders have been passed to terminate, amend or vary

the equity distribution agreement dated 12 November 2021 made between the Company and Alliance

Global Partners, as amended by that certain amendment no. 1 to the equity distribution agreement,

dated 29 July 2022 (the “Equity Distribution Agreement”), or prevent it

being fulfilled in accordance with its terms, and that there are no orders, judgements or

other agreements which do the same; |

| 3.1.14 | shareholder

resolutions passed on 6 July 2023 providing authority for the directors to consolidate and

divide all of the Company’s existing ordinary shares of $0.012 each into such reduced

number of ordinary shares of such increased nominal value as the Company’s board may

determine at any time prior to 23 October 2023; |

| 3.1.15 | written

resolutions of the board of directors of the Company passed on 27 July 2023 which resolved

to approve the filing of the Registration Statement with the Securities and Exchange Commission; |

| 3.1.16 | written

resolutions of the board of directors passed on 2 October 2023 which resolved to approve

the consolidation of the Company’s existing ordinary shares of $0.012 each into 2,578,826

ordinary shares of $0.12 each; |

| 3.1.17 | a

minute of the general meeting of the Company held on 28 December 2023 at which certain shareholder

resolutions were passed, including the resolutions providing a general authority to allot

ordinary shares of $0.12 each in the capital of the Company and disapplying statutory pre-emption

rights in respect of such allotment of ordinary shares or the grant of rights to subscribe

for or convert into ordinary shares up to an aggregate nominal value of $3,600,000; |

| 3.1.18 | written

resolutions of the board of directors of the Company passed on 25 July 2024 which resolved

to approve the filing of the Registration Statement with the Securities and Exchange Commission; |

| 3.1.19 | a

directors’ certificate dated 26 July 2024 in relation to the ordinary shares of the

Company to be issued pursuant to the Company’s 2017 Omnibus Incentive Plan including,

amongst other things, confirmation that there is sufficient authority pursuant to prior shareholder

resolutions that have been passed to allot the New Shares; |

| 3.1.20 | a

certificate of good standing of the Company dated 22 July 2024; |

| 3.1.21 | at

11.10am on 26 July 2024 an online search of the public records on file and available for

inspection at Companies House in respect of the Company; and |

| 3.1.22 | at

13:46 on 25 July 2024 an online search of the Central Registry of Winding-up Petitions at

the Insolvency and Companies List (formerly the Companies Court) in London in respect of

the Company. |

| 3.2 | Except

as stated above, we have not examined any other documents or corporate or other records and

we have not made any other searches, enquiries or investigations for the purpose of giving

the Opinions. |

| 4.1 | Based

on and subject to the qualifications, assumptions and limitations set out in this Opinion

Letter and subject to any matters not disclosed to us, we are of the opinion that: |

| 4.1.1 | the

Company is a public limited company duly incorporated under English law, noting that our

searches undertaken on 26 July 2024 revealed no order or resolution for the winding-up of

the Company and no notice of the appointment of a receiver, administrative receiver or administrator

in respect of it or any of its assets; and |

| 4.1.2 | the

New Shares will, when issued and delivered in accordance with the terms of the Plan and when

the names of the holders of such New Shares or their nominees are entered into the register

of members of the Company and subject to the receipt by the Company of the aggregate issue

price in respect of all the New Shares, be validly issued, fully paid and no further amount

may be called thereon. |

| 4.2 | The

opinions in paragraph 4.1 are given only for the benefit of VivoPower International PLC and

they may not be relied upon by any other person or for any other purpose. |

| 4.3 | No

person who is permitted to rely on this Opinion Letter may assign it to, or hold the benefit

of it on trust for, any other person. |

| 4.4 | These

Opinions may not be disclosed to any person, or quoted in any public document, or otherwise

made public in any way, without our prior written consent, except as follows, on a non-reliance

basis: |

| 4.4.1 | where

disclosure is required or requested by any court of competent jurisdiction or any governmental,

banking, taxation or other regulatory authority or similar body, the rules of any relevant

stock exchange or pursuant to any applicable law or regulation; or |

| 4.4.2 | where

disclosure is required in connection with, and for the purposes of, any litigation, arbitration,

administrative or other investigations, proceedings or disputes, |

but

in each case only on the condition that: (i) such disclosure is made only to enable any such person to be informed that an opinion has

been given and to be made aware of its terms; (ii) we do not assume any duty or liability to any person to whom such disclosure is made;

(iii) the recipient is informed of the confidential nature of this opinion; and (iv) the recipient may not disclose this opinion to any

other person.

| 4.5 | Our

liability under this Opinion Letter is limited to $3,000,000 for any one claim or series

of claims arising out of this Opinion Letter. |

| 4.6 | The

Opinions are given only by Shoosmiths LLP, an English limited liability partnership, and

no partner, member or employee shall have any personal responsibility or owe any duty of

care in relation to it. |

| 4.7 | We

consent to the filing of this Opinion Letter to the Registration Statement subject to paragraph

4.2 above (and without creating any assumption of duty on our part to any person other than

the Company). In giving such consent, we do not thereby admit that we are in the category

of persons whose consent is required under Section 7 of the Securities Act or the rules and

regulations thereunder. |

We

have assumed:

| 5.1.1 | the

genuineness of all signatures and seals on the Documents (or on the relevant originals where

we have examined copies) and the authenticity and completeness of those Documents; |

| 5.1.2 | the

conformity to the original Documents of any Documents submitted to us as certified or uncertified

copies or scans of the original Documents; and |

| 5.1.3 | that

there have been no variations to any of the Documents provided to us or to the originals

thereof and none of the Documents have been superseded or rescinded. |

| 5.2 | Other

parties and laws |

In

relation to the parties to the Documents and all laws other than those of England and Wales we have assumed:

| 5.2.1 | the

capacity, power and authority to execute and the due execution of the Documents by each party

to it (other than the Company as a matter of English law); |

| 5.2.2 | that

the obligations expressed to be assumed by each party to the Documents other than the Company

are valid and legally binding upon them (as a matter of English law); |

| 5.2.3 | that

all obligations under the Documents are valid, legally binding upon, and enforceable against,

the parties thereto as a matter of all relevant laws other than the laws of England and Wales; |

| 5.2.4 | due

compliance by all relevant parties other than the Company with all matters (including, without

limitation, the making of necessary filings, lodgements, registrations and notifications

and the payment of stamp duties and other documentary taxes and charges) that govern or relate

to the Documents or such parties; |

| 5.2.5 | where

any consents, directions, authorisations, approvals or instructions have to be obtained under

any law, regulation or practice for the performance of the Documents (other than any corporate

authorisations, approvals and company law requirements the subject of this letter), they

have been obtained or that they will be forthcoming within any relevant period in order to

be fully effective for such purpose; and |

| 5.2.6 | other

than European Union Law as it affects the laws of England and Wales, there are no laws of

any jurisdiction outside England and Wales which would, or might, affect the Opinions. |

| 5.3 | Corporate

actions and status |

In

relation to the Company, we have assumed:

| 5.3.1 | that

each resolution of the directors and shareholders of the Company certified as being true

and accurate and provided to us in connection with the giving of the Opinions was duly passed

by the required majority at a properly convened and quorate meeting of directors (or a duly

authorised committee thereof) and of shareholders of the Company or otherwise in accordance

with the constitutional documents of the Company and/or the Companies Act 2006; |

| 5.3.2 | that

each person identified as a director or a secretary in any resolution of the directors of

the Company was validly appointed as such and was in office at the date of the Documents; |

| 5.3.3 | that

any provisions contained in the Companies Act 2006 and/or the articles of association of

the Company relating to the declaration of directors’, interests or the power of interested

directors to vote were duly observed; |

| 5.3.4 | that

any restrictions in the articles of association of the Company on that Company’s and/or

on its directors’ authority to guarantee will not be contravened by the entry into

and performance by it of the Documents to which it is a party; |

| 5.3.5 | that

the execution and delivery of the Documents by the Company and the exercise of its rights

and performance of its obligations under the Documents will promote the success of the Company

for the benefit of its members as a whole; |

| 5.3.6 | that

no step has been taken to wind up the Company nor to appoint a receiver, administrator or

like officer in respect of the Company or any of its assets and that no voluntary arrangement

has been proposed in respect of the Company; and |

| 5.3.7 | there

are no agreements, letters or other arrangements having contractual effect which modify the

terms of, or affect, the Documents or which render the Company incapable of or prohibit it

from performing any of its obligations under the Documents and no provision of the Documents

have been waived and there are no contractual or similar restrictions contained in any agreement

or arrangement (other than the Documents) which are binding on the Company which would prohibit

it from performing any of its obligations under the Documents. |

| 5.4.1 | All

Documents submitted to us as copies or certified copies are true copies of the originals

and such originals and all Documents submitted to us as originals are genuine and complete

and all signatures (including electronic signatures), stamps and seals on the documents are

genuine. |

| 5.4.2 | Each

Document accurately records the agreement of the parties to it and has not been amended,

varied, waived, superseded, rescinded, breached, revoked or terminated. |

| 5.4.3 | The

Documents are in the form produced to the directors of the Company. |

| 5.4.4 | There

have been no amendments to the articles of association of the Company since the date referred

to in paragraph 3.1.2. |

| 5.5.1 | The

Documents have been signed by or on behalf of each party to it by person(s) authorised by

the relevant party to (in the presence of a witness where applicable). |

| 5.5.2 | The

making of the signatures on the signature pages to the Documents was made or done in a manner

recognised by law as valid and the Documents have remained intact since those signatures

were made or affixed (as the case may be). |

| 5.5.3 | The

Documents have been dated with the date on which it was signed and duly delivered by the

parties to it (where applicable). |

| 5.6.1 | The

information disclosed in response to the searches referred to in paragraph 3.1 of this Opinion

Letter was accurate, complete and up to date at the time of those searches and those responses

did not fail to disclose any matters which they should have disclosed and which were relevant

for the purposes of this Opinion Letter. Since the date of those searches and enquiries there

has been no alteration in the status of the Company as revealed in those searches. |

| 5.6.2 | No

event has occurred in relation to the Company, such as the passing of a resolution for or

the presentation of a petition or the taking of any other action for the winding-up of, or

the appointment of a liquidator, administrator, administrative receiver or receiver of the

Company, in respect of which a filing at the Companies Registry or at the Central Index of

the Companies Court was required to be made and has not been made or has been made but has

not at the date of the searches appeared on the relevant search result relating to the Company. |

| 5.7.1 | None

of the parties to the Documents are or will be seeking to achieve any purpose not apparent

from the Documents which might render any of the Documents illegal or void. |

| 5.7.2 | Where

any liability or obligation or right or benefit of a party to the Documents are dependent

upon the satisfaction of conditions precedent, those conditions have been or will be duly

and properly satisfied. |

| 5.7.3 | There

is no other matter or document which would, or might, affect the Opinions and which was not

revealed by the Documents. |

| 6.1.1 | We

express no opinion as to matters of fact, opinion or intention. |

| 6.1.2 | No

opinion is expressed as to any provision of the Documents to the extent it purports to declare

or impose a trust, turnover or similar arrangement in relation to any payments or assets

received. |

| 6.1.3 | Except

to the extent expressly set out in the Opinions, we express no opinion as to any taxation,

financial or accountancy matters or any liability to tax which may arise or be suffered as

a result of, or in connection with, the Documents or any transaction relating to them. |

| 6.1.4 | We

have not investigated the tax affairs of the Company and the Opinion is subject to the general

tax laws of the United Kingdom. |

| 6.1.5 | We

express no opinion on immunity including the existence, scope, nature and waiver of it or

any entitlement to claim immunity from suit or enforcement of the Company and any consequences

of such entitlement on its obligations under, or the enforceability of, the Documents. |

| 6.2.1 | The

validity, performance and enforcement of the Documents may be limited by bankruptcy, insolvency,

liquidation, reorganisation or prescription or similar laws of general application relating

to or affecting the rights of creditors. |

| 6.2.2 | Any

provision in the Documents which confers, purports to confer or waives a right of set-off

or similar right may be ineffective against a liquidator or creditor. |

| 6.2.3 | A

power of attorney may, in limited circumstances, be revoked by the winding-up or dissolution

of the donor company. |

| 6.2.4 | The

searches and enquiries referred to in paragraph 3 of this Opinion Letter are not conclusively

capable of revealing whether insolvency or similar procedures, or steps towards them, have

been started against the Company. |

| 6.3.1 | Remedies

such as specific performance or the issue of an injunction are available only at the discretion

of the courts of England and Wales according to general principles of equity. Specific performance

is not usually granted and an injunction is not usually issued where damages would be an

adequate alternative. |

| 6.3.2 | Enforcement

of claims arising pursuant to the Documents may become barred under the Limitation Act 1980

or may be subject to a defence of set-off or counterclaim. |

| 6.3.3 | Enforcement

may be limited by the provisions of the laws of England and Wales applicable to agreements

held to have been frustrated by events happening after execution of a document. |

| 6.3.4 | A

party to a contract may be able to avoid its obligations under that contract (and may have

other remedies) where it has been induced to enter into that contract by a misrepresentation

and the courts of England and Wales will generally not enforce an obligation if there has

been fraud. |

| 6.3.5 | In

this letter “enforceable” means, in relation to an obligation, that it is of

a type which the courts of England and Wales enforce. It does not mean that such obligation

will be enforced in all circumstances in accordance with the terms of the relevant Document. |

| 6.4.1 | The

courts of England and Wales may stay proceedings if concurrent proceedings are being brought

elsewhere. |

| 6.4.2 | There

could be circumstances in which the courts of England and Wales would not treat as conclusive

those certificates and determinations which any of the Documents state are to be so treated. |

| 6.4.3 | The

question whether or not any provisions of the Documents which may be invalid on account of

illegality may be severed from the other provisions thereof in order to save those other

provisions would be determined by the courts of England and Wales in their discretion. |

An

express choice of the laws of England and Wales will be subject to the discretion of the courts of England and Wales to give effect to

the mandatory provisions of law of the country where the obligations arising out of the contract are to be performed insofar as those

provisions render performance of the contract unlawful.

General

| 6.6 | We

have not investigated the laws of any country other than England and Wales and the Opinions

are given only with respect to the laws of England and Wales as at the date of this letter. |

| 6.7 | Where

any party to any Document is vested with a discretion or may determine a matter in its opinion,

the laws of England and Wales may require that such discretion is exercised reasonably and

for a proper purpose and/or that such opinion is formed in good faith based on reasonable

grounds. |

| 6.8 | Any

provisions excluding liability may be limited by law. |

This

Opinion Letter is given on the condition that it will be construed in accordance with English law and that each addressee submits to

the jurisdiction of the courts of England and Wales and waives any objection to the exercise of such jurisdiction in relation to any

dispute arising out of or in connection with this Opinion Letter.

| Yours

faithfully |

|

| |

|

| /s/

SHOOSMITHS LLP |

|

| |

|

| SHOOSMITHS

LLP |

|

| Dated:

29 July 2024 |

|

Exhibit

23.1

CONSENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We

hereby consent to the use in this Registration Statement on Form S-8 of VivoPower International plc of our report dated October 2, 2023

relating to the financial statements of VivoPower International plc, which appears in this Registration Statement. We also consent to

the reference to us under the heading “Experts” in such Registration Statement.

/s/

PKF Littlejohn LLP

London, England

July

25, 2024

Exhibit

107

Calculation

of Filing Fee Table

Form

S-8

(Form

Type)

VivoPower

International PLC

(Exact

Name of Registrant as Specified in its Charter)

Table

1: Newly Registered Securities

| Security Type | |

Security Class Title | |

Fee Calculation Rule | |

Amount Registered (1) | |

Proposed Maximum Offering Price Per Unit | |

Maximum Aggregate Offering Price | |

Fee Rate | |

Amount of Registration Fee |

| Equity | |

Ordinary Shares, nominal value $0. 12 per share | |

457(c) and 457(h) | |

| 221,987 | | |

$2.555 (2) | |

$ | 567,176.785 | | |

$ | 0.00014760 | | |

$ | 83.72 | |

| Total Offering Amounts | |

| | | |

| |

$ | 567,176.785 | | |

| | | |

$ | 83.72 | |

| Total Fee Offsets | |

| | | |

| |

| | | |

| | | |

| - | |

| Net Fee Due | |

| | | |

| |

| | | |

| | | |

$ | 83.72 | |

| (1) |

Represents

ordinary shares, nominal value $0.12 per share (the “Ordinary Shares”) that may be issued under the Amended and Restated

VivoPower International PLC 2017 Omnibus Equity Incentive Plan (the “Plan”). Pursuant to Rule 416(a) under the Securities

Act of 1933, as amended (the “Securities Act”), this registration statement shall also cover any additional Ordinary

Shares that become issuable under the Plan as a result of any stock dividend, stock split, recapitalization or similar transaction

effected without the Registrant’s receipt of consideration which would increase the number of outstanding Ordinary Shares. |

| (2) |

Estimated

solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) and Rule 457(h) promulgated under

the Securities Act on the basis of the average of the high and the low price of Registrant’s Common Stock as reported on The

Nasdaq Capital Market on July 26, 2024. |

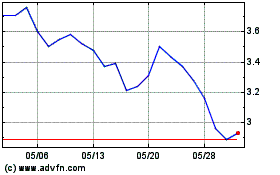

VivoPower (NASDAQ:VVPR)

過去 株価チャート

から 6 2024 まで 7 2024

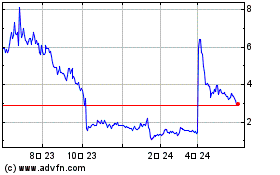

VivoPower (NASDAQ:VVPR)

過去 株価チャート

から 7 2023 まで 7 2024