0001825473

false

00-0000000

0001825473

2023-09-25

2023-09-25

0001825473

PRSR:UnitsEachConsistingOfOneClassOrdinaryShare0.0001ParValueAndOnethirdOfOneRedeemableWarrantMember

2023-09-25

2023-09-25

0001825473

PRSR:ClassOrdinarySharesParValue0.0001PerShareMember

2023-09-25

2023-09-25

0001825473

PRSR:RedeemableWarrantsEachWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50PerShareMember

2023-09-25

2023-09-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 25, 2023

PROSPECTOR CAPITAL CORP.

(Exact name of registrant as specified in its

charter)

| Cayman Islands |

|

001-39845 |

|

N/A |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

| 1250 Prospect Street, Suite 200 |

|

|

| La Jolla, California |

|

92037 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (650) 396-7700

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange

on which registered |

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-third of one redeemable warrant |

|

PRSRU |

|

The Nasdaq Stock Market LLC |

Class A ordinary shares, par value

$0.0001 per share |

|

PRSR |

|

The Nasdaq Stock Market LLC |

| Redeemable warrants, each warrant exercisable for one Class A ordinary share at an exercise price of $11.50 per share |

|

PRSRW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 1.01 Entry Into A Material Definitive Agreement

Amendment to Business Combination Agreement

On September 25, 2023, Prospector Capital Corp., a Cayman Islands exempted

company (“Prospector”), LeddarTech Inc., a corporation existing under the

laws of Canada (“LeddarTech”), and LeddarTech Holdings Inc., a corporation

existing under the laws of Canada and a wholly owned subsidiary of LeddarTech (“Newco”),

executed the first amendment (the “Amendment”) to that certain Business Combination

Agreement, dated as of June 12, 2023 (as the same may be amended, supplemented or otherwise modified from time to time, the “BCA”),

among Prospector, LeddarTech and Newco, which:

| | | |

| ● | clarifies

that Rollover Equity Awards shall be subject to the same terms and conditions, other than

vesting provisions, that applied to the corresponding Company M-Option immediately prior

to the Arrangement Effective Time, with each Rollover Equity Award vesting after a 6-month

period following the issuance thereof. |

| ● | clarifies

that for Canadian income tax purposes, the parties intend that the Share Exchange will occur

on a tax deferred basis for certain Canadian resident Company Shareholders who make a joint

tax election with Amalco under subsections 85(1) or (2) of the Tax Act. |

| ● | provides

that an Eligible Holder who receives Exchange Consideration shall be entitled to make joint

tax elections with Amalco under subsections 85(1) or (2) of the Tax Act or any equivalent

provincial legislation with respect to the Share Exchange, subject to and in accordance with

the Plan of Arrangement, and clarifies that Amalco will not be responsible for any taxes,

interest or penalties resulting from the failure by a former Company Common Shareholder to

properly complete or file the election forms in the form and manner within the time prescribed

by the Tax Act (or any applicable provincial legislation). |

| ● | redefines

“Option Pool” to mean five million (5,000,000) Surviving Company Common Shares

reserved for grant under the Surviving Company Equity Incentive Plan. |

The

foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by the terms and conditions of

the Amendment, a copy of which is attached hereto as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference.

All capitalized terms not defined herein shall have the respective meanings given to them in the BCA.

Additional

Information and Where to Find It

In

connection with the proposed Business Combination, Prospector, LeddarTech and Newco will prepare, and Newco (as predecessor to the Surviving

Company) will file with the SEC, the Registration Statement. Prospector, LeddarTech and Newco will prepare and file the Registration

Statement with the SEC and Prospector will mail the Registration Statement to its shareholders and file other documents regarding the

Business Combination with the SEC. This Form 8-K is not a substitute for any proxy statement, registration statement, proxy statement/prospectus

or other documents Prospector or Newco may file with the SEC in connection with the Business Combination. INVESTORS AND SECURITY HOLDERS

ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE REGISTRATION STATEMENT WHEN IT BECOMES AVAILABLE, ANY AMENDMENTS OR SUPPLEMENTS

TO THE REGISTRATION STATEMENT, AND OTHER DOCUMENTS FILED BY PROSPECTOR OR NEWCO WITH THE SEC IN CONNECTION WITH THE BUSINESS COMBINATION

BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the

Registration Statement and other documents filed with the SEC by Prospector or Newco through the website maintained by the SEC at www.sec.gov.

No Offer or Solicitation

This Form 8-K does not constitute an offer to sell or the solicitation

of an offer to buy any securities of Prospector or Newco, a solicitation of any vote or approval, nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section

10 of the Securities Act of 1933, as amended (the “Securities Act”).

Participants in the Solicitation

Prospector, LeddarTech and Newco, and certain of their respective directors,

executive officers and employees, may be deemed to be participants in the solicitation of proxies in connection with the Business Combination.

Information about the directors and executive officers of Prospector can be found in the Annual Report on Form 10-K for the fiscal year

ended December 31, 2022, which was filed with the SEC on March 31, 2023. Information regarding the persons who may, under the rules of

the SEC, be deemed participants in the solicitation of proxies in connection with the Business Combination, including a description of

their direct or indirect interests, by security holdings or otherwise, will be set forth in the Registration Statement and other relevant

materials when they are filed with the SEC. These documents can be obtained free of charge from the source indicated above.

Caution Concerning Forward-Looking Statements

Certain statements contained in this Form 8-K may be considered forward-looking

statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section

21E of the Securities and Exchange Act of 1934, as amended, including statements regarding the Business Combination involving Prospector,

LeddarTech and Newco, and the ability to consummate the Business Combination. Forward-looking statements generally include statements

that are predictive in nature and depend upon or refer to future events or conditions, and include words such as “may,” “will,”

“should,” “would,” “expect,” “anticipate,” “plan,” “likely”, “believe,”

“estimate,” “project,” “intend,” and other similar expressions among others. Statements that are not

historical facts are forward-looking statements. Forward-looking statements are based on current beliefs and assumptions that are subject

to risks and uncertainties and are not guarantees of future performance. Actual results could differ materially from those contained in

any forward-looking statement as a result of various factors, including, without limitation: (i) the risk that the conditions to the Closing

of the Business Combination are not satisfied, including the failure to timely or at all obtain shareholder approval for the Business

Combination or the failure to timely or at all obtain any required regulatory clearances, including under the HSR Act or of the Superior

Court of Québec; (ii) uncertainties as to the timing of the consummation of the Business Combination and the ability of each of

Prospector, LeddarTech and Newco to consummate the Business Combination; (iii) the possibility that other anticipated benefits of the

Business Combination will not be realized, and the anticipated tax treatment of the Business Combination; (iv) the occurrence of any event

that could give rise to termination of the Business Combination; (v) the risk that shareholder litigation in connection with the Business

Combination or other settlements or investigations may affect the timing or occurrence of the Business Combination or result in significant

costs of defense, indemnification and liability; (vi) changes in general economic and/or industry specific conditions; (vii) possible

disruptions from the Business Combination that could harm LeddarTech’s business; (viii) the ability of LeddarTech to retain, attract

and hire key personnel; (ix) potential adverse reactions or changes to relationships with customers, employees, suppliers or other parties

resulting from the announcement or completion of the Business Combination; (x) potential business uncertainty, including changes to existing

business relationships, during the pendency of the Business Combination that could affect LeddarTech’s financial performance; (xi)

legislative, regulatory and economic developments; (xii) unpredictability and severity of catastrophic events, including, but not limited

to, acts of terrorism, outbreak of war or hostilities and any epidemic, pandemic or disease outbreak (including COVID-19), as well as

management’s response to any of the aforementioned factors; and (xiii) other risk factors as detailed from time to time in Prospector’s

reports filed with the SEC, including Prospector’s Annual Report on Form 10-K, periodic Quarterly Reports on Form 10-Q, periodic

Current Reports on Form 8-K and other documents filed with the SEC. The foregoing list of important factors is not exhaustive. Neither

Prospector nor LeddarTech can give any assurance that the conditions to the Business Combination will be satisfied. Except as required

by applicable law, neither Prospector nor LeddarTech undertakes any obligation to revise or update any forward-looking statement, or to

make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: September 28, 2023 |

PROSPECTOR CAPITAL CORP. |

| |

|

|

| |

By: |

/s/ Derek Aberle |

| |

Name: |

Derek Aberle |

| |

Title: |

Chief Executive Officer |

3

Exhibit 2.1

AMENDMENT AGREEMENT

AMENDMENT No. 1 (this “Amendment”),

dated as of September 25, 2023, to the Business Combination Agreement (the “Agreement”), dated as of June 12, 2023,

made by and among Prospector Capital Corp., a Cayman Islands exempted company (“Prospector”), LeddarTech Inc., a corporation

existing under the laws of Canada (the “Company”), and LeddarTech Holdings Inc., a company incorporated under the laws

of Canada (“Newco”). Prospector, the Company and Newco shall be referred to herein from time to time collectively as

the “Parties”. Capitalized terms used but not defined herein shall have the meanings assigned to such terms in the

Agreement.

WITNESSETH:

WHEREAS, the Parties have entered

into the Agreement; and

WHEREAS, pursuant to and in

accordance with Section 8.3 of the Agreement, the Parties wish to amend the Agreement as set forth in this Amendment.

NOW, THEREFORE, in consideration

of the rights and obligations contained herein, and for other good and valuable consideration, the adequacy of which is hereby acknowledged,

the Parties agree as follows:

Section 1. Amendment to Section 2.4(b)

of the Agreement. The text of Section 2.4(b) of the Agreement is deleted in its entirety and replaced with the following:

notwithstanding section

4.10 of each of the Company Management Stock Option Plans, each Company M-Option outstanding immediately prior to the Arrangement Effective

Time shall be exchanged for an option to purchase a number of Surviving Company Common Shares equal to the number of Class M Shares subject

to such Company M-Option immediately prior to the Arrangement Effective Time multiplied by the Per Share Consideration (rounded down to

the nearest whole share) under the Surviving Company Equity Incentive Plan at an exercise price per share equal to the exercise price

per share of such Company M-Option immediately prior to the Arrangement Effective Time divided by the Per Share Consideration (rounded

up to the nearest whole cent) and the portion of the Surviving Company Earnout Special Shares to be allocated to each such Rollover Equity

Award upon exercise of such Rollover Equity Award pursuant to and in accordance with Section 2.7(a)(ii) and the Allocation Schedule. Each

such Rollover Equity Award shall be subject to the same terms and conditions (including applicable expiration and forfeiture provisions)

that applied to the corresponding Company M-Option immediately prior to the Arrangement Effective Time (provided that (i) each such Rollover

Equity Award shall vest after a 6-month period following the issuance thereof, and (ii) the rights set forth in section 4.10 of each of

the Company Management Stock Option Plans shall be extinguished together with any other rights similar to the rights set forth in section

4.10(y) of the Company Management Stock Option Plans enabling the request for payment of an amount in cash by the Company under the Company

Management Stock Option Plans), subject to the adjustments required by this Section 2.4(b) after giving effect to the Arrangement. Such

assumption and conversion shall occur in a manner intended to comply with the requirements of subsection 7(1.4) of the Tax Act.

Section 2. Amendment to Section 5.5(c)

of the Agreement. The text of Section 5.5(c) of the Agreement is deleted in its entirety and replaced with the following:

For Canadian income

tax purposes, the Parties intend that (i) the Share Exchange will occur on a tax deferred basis for certain Canadian resident Company

Shareholders who make a joint tax election with Amalco under subsections 85(1) or (2) of the Tax Act, and (ii) subsection 7(1.4)

of the Tax Act apply to the exchange of certain employee options as described in the Plan of Arrangement.

Section 3. Amendment to Section 5.5(d)

of the Agreement and Addition of Section 5.5(e). The text of Section 5.5(d) of the Agreement is moved to the novel Section 5.5(e)

of the Agreement, and such former Section 5.5(d) of the Agreement is replaced with the following:

Subject to the provisions

of the Plan of Arrangement, an Eligible Holder (as defined in the Plan of Arrangement) who receives Exchange Consideration shall be entitled,

in the manner and in accordance with any deadlines contemplated by the Plan of Arrangement, to make joint tax elections with Amalco under

subsections 85(1) or (2) of the Tax Act or any equivalent provincial legislation with respect to the Share Exchange, subject to and in

accordance with the Plan of Arrangement. Amalco will not be responsible for the proper completion of any election form and, except for

Amalco’s obligation to return duly completed and timely received election forms, Amalco will not be responsible for any taxes, interest

or penalties resulting from the failure by a former Company Common Shareholder to properly complete or file the election forms in the

form and manner and within the time prescribed by the Tax Act (or any applicable provincial legislation).

Section 4. Amendment

to Section 5.16 of the Agreement. The text of Section 5.16 of the Agreement is deleted in its entirety and replaced with the following:

Immediately prior

to Closing, the Company board of directors shall approve and adopt an equity incentive plan, in substantially the form attached hereto

as Exhibit E and with any changes or modifications thereto as the Company and Prospector may mutually agree (such agreement not

to be unreasonably withheld, conditioned or delayed by either the Company or Prospector, as applicable), which shall be adopted and assumed

by the Surviving Company (the “Surviving Company Equity Incentive Plan”) at the time of the Company Amalgamation, in

the manner prescribed under applicable Laws effective as of immediately following the Closing, reserving five million (5,000,000) Surviving

Company Common Shares for grant thereunder

(the “Option Pool”). The Surviving Company Equity Incentive Plan shall ensure that cancelled options are returned to

the Option Pool for reissuance should employees depart and surrender vested and/or unvested options or otherwise fail to exercise their

options before the exercise date.

Section 5. Addition to Section 1.1 of

the Plan of Arrangement. The following definition of “Eligible Holder” is added in Section 1.1 of the Plan of Arrangement:

“Eligible

Holder” means a Company Common Shareholder that is (a) a resident of Canada for purposes of the Tax Act and not exempt from

tax under Part I of the Tax Act, or (b) a partnership, any member of which is a resident of Canada for purposes of the Tax Act and not

exempt from tax under Part I of the Tax Act;

Section 6. Amendment to Section 3.1(k)(ii)

of the Plan of Arrangement. The text of Section 3.1(k)(ii) of the Plan of Arrangement is deleted in its entirety and replaced with

the following:

notwithstanding section

4.10 of each of the Company Management Stock Option Plans, each Company M-Option outstanding immediately prior to the Arrangement Effective

Time shall be exchanged for an option to purchase a number of Surviving Company Common Shares equal to the number of Class M Shares subject

to such Company M-Option immediately prior to the Arrangement Effective Time multiplied by the Per Share Consideration (rounded down to

the nearest whole share) under the Surviving Company Equity Incentive Plan at an exercise price per share equal to the exercise price

per share of such Company M-Option immediately prior to the Arrangement Effective Time divided by the Per Share Consideration (rounded

up to the nearest whole cent), and the portion of the Surviving Company Earnout Special Shares to be allocated to each such Rollover Equity

Award upon exercise of such Rollover Equity Award pursuant to and in accordance with Section 2.7(a)(iii) of the Business Combination Agreement

and the Allocation Schedule. Each such Rollover Equity Award shall be subject to the same terms and conditions (including applicable expiration

and forfeiture provisions) that applied to the corresponding Company M-Option immediately prior to the Arrangement Effective Time (provided

that (i) the options to purchase Surviving Company Common Shares shall vest after a 6-month period following the issuance thereof, and

(ii) the rights set forth in section 4.10 of each of the Company Management Stock Option Plans shall be extinguished together with any

other rights similar to the rights set forth in section 4.10(y) of the Company Management Stock Option Plans enabling the request for

payment of an amount in cash by the Company under the Company Management Stock Option Plans), subject to the adjustments required by this

Section 3.1(k)(i)(ii) after giving effect to the Arrangement;

Section 7. Addition of Section 3.2 in

the Plan of Arrangement. The following text is added as Section 3.2 of the Plan of Arrangement:

Each Company Common

Shareholder who is an Eligible Holder shall be entitled to make an income tax election pursuant to subsection 85(1) of the Tax Act, or

subsection 85(2) of the Tax Act if such Company Common Shareholder is a partnership (and in each case, where applicable, the analogous

provisions of provincial income tax law), with respect to the transfer of its Company Common Shares to Amalco and the receipt of the Amalco

Common Shares and Amalco Earnout Special Shares in respect thereof by: (A) notifying Amalco of its intention to make such an income tax

election by completing the Letter of Transmittal accordingly; and (B) providing two signed copies of the necessary prescribed election

form(s) to Amalco within 90 days following the Effective Date, duly completed with the details of the number of Company Common Shares

transferred and the applicable agreed amounts for the purposes of such elections. Thereafter, subject to the election forms being correct

and complete and complying with the provisions of the Tax Act (and applicable provincial income tax law), the forms will be signed by

Amalco and returned to such former Company Common Shareholder within 30 days after the receipt thereof by Amalco for filing with the Canada

Revenue Agency (or the applicable provincial taxing authority) by such former Company Common Shareholder. Amalco will not be responsible

for the proper completion of any election form and, except for Amalco’s obligation to return duly completed and timely received

election forms, Amalco will not be responsible for any taxes, interest or penalties resulting from the failure by a former Company Common

Shareholder to properly complete or file the election forms in the form and manner and within the time prescribed by the Tax Act (or any

applicable provincial legislation).

Section 8. Assignment.

This Amendment may not be assigned by any Party (whether by operation of law or otherwise) without the prior written consent of the other

Parties. Any attempted assignment of this Amendment not in accordance with the terms of this Section 8 shall be void.

Section 9. No Third

Party Beneficiary. This Amendment shall be binding upon and inure solely to the benefit of the Parties hereto and their permitted

assigns and nothing herein, express or implied, is intended to or shall confer upon any other Person any legal or equitable right, benefit

or remedy of any nature whatsoever.

Section 10. Entire

Agreement. This Amendment constitutes the entire agreement of the Parties hereto with respect to the subject matter hereof and supersedes

all prior agreements and undertakings, both written and oral, among the Parties with respect to the subject matter hereof. Except as amended

by this Amendment, the Agreement shall continue in full force and effect.

Section 11. Construed

Together. The Agreement shall henceforth be read and construed in conjunction with this Amendment. References to the “Agreement”

in the Agreement or the “Business Combination Agreement” in any other document delivered in connection with, or pursuant to,

the Agreement, shall mean the Agreement as amended by this Amendment.

Section 12. Severability.

If any term or other provision of this Amendment is invalid, illegal or incapable of being enforced by any Law or public policy, all other

terms and provisions of this Amendment shall nevertheless remain in full force and effect so long as the economic or legal substance of

the transactions contemplated by this Amendment is not affected in any manner materially adverse to any Party. Upon such determination

that any term or other provision is invalid, illegal or incapable of being enforced, the Parties hereto shall negotiate in good faith

to modify this Amendment so as to effect the original intent of the Parties as closely as possible in an acceptable manner in order that

the transactions contemplated by this Amendment are consummated as originally contemplated to the greatest extent possible.

Section 13. Counterparts.

This Amendment may be executed and delivered (including by facsimile and electronic transmission) in one or more counterparts, and by

the different Parties hereto in separate counterparts, each of which when executed shall be deemed to be an original but all of which

taken together shall constitute one and the same agreement.

Section 14. Governing

Law. This Amendment shall be governed by and construed in accordance with the laws of the State of New York applicable to contracts

executed in and to be performed in that State, except to the extent mandatorily governed by the laws of Canada, including the provisions

relating to the Arrangement and the Plan of Arrangement (except that the Cayman Islands Act shall also apply to the Prospector Continuance).

IN WITNESS WHEREOF, each of

the Parties have caused this Amendment to be executed by as of the date first written above by their respective officers thereunto duly

authorized.

| |

PROSPECTOR CAPITAL CORP. |

| |

|

|

|

| |

By: |

/s/ Derek Kenneth Aberle |

| |

|

Name: |

Derek Kenneth Aberle |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| |

LEDDARTECH INC. |

| |

|

|

|

| |

By: |

/s/ Charles Boulanger |

| |

|

Name: |

Charles Boulanger |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| |

LEDDARTECH HOLDINGS INC. |

| |

|

|

|

| |

By: |

/s/ Charles Boulanger |

| |

|

Name: |

Charles Boulanger |

| |

|

Title: |

Chief Executive Officer |

6

v3.23.3

Cover

|

Sep. 25, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 25, 2023

|

| Entity File Number |

001-39845

|

| Entity Registrant Name |

PROSPECTOR CAPITAL CORP.

|

| Entity Central Index Key |

0001825473

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

1250 Prospect Street

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

La Jolla

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92037

|

| City Area Code |

650

|

| Local Phone Number |

396-7700

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-third of one redeemable warrant |

|

| Title of 12(b) Security |

Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-third of one redeemable warrant

|

| Trading Symbol |

PRSRU

|

| Security Exchange Name |

NASDAQ

|

| Class A ordinary shares, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A ordinary shares, par value

|

| Trading Symbol |

PRSR

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, each warrant exercisable for one Class A ordinary share at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants, each warrant exercisable for one Class A ordinary share at an exercise price of $11.50 per share

|

| Trading Symbol |

PRSRW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PRSR_UnitsEachConsistingOfOneClassOrdinaryShare0.0001ParValueAndOnethirdOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PRSR_ClassOrdinarySharesParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PRSR_RedeemableWarrantsEachWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

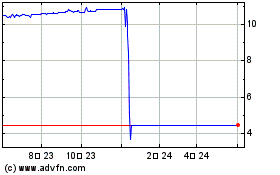

Prospector Capital (NASDAQ:PRSRU)

過去 株価チャート

から 4 2024 まで 5 2024

Prospector Capital (NASDAQ:PRSRU)

過去 株価チャート

から 5 2023 まで 5 2024