Form 8-K - Current report

2024年8月10日 - 6:15AM

Edgar (US Regulatory)

false

0001893311

0001893311

2024-08-09

2024-08-09

0001893311

luxh:CommonStock0.00001ParValuePerShareMember

2024-08-09

2024-08-09

0001893311

luxh:SeriesACumulativeRedeemablePreferredMember

2024-08-09

2024-08-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 9, 2024

LuxUrban Hotels Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-41473 |

|

82-3334945 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 212 Biscayne Blvd, Suite 253, Miami, Florida |

|

33137 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (877) 269-5952

N/A

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions

(see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Ticker symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.00001 per share |

|

LUXH |

|

The Nasdaq Stock Market LLC |

| 13.00% Series A Cumulative Redeemable Preferred Stock $0.00001 |

|

LUXHP |

|

The Nasdaq Stock Market LLC |

| Item 4.02 | Non-Reliance on Previously Issued Financial Statements

or a Related Audit Report or Completed Interim Review. |

On August 9, 2024, the Chief Financial Officer

of LuxUrban Hotels Inc. (“Company”) in consultation with the Company’s board of directors and the Company’s independent

registered public accounting firm, concluded that the Company’s previously issued unaudited condensed consolidated financial statements

contained within the Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024 should no longer be relied upon due to

an overstatement of revenues and other errors in such financial statements, and therefore a restatement of these prior financial statements

is required. Accordingly, the Company intends to restate the aforementioned financial statements by amending its quarterly report on Form

10-Q for the quarter ended March 31, 2024 as soon as reasonably practicable. The Company expects to file the amended quarterly report

during the week of August 12, 2024.

The impact of this restatement on the Company’s

first quarter 2024 unaudited condensed consolidated financial statements is expected to be approximately a $13.75 million decrease in

revenues, a write-off of approximately $1.5 million for deposits with third party reservation processors, an increase in unearned revenue

of approximately $8.05 million, and an increase in net loss of approximately $9.55 million.

Management has determined that, as a result of

the errors described above, management’s previous conclusions regarding the effectiveness of the Company’s disclosure controls and procedures

as of March 31, 2024 need to be modified. The Company will provide management’s modified conclusions in the restated interim financial

statements.

Safe Harbor Statement:

The following is a Safe Harbor Statement under

the Private Securities Litigation Reform Act of 1995:

This press release includes forward-looking statements.

As a general matter, forward-looking statements reflect our current expectations and projections relating to our financial condition,

results of operations, plans, objectives, future performance and business. These statements may be identified by the use of forward looking

terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,”

“will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,”

“estimates,” “anticipates,” or the negative version of those words or other comparable words, but the absence of these

words does not necessarily mean that a statement is not forward-looking. The Private Securities Litigation Reform Act of 1995 provides

a safe harbor for the disclosure of forward-looking statements.

The forward-looking statements contained in this

press release are based upon our historical performance, current plans, estimates, expectations and other factors we believe are appropriate

under the circumstances. The inclusion of this forward-looking information should not be regarded as a representation by us that the future

plans, estimates or expectations contemplated by us will be achieved since these forward-looking statements are subject to various risks

and uncertainties and assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy

and liquidity. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect,

our actual results may vary materially from those indicated in these statements. Some of the key uncertainties and factors that could

affect our future performance and cause actual results to differ materially from those expressed or implied by forward-looking statements

are: our ability to submit periodic filings before regulatory deadlines; our expectations regarding our revenues, expenses and operations

and our ability to sustain profitability; our ability to recruit and retain qualified executive search consultants to staff our operations

appropriately; our ability to expand our customer base and relationships, especially given the off-limit arrangements we are required

to enter into with certain of our clients; further declines in the global economy and our ability to execute successfully through business

cycles; our anticipated cash needs; our anticipated growth strategies and sources of new revenues; unanticipated trends and challenges

in our business and the markets in which we operate; social or political instability in markets where we operate; the impact of foreign

currency exchange rate fluctuations; price competition; the ability to forecast, on a quarterly basis, variable compensation accruals

that ultimately are determined based on the achievement of annual results; and the mix of profit and loss by country in which we operate.

The above list should not be construed as exhaustive

and should be read in conjunction with the other cautionary statements that are included in our annual report on Form 10-K filed on April

15, 2024. The forward looking statements included in this press release are made only as of the date hereof. We do not undertake any obligation

to update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. You should,

however, review the factors and risks we describe in the reports we will file from time to time with the Securities and Exchange Commission.

| Item 9.01 |

Financial Statements and Exhibits |

None.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: August 9, 2024 |

LUXURBAN HOTELS INC. |

| |

|

| |

By: |

/s/ Michael James |

| |

|

Michael James, Chief Financial Officer |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=luxh_CommonStock0.00001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=luxh_SeriesACumulativeRedeemablePreferredMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

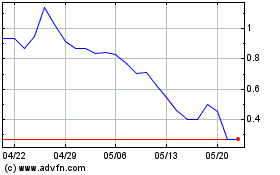

LuxUrban Hotels (NASDAQ:LUXH)

過去 株価チャート

から 11 2024 まで 12 2024

LuxUrban Hotels (NASDAQ:LUXH)

過去 株価チャート

から 12 2023 まで 12 2024