FALSE000100528600010052862024-08-282024-08-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 28, 2024

LIFECORE BIOMEDICAL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 000-27446 | | 94-3025618 |

(State or other jurisdiction of incorporation) | | (Commission file number) | | (IRS Employer Identification No.) |

| | | | | | | | |

3515 Lyman Boulevard | |

| Chaska, | Minnesota | 55318 |

| (Address of principal executive offices) | (Zip Code) |

(952) 368-4300

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock | LFCR | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02 Unregistered Sales of Equity Securities.

As described in Item 5.02 below, on September 3, 2024, Lifecore Biomedical, Inc. (the “Company”) will issue a restricted stock unit (“RSU”) award with respect to 262,500 shares of its common stock and a performance stock unit (“PSU”) award for up to 750,000 shares of its common stock to Ryan D. Lake under the Company’s Equity Inducement Plan adopted on March 20, 2024 (the “Inducement Plan”).

The RSU award and PSU award were granted in reliance upon the exemption from registration afforded by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The securities have not been registered under the Securities Act, and may not be offered or sold without registration or an applicable exemption from registration requirements. The information set forth below in Item 5.02 with respect to the Company’s grants of these inducement awards to Mr. Lake are incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 28, 2024, the Company appointed Ryan D. Lake as the Company’s Chief Financial Officer and Secretary, effective September 3, 2024 (the “Effective Date”). Mr. Lake will succeed John D. Morberg, the Company’s current Chief Financial Officer and Secretary, whose employment will end September 2, 2024. Mr. Morberg’s separation will be treated as a termination by the Company without Cause subsequent to a Change in Control under that certain Executive Employment Agreement (the “Morberg Employment Agreement”), dated January 19, 2021, between the Company and Mr. Morberg (as such capitalized terms are defined in the Morberg Employment Agreement).

Mr. Lake, age 47, most recently served as the Chief Financial Officer of Societal CDMO, Inc., a bi-coastal contract development and manufacturing organization, or CDMO, with capabilities spanning pre-investigational new drug development to commercial manufacturing and packaging for a wide range of therapeutic dosage forms with a primary focus on small molecules. Mr. Lake served as the Chief Financial Officer of Societal CDMO (formerly Recro Pharma, Inc.), which was a public company and listed on the Nasdaq Stock Market, from January 2018 until its sale to CoreRx, Inc. in April 2024. He remained with Societal CDMO after the sale to CoreRx during a transition period that ended in May 2024. As Societal CDMO’s Chief Financial Officer, Mr. Lake was responsible for all finance and accounting functions, SEC reporting, investor relations, and information technology and security. He also played an instrumental role in the sale of Societal CDMO to CoreRx in April 2024. Mr. Lake previously served as Societal CDMO’s Senior Vice President of Finance and Chief Accounting Officer from June 2017 to January 2018. Mr. Lake also concurrently served as the Chief Financial Officer of Baudax Bio, Inc. taking the company public when Recro Pharma, Inc. spun-out its Acute Care Division from its Contract Development and Manufacturing Organization from November 2019 to March 2021. Prior to joining Societal CDMO, Mr. Lake served as Chief Financial Officer and Vice President of Finance of Aspire Bariatrics, Inc., a privately-held, commercial-stage, medical device company from July 2015 to June 2017. In addition to responsibility for all of Aspire Bariatrics’ finance and accounting and human resources functions, Mr. Lake supported Aspire Bariatrics through multiple rounds of capital raising and commercial scale-up and product launch. From 2012 to 2015, Mr. Lake held executive management and senior finance positions, including Director of the Natural Materials Division, Controller and Senior Director of Finance, at DSM Biomedical (successor to Kensey Nash Corporation after its acquisition in 2012), a division of Royal DSM (listed on Euronext Amsterdam), a global science-based company active in health, nutrition and materials. From 2002 to 2012, Mr. Lake held various senior financial positions of increasing responsibility, most notably Interim Chief Financial Officer and Senior Director of Finance, with Kensey Nash Corporation, a Nasdaq- listed medical device company. Earlier in his career, Mr. Lake worked at Deloitte & Touche, LLP. Mr. Lake has a B.S. degree in Accounting from West Chester University of Pennsylvania and is a certified public accountant and Chartered Global Management Accountant.

On August 28, 2024, Mr. Lake entered into an employment agreement with the Company (the “Employment Agreement”). The Employment Agreement was recommended by the Compensation Committee and approved by the Board. Pursuant to the Employment Agreement, Mr. Lake will join the Company on the Effective Date as the Company’s Chief Financial Officer. Mr. Lake’ employment is at-will and may be terminated at any time for any reason, subject to the terms of the Employment Agreement and the Company’s Executive Change in Control Severance Plan (the “CIC Severance Plan”), as described below.

Under the Employment Agreement, Mr. Lake will be entitled to receive the following compensation and benefits in connection with his service as Chief Financial Officer of the Company:

•an annual base salary of $470,000;

•beginning with the Company’s fiscal year 2025, eligibility to participate in the Company’s annual incentive plan and for the 2025 annual incentive plan, eligibility for a bonus of 60% of his base salary at the target level of achievement, without pro-ration;

•a restricted stock unit (“RSU”) award for 262,500 shares of the Company’s common stock, which will vest and be settled as to 52,500 shares of the RSU on each of the first five anniversaries of the Effective Date and other terms consistent with the previously disclosed Restricted Stock Unit Award Agreement dated May 20, 2024 to Paul Josephs under the Inducement Plan;

•a performance stock unit (“PSU”) award for up to 750,000 shares, with PSU vesting, settlement and other terms consistent with the previously disclosed Performance Stock Unit Award Agreement dated May 20, 2024 to Paul Josephs under the Inducement Plan;

•eligibility under the Company’s CIC Severance Plan to receive, upon a “Qualifying Termination” of employment, benefits at the “Tier 2” level as described in the CIC Severance Plan, and if Mr. Lake’s employment is terminated by the Company without Cause (other than a Qualifying Termination) or if the Company materially breaches the terms of the Employment Agreement (after notice and opportunity to cure), the same severance benefits under the CIC Severance Plan as if he had experienced a Qualifying Termination without duplication in the amount of or types of payments or benefits, provided that (a) the vesting of the PSUs will not be accelerated, (b) Mr. Lake must satisfy the conditions required by the CIC Severance Plan to receive severance benefits (including execution of a general release of claims that is not revoked or rescinded) and (c) no amendment, modification, suspension, or termination of the CIC Severance Plan that reduces the benefits to which Mr. Lake may become entitled under the CIC Severance Plan or under the Employment Agreement from those benefits as of the Effective Date will apply to Mr. Lake without his express written consent;

•in addition to the severance benefits described above, Mr. Lake will be provided, at the Company’s expense, with senior executive level outplacement services for a period of twelve (12) months from the date of termination by the Company without Cause (other than a Qualifying Termination) or if the Company materially breaches the terms of the Employment Agreement; and

•participation in the benefit plans and programs of the Company in which similarly situated employees of the Company participate, as may be in effect from time to time, and five weeks of vacation per calendar year (pro-rated for 2024).

The RSU award and PSU award to Mr. Lake, which were material inducements to him accepting employment with the Company, will be granted on the Effective Date under the Company’s Equity Inducement Plan adopted on March 20, 2024. Mr. Lake will work remotely and spend approximately one week a month of his working time at the Company’s headquarters, subject to reimbursement for reasonable out of pocket expenses.

The Employment Agreement also provides for entry into a non-solicitation, confidentiality and inventions agreement with the Company. In addition, Mr. Lake and the Company will enter into the Company’s standard indemnification agreement.

There are no other arrangements or understandings between Mr. Lake and any other persons pursuant to which Mr. Lake was appointed Chief Financial Officer of the Company. Mr. Lake does not have any family relationship with any of the Company’s directors or executive officers or any persons nominated or chosen by the Company to be a director or executive officer. Other than with respect to the equity awards contemplated by this Current Report, Mr. Lake does not beneficially own any shares of the Company’s common stock, and Mr. Lake does not have any direct or indirect material interest in any transaction or proposed transaction required to be reported under Item 404(a) of Regulation S-K.

The foregoing description of the Employment Agreement is not complete and is qualified in its entirety by reference to the full text of the Employment Agreement, which is attached to this Current Report on Form 8-K as Exhibit 10.1 and incorporated by reference herein.

Item 7.01 Regulation FD

On August 29, 2024, the Company issued the press release announcing the Chief Financial Officer transition. A copy of this press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished in this Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1 attached hereto) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be

incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are furnished as part of this report:

| | | | | | | | | | |

| Exhibit No. | | Description | | |

| | | | |

| | | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 29, 2024

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| LIFECORE BIOMEDICAL, INC. |

| | |

| | |

By: | /s/ Paul Josephs | |

| Paul Josephs | |

| President and Chief Executive Officer | |

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT (the “Agreement”) is made and entered into by and between Lifecore Biomedical, Inc., a Delaware corporation (the “Company”) and Ryan D. Lake, an individual (the “Executive”), effective as of September 3, 2024 (the “Effective Date”).

BACKGROUND

WHEREAS, the Executive and the Company wish to enter into this Agreement to set forth the terms and conditions of Executive’s employment with the Company as its Chief Financial Officer beginning as of the Effective Date.

NOW, THEREFORE, in consideration of the mutual covenants and agreements set forth herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound hereby, agree as follows:

1.Employment and Duties. The Executive will serve as Chief Financial Officer of the Company beginning as of the Effective Date. The Executive shall report to the Chief Executive Officer of the Company and will assist the Board of Directors of the Company (the “Board”) in developing and implementing the Company’s ongoing business strategies and objectives. In such capacity, the Executive shall perform all such duties as are assigned to the Executive, consistent with the Executive’s titled position, by the Company’s Chief Executive Officer. The Executive will devote his full business time and the Executive’s reasonable best efforts to promote the interests of the Company. Nothing contained herein shall preclude the Executive from managing personal investments, participating in charitable, community, educational and professional activities, or, with the prior written consent of the Chief Executive Officer, serve on the board of directors of one for profit company that does not compete with the Company provided that such activities do not interfere with the performance of the Executive’s duties. The Executive represents and warrants that the Executive does not have any type of written or oral non-competition agreement or any other agreement that would prevent the Executive from accepting this offer of employment or performing services for the Company. If the Executive has any type of written or oral non-competition agreement or any other agreement that is in force and effect on the Effective Date, the Executive has provided a copy for the Company to review, and the Company hereby acknowledges that Executive has provided a copy of his agreement with his prior employer.

2.Location. The Executive’s position will be based in Chester Springs, Pennsylvania or the city and state of the Executive’s primary residence. While the Executive will not be required to maintain a residence in the same location as the Company’s headquarters, the Executive will spend approximately one week a month of the Executive’s working time at the Company’s headquarters. For so long as the Executive does not live in the vicinity of the Company’s headquarters, the Company will reimburse the Executive for reasonable out of pocket expenses, up to a maximum amount to be set by the Compensation Committee annually, associated with (a) monthly rent of an apartment, hotel accommodations or other similar temporary housing (including utilities); (b) rental car or a car allowance for travel in the Twin

Cities; and (c) airfare for four trips per month from the Executive’s current residence to the Twin Cities. Initially, the maximum amount of reimbursement of these expenses will be $5,000 per month.

3.Term. The term of the Executive’s employment hereunder shall continue until terminated pursuant to the terms of this Agreement.

4.Base Salary. The Company shall pay the Executive in accordance with its normal bi-weekly payroll practices an annual salary at the initial rate of $470,000 per year (the annual base salary that is then in effect, the “Base Salary”). The Executive’s compensation will be established by the Compensation Committee of the Board (the “Compensation Committee”) and the Board, and will be typically reviewed, and may be increased (but not decreased except as part of an across-the-board reduction impacting substantially all of the executive officers of the Company), annually.

5.Other Compensation and Benefits.

(a)Annual Incentive Plan Participation. Commencing with the Company’s fiscal year 2025 that begins May 27, 2024 and ends May 25, 2025, the Executive will be eligible to participate in the Company’s annual incentive plan (“AIP”), which is a cash incentive program based upon the Company’s achievement of specific annual performance goals as determined by the Compensation Committee, and will be eligible to participate in any successor or similar plan maintained by the Company for the benefit of executive officers, subject to the terms and conditions of such plans and at the discretion of and subject to approval by the Compensation Committee and/or Board. For the 2025 AIP, the Executive will be eligible for a bonus of 60% of his Base Salary at the target level of achievement and such bonus shall not be pro-rated. The Compensation Committee and/or Board will determine the Company’s achievement against the performance goals of the 2025 AIP following the completion of the 2025 fiscal year. The Executive must be employed as of the end of the fiscal year and as of the payment date to be eligible to receive incentive pay under the 2025 AIP. Additionally, all incentive compensation is subject to “clawback” as provided in the Company’s Compensation Recoupment Policy. On or before the Effective Date, the Executive will be required to execute and deliver an acknowledgment that the Executive is bound by and subject to the Compensation Recoupment Policy as a condition of participation in the 2025 AIP.

(b)Benefit Plans. The Executive shall be eligible to participate in all health insurance, savings and retirement, and other benefit plans, if any, that are from time to time generally applicable to other employees of the Company, subject to the terms and conditions of such plans.

(c)Vacation Days. The Executive shall be entitled to five (5) weeks of paid vacation time per calendar year pro-rated for 2024, in accordance with the plans, practices, policies, and programs of the Company.

(d)Expense Reimbursement. The Executive shall be entitled to receive reimbursement for all reasonable employment-related expenses incurred by the

Executive upon the receipt by the Company of an accounting in accordance with practices, policies and procedures applicable to other employees of the Company.

(e)New Hire Equity Awards. As a material inducement to the Executive entering into this Agreement and accepting employment with the Company, the Executive will be granted the equity-based awards described in clause (i) and (ii) effective as of the Effective Date, with such awards granted under the Lifecore Biomedical, Inc. Equity Inducement Plan and subject to award agreements that will be provided to the Executive following the Effective Date. All awards are at the discretion of and subject to approval by the Compensation Committee and/or the Board.

(i)Restricted Stock Unit: The Executive will be granted as of the Effective Date a restricted stock unit (“RSU”) award for 262,500 shares of the Company’s common stock, which will vest and be settled as to 52,500 shares of the RSU on each of the first five anniversaries of the Effective Date. The intent of the Company and the Executive is that the terms of the RSU award will mirror the terms of that certain Restricted Stock Unit Award Agreement dated May 20, 2024 to Paul Josephs under the Lifecore Biomedical, Inc. Equity Inducement Plan.

(ii)Performance Stock Unit. The Executive will be granted as of the Effective Date a performance stock unit (“PSU”) award for up to 750,000 shares with the terms set forth on Exhibit A. The intent of the Company and the Executive is that the terms of the PSU award will mirror the terms of that certain Performance Stock Unit Award Agreement dated May 20, 2024 to Paul Josephs under the Lifecore Biomedical, Inc. Equity Inducement Plan.

6.Confidentiality Agreement. As a condition of the Executive’s employment as Chief Financial Officer, the Executive is required to execute and deliver, on the Effective Date, a non-solicitation, confidentiality and inventions agreement in the form previously provided by the Company.

7.Termination of Employment. The Executive’s employment with the Company is on an “at will” basis, meaning that either the Executive or the Company may terminate the Executive’s employment and this Agreement at any time and for any reason, subject to the provisions of Section 8 and Section 9. Each of the Executive and the Company shall provide the other thirty (30) days prior written notice of any termination of the Executive’s employment, other than a termination for Cause, death or disability. Additionally, the Executive’s employment will terminate automatically upon the death of Executive or when Executive becomes disabled, meaning the Executive is unable to perform or expected to be unable to perform the essential functions of the Executive’s position under this Agreement with or without reasonable accommodation for a period of 180 days (which need not be consecutive) in any 12-month period.

8.Participation in CIC Severance Plan. The Executive will become a participant in the Company’s Executive Change in Control Severance Plan (as amended and as may be amended from time to time, the “CIC Severance Plan”) upon execution, on or before

the Effective Date, of a Participation Notice as provided in the CIC Severance Plan. The Participation Notice will provide that the Executive’s benefits under the CIC Severance Plan will be at the “Tier 2” level as described on Exhibit A to the CIC Severance Plan and will provide that the definition of “Good Reason” as used in the CIC Severance Plan will include the Company’s material breach of any provision of this Agreement. Notwithstanding anything in this Agreement or the CIC Severance Plan to the contrary, no amendment, modification, suspension, or termination of the CIC Severance Plan that reduces the benefits to which the Executive may become entitled under the CIC Severance Plan or under Section 9 from those benefits as of the Effective Date will apply to the Executive without the Executive’s express written consent.

9.Severance. As used in this section, the terms “Cause,” “Qualifying Termination,” and “Severance Benefits” have the meanings ascribed to them in the CIC Severance Plan. If the Executive’s employment is terminated by the Company without Cause (other than a Qualifying Termination) or the Company materially breaches the terms of this Agreement, the Executive will be entitled to the same Severance Benefits under the CIC Severance Plan as if the Executive had experienced a Qualifying Termination; provided that (a) the vesting of the PSUs described in Section 4(e)(ii) will not be accelerated and (b) the Executive must satisfy the conditions required by the CIC Severance Plan to receive Severance Benefits (including that the Executive execute a general release of claims as provided in the CIC Severance Plan and the Executive does not revoke or rescind such release). In no event will the Executive receive or be entitled to any duplication in the amount of or types of payments or benefits to the Executive in the event of termination of employment. The Executive will be provided, at the Company’s expense, with senior executive level outplacement services for a period of twelve (12) months from the date of termination. Notwithstanding the foregoing, the Executive will not be entitled to any Severance Benefits for the Company’s material breach of this Agreement unless (1) the Executive provides notice to the Company of the Company’s alleged material breach within 30 days of its occurrence; (2) the Company fails within 30 days (the “Cure Period”) from the date of such notice to remedy such breach; and (3) if such breach is not remedied, the Executive must resign within 20 days after the end of the Cure Period. If the Company remedies such conditions within the Cure Period, the Executive may withdraw his proposed termination or may resign with no benefits as a voluntary termination.

10.Other Roles. Contemporaneous with the termination of the Executive’s employment for any reason, unless otherwise requested by the Board, the Executive will resign from all officer and director positions with the Company and its affiliates and execute such documents as may be requested by the Company to confirm that resignation.

11.Notices. All notices, consents, waivers or other communications which are required or permitted hereunder will be sufficient if given in writing and delivered personally, by overnight mail service, by fax transmission (which is confirmed) or by registered or certified mail, return receipt requested, postage prepaid, to the parties at the addresses set forth below (or to such other addressee or address as will be set forth in a notice given in the same manner):

If to the Company: Lifecore Biomedical, Inc.

3515 Lyman Boulevard

Chaska, Minnesota 55318

Attn: Board of Directors

If to the Executive: Address contained in Company personnel records.

All such notices will be deemed to have been given three business days after mailing if sent by registered or certified mail, one business day after mailing if sent by overnight courier service, or on the date delivered or transmitted if delivered personally or sent by fax transmission.

12.Indemnification. The Executive will be indemnified during the Executive’s employment and after the end of the Executive’s employment in accordance with the provisions of the Company’s Certificate of Incorporation and Bylaws, the Delaware General Corporation Law, and the Company’s standard form of indemnification agreement to be entered into between the Company and the Executive effective as of the Effective Date.

13.Non-Disparagement. Both during the term of this Agreement and at all times thereafter, regardless of the reason for termination, the Executive shall not disparage the Company or any of its products, services, directors, officers, agents or employees, or otherwise take any action which could reasonably be expected to adversely affect the personal or professional reputation of the Company or any of its products, services, directors, officers, agents or employees. Similarly, the Company (meaning, solely for this purpose, the directors, executive officers and authorized spokespersons of the Company) will not disparage the Executive. Notwithstanding the foregoing, nothing in this Agreement will prohibit the Executive or the Company from (a) responding to any inquiry from, or providing truthful testimony before any self-regulatory organization or any state or federal regulatory authority, (b) making any other truthful disclosure required by law or legal process, or (c) defending any charge, action, investigation or proceeding initiated by or on behalf of the other.

14.Miscellaneous.

(a)No provision of this Agreement may be amended unless such amendment, modification or discharge is agreed to in writing signed by the parties hereto.

(b)No waiver by any party hereto of any breach of, or compliance with, any condition or provision of this Agreement by the other party shall be deemed a waiver of similar or dissimilar provisions or conditions at the same or at any prior or subsequent time. No such waiver shall be enforceable unless expressed in a written instrument executed by the party against whom enforcement is sought.

(c)This Agreement constitutes the entire agreement of the parties on the subject matter and no agreements or representations, oral or otherwise, expressed or implied, with respect to the subject matter hereof have been made by either party which are not set forth expressly in this Agreement. For the avoidance of doubt, any prior agreements or representations made by either party which are not set forth expressly in this Agreement, are hereby superseded. In the event of any conflict between this Agreement and any policy of the Company, the terms of this Agreement will control.

(d)This Agreement shall be binding upon and inure to the benefit of the Company, its successors and assigns, and the Executive and the Executive’s heirs, executors, administrators and legal representatives. The Company may not assign its rights and obligations under this Agreement to any person without the prior written consent of the Executive, except to a successor to the Company’s business that expressly adopts and agrees to be bound by this Agreement.

(e)This Agreement will be governed by, and construed in accordance with, the substantive laws of the State of Minnesota without regard to its conflict of law principles, unless a superseding Federal law is applicable. The Executive agrees that the state and federal courts located in the State of Minnesota, without regard to or application of conflict of laws principles, will have jurisdiction in any action, suit or proceeding based on or arising out of this Agreement, the documents referenced herein and the Executive’s employment relationship with the Company. The Executive hereby: (a) submits to the personal jurisdiction of such courts; (b) consent to service of process in connection with any action, suit or proceeding against the Executive; and (c) waive any other requirement (whether imposed by statute, rule of court or otherwise) with respect to personal jurisdiction, venue or service of process.

(f)This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original but all of which together shall constitute one and the same instrument.

(g)This Agreement has been jointly drafted by the respective representatives of the Company and the Executive and no party shall be considered as being responsible for such drafting for the purpose of applying any rule construing ambiguities against the drafter or otherwise. No draft of this Agreement shall be taken into account in construing this Agreement.

[Execution page follows]

IN WITNESS WHEREOF, the parties have executed this Agreement on the day and year indicated below, respectively, but effective as of the Effective Date.

Lifecore Biomedical, Inc.

/s/ Paul Josephs

Paul Josephs

Chief Executive Officer

Dated: August 28, 2024

/s/ Ryan D. Lake

Ryan D. Lake

Dated: August 28, 2024

Exhibit A

TERMS OF PSU AWARD

The PSUs will vest during a five year performance period based on achievement of the Performance Price, which is the average closing price of the Company’s common stock during at least 20 consecutive trading days within the five year performance period. Based on the Performance Price, the number of PSUs (if any) that will vest will be determined by the corresponding Performance Vesting Percentage, which will be a percentage ranging from 10%-100% in 10% increments corresponding to ten consecutive minimum Performance Prices from the following table:

| | |

| Performance Price |

$5.00 |

$7.50 |

$10.00 |

$12.50 |

$15.00 |

$17.50 |

$20.00 |

$22.50 |

$25.00 |

$30.00 |

$35.00 |

$40.00 |

The ten Performance Prices will be set on the Effective Date and will be the ten consecutive Performance Prices from the table above beginning with the Performance Price that is closest to, but exceeds, the volume weighted average price of the Company’s common stock for the 10 trading days prior to the Effective Date. By way of example, if the volume weighted average price of the Company’s common stock for the 10 trading days prior to the Effective Date was $6.35 per share, then the first Performance Price for the PSU award would be $7.50 with a 10% Performance Vesting Percentage and the last Performance Price would be $35.00 with a 100% Performance Vesting Percentage.

In no event will the Performance Vesting Percentage exceed 100% regardless of the Performance Price and in no event will the PSUs be vested with respect to any Performance Price on more than one occasion.

If a tranche of the PSU award vests during the five-year performance period following the Effective Date, the Company will issue the Executive unrestricted shares of the Company’s common stock on the vesting date in settlement of 50% of the vested portion of that tranche of the PSU award and will issue the Executive unrestricted shares of the Company’s common stock

on the one year anniversary of the vesting date in settlement of the other 50% of the vested portion of that tranche of the PSU award.

If, as of the last day of the five year performance period, there are any PSUs that have not vested, such unvested PSUs will be forfeited to the Company. If the Executive’s employment with the Company terminates during the performance period (other than a Qualifying Termination as described in the CIC Severance Plan or as described in Section 9 of the Agreement to which this Exhibit A is attached), all vested and unvested PSUs will be forfeited to the Company as of the date of such termination.

For the purposes of the CIC Severance Plan, the “target” level of performance for the PSUs will be based on the value of the per share consideration received by holders of the Company’s common stock in the Change in Control (as defined in the CIC Severance Plan). To the extent that the per share consideration for the Company’s common stock in such Change in Control transaction is between the prices in two of the tranches above, the PSU vesting will be prorated based on straight line calculation. For the avoidance of doubt, any shares of the Company’s common stock to be issued in connection with the vesting of the PSUs in connection with a Change in Control will be settled and deemed issued as of immediately prior to the Change in Control.

Lifecore Biomedical Announces Chief Financial Officer Transition August 29, 2024 Experienced CDMO Industry Financial Executive Ryan Lake Appointed CFO CHASKA, Minn., Aug. 29, 2024 (GLOBE NEWSWIRE) -- Lifecore Biomedical, Inc. (NASDAQ: LFCR) (“Lifecore” or the “Company”), a fully integrated contract development and manufacturing organization (“CDMO”), today announced that John Morberg will be stepping down from his position as chief financial officer to pursue other professional opportunities and spend time with his family, effective September 2, 2024. In addition, the Company is pleased to announce that Ryan Lake, an accomplished CDMO financial executive, will succeed Mr. Morberg as CFO beginning September 3, 2024. “On behalf of the board of directors, along with the entire Lifecore team, I would like to express our gratitude to John for his years of service as the Company’s chief financial officer. During his tenure, he has proven to be an invaluable member of leadership making significant contributions to the Company’s overall success, while also skillfully navigating the organization through numerous complex transactions as it transitioned into a dedicated CDMO,” said Paul Josephs, president and chief executive officer of Lifecore. “We wish John the best in all his future endeavors.” Mr. Josephs continued, “We are excited to bring Ryan on board at this important time for Lifecore as we work to refine and execute a comprehensive strategy to marry our unique strengths with the significant opportunities in the CDMO space in order to achieve sustained growth. Ryan’s impressive experience uniquely positions him for this role. Not only has he served as a successful public company CFO within the CDMO space, but he has also experienced firsthand the complexities of creating a dedicated CDMO from a larger organization with multiple business arms. These parallels with the Lifecore story equip him with valuable insight and experience that will serve the Company well on our exciting path forward.” During his career, Mr. Lake has been credited with leading and advising corporations through mergers, acquisitions, spin-offs, recapitalizations, integrations, equity, debt, and stock market transactions. He has raised over $700 million in capital and has participated in M&A transactions worth over $700 million in value. Mr. Lake has significant experience within the CDMO industry, having most recently served as the CFO of Societal CDMO, Inc., a company dedicated to solving complex formulation and manufacturing challenges primarily in small molecule therapeutic development, which was publicly traded on the Nasdaq Stock Market until its recent acquisition by CoreRx. “Our commitment to transparency and value creation has never been stronger,” said Mr. Josephs. “With Ryan joining us, we gain a leader whose exceptional skills in investor relations and financial strategy will be instrumental in steering Lifecore toward its next chapter of growth. Ryan’s proven ability to communicate effectively with stakeholders and manage complex financial operations will enhance our commitment to delivering long-term value.” As CFO of Societal CDMO (formerly Recro Pharma, Inc.), Mr. Lake played an instrumental role in strategically transitioning the company into a dedicated CDMO through the spin-off of the organization’s therapeutic pipeline development arm. Following this transaction, he was intimately involved in a comprehensive corporate rebranding and the creation and execution of a strategic plan to grow the company, adding critical new capabilities to its service offerings, and in turn expanding its customer base. Mr. Lake also led efforts to strengthen the company’s financial position, including leveraging non-core assets, and built visibility with key financial community stakeholders. These efforts helped contribute to the successful acquisition of Societal CDMO by CoreRx, another CDMO, in April 2024. Prior to his time with Societal, Mr. Lake served as CFO and vice president of finance of Aspire Bariatrics, Inc., a privately held, commercial-stage, medical device company. From 2012 to 2015, he held executive management and senior finance positions, including director of the natural materials division, controller and senior director of finance, at DSM Biomedical (successor to Kensey Nash after its acquisition in 2012), a division of Royal DSM (listed on Euronext Amsterdam), a global science-based company active in health, nutrition and materials. From 2002 to 2012, Mr. Lake served in various senior financial positions, most notably interim CFO and senior director of finance, with Kensey Nash Corporation, a Nasdaq-listed, medical device company. Earlier in his career, Mr. Lake worked at Deloitte & Touche, LLP. About Lifecore Biomedical Lifecore Biomedical, Inc. (Nasdaq: LFCR) is a fully integrated contract development and manufacturing organization (CDMO) that offers highly differentiated capabilities in the development, fill and finish of sterile injectable pharmaceutical products in syringes, vials, and cartridges, including complex formulations. As a leading manufacturer of premium, injectable-grade hyaluronic acid, Lifecore brings more than 40 years of expertise as a partner for global and emerging biopharmaceutical and biotechnology companies across multiple therapeutic categories to bring their innovations to market. For more information about the Company, visit Lifecore’s website at www.lifecore.com. Important Cautions Regarding Forward-Looking Statements This press release contains forward-looking statements regarding future events and our future results that are subject to the safe harbor created under the Private Securities Litigation Reform Act of 1995 and other safe harbors under the Securities Act of 1933 and the Securities Exchange Act of 1934. Words such as “anticipate”, “estimate”, “expect”, “project”, “plan”, “intend”, “believe”, “may”, “might”, “will”, “should”, “can have”, “likely” and similar expressions are used to identify forward-looking statements. In addition, all statements regarding our preliminary estimates of historical financial data for the Historical Periods, current operating and financial expectations in light of historical results, anticipated capacity and utilization, anticipated liquidity, and anticipated future customer relationships usage are forward-looking statements. All forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially, including such factors among others, as the Company’s ability to successfully enact its business strategies, including with respect to installation, capacity generation and its ability to attract demand for its services, and its ability expand its relationship with its existing customers or attract new customers; the impact of inflation on the Company’s business and financial condition;; changes in business conditions and general economic conditions both domestically and globally including rising interest rates and fluctuation in foreign

currency exchange rates; the Company’s ability to access to capital to fund its business strategies; and other risk factors set forth from time to time in the Company’s SEC filings, including, but not limited to, the Annual Report on Form 10-K for the year ended May 26, 2024 (the “2024 10-K”). For additional information about factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to our filings with the Securities and Exchange Commission, including the risk factors contained in the 2024 10-K. Forward-looking statements represent management’s current expectations as of the date hereof and are inherently uncertain. Except as required by law, we do not undertake any obligation to update forward-looking statements made by us to reflect subsequent events or circumstances. Lifecore Biomedical, Inc. Contact Information: Vida Strategic Partners Stephanie Diaz (Investors) 415-675-7401 sdiaz@vidasp.com Tim Brons (Media) 415-675-7402 tbrons@vidasp.com Source: Lifecore Biomedical, Inc.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

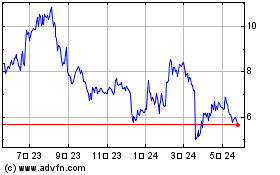

Lifecore Biomedical (NASDAQ:LFCR)

過去 株価チャート

から 11 2024 まで 12 2024

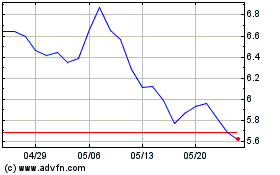

Lifecore Biomedical (NASDAQ:LFCR)

過去 株価チャート

から 12 2023 まで 12 2024