As filed with the Securities and Exchange

Commission on February 20, 2024

Registration No. 333-276669

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM F-3/A

Amendment No. 1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Jiuzi Holdings Inc.

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

4953 |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(Translation of Registrant’s

Name into English) |

|

(I.R.S. Employer

Identification No.) |

No.168

Qianjiang Nongchang Gengwen Road, 15th Floor

Economic

and Technological Development Zone

Xiaoshan

District, Hangzhou City

Zhejiang

Province 310000

People’s

Republic of China

+86-0571-82651956

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Puglisi

& Associates

850

Library Avenue

Suite

204

Newark,

Delaware 19711

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

With

a Copy to:

|

Joan

Wu, Esq.

Hunter

Taubman Fischer & Li LLC

950

Third Avenue, 19th Floor

New

York, NY 10022

212-530-2208 |

Approximate date of commencement

of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. ☒

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration

statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the

Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company

☒

If an emerging growth company

that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the

extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B)

of the Securities Act. ☐

† The term “new

or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting

Standards Codification after April 5, 2012.

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

The information in

this prospectus is not complete and may be changed. The selling shareholders named in this prospectus may not sell these securities until

the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to

sell these securities and the selling shareholders named in this prospectus are not soliciting offers to buy these securities in any

jurisdiction where the offer or sale is not permitted.

Subject to completion,

dated February 20, 2024

PROSPECTUS

Jiuzi Holdings Inc.

113,636,360 Ordinary Shares

This prospectus relates to 113,636,360 ordinary

shares of the Company, par value $0.00015 per share (“Ordinary Shares”) that may be sold from time to time by the selling

shareholders named in this prospectus, issued pursuant to certain Securities Purchase Agreement by and among us and certain non-affiliated

investors (the “Investors”), dated as of October 20, 2023 (the “Securities Purchase Agreement”).

We will not receive any of the proceeds from the

sale of our Ordinary Shares by the selling shareholders.

The selling shareholders named in this prospectus,

may sell all or a portion of the Ordinary Shares held by them and offered hereby from time to time directly or through one or more underwriters,

broker-dealers or agents. If the Ordinary Shares are sold through underwriters or broker-dealers, the selling shareholders will be responsible

for underwriting discounts or commissions or agent’s commissions. The Ordinary Shares may be sold in one or more transactions at

fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale or at negotiated prices.

We will bear all costs, expenses and fees in connection

with the registration of the Ordinary Shares offered hereby. For additional information on the methods of sale that may be used by the

selling shareholders, see “Plan of Distribution” beginning on page 23 of this prospectus.

Our ordinary shares are traded on the Nasdaq Capital Market under the

symbol “JZXN”. On February 16, 2024 the last reported sale price of our ordinary shares on Nasdaq Capital Market was $0.92

per ordinary share.

Any references to “Jiuzi” are

to Jiuzi Holdings Inc., the holding company and any references to “we”, “us”, “our Company,” “the

Company,” or “our” are to Jiuzi Holdings Inc. and its subsidiaries. We conduct operations through Zhejiang Jiuzi New

Energy Vehicles Co., Ltd., or Zhejiang Jiuzi, our operating subsidiary in China.

Jiuzi is a Cayman Islands incorporated

holding company and it does not conduct operations. Jiuzi conducts business through its subsidiaries in China. Investors are cautioned

that you are not buying shares of a China-based operating company but instead are buying shares of a Cayman Islands holding company with

operations conducted by its subsidiaries.

Jiuzi is

a Cayman Islands incorporated holding company, conducting business through its subsidiaries’ operations in China. Cash

is transferred through our organization in the manner as follows: (i) Jiuzi may transfer funds to the Jiuzi WFOE, through its Hong Kong

subsidiary, Jiuzi (HK) Limited, or Jiuzi HK, by additional capital contributions or shareholder loans, as the case may be; (ii) Jiuzi

WFOE may provide loans to Zhejiang Jiuzi, subject to statutory limits and restrictions; (iii) funds from Zhejiang Jiuzi to Jiuzi WFOE

are remitted as services fees; and (iv) Jiuzi WFOE may make dividends or other distributions to us through Jiuzi HK. Jiuzi is permitted

under the Cayman Islands laws to provide funding to our subsidiaries in Hong Kong and PRC through loans or capital contributions without

restrictions on the amount of the funds, subject to satisfaction of applicable government registration, approval and filing requirements.

Jiuzi HK is also permitted under the laws of Hong Kong to provide funding to Jiuzi through dividend distribution without restrictions

on the amount of the funds. Current PRC regulations permit our PRC subsidiaries to pay dividends to the Jiuzi HK only out of their accumulated

profits, if any, determined in accordance with Chinese accounting standards and regulations. As of the date of this prospectus, there

has been no distribution of dividends or assets among the holding company and the subsidiaries. Our Company and our subsidiaries do not

have any plan to distribute earnings in the foreseeable future. As of the date of this prospectus, none of our subsidiaries have made

any dividends or distributions to our Company and our Company has not made any dividends or distributions to our shareholders. We currently

intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate

declaring or paying any dividends in the foreseeable future. However, if we determine to pay dividends on any of our ordinary shares

in the future, as a holding company, we will be dependent on receipt of funds from Zhejiang Jiuzi by way of dividend payments. We currently

have not maintained any cash management policies that dictate the purpose, amount and procedure of cash transfers between the Company

and our subsidiaries. To the extent cash in the business is in the PRC or Hong Kong or our PRC or Hong Kong entity, the funds may not

be available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions

and limitations on the ability of us or our subsidiaries by the PRC government to transfer cash.

Under existing PRC foreign exchange regulations,

payment of current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made

in foreign currencies without prior approval from the State Administration of Foreign Exchange, or the SAFE, by complying with certain

procedural requirements. Therefore, our PRC subsidiaries are able to pay dividends in foreign currencies to us without prior approval

from SAFE, subject to the condition that the remittance of such dividends outside of the PRC complies with certain procedures under PRC

foreign exchange regulations, such as the overseas investment registrations by our shareholders or the ultimate shareholders of our corporate

shareholders who are PRC residents. Approval from, or registration with, appropriate government authorities is, however, required where

the RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated

in foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current

account transactions. Current PRC regulations permit our PRC subsidiaries to pay dividends to the Company only out of their accumulated

profits, if any, determined in accordance with Chinese accounting standards and regulations. As of the date of this prospectus, there

are no restrictions or limitations imposed by the Hong Kong government on the transfer of capital within, into and out of Hong Kong (including

funds from Hong Kong to the PRC), except for transfer of funds involving money laundering and criminal activities. Cayman Islands law

prescribes that a company may only pay dividends out of its profits. Other than that, there is no restrictions on Jiuzi’s ability

to transfer cash between us and our subsidiaries, or to investors. See “Prospectus Summary – Transfers of Cash to and from

Our Subsidiaries,” See “Transfers of Cash Between Our Company and Our Subsidiaries” and “Condensed Consolidating

Schedule and Consolidated Financial Statements” of the Prospectus Summary and “Prospectus Summary – Summary of Risk

Factors,” and “Risk Factors - Risks Related to Doing Business in China - To the extent cash or assets in the business is

in the PRC or Hong Kong or a PRC or Hong Kong entity, the funds or assets may not be available to fund operations or for other use outside

of the PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries

by the PRC government to transfer cash or assets,” and “Risk Factors - Risks Related to Doing Business in China - We rely

on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have,

and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material adverse effect on our ability

to conduct our business”.

Because of our corporate structure, we

are subject to risks due to uncertainty of the interpretation and the application of the PRC laws and regulations, including but not

limited to limitation on foreign ownership of internet technology companies, and regulatory review of oversea listing of PRC companies

through a special purpose vehicle. We are also subject to the risks of uncertainty about any future actions of the PRC government in

this regard. We may also be subject to sanctions imposed by PRC regulatory agencies including Chinese Securities Regulatory Commission

if we fail to comply with their rules and regulations. If the Chinese regulatory authorities disallow our holding company structure in

the future, it will likely result in a material change in our financial performance and our results of operations and/or the value of

our ordinary shares, which could cause the value of such securities to significantly decline or become worthless. For a detailed description

of the risks relating to our holding company structure, doing business in the PRC, and the offering as a result of the structure, see “Risk

Factors - Risks Related to Our Corporate Structure,” and “Risk Factors - Risks Related to Doing Business China” on

pages 10 and 11 of item 3. D of the 2022 Annual Report.

Additionally, we are subject to certain

legal and operational risks associated with Zhejiang Jiuzi’s operations in China. PRC laws and regulations governing our current

business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in the VIE’s

operations, significant depreciation of the value of our ordinary shares, or a complete hindrance of our ability to offer or continue

to offer our securities to investors. Recently, the PRC government initiated a series of regulatory actions and statements to regulate

business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing

supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the

scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions

are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new

laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact

such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list

on an U.S. or other foreign exchange. As of the date of this prospectus, neither we nor Zhejiang Jiuzi has been involved in any investigations

or received any inquiry, notice, warning, or sanctions regarding our continued listing and offering of securities from the China Securities

Regulatory Commission or any other PRC governmental authorities. Based on the advice of our PRC counsel, Zhejiang Taihang Law Firm, we

will not be subject to cybersecurity review with the Cyberspace Administration of China, or the “CAC,” pursuant to the Cybersecurity

Review Measures, which became effective on February 15, 2022 because (1) we currently do not have over one million users’ personal

information; (2) we do not collect data that affects or may affect national security and we do not anticipate that we will be collecting

over one million users’ personal information or data that affects or may affect national security in the foreseeable future, which

we understand might otherwise subject us to the Cybersecurity Review Measures. Since these statements and regulatory actions are newly

published, however, official guidance and related implementation rules have not been issued. It is highly uncertain what the potential

impact such modified or new laws and regulations will have on the daily business operations of our subsidiaries, our ability to accept

foreign investments, and our continued listing on an U.S. exchange. The Standing Committee of the National People’s Congress (the

“SCNPC”) or PRC regulatory authorities may in the future promulgate laws, regulations, or implementing rules that require

us or our subsidiaries to obtain regulatory approval from Chinese authorities for our continued listing in the U.S. In other words, although

the Company is currently not required to obtain permission from any of the PRC federal or local government to obtain such permission

and has not received any denial to list on the U.S. exchange, our operations could be adversely affected, directly or indirectly; our

ability to offer, or continue to offer, securities to investors would be potentially hindered and the value of our securities might significantly

decline or be worthless, by existing or future laws and regulations relating to its business or industry or by intervene or interruption

by PRC governmental authorities, if we or our subsidiaries (i) do not receive or maintain such permissions or approvals, (ii) inadvertently

conclude that such permissions or approvals are not required, (iii) applicable laws, regulations, or interpretations change and we are

required to obtain such permissions or approvals in the future, or (iv) any intervention or interruption by PRC governmental with little

advance notice. Our HK subsidiary is a holding company, and does not have any business operation. Therefore, we are not subject to various

regulations in HK, including regulations resulting in oversight over data security, regarding our business operations.

Furthermore,

on February 17, 2023, the China Securities Regulatory Commission (the “CSRC”) released the Trial Administrative Measures

of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”) and five supporting guidelines,

which took effect on March 31, 2023. Pursuant to the Trial Measures, if a domestic company fails to complete required filing procedures

or conceals any material fact or falsifies any major content in its filing documents, such domestic company may be subject to administrative

penalties, such as an order to rectify, warnings, fines, and its controlling shareholders, actual controllers, the person directly in

charge and other directly liable persons may also be subject to administrative penalties, such as warnings and fines. On the same day,

the CSRC also held a press conference for the release of the Trial Measures and issued the Notice on Administration for the Filing of

Overseas Offering and Listing by Domestic Companies, or the CSRC Notice, which, among others, clarifies that PRC domestic companies that

have already been listed overseas before the effective date of the Trial Measures, which is March 31, 2023, shall be deemed as Existing

Issuers, and Existing Issuers are not required to complete the filing procedures with the CSRC immediately, and they shall be required

to file with the CSRC for any subsequent offerings. Based on the foregoing, we are an Existing Issuer, and is required to file with the

CSRC for any subsequent offerings within three (3) working days after the completion of each offering. As confirmed by our PRC legal

counsel, Zhejiang Taihang Law Firm, the Selling Shareholders’ resale of the Ordinary Sales as described hereunder does not constitute

a “subsequent offering” under the CSRC rules and hence we are not required to complete the filing procedures with CSRC for

the Selling Shareholders’ resale. See “Risk Factors — Risks Related to Doing Business in China – The recent

joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable Act all

call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their

auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our offering.”

beginning on page 26 of the 2022 Annual Report.

Pursuant to the Holding Foreign Companies

Accountable Act, (the “HFCAA”), if the Public Company Accounting Oversight Board, or the PCAOB, is unable to inspect an issuer’s

auditors for three consecutive years, the issuer’s securities are prohibited to trade on a U.S. stock exchange. The PCAOB issued

a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public

accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more

authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken

by one or more authorities in Hong Kong. Furthermore, the PCAOB’s report identified the specific registered public accounting

firms which are subject to these determinations. On June 22, 2021, United States Senate has passed the Accelerating Holding Foreign

Companies Accountable Act (the “Accelerating HFCAA”), which, if enacted, would decrease the number of “non-inspection

years” from three years to two years, and thus, would reduce the time before our securities may be prohibited from trading or delisted

if the PCAOB determines that it cannot inspect or investigate completely our auditor. As of the date of the prospectus, Audit Alliance

LLP (“AA”), our current auditor, and WWC, P.C. (“WWC”), our former auditor, are not subject to the

determinations as to inability to inspect or investigate completely as announced by the PCAOB on December 16, 2021. On August 26, 2022,

the PCAOB announced that it had signed a Statement of Protocol (the “Statement of Protocol”) with the China Securities

Regulatory Commission and the Ministry of Finance of China. The terms of the Statement of Protocol would grant the PCAOB complete

access to audit work papers and other information so that it may inspect and investigate PCAOB-registered accounting firms headquartered

in China and Hong Kong. According to the PCAOB, its December 2021 determinations under the HFCAA remain in effect. The PCAOB is

required to reassess these determinations by the end of 2022. Under the PCAOB’s rules, a reassessment of a determination under

the HFCA Act may result in the PCAOB reaffirming, modifying or vacating the determination. However, recent developments with

respect to audits of China-based companies create uncertainty about the ability of AA or WWC to fully cooperate with the PCAOB’s

request for audit work papers without the approval of the Chinese authorities. In the event it is later determined that the PCAOB is

unable to inspect or investigate completely the Company’s auditor because of a position taken by an authority in a foreign jurisdiction,

then such lack of inspection could cause trading in the Company’s securities to be prohibited under the HFCAA ultimately result

in a determination by a securities exchange to delist the Company’s securities. See “Risk Factors — Risks Related

to Doing Business in China – The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the

Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies

upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments

could add uncertainties to our offering.” beginning on page 26 of the 2022 Annual Report.

Investing in our securities involves a

high degree of risk. You should carefully consider the risk factors beginning on page 17 of this prospectus and set forth in the

documents incorporated by reference herein before making any decision to invest in our securities.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus or any prospectus

supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 20,

2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus describes the general manner in

which the selling shareholders identified in this prospectus may offer from time to time up to 113,636,360 Ordinary Shares.

You should rely only on the information contained

in this prospectus and the related exhibits, any prospectus supplement or amendment thereto and the documents incorporated by reference,

or to which we have referred you, before making your investment decision. We have not, and the selling shareholders have not, authorized

any other person to provide you with different or additional information. If anyone provides you with different or inconsistent information,

you should not rely on it. This prospectus is not an offer to sell, nor are the selling shareholders seeking an offer to buy, the Ordinary

Shares offered by this prospectus in any jurisdiction where the offer or sale is not permitted. You should assume that the information

contained in this prospectus or in any applicable prospectus supplement is accurate only as of the date on the front cover thereof or

the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any applicable prospectus

supplement or any sales of the Ordinary Shares offered hereby or thereby.

If necessary, the specific manner in which the

Ordinary Shares may be offered and sold will be described in a supplement to this prospectus, which supplement may also add, update or

change any of the information contained in this prospectus. To the extent there is a conflict between the information contained in this

prospectus and any prospectus supplement, you should rely on the information in such prospectus supplement, provided that if any statement

in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated

by reference in this prospectus or any prospectus supplement—the statement in the document having the later date modifies or supersedes

the earlier statement.

Neither the delivery of this prospectus nor any

distribution of Ordinary Shares pursuant to this prospectus shall, under any circumstances, create any implication that there has been

no change in the information set forth or incorporated by reference into this prospectus or in our affairs since the date of this prospectus.

Our business, financial condition, results of operations and prospects may have changed since such date.

Except where the context otherwise requires and

for purposes of this prospectus only, “we,” “us,” “our,” “our company,” and the “Company”

refer to Jiuzi Holdings Inc. and its subsidiaries.

| ● | “Guangxi Zhitongche” refers to Guangxi Nanning

Zhitongche New Energy Technology Co., Ltd., a PRC company which is 90% owned by Hangzhou Zhitongche; |

| ● | “Hangzhou Zhitongche” refers to Hangzhou Zhitongche

Technology Co., Ltd., a PRC company wholly owned by Zhejiang Jiuzi; |

| ● | “Jiuzi HK” refers to Jiuzi (HK) Limited, a limited

liability company organized under the laws of Hong Kong; |

| ● | “Jiuzi New Energy” refers to Zhejiang Jiuzi New

Energy Network Technology Co., Ltd., a PRC company wholly owned by Zhejiang Jiuzi; |

| ● | “Jiuzi WFOE” refers to Zhejiang Navalant New Energy

Automobile Co. Ltd, a limited liability company organized under the laws of the PRC, which is wholly-owned by Jiuzi HK; |

| ● | “Shangli Jiuzi” refers to Shangli Jiuzi New Energy

Vehicles Co., Ltd., a PRC company and 59% owned subsidiary of Zhejiang Jiuzi; |

| ● | “Zhejiang Jiuzi” refers to Zhejiang Jiuzi New

Energy Vehicles Co., Ltd., a wholly owned subsidiary of Jiuzi WFOE in the PRC |

We have relied on statistics

provided by a variety of publicly available sources regarding China’s expectations of growth. We did not, directly or indirectly,

sponsor or participate in the publication of such materials, and these materials are not incorporated in this prospectus other than to

the extent specifically cited in this prospectus. We have sought to provide current information in this prospectus and believe that the

statistics provided in this prospectus remain up-to-date and reliable, and these materials are not incorporated in this prospectus other

than to the extent specifically cited in this prospectus.

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. All statements

contained in this prospectus other than statements of historical fact, including statements regarding our future results of operations

and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The

words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” and similar expressions are intended to identify forward-looking statements. We have based

these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may

affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives,

and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those

described in the “Risk Factors” section. Moreover, we operate in a very competitive and rapidly changing environment. New

risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors

on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those

contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and

trends discussed in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied

in the forward-looking statements.

You should not rely upon

forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may

not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot

guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, we undertake no duty

to update any of these forward-looking statements after the date of this prospectus or to conform these statements to actual results or

revised expectations.

INDUSTRY AND MARKET DATA

Unless otherwise indicated, information contained

in this prospectus concerning our industry and the market in which we operate, including our market position, market opportunity and market

size, is based on information from various sources, on assumptions that we have made based on such data and other similar sources and

on our knowledge of the markets for our products. These data sources involve a number of assumptions and limitations, and you are cautioned

not to give undue weight to such estimates.

We have not independently verified any third-party

information. While we believe the market position, market opportunity and market size information included in this prospectus is generally

reliable, such information is inherently imprecise. In addition, projections, assumptions and estimates of our future performance and

the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety

of factors, including those described in the section titled “Risk Factors” and elsewhere in this prospectus. These and other

factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

OUR COMPANY

Company Overview

This summary highlights information contained in the documents incorporated

herein by reference. Before making an investment decision, you should read the entire prospectus, and our other filings with the SEC,

including those filings incorporated herein by reference, carefully, including the sections entitled “Risk Factors” and “Special

Note Regarding Forward-Looking Statements.”

We, through Zhejiang Jiuzi, franchise and operate

retail stores under brand name “Jiuzi”, which sell new energy vehicles, or NEVs, in third-fourth tier cities in China. Almost

all of the NEVs we sell are battery-operated electric vehicles. We also sell a few plug-in electric vehicles on demand from vehicle buyers.

As of the date hereof, we have 31 operating franchise stores and one company-owned store in China. The business relationship between Jiuzi

and its independent franchisees is supported by adhering to standards and policies and is of fundamental importance to the overall performance

and protection of the “Jiuzi” brand.

Primarily a franchisor, our franchising model

enables an individual to be its own employer and maintain control over all employment-related matters, marketing and pricing decisions,

while also benefiting from our Jiuzi brand, resources and operating system. In collaboration with franchisees, we are able to further

develop and refine our operating standards, marketing concepts and product and pricing strategies.

Our revenues consist of (i) NEVs sales in our

company-owned store and NEVs sales supplied to our franchisees; (ii) initial franchisee fees of RMB 4,000,000, or approximately US$575,500,

for each franchise store, payable over time based on performance obligations of the parties, from our franchisees; and (iii) on-going

royalties based on 10% percent of net incomes from our franchisees. These fees, along with operating rights, are stipulated in our franchise

agreements.

We source NEVs through more than twenty NEV manufacturers,

including BYD, Geely, and Chery, as well as battery/component manufacturers such as Beijing Zhongdian Boyu, Shenzhen Jishuchongke and

Youbang Electronics which focus on manufacturing charging piles, and Guoxuan Gaoke, and Futesi in battery production. We are able to access

more brands and obtain more competitive pricing to attract potential franchisees and to meet customer demands. On the capital side, we

introduce franchisees to various capital platforms including Beijing Tianjiu Xingfu Control Group and Qinghua Qidi Zhixing, through which

our franchisees and their vehicle buyers can obtain financing. Our business partners help us in providing a variety of products and extend

our geographic reach.

Benefiting from favorable state policies subsidizing

the NEV industry, China’s NEVs production started flourishing around 2015 and 2016, pursuant to the 2016-2020 New Energy Vehicle

Promotion Fiscal Support Guidance and Notice regarding “the Thirteenth Five-year Plan” New Energy Vehicles Battery Infrastructure

Support Policy. In 2016, China released a series of financial subsidy policies targeted at NEV production. We conducted market research

in 2016 and eventually launched our business in 2017. We have built a full-scale modern business management operation, supported by our

operations department and marketing department. We aim to build an online-offline operating system in which our headquarters effectively

empowers our franchisees with our brand recognition, client source, financial support, operating and transportation assistance through

the online platform. Our fully-developed supply chain will provide solid support for store location expansion. Our franchisees’

conformity to Jiuzi’s standards will help us in our business expansion and implementation of our growth strategy.

We plan to adopt an innovative one-stop vehicle

sales model for our vehicle buyers, who is expected to have access to more brands, better services and more affordable pricing. Our current

business model is focused on vehicle selection and purchase, which provides buyers with multi-brand price comparison and test-driving

experience. Through the online platform, we are currently developing, we expect to provide a multi-dimensional service platform and a

one-stop experience covering online vehicle selection and purchase and off-line vehicle delivery and maintenance. Our app will provide

potential buyers with information on various car brands and models, as well as services to register vehicles, make appointments for maintenance,

repairs, and remote error diagnosis services, etc.

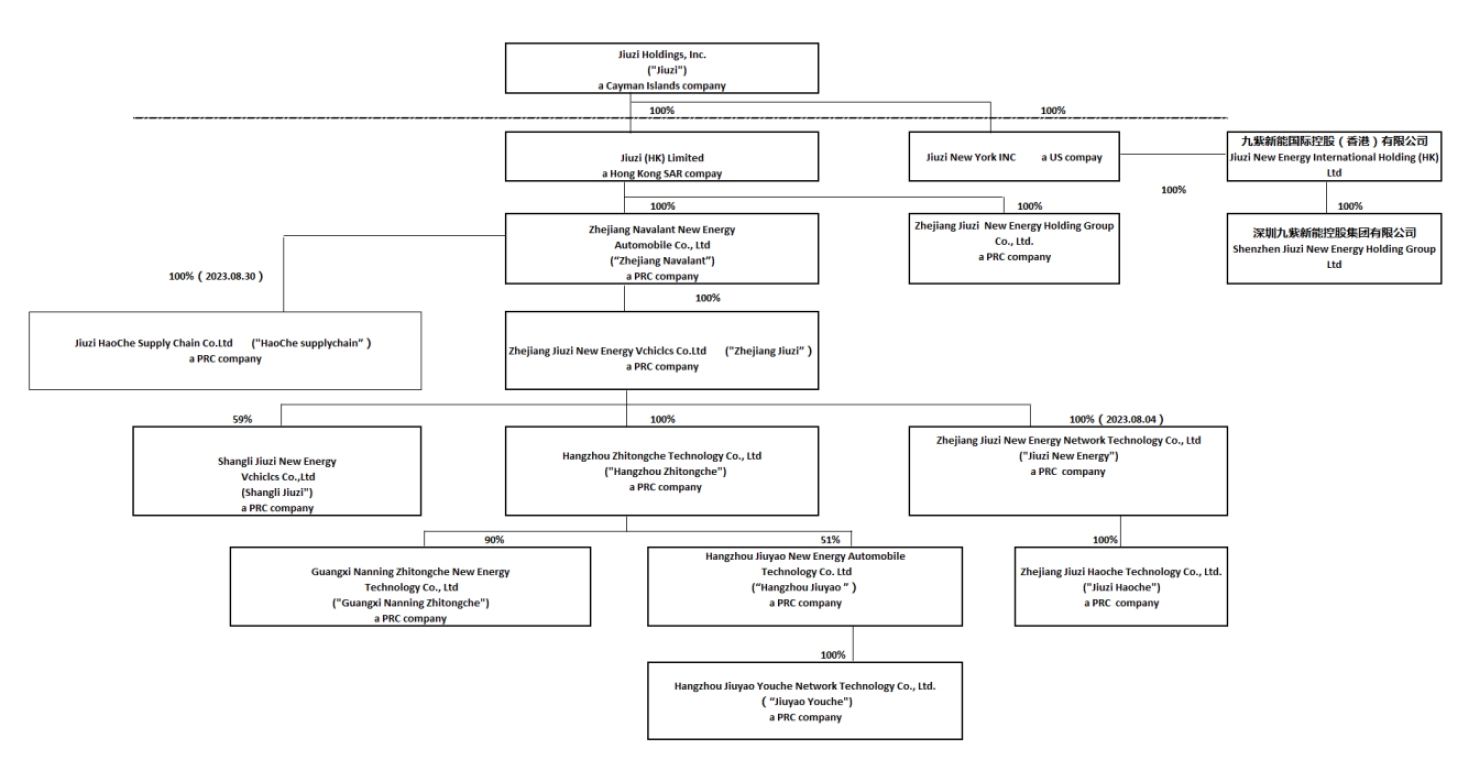

Organizational Structure

We are incorporated in

the Cayman Islands. As a holding company with no material operations of our own, we conduct our operations in China through our PRC Operating

Subsidiaries, Zhejiang Jiuzi New Energy Vehicles Co., Ltd., or Zhejiang Jiuzi.

“Risk Factors – Risks Related to Our Corporate Structure”

and “Risk Factors – Risks Related to Doing Business in China.”

The following diagram illustrates the corporate structure of our subsidiaries:

Subsidiaries

Jiuzi Holdings Inc. is

a Cayman Islands exempted company incorporated on October 10, 2019. We conduct our business in China through our PRC Operating Subsidiaries.

The consolidation of our Company and our PRC Operating Subsidiaries has been accounted for at historical cost and prepared on the basis

as if the aforementioned transactions had become effective as of the beginning of the first period presented in the accompanying consolidated

financial statements.

Jiuzi HK was incorporated

on October 25, 2019 under the law of Hong Kong SAR. Jiuzi HK is our wholly-owned subsidiary and is currently not engaging in any active

business and merely acting as a holding company.

Jiuzi WFOE was incorporated

on June 5, 2020 under the laws of the People’s Republic of China. It is a wholly-owned subsidiary of Jiuzi HK and a wholly foreign-owned

entity under the PRC laws. The registered principal activity of the company is new energy vehicle retail, new energy vehicle component

sales, new energy vehicle battery sales, vehicle audio equipment and electronics sales, vehicle ornament sales, technology service and

development, marketing planning, vehicle rentals, etc. Jiuzi WFOE had entered into contractual arrangements with Zhejiang Jiuzi and its

shareholders.

Zhejiang Jiuzi was incorporated

on May 26, 2017 under the laws of the People’s Republic of China. Its registered business scope includes wholesale and retail of

NEVs and NEV components, vehicle maintenance products, technology development of NEVs, Marketing and consulting regarding NEV products,

vehicle rentals, event organization, client services regarding vehicle registration, and online business technology. Its registered capital

amount is approximately $304,893 (RMB 2,050,000).

Shangli Jiuzi was incorporated

on May 10, 2018 under the laws of the People’s Republic of China. Its registered business scope is to engage in retailing NEVs,

NEV components, NEV batteries, NEV marketing, vehicle maintenance, used vehicle sales, and car rentals. Zhejiang Jiuzi is the beneficial

owner of 59% equity interest of Shangli Jiuzi. Shangli Jiuzi’s registered capital amount is approximately $1,412,789 (RMB 10,000,000).

Hangzhou Zhitongche was

incorporated on February 2, 2018 under the laws of the People’s Republic of China. Its registered business scope is technical service,

technology development, consultation and exchange, and NEV sales and leasing. On October 28, Zhejiang Jiuzi purchased 100% equity interest

of Hangzhou Zhitongche from its shareholders for a nominal consideration, and became the its beneficial owner. Hangzhou Zhitongche’s

registered capital amount is RMB 30,000,000.

Jiuzi New Energy was

incorporated on July 1, 2021 under the laws of the People’s Republic of China. Its registered business scope is software outsourcing

services, industrial internet data services, network and information security software development, artificial intelligence application

software development, and cloud computing equipment technical services, among others. Zhejiang Jiuzi is the beneficial owner of 100% equity

interest of Jiuzi New Energy. Jiuzi New Energy’s registered capital amount is RMB 10,000,000.

Guangxi Zhitongche was

incorporated on December 31, 2021 under the laws of the People’s Republic of China. Its registered business scope is technical service,

technology development, consultation and exchange, and NEV sales and leasing, auto parts retail, business management consulting and planning,

among others. Hangzhou Zhitongche is the beneficial owner of 90% equity interest of Guangxi Zhitongche. Guangxi Zhitongche’s registered

capital amount is approximately RMB1,000,000.

Hangzhou Jiuyao New Energy

Automobile Technology Co. Ltd. was incorporated on January 24, 2022 in PRC. Its scope of business includes technical service, technology

development, technical consultation and promotion, as well as sales of automobiles and new energy vehicles, and sales of electrical accessories

and accessories for new energy vehicles. Hangzhou Jiuyao is 51% owned by Hangzhou Zhitongche, as such Hangzhou Jiuyao is accounted as

a subsidiary of Zhejiang Jiuzi.; the remaining 49% equity interest is owned by unrelated third-party investors.

Hangzhou Jiuzi Haoche

Technology Co., Ltd. was incorporated on January 21, 2022 under the laws of the People’s Republic of China. Its registered business

scope is software outsourcing services, industrial internet data services, network and information security software development, artificial

intelligence application software development, technology development, consulting and transfer, market planning, convention planning,

and cloud computing equipment technical services. Hangzhou Jiuzi Haoche Technology Co., Ltd. is a wholly owned subsidiary of Jiuzi New

Energy and has a registered capital with the amount of RMB5,000,000.

The Restructuring

Prior to the restructuring

completed in January 20, 2023, Jiuzi WFOE entered into a series of VIE Agreements with Zhejiang Jiuzi and the shareholders of Zhejiang

Jiuzi, which established the former VIE structure.

As a result of the VIE

Agreements, Jiuzi WFOE was regarded as the primary beneficiary of Zhejiang Jiuzi, and we treated Zhejiang Jiuzi and its subsidiaries as

variable interest entities under U.S. GAAP for accounting purposes. We have consolidated the financial results of Zhejiang Jiuzi

and its subsidiaries in our consolidated financial statements in accordance with U.S. GAAP.

In November 2022, the

board of directors of the Company decided to dissolve the VIE structure. On November 10, 2022, Zhejiang Jiuzi entered into a termination

agreement (the “Termination Agreement”) with Jiuzi WFOE, pursuant to which the VIE agreements entered into among Zhejiang

Jiuzi, Jiuzi WFOE and certain shareholders of Zhejiang Jiuzi shall be terminated effective upon the conditions are met. On November 10,

2022, with approval of Jiuzi WFOE and approval of the board of directors of Zhejiang Jiuzi, Zhejiang Jiuzi issued 0.1% equity interest

in Zhejiang Jiuzi to a third-party investor. The issuance was completed on November 27, 2022. On January 20, 2023, Jiuzi WFOE exercised

its call option under the Exclusive Option Agreements dated June 15, 2020 with certain shareholder of Zhejiang Jiuzi and entered into

equity transfer agreements with all the shareholders of Zhejiang Jiuzi to purchase all the equity interest in Zhejiang Jiuzi. The transaction

underlying the equity transfer agreement was completed and the VIE Agreements were terminated pursuant to the Termination Agreement on

January 20, 2023. As a result, Zhejiang Jiuzi became a wholly owned subsidiary of Jiuzi WFOE and the VIE structure is dissolved.

Corporate Information

Our principal executive office is located at No.168

Qianjiang Nongchang Gengwen Road, Suite 1501, 15th Floor, Economic and Technological Development Zone, Xiaoshan District, Hangzhou City,

Zhejiang Province, China 310000. The telephone number of our principal executive offices is +86-0571-82651956. Our registered agent in

the Cayman Islands is Osiris International Cayman Limited. Our registered office and our registered agent’s office in the Cayman

Islands are both located at Suite #4-210, Governors Square, 23 Lime Tree Bay Avenue, PO Box 32311, Grand Cayman KY1-1209, Cayman Islands.

Our agent for service of process in the United States is Cogency Global Inc.

The SEC maintains an internet site at http://www.sec.gov

that contains reports, information statements, and other information regarding issuers that file electronically with the SEC.

CONDENSED CONSOLIDATING SCHEDULE AND CONSOLIDATED

FINANCIAL STATEMENTS

On January 20, 2023, Jiuzi WFOE exercised

its call option under the Exclusive Option Agreements dated June 15, 2020 with certain shareholder of Zhejiang Jiuzi and entered into

equity transfer agreements with all the shareholders of Zhejiang Jiuzi to purchase all the equity interest in Zhejiang Jiuzi. The transaction

underlying the equity transfer agreement was completed and the VIE Agreements were terminated pursuant to the Termination Agreement on

January 20, 2023. As a result, the VIE structure is dissolved and Zhejiang Jiuzi became a wholly owned subsidiary of Jiuzi WFOE.

The consolidated financial statements included

in this prospectus reflect financial position and cash flows of the registrant, Cayman Islands incorporated parent company, Jiuzi Holdings

Inc. together with those of its subsidiaries, on a consolidated basis. The tables below are condensed consolidating schedules summarizing

separately the financial position and cash flows of Jiuzi Holdings Inc. (“Cayman” in the tables below), Jiuzi HK (“HK”

in the tables below), Jiuzi WOFE (“WOFE” in the tables below) and Zhejiang Jiuzi and its subsidiaries (“Consolidated

subsidiaries” in the tables below), together with eliminating adjustments:

Consolidated Statements of Operations Information

| | |

For

the year ended October 31, 2022 | |

| | |

Cayman | | |

HK | | |

Elimination | | |

Subtotal | | |

WFOE | | |

Consolidated

Subsidiaries | | |

Elimination | | |

Subtotal | | |

Elimination | | |

Consolidated | |

| Revenues | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 6,215,718 | | |

| - | | |

| 6,215,718 | | |

| - | | |

| 6,215,718 | |

| Cost of revenues | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 6,458,162 | | |

| - | | |

| 6,458,162 | | |

| - | | |

| 6,458,162 | |

| Share of income (loss) from

subsidiaries | |

| (12,295,546 | ) | |

| (12,228,930 | ) | |

| 12,295,546 | | |

| (12,228,930 | ) | |

| (12,235,731 | ) | |

| - | | |

| 12,235,731 | | |

| - | | |

| 12,228,930 | | |

| - | |

| Net Income (loss) | |

| (16,832,101 | ) | |

| (12,295,546 | ) | |

| 12,295,546 | | |

| (16,832,101 | ) | |

| (12,228,930 | ) | |

| (12,235,731 | ) | |

| 12,235,731 | | |

| (12,228,930 | ) | |

| 12,228,930 | | |

| (16,832,101 | ) |

| Comprehensive income | |

| (18,429,093 | ) | |

| (13,610,922 | ) | |

| 13,610,922 | | |

| (18,429,093 | ) | |

| (13,544,304 | ) | |

| (12,358,696 | ) | |

| 12,358,696 | | |

| (13,544,304 | ) | |

| 13,544,304 | | |

| (18,429,093 | ) |

| | |

For

the year ended October 31, 2021 | |

| | |

Cayman | | |

HK | | |

Elimination | | |

Subtotal | | |

WFOE | | |

Consolidated

Subsidiaries | | |

Elimination | | |

Subtotal | | |

Elimination | | |

Consolidated | |

| Revenues | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 9,536,987 | | |

| - | | |

| 9,536,987 | | |

| - | | |

| 9,536,987 | |

| Cost of revenues | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,909,704 | | |

| - | | |

| 4,909,704 | | |

| - | | |

| 4,909,704 | |

| Share of income (loss) from

subsidiaries | |

| 1,307,998 | | |

| 1,455,984 | | |

| (1,307,998 | ) | |

| 1,455,984 | | |

| 1,433,167 | | |

| - | | |

| (1,433,167 | ) | |

| | | |

| (1,455,984 | ) | |

| - | |

| Net Income (loss) | |

| 778,037 | | |

| 1,307,998 | | |

| (1,307,998 | ) | |

| 778,037 | | |

| 1,455,984 | | |

| 1,433,167 | | |

| (1,433,167 | ) | |

| 1,455,984 | | |

| (1,455,984 | ) | |

| 778,037 | |

| Comprehensive income | |

| 778,037 | | |

| 1,307,998 | | |

| (1,307,998 | ) | |

| 778,037 | | |

| 1,488,184 | | |

| 2,008,024 | | |

| (1,433,167 | ) | |

| 2,063,041 | | |

| (1,455,984 | ) | |

| 1,385,094 | |

Consolidated Balance Sheets Information

| | |

As

of October 31, 2022 | |

| | |

Cayman | | |

HK | | |

Elimination | | |

Subtotal | | |

WFOE | | |

Consolidated

Subsidiaries | | |

Elimination | | |

Subtotal | | |

Elimination | | |

Consolidated | |

| Current assets | |

| 2,000,446 | | |

| 61,673 | | |

| - | | |

| 2,062,119 | | |

| 13,587 | | |

| 10,172,690 | | |

| - | | |

| 10,384,852 | | |

| - | | |

| 12,248,396 | |

| Intercompany receivables | |

| 10,878,595 | | |

| - | | |

| (10,575,297 | ) | |

| 303,298 | | |

| 9,073,749 | | |

| - | | |

| (9,073,749 | ) | |

| - | | |

| (303,298 | ) | |

| - | |

| Investments in subsidiaries | |

| (3,958,189 | ) | |

| 6,556,413 | | |

| 3,958,189 | | |

| 6,556,413 | | |

| (2,501,756 | ) | |

| - | | |

| 2,501,756 | | |

| - | | |

| (6,556,413 | ) | |

| - | |

| Non-current assets | |

| 6,920,406 | | |

| 6,556,413 | | |

| (6,617,108 | ) | |

| 6,859,711 | | |

| 6,571,991 | | |

| 3,077,780 | | |

| (6,571,993 | ) | |

| 2,879,203 | | |

| (6,859,711 | ) | |

| 3,077,780 | |

| Total assets | |

| 8,920,852 | | |

| 6,618,086 | | |

| (6,617,108 | ) | |

| 8,921,830 | | |

| 6,585,578 | | |

| 13,250,470 | | |

| (6,571,993 | ) | |

| 13,264,055 | | |

| - | | |

| 15,326,174 | |

| Intercompany payables | |

| - | | |

| 10,575,297 | | |

| (10,575,297 | ) | |

| - | | |

| - | | |

| 9,377,047 | | |

| (9,073,749 | ) | |

| 303,298 | | |

| (303,298 | ) | |

| - | |

| Total liabilities | |

| 2,839,632 | | |

| 10,576,275 | | |

| (10,575,297 | ) | |

| 2,840,610 | | |

| 29,165 | | |

| 15,752,226 | | |

| (9,073,749 | ) | |

| 6,707,642 | | |

| (303,298 | ) | |

| 9,244,954 | |

| Shareholders’ equity | |

| 6,081,220 | | |

| (3,958,189 | ) | |

| 3,958,189 | | |

| 6,081,220 | | |

| 6,556,413 | | |

| (2,501,756 | ) | |

| 2,501,756 | | |

| 6,556,413 | | |

| (6,556,413 | ) | |

| 6,081,220 | |

| | |

As

of October 31, 2021 | |

| | |

Cayman | | |

HK | | |

Elimination | | |

Subtotal | | |

WFOE | | |

Consolidated

Subsidiaries | | |

Elimination | | |

Subtotal | | |

Elimination | | |

Consolidated | |

| Current assets | |

| 3,930,303 | | |

| 365,515 | | |

| - | | |

| 4,295,818 | | |

| 2,638,437 | | |

| 15,285,949 | | |

| - | | |

| 17,924,386 | | |

| - | | |

| 22,220,204 | |

| Intercompany receivables | |

| 8,353,208 | | |

| - | | |

| (8,012,522 | ) | |

| 340,686 | | |

| 4,891,978 | | |

| - | | |

| (4,891,978 | ) | |

| - | | |

| (340,686 | ) | |

| - | |

| Investments in subsidiaries | |

| 10,045,861 | | |

| 17,692,868 | | |

| (10,045,861 | ) | |

| 17,692,868 | | |

| 10,163,310 | | |

| - | | |

| (10,163,310 | ) | |

| - | | |

| (17,692,868 | ) | |

| - | |

| Non-current assets | |

| 18,399,069 | | |

| 17,692,868 | | |

| (18,058,383 | ) | |

| 18,033,554 | | |

| 15,055,288 | | |

| 5,932,720 | | |

| (15,055,288 | ) | |

| 5,932,720 | | |

| (18,033,554 | ) | |

| 5,932,720 | |

| Total assets | |

| 22,329,372 | | |

| 18,058,383 | | |

| (18,058,383 | ) | |

| 22,329,372 | | |

| 17,693,725 | | |

| 21,218,669 | | |

| (15,055,288 | ) | |

| 23,857,106 | | |

| (18,033,554 | ) | |

| 28,152,924 | |

| Intercompany payables | |

| - | | |

| 8,012,522 | | |

| (8,012,522 | ) | |

| - | | |

| - | | |

| 5,232,664 | | |

| (4,891,978 | ) | |

| 340,686 | | |

| (340,686 | ) | |

| - | |

| Total liabilities | |

| - | | |

| 8,012,522 | | |

| (8,012,522 | ) | |

| - | | |

| 857 | | |

| 11,055,359 | | |

| (4,891,978 | ) | |

| 6,164,238 | | |

| (340,686 | ) | |

| 5,823,552 | |

| Shareholders’ equity | |

| 22,329,372 | | |

| 10,045,861 | | |

| (10,045,861 | ) | |

| 22,329,372 | | |

| 17,692,868 | | |

| 10,163,310 | | |

| (10,163,310 | ) | |

| 17,692,868 | | |

| (17,692,868 | ) | |

| 22,329,372 | |

Consolidated Cash Flows Information

| | |

For

the year ended October 31, 2022 | |

| | |

Cayman | | |

HK | | |

Elimination | | |

Subtotal | | |

WFOE | | |

Consolidated

Subsidiaries | | |

Elimination | | |

Subtotal | | |

Elimination | | |

Consolidated | |

| Net cash provided

by (used in) operating activities | |

| (3,190,669 | ) | |

| (66,617 | ) | |

| - | | |

| (3,257,286 | ) | |

| (5,309,275 | ) | |

| (306,089 | ) | |

| - | | |

| (5,615,364 | ) | |

| - | | |

| (8,872,650 | ) |

| Net cash provided by (used

in) investing activities | |

| - | | |

| (2,800,000 | ) | |

| - | | |

| (2,800,000 | ) | |

| - | | |

| 236,884 | | |

| - | | |

| 236,884 | | |

| 2,800,000 | | |

| 236,884 | |

| Net cash provided by (used

in) financing activities | |

| 3,742,490 | | |

| - | | |

| - | | |

| 3,742,490 | | |

| 2,800,000 | | |

| (115,742 | ) | |

| - | | |

| 2,684,258 | | |

| (2,800,000 | ) | |

| 3,626,748 | |

| | |

For

the year ended October 31, 2021 | |

| | |

Cayman | | |

HK | | |

Elimination | | |

Subtotal | | |

WFOE | | |

Consolidated

Subsidiaries | | |

Elimination | | |

Subtotal | | |

Elimination | | |

Consolidated | |

| Net cash provided

by (used in) operating activities | |

| (8,878,937 | ) | |

| 8,012,522 | | |

| - | | |

| (866,415 | ) | |

| (121,627 | ) | |

| (1,160,565 | ) | |

| - | | |

| (1,282,192 | ) | |

| (2,662,530 | ) | |

| (4,811,137 | ) |

| Net cash provided by (used

in) investing activities | |

| - | | |

| (7,500,000 | ) | |

| - | | |

| (7,500,000 | ) | |

| - | | |

| (1,485,306 | ) | |

| - | | |

| (1,485,306 | ) | |

| 7,500,000 | | |

| (1,485,306 | ) |

| Net cash provided by (used

in) financing activities | |

| 12,809,240 | | |

| - | | |

| - | | |

| 12,809,240 | | |

| 7,500,000 | | |

| 38,916 | | |

| - | | |

| 7,538,916 | | |

| (7,500,000 | ) | |

| 12,848,156 | |

Risk Factors Summary

Investing in our Company involves significant risks. You should carefully

consider all of the information in this prospectus before making an investment in our Company. Below please find a summary of the risks

and challenges we face organized under relevant headings. These risks are discussed more fully in the section titled “Item 3.D.

Risk Factors” in our 2022 Annual Report, as amended, on Form 20-F for the year ended October 31, 2022, which is incorporated in

this prospectus by reference.

Risks Related to Our Business and Industry

| ● | We rely on China’s automotive industry for our net

revenues and future growth, the prospects of which are subject to many uncertainties, including government regulations and policies.

See “Risk Factors- Risks Related to Our Business and Industry- We rely on China’s automotive industry for our net revenues

and future growth, the prospects of which are subject to many uncertainties, including government regulations and policies.” on

page 5 of the 2022 Annual Report. |

| ● | Our business is substantially dependent on our collaboration

with our suppliers, including automakers, auto dealers, and automotive service providers, and our agreements with them typically do not

contain long-term contractual commitments. See “Risk Factors- Risks Related to Our Business and Industry-Our business is substantially

dependent on our collaboration with our suppliers, including automakers, auto dealers, and automotive service providers, and our agreements

with them typically do not contain long-term contractual commitments” on page 5 of the 2022 Annual Report. |

| ● | We may be affected by the perceptions about electric vehicle

quality, safety, design, performance, and cost, especially if adverse events or accidents occur that are linked to the quality or safety

of electric vehicles, and the speed of the vehicles and battery performance. See “Risk Factors- Risks Related to Our Business and

Industry- We may be affected by the perceptions about electric vehicle quality, safety, design, performance, and cost, especially if

adverse events or accidents occur that are linked to the quality or safety of electric vehicles, and the speed of the vehicles and battery

performance.” on page 6 of the 2022 Annual Report. |

| ● | We may be affected by perceptions about vehicle safety in

general, particularly safety issues that may be attributed to the use of advanced technology, including electric vehicle and regenerative

braking systems, battery overheating issues, and periodic maintenance requirements. See “Risk Factors- Risks Related to Our Business

and Industry- We may be affected by perceptions about vehicle safety in general, particularly safety issues that may be attributed to

the use of advanced technology, including electric vehicle and regenerative braking systems, battery overheating issues, and periodic

maintenance requirements.” on page 6 of the 2022 Annual Report. |

| ● | We may be affected by the limited range over which electric

vehicles may be driven on a single battery charge and the speed at which batteries can be recharged. See “Risk Factors- Risks Related

to Our Business and Industry- We may be affected by the limited range over which electric vehicles may be driven on a single battery

charge and the speed at which batteries can be recharged.” on page 7 of the 2022 Annual Report. |

| ● | We may fail to successfully grow or operate our franchise

business as our franchisees may fail to operate the franchise stores effectively or we may be unable to maintain our relationships with

our franchisees. See “Risk Factors- Risks Related to Our Business and Industry- We may fail to successfully grow or operate our

franchise business as our franchisees may fail to operate the franchise stores effectively or we may be unable to maintain our relationships

with our franchisees.” on page 8 of the 2022 Annual Report. |

| ● | We may not be able to effectively monitor the operations

of franchise stores. See “Risk Factors- Risks Related to Our Business and Industry- We may not be able to effectively monitor the

operations of franchise stores.” on page 8 of the 2022 Annual Report. |

| ● | We may be affected by the limited range over which electric

vehicles may be driven on a single battery charge and the speed at which batteries can be recharged. See “Risk Factors- Risks Related

to Our Business and Industry- We may be affected by the limited range over which electric vehicles may be driven on a single battery

charge and the speed at which batteries can be recharged.” on page 7 of the 2022 Annual Report. |

| ● | Adverse publicity associated with our network marketing program,

or those of similar companies, could harm our financial condition and operating results. See “Risk Factors- Risks Related to Our

Business and Industry- Adverse publicity associated with our network marketing program, or those of similar companies, could harm our

financial condition and operating results.” on page 9 of the 2022 Annual Report. |

Risks Related to

Our Corporate Structure

| ● | Previous contractual arrangements in relation to the PRC

Operating Entities may be subject to scrutiny by the PRC tax authorities and they may determine that we or the PRC Operating Entities

owe additional taxes, which could negatively affect our financial condition and the value of your investment. See “Risk Factors-

Risks Related to Our Corporate Structure- Previous contractual arrangements in relation to the PRC Operating Entities may be subject

to scrutiny by the PRC tax authorities and they may determine that we or the PRC Operating Entities owe additional taxes, which could

negatively affect our financial condition and the value of your investment.” on page 10 of the 2022 Annual Report. |

| ● | We may lose the ability to use and enjoy assets held by our

PRC Operating Entities that are critical to the operation of our business if the any of the PRC Operating Entities declare bankruptcy

or become subject to a dissolution or liquidation proceeding. See “Risk Factors- Risks Related to Our Corporate Structure- We may

lose the ability to use and enjoy assets held by our PRC Operating Entities that are critical to the operation of our business if the

any of the PRC Operating Entities declare bankruptcy or become subject to a dissolution or liquidation proceeding.” on page 10

of the 2022 Annual Report. |

| ● | Our current corporate structure and business operations may

be substantially affected by the newly enacted Foreign Investment Law. See “Risk Factors- Risks Related to Our Corporate Structure-

Our current corporate structure and business operations may be substantially affected by the newly enacted Foreign Investment Law.”

on page 10 of the 2022 Annual Report. |

| ● | We are a holding company and will rely on dividends paid

by our subsidiaries for our cash needs. Any limitation on the ability of our subsidiaries to make dividend payments to us, or any tax

implications of making dividend payments to us, could limit our ability to pay our parent company expenses or pay dividends to holders

of our Ordinary Shares. See “Risk Factors-Risks Related to Doing Business in China- We are a holding company and will rely on dividends

paid by our subsidiaries for our cash needs. Any limitation on the ability of our subsidiaries to make dividend payments to us, or any

tax implications of making dividend payments to us, could limit our ability to pay our parent company expenses or pay dividends to holders

of our Ordinary Shares.” on page 10 of the 2022 Annual Report. |

| ● | The approval or filing requirement of the China Securities

Regulatory Commission may be required in connection with any future offing we may conduct, and, if required, we cannot predict whether

we will be able to obtain such approval or complete such filings. ability to pay our parent company expenses or pay dividends to holders

of our Ordinary Shares. See “Risk Factors- Risks Related to Our Corporate Structure- The approval or filing requirement of the

China Securities Regulatory Commission may be required in connection with any future offing we may conduct, and, if required, we cannot

predict whether we will be able to obtain such approval or complete such filings. ability to pay our parent company expenses or pay dividends

to holders of our ordinary shares.” on page 11 of the 2022 Annual Report. |

Risks Related to Doing Business in China

| ● | There are significant legal and other obstacles to obtaining

information needed for shareholder investigations or litigation outside China or otherwise with respect to foreign entities. See “Risk

Factors-Risks Related to Doing Business in China- There are significant legal and other obstacles to obtaining information needed for

shareholder investigations or litigation outside China or otherwise with respect to foreign entities.” on page 11 of the 2022 Annual

Report. |

| ● | PRC regulation of loans to, and direct investments in, PRC

entities by offshore holding companies may delay or prevent us from using proceeds from the offering and/or future financing activities

to make loans or additional capital contributions to our PRC operating subsidiaries. See “Risk Factors-Risks Related to Doing Business

in China- PRC regulation of loans to, and direct investments in, PRC entities by offshore holding companies may delay or prevent us from

using proceeds from the offering and/or future financing activities to make loans or additional capital contributions to our PRC operating

subsidiaries.” on page 12 of the 2022 Annual Report. |

| ● | Changes in China’s economic, political or social conditions

or government policies could have a material adverse effect on our business and results of operations. See “Risk Factors-Risks

Related to Doing Business in China- Changes in China’s economic, political or social conditions or government policies could have

a material adverse effect on our business and results of operations.” on page 14 of the 2022 Annual Report. |

| ● | Adverse changes in political and economic policies of the

PRC government could have a material adverse effect on the overall economic growth of China, which could reduce the demand for our products

and services and materially and adversely affect our competitive position. See “Risk Factors-Risks Related to Doing Business in

China- Adverse changes in political and economic policies of the PRC government could have a material adverse effect on the overall economic

growth of China, which could reduce the demand for our products and services and materially and adversely affect our competitive position.”

on page 14 of the 2022 Annual Report. |

| ● | Under the Enterprise Income Tax Law, we may be classified

as a “Resident Enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our

non-PRC stockholders. See “Risk Factors-Risks Related to Doing Business in China- Under the Enterprise Income Tax Law, we may be

classified as a “Resident Enterprise” of China. Such classification will likely result in unfavorable tax consequences to

us and our non-PRC stockholders.” on page 15 of the 2022 Annual Report. |

| ● | The PRC government imposes controls on the convertibility

of the RMB into foreign currencies and, in certain cases, the remittance of currency out of China. See “Risk Factors-Risks Related

to Doing Business in China-Governmental control of currency conversion may limit our ability to utilize our net revenues effectively

and affect the value of your investment” page 17 of the 2022 Annual Report. |

| ● | The Chinese

government exerts substantial influence over the manner in which we must conduct our business

activities. We are currently not required to obtain approval from Chinese authorities to

list on U.S exchanges, however, if our operating subsidiary or the holding company were required

to obtain approval in the future and were denied permission from Chinese authorities to list

on U.S. exchanges, we will not be able to continue listing on U.S. exchange, which would

materially affect the interest of the investors. See “Risk Factors- The Chinese government

exerts substantial influence over the manner in which we must conduct our business activities.

We are currently not required to obtain approval from Chinese authorities to list on U.S

exchanges, however, if our operating subsidiary or the holding company were required to obtain

approval in the future and were denied permission from Chinese authorities to list on U.S.

exchanges, we will not be able to continue listing on U.S. exchange, which would materially

affect the interest of the investors.” on page 19 of the of the 2022 Annual Report. |

| ● | The recent joint statement by the SEC and PCAOB, proposed

rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria

to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are

not inspected by the PCAOB. These developments could add uncertainties to our offering. See “Risk Factors-Risks Related to Doing

Business in China- The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign

Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing

the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add

uncertainties to our offering.” on page 26 of the 2022 Annual Report. |

| |

● |

Uncertainties

with respect to the PRC legal system, including uncertainties regarding the enforcement of laws, and sudden or unexpected changes

in laws and regulations in China could adversely affect us and limit the legal protections available to you and us at any time, which

could result in a material change in our operations and/or the value of our securities. See “Uncertainties with respect to

the PRC legal system, including uncertainties regarding the enforcement of laws, and sudden or unexpected changes in laws and regulations

in China could adversely affect us and limit the legal protections available to you and us at any time, which could result in a material

change in our operations and/or the value of our securities.” on page 18 of this prospectus. |

Risks Related to Our Securities and this

Offering

| ● | The trading price of the Ordinary Shares is volatile, which

could result in substantial losses to investors. See “Risk Factors-Risks Related to Our Ordinary Shares- The trading price of the

ordinary shares is volatile, which could result in substantial losses to investors.” on page 30 of the 2022 Annual Report. |

| ● | Techniques employed by short sellers may drive down the market

price of the Ordinary Shares. See “Risk Factors-Risks Related to Our Ordinary Share- Techniques employed by short sellers may drive

down the market price of the ordinary shares.” on page 31 of the 2022 Annual Report. |

| ● | Our memorandum and articles of association contain anti-takeover

provisions that could materially adversely affect the rights of holders of our Ordinary Shares. See “Risk Factors-Risks Related

to Our Ordinary Share- Our memorandum and articles of association contain anti-takeover provisions that could materially adversely affect

the rights of holders of our ordinary shares.” page 32 of the 2022 Annual Report. |

| ● | We are a foreign private issuer within the meaning of the

rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies. See “Risk

Factors-Risks Related to Our Ordinary Share- We are a foreign private issuer within the meaning of the rules under the Exchange Act,

and as such we are exempt from certain provisions applicable to U.S. domestic public companies.” on page 32 of the 2022 Annual

Report. |

| ● | To the extent cash or assets in the business is in the PRC

or Hong Kong or a PRC or Hong Kong entity, the funds or assets may not be available to fund operations or for other use outside of the

PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries and

the VIE by the PRC government to transfer cash or assets. See “Risk Factors- Risks Related to Our Securities and this Offering-

To the extent cash or assets in the business is in the PRC or Hong Kong or a PRC or Hong Kong entity, the funds or assets may not be

available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions

and limitations on the ability of us or our subsidiaries and the VIE by the PRC government to transfer cash or assets.” on page

17 of this registration statement. |

Legal and Operational Risks of Operating in the PRC

Jiuzi is a Cayman Islands incorporated holding

company, we are subject to certain legal and operational risks associated with Zhejiang Jiuzi’s operations in China. PRC laws and

regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material

change in Zhejiang Jiuzi’s operations, significant depreciation of the value of our ordinary shares, or a complete hinderance of

our ability to offer or continue to offer our securities to investors. Recently, the PRC government initiated a series of regulatory

actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities

in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure,

adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these

statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will

respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated,

if any, and the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to

accept foreign investments and list on an U.S. or other foreign exchange. As of the date of this prospectus, neither we nor Zhejiang

Jiuzi have been involved in any investigations or received any inquiry, notice, warning, or sanctions regarding our continued listing

from the China Securities Regulatory Commission or any other PRC governmental authorities. Based on the advice of our PRC counsel, Zhejiang

Taihang Law Firm, we will not be subject to cybersecurity review with the Cyberspace Administration of China, or the “CAC,”

pursuant to the Cybersecurity Review Measures, which became effective on February 15, 2022 because (1) we currently do not have over

one million users’ personal information; (2) we do not collect data that affects or may affect national security and we do not