Ebang International Holdings Inc. (Nasdaq: EBON, the “Company,”

“we” or “our”), today announced its unaudited financial results for

the first six months of fiscal year 2024.

Operational and Financial Highlights for

the First Six Months of Fiscal Year 2024

Total net revenues in the

first six months of 2024 were US$2.11 million, representing a

37.41% period-over-period decrease from US$3.38 million in the same

period of 2023.

Gross profit in the first

six months of 2024 was US$0.08 million compared to the gross profit

of US$0.28 million in the same period of 2023.

Net loss in the first six

months of 2024 was US$6.65 million compared to US$8.38 million in

the same period of 2023.

Dong Hu, Chairman and Chief Executive Officer of

the Company, commented, “Our financial results for the first half

of 2024 reflect our continuing efforts to transition our business

while we expand our products and services into industries that we

believe will be supported by our existing core technologies,

R&D expertise and manufacturing capacity. We are pleased with

the progress that we have been able to make, particularly as we

have faced and will continue to face challenges from macroeconomic

conditions, policy changes, market fluctuations, evolving or

shifting trends, and competition within the industry, that

contributed to both highlights and downturns in our financial

performance. We have been reflecting on our strengths and core

competencies and experience in design, R&D and manufacturing

and determined that there was an unmet need in the renewable energy

space for us to exploit, where we aim to integrate cutting-edge

technology into this market, with a particular focus on advanced

solar cell manufacturing.”

Continued Mr. Hu: “We believe that this year

will mark a significant turning point for us where we build on past

achievements and monetize our prior efforts. The transition will

begin paying off now that we have commenced our strategic entry

into the renewable energy sector. Our past experiences have

equipped us with invaluable expertise in R&D and manufacturing,

forming the core of our competitive advantage. These advanced

professional skills and substantial technological reserves have

become our foundation for mutual learning and collaboration across

various industries. We are resolute in our belief that

opportunities and challenges coexist and are committed to actively

expanding new business areas and commercial models while

maintaining strict control over operational costs to ensure the

Company’s sustainable and stable development. We believe that

through technological innovation, we can stand out and meet the

ever-growing and evolving market demands for this new industry

sector we’re pursuing, i.e. renewable energy production, and

contribute to the betterment of our planet and future.”

Unaudited Financial Results for the

First Six Months of Fiscal Year 2024

Total net revenues in the

first six months of 2024 were US$2.11 million, representing a

37.41% period-over-period decrease from US$3.38 million in the same

period of 2023. The period-over-period decrease in total net

revenues was due to changes in the market condition in the first

six months of 2024, which resulted in a decrease in service revenue

and product revenue in the first six months of 2024 as compared to

the same period of 2023.

Cost of revenues in the

first six months of 2024 was US$2.03 million, representing a 34.32%

period-over-period decrease from US$3.09 million in the same period

of 2023. The period-over-period decrease in cost of revenues was

mainly due to the impact of a decrease in impairment cost in

relation to products for the first six months of 2024, compared to

the same period in 2023.

Gross profit in the first

six months of 2024 was US$0.08 million, compared to the gross

profit of US$0.28 million in the same period of 2023.

Total operating

expenses in the first six months of 2024 were

US$12.50 million compared to US$13.64 million in the same period of

2023.

- Selling

expenses in the first six months of 2024 were US$0.66

million compared to US$0.75 million in the same period of 2023. The

period-over-period decrease in selling expenses was mainly caused

by decreased general advertising and marketing expenses related to

our Fintech business for the first six months of 2024.

- General and administrative

expenses in the first six months of 2024 were

US$11.84 million compared to US$12.89 million in the same period of

2023. The period-over-period decrease in general and administrative

expenses was mainly due to our optimization and streamlining of

business operations, including resource allocation, cost, and

expense control.

Loss from operations in

the first six months of 2024 was US$12.42 million compared to

US$13.35 million in the same period of 2023.

Interest income in the

first six months of 2024 was US$6.04 million compared to US$3.22

million in the same period of 2023. The period-over-period increase

in interest income was mainly caused by an increase in interest

rate for US dollar deposits and the Company had more fixed-term

deposit with large principals for the first six months of 2024,

compared to the same period in 2023.

Other income in the first

six months of 2024 was US$0.33 million compared to US$1.04 million

in the same period of 2023. The period-over-period decrease in

other income was mainly due to the Company taking possession of

customer deposits collected from previous years as a result of

defaults by customers under their respective contracts with the

Company for the first six months of 2023, while no such event

occurred in the first six months of 2024.

Other expense in the first

six months of 2024 was US$0.06 million compared to US$0.04 million

in the same period of 2023.

Net loss in the first six

months of 2024 was US$6.65 million compared to US$8.38 million in

the same period of 2023.

Net loss attributable to Ebang

International Holdings Inc. in the first six months

of 2024 was US$6.23 million compared to US$7.82 million in the same

period of 2023.

Basic and diluted net loss per

share in the first six months of 2024 were both

US$0.99 compared to US$1.25 in the same period of 2023.

About Ebang International Holdings

Inc.

Ebang International Holdings Inc. (Nasdaq: EBON)

is a global blockchain technology and Fintech company with strong

application-specific integrated circuit (ASIC) chip design and

manufacturing capability. Leveraging its deep understanding of the

Fintech industry and compliance with laws and regulations across

various jurisdictions, the Company has launched professional,

convenient and innovative Fintech service platforms. The Company

strives to diversify its business and products to increase

shareholder value and has begun to expand into the renewable energy

industry. For more information, please visit

https://ir.ebang.com/.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and as defined in the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, without limitation, the

Company’s development plans and business outlook, which can be

identified by terminology such as “may,” “will,” “expects,”

“anticipates,” “aims,” “potential,” “future,” “intends,” “plans,”

“believes,” “estimates,” “continue,” “likely to,” and other similar

expressions intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. Such statements are not historical facts, and

are based upon the Company’s current beliefs, plans and

expectations, and the current market and operating conditions.

Forward-looking statements include, but are not limited to,

statements regarding our future operating results and financial

position, our business strategy and plans, expectations relating to

our industry, the regulatory environment, market conditions, trends

and growth, expectations relating to customer behaviors and

preferences, our market position and potential market

opportunities, and our objectives for future operations.

Forward-looking statements involve inherent known or unknown risks,

uncertainties and other factors, all of which are difficult to

predict and many of which are beyond the Company’s control, which

may cause the Company’s actual results, performance and

achievements to differ materially from those contained in any

forward-looking statement. These risks and uncertainties include

our ability to successfully execute our business and growth

strategy and maintain future profitability, market acceptance of

our products and services, our ability to further penetrate our

existing customer base and expand our customer base, our ability to

develop new products and services, our ability to expand

internationally, our ability to successfully develop in the new

industry into which we expand, the success of any acquisitions or

investments that we make, the efforts of increased competition in

our markets, our ability to stay in compliance with applicable laws

and regulations, market conditions across the blockchain, Fintech

and general market, political and economic conditions. Further

information regarding these and other risks, uncertainties or

factors is included in the Company’s filings with the U.S.

Securities and Exchange Commission. These forward-looking

statements are made only as of the date indicated, and the Company

undertakes no obligation to update or revise the information

contained in any forward-looking statements as a result of new

information, future events or otherwise, except as required under

applicable law.

Investor Relations Contact

For investor and media inquiries, please contact:

Ebang International Holdings Inc.Email: ir@ebang.com

Ascent Investor Relations LLCMs. Tina XiaoTel: (917)

609-0333Email: tina.xiao@ascent-ir.com

|

|

|

|

EBANG INTERNATIONAL HOLDINGS INC.CONDENSED

CONSOLIDATED BALANCE

SHEETS (Unaudited)(Stated in

US dollars) |

|

|

|

|

|

|

|

June 30,2024 |

|

|

December 31,2023 |

|

| |

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

229,517,387 |

|

|

$ |

241,634,262 |

|

|

Restricted cash, current |

|

|

390,067 |

|

|

|

88,614 |

|

|

Short-term investments |

|

|

5,816,326 |

|

|

|

496,122 |

|

|

Accounts receivable, net |

|

|

817,150 |

|

|

|

946,514 |

|

|

Advances to suppliers (1) |

|

|

335,926 |

|

|

|

198,617 |

|

|

Inventories, net |

|

|

65,201 |

|

|

|

198,846 |

|

|

Prepayments |

|

|

48,643 |

|

|

|

304,453 |

|

|

Due from related parties |

|

|

580,319 |

|

|

|

- |

|

|

Other current assets, net |

|

|

6,012,936 |

|

|

|

5,691,679 |

|

| Total current

assets |

|

|

243,583,955 |

|

|

|

249,559,107 |

|

|

|

|

|

|

|

|

|

|

|

| Non-current

assets: |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

31,181,673 |

|

|

|

33,151,061 |

|

|

Intangible assets, net |

|

|

2,172,852 |

|

|

|

2,329,777 |

|

|

Operating lease right-of-use assets |

|

|

5,169,194 |

|

|

|

6,119,535 |

|

|

Operating lease right-of-use assets - related parties |

|

|

16,934 |

|

|

|

31,197 |

|

|

Restricted cash, non-current |

|

|

879,338 |

|

|

|

1,197,286 |

|

|

VAT recoverables |

|

|

3,963,629 |

|

|

|

4,061,079 |

|

|

Other assets (1) |

|

|

1,783,969 |

|

|

|

1,790,606 |

|

| Total non-current

assets |

|

|

45,167,589 |

|

|

|

48,680,541 |

|

|

|

|

|

|

|

|

|

|

|

| Total

assets |

|

$ |

288,751,544 |

|

|

$ |

298,239,648 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

150,966 |

|

|

$ |

292,570 |

|

|

Accrued liabilities and other payables |

|

|

8,887,387 |

|

|

|

9,804,848 |

|

|

Operating lease liabilities, current |

|

|

1,753,734 |

|

|

|

1,764,259 |

|

|

Operating lease liabilities - related parties, current |

|

|

16,160 |

|

|

|

28,849 |

|

|

Advances from customers |

|

|

56,587 |

|

|

|

69,361 |

|

| Total current

liabilities |

|

|

10,864,834 |

|

|

|

11,959,887 |

|

|

|

|

|

|

|

|

|

|

|

| Non-current

liabilities: |

|

|

|

|

|

|

|

|

|

Deferred tax liabilities |

|

|

53,944 |

|

|

|

74,225 |

|

|

Operating lease liabilities, non-current |

|

|

3,907,017 |

|

|

|

4,880,845 |

|

|

Operating lease liabilities – related parties, non-current |

|

|

774 |

|

|

|

2,347 |

|

| Total non-current

liabilities |

|

|

3,961,735 |

|

|

|

4,957,417 |

|

|

|

|

|

|

|

|

|

|

|

| Total

liabilities |

|

|

14,826,569 |

|

|

|

16,917,304 |

|

|

|

|

|

|

|

|

|

|

|

| Equity: |

|

|

|

|

|

|

|

|

|

Class A ordinary share, HKD0.03 par value, 11,112,474 shares

authorized, 4,989,746 shares issued, and 4,726,424 shares

outstanding as of June 30, 2024 and December 31, 2023 |

|

|

18,178 |

|

|

|

18,178 |

|

|

Class B ordinary share, HKD0.03 par value, 1,554,192 shares

authorized, issued and outstanding as of June 30, 2024 and December

31, 2023 |

|

|

5,978 |

|

|

|

5,978 |

|

|

Additional paid-in capital |

|

|

397,408,663 |

|

|

|

397,467,795 |

|

|

Statutory reserves |

|

|

11,079,649 |

|

|

|

11,079,649 |

|

|

Accumulated deficit |

|

|

(121,069,174 |

) |

|

|

(114,840,665 |

) |

|

Accumulated other comprehensive loss |

|

|

(14,493,243 |

) |

|

|

(13,887,088 |

) |

| Total Ebang

International Holdings Inc. shareholders’ equity |

|

|

272,950,051 |

|

|

|

279,843,847 |

|

| Non-controlling interest |

|

|

974,924 |

|

|

|

1,478,497 |

|

| Total

equity |

|

|

273,924,975 |

|

|

|

281,322,344 |

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and

equity |

|

$ |

288,751,544 |

|

|

$ |

298,239,648 |

|

|

(1 |

) |

Certain prior year amounts have been reclassified to conform to the

current period’s presentation. These reclassifications had no

impact on net earnings and financial position. |

|

|

|

|

EBANG INTERNATIONAL HOLDINGS INC.INTERIM

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONSAND

COMPREHENSIVE

LOSS(Unaudited)(Stated in US

dollars) |

|

|

|

|

| |

|

For the

six monthsended June

30,2024 |

|

|

For thesix

monthsendedJune

30,2023 |

|

| |

|

|

|

|

|

|

|

Product revenue |

|

$ |

359,498 |

|

|

$ |

1,146,384 |

|

|

Service revenue(1) |

|

|

1,754,376 |

|

|

|

2,231,023 |

|

|

Total revenues |

|

|

2,113,874 |

|

|

|

3,377,407 |

|

|

Cost of revenues |

|

|

2,032,038 |

|

|

|

3,093,730 |

|

|

Gross profit |

|

|

81,836 |

|

|

|

283,677 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Selling expenses |

|

|

657,507 |

|

|

|

745,381 |

|

|

General and administrative expenses |

|

|

11,841,322 |

|

|

|

12,891,709 |

|

|

Total operating expenses |

|

|

12,498,829 |

|

|

|

13,637,090 |

|

|

|

|

|

|

|

|

|

|

|

|

Gain from disposal of subsidiaries |

|

|

- |

|

|

|

(7,524 |

) |

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(12,416,993 |

) |

|

|

(13,345,889 |

) |

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses): |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

6,035,650 |

|

|

|

3,221,667 |

|

|

Other income |

|

|

333,151 |

|

|

|

1,042,669 |

|

|

Gain from investment |

|

|

3,104 |

|

|

|

803,605 |

|

|

Net gain (loss) on disposal of cryptocurrencies(1) |

|

|

(64,344 |

) |

|

|

708,935 |

|

|

Exchange loss |

|

|

(520,020 |

) |

|

|

(787,895 |

) |

|

Government grants |

|

|

27,854 |

|

|

|

12,800 |

|

|

Other expenses |

|

|

(61,744 |

) |

|

|

(43,518 |

) |

|

Total other income |

|

|

5,753,651 |

|

|

|

4,958,263 |

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes benefit |

|

|

(6,663,342 |

) |

|

|

(8,387,626 |

) |

|

|

|

|

|

|

|

|

|

|

|

Income taxes benefit |

|

|

17,928 |

|

|

|

3,349 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(6,645,414 |

) |

|

|

(8,384,277 |

) |

|

Less: net loss attributable to non-controlling interest |

|

|

(416,905 |

) |

|

|

(566,280 |

) |

|

Net loss attributable to Ebang International Holdings

Inc. |

|

$ |

(6,228,509 |

) |

|

$ |

(7,817,997 |

) |

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(6,645,414 |

) |

|

$ |

(8,384,277 |

) |

|

Other comprehensive loss: |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

(692,823 |

) |

|

|

(2,857,279 |

) |

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive loss |

|

|

(7,338,237 |

) |

|

|

(11,241,556 |

) |

|

Less: comprehensive loss attributable to

non-controlling interest |

|

|

(503,573 |

) |

|

|

(774,138 |

) |

|

Comprehensive loss attributable to Ebang International

Holdings Inc. |

|

$ |

(6,834,664 |

) |

|

$ |

(10,467,418 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss per ordinary share attributable to Ebang

International Holdings Inc. |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.99 |

) |

|

$ |

(1.25 |

) |

|

Diluted |

|

$ |

(0.99 |

) |

|

$ |

(1.25 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average ordinary shares outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

|

6,280,616 |

|

|

|

6,269,529 |

|

|

Dilute |

|

|

6,280,616 |

|

|

|

6,269,529 |

|

|

(1 |

) |

Certain prior year amounts have been reclassified to conform to the

current period’s presentation. These reclassifications had no

impact on net earnings and financial position. |

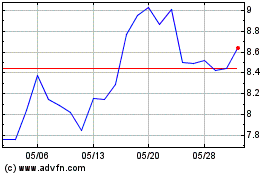

Ebang (NASDAQ:EBON)

過去 株価チャート

から 11 2024 まで 12 2024

Ebang (NASDAQ:EBON)

過去 株価チャート

から 12 2023 まで 12 2024