Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

2024年9月4日 - 9:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission file number: 001-39109

Fangdd Network Group Ltd.

Room 1501, Shangmei Technology Building

No. 15 Dachong Road

Nanshan District, Shenzhen, 518072

People’s Republic of China

Phone: +86 755 2699 8968

(Address and Telephone Number of Principal Executive

Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

EXHIBIT INDEX

Signature

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Fangdd Network Group Ltd. |

| |

|

| |

By: |

/s/ Xi Zeng |

| |

|

Name: |

Xi Zeng |

| |

|

Title: |

Chief Executive Officer and

Chairman of the Board of Directors |

Date: September 4, 2024

2

Exhibit 99.1

FANGDD ANNOUNCES FURTHER UPDATES ON ITS SUBSTITUTION

LISTING PLAN

SHENZHEN, China, September 4, 2024 (GLOBE NEWSWIRE)

-- Fangdd Network Group Ltd. (Nasdaq: DUO) (“FangDD” or the “Company”) today announced further updates on its

substitution listing plan.

As previously announced on June 3 and July 31,

2024, the Company intends to terminate its existing American depositary receipts facility and list its Class A ordinary shares for trading

on The Nasdaq Stock Market LLC (“Nasdaq”) in substitution for the American depositary shares (the “ADSs”) (the

“Substitution Listing”). The Company expects that, upon the effectiveness of the Substitution Listing, its ADSs will cease

to be listed on Nasdaq while the Class A ordinary shares represented by the ADSs will trade on Nasdaq under the symbol of “DUO.”

The Company has appointed VStock Transfer, LLC as its United States transfer agent (the “U.S. Transfer Agent”) for the Substitution

Listing.

To facilitate the Substitution Listing, The Bank

of New York Mellon (the “Depositary”) will call for the surrender of all ADSs to be exchanged into the Company’s Class

A ordinary shares on a mandatory basis (the “Mandatory Exchange”). For ADSs held by participants of The Depository Trust Company

(“DTC”), the Depositary will instruct the U.S. Transfer Agent to register a transfer of the number of deposited shares represented

by those ADSs to DTC for allocation by DTC to the participant accounts entitled to them; and for uncertificated ADSs held by owners other

than DTC, the Depositary will instruct the U.S. Transfer Agent to register transfers of the number of deposited shares represented by

uncertificated ADSs in the names of the respective owners.

The Company anticipates that the Mandatory

Exchange will not take effect on September 4, 2024, as initially scheduled. The Company is actively working with the Depositary,

DTC, Nasdaq and other related parties to finalize the plan of Mandatory Exchange and will announce the effective date as soon as it

becomes available. ADS holders do not need to take any action and the Depositary will not charge ADS holders any fees in connection

with the Mandatory Exchange. The Depositary will issue a notice regarding the Mandatory Exchange to supersede its prior notice

issued to ADS holders on July 30, 2024.

There remains uncertainty regarding whether and

when the Company will be able to obtain clearance from Nasdaq to effectuate the Mandatory Exchange and the Substitution Listing. Prior

to the exchange date, Nasdaq may suspend the trading of the Company’s ADSs until such time as the Mandatory Exchange and the Substitution

Listing shall have taken effect or as otherwise determined by Nasdaq.

About FangDD

Fangdd Network Group Ltd. (Nasdaq: DUO) is a customer-oriented

property technology company in China, focusing on providing real estate transaction digitalization services. Through innovative use of

mobile internet, cloud, big data, artificial intelligence, among others, FangDD has fundamentally revolutionized the way real estate transaction

participants conduct their business through a suite of modular products and solutions powered by SaaS tools, products and technology.

For more information, please visit http://ir.fangdd.com.

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by terminology such as “aim,” “anticipate,” “believe,”

“estimate,” “expect,” “hope,” “going forward,” “intend,” “ought to,”

“plan,” “project,” “potential,” “seek,” “may,” “might,” “can,”

“could,” “will,” “would,” “shall,” “should,” “is likely to” and

the negative form of these words and other similar expressions. Among other things, statements that are not historical facts, including

statements about the Company’s beliefs and expectations are or contain forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking

statement. All information provided in this press release is as of the date of this press release and is based on assumptions that the

Company believes to be reasonable as of this date, and the Company does not undertake any obligation to update any forward-looking statement,

except as required under applicable law.

Investor Relations Contact

Ms. Linda Li

Director, Capital Markets Department

Phone: +86-0755-2699-8968

E-mail: ir@fangdd.com

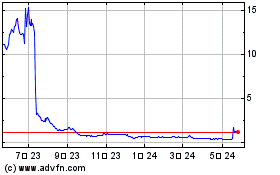

FangDD Network (NASDAQ:DUO)

過去 株価チャート

から 11 2024 まで 12 2024

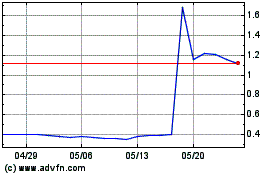

FangDD Network (NASDAQ:DUO)

過去 株価チャート

から 12 2023 まで 12 2024