false

0001053691

1

1

1

0

0

5.8

0.3

1.0

15.8

95.9

8.6

0

0

0

1

4

10

0

0

0

0

0

0

0

1

1

1

3

00010536912023-01-012023-12-31

thunderdome:item

xbrli:shares

0001053691us-gaap:SubsequentEventMember2024-02-262024-02-26

iso4217:USD

0001053691srt:ScenarioForecastMemberus-gaap:PrivatePlacementMember2024-03-282024-04-01

0001053691crvo:SeriesAWarrantMembersrt:ScenarioForecastMember2024-04-01

0001053691crvo:PrefundedWarrantMembersrt:ScenarioForecastMember2024-04-01

0001053691srt:ScenarioForecastMemberus-gaap:PrivatePlacementMember2024-04-01

0001053691us-gaap:StateAndLocalJurisdictionMemberus-gaap:ResearchMember2023-12-31

0001053691us-gaap:DomesticCountryMemberus-gaap:ResearchMember2023-12-31

0001053691us-gaap:StateAndLocalJurisdictionMember2023-12-31

0001053691us-gaap:DomesticCountryMember2023-12-31

00010536912022-12-31

00010536912023-12-31

xbrli:pure

00010536912022-01-012022-12-31

0001053691us-gaap:RestrictedStockUnitsRSUMembersrt:DirectorMember2023-12-31

0001053691us-gaap:RestrictedStockUnitsRSUMembersrt:DirectorMember2022-12-31

utr:Y

0001053691us-gaap:EmployeeStockOptionMember2023-01-012023-12-31

0001053691us-gaap:EmployeeStockOptionMember2023-12-31

00010536912023-01-012023-12-13

0001053691us-gaap:EmployeeStockOptionMember2022-01-012022-12-31

0001053691us-gaap:EmployeeStockOptionMembersrt:MaximumMember2023-01-012023-12-31

0001053691us-gaap:EmployeeStockOptionMembersrt:MinimumMember2023-01-012023-12-31

iso4217:USDxbrli:shares

00010536912021-12-31

0001053691us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-31

0001053691us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-31

0001053691us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-31

0001053691us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-31

0001053691crvo:The2018EmployeeDirectorAndConsultantEquityIncentivePlanMember2023-12-31

0001053691us-gaap:EmployeeStockOptionMembercrvo:The2018EmployeeDirectorAndConsultantEquityIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-012023-12-31

0001053691us-gaap:EmployeeStockOptionMembercrvo:The2018EmployeeDirectorAndConsultantEquityIncentivePlanMember2023-01-012023-12-31

0001053691crvo:EquityIncentivePlan2015Member2024-01-01

0001053691crvo:EquityIncentivePlan2015Member2023-12-31

0001053691crvo:EquityIncentivePlan2015Member2023-01-012023-12-31

0001053691crvo:SalesAgreementMember2023-12-31

0001053691crvo:PrefundedWarrantMember2023-12-31

0001053691crvo:HistoricalEIPCommonStockWarrantsMember2023-12-31

0001053691crvo:HistoricalDiffusionCommonStockWarrantsMembersrt:MaximumMember2023-12-31

0001053691crvo:HistoricalDiffusionCommonStockWarrantsMembersrt:MinimumMember2023-12-31

0001053691crvo:HistoricalDiffusionCommonStockWarrantsMember2023-12-31

00010536912023-07-012023-07-31

00010536912023-07-31

0001053691crvo:PrefundedWarrantsMember2023-08-16

0001053691crvo:ConversionOfPreferredStockIntoCommonStockMember2023-01-012023-12-31

0001053691crvo:ConversionOfDebtIntoCommonStockMember2023-01-012023-12-31

0001053691us-gaap:ConvertibleDebtMember2023-01-012023-12-31

0001053691crvo:ConversionOfDebtIntoCommonStockMember2023-08-162023-08-16

0001053691us-gaap:ConvertibleDebtMember2023-08-162023-08-16

0001053691crvo:PrefundedWarrantMember2023-06-30

0001053691us-gaap:ConvertibleDebtMember2023-06-30

0001053691us-gaap:ConvertibleDebtSecuritiesMember2022-04-01

0001053691us-gaap:ConvertibleDebtMembersrt:MaximumMember2023-12-31

0001053691us-gaap:ConvertibleDebtMembersrt:MinimumMember2023-12-31

0001053691us-gaap:ConvertibleDebtSecuritiesMember2023-12-31

0001053691us-gaap:ConvertibleDebtSecuritiesMember2022-06-30

0001053691us-gaap:ConvertibleDebtMember2022-01-012022-12-31

0001053691crvo:The2021NotesMember2021-12-012021-12-31

0001053691crvo:The2020NotesMember2020-12-012020-12-31

0001053691us-gaap:LineOfCreditMember2022-12-31

0001053691us-gaap:LineOfCreditMember2023-12-31

0001053691us-gaap:LineOfCreditMembercrvo:LIBORMember2020-01-012020-12-31

0001053691us-gaap:LineOfCreditMember2020-12-31

0001053691us-gaap:SubsequentEventMembercrvo:NationalInstituteOfAgingGrantMember2024-01-012024-01-01

0001053691us-gaap:SubsequentEventMembercrvo:NationalInstituteOfAgingGrantMember2024-02-012024-02-29

0001053691crvo:NationalInstituteOfAgingGrantMember2023-12-31

0001053691crvo:NationalInstituteOfAgingGrantMember2023-01-012023-12-31

0001053691srt:ScenarioForecastMembercrvo:NationalInstituteOfAgingGrantMember2025-01-012025-12-31

0001053691srt:ScenarioForecastMembercrvo:NationalInstituteOfAgingGrantMember2024-01-012024-12-31

0001053691crvo:NationalInstituteOfAgingGrantMember2023-01-31

0001053691crvo:VertexOptionAndLicenseAgreementMember2022-01-012022-12-31

0001053691crvo:VertexOptionAndLicenseAgreementMember2023-01-012023-12-31

0001053691crvo:VertexOptionAndLicenseAgreementMember2014-08-012014-08-31

0001053691crvo:VertexOptionAndLicenseAgreementMember2014-08-31

0001053691crvo:MergerAgreementMember2023-08-16

00010536912023-08-16

0001053691us-gaap:EmployeeStockOptionMember2022-01-012022-12-31

0001053691us-gaap:EmployeeStockOptionMember2023-01-012023-12-31

0001053691us-gaap:WarrantMember2022-01-012022-12-31

0001053691us-gaap:WarrantMember2023-01-012023-12-31

0001053691us-gaap:SeriesBPreferredStockMember2022-01-012022-12-31

0001053691us-gaap:SeriesBPreferredStockMember2023-01-012023-12-31

0001053691crvo:SeriesA2PreferredStockMember2022-01-012022-12-31

0001053691crvo:SeriesA2PreferredStockMember2023-01-012023-12-31

0001053691crvo:SeriesA1PreferredStockMember2022-01-012022-12-31

0001053691crvo:SeriesA1PreferredStockMember2023-01-012023-12-31

0001053691us-gaap:ConvertibleDebtMemberus-gaap:MeasurementInputCostToSellMember2023-12-31

0001053691us-gaap:ConvertibleDebtMemberus-gaap:MeasurementInputPriceVolatilityMember2023-12-31

0001053691us-gaap:ConvertibleDebtMemberus-gaap:MeasurementInputExpectedTermMember2023-12-31

0001053691us-gaap:FairValueInputsLevel3Member2022-12-31

0001053691us-gaap:FairValueInputsLevel3Member2023-12-31

0001053691us-gaap:FairValueInputsLevel3Member2022-01-012022-12-31

0001053691us-gaap:FairValueInputsLevel3Member2023-01-012023-12-31

0001053691us-gaap:FairValueInputsLevel3Member2021-12-31

0001053691us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-31

0001053691us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-31

0001053691us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-31

0001053691us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001053691us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001053691us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-31

0001053691crvo:MergerAgreementMember2023-08-162023-08-16

00010536912023-01-012023-01-31

0001053691crvo:RewinDLBTrialMember2023-01-31

0001053691crvo:PrefundedWarrantsMember2023-09-30

0001053691crvo:ReverseStockSplitMember2023-08-162023-08-16

0001053691crvo:ConversionOfDebtIntoCommonStockMember2022-01-012022-12-31

0001053691us-gaap:RetainedEarningsMember2023-12-31

0001053691us-gaap:AdditionalPaidInCapitalMember2023-12-31

0001053691us-gaap:CommonStockMember2023-12-31

0001053691us-gaap:PreferredStockMember2023-12-31

0001053691us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredStockMember2023-12-31

0001053691crvo:SeriesA2PreferredStockMemberus-gaap:PreferredStockMember2023-12-31

0001053691crvo:SeriesA1PreferredStockMemberus-gaap:PreferredStockMember2023-12-31

0001053691us-gaap:RetainedEarningsMember2023-01-012023-12-31

0001053691us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-31

0001053691us-gaap:CommonStockMember2023-01-012023-12-31

0001053691us-gaap:PreferredStockMember2023-01-012023-12-31

0001053691us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredStockMember2023-01-012023-12-31

0001053691crvo:SeriesA2PreferredStockMemberus-gaap:PreferredStockMember2023-01-012023-12-31

0001053691crvo:SeriesA1PreferredStockMemberus-gaap:PreferredStockMember2023-01-012023-12-31

0001053691us-gaap:RetainedEarningsMember2022-12-31

0001053691us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001053691us-gaap:CommonStockMember2022-12-31

0001053691us-gaap:PreferredStockMember2022-12-31

0001053691us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredStockMember2022-12-31

0001053691crvo:SeriesA2PreferredStockMemberus-gaap:PreferredStockMember2022-12-31

0001053691crvo:SeriesA1PreferredStockMemberus-gaap:PreferredStockMember2022-12-31

0001053691us-gaap:RetainedEarningsMember2022-01-012022-12-31

0001053691us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-31

0001053691us-gaap:CommonStockMember2022-01-012022-12-31

0001053691us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredStockMember2022-01-012022-12-31

0001053691crvo:SeriesA2PreferredStockMemberus-gaap:PreferredStockMember2022-01-012022-12-31

0001053691crvo:SeriesA1PreferredStockMemberus-gaap:PreferredStockMember2022-01-012022-12-31

0001053691us-gaap:RetainedEarningsMember2021-12-31

0001053691us-gaap:AdditionalPaidInCapitalMember2021-12-31

0001053691us-gaap:CommonStockMember2021-12-31

0001053691us-gaap:PreferredStockMember2021-12-31

0001053691us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredStockMember2021-12-31

0001053691crvo:SeriesA2PreferredStockMemberus-gaap:PreferredStockMember2021-12-31

0001053691crvo:SeriesA1PreferredStockMemberus-gaap:PreferredStockMember2021-12-31

0001053691us-gaap:SeriesBPreferredStockMember2022-12-31

0001053691us-gaap:SeriesBPreferredStockMember2023-12-31

0001053691crvo:SeriesA2PreferredStockMember2022-12-31

0001053691crvo:SeriesA2PreferredStockMember2023-12-31

0001053691crvo:SeriesA1PreferredStockMember2022-12-31

0001053691crvo:SeriesA1PreferredStockMember2023-12-31

0001053691crvo:SeriesPreferredStockMember2022-12-31

0001053691crvo:SeriesPreferredStockMember2023-12-31

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON MAY 10, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________

CERVOMED INC.

(Exact name of registrant as specified in its charter)

____________________

|

Delaware

|

2834

|

30-0645032

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(IRS Employer

Identification No.)

|

20 Park Plaza, Suite 424

Boston, MA 02116

Tel: (617) 744-4400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

____________________

John Alam, M.D.

Chief Executive Officer

20 Park Plaza, Suite 424

Boston, MA 02116

Tel: (617) 744-4400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

____________________

Copies to:

William C. Hicks

Jason S. McCaffrey

Mintz, Levin, Cohn, Ferris, Glovsky & Popeo, P.C.

One Financial Center

Boston, Massachusetts 02111

Telephone: (617) 542-6000

____________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non- accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

| |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS—SUBJECT TO COMPLETION, DATED MAY 10, 2024

5,064,570 Shares of Common Stock

___________________

This prospectus relates to the resale from time to time, by the selling stockholders identified in this prospectus or their donees, pledgees, assignees, transferees, distributees or other successors-in-interest (the “selling stockholders”) of up to an aggregate of 5,064,570 shares of our common stock, par value $0.001 per share (the “Common Stock” or “common stock”), issued by us in a private placement on April 1, 2024 (the “2024 Private Placement”), or, with respect to the Warrant Shares (as defined below), issuable by us pursuant to the Warrants (as defined below) issued by us in the 2024 Private Placement, consisting of (i) 2,083,262 shares of our Common Stock (the “PIPE Shares”), (ii) 449,023 shares of our Common Stock issuable upon the exercise of pre-funded warrants (the “Pre-Funded Warrants”) to purchase shares of our common stock held by a selling stockholder (the “Pre-Funded Warrant Shares”), and (iii) 2,532,285 shares of our Common Stock issuable upon the exercise of outstanding Series A warrants (the “Series A Warrants,” and collectively with the Pre-Funded Warrants, the “Warrants”) to purchase shares of our Common Stock held by the selling stockholders (the “Series A Warrant Shares,” and together with the Pre-Funded Warrant Shares, the “Warrant Shares”).

We are not selling any shares of Common Stock under this prospectus and will not receive any proceeds from the sale by the selling stockholders of such shares. We will, however, receive the net proceeds of any Warrants exercised for cash. We are paying the cost of registering the shares of Common Stock covered by this prospectus as well as various related expenses. The selling stockholders are responsible for any underwriting discounts and selling commissions and/or similar charges incurred in connection with the sale of the shares.

Sales of the shares by the selling stockholders may occur at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices. The selling stockholders may sell shares to or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions from the selling stockholders, the purchasers of the shares, or both. See “Plan of Distribution” beginning on page 112 in this prospectus.

Our Common Stock is listed on the NASDAQ Capital Market under the symbol “CRVO.” On May 9, 2024, the closing price of our Common Stock was $23.90.

Investing in our securities involves risks. See “Risk Factors” beginning on page 9 of this prospectus for a discussion of the factors you should carefully consider before deciding to purchase these securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

| |

Page

No.

|

| |

|

|

About This Prospectus

|

1

|

|

Introductory Notes

|

2

|

|

Prospectus Summary

|

5

|

|

Risk Factors

|

9

|

|

Cautionary Note Regarding Forward-Looking Statements

|

47

|

|

Use of Proceeds

|

48

|

|

Market Information and Dividend Policy

|

49

|

|

Management’s Discussion and Analysis and Results of Operations

|

50

|

|

Business

|

57

|

|

Management

|

90

|

|

Executive and Director Compensation

|

99

|

|

Certain Relationships and Related Party Transactions

|

106

|

|

Security Ownership of Certain Beneficial Owners and Management

|

108

|

|

Selling Stockholders

|

110

|

|

Plan of Distribution

|

112

|

|

Description of Capital Stock

|

114

|

|

Legal Matters

|

118

|

|

Experts

|

118

|

|

Where You Can Find More Information

|

118

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (“SEC”). As permitted by the rules and regulations of the SEC, the registration statement filed by us includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at the SEC’s website or its offices, as described below under the heading “Where You Can Find More Information”.

You should rely only on the information contained in this prospectus. We have not authorized any person to provide you with information different from that contained in this prospectus. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies, regardless of the time of delivery of this prospectus or of any sale of the securities offered hereby. Our business, financial condition, results of operations, and prospects may have changed since that date. We do not take any responsibility for, nor do we provide any assurance as to the reliability of, any information other than the information in this prospectus. Neither the delivery of this prospectus nor the sale of our Common Stock means that information contained in this prospectus is correct after the date of this prospectus. You should not consider this prospectus to be an offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation relating to the securities is not authorized. Furthermore, you should not consider this prospectus to be an offer or solicitation relating to the securities if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive such an offer or solicitation.

Neither we nor the selling stockholders are offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted. We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities as to distribution of the prospectus outside of the United States.

INTRODUCTORY NOTES

Note Regarding Company References and Other Defined Terms

As previously disclosed in our Current Report on Form 8-K filed on August 17, 2023 with the SEC, on August 16, 2023, the Delaware corporation formerly known as “Diffusion Pharmaceuticals Inc.” completed a merger transaction in accordance with the terms and conditions of the Agreement and Plan of Merger, dated March 30, 2023 (the “Merger Agreement”) by and among Diffusion Pharmaceuticals Inc. (“Diffusion”), Dawn Merger Inc., a wholly-owned subsidiary of Diffusion (“Merger Sub”) and EIP Pharma, Inc. (“EIP”), pursuant to which Merger Sub merged with and into EIP, with EIP surviving the Merger a wholly-owned subsidiary of Diffusion (the “Merger”). Additionally, on August 16, 2023, Diffusion changed its name from “Diffusion Pharmaceuticals Inc.” to “CervoMed Inc.”

Prior to the Effective Time (as defined below), in connection with the transactions contemplated by the Merger Agreement, Diffusion effected a reverse stock split of the Company’s common stock, par value $0.001 per share (“Common Stock” or “common stock”), at a ratio of 1-for-1.5 (the “Reverse Stock Split”). At the Effective Time, each outstanding share of EIP capital stock was converted into the right to receive 0.1151 shares of Company common stock.

For accounting purposes, the Merger is treated as a reverse recapitalization under US GAAP and EIP is considered the accounting acquirer. Accordingly, EIP’s historical results of operations are deemed the Company’s historical results of operations for all periods prior to the Merger and, for all periods following the Merger, the results of operations of the combined company will be included in the Company’s consolidated financial statements. Following the completion of the Merger, the business conducted by the Company became primarily the business conducted by EIP.

Accordingly, unless the context otherwise requires, all references in this prospectus to (i) “CervoMed,” the “Company,” “we,” “our,” or “us,” refer to the business of EIP for all dates and periods prior to August 16, 2023 and to the business of CervoMed for all dates and periods subsequent to (and including) August 16, 2023 and (ii) “common stock” refer to the common stock, par value $0.001 per share, of the Company, after giving effect to the Reverse Stock Split. Historical share and per share figures of EIP have been retroactively restated based upon the exchange ratio of 0.1151.

We have also used several other defined terms in this prospectus, many of which are explained or defined below:

|

Term

|

Definition

|

|

2015 Equity Plan

|

CervoMed Inc. 2015 Equity Incentive Plan, as amended

|

|

2018 Equity Plan

|

CervoMed Inc. 2018 Employee, Director and Consultant Equity Incentive Plan, as amended

|

|

2020 Notes

|

the previously outstanding convertible promissory notes of EIP, dated as of December 4, 2020, as amended

|

|

2021 Notes

|

the previously outstanding convertible promissory notes of EIP, dated as of December 10, 2021, as amended

|

|

2022 Sales Agreement

|

our At-The-Market Sales Agreement, dated July 22, 2022, with BTIG, as agent

|

|

2024 Private Placement

|

our private placement of an aggregate of 2,532,285 units, each consisting of (i) (A) one share of common stock or (B) one Pre-Funded Warrant in lieu thereof and (ii) one Series A Warrant, for aggregate gross proceeds of up to approximately $149.4 million, completed on April 1, 2024

|

|

401(k) Plan

|

CervoMed Inc. 401(k) Defined Contribution Plan

|

|

AD

|

Alzheimer’s Disease

|

|

ACA

|

Affordable Care Act and the Healthcare and Education Reconciliation Act

|

|

ACR20

|

American College of Rheumatology 20

|

|

AIA

|

America Invents Act

|

|

AKS

|

anti-kickback statute

|

|

Alpine Rewards

|

Alpine Rewards LLC, outside independent consultant to the Compensation Committee

|

|

ANDA

|

abbreviated new drug application

|

|

ASC

|

Accounting Standard Codification of the FASB

|

|

AscenD-LB Trial

|

our Phase 2a clinical trial evaluating neflamapimod for the treatment of patients with DLB, completed in the second half of 2021

|

|

Audit Committee

|

the Audit Committee of the Board

|

|

Bayh-Doyle Act

|

Bayh-Dole Act of 1980

|

|

BID

|

twice daily

|

|

BFC

|

basal forebrain cholinergic

|

|

BTIG

|

BTIG LLC

|

|

Board

|

the board of directors of the Company

|

|

Boger Trust

|

the Joshua S. Boger 2021 Trust DTD 12/09/2021

|

|

Bylaws

|

the Bylaws, as amended, of the Company

|

|

CARES Act

|

Coronavirus Aid, Relief, and Economic Security Act

|

|

CCPA

|

the California Consumer Privacy Act

|

|

CPRA

|

the California Privacy Rights Act

|

|

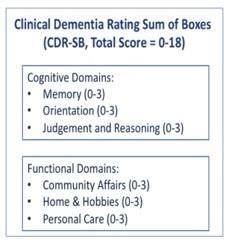

CDR-SB

|

Clinical Dementia Rating Sum of Boxes test

|

|

CGIC

|

the Alzheimer’s Disease Cooperative Study-Clinician Global Impression of Change

|

|

cGMP

|

current good manufacturing practices

|

|

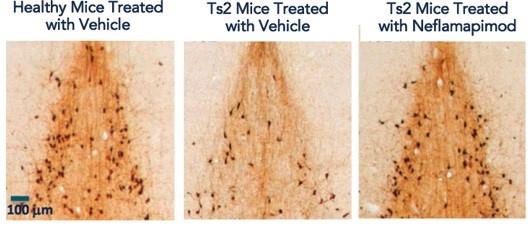

ChAT+ neurons

|

neurons staining positively for choline acetyl transferase

|

|

CMC

|

chemistry, manufacturing and controls

|

|

CMO

|

contract manufacturing organization

|

|

CMS

|

the U.S. Centers for Medicare & Medicaid Services

|

|

Compensation Committee

|

the Compensation Committee of the Board

|

|

Convertible Notes

|

collectively, the 2020 Notes and the 2021 Notes

|

|

CNS

|

central nervous system

|

|

Code

|

the U.S. Internal Revenue Code of 1986, as amended

|

|

CREATES Act

|

the Creating and Restoring Equal Access to Equivalent Samples Act of 2019

|

|

CRL

|

Complete Response Letter

|

|

CRO

|

contract research organization

|

|

CSF

|

cerebrospinal fluid

|

|

DGCL

|

Delaware General Corporation Law

|

|

DGM

|

deep grey matter

|

|

Diffusion Registration Statement

|

Amendment No. 2 to our Registration Statement on Form S-4, filed with the SEC on July 11, 2023, as amended from time to time

|

|

DLB

|

dementia with Lewy bodies

|

|

DNP

|

the FDA’s Division of Neurology Products

|

|

DSCSA

|

Drug Supply Chain Security Act

|

|

EEA

|

European Economic Area

|

|

EEG

|

electroencephalogram

|

|

Effective Time

|

the effective time of the Merger on August 16, 2023

|

|

EIP Common Stock

|

the common stock, par value $0.001, of EIP issued and outstanding prior to the Merger

|

|

EIP Convertible Notes

|

collectively, the 2020 Notes and the 2021 Notes

|

|

EMA

|

European Medicines Agency

|

|

EOAD

|

Early Onset Alzheimer’s Disease

|

|

EOT

|

end of treatment

|

|

Exchange Act

|

Securities Exchange Act of 1934, as amended

|

|

Exchange Ratio

|

the “Exchange Ratio” as defined in the Merger Agreement

|

|

FASB

|

Financial Accounting Standards Board

|

|

FCPA

|

the Foreign Corrupt Practices Act

|

|

FDA

|

U.S. Food and Drug Administration

|

|

FDCA

|

Federal Food, Drug, and Cosmetic Act

|

|

FDIC

|

Federal Deposit Insurance Corporation

|

|

FTC

|

Federal Trade Commission

|

|

FTD

|

frontotemporal dementia

|

|

GBM

|

glioblastoma multiforme brain cancer

|

|

GCP

|

good clinical practice

|

|

GDPR

|

European Union General Data Protection Regulation

|

|

GLP

|

good laboratory practice

|

|

HIPAA

|

the Health Insurance Portability and Accountability of Act of 1996

|

|

HVLT

|

Hopkins Verbal Learning Test

|

|

IMM

|

irreversible morbidity and mortality

|

|

IND

|

investigational new drug application

|

|

IRA

|

Inflation Reduction Act of 2022

|

|

IRB

|

institutional review board

|

|

IT

|

information technology

|

|

MA

|

marketing authorization

|

|

MCI

|

mild cognitive impairment

|

|

MRI

|

magnetic resonance imaging

|

|

MSN

|

medial septal nucleus

|

|

Nasdaq

|

Nasdaq Stock Market, LLC

|

|

NbM

|

Nucleus basalis of Meynert

|

|

NCE

|

new chemical entity

|

|

NDA

|

new drug application

|

|

NEO

|

named executive officer, as defined in Rule 402(m) of Regulation S-K

|

|

NGF

|

nerve growth factor

|

|

NIA

|

the National Institute on Aging of the National Institutes of Health

|

|

NIA Grant

|

the $21 million grant awarded to us by the NIA in January 2023 to support the RewinD-LB Trial

|

|

NIH

|

National Institutes of Health

|

|

NOL

|

net operating loss

|

|

NTB

|

Neuropsychological Test Battery

|

|

NYSE

|

New York Stock Exchange

|

|

p38α

|

p38 mitogen-activated protein kinase alpha

|

|

PBM

|

pharmacy benefit manger

|

|

PD

|

Parkinson’s disease

|

|

PDAB

|

prescription drug affordability board

|

|

PDD

|

Parkinson’s disease dementia

|

|

PDMA

|

Prescription Drug Marketing Act

|

|

PDUFA

|

Prescription Drug User Fee Act, as amended

|

|

PET

|

positron emission tomography

|

|

POC

|

proof-of-concept

|

|

PPA

|

primary progressive aphasia

|

|

Pre-Funded Warrants

|

the pre-funded warrants each to purchase one share of common stock at a purchase price of $0.001 per share issued in connection with the 2024 Private Placement

|

|

PREA

|

Pediatric Research Equity Act

|

|

ptau181

|

plasma phosphorylated tau at position 181

|

|

RA

|

rheumatoid arthritis

|

|

R&D

|

research and development

|

|

Regulation S-K

|

Regulation S-K promulgated under the Securities Act

|

|

REMS

|

Risk Evaluation and Mitigation Strategy

|

|

RewinD-LB Trial

|

our Phase 2b clinical trial evaluating neflamapimod for the treatment of patients with DLB, initiated in the second quarter of 2023

|

|

RLD

|

reference-listed drug

|

|

SAB

|

scientific advisory board

|

|

SAE

|

serious adverse events

|

|

SEC

|

U.S. Securities and Exchange Commission

|

|

Section 382

|

Section 382 of the Code

|

|

Securities Act

|

Securities Act of 1933, as amended

|

|

Series A Warrants

|

the warrants to purchase an aggregate of 2,532,285 shares of common stock at a purchase price of $39.24 per share issued in connection with the 2024 Private Placement

|

|

TCJA

|

Tax Cuts and Jobs Act of 2017

|

|

TID

|

three times daily

|

|

TSC

|

trans sodium crocetinate

|

|

TUG

|

Timed Up and Go test

|

|

UPL

|

upper payment limit

|

|

U.S.

|

United States of America

|

|

US GAAP

|

U.S. generally accepted accounting principles

|

|

USPTO

|

U.S. Patent and Trademark Office

|

|

Vertex

|

Vertex Pharmaceuticals Incorporated

|

|

Vertex Agreement

|

the Option and License Agreement, dated as of August 27, 2012, by and between EIP Pharma LLC and Vertex, as amended

|

Explanatory Note Regarding 2024 Private Placement

On April 1, 2024, we closed the 2024 Private Placement, pursuant to which we sold to the selling stockholders an aggregate of 2,532,285 units, each comprised of (i) (A) one share of common stock or (B) one Pre-Funded Warrant and (ii) one Series A Warrant. The aggregate upfront gross proceeds from the PIPE were approximately $50.0 million, before deducting offering fees and expenses, and additional gross proceeds of up to approximately $99.4 million may be received if the Series A Warrants are exercised in full for cash.

The information contained in this registration statement and prospectus that is provided as of, prior to, or with respect to periods ending on or before March 31, 2024, including our consolidated financial statements for the year ended December 31, 2023, and the corresponding information regarding our liquidity, capital resources and cash runway as of December 31, 2023, set forth in, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and certain other information, does not reflect the consummation of, or our receipt of proceeds from, the 2024 Private Placement.

Note Regarding Trademarks, Trade Names, and Service Marks

This prospectus includes trademarks, trade names, and service marks owned by us or other companies. All trademarks, service marks and trade names included in this prospectus are the property of their respective owners. To the extent any such terms appear without the trade name, trademark, or service mark notice, such presentation is for convenience only and should not be construed as being used in a descriptive or generic sense.

PROSPECTUS SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information that may be important to you. You should read this entire prospectus carefully, including the sections titled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision.

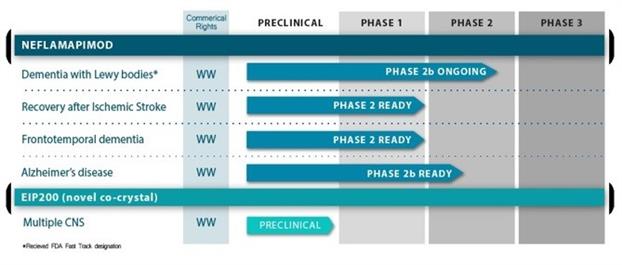

Overview

We are a clinical-stage biotechnology company focused on developing treatments for age-related neurologic disorders. We are currently focused on the development of our lead drug candidate, neflamapimod, an investigational, orally administered, small molecule brain penetrant that inhibits p38α in the neurons (nerve cells) within the brains of people with neurodegenerative diseases. Neflamapimod has the potential to treat and improve synaptic dysfunction, the reversible aspect of the underlying disease processes in DLB and certain other major neurological disorders, and is currently being evaluated in our ongoing RewinD-LB Trial, a Phase 2b study in patients with DLB funded by a $21.0 million grant from the NIA. We expect to complete enrollment in the RewinD-LB Trial during the second quarter of 2024 and to report initial results from the placebo-controlled portion of the study during the fourth quarter of 2024.

2024 Private Placement

On March 28, 2024, we entered into the Purchase Agreement with the Purchasers for the private placement of an aggregate of 2,532,285 Units, each Unit comprised of (i) (A) one share of Common Stock or (B) one Pre-Funded Warrant, and, in each case, (ii) one Series A Warrant. A Unit comprised of one share of Common Stock and one Series A Warrant had a purchase price of $19.745 and a Unit comprised of one Pre-Funded Warrant and one Series A Warrant had a purchase price of $19.744. The 2024 Private Placement closed on April 1, 2024.

The gross proceeds for the 2024 Private Placement were approximately $50.0 million, before deducting offering fees and expenses, and up to an additional $99.4 million in gross proceeds if the Series A Warrants are fully exercised for cash. We expect to use the net proceeds from the 2024 Private Placement to fund research and development of neflamapimod, working capital and general corporate purposes. We estimate, based on our current operating plan, that the upfront, net proceeds from the 2024 Private Placement, together with our cash and cash equivalents as of December 31, 2023, and remaining funds to be receive from the NIA Grant, will be sufficient to fund our operations through the end of 2025.

Morgan Stanley and Canaccord Genuity acted as placement agents (together, the “Placement Agents”) for the 2024 Private Placement. The Placement Agents received a portion of a combined fee equal to approximately 6% of the aggregate gross proceeds from the securities sold in the 2024 Private Placement, plus the reimbursement of certain expenses.

Each Pre-Funded Warrant has an exercise price of $0.001 per Warrant Share, is immediately exercisable on the date of issuance and will not expire. Under the terms of the Pre-Funded Warrants, we may not effect the exercise of any portion of any Pre-Funded Warrant, and a holder will not have the right to exercise any portion of any Pre-Funded Warrant, which, upon giving effect to such exercise, would cause a holder (together with its affiliates) to own more than a specified beneficial ownership limitation of either 4.99% or 9.99% (as selected by such holder prior to the issuance of the Pre-Funded Warrant) of the number of shares of Common Stock outstanding immediately after giving effect to such exercise, as such percentage ownership is determined in accordance with the terms of the Pre-Funded Warrants. However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99%, provided that any increase in such percentage shall not be effective until 61 days after such notice is delivered to the Company.

The Series A Warrants have an exercise price equal to $39.24 per Warrant Share, are exercisable immediately and will expire at the earlier of (i) April 1, 2027 or (ii) 180 days after the date that we make a public announcement of positive top-line data from the our Phase 2b RewinD-LB clinical trial evaluating neflamapimod for treatment of patients with dementia with Lewy bodies. Under the terms of the Series A Warrants, we may not effect the exercise of any portion of any Series A Warrant, and a holder will not have the right to exercise any portion of any Series A Warrant, which, upon giving effect to such exercise, would cause a holder (together with its affiliates) to own more than a specified beneficial ownership limitation of either 4.99% or 9.99% (as selected by such holder prior to the issuance of the Series A Warrant) of the number of shares of Common Stock outstanding immediately after giving effect to such exercise, as such percentage ownership is determined in accordance with the terms of the Series A Warrants. However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99%, provided that any increase in such percentage shall not be effective until 61 days after such notice is delivered to the Company.

Pursuant to the Purchase Agreement, we agreed to file a registration statement with the SEC within 45 days after the closing of the 2024 Private Placement (subject to certain exceptions) for purposes of registering the resale of the PIPE Shares and the Warrant Shares.

The registration statement of which this prospectus is a part relates to the offer and resale of the PIPE Shares and Warrant Shares issued to the Purchaser pursuant to the Purchase Agreement in the closing that occurred on April 1, 2024. When we refer to the selling stockholder in this prospectus, we are referring to the Purchaser named in this prospectus as the selling stockholder and, as applicable, any donee, pledgees, assignees, transferees or other successors-in-interest selling PIPE Shares or Warrant Shares received after the date of this prospectus from the selling stockholder as a gift, pledge, or other non-sale related transfer.

The securities issued in the 2024 Private Placement were issued and offered pursuant to the exemption from registration provided in Section 4(a)(2) of the Securities Act.

Risk Factors

Investing in our securities involves risks. You should carefully consider the risks described in “Risk Factors” beginning on page 9 before making a decision to invest in our securities, as well as subsequent filings with the SEC. If any of these risks actually occurs, our business, financial condition and results of operations would likely be materially adversely affected. Some of the risks related to our business and industry are summarized below.

● The Company is a clinical stage company and has incurred significant losses since its inception. The Company expects its net losses to continue for the foreseeable future. The Company is not currently profitable and may never achieve or sustain profitability. The Company is unable to predict the extent of future losses or when it might become profitable, if ever.

● The Company will require additional capital to fund its operations. If the Company fails to obtain necessary financing on acceptable terms, or at all, it may not be able to complete the development and commercialization of neflamapimod.

● The Company currently does not have, and may never have, any products that generate significant revenues.

● The Company is heavily dependent on the success of its lead product candidate, neflamapimod, which is still under clinical development. If neflamapimod does not receive regulatory approval or is not successfully commercialized, the Company’s business will be materially harmed.

● The development and commercialization of drug products is subject to extensive regulation, and the regulatory approval processes of the FDA and comparable foreign authorities are lengthy, time-consuming, and inherently unpredictable. There is no guarantee that the Company’s planned clinical trials for neflamapimod to treat patients with DLB, or in any other indications that the Company may pursue, will be successful. If the Company is ultimately unable to obtain regulatory approval for neflamapimod on a timely basis, or at all, its business will be substantially harmed.

● Clinical drug development involves a lengthy and expensive process, with an uncertain outcome. The Company may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of neflamapimod or any other product candidates the Company may develop or acquire.

● The Company has concentrated its research and development efforts on the treatment of DLB, a disease that has seen limited success in drug development. The ability to successfully develop drugs for DLB and other age-related neurologic disorders is extremely difficult and is subject to a number of unique challenges. In addition, its rationale for neflamapimod in the treatment of DLB is based on a scientific understanding of the disease that may be wrong.

● Enrollment and retention of participants in clinical trials is an expensive and time-consuming process and could be made more difficult or rendered impossible by multiple factors outside the Company’s control.

● Results of preclinical studies and early clinical trials may not be indicative of results obtained in later trials. In addition, preliminary, topline and interim data from the Company’s clinical trials that the Company may announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final data.

● If the Company does not adequately protect its proprietary rights, the Company may not be able to compete effectively.

● The Company has no history of commercializing pharmaceutical products, which may make it difficult to evaluate the prospects for its future viability.

● Even if neflamapimod or any other product candidate the Company develops receives marketing approval, it may fail to achieve the level of acceptance necessary for commercial success.

● The Company’s future success depends in large part on the Company’s ability to retain its key employees, as well as its ability to attract, train and motivate additional qualified personnel. The Company may also encounter difficulties in managing its growth, which could disrupt its operations.

● The Company has identified material weaknesses in its internal control over financial reporting which, if not corrected, could affect the reliability of the Company’s financial statements and have other adverse consequences. The Company may identify additional material weaknesses in its internal controls over financial reporting which it may not be able to remedy in a timely manner. If the Company fails to maintain proper and effective internal controls, its ability to produce accurate financial statements on a timely basis could be impaired.

Corporate Information

Our principal executive offices are located at 20 Park Plaza, Suite 424, Boston, Massachusetts 02116. The telephone number at our principal executive office is (617) 744-4400. Our corporate website is located at www.cervomed.com. Information contained on our website is not part of, or incorporated in, this prospectus. Our Common Stock is traded on the NASDAQ Capital Market under the symbol “CRVO.”

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of any fiscal year for so long as either (1) the market value of our shares of Common Stock held by non-affiliates does not equal or exceed $250.0 million as of the prior June 30th, or (2) our annual revenues did not equal or exceed $100.0 million during such completed fiscal year and the market value of our shares of Common Stock held by non-affiliates did not equal or exceed $700.0 million as of the prior June 30th. To the extent we take advantage of any reduced disclosure obligations, it may make comparison of our financial statements with other public companies difficult or impossible.

|

The Offering

|

| |

|

Common Stock offered by the Selling Stockholders

|

|

An aggregate of 5,064,570 shares of Common Stock, including 2,083,262 PIPE Shares and 2,981,308 Warrant Shares. The selling stockholders are identified in the table commencing on page 110.

|

| |

|

|

|

Use of proceeds

|

|

We will not receive any proceeds from the sale by the selling stockholders of the shares of Common Stock covered by this prospectus. We will, however, receive the exercise price of (i) $0.001 per share of any of the Pre-Funded Warrants, and (ii) $39.24 per share of any of the Series A Warrants, in each case, exercised for cash.

|

| |

|

|

|

Risk factors

|

|

You should read the “Risk Factors” section starting on page 9 of this prospectus for a discussion of factors to consider before deciding to invest in our securities.

|

| |

|

|

|

NASDAQ Ticker Symbol

|

|

“CRVO”

|

RISK FACTORS

Investing in our securities involves a high degree of risk. Set forth below are certain material risks and uncertainties known to us that could adversely affect our business, financial condition, or results of operations or could cause our actual results to differ materially from our expectations expressed in our filings with the SEC and other public statements. The occurrence of the events contemplated by one or more of the factors we describe below could cause the market price of our securities to decline, resulting in the loss of all or part of any investment in our common stock. Furthermore, other risks that are currently unknown to us or that we currently believe to be immaterial may also, nevertheless, adversely affect our business, financial condition, or results of operations in a way that is material.

You should carefully consider the risk factors set forth below as may updated by our subsequent filings under the Exchange Act and all the other information in this prospectus, including our consolidated financial statements and the related notes included in this prospectus and the information set forth in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as in our other filings with the SEC, before making any investment decisions. Furthermore, the risks and uncertainties described below and in the other information mentioned above are not the only ones the Company faces. Additional risks and uncertainties not presently known to the Company or that we currently believe to be immaterial could, nevertheless, adversely affect the Company’s business, operating results and financial condition, as well as adversely affect the value of an investment in the Company’s securities, and the occurrence of any of these risks might cause you to lose all or part of your investment.

| |

●

|

The Company is a clinical stage biopharmaceutical company and has incurred significant losses since its inception. The Company expects its net losses to continue for the foreseeable future. The Company is not currently profitable and may never achieve or sustain profitability. The Company is unable to predict the extent of future losses or when it might become profitable, if ever.

|

| |

●

|

The Company will require additional capital to fund its operations. If the Company fails to obtain necessary financing on acceptable terms, or at all, it may not be able to complete the development and commercialization of neflamapimod.

|

| |

●

|

The Company currently does not have, and may never have, any products that generate significant revenues.

|

| |

●

|

The Company is heavily dependent on the success of its lead product candidate, neflamapimod, which is still under clinical development. If neflamapimod does not receive regulatory approval or is not successfully commercialized, the Company’s business will be materially harmed.

|

| |

●

|

The development and commercialization of drug products is subject to extensive regulation, and the regulatory approval processes of the FDA and comparable foreign authorities are lengthy, time-consuming, and inherently unpredictable. There is no guarantee that the Company’s planned clinical trials for neflamapimod to treat patients with DLB, or in any other indications that the Company may pursue, will be successful. If the Company is ultimately unable to obtain regulatory approval for neflamapimod on a timely basis, or at all, its business will be substantially harmed.

|

| |

●

|

Clinical drug development involves a lengthy and expensive process, with an uncertain outcome. The Company may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of neflamapimod or any other product candidates the Company may develop or acquire.

|

| |

●

|

The Company has concentrated its research and development efforts on the treatment of DLB, a disease that has seen limited success in drug development. The ability to successfully develop drugs for DLB and other age-related neurologic disorders is extremely difficult and is subject to a number of unique challenges. In addition, its rationale for neflamapimod in the treatment of DLB is based on a scientific understanding of the disease that may be wrong.

|

| |

●

|

Enrollment and retention of participants in clinical trials is an expensive and time-consuming process and could be made more difficult or rendered impossible by multiple factors outside the Company’s control.

|

| |

●

|

Results of preclinical studies and early clinical trials may not be indicative of results obtained in later trials. In addition, preliminary, topline and interim data from the Company’s clinical trials that the Company may announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final data.

|

| |

●

|

If the Company does not adequately protect its proprietary rights, the Company may not be able to compete effectively.

|

| |

●

|

The Company has no history of commercializing pharmaceutical products, which may make it difficult to evaluate the prospects for its future viability.

|

| |

●

|

Even if neflamapimod or any other product candidate the Company develops receives marketing approval, it may fail to achieve the level of acceptance necessary for commercial success.

|

| |

●

|

The Company’s future success depends in large part on the Company’s ability to retain its key employees, as well as its ability to attract, train and motivate additional qualified personnel. The Company may also encounter difficulties in managing its growth, which could disrupt its operations.

|

| |

●

|

The Company has identified material weaknesses in its internal control over financial reporting which, if not corrected, could affect the reliability of the Company’s consolidated financial statements and have other adverse consequences. The Company may identify additional material weaknesses in its internal controls over financial reporting which it may not be able to remedy in a timely manner. If the Company fails to maintain proper and effective internal controls, its ability to produce accurate financial statements on a timely basis could be impaired.

|

Risks Related to the Company’s Limited Operating History, Financial Condition and Need for Additional Capital

The Company is a clinical stage biopharmaceutical company and has incurred significant losses since its inception. The Company expects its net losses to continue for the foreseeable future. The Company is not currently profitable and may never achieve or sustain profitability. The Company is unable to predict the extent of future losses or when it might become profitable, if ever.

Investment in pharmaceutical product development is highly speculative because it entails substantial upfront capital expenditures and significant risk that any potential product candidate will fail to demonstrate adequate effect or an acceptable safety profile, gain regulatory approval, and become commercially viable. The Company has incurred net losses since its inception, and as of December 31, 2023, it had an accumulated deficit of approximately $54.4 million. The Company expects to incur net losses for the foreseeable future as it incurs significant clinical development costs related to the advancement of neflamapimod. The Company has not commercialized any products and has never generated revenue from neflamapimod or any other product. In order to obtain revenues from any product candidate, the Company must succeed, either alone or in collaboration with others, in developing, obtaining regulatory approval for, and manufacturing and marketing drugs with significant market potential. The Company may never succeed in these activities and may never generate revenues that are significant enough to achieve profitability.

The Company expects to incur significant additional operating losses for at least the next several years as it advances neflamapimod through clinical development, conducts clinical trials, seeks regulatory approval and commercializes neflamapimod, if it is ultimately approved for marketing. The costs of advancing product candidates into each successive clinical phase of the clinical development process tend to increase substantially. Therefore, the total costs to advance neflamapimod to marketing approval in even a single jurisdiction will be substantial. Due to the numerous risks and uncertainties associated with pharmaceutical product development, the Company is unable to accurately predict the timing or amount of increased expenses, or when or if it will be able to begin generating revenue from the commercialization of neflamapimod, let alone achieve or maintain profitability.

The amount of the Company’s future net losses will depend, in part, on the rate of future growth of its expenses, if and when neflamapimod is approved for marketing in various jurisdictions and its ability to generate revenues from any drug candidate that may ultimately be approved. If the Company is unable to develop and commercialize one or more product candidates, either alone or through collaborations, or if revenues from any product that receives marketing approval are insufficient, it will not achieve profitability. Even if the Company does achieve profitability, it may not be able to sustain it, which could materially and adversely affect its business.

The Company will require additional capital to fund its operations. If the Company fails to obtain necessary financing on acceptable terms, or at all, it may not be able to complete the development and commercialization of neflamapimod.

The Company expects to spend substantial amounts to complete the development of, seek regulatory approvals for, and commercialize neflamapimod, if it is ultimately approved for marketing. These expenditures will include costs related to the RewinD-LB Trial and costs associated with its license agreement with Vertex, under which the Company is obligated to make certain payments in connection with the achievement of specified events.

Until such time, if ever, that the Company can generate sufficient product revenue and achieve profitability, it expects to seek to finance future cash needs through equity or debt financings and/or corporate collaboration, licensing arrangements and grants. In connection with the Company’s Annual Report, based upon the Company’s then current operating plan, the Company determined that the Company’s cash and cash equivalents as of December 31, 2023, would not be sufficient to enable the Company to fund its operating expenses and capital expenditure requirements for a period of at least 12 months following the issuance of the financial statements included elsewhere in this registration statement without an additional equity or debt financing. On April 1, 2024, the Company closed the 2024 Private Placement. The aggregate upfront gross proceeds from the 2024 Private Placement were approximately $50.0 million, before deducting offering fees and expenses, and additional gross proceeds of up to approximately $99.4 million may be received if the Series A Warrants are exercised in full for cash. The foregoing estimate of the Company’s cash runway based on its cash and cash equivalents as of December 31, 2023 does not reflect the Company’s receipt of proceeds from the 2024 Private Placement.

The Company’s estimates and expectations regarding its cash runway are based on assumptions that may prove to be incorrect, and changing circumstances could cause it to consume capital faster or in different ways than the Company currently expects. For example, the RewinD-LB Trial may be more expensive, time-consuming, or difficult to implement than the Company currently anticipates. Because the length of time and activities associated with the successful development of neflamapimod are highly uncertain, the Company is unable to estimate the actual funds it will require to complete research and development and ultimately commercialize its drug candidate for one or more indications.

The Company’s future capital requirements will depend on, and could increase significantly as a result of, many factors, including:

| |

●

|

the enrollment, progress, timing, costs and results of the RewinD-LB Trial and any future phase 3 trial evaluating neflamapimod in DLB, as well as if and when it pursues additional development plans for neflamapimod in other disease indications, such as recovery after anterior circulation ischemic stroke or EOAD;

|

| |

●

|

the outcome, timing and cost of meeting regulatory requirements established by the FDA and other comparable foreign regulatory authorities;

|

| |

●

|

its ability to reach certain milestone events set forth in its collaboration agreements and the timing of such achievements, triggering obligations to make applicable payments;

|

| |

●

|

the hiring of additional clinical, scientific and commercial personnel to pursue the Company’s development plans, as well the increased costs of internal and external resources as to support the Company’s operations as a public reporting company;

|

| |

●

|

the cost and timing of securing manufacturing arrangements for clinical or commercial production;

|

| |

●

|

the cost of establishing, either internally or in collaboration with others, sales, marketing and distribution capabilities to commercialize neflamapimod, if approved;

|

| |

●

|

the cost of filing, prosecuting, enforcing, and defending its patent claims and other intellectual property rights, including defending against any patent infringement actions brought by third parties against the Company;

|

| |

●

|

the ability to receive additional non-dilutive funding, including the Company’s pending request for additional funding under the NIA Grant and other grants from organizations and foundations;

|

| |

●

|

the Company’s ability to establish strategic collaborations, licensing or other arrangements with other parties on favorable terms, if at all; and

|

| |

●

|

the extent to which the Company may in-license or acquire other product candidates or technologies.

|

The Company may raise additional capital in the future through a variety of sources, including public or private equity offerings, debt financings, grant funding, or strategic collaborations and licensing arrangements. However, adequate additional financing may not be available to the Company on acceptable terms, or at all. The Company’s failure to raise capital as and when needed would have a negative effect on its financial condition and its ability to pursue its business strategy. If the Company is unable to secure additional capital in sufficient amounts or on terms acceptable to the Company, it may have to delay, scale back or discontinue its development or commercialization activities for neflamapimod.

Further, to the extent that the Company raises additional capital through the sale of common stock or securities convertible or exchangeable into common stock, current stockholder’s ownership interest in the Company will be diluted. In addition, any debt financing may subject the Company to fixed payment obligations and covenants limiting or restricting its ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If the Company raises additional capital through collaborations, strategic alliances or licensing arrangements with third parties, the Company may have to relinquish certain valuable intellectual property or other rights to its product candidates, technologies, future revenue streams or research programs or grant licenses on terms that may not be favorable to it. Even if the Company were to obtain sufficient funding, there can be no assurance that it will be available on terms acceptable to the Company or its stockholders.

The Company currently does not have, and may never have, any products that generate significant revenues.

The Company is a clinical-stage biopharmaceutical company focused on developing treatments for age-related neurologic disorders, currently has no products that are approved for commercial sale, and it is possible it may never be able to develop a marketable product. To date, the Company has not generated any revenues from its lead product candidate, neflamapimod, or from any other product candidate. The Company cannot guarantee that neflamapimod, or any other product candidate that it may develop or acquire in the future, will ever become a marketable product.

The research, testing, manufacturing, labeling, approval, sale, marketing and distribution of drug products are subject to extensive regulation in the U.S. and in other countries. Before the FDA and other regulatory authorities in the European Union and elsewhere will approve neflamapimod (or any other drug candidate) for commercialization, the Company must demonstrate that it satisfies rigorous standards of safety and efficacy for each of its intended uses. If approved, in order to compete effectively in the commercial marketplace, drugs must be easy to administer, cost-effective and economical to manufacture on a commercial scale. The Company may not achieve any of these objectives.

The Company initiated its RewinD-LB Trial in the second quarter of 2023 and anticipates completing enrollment in the study in the second quarter of 2024. The Company cannot be certain that the RewinD-LB Trial or any future clinical development of neflamapimod will be successful, or that it will receive the regulatory approvals required to commercialize neflamapimod for any intended use, or that any future research and drug discovery programs undertaken by the Company will yield a drug candidate suitable for investigation through clinical trials. Even if the Company is able to successfully develop neflamapimod through approval and commercialization, any revenues from sales of the drug may not materialize for several years, if at all.

The RewinD-LB Trial is funded by a non-dilutive grant that is subject to certain conditions for funding in subsequent years.

The Company’s RewinD-LB Trial is funded by a grant from the NIA, the funds from which will be disbursed over the course of the study as costs are incurred. The Company’s receipt of the funds awarded to support future year costs are subject to both the availability of funds (i.e., the NIA is funded by Congress in subsequent fiscal years) and the Company’s demonstration of progress in the project that is in line with the timelines provided in the grant. If such funds are no longer available, including due to a government shutdown that prohibits the disbursal of such funds, or the Company fails to demonstrate such progress, the Company’s ability to continue its clinical programs may be impaired and delayed, and the Company may otherwise need to seek additional financing. For example, the Company was granted access to $7.3 million under the NIA Grant in February 2024, 90% of the full amount of the second year of funding provided for in the NIA Grant, due to then-current NIA policy as a result of the U.S. government being funded at such time on the basis of a continuing resolution. Consolidated appropriations acts were signed into law in March 2024, and the Company expects to receive the remaining 10% of the year 2 amount by June 30, 2024.

In addition, in December 2023, we submitted a request for supplemental funds in the amount of $4.0 million, of which, if approved, $3.9 million would be received in the current year and the remainder would be received in next the funding year. The request for supplemental funds was initially reviewed by the NIA in January 2024 but, due to the NIA working under a continuing resolution at such time, completion of the review was delayed and the request is currently scheduled to be reviewed for approval in May 2024. We currently expect to receive the remaining 10%, or $0.8 million, of the previously approved year 2 funding by June 30, 2024, the supplemental amount of $4.0 million following NIA review of our supplemental request, and the year 3 funding of $6.2 million in February 2025. However, there can be no guarantee that the NIA will approve this supplement request and that any such amounts will be received. If the Company is unable to secure additional capital through approval of the supplemental request or other means, it may have to delay, scale back or discontinue its development or commercialization activities for neflamapimod.

The Company could be subject to audit and repayment of the NIA Grant.

In connection with the NIA Grant, the Company may be subject to routine audits by certain government agencies. As part of an audit, these agencies may review the Company’s performance, cost structures and compliance with applicable laws, regulations, policies and standards and the terms and conditions of the applicable NIA Grant. If any of the Company’s expenditures are found to be unallowable or allocated improperly or if the Company has otherwise violated terms of the NIA Grant, the expenditures may not be reimbursed and/or it may be required to repay funds already disbursed. Any such audit may result in a material adjustment to the Company’s results of operations and financial condition and harm the Company’s ability to operate in accordance with its business plan.

The Company may be required to make significant payments to Vertex in connection with the Company’s license agreement.

Pursuant to the Vertex Agreement, the Company previously acquired an exclusive license to develop and commercialize neflamapimod for the diagnosis, treatment, and prevention of AD and other CNS disorders. Under the Vertex Agreement, the Company is subject to significant potential future obligations, including payment of development milestones and royalties on net product sales, as well as other material obligations. The Vertex Agreement sets forth specific regulatory and product approval events and the related payments that the Company would be obligated to make to Vertex, if and when such events occur.

Among other obligations, the Vertex Agreement provides that the Company will make royalty payments to Vertex in the event aggregate net sales for a commercialized licensed product meet specified thresholds, subject to adjustment in the event of certain events, such as the absence of a valid patent claim or if fees are due to a third party for a license necessary for the development, manufacture, sale or use of a licensed product. Such royalties will be on a sliding scale as a percentage of net sales, depending on the amount of net sales in the applicable years. The Company is also obligated to make a milestone payment to Vertex upon net sales reaching a certain specified amount in any 12-month period.

The first expected milestone events concern filing of an NDA with the FDA for marketing approval of a licensed product in the U.S., or a similar filing for a non-U.S. major market. Thus, although the Company does not expect any milestone or royalty payments to be due until such time, these potential obligations represent significant cash amounts that it may ultimately be obligated to pay. The Company cannot guarantee that it will have sufficient funds available to meet its obligations if and when these payments become due. The obligation to pay some or all of these milestone and royalty amounts may materially harm the Company’s development efforts, as well as its overall financial condition.

The Company may expend its limited resources to pursue a particular product candidate or indication and fail to capitalize on product candidates or indications that may be more profitable or for which there is a greater likelihood of success.

The Company intends to focus its limited financial and other resources on developing neflamapimod and future product candidates for specific indications that the Company identifies as most likely to succeed, in terms of both regulatory approval and commercialization. As a result, the Company may forego or delay pursuit of opportunities with other product candidates or for other indications that may prove to have greater commercial potential. The Company’s resource allocation decisions may cause the Company to fail to capitalize on viable commercial products or profitable market opportunities. Spending on current and future research and development programs and on product candidates for specific indications may not yield any commercially viable products. If the Company does not accurately evaluate the commercial potential or target market for a particular product candidate, it may relinquish valuable rights to that product candidate through collaboration, licensing or other royalty arrangements in cases in which it would have been more advantageous for the Company to retain sole development and commercialization rights to such product candidate.

Risks Related to the Company’s Product Development and Regulatory Approval

The Company is heavily dependent on the success of its lead product candidate, neflamapimod, which is still under clinical development. If neflamapimod does not receive regulatory approval or is not successfully commercialized, the Company’s business will be materially harmed.

The Company has invested almost all of its efforts and financial resources to date in the development of neflamapimod. To date, the Company has not initiated or completed a pivotal clinical trial, obtained marketing approval for any product candidate, manufactured a commercial scale product or arranged for a third party to do so on its behalf, or conducted sales and marketing activities necessary for successful product commercialization. The Company’s future success is substantially dependent on its ability to successfully complete clinical development of, obtain regulatory approval for, and successfully commercialize neflamapimod as a treatment for DLB and additional indications, which may never occur.

The Company expects a substantial portion of its efforts and expenditures over the next few years will be devoted to the advancement of neflamapimod’s clinical development. In order to be successful, the Company will need to successfully manage clinical and manufacturing activities, the pursuit of regulatory approval in multiple jurisdictions, securing manufacturing supply, building a commercial organization, and significant marketing efforts, among other requirements, before it can generate any revenues from commercial sales. The Company cannot be certain that it will be able to successfully complete any or all of these activities.