| PROSPECTUS |

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-279683 |

AUDDIA INC.

Up to 5,905,898 Shares of Common Stock

This prospectus relates

to the offer and resale, from time to time, of up to an aggregate of 5,905,898 shares of our common stock, par value $0.001 per share,

consisting of, (a) up to 4,655,761 shares of common stock issuable upon conversion of our Series B Convertible Preferred Stock, par value

$0.001 per share (the “Series B Convertible Preferred Stock”) and (b) up to 1,250,137 shares of common stock issuable upon

the exercise of warrants (the “Common Warrants”), each sold in a private investment in public equity financing (the “PIPE

Offering”) pursuant to a Securities Purchase Agreement, dated April 23, 2024 (the “2024 SPA”), by and between us and

the purchasers named therein (the “Selling Stockholders”).

We are not selling any securities under this prospectus,

and we will not receive proceeds from the sale of the shares of our common stock by the Selling Stockholders. However, we may receive

proceeds from the cash exercise of the Common Warrants, which, if exercised in cash at the current applicable exercise price, would result

in gross proceeds to us of approximately $2.3 million.

We will pay the expenses

of registering the shares of common stock offered by this prospectus, but all selling and other expenses incurred by the Selling Stockholders

will be paid by the Selling Stockholders. The Selling Stockholders may sell our shares of common stock offered by this prospectus from

time to time on terms to be determined at the time of sale through ordinary brokerage transactions or through any other means described

in this prospectus under “Plan of Distribution.” The prices at which the Selling Stockholders may sell shares will be determined

by the prevailing market price for our common stock or in negotiated transactions.

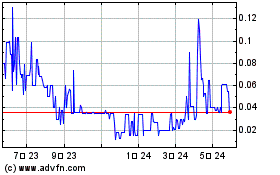

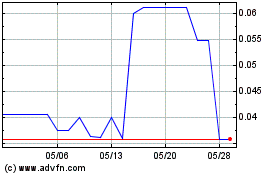

Our common stock is listed on the Nasdaq Capital

Market under the symbol “AUUD.” On November 7, 2024, the closing price for our common stock, as reported on the Nasdaq Capital

Market, was $0.5499 per share. Our warrants offered in connection with our initial public offering (the “Series A Warrants”)

are quoted on the Nasdaq Capital Market under the symbol “AUUDW.” The last reported sale price of our Series A Warrants on

the Nasdaq Capital Market on November 7, 2024 was $0.025 per Series A Warrant.

We have received deficiency letters from The

Nasdaq Stock Market LLC (“Nasdaq”) that we are not in compliance with Nasdaq’s (i) minimum bid price requirement of

at least $1.00 per share (the “Bid Price Requirement”) and (ii) the requirement to have at least $2,500,000 in stockholders’

equity (the “Equity Requirement”). On October 16, 2024, we received a written notice from Nasdaq indicating that

we were not in compliance with the Bid Price Requirement set forth in Nasdaq Listing Rule 5550(a)(2) for continued listing on the Nasdaq

Capital Market (the “Bid Price Notice”). The Bid Price Notice does not result in the immediate delisting of the Company’s

common stock from the Nasdaq Capital Market. The Bid Price Notice indicated that the Company has 180 calendar days (or until April 14,

2025) in which to regain compliance. On April 16, 2024, the Company received a letter from Nasdaq granting an exception to the

Equity Requirement until May 20, 2024, to demonstrate compliance with Listing Rule 5550(b)(1). On May 24, 2024, the Company received

a letter from Nasdaq indicating that the Company has regained compliance with the Equity Requirement in Listing Rule 5550(b) (1). The

Company will be subject to a Mandatory Panel Monitor for a period of one year from the date of the letter in accordance with application

of Listing Rule 5815(d)(4)(B). See “Risk Factors — We may not be able to continue our current

listing of our common stock on the Nasdaq Capital Market. A delisting of our common stock from Nasdaq could limit the liquidity of our

stock, increase its volatility and hinder our ability to raise capital.”

You should read this

prospectus, together with additional information described under the headings “Where You Can Find More Information” carefully

before you invest in any of our securities.

INVESTING IN OUR SECURITIES

INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 10 OF THIS PROSPECTUS AND ANY SIMILAR

SECTION CONTAINED IN ANY DOCUMENT INCORPORATED BY REFERENCE HEREIN CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated November 8, 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

The registration statement

we filed with the Securities and Exchange Commission (the “SEC”) includes exhibits that provide more detail of the matters

discussed in this prospectus. You should read this prospectus, the related exhibits filed with the SEC, and the documents incorporated

by reference herein before making your investment decision. You should rely only on the information provided in this prospectus and the

documents incorporated by reference herein or any amendment thereto. You should not assume that the information contained in this prospectus

or any related free writing prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any

information we have incorporated by reference herein is correct on any date subsequent to the date of the document incorporated by reference,

even though this prospectus or any related free writing prospectus is delivered, or securities are sold, on a later date. This prospectus

contains or incorporates by reference summaries of certain provisions contained in some of the documents described herein, but reference

is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents.

Copies of some of the documents referred to herein have been filed or have been incorporated by reference as exhibits to the registration

statement of which this prospectus forms a part, and you may obtain copies of those documents as described in this prospectus under the

heading “Where You Can Find More Information.”

You should rely only

on the information that we have included or incorporated by reference in this prospectus and any related free writing prospectus that

we may authorize to be provided to you. Neither we, nor the Selling Stockholders, have authorized any dealer, salesman or other person

to give any information or to make any representation other than those contained or incorporated by reference in this prospectus or any

related free writing prospectus that we may authorize to be provided to you. You must not rely upon any information or representation

not contained or incorporated by reference in this prospectus or any related free writing prospectus. This prospectus and any related

free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered

securities to which they relate, nor does this prospectus or any related free writing prospectus constitute an offer to sell or the solicitation

of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

PROSPECTUS SUMMARY

The following summary

highlights information contained elsewhere in this prospectus. This summary is not complete and may not contain all the information you

should consider before investing in our common stock. You should read this entire prospectus carefully, especially the risks of investing

in our common stock discussed under the heading “Risk Factors” included elsewhere

in this prospectus and in the sections titled “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes thereto

included in our Annual Report on Form 10-K for the year ended December 31, 2023, before making an investment decision. Except as otherwise

indicated herein or as the context otherwise requires, references in this prospectus and the documents incorporated by reference in this

prospectus to “Auddia,” “the Company,” “we,” “us” and “our” refer to Auddia

Inc. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Information Regarding Forward-Looking Statements.”

This prospectus includes

trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included in this

prospectus are the property of their respective owners.

Overview

Auddia is a technology company headquartered in

Boulder, CO that is reinventing how consumers engage with audio through the development of a proprietary AI platform for audio and innovative

technologies for podcasts. Auddia is leveraging these technologies within its industry-first audio Superapp, faidr (previously known as

the Auddia App).

faidr gives consumers the opportunity to listen

to any AM/FM radio station with commercial breaks replaced with personalized audio content, including popular and new music, news, and

weather. The faidr app represents the first-time consumers can combine the local content uniquely provided by AM/FM radio with commercial-free

and personalized listening many consumers demand from digital-media consumption. In addition to commercial-free AM/FM, faidr includes

podcasts – also with ads removed or easily skipped by listeners – as well as exclusive content, branded faidrRadio, which

includes new artist discovery, curated music stations, and Music Casts. Music Casts are unique to faidr. Hosts and DJs can combine on-demand

talk segments with dynamic music streaming, which allows users to hear podcasts with full music track plays embedded in the episodes.

Auddia has also developed a differentiated podcasting

capability with ad-reduction features and also provides a unique suite of tools that helps podcasters create additional digital content

for their podcast episodes as well as plan their episodes, build their brand, and monetize their content with new content distribution

channels. This podcasting feature also gives users the ability to go deeper into the stories through supplemental, digital content, and

eventually comment and contribute their own content to episode feeds.

The combination of AM/FM streaming and podcasting,

with Auddia’s unique, technology-driven differentiators, addresses large and rapidly growing audiences.

We have developed our AI platform on top of

Google’s TensorFlow open-source library that is being “taught” to know the difference between all types of audio content

on the radio. For instance, the platform recognizes the difference between a commercial and a song and is learning the differences between

all other content to include weather reports, traffic, news, sports, DJ conversation, etc. Not only does the technology learn the differences

between the various types of audio segments, but it also identifies the beginning and end of each piece of content.

We are leveraging this technology platform

within our premium AM/FM radio listening experience through the faidr App. The faidr App is intended to be downloaded by consumers who

will pay a subscription fee in order to listen to any streaming AM/FM radio station and podcasts, all with commercial interruptions removed

from the listening experience, in addition to the faidrRadio exclusive content offerings. Advanced features will allow consumers to skip

any content heard on the station and request audio content on-demand. We believe the faidr App represents a significant differentiated

audio streaming product, or Superapp, that will be the first to come to market since the emergence of popular streaming music apps such

as Pandora, Spotify, Apple Music, Amazon Music, etc. We believe that the most significant point of differentiation is that

in addition to ad-free AM/FM streaming and ad-reduced podcasts, the faidr App is intended to deliver non-music content that includes

local sports, news, weather, traffic and the discovery of new music alongside exclusive programming. No other audio streaming app available

today, including category leaders like TuneIn, iHeart, and Audacy, can compete with faidr’s full product offerings.

We launched an MVP version of faidr through

several consumer trials in 2021 to measure consumer interest and engagement with the App. The full app launched on February 15, 2022,

and included all major U.S. radio stations in the US. In February 2023, we added faidrRadio, our exclusive content offerings, to the

app. Podcasts were added to the app for the iOS version before the end of Q1 2023 as planned and added to the Android app in May of 2023.

We also developed a testbed differentiated

podcasting capability called Vodacast, which leveraged technologies and proven product concepts to differentiate its podcasts offering

from other competitors in the radio-streaming product category.

With podcasting growing and predicted to grow

at a rapid rate, the Vodacast podcast platform was conceptualized to fill a void in the emerging audio media space. The platform was

built to become the preferred podcasting solution for podcasters by enabling them to deliver digital content feeds that match the audio

of their podcast episodes, and by enabling podcasters to make additional revenue from new digital advertising channels, subscription

channels, on-demand fees for exclusive content, and through direct donations from their listeners.

Throughout 2023 and 2024, Auddia has been

migrating their podcasting capabilities into the flagship faidr app bringing the advanced podcasting functionality from Vodacast into

faidr as part of the overall strategy to build a single audio Superapp. In July 2024, Auddia sunsetted the Vodacast app. Podcast functionality

continues to be developed in faidr and in August 2024, we released our Forward+ and Chapter Visualization into our differentiated AI

Podcast Player which delivers ad-reduction controls to a listener.

Today, podcasters do not have a preference as

to where their listeners access their episodes, as virtually all listening options (mobile apps and web players) deliver only their podcast

audio. By creating significant differentiation on which they can make net new and higher margin revenue, we believe that podcasters will

promote faidr to their listeners, thus creating a powerful, organic marketing dynamic.

One innovative and proprietary part of Auddia’s

podcast capabilities, originally presented on their Vodacast differentiated podcasting capability, is the availability of tools to create

and distribute an interactive digital feed, which supplements podcast episode audio with additional digital. These content feeds allow

podcasters to tell deeper stories to their listeners while giving podcasters access to digital revenue for the first time. Podcasters

will be able to build these interactive feeds using The Podcast Hub, a content management system that was originally developed and trialed

as part of Auddia’s Vodacast platform, which also serves as a tool to plan and manage podcast episodes. The digital feed activates

a new digital ad channel that turns every audio ad into a direct-response, relevant-to-the-story, digital ad, increasing the effectiveness

and value of their established audio ad model. The feed also presents a richer listening experience, as any element of a podcast episode

can be supplemented with images, videos, text and web links. This feed will appear fully synchronized in the faidr mobile App, and it

also can be hosted and accessed independently (e.g., through any browser), making the content feed universally distributable.

Over time, users will be able to comment, and

podcasters will be able to grant some users publishing rights to add content directly into the feed on their behalf. This will create

another first for podcasting, a dialog between creator and fan, synchronized to the episode content. The interactive feed for podcasts

has been developed and tested on Vodacast and is expected to be another differentiator added into faidr for podcast listeners later in

2025.

The podcast capabilities within faidr will also

introduce a unique and industry first multi-channel, highly flexible set of revenue channels that podcasters can activate in combination

to allow listeners to choose how they want to consume and pay for content. “Flex Revenue” allows podcasters to continue to

run their standard audio ad model and complement those ads with direct response enabled digital ads in each episode content feed, increasing

the value of advertising on any podcast. “Flex Revenue” will also activate subscriptions, on-demand fees for content (e.g.,

listen without audio ads for a micro payment fee) and direct donations from listeners. Using these channels in combination, podcasters

can maximize revenue generation and exercise higher margin monetization models, beyond basic audio advertising. “Flex Revenue”

and the initial inclusion of the new revenue channels that come with it will be added to podcasting in the faidr app, and the first elements

of this new monetization capability is expected to be commercially available in 2025, beginning with subscription plans to access

ad-reduction in podcasts.

The faidr mobile App is available today through

the iOS and Android App stores.

Software Products and Services

The faidr App

The faidr App is our flagship product and

is expected to generate the majority of our future revenue.

How the faidr App Works

A faidr subscriber will select a specific streaming

radio station to record and be able to listen to the recording of that station in a customized manner. The faidr App will record the station

in real time and its AI algorithm will identify the beginning and end of audio content segments including music and commercials. When

the recorded station is played back by the App subscriber, faidr will identify the audio content segments the user chooses not to consume

and automatically switch the audio playback of the recording to a different piece of audio content. For example, if a consumer chooses

not to listen to commercials during the playback of their recording of a station, the faidr App will automatically cover the commercial

segments with other content such as additional music.

We are developing strategies and content relationships

to access additional content sources to cover commercials and respond to skips across many content segments in addition to music and

commercials, such as sports, news, talk and weather. As the audio content ecosystem continues to expand, we believe faidr will represent

an attractive distribution platform for content providers. There is no guarantee the audio content ecosystem will continue to expand

along its current trajectory or that we will be able to secure access to content in an economically advantageous manner, both of which

would negatively impact the user experience within faidr. We have not yet secured the rights from content providers to place any

audio content into the platform in an on-demand use case.

Users of faidr can also access any podcast that’s

publicly available as well as exclusive programming, music stations and Music Casts, through faidrRadio.

Faidr’s Forward+ capability enables

podcast listeners to skip ads in one single step instead of utilizing the typical 30 second skip on most traditional players.

The faidr App is built on a proprietary artificial

intelligence platform developed and owned by us and subject to one issued patent and additional patent applications that are pending.

Copyright Law

To secure the rights to stream music and other

content through the faidr app, we may enter into license agreements with copyright owners of sound recordings and musical works or their

authorized agents. In June 2021, we filed a Notice of Use of Sound Recordings Under Statutory License in accordance with 37 CFR §

370.2, which authorized us to make noninteractive digital audio transmissions and reproductions of certain sound recordings pursuant

to the statutory licenses set forth in 17 U.S.C. §§ 112 and 114. We are also in the process of obtaining licenses with the

performing rights organizations in the United States, which negotiate blanket licenses with copyright users for the public performance

of compositions in their repertory, collect royalties under such licenses, and distribute those royalties to copyright owners.

The faidr App’s architecture presents

a built-in digital audio recorder (“DAR”) that will allow consumers to record third-party transmissions made available through

the faidr App. We believe such consumer-initiated recordings are authorized as non-infringing, fair use time shifting by consumers pursuant

to the Supreme Court’s decision in Sony Corp. of America v. Universal City Studios, Inc., 464 U.S. 417 (1984). The Supreme

Court also ruled that the manufacturers of home video recording devices were not liable for reproductions made by consumers where the

devices had substantial non-infringing uses. faidr’s DAR is analogous to the Betamax television recorders found non-infringing

in the Universal City Studios decision. With the faidr’s DAR, users can select radio stations to record. Users can also control

their listening experience by deciding whether they will listen to commercials or other programming categories selected by the user.

We believe believes giving users the ability to avoid commercials is protected, non-infringing activity.

If a court were to hold that one or more functionalities

offered by the faidr App resulted in the violation of protected rights of third parties, we could be subject to liability for infringement,

the damages for which could be material.

Podcast Platform

Auddia’s Podcast Platform, which

includes the previously developed and commercially trialed Vodacast mobile app, is an interactive differentiated podcasting capability

we have built that allows podcasters to give their audiences an interactive audio experience. Podcast listeners are able to see video

and other digital content that correlates with the podcast audio and is presented to the listener as a digital feed. All content presented

in the digital feed can be synched to the podcast audio content. This allows podcast listeners to visually experience, interact with,

and eventually comment on audio content in podcasts.

Much of the technology we use in this platform

to create the feed of digital content synchronized to the audio content of the podcast is based on the core functionality and product

concepts the Company has used historically to provide synchronized digital feeds to over 580 radio stations.

The digital feed introduces a new revenue stream

to podcasters, such as synchronized digital advertising while providing end users a new digital content channel that compliments the core

audio of the podcast.

All of the content and functionality that

is made available within the Podcast Platform, through the Vodacast mobile app, is currently being added to the faidr app, diversifying

the podcast offering of faidr and bringing that app up to parity with the major, competing apps like iHeart Radio, TuneIn and Audacy.

In August 2024, new ad-reduction features were added to faidr which demonstrates our differentiation in the podcasting arena, for both

podcasters and consumers.

Business Model and Customer Acquisition Strategy

for faidr

We have an eight-year plus history of working

closely with the broadcast radio industry in the United States to help the industry adapt to both digital advertising and digital media

technologies.

We announced several broadcast radio partnerships

during 2021 in which we performed commercial trials within these markets. Based on the initial results from our commercial trials, we

believe consumers are drawn to an interruption-free radio experience. We executed a full launch in February 2022 that initially included

approximately 4,000 radio stations on the faidr App. We have continued to add stations to the faidr App which now presents more than

13,000 AM/FM streams.

Radio stations owned by broadcasters will be economically

incentivized to promote faidr to their listeners. We intend to leverage subscription revenue to compensate participating radio broadcasters

for promotional support and their increased music streaming fees. We believe that if participating broadcasters can generate increased

revenue from their content, they can decrease their on-air advertising load while increasing the price paid for each commercial, as the

commercial is more likely to be heard by consumers in a less cluttered advertising environment. In addition, we intend to offer tiered

subscriptions to the faidr App where lower priced subscriptions allow a lower level of functionality and control. We believe that our

history and existing relationships with broadcast radio will drive customer acquisition for the faidr App.

Our business model is based on creating a pool

of subscription revenue across all streaming stations and other content providers utilizing the faidr platform. This subscription pool,

excluding direct subscriber acquisition costs and increased music streaming fees, is expected to be shared with radio stations and other

content providers, such as podcasters whose episodes are available ad-free, based either on the time each listener spends listening or

the amount of plays on faidr. We believe this business model will result in broadcasters and podcasters promoting the listening of their

content within faidr, similar to how radio stations are currently using airtime to promote the listening of their stations on Alexa and

other smart speaker systems.

Our major podcast differentiators once implemented

in faidr, will be marketed to podcasters and podcasting companies with business-to-business strategies that focus on communicating the

value proposition and monetization opportunity. The potential to earn new, incremental revenue on the faidr platform, in addition to the

other key value propositions of the platform, is expected to organically drive podcasters to promote the platform directly to their listeners.

Direct-to-consumer marketing will be done independently by the Company and, in some cases, in partnership with podcasters who leverage

their audio content programs to promote to their established audiences. As is the case with other proven marketing strategies, we intend

to have our partners benefit from a participative revenue share through faidr podcasting.

Recent Developments

On April 23, 2024, we entered into the 2024

SPA with the Selling Stockholders for a convertible preferred stock and warrants financing. At the closing, we issued 2,314 shares of

Series B Convertible Preferred Stock at a purchase price of $1,000 per share of Series B Convertible Preferred Stock. The Series B Convertible

Preferred Stock is convertible into common stock at an initial conversion price of $1.851 per share of common stock. The Company also

issued the Common Warrants exercisable for 1,250,137 shares of common stock with a five year term.

The Common Warrants are immediately exercisable

for $1.851 per share of common stock, subject to certain adjustments, including with respect to stock dividends, splits, subsequent rights

offerings, pro rata distributions and a Fundamental Transaction (as defined in the Common Warrant) and until the fifth anniversary of

the original issuance date (the “Expiration Date”). The exercise of the Warrants are subject to beneficial ownership limitations.

The Company’s common stock price on

Nasdaq has declined significantly over the past several months. It is likely, therefore, that we will issue equity in future financing

transactions at an effective price per common share that is below the $1.851 (x) conversion price for the Series B Convertible Preferred

Stock and (y) exercise price of the Common Warrants. Certain future stock issuances at an effective price below $1.851 will result in

a downward conversion price adjustment for the Series B Convertible Preferred Stock. This would result in the Series B Convertible Preferred

Stock converting into more shares of common stock and would cause additional dilution. Certain future stock issuances at an effective

price below $1.851 will also result in a downward exercise price adjustment for the Common Warrants. For additional information regarding

potential adjustments for the Series B Convertible Preferred Stock, see “Description of Capital Stock—Preferred

Stock— Series B Convertible Preferred Stock” above.

Risks Associated with Our Business

Investing in our securities involves a high degree

of risk. You should carefully consider the risks described in “Risk Factors” beginning

on page 10 before making a decision to invest in our common stock. If any of these risks actually occurs, our business, financial condition,

results of operations and prospects would likely be materially, adversely affected. In that event, the trading price of our common stock

could decline, and you could lose part or all of your investment.

Going Concern Opinion

Our working capital deficiency, stockholders’

deficit, and recurring losses from operations raise substantial doubt about our ability to continue as a going concern. As a result, our

independent registered public accounting firm included an explanatory paragraph in its report on our financial statements for the year

ended December 31, 2023 with respect to this uncertainty. Our ability to continue as a going concern will require us to obtain additional

funding.

The Company secured approximately $10.4 million

in additional financing year-to-date through September 12, 2024, which enabled us to pay down $2.75 million in connection with the Secured

Bridge Notes and will only be sufficient to fund our current operating plans into the second quarter of 2025. The Company has based these

estimates, however, on assumptions that may prove to be wrong. We will need additional funding to complete the development of our full

product line and scale products with a demonstrated market fit. Management has plans to secure such additional funding. If we are unable

to raise capital when needed or on acceptable terms, we would be forced to delay, reduce, or eliminate our technology development and

commercialization efforts.

As a result of the Company’s recurring losses

from operations, and the need for additional financing to fund its operating and capital requirements, there is uncertainty regarding

the Company’s ability to maintain liquidity sufficient to operate its business effectively, which raises substantial doubt as to

the Company’s ability to continue as a going concern.

Implications of Being

an Emerging Growth Company and a Smaller Reporting Company

We qualify as an “emerging growth company”

as defined in the Jumpstart our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage

of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| |

· |

inclusion of only two years, as compared to three years, of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| |

|

|

| |

· |

an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”); |

| |

|

|

| |

· |

an exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board (the “PCAOB”) requiring mandatory audit firm rotation; |

| |

|

|

| |

· |

reduced disclosure about executive compensation arrangements; and |

| |

|

|

| |

· |

an exemption from the requirement to seek non-binding advisory votes on executive compensation or golden parachute arrangements. |

We may take advantage of these provisions until

we are no longer an emerging growth company. We will remain an emerging growth company until the earliest of (1) the last day of the

fiscal year (a) following the fifth anniversary of the completion of our February 2021 IPO, (b) in which we have total annual gross revenue

of at least $1.235 billion or (c) in which we are deemed to be a large accelerated filer, which means the market value of our

common stock that is held by non-affiliates exceeds $700 million as of the prior December 31st, and (2) the date on which we have issued

more than $1.0 billion in non-convertible debt during the prior three-year period.

We have taken advantage

of the reduced reporting requirements in this prospectus and in the documents incorporated by reference into this prospectus. Accordingly,

the information contained herein may be different from the information you receive from other public companies that are not emerging growth

companies.

The JOBS Act permits

an emerging growth company such as us to take advantage of an extended transition period to comply with new or revised accounting standards

applicable to public companies until those standards would otherwise apply to private companies.

We are also a “smaller

reporting company” meaning that the market value of our stock held by non-affiliates is less than $700 million and our annual revenue

was less than $100 million during the most recently completed fiscal year. We may continue to be a smaller reporting company if either

(i) the market value of our stock held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million

during the most recently completed fiscal year and the market value of our stock held by non-affiliates is less than $700 million. If

we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from

certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company we may

choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and, similar

to emerging growth companies, smaller reporting companies have reduced disclosure obligations regarding executive compensation.

Our Corporate Information

We were originally formed

as Clip Interactive, LLC in January 2012, as a limited liability company under the laws of the State of Colorado. Immediately prior to

our initial public offering in February 2021, we converted into a Delaware corporation pursuant to a statutory conversion and were renamed

Auddia Inc.

Our principal executive offices are located at

1680 38th Street, Suite 130, Boulder, CO 80301. Our main telephone number is (303) 219-9771. Our internet website is www.auddia.com.

The information contained in, or that can be accessed through, our website is not incorporated by reference and is not a part of this

prospectus.

Trademarks

The Company also holds the trademark for “AUDDIA”

which is used as the corporate brand name, as well as “FAIDR” which is used as the name of the consumer-facing mobile application

that delivers the Company’s commercial free radio service. The Company also holds trademarks and is in the process of applying for

trademarks for key products and brands. The Company holds the trademark for our product named “PLAZE”, which is a potential

commercial-free music streaming product that is a potential future, strategic opportunity of our business.

We have omitted the ® and

™ designations, as applicable, for the trademarks used in this prospectus.

INFORMATION REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus and the

documents incorporated by reference in this prospectus include forward-looking statements, which involve risks and uncertainties. These

forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believe,” “estimate,”

“project,” “anticipate,” “expect,” “seek,” “predict,” “continue,”

“possible,” “intend,” “may,” “might,” “will,” “could,” would”

or “should” or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements

include all matters that are not historical facts. They appear in a number of places throughout this prospectus and the documents incorporated

by reference in this prospectus, and include statements regarding our intentions, beliefs or current expectations concerning, among other

things, our product candidates, research and development, commercialization objectives, prospects, strategies, the industry in which we

operate and potential collaborations. We derive many of our forward-looking statements from our operating budgets and forecasts, which

are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to

predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results.

Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of when

such performance or results will be achieved. In light of these risks and uncertainties, the forward-looking events and circumstances

discussed in this prospectus may not occur and actual results could differ materially from those anticipated or implied in the forward-looking

statements.

Forward-looking statements

speak only as of the date of this prospectus. You should not put undue reliance on any forward-looking statements. We assume no obligation

to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking

information, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should

be drawn that we will make additional updates with respect to those or other forward-looking statements.

You should read this

prospectus, the documents incorporated by reference in this prospectus, and the documents that we reference in this prospectus and have

filed with the SEC as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual

future results, levels of activity, performance and events and circumstances may be materially different from what we expect. All forward-looking

statements are based upon information available to us on the date of this prospectus.

By their nature, forward-looking

statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the

future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations,

financial condition, business and prospects may differ materially from those made in or suggested by the forward-looking statements contained

in this prospectus. In addition, even if our results of operations, financial condition, business and prospects are consistent with the

forward-looking statements contained in this prospectus, those results may not be indicative of results in subsequent periods.

Forward-looking statements

necessarily involve risks and uncertainties, and our actual results could differ materially from those anticipated in the forward-looking

statements due to a number of factors, including those set forth below under “Risk Factors”

and elsewhere in this prospectus. The factors set forth below under “Risk Factors”

and other cautionary statements made in this prospectus should be read and understood as being applicable to all related forward-looking

statements wherever they appear in this prospectus. The forward-looking statements contained in this prospectus represent our judgment

as of the date of this prospectus. We caution readers not to place undue reliance on such statements. Except as required by law, we undertake

no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events

occur in the future. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are

expressly qualified in their entirety by the cautionary statements contained above and throughout this prospectus.

You should read and

consider the information set forth in the section titled “Risk Factors,”

together with all of the other information included in or incorporated by reference in this prospectus and the documents that we have

filed as exhibits to the registration statement of which this prospectus is a part completely and with the understanding that our actual

future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary

statements.

THE OFFERING

| Securities Offered by the Selling Stockholders |

This prospectus covers the resale of a total of up to 5,905,898 shares of our common stock, consisting of, (a) up to 4,655,761 shares of common stock issuable upon conversion of our Series B Convertible Preferred Stock and (b) up to 1,250,137 shares of common stock issuable upon the exercise of the Common Warrants, each sold in the PIPE Offering pursuant to the 2024 SPA, by and between us and the Selling Stockholders. |

| |

|

| Common Stock Outstanding Prior to this Offering |

5,673,675 shares |

| |

|

| Common Stock to be Outstanding After this Offering |

Up to 11,579,573 shares |

| Use of Proceeds |

We will not receive any proceeds from the sale by the Selling Stockholders of the shares of common stock being offered by this prospectus. However, we may receive proceeds from the cash exercise of the Common Warrants, which, if exercised in cash at the current exercise price with respect to all Common Warrants, would result in gross proceeds to us of approximately $2.3 million. The proceeds from such Common Warrant exercises, if any, will be used for working capital and general corporate purposes. See “Use of Proceeds” on page 12 of this prospectus. |

| |

|

| Nasdaq Capital Market Symbols |

Common Stock “AUUD”. Series A Warrants “AUUDW”. |

| |

|

| Risk Factors |

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our securities. |

The number of shares outstanding after this offering is based on 5,673,675

shares of our common stock outstanding as of October 15, 2024, and excludes:

| · | 8,929

shares of our common stock reserved for issuance under outstanding stock options granted

under our 2013 Equity Incentive Plan, |

| · | 6,774

shares of our common stock reserved for issuance under outstanding restricted stock units

granted under our 2020 Equity Incentive Plan, |

| · | 39,632 shares of our common stock

reserved for issuance under outstanding stock options granted under our 2020 Equity Incentive

Plan, |

| · | 103,308 shares of our common

stock reserved for future grant under our 2020 Equity Incentive Plan, |

| · | 32,150 shares of our common stock

reserved for issuance under outstanding stock options and outstanding restricted stock units

granted as employment inducement awards to three of our former and current executives outside

of our 2013 and 2020 Equity Incentive Plans, |

| · | 1,026,674 shares of common stock

reserved for issuance upon the exercise of outstanding common stock warrants, |

| · | 139,956 shares of common stock

reserved for issuance upon the exercise of our publicly traded outstanding Series A Warrants, |

| · | 1,250,137 shares of common stock

reserved for issuance upon the exercise of warrants sold in a private placement, |

| · | 12,774 shares of common stock

reserved for issuance upon the exercise of an outstanding IPO underwriter representative

common stock warrant, and |

| · | Up to 2,290,000 shares or $1,823,951

of common stock that may be sold in the future by the Company to While Lion pursuant to the

Equity Line Purchase Agreement. |

RISK FACTORS

Investing in our securities involves a high

degree of risk. You should carefully consider the risks and uncertainties described below, together with the risks set forth under the

section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated

by reference herein. You should also refer to the other information contained in this prospectus, and the documents incorporated by reference

herein including our financial statements and the related notes, and the section titled “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” included in our Annual Report on Form 10-K for the year ended December 31, 2023,

before deciding to invest in our securities. The risks and uncertainties described below are not the only ones we face. Other sections

of this prospectus may include additional factors which could adversely affect our business, results of operations and financial performance.

Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors

that affect us. If any of the following risks actually occurs, our business, financial condition, results of operations and prospects

could be materially and adversely affected, the trading price of our common stock could decline and you could lose all or part of your

investment.

Risks Relating to

this Offering

The Selling Stockholders

may sell their shares of common stock in the open market, which may cause our stock price to decline.

The Selling Stockholders

may sell the shares of common stock being registered in this offering in the public market. That means that up to 5,905,898 shares of

common stock, the number of shares being registered in this offering for sale by the Selling Stockholders if they exercise the Common

Warrants, may be sold in the public market. Such sales will likely cause our stock price to decline.

Sales of our common

stock by the Selling Stockholders could encourage short sales by third parties, which could contribute to the further decline of our stock

price.

The significant downward

pressure on the price of our common stock caused by the sale of material amounts of common stock could encourage short sales by third

parties. Such an event could place further downward pressure on the price of our common stock.

Risks related to our

financial position and need for additional capital

Our auditors have

expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain further financing.

Our past working capital deficiency, stockholders’

deficit and recurring losses from operations raised substantial doubt about our ability to continue as a going concern. As a result,

our independent registered public accounting firm has included an explanatory paragraph in its report on our financial statements for

the year ended December 31, 2023 with respect to this uncertainty. Our existing cash of $804,556 at December 31, 2023. The Company

secured approximately $10.4 million in additional financing year-to-date through October 15, 2024, which enabled us to pay down

$2.75 million in connection with the Secured Bridge Notes and will only be sufficient to fund our current operating plans into the second

quarter of 2025. The Company has based these estimates, however, on assumptions that may prove to be wrong. We will need additional funding

to complete the development of our full product line and scale products with a demonstrated market fit. Management has plans to secure

such additional funding. If we are unable to raise capital when needed or on acceptable terms, we would be forced to delay, reduce, or

eliminate our technology development and commercialization efforts.

We may not be able

to continue our current listing of our common stock on the Nasdaq Capital Market. A delisting of our common stock from Nasdaq could limit

the liquidity of our stock, increase its volatility and hinder our ability to raise capital.

We may not be able to

satisfy the requirements for the continued listing of our common stock on Nasdaq.

On November 21, 2023,

we received a written notice from Nasdaq indicating that we are not in compliance with Nasdaq Listing Rule 5550(b)(1), which requires

companies listed on The Nasdaq Capital Market to maintain a minimum of $2,500,000 in stockholders’ equity for continued listing

(the “Stockholders’ Equity Requirement”). In our quarterly report on Form 10-Q for the period ended September 30, 2023,

we reported stockholders’ equity of $2,415,012, and, as a result, did not satisfy Listing Rule 5550(b)(1). As a result, the Nasdaq

staff determined to delist our Common Stock from Nasdaq, unless we appealed the Staff’s determination to a Hearings Panel (the

“Panel”), We appealed the Nasdaq Staff’s determination, and our hearing with the Panel occurred on January 18, 2024.

On January 30, 2024, the Panel granted our

request for an exception to the Exchange’s listing rules until April 22, 2024, to demonstrate with all applicable continued listing

requirements for the Nasdaq Capital Market. On April 16, 2024, we received a letter from Nasdaq granting an exception to the Exchange’s

listing rules until May 20, 2024, to demonstrate compliance with the Stockholders’ Equity Requirement.

On May 24, 2024, we received a letter from

Nasdaq indicating that we had regained compliance with the Equity Requirement. We will be subject to a Mandatory Panel Monitor for a

period of one year from the date of the letter in accordance with application of Listing Rule 5815(d)(4)(B).

Nasdaq listing rules require listed securities

to maintain a minimum bid price of $1.00 per share. As previously reported in our Current Report on Form 8-K filed on October 23, 2024,

we received a written notice from Nasdaq indicating that we were was not in compliance with the $1.00 minimum bid price requirement set

forth in Nasdaq Listing Rule 5550(a)(2) for continued listing (the “Bid Price Requirement”). The Bid Price notice does not

result in the immediate delisting of the Company’s common stock from the Nasdaq Capital Market. The Bid Price notice indicated

that the Company has 180 calendar days (or until April 14, 2025) in which to regain compliance.

If our common stock is delisted by Nasdaq, our

common stock may be eligible for quotation on an over-the-counter quotation system or on the pink sheets. Upon any such delisting, our

common stock would become subject to the regulations of the SEC relating to the market for penny stocks. A penny stock is any equity security

not traded on a national securities exchange that has a market price of less than $5.00 per share. The regulations applicable to penny

stocks may severely affect the market liquidity for our common stock and could limit the ability of shareholders to sell securities in

the secondary market. In such a case, an investor may find it more difficult to dispose of or obtain accurate quotations as to the market

value of our common stock, and there can be no assurance that our common stock will be eligible for trading or quotation on any alternative

exchanges or markets.

Delisting from Nasdaq could adversely affect our

ability to raise additional financing through public or private sales of equity securities, would significantly affect the ability of

investors to trade our securities and would negatively affect the value and liquidity of our common stock. Delisting could also have other

negative results, including the potential loss of confidence by employees, the loss of institutional investor interest and fewer business

development opportunities.

If our common stock is

delisted by Nasdaq, our common stock may be eligible for quotation on an over-the-counter quotation system or on the pink sheets. Upon

any such delisting, our common stock would become subject to the regulations of the SEC relating to the market for penny stocks. A penny

stock is any equity security not traded on a national securities exchange that has a market price of less than $5.00 per share. The regulations

applicable to penny stocks may severely affect the market liquidity for our common stock and could limit the ability of shareholders to

sell securities in the secondary market. In such a case, an investor may find it more difficult to dispose of or obtain accurate quotations

as to the market value of our common stock, and there can be no assurance that our common stock will be eligible for trading or quotation

on any alternative exchanges or markets.

Delisting from Nasdaq

could adversely affect our ability to raise additional financing through public or private sales of equity securities, would significantly

affect the ability of investors to trade our securities and would negatively affect the value and liquidity of our common stock. Delisting

could also have other negative results, including the potential loss of confidence by employees, the loss of institutional investor interest

and fewer business development opportunities.

MARKET AND INDUSTRY

DATA

Unless otherwise indicated,

information contained (or incorporated by reference) in this prospectus concerning our industry and the markets in which we operate is

based on information from independent industry and research organizations, other third-party sources and management estimates. Management

estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well as

data from our internal research, and are based on assumptions made by us upon reviewing such data and our knowledge of such industry and

markets which we believe to be reasonable. Although we believe the data from these third-party sources is reliable, we have not independently

verified any third-party information. In addition, projections, assumptions and estimates of the future performance of the industry in

which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those

set forth under the section titled “Risk Factors” included in this prospectus and the section titled “Risk Factors” included in our Annual Report on Form 10-K for the year ended December 31, 2023. These and other factors could

cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

USE OF PROCEEDS

We are not selling any

securities under this prospectus and will not receive any proceeds from the sale of the common stock offered by this prospectus by the

Selling Stockholders. However, we may receive proceeds from the cash exercise of the Common Warrants, which, if exercised in cash at the

current exercise price with respect to all Common Warrants, would result in gross proceeds to us of approximately $2.31 million. The proceeds

from such Common Warrant exercises, if any, will be used for working capital and general corporate purposes. We cannot predict when or

whether the Common Warrants will be exercised, and it is possible that some or all of the Common Warrants may expire unexercised. For

information about the Selling Stockholders, see “Selling Stockholders.”

The Selling Stockholders

will pay any underwriting discounts and commissions and expenses incurred by the Selling Stockholders for brokerage or legal services

or any other expenses incurred by the Selling Stockholders in disposing of the shares of common stock offered hereby. We will bear all

other costs, fees and expenses incurred in effecting the registration of the shares of common stock covered by this prospectus, including

all registration and filing fees and fees and expenses of our counsel and accountants.

DIVIDEND POLICY

We have not declared

or paid any cash dividends on our capital stock since our inception. We intend to retain future earnings, if any, to finance the operation

and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future. We intend to capitalize the required dividends on our Series C Convertible Preferred Stock or pay such dividends

in common shares.

MARKET FOR REGISTRANT’S

COMMON EQUITY, RELATED STOCKHOLDER MATTERS

Our common stock has been traded on the Nasdaq

Stock Market under the symbol “AUUD” since our IPO on February 17, 2021. Our Series A Warrants have been traded on the Nasdaq

Stock Market under the symbol “AUUDW” since our IPO on February 17, 2021. As of October 15, 2024, there were approximately

141 holders of record of our common stock and 1 holder of record of our Series A warrants. These numbers are based on the actual number

of holders registered at such date and does not include holders whose shares are held in “street name” by brokers and other

nominees.

Dividends

We have never paid any

cash dividends on our common stock. We currently intend to retain all available funds and any future earnings for use in the operation

of our business and do not anticipate paying any cash dividends on our common stock in the foreseeable future. Any future determination

to declare dividends will be made at the discretion of our board of directors and will depend on our financial condition, operating results,

capital requirements, general business conditions and other factors that our board of directors may deem relevant.

DESCRIPTION OF CAPITAL

STOCK

The following description

is intended as a summary of our certificate of incorporation (which we refer to as our “charter”) and our bylaws, each of

which is filed as an exhibit to the registration statement of which this prospectus forms a part, and to the applicable provisions of

the Delaware General Corporation Law. Because the following is only a summary, it does not contain all of the information that may be

important to you. For a complete description, you should refer to our charter and bylaws.

We have two classes of

securities registered under Section 12 of the Exchange Act. Our shares of common stock are listed on The Nasdaq Stock Market under the

trading symbol “AUUD.” Our Series A Warrants are listed on the Nasdaq Stock Market under the trading symbol “AUUDW.”

Authorized Capital

Stock

Our authorized capital

stock consists of 100,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value

$0.001 per share.

Common Stock

The holders of our common

stock are entitled to one vote for each share held on all matters submitted to a vote of the stockholders. The holders of our common stock

do not have any cumulative voting rights. Holders of our common stock are entitled to receive ratably any dividends declared by our board

of directors out of funds legally available for that purpose, subject to any preferential dividend rights of any outstanding preferred

stock. Our common stock has no preemptive rights, conversion rights or other subscription rights or redemption or sinking fund provisions.

In the event of our liquidation,

dissolution or winding up, holders of our common stock will be entitled to share ratably in all assets remaining after payment of all

debts and other liabilities and any liquidation preference of any outstanding preferred stock. Each outstanding share of common stock

is duly and validly issued, fully paid and non-assessable.

Preferred stock

Our board will have the

authority, without further action by our stockholders, to issue up to 10,000,000 shares of preferred stock in one or more series and to

fix the rights, preferences, privileges and restrictions thereof. These rights, preferences and privileges could include dividend rights,

conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting,

or the designation of, such series, any or all of which may be greater than the rights of common stock. The issuance of our preferred

stock could adversely affect the voting power of holders of common stock and the likelihood that such holders will receive dividend payments

and payments upon our liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring or preventing

a change in control of our company or other corporate action.

Series A Preferred

Stock

On November 10, 2023,

we entered into a securities purchase agreement with Jeffrey Thramann, our Executive Chairman, pursuant to which we issued and sold one

(1) share of our newly designated Series A Preferred Stock for an aggregate purchase price of $1,000.

The share of Series A

Preferred Stock will have 30,000,000 votes and will vote together with the outstanding shares of our common stock as a single class exclusively

with respect to any proposal to amend our Certificate of Incorporation to effect a reverse stock split of our common stock. The share

of Series A Preferred Stock will be voted, without action by the holder, on any such reverse stock split proposal in the same proportion

as shares of common stock are voted on such proposal (excluding any shares of common stock that are not voted).

On December 29, 2023,

we redeemed the one outstanding share of Series A Preferred Stock in accordance with its terms. The redemption price was $1,000. No Series

A Preferred Stock remains outstanding.

The Series A Preferred

Stock otherwise has no voting rights, except as may otherwise be required by the General Corporation Law of the State of Delaware. The

share of Series A Preferred Stock is not convertible into, or exchangeable for, shares of any other class or series of our stock or other

securities. The share of Series A Preferred Stock has no rights with respect to any distribution of our assets, including upon a liquidation,

bankruptcy, reorganization, merger, acquisition, sale, dissolution or winding up, whether voluntarily or involuntarily. The holder of

the Share of Series A Preferred Stock will not be entitled to receive dividends of any kind. The share of Series A Preferred Stock shall

be redeemed in whole, but not in part, at any time (i) if such redemption is ordered by our board in its sole discretion or (ii) automatically

upon the effectiveness of the amendment to the Certificate of Incorporation implementing a reverse stock split. Upon such redemption,

the holder of the Series A Preferred Stock will receive consideration of $1,000.00 in cash.

Series B Convertible

Preferred Stock

On November 10, 2023,

we entered into a securities purchase agreement with accredited investors, pursuant to which we issued and sold 2,314 shares of our newly

designated Series B Convertible Preferred Stock for an aggregate purchase price of $2,314,000.

Holders of the Series B Convertible Preferred

Stock will be entitled to dividends in the amount of 10% per annum, payable quarterly. We have the option to pay dividends on the Series

B Convertible Preferred Stock in additional shares of common stock. If we elect to pay in the form of common stock, the number of dividend

shares to be issued shall be calculated by using a “Dividend Conversion Price” equal to the lower of (i) the then applicable

Conversion Price (as defined in the Certificate of Designations) as in effect on the applicable dividend date, or (ii) 90% of the lowest

volume-weighted average price (“VWAP”) of the common stock during the five (5) consecutive trading day period ending and including

the trading day immediately preceding the applicable dividend date. We also have the option to cumulate or “capitalize” the

dividends, in which case the accrued dividend amount shall be added to the stated value of each share of Series B Convertible Preferred

Stock.

The stated value of each

share of Series B Convertible Preferred Stock (including all the unpaid dividends and other amounts payable on the Series B Convertible

Preferred Stock) will be convertible into common stock at an initial fixed Conversion Price of $1.851 per share of common stock. The Series

B Convertible Preferred Stock may be converted into shares of common stock at any time at the option of the holder. The Series B Convertible

Preferred Stock may also be converted into shares of common stock at our option if the closing price of the common stock exceeds 300%

of the Conversion Price for 20 consecutive trading days.

The Conversion Price

of the Series B Convertible Preferred Stock is subject to certain anti-dilution adjustments, including in the event of any stock splits

or combinations, certain dividends and distributions, reclassification, exchange or substitution of our common stock or in the event that

we grant, issue or sell (or enters into any agreement to grant, issue or sell), or are deemed to have granted, issued or sold, any shares

of common stock for a consideration per share (the “New Issuance Price”) less than a price equal to the Conversion Price in

effect immediately prior to such granting, issuance or sale or deemed granting, issuance or sale (the foregoing a “Dilutive Issuance”)

Immediately after such Dilutive Issuance, the Conversion Price then in effect shall be reduced to an amount equal to the New Issuance

Price.

The Series B Convertible

Preferred Stock has no voting rights, except as may otherwise be required by the General Corporation Law of the State of Delaware. The

stated value of each share of Series B Convertible Preferred Stock (including all the unpaid dividends and other amounts payable on the

Series B Convertible Preferred Stock) will be convertible into common stock at an initial fixed Conversion Price of $1.851 per share of

common stock. The Series B Convertible Preferred Stock may be converted into shares of common stock at any time at the option of the holder.

The Conversion Price

of the Series B Convertible Preferred Stock is subject to certain anti-dilution adjustments, including in the event of any stock splits

or combinations, certain dividends and distributions, reclassification, exchange or substitution of our common stock or in the event that

we grant, issue or sell (or enters into any agreement to grant, issue or sell), or are deemed to have granted, issued or sold, any shares

of common stock for a consideration per share (the “New Issuance Price”) less than a price equal to the Conversion Price in

effect immediately prior to such granting, issuance or sale or deemed granting, issuance or sale (the foregoing a “Dilutive Issuance”)

Immediately after such Dilutive Issuance, the Conversion Price then in effect shall be reduced to an amount equal to the New Issuance

Price.

The Certificate of Designations

contains customary events of default, or “Triggering Events”, including, among others, (i) certain events of bankruptcy, insolvency

or reorganization; (ii) failure to comply with the listing rules of Nasdaq; (iii) certain breaches of the transaction agreements related

to this financing; and (iv) any of the shares of the Series B Convertible Preferred Stock remaining outstanding on or after April 23,

2026.

Upon the occurrence of

a Triggering Event, (i) the dividend rate on the Series B Convertible Preferred Stock will increase to 18%, and (ii) the Conversion Price

then in effect will be adjusted to an “Alternate Conversion Price” equal to the lowest of (i) the applicable Conversion Price

as then in effect, and (ii) the greater of (x) the “Floor Price” of $0.3702 and (y) 80% of the lowest VWAP of the common stock

during the five (5) consecutive trading day period immediately preceding the delivery or deemed delivery of the applicable conversion

notice.

At any time, we shall

have the right to redeem all, but not less than all, of the Series B Convertible Preferred Shares then outstanding in cash at a 25% redemption

premium to the greater of (i) the face value of our common stock underlying the Series B Convertible Preferred Shares and (ii) the equity

value of our common stock underlying the Series B Convertible Preferred Shares. The equity value of our common stock underlying the Series

B Convertible Preferred Shares is calculated using the greatest closing sale price of our common stock on any trading day immediately

preceding the date we notify the holders of our election to redeem and the date we make the entire payment required.

Upon our liquidation,

dissolution or winding up, holders of Series B Convertible Preferred Stock shall be entitled to receive in cash out of our assets, before

any amount shall be paid to the holders of any of shares of common stock, an amount per shares of Series B Convertible Preferred Stock

equal to the sum of (i) the Black Scholes Value (as defined in the Warrants) with respect to the outstanding portion of all Warrants held

by such holder (without regard to any limitations on the exercise thereof) as of the date of such event and (ii) the greater of (A) 125%

of the applicable liquidation value and (B) the amount per share such holder would receive if such holder converted such share of Series

B Convertible Preferred Stock into common stock immediately prior to the date of such payment.

We have no other shares

of preferred stock are currently outstanding.

Anti-Takeover Effects

of Delaware Law and Provisions of Our Charter and Our Bylaws

Certain provisions of

the DGCL and of our charter and our bylaws could have the effect of delaying, deferring or preventing another party from acquiring control

of us and encouraging persons considering unsolicited tender offers or other unilateral takeover proposals to negotiate with our board

of directors rather than pursue non-negotiated takeover attempts. These provisions include the items described below.

Delaware Anti-Takeover

Statute

We are subject to the

provisions of Section 203 of the DGCL. In general, Section 203 prohibits a publicly held Delaware corporation from engaging in a “business

combination” with an “interested stockholder” for a three-year period following the time that this stockholder becomes

an interested stockholder, unless the business combination is approved in a prescribed manner. Under Section 203, a business combination

between a corporation and an interested stockholder is prohibited unless it satisfies one of the following conditions:

| |

· |

before the stockholder became interested, our Board approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder; |

| |

|

|

| |

· |

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the voting stock outstanding, shares owned by persons who are directors and also officers, and employee stock plans, in some instances, but not the outstanding voting stock owned by the interested stockholder; or |

| |

|

|

| |

· |

at or after the time the stockholder became interested, the business combination was approved by our Board and authorized at an annual or special meeting of the stockholders by the affirmative vote of at least two-thirds of the outstanding voting stock which is not owned by the interested stockholder. |

Section 203 defines a

business combination to include:

| |

· |

any merger or consolidation involving the corporation and the interested stockholder; |

| |

|

|

| |

· |

any sale, transfer, lease, pledge, exchange, mortgage or other disposition involving the interested stockholder of 10% or more of the assets of the corporation; |

| |

|

|

| |

· |

subject to exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder; or |

| |

|

|

| |

· |

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation. |

In general, Section 203

defines an interested stockholder as any entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation

and any entity or person affiliated with or controlling or controlled by the entity or person.

Board Composition

and Filling Vacancies

Our charter provides

that stockholders may remove directors only for cause and only by the affirmative vote of the holders of at least two-thirds of our outstanding

common stock. Our charter and bylaws authorize only our board of directors to fill vacant directorships, including newly created seats.

In addition, the number of directors constituting our board of directors may only be set by a resolution adopted by a majority vote of

our entire board of directors. These provisions would prevent a stockholder from increasing the size of our board of directors and then

gaining control of our board of directors by filling the resulting vacancies with its own nominees. This makes it more difficult to change

the composition of our board of directors but promotes continuity of management.

No Written Consent

of Stockholders

Our charter and bylaws

provide that all stockholder actions are required to be taken by a vote of the stockholders at an annual or special meeting, and that

stockholders may not take any action by written consent in lieu of a meeting. This limit may lengthen the amount of time required to take

stockholder actions and would prevent the amendment of our bylaws or removal of directors by our stockholders without holding a meeting

of stockholders.

Meetings of Stockholders

Our charter and bylaws

provide that only a majority of the members of our Board then in office, our Executive Chairman or our Chief Executive Officer may call

special meetings of stockholders and only those matters set forth in the notice of the special meeting may be considered or acted upon

at a special meeting of stockholders.

Advance Notice Requirements

Our bylaws provide advance

notice procedures for stockholders seeking to bring matters before our annual meeting of stockholders or to nominate candidates for election

as directors at our annual meeting of stockholders. Our bylaws also specify certain requirements regarding the form and content of a stockholder’s

notice. These provisions might preclude our stockholders from bringing matters before our annual meeting of stockholders or from making

nominations for directors at our annual meeting of stockholders if the proper procedures are not followed. We expect that these provisions

might also discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate

of directors or otherwise attempting to obtain control of our company.

Amendment to Our Charter

and Bylaws

The DGCL, provides, generally,