UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

Ainos, Inc.

Common Stock, par value $0.01 per share

(Title of Class of Securities)

00902F303

Joseph Tung

Room 1901, No. 333, Section 1 Keelung Rd.

Taipei, 110, Taiwan,

Republic of China

Tel: +886-2-6636-5678

(Name, Address

and Telephone Number of Person Authorized to

Receive Notices and Communications)

May 3, 2024

(Date of Event

Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format

shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom

copies are to be sent.

* The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

CUSIP No. 00902F303

| 1 |

NAME

OF REPORTING PERSON:

ASE Technology Holding Co., Ltd.

(“ASX”) |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS):

(a) ☒

(b) ☐ |

| 3 |

SEC

USE ONLY:

|

| 4 |

SOURCE

OF FUNDS (SEE INSTRUCTIONS):

WC |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e):

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Taiwan, Republic of China |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER:

0 |

| 8 |

SHARED

VOTING POWER:

2,312,077 (1) |

| 9 |

SOLE

DISPOSITIVE POWER:

0 |

| 10 |

SHARED

DISPOSITIVE POWER:

2,312,077

(1) |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

2,312,077 (1) |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS):

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

27.4% (2) |

| 14 |

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS):

CO |

|

|

|

|

_______________________

(1) Represents

beneficial ownership of 2,312,077 shares of Common Stock, $0.01 par value (the “Common Stock”), of Ainos, Inc., a Texas corporation

(the “Issuer”) consisting of the following: (i) 29,411 shares owned directly by ASE Test Taiwan (as defined below); (ii)

282,666 shares pursuant to the 2023 Agreement (as defined below) between ASE Test Taiwan and the Issuer; and (iii) 2,000,000 shares of

common stock pursuant to the 2024 Agreement (as defined below) between ASE Test Taiwan and the Issuer. For further details, please see

Item 3 and Item 6.

(2) Based

on the sum of (i) 6,144,506 shares of common stock outstanding as of March 31, 2024 as set forth in the Registration Statement on Form

S-1 of the Issuer filed with the SEC on April 8, 2024, (ii) 282,666 shares of common stock convertible pursuant to the 2023 Agreement

(as defined below) and (iii) 2,000,000 shares of common stock convertible pursuant to the 2024 Agreement (as defined below).

CUSIP No. 00902F303

| 1 |

NAME

OF REPORTING PERSON:

ASE Test, Inc. (“ASE Test Taiwan”) |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS):

(a) ☒

(b) ☐ |

| 3 |

SEC

USE ONLY:

|

| 4 |

SOURCE

OF FUNDS (SEE INSTRUCTIONS):

WC |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e):

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION:

Taiwan, Republic of China |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER:

0 |

| 8 |

SHARED

VOTING POWER:

2,312,077 (1) |

| 9 |

SOLE

DISPOSITIVE POWER:

0 |

| 10 |

SHARED

DISPOSITIVE POWER:

2,312,077 (1) |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

2,312,077 (1) |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS):

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

27.4% (2) |

| 14 |

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS):

CO |

|

|

|

|

________________________

| (1) | Represents

beneficial ownership of 2,312,077 shares of Common Stock, $0.01 par value (the “Common

Stock”), of Ainos, Inc., a Texas corporation (the “Issuer”) consisting

of the following: (i) 29,411 shares owned directly by ASE Test Taiwan (as defined below);

(ii) 282,666 shares pursuant to the 2023 Agreement (as defined below) between ASE Test Taiwan

and the Issuer; and (iii) 2,000,000 shares of common stock pursuant to the 2024 Agreement

(as defined below) between ASE Test Taiwan and the Issuer. For further details, please see

Item 3 and Item 6. |

| (2) | Based

on the sum of (i) 6,144,506 shares of common stock outstanding as of March 31, 2024 as set

forth in the Registration Statement on Form S-1 of the Issuer filed with the SEC on April

8, 2024, (ii) 282,666 shares of common stock convertible pursuant to the 2023 Agreement (as

defined below) and (iii) 2,000,000 shares of common stock convertible pursuant to the 2024

Agreement (as defined below). |

Item

1. Security and Issuer

This Schedule

13D is being filed to reflect the acquisition by ASE Test Taiwan (as defined below) of a Convertible Note in the aggregate principal

amount of $9,000,000 pursuant to a Convertible Note and Warrant Purchase Agreement entered into on May 3, 2024 (the “2024 Agreement”)

between the Issuer and ASE Test Taiwan. The note bears 6% compound interest and has a three-year term. The note will be convertible into

shares of Common Stock at a conversion price of $4.50 per share (or 2,000,000 shares), subject to customary anti-dilution adjustments.

This statement

on Schedule 13D (this “Statement”) relates to the Common Stock, par value $0.01 per share of the Issuer. The address of the

principal executive corporate offices of the Issuer is 8880 Rio San Diego Drive, Suite 800, San Diego, CA 92108.

Item

2. Identity and Background

(a)-(c)

This Schedule 13D is being filed by (i) ASE Technology Holding Co., Ltd., a Taiwanese corporation (“ASX”), with a principal

executive office at 26, Chin 3rd Rd., Nanzih Dist., Kaohsiung, 811, Taiwan, Republic of China, and (ii) its indirect wholly-owned subsidiary,

ASE Test, Inc., a Taiwanese corporation (“ASE Test Taiwan”), with a principal executive office at 10, West 5th Street, Nanzih

Dist., Kaohsiung, 811, Taiwan (ASX and ASE Test Taiwan, collectively, the “Reporting Persons”). ASE Test Taiwan is directly

wholly-owned by Advanced Semiconductor Engineering, Inc., a Taiwan company, which is itself directly held by ASX.

The

principal business of ASX includes semiconductor packaging, design and production of interconnect materials, front-end engineering testing,

wafer probing, and final testing services, as well as electronic manufacturing services. The principal business of ASE Test Taiwan is

providing semiconductor testing services.

For

disclosure relating to the directors and executive officers of ASX and ASE Test Taiwan, see Appendix A hereto.

(d)

During the last five years, none of the Reporting Persons nor any director or executive officer of the Reporting Persons have been convicted

in a criminal proceeding.

(e)

During the last five years, none of the Reporting Persons nor any director or executive officer of Reporting Persons was a party to a

civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject

to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state

securities laws or finding any violation with respect to such laws.

(f)

The Reporting Persons are organized in Taiwan, Republic of China.

Item

3. Source and Amount of Funds or Other Consideration

On

May 3, 2024, ASE Test Taiwan entered into a Convertible Note and Warrant Purchase Agreement with the Issuer pursuant to which ASE Test

Taiwan purchased from the Issuer a Convertible Note in the aggregate principal amount of $9,000,000. The note bears 6% compound interest

and has a three-year term. The note will be convertible into shares of Common Stock at a conversion price of $4.50 per share (or 2,000,000

shares), subject to customary anti-dilution adjustments. As part of the transaction, ASE Test Taiwan will receive a five-year common

stock purchase warrant which will vest and become exercisable on the first day following a six-month period from the date of issue. The

warrant may be exercised for up to 500,000 shares of Common Stock at a price of $4.50 per share, customary to anti-dilution adjustments.

The

purchase of the Convertible Note was funded by ASE Test Taiwan with cash on hand.

Item

4. Purpose of Transaction

The purpose of the

acquisition was to make a financial investment in the Issuer.

The

Reporting Persons may engage in discussions with management, the board of directors of the Issuer (the “Board”), other shareholders

of the Issuer and other relevant parties concerning the business, assets, capitalization, financial condition, operations, management,

strategy, potential business combinations and strategic alternatives, and future plans of the Issuer. The Reporting Persons also may

consider, formulate, discuss and seek to cause the Issuer to implement various plans or proposals intended to protect, preserve or enhance

stockholder value or protect, preserve or enhance the value of the Issuer’s assets, including plans or proposals that may involve

extraordinary matters relating to the Issuer. Any such actions or transactions may be taken, advocated by, or involve the Reporting Persons

alone or in conjunction with other shareholders, financing sources and/or other third parties, and could include proposing or considering

one or more of the actions described in subsections (a) through (j) of Item 4 of Schedule 13D.

The

Reporting Persons intend to review their investments in the Issuer on a continuing basis. Depending on various factors, including, without

limitation, the Issuer’s financial position and strategic direction, actions taken by the Board, price levels of shares of the

Common Stock, other investment opportunities available to the Reporting Persons, concentration of positions in the portfolios managed

by the Reporting Persons, market conditions and general economic and industry conditions, the Reporting Persons may take such actions

with respect to their investment in the Issuer as they deem appropriate, including, without limitation, purchasing additional shares

of the Common Stock or other financial instruments related to the Issuer or the Common Stock or selling some or all of the Common Stock,

engaging in hedging or similar transactions involving securities relating to the Issuer or the Common Stock and/or otherwise changing

their intention with respect to any and all matters referred to in subsections (a) through (j) of Item 4 of Schedule 13D.

Item

5. Interest in Securities of the Issuer

(a) - (b)

| Reporting

Person |

Number

of Shares with Sole Voting and Dispositive Power |

Number

of Shares with Shared Voting and Dispositive Power |

Aggregate

Number of Shares Beneficially Owned |

Percentage

of Common Stock Beneficially Owned |

| ASE

Technology Holding Co., Ltd. |

0 |

2,312,077 |

2,312,077 |

27.4% |

| ASE

Test, Inc. |

0 |

2,312,077 |

2,312,077 |

27.4% |

The May 3, 2024

warrant shares are not included in the table as they are not exercisable for six months from the date of issuance.

(c) Except as reported

in Item 3 above, the Reporting Persons have not affected any transactions in the shares of Common Stock in the sixty days prior to the

date hereof.

(d) The information

in Item 2 is incorporated by reference into this Item 5(d).

(e) Not applicable.

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

The

Reporting Persons’ responses to Items 3 – 5 are incorporated by reference into this Item 6.

ASE

Test Taiwan directly holds 29,411 shares of Common Stock.

On

March 13, 2023, the Issuer entered into a Convertible Promissory Note Purchase Agreement (the “2023 Agreement”) with ASE

Test Taiwan pursuant to which ASE Test Taiwan committed to pay a total aggregate amount of $2,000,000 to the Issuer in exchange for convertible

promissory note(s) in three tranches in the amounts of $1,000,000 (the “First Tranche”), $500,000 (the “Second Tranche”),

and $500,000 (the “Third Tranche”) conditioned, among other things, on the Issuer achieving certain

business milestones. ASE Test Taiwan provided $1,500,000 on as April 12, 2023 and the remaining $500,000 on September 12, 2023. Accordingly,

ASE Test Taiwan holds a convertible note that will mature on March 13, 2025 and bears interest at the rate of 6% compounded interest

per annum. At any time after the issuance and before the maturity date, the note is convertible into the Issuer's Common Stock at the

conversion price of $7.50 per share (or 282,666 shares),

subject to anti-dilutive adjustment as set forth in the note.

Effective

May 3, 2024, Ainos Inc., a Cayman Islands corporation (“Ainos KY”) and ASE Test Taiwan entered into a voting agreement with

respect to the voting stock of the Issuer (the "Voting Agreement"). Pursuant to the Voting Agreement, ASE Test Taiwan has agreed

to vote all of its current or future acquired voting stock of the Issuer in the manner determined by Ainos KY in its sole discretion.

The Voting Agreement will continue in effect until May 3, 2025 and thereafter will automatically renew for additional one-year periods

unless ASE Test Taiwan provides prior notice of termination. As part of the Voting Agreement, ASE Test Taiwan agreed that, without Ainos

KY’s written consent, it would not sell or transfer more than 20% of its shares of the Issuer in any calendar year period through

the fifth anniversary of the date of the Voting Agreement. If, in any calendar year, ASE Test Taiwan does not sell the full 20% allocation,

the remaining percentage will be added to and increase the following year's allocation. The transfer restrictions will terminate upon

the termination of the Voting Agreement.

Except

as set forth herein, neither of the Reporting Persons has any contracts, arrangements, understandings or relationships (legal or otherwise)

with any person with respect to any securities of the Issuer, including but not limited to any contracts, arrangements, understandings

or relationships concerning the transfer or voting of such securities, finder’s fees, joint ventures, loan or option arrangements,

puts or calls, guarantees of profits, division of profits or losses, or the giving or withholding of proxies.

Item

7. Material to be Filed as Exhibit

| Exhibit

No. |

Description |

| 1 |

*Joint Filing Agreement, dated May 3, 2024, by and between the Reporting Persons. |

| 2.1 |

Convertible

Promissory Note Purchase Agreement, dated March 13, 2023, by and between the Issuer and ASE Test Taiwan in the principal amount of

$2,000,000 (incorporated by reference to Exhibit 2.1(a) to the Issuer's Current Report on Form 8-K filed on March 14, 2023). |

| 2.2 |

Convertible Promissory Note, dated May 3, 2024, issued by the Issuer in favor of ASE Test Taiwan in the principal amount of $9,000,000 (incorporated by reference to Exhibit 4.2 to the Issuer’s Current Report on Form 8-K filed on May 6, 2024). |

| 2.3 |

Common Stock Warrant, dated May 3, 2024, issued by the Issuer to ASE Test Taiwan (incorporated by reference to Exhibit 4.3 to the Issuer’s Current Report on Form 8-K filed on May 6, 2024). |

| 2.4 |

Convertible Note and Warrant Purchase Agreement, dated May 3, 2024, by and between the Issuer and ASE Test Taiwan (incorporated by reference to Exhibit 10.1 to the Issuer’s Current Report on Form 8-K (File No. 001-41461) on May 6, 2024). |

| 2.5 |

Voting Agreement, dated May 3, 2024, by and between Ainos KY and ASE Test Taiwan (incorporated by reference to Exhibit 4.1 to the Issuer’s Current Report on Form 8-K (File No. 001-41461) on May 6, 2024). |

____________________

*

Filed herewith.

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Dated: May 8, 2024

| |

ASE

TECHNOLOGY HOLDING CO., LTD. |

| |

|

| |

|

| |

By: /s/ Joseph Tung |

| |

Name: Joseph Tung |

| |

Title: Director and Chief Financial

Officer |

| |

|

| |

ASE

TEST INC. |

| |

|

| |

|

| |

By: /s/ Alan Li |

| |

Name: Alan Li |

| |

Title: Director |

Schedule A

Directors and

Executive Officers of ASE Technology Holding Co., Ltd.

|

Name of director

or executive officer |

Residence

or business address |

Present principal occupation

or employment |

Nationality |

| Jason C.S. Chang |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Director and Chairman |

Singapore |

| Richard H.P. Chang |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Director, Vice Chairman and President |

Hong Kong |

| Chi-Wen Tsai |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Director; Chairman and President, Siliconware Precision Industries Co., Ltd. |

Taiwan |

| Yen-Chun Chang |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Director; Chief Operating Officer, Siliconware Precision Industries Co., Ltd. |

Taiwan |

| Tien Wu |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Director and Chief Operating Officer |

Taiwan |

| Joseph Tung |

Room 1901, No. 333, Section 1 Keelung Rd.

Taipei, 110, Taiwan,

Republic of China |

Director and Chief Financial Officer |

Taiwan |

| Raymond Lo |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Director; General Manager, ASE Test Taiwan and Kaohsiung packaging facility |

Taiwan |

| Tien-Szu Chen |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Director; General Manager, Advanced Semiconductor Engineering Inc. Chung-Li branch |

Taiwan |

| Rutherford Chang |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Director; General Manager, China Region of Advanced Semiconductor Engineering Inc. |

United States |

| Shen-Fu Yu |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Independent Director and Member, Audit Committee, Compensation Committee, and Risk Management Committee |

Taiwan |

| Mei-Yueh Ho |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Independent Director and Member, Audit Committee, and Risk Management Committee |

Taiwan |

| Wen-Chyi Ong |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Independent Director and Member, Audit Committee, and Compensation Committee |

Taiwan |

| Du-Tsuen Uang |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Chief Administration Officer |

Taiwan |

| Andrew Tang |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Chief Procurement Officer; Vice Chairman, Advanced Semiconductor Engineering Inc. |

United States |

| Chun-Che Lee |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

General Manager, ASE Electronics

Inc. |

Taiwan |

| Chung Lin |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

General Manager, ASE (Shanghai) Inc. |

Taiwan |

|

Name of director

or executive officer |

Residence

or business address |

Present principal occupation

or employment |

Nationality |

| Gichol Lee |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

General Manager, ASE (Korea) Inc. |

Korea |

| Chih-Hsiao Chung |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

General Manager, ASE Japan Co. Ltd. and Wuxi Tongzhi Microelectronics Co., Ltd. |

Taiwan |

| Kwai Mun Lee |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

President, ASE South-East Asia operations |

Singapore |

| Yean Peng Chen |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

General Manager, ASE Singapore Pte. Ltd. |

Singapore |

| Heng Ee Ooi |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

General Manager, ASE Electronics (M) Sdn. Bhd. |

Malaysia |

| Kenneth Hsiang |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Chief Executive Officer, ISE Labs, Inc. and ISE Labs, China, Ltd. |

United States |

| Chi-Pin Chang |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

General Manager, Siliconware USA, Inc. |

Taiwan |

| Kevin Yu |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

General Manager, Siliconware Technology (Suzhou) Limited |

Taiwan |

| Jeffrey Chen |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Director; Chairman, Universal Scientific Industrial (Shanghai) Co., Ltd. |

Taiwan |

| Chen-Yen Wei |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Chairman, Universal Scientific Industrial Co., Ltd.; President, Universal Scientific Industrial (Shanghai) Co., Ltd.; General Manager, Universal Global Scientific Industrial Co., Ltd. |

Taiwan |

| Ta-I Lin |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

General Manager, Universal Global Technology (Kunshan) Co. Ltd. |

Taiwan |

| Jing Cao |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

General Manager, Universal Global Technology (Shanghai) Co., Ltd. |

United States |

| Yueh-Ming Lin |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

General Manager, Universal Global Technology (Huizhou) Co., Ltd. |

Taiwan |

| Hui-Min Liu |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

General Manager, UNIVERSAL SCIENTIFIC INDUSTRIAL VIETNAM COMPANY LIMITED |

Taiwan |

| Bernardo Santos Balderrama |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

General Manager, Universal Scientific Industrial De Mexico S.A. De C.V. |

Mexico |

| Nicolas Denis |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

Chief Executive Officer, Financière AFG |

France |

| Ying Pin Wu |

26, Chin 3rd Rd.,

Nanzih Dist.,

Kaohsiung, 811, Taiwan

Republic of China |

General Manager, Asteelflash Suzhou Co., Ltd. |

United States |

Directors and

Executive Officers of ASE Test Taiwan

Name

of director

or executive

officer

|

Residence

or business

address

|

Present

principal occupation

or employment

|

Nationality |

| Jason

C.S. Chang |

10, West 5th Street, Nanzih Dist.,

Kaohsiung, 811, Taiwan |

Director

and Chairman |

Singapore |

| Rutherford

Chang |

10, West 5th Street, Nanzih Dist.

, Kaohsiung, 811, Taiwan |

Director;

General Manager, China Region of Advanced

Semiconductor Engineering Inc. |

United

States |

| Raymond

Lo |

10, West 5th Street, Nanzih Dist.,

Kaohsiung, 811, Taiwan |

Director;

General Manager, ASE Test Taiwan and Kaohsiung packaging facility |

Taiwan |

| Tien-Szu

Chen |

10, West 5th Street, Nanzih Dist.,

Kaohsiung, 811, Taiwan |

Director;

General Manager, Advanced Semiconductor Engineering Inc. Chung-Li branch |

Taiwan |

| Jeffrey

Chen |

10, West 5th Street, Nanzih Dist.,

Kaohsiung, 811, Taiwan |

Director;

Chairman, Universal Scientific Industrial (Shanghai) Co., Ltd. |

Taiwan |

| Shih

Hua Pan |

10, West 5th Street, Nanzih Dist.,

Kaohsiung, 811, Taiwan |

Director |

Taiwan |

| Chun

Che Lee |

10, West 5th Street, Nanzih Dist.,

Kaohsiung, 811, Taiwan |

Director |

Taiwan |

| Jerry

Chang |

10, West 5th Street, Nanzih Dist.,

Kaohsiung, 811, Taiwan |

Director

|

United

States |

| Alan

Li |

10, West 5th Street, Nanzih Dist.,

Kaohsiung, 811, Taiwan |

Director |

Taiwan |

| Alan

Cheng |

10, West 5th Street, Nanzih Dist.,

Kaohsiung, 811, Taiwan |

Director |

Taiwan |

| Anne

Chang |

10, West 5th Street, Nanzih Dist.,

Kaohsiung, 811, Taiwan |

Director |

Taiwan |

EXHIBIT 1

JOINT FILING

AGREEMENT

In accordance with

Rule 13d-1(k) promulgated under the Securities Exchange Act of 1934, as amended, the undersigned agree to the joint filing on behalf

of each of them of a Statement on Schedule 13D (including any amendments thereto) with respect to the Common Stock of Ainos, Inc. and

further agree that this Agreement be included as an exhibit to such joint filing.

This Agreement may

be executed in counterparts, each of which will be deemed an original, but all of which together shall constitute one and the same instrument.

The undersigned,

being duly authorized, hereby execute this Agreement this May 8, 2024.

| | ASE

TECHNOLOGY HOLDING CO., LTD. |

| | |

| | |

| | By: /s/ Joseph Tung |

| | Name: Joseph Tung |

| | Title: Director and Chief Financial

Officer |

| | |

| | ASE

TEST INC. |

| | |

| | |

| | By: /s/ Alan Li |

| | Name: Alan Li |

| | Title: Director |

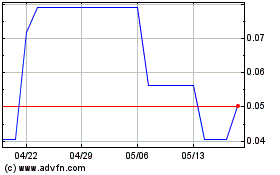

Ainos (NASDAQ:AIMDW)

過去 株価チャート

から 4 2024 まで 5 2024

Ainos (NASDAQ:AIMDW)

過去 株価チャート

から 5 2023 まで 5 2024