Xtrackers

Investment Company with Variable Capital

Registered office: 49, avenue J.F. Kennedy, L-1855

Luxembourg,

R.C.S. Luxembourg B-119.899

(the "Company")

Important Notice to Shareholders of

Xtrackers Stoxx Europe 600 Banks Swap UCITS ETF (ISIN:

LU0292103651)

Xtrackers Stoxx Europe 600 Basic Resources Swap UCITS ETF (ISIN:

LU0292100806)

Xtrackers Stoxx Europe 600 Food & Beverage Swap UCITS ETF

(ISIN: LU0292105359)

Xtrackers Stoxx Europe 600 Health Care Swap UCITS ETF (ISIN:

LU0292103222)

Xtrackers Stoxx Europe 600 Industrial Goods Swap UCITS ETF

(ISIN: LU0292106084)

Xtrackers Stoxx Europe 600 Telecommunications Swap UCITS ETF

(ISIN: LU0292104030)

Xtrackers Stoxx Europe 600 Utilities Swap UCITS ETF (ISIN:

LU0292104899)

Xtrackers Stoxx Europe 600 Oil & Gas Swap UCITS ETF (ISIN:

LU0292101796)

Xtrackers Stoxx Europe 600 Technology Swap UCITS ETF (ISIN:

LU0292104469)

(each a "Sub-Fund" and together the "Sub-Funds")

30 July 2021

The board of directors of the Company (the "Board of Directors")

hereby informs the shareholders of the Sub-Funds (the

"Shareholders") that it has resolved to make certain changes to the

Sub-Funds, as detailed below (collectively referred to as the

"Changes").

Capitalised terms not defined herein shall have the same meaning

ascribed to them in the most recent version of the prospectus of

the Company (the "Prospectus"), unless the context otherwise

requires.

The Changes in relation to each Sub-Fund will be carried out on

a date between 1 September 2021 and 30 November 2021 (each an

"Effective Date"). A notice will be published on the website of the

Company, www.Xtrackers.com (the "Company's Website"), on or around

the relevant Effective Date confirming implementation of the

Changes.

A) OVERVIEW OF THE CHANGES

1) Change of Reference Index and Index Administrator

Currently the investment objective of each Sub-Fund is to

reflect the performance of indices administered by STOXX Ltd. As

from the relevant Effective Date, each Sub-Fund shall reflect the

performance of indices administered by MSCI Limited and the current

Reference Index for each Sub-Fund (each a "Current Reference

Index") shall be replaced with a respective new reference index

(each a "New Reference Index") as follows:

Sub-Fund name Current Reference Index New Reference Index

Xtrackers Stoxx Europe STOXX(R) Europe 600 Banks MSCI Europe Financials

600 Banks Swap UCITS ETF Index ESG Screened 20-35

Select Index

Xtrackers Stoxx Europe STOXX(R) Europe 600 Basic MSCI Europe Materials

600 Basic Resources Swap Resources Index ESG Screened 20-35

UCITS ETF Select Index

Xtrackers Stoxx Europe STOXX(R) Europe 600 Food MSCI Europe Consumer

600 Food & Beverage Swap & Beverage Index Staples ESG Screened

UCITS ETF 20-35 Select Index

Xtrackers Stoxx Europe STOXX(R) Europe 600 MSCI Europe Health Care

600 Health Care Swap Health Care Index ESG Screened 20-35

UCITS ETF Select Index

Xtrackers Stoxx Europe STOXX(R) Europe 600 MSCI Europe Industrials

600 Industrial Goods Swap Industrial Goods Index ESG Screened 20-35

UCITS ETF Select Index

Xtrackers Stoxx Europe STOXX(R) Europe 600 MSCI Europe

600 Telecommunications Telecommunications Index Communication Services

Swap UCITS ETF ESG Screened 20-35

Select Index

Xtrackers Stoxx Europe STOXX(R) Europe 600 MSCI Europe Utilities

600 Utilities Swap UCITS Utilities Index ESG Screened 20-35

ETF Select Index

Xtrackers Stoxx Europe STOXX(R) Europe 600 Oil & MSCI Europe Energy ESG

600 Oil & Gas Swap UCITS Gas Index Screened 20-35 Select

ETF Index

Xtrackers Stoxx Europe STOXX(R) Europe 600 MSCI Europe Information

600 Technology Swap UCITS Technology Index Technology ESG Screened

ETF 20-35 Select Index

Further details on each Current Reference Index and the

respective New Reference Index can be found in Appendix 1 to this

notice.

Differences between each Current Reference Index and the

respective New Reference Index include, but are not limited to, the

following:

1. Sector classification: Each Current Reference Index reflects the

performance of leading companies in certain sectors, as per the Industry

Classification Benchmark ("ICB") standard, in Western Europe. Each New

Reference Index includes large and mid-cap securities across certain

developed market countries in Europe, which are classified as belonging

to certain sectors, as per the Global Industry Classification Standard

(GICS(R)) (as set out in Appendix 1 below). As such, each New Reference

Index may contain securities that were not eligible for inclusion in the

respective Current Reference Index and conversely may exclude securities

that were included in the respective Current Reference Index.

2. ESG: Each Current Reference Index does not apply environmental, social

and governance ("ESG") screens. Each respective New Reference Index

applies an ESG screening approach which excludes companies that, amongst

others, are associated with controversial, civilian, conventional and

nuclear weapons and tobacco, are assigned an MSCI ESG Rating of CCC,

derive revenues from thermal coal and oil sands extractions and that are

not in compliance with the United Nations Global Compact principles. Each

New Reference Index's ESG standards limit the number of securities

eligible for inclusion in each New Reference Index. As a result, each New

Reference Index, and as such, the relevant Sub-Fund may be more heavily

weighted in securities or countries that underperform the market as a

whole or underperform other funds screened for ESG standards, or which do

not screen for such standards. Each New Reference Index promotes ESG

characteristics, therefore each Sub-Fund will qualify as a product

subject to Article 8 of SFDR as of the Effective Date.

3. Weighting: Each Current Reference Index and the respective New Reference

Index are market capitalisation weighted.

However, for each Sub-Fund other than Xtrackers Stoxx Europe 600

Oil & Gas Swap UCITS ETF and Xtrackers Stoxx Europe 600

Technology Swap UCITS ETF each New Reference Index aims to avoid

concentration by capping entities within the index such that the

weight of the largest group entity is capped at 31.5% and the

weights of all other entities are capped at 18%, at each quarterly

re-balancing (that is 35% and 20% respectively, with a buffer of

10% applied on these limits at each index rebalancing), in

accordance with the MSCI Capped Indexes methodology. Owing to the

potentially concentrated nature of each New Reference Index,

constituents may be subject to additional rebalancing at each

month-end on an as-needed basis, as follows; where the weight of

the largest group entity has exceeded 35% or any other entities

have exceeded 20% in the lead up to each month-end, such entities

will be rebalanced to 31.5% and 18% respectively. Each New

Reference Index may also be rebalanced at other times in order to

reflect corporate activity such as mergers and acquisitions or due

to a breach of the capping constraints as set out above.

For Xtrackers Stoxx Europe 600 Oil & Gas Swap UCITS ETF and

Xtrackers Stoxx Europe 600 Technology Swap UCITS ETF each New

Reference Index aims to avoid concentration by capping entities

within the index such that the weight of the largest group entity

is capped at 28% and the weights of all other entities are capped

at 16%, at each quarterly re-balancing (that is 35% and 20%

respectively, with a buffer of 20% applied on these limits at each

index rebalancing), in accordance with the MSCI Capped Indexes

methodology. Owing to the potentially concentrated nature of each

New Reference Index, constituents may be subject to additional

rebalancing at each month-end on an as-needed basis, as follows;

where the weight of the largest group entity has exceeded 35% or

any other entities have exceeded 20% in the lead up to each

month-end, such entities will be rebalanced to 28% and 16%

respectively. Each New Reference Index may also be rebalanced at

other times in order to reflect corporate activity such as mergers

and acquisitions or due to a breach of the capping constraints as

set out above.

Each Current Reference Index includes a different capping

mechanism to the New Reference Index such that the largest

component's weight is capped at 30 percent of each Current

Reference Index's total free float market capitalisation and the

weight of the second largest component is capped at 15 percent of

the Current Reference Index's total free float market

capitalisation.

Further details on the index methodology of each New Reference

Index and information on the Global Industry Classification

Standards can be found on https://www.msci.com.

The change to each New Reference Index is proposed as part of

the Company's continuous review of its existing product range and

due to increased demand for ESG compliant investments in the

relevant Sub-Fund whilst providing relevant sector exposure. The

Board of Directors deems it to be in the best interests of the

Shareholders to restructure each Sub-Fund to reflect the New

Reference Index. Further details on MSCI ESG Ratings can be found

on https://www.msci.com/esg-ratings.

2) Change to the Investment Policy

The Board of Directors has resolved to switch the investment

policy of each of the Sub-Funds from their current Indirect

Investment Policy such that, as from the relevant Effective Date,

each Sub-Fund will be passively managed in accordance with a Direct

Investment Policy and will become a Full Replication Fund.

Following the switch to a Direct Investment Policy, the applicable

Significant Market will change from Indirect Replication

Significant Market to Direct Replication Significant Market.

The switch in Investment Policy is proposed due to increased

investor demand for direct replication sector ETFs.

3) Securities Lending

With effect from the respective Effective Date, each Sub-Fund

may start engaging in securities lending activities to generate

additional income and reduce costs. The proportion of each

Sub-Fund's net assets subject to Securities Lending Transactions

may vary between 0% and 50%.

Where the Sub-Funds enter into Securities Lending Transactions,

the collateral received in relation to such transactions shall

comply with ESG standards as determined by the relevant Investment

Manager, Sub-Portfolio Manager and/or Securities Lending Agent, in

accordance with and within the limits set forth in the Agency

Securities Lending and Repurchase Agreement and in addition to the

criteria defined under the sections "Collateral Arrangements in

Respect of Securities Lending Transaction(s)" and "Securities

Lending and Repurchase Transactions" of the Prospectus. Collateral

conforming to such ESG standards shall be identified by reference

to an appropriate developed market ESG equity index, as determined

from time to time by the relevant Investment Manager, Sub-Portfolio

Manager and/or Securities Lending Agent and will incorporate as a

minimum ESG screens substantially similar to those of each New

Reference Index. The securities held as collateral in respect to

Securities Lending Transactions are available on the website of the

Company www.Xtrackers.com.

4) Change in Cut-Off Time

As from the relevant Effective Date, the applicable Cut-off Time

of each Sub-Fund shall be amended from 3:00 p.m. Luxembourg time on

the relevant Transaction Day to 3.30 p.m. Luxembourg time on the

relevant Transaction Day.

5) Change to Sub-Fund name

As a result of the changes to the Reference Index, Index

Administrator, and Investment Policy, as described above, the name

of each Sub-Fund shall change as follows as from the relevant

Effective Date:

Current Sub-Fund name New Sub-Fund name

Xtrackers Stoxx Europe 600 Banks Swap Xtrackers MSCI Europe Financials ESG

UCITS ETF Screened UCITS ETF

Xtrackers Stoxx Europe 600 Basic Xtrackers MSCI Europe Materials ESG

Resources Swap UCITS ETF Screened UCITS ETF

Xtrackers Stoxx Europe 600 Food & Xtrackers MSCI Europe Consumer Staples

Beverage Swap UCITS ETF ESG Screened UCITS ETF

Xtrackers Stoxx Europe 600 Health Care Xtrackers MSCI Europe Health Care ESG

Swap UCITS ETF Screened UCITS ETF

Xtrackers Stoxx Europe 600 Industrial Xtrackers MSCI Europe Industrials ESG

Goods Swap UCITS ETF Screened UCITS ETF

Xtrackers Stoxx Europe 600 Xtrackers MSCI Europe Communication

Telecommunications Swap UCITS ETF Services ESG Screened UCITS ETF

Xtrackers Stoxx Europe 600 Utilities Xtrackers MSCI Europe Utilities ESG

Swap UCITS ETF Screened UCITS ETF

Xtrackers Stoxx Europe 600 Oil & Gas Xtrackers MSCI Europe Energy ESG

Swap UCITS ETF Screened UCITS ETF

Xtrackers Stoxx Europe 600 Technology Xtrackers MSCI Europe Information

Swap UCITS ETF Technology ESG Screened UCITS ETF

B) General Information

For the avoidance of doubt, the Sub-Funds' fees will remain

unchanged.

Shareholders should be aware that material transaction costs and

duties may arise as a result of the Changes which will be borne by

the relevant Sub-Fund.

Shareholders who subscribe for Shares in the relevant

Sub-Fund(s) on the primary market and who do not agree with the

Changes, are entitled to redeem their Shares in the Sub-Fund(s) in

accordance with the Prospectus. Such redemptions shall be free of

any Redemption Charge from the date of this notice until 3.00 p.m.

(Luxembourg time) on 31 August 2021. Please note that the Company

does not charge any redemption fee for the sale of Shares in the

secondary market. Orders to sell Shares through a stock exchange

can be placed via an authorised intermediary or stockbroker.

Shareholders should note that orders in the secondary market may

incur costs over which the Company has no control and to which the

above exemption on redemption charges does not apply.

Copies of the revised Prospectus and the key information

document for each Sub-Fund reflecting the Changes will be made

available on the Company's Website on or around the Effective Date,

and copies thereof may be obtained on request free of charge at the

registered office of the Company or at the offices of foreign

representatives, once available.

Shareholders who have any queries or to whom any of the above is

not clear should seek advice from their stockbroker, bank manager,

legal advisor, accountant or other independent financial

advisor.

Depending on the country of tax domicile or residence of the

Shareholder the Changes may, for example, lead to a taxable event

for the Shareholder. Shareholders are strongly urged to consult

their tax advisers as to the tax implications of the Changes,

specific to their individual cases.

Further information in relation to the Changes may be obtained

from the legal entities mentioned under Contact information below,

the offices of foreign representatives or by sending an email to

Xtrackers@dws.com.

Neither the contents of the Company's website nor the contents

of any other website accessible from hyperlinks on the Company's

website is incorporated into, or forms part of, this

announcement.

Xtrackers

The Board of Directors

Contact information

Xtrackers

49, avenue J.F. Kennedy, L-1855 Luxembourg, Grand Duchy of

Luxembourg

DWS Investment S.A.

2, boulevard Konrad Adenauer, L-1115 Luxembourg, Grand Duchy of

Luxembourg

Appendix 1

Current Sub-Fund New Sub-Fund Current Reference Current Industry New Reference New Industry

name name Index / Bloomberg Classification Index / Classification

Ticker includes companies Bloomberg includes

of the following Ticker companies of the

type (ICB)(1) following type

(GICS(R) )(2)

Xtrackers Stoxx Xtrackers STOXX(R) Europe Banks MSCI Europe Banks, Asset

Europe 600 Banks MSCI Europe 600 Banks Index Financials Management &

Swap UCITS ETF Financials (SX7R) ESG Screened Custody Banks,

ESG Screened 20-35 Select Mortgage REITs

UCITS ETF Index and insurances

(NE734596)

Xtrackers Stoxx Xtrackers STOXX(R) Europe Forestry & Paper, MSCI Europe Chemicals,

Europe 600 Basic MSCI Europe 600 Basic Industrial Metals Materials ESG Forestry & Paper,

Resources Swap Materials ESG Resources Index and Mining Screened Metals and

UCITS ETF Screened (SXPR) 20-35 Select Mining

UCITS ETF Index

(NE734591)

Xtrackers Stoxx Xtrackers STOXX(R) Europe Brewers, MSCI Europe Food and Staples

Europe 600 Food & MSCI Europe 600 Food & Distillers & Consumer Retailing,

Beverage Swap Consumer Beverage Index Vintners, Soft Staples ESG Beverage,

UCITS ETF Staples ESG (SX3R) Drinks, Farming & Screened Tobacco,

Screened Fishing and Food 20-35 Select Household

UCITS ETF Products Index Products and

(NE734594) Personal

Products

Xtrackers Stoxx Xtrackers STOXX(R) Europe Health Care MSCI Europe Health Care

Europe 600 Health MSCI Europe 600 Health Care Providers, Medical Health Care Equipment &

Care Swap UCITS Health Care Index (SXDR) Equipment, Medical ESG Screened Services, Health

ETF ESG Screened Supplies, 20-35 Select Care Technology,

UCITS ETF Biotechnology and Index Biotechnology and

Pharmaceuticals. (NE734595) Pharmaceuticals

Xtrackers Stoxx Xtrackers STOXX(R) Europe Aerospace, MSCI Europe Aerospace,

Europe 600 MSCI Europe 600 Industrial Defense, Industrials Defense,

Industrial Goods Industrials Goods Index Containers & ESG Screened Electrical

Swap UCITS ETF ESG Screened (SXNR) Packaging, 20-35 Select Equipment,

UCITS ETF Diversified Index Machinery,

Industrials, (NE734592) Trading Companies

Electrical and Distributors

Components &

Equipment,

Electronic

Equipment,

Commercial

Vehicles & Trucks,

Industrial

Machinery,

Industrial

Transportation and

Support Services

Xtrackers Stoxx Xtrackers STOXX(R) Europe Fixed Line MSCI Europe Diversified

Europe 600 MSCI Europe 600 Telecommunications Communication Telecommunication

Telecommunications Communication Telecommunications and Mobile Services ESG Services,

Swap UCITS ETF Services ESG Index (SXKR) Telecommunications Screened Wireless

Screened 20-35 Select Telecommunication

UCITS ETF Index Services, Media

(NE734598) and

Entertainment

Xtrackers Stoxx Xtrackers STOXX(R) Europe Electricity, Gas MSCI Europe Electric

Europe 600 MSCI Europe 600 Utilities Distribution, Utilities ESG Utilities, Gas

Utilities Swap Utilities ESG Index (SX6R) Multiutilities and Screened Distribution,

UCITS ETF Screened Water 20-35 Select Multiutilities

UCITS ETF Index and Water

(NE734599) Utilities

Xtrackers Stoxx Xtrackers STOXX(R) Europe Exploration & MSCI Europe Energy Equipment

Europe 600 Oil & MSCI Europe 600 Oil & Gas Production, Energy ESG & Services and

Gas Swap UCITS Energy ESG Index (SXER) Integrated Oil & Screened Oil, Gas &

ETF Screened Gas, Oil Equipment 20-35 Select Consumable Fuels

UCITS ETF & Services and Index

Pipelines (NE734590)

Xtrackers Stoxx Xtrackers STOXX(R) Europe Computer Services, MSCI Europe IT Services,

Europe 600 MSCI Europe 600 Technology Internet, Information Software,

Technology Swap Information Index (SX8R) Software, Computer Technology Communications

UCITS ETF Technology Hardware, ESG Screened and Electronic

ESG Screened Electronic Office 20-35 Select Equipment,

UCITS ETF Equipment, Index Technology

Semiconductors and (NE734597) Hardware and

Telecommunications Semiconductors &

Equipment Semiconductor

Equipment

(1) Further details on the ICB classifications of industries,

supersectors, sectors and subsectors can be found on

https://www.stoxx.com/document/Resources/Methodology/Sector_Classification_ICB/icb_structure.pdf

(2) Further details on the GICS classifications of sectors,

industry groups, industries and subindustries can be found on

https://www.msci.com/documents/1296102/11185224/GICS+Methodology+2020.pdf/9caadd09-790d-3d60-455b-2a1ed5d1e48c?t=1578405935658

View source version on businesswire.com:

https://www.businesswire.com/news/home/20210730005043/en/

CONTACT:

Xtrackers

SOURCE: Xtrackers

Copyright Business Wire 2021

(END) Dow Jones Newswires

July 30, 2021 04:00 ET (08:00 GMT)

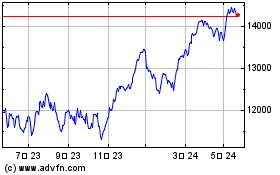

X Eu Materi Esg (LSE:XSPR)

過去 株価チャート

から 11 2024 まで 12 2024

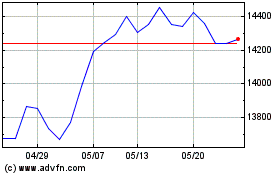

X Eu Materi Esg (LSE:XSPR)

過去 株価チャート

から 12 2023 まで 12 2024