TIDMORCP

RNS Number : 8046W

Oracle Coalfields PLC

06 February 2012

6 February 2012

Oracle Coalfields PLC

("Oracle" or the "Company")

Technical Feasibility Study

Oracle Coalfields PLC (AIM:ORCP), the coal explorer and

developer of a lignite mineral property located in the

south-eastern desert of Sindh Province, Pakistan, today announces

the results of the technical feasibility study ("FS") on Block VI

of the Thar Coalfield.

The exploration licence for Block VI (NO.DMD/S/Ex-L-Coal

(11)/10/2914) with an area of 66.1km(2) ("Licence Area") is held by

Oracle's 80 per cent owned subsidiary, Sindh Carbon Energy Limited

("Sindh Carbon"), a private company incorporated in Sindh Province,

Pakistan. On 2November 2011 Sindh Carbon submitted an application

for the conversion of the current exploration licence to a mining

licence.

Highlights from the FS:

-- Within the Licence Area there are Mineral Resources (reported

in accordance with the terms and definitions of the JORC Code -

defined below) in the mining area (approximately 20 square

kilometres) of 529 millions of wet tonnes (Mwt) with gross

calorific value (CV) of 3,182k calories per wet kilogramme (wkg),

with ash content at 5.89 per cent and Sulphur at 0.91 per cent.

-- Probable Coal Reserves (Phase 1 of Mining Area) of 113Mwt

with gross CV 2,831kcal/wkg, Ash 11.50 per cent and Sulphur 0.79

per cent with a strip ratio of 8.54bcm waste (Bank Cubic Metre):1wt

lignite.

-- Total capital expenditure for open cast mine development is

estimated at US$610m (including US$224m for mining equipment) for

5Mwt per annum of lignite production.

-- Total cash cost of production of US$42.21 per wet tonne.

-- Confirmed product quality suitable for power generation.

-- 23 year mine life.

Shahrukh Khan, CEO of Oracle, said:

"This is another important step for Oracle as we look to provide

a sustainable source of energy to Pakistan and bring its first

large scale open-pit coal mine into production. The FS indicates

the technical and economic viability of the mining project.

"Further work is continuing to refine the overall project

economics, specifically in respect of off-take agreements with

respect to the Power Plant (defined below); and the mining

contractor opportunities, prior to making any definitive

announcements on the overall economics. The Government of Sindh in

recent published announcements recognises a Project IRR in excess

of 20 per cent assuming completion of certain financing

milestones.

"The Board looks forward to progressing the technical

feasibility study to bankable standard ("BFS") in 2012, when we

will also be seeking direct funding for the mining project."

The FS is targeting the development of a lignite mining

operation (the "Lignite Mining Project", "LMP") to supply a

mine-site power station with an annual mine production target of

5Mwt (47.80 per cent moisture) of lignite at an overall stripping

ratio of 8.54bcm to one wet tonne lignite and a total mine-site

production cost of US$42.21 per wet tonne of lignite (47.80per cent

moisture) delivered over an expected mine life of 23 years.

The total mine site capital expenditure for construction and

development to full production is US$610m with an expected

construction period of 27 months. The current FS defines sufficient

coal reserves to support a 23 year mine life, defined as Phase

1.

The FS was compiled by SRK Consulting (UK) Limited ("SRK") with

certain of the underlying technical disciplines (Geology; Mineral

Resources and Ore Reserves; Mining Engineering; Hydrogeology - mine

site; Geochemistry; and Financial Modelling) authored by SRK

directly and others, whilst reviewed by SRK, authored as follows:

Environmental and Social Studies by Wardell Armstrong LLP and

Hagler Bailey Pakistan (Pvt) Limited; Hydrogeology- semi regional

ground water by RPS Aqua Terra (Pty) Limited; Infrastructure by WSP

Group plc.

Where appropriate, local consultants were also employed to

complete certain tasks, under the supervision of the above named

consultancies. The specific scope of the FS was limited to the mine

site and specifically excludes any consideration for the

development, construction and operation of the Power Generation

Plant Project ("Power Plant").

Further work is required to progress this Feasibility Study to a

bankable standard ("BFS"). The environmental work completed to date

has targeted compliance with both local regulatory requirements and

international standards (specifically: Equator Principles, IFC

Performance Standards, World Bank EHS Guidelines and ICMM

guidelines).

Although further work is required, the economic viability of the

LMP is dependent upon various assumptions in respect of the Power

Plant which are not yet supported by a BFS.

The reporting standard adopted for the reporting of the Mineral

Resource and Ore Reserve Statements for the LMP is that defined by

the terms and definitions given in "The 2004 Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves (the "JORC Code") as published by the Joint Ore Reserves

Committee of the Australasian Institute of Mining and Metallurgy,

Australian Institute of Geoscientists and Minerals Council of

Australia". The JORC Code is an internationally recognised

reporting code as defined by the Combined Reserves International

Reporting Standards Committee.

For further information, please follow this link to view the

mining area at:

http://www.oraclecoalfields.com/graphic.pdf

The total Mineral Resource of the mining area reported by SRK to

Oracle is 529Mwt lignite which comprises total Measured and

Indicated Mineral Resources of 459Mwt lignite and Inferred Mineral

Resources of 70Mwt lignite. Individual qualities for each

classification are included in the table below where the following

also apply:

1. Measured and Indicated Mineral Resources are inclusive of

those Mineral Resources modified to produce Coal Reserves, i.e.

they are reported on an 'inclusive basis'; and

2. Mineral Resources are deemed to be potentially economic by

open-pit methods and are constrained within an optimised shell

corresponding to a long term price ("LTP") assumption of US$60 per

wet tonne.

Mineral Resource Statement 03 January 2012

Mineral Resources Tonnage Moisture RD Gross CV Ash Sulphur

(M (wt) ) (%) (wg/cm(3) (kcal/wkg) (%) (%)

)

------------------ --------- -------- --------- ---------- ---- -------

Measured 151 48.00 1.15 3,025 5.10 0.60

Indicated 308 45.30 1.15 3,257 5.60 0.91

Subtotal 459 46.19 1.15 3,181 5.44 0.81

------------------ --------- -------- --------- ---------- ---- -------

Inferred 70 45.40 1.15 3,193 8.90 1.58

Total 529 46.08 1.15 3,182 5.89 0.91

------------------ --------- -------- --------- ---------- ---- -------

The total Coal Reserves reported as at 03 January 2012 within

Phase 1 are 113Mwt, all of which are classified as Probable Coal

Reserves. This comprises both Measured (80 per cent) and Indicated

(20 per cent) Mineral Resources modified to Coal Reserves reporting

within an engineered pit design based on a LTP assumption of

US$37.50Mwt of lignite. The classification of all Coal Reserves as

Probable is a direct consequence of assumptions regarding certain

of the modifying factors and sales revenue. Furthermore, the

declaration of Coal Reserves assumes the successful granting of a

mining licence.

The assumed modifying factors include lignite weighted average

(tonnage basis): mining losses of 7 per cent. (ranging from 3 per

cent to 26 per cent); dilution of 6 per cent (ranging from 3 per

cent to 29 per cent); and dilutant quality 100 per cent Ash.

Phase 1 Coal Reserve Statement 03 January 2012

Coal Reserves Tonnage Moisture RD Gross CV Ash Sulphur

(M (wt) ) (%) (wg/cm(3) (kcal/wkg) (%) (%)

)

-------------- --------- -------- --------- ---------- ----- -------

Proved - - - - - -

Probable 113 47.80 1.18 2,831 11.50 0.79

Total 113 47.80 1.18 2,831 11.50 0.79

============== ========= ======== ========= ========== ===== =======

The Competent Person who assumes responsibility for reporting of

the mineral resources is Mr Paul Bright, CEng, MIMMM, and BSc, who

is an employee of SRK. He is a Member of the Institute of

Materials, Metals and Mining ("IMMM") which is a Recognised

Overseas Professional Organisation ("ROPO") within the meaning of

the JORC Code. Mr Paul Bright is a coal geologist with over 30

years' experience in the coal mining industry and has been involved

in the reporting of mineral resources on various properties

internationally during the past five years.

The Competent Person who assumes responsibility for reporting of

the coal reserves is Mr Vince Osborne, RPEQ (Aus), MAuSIMM, BSc,

who is an employee of SRK. He is a Member of the Australian

Institute of Mining and Metallurgy ("AuSIMM") which is a ROPO. Mr

Vince Osborne is a mining engineer with over 25 years' experience

in the coal mining industry and has been involved in the reporting

of coal reserves on various properties internationally during the

past five years.

Both Mr Bright and Mr Osborne have reviewed this announcement

and have consented to its publication.

Further work

-- Completion of negotiations with an international mining contractor.

-- Finalisation of BFS including further studies to refine the following areas: geochemistry; hydrogeology; operating expenditure and capital expenditure updates; and power generation off-take agreements.

-- Completion of Environmental and Social Impact Assessment

("ESIA") in accordance with international standards.

-- Securing financial support for the engineering, procurement,

construction and completion of the Lignite Mining Project.

-- Assessment of opportunities for securing supplementary

off-take agreements with the cement industry in Pakistan.

-- Finalisation of mine site construction timeline following

Completion of BFS and ESIA for the Power Plant.

There will be additional information available on the company

website. This can be found at:

http://www.oraclecoalfields.com

For further information contact:

Oracle Coalfields PLC Telephone: +44 (0) 207 317 4050

Shahrukh Khan, CEO E-mail:s.khan@oraclecoalfields.com

Website: www.oraclecoalfields.com

----------------------------------- ------------------------------------

Novus Capital Markets Telephone: +44 (0) 207 107 1881

Nicholas Lee, Charles Goodfellow

----------------------------------- ------------------------------------

Blythe Weigh Communications Telephone: 0207 138 3204

Tim Blythe +44(0) 7816 924 626

Matthew Neal +44 (0) 7917 800 011

----------------------------------- ------------------------------------

Libertas Capital Corporate Finance Telephone: +44 (0) 207 569 9650

Limited

Sandy Jamieson , Neil Pidgeon

----------------------------------- ------------------------------------

- Ends -

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLLFEEFAIVIIF

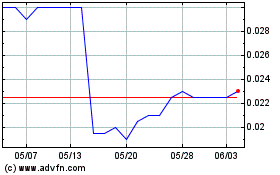

Oracle Power (LSE:ORCP)

過去 株価チャート

から 6 2024 まで 7 2024

Oracle Power (LSE:ORCP)

過去 株価チャート

から 7 2023 まで 7 2024