First Quarter Results

2007年4月26日 - 11:31PM

RNSを含む英国規制内ニュース (英語)

RNS Number:5837V

KazakhGold Group Ltd

26 April 2007

April 26, 2007

First Quarter 2007 Update

KAZAKHGOLD'S FOCUS ON BECOMING ONE MILLION OUNCE PER YEAR PRODUCER

Highlights

* First quarter gold production increased to 33,910 ounces (Q1 2006:

33,624 ounces)

* Average gold price received US$547 per ounce, 31% higher than in first

quarter 2006

* Preliminary JORC evaluation confirms world class asset base

* 7m ounces likely to be classified as measured or indicated; 8m ounces

as inferred

* Construction started on production expansion projects at Aksu and

Zholymbet

* Highly experienced international management team appointed

* Romaltyn plant refurbishment underway

* Agreement reached in principle with Oxus Gold to purchase Jerooy plant

equipment, and balance of Romaltyn in Romania and Turkish gold copper

projects

* Construction underway at Kaskabulakskoe and Akzhal Heap Leach projects

* 21,800 metres of exploration core drilling completed at Aksu, Bestobe and

Zolymbet representing 26% of a planned 83,500m for the year

Report on Activities

Reconciliation Study of Reserves and Resources

Wardell Armstrong International (WAI) have completed a preliminary JORC

reconciliation study of the Group's Soviet classified reserve statement dated 1

January 2007. The results confirm a world class asset base with significant

potential for resource classification upgrade and a significant proportion of

the ounces contained within the designated open pit mining zones at each of the

deposits.

The results of the preliminary JORC reconciliation show that the company has an

asset base with in excess of 7Moz of gold likely to be classified as either

Measured or Indicated following WAI's preliminary study, which is ongoing. In

addition, WAI estimate that a further 8Moz of gold are at the Inferred status

with a realistic likelihood of upgrading to the Indicated category or better.

Moreover, a significant proportion of this 15Moz lies within designated open pit

zones at each of the deposits.

In addition to this, the Company also holds nearly 22Moz of gold which WAI

designates as unclassified due to the need to do further evaluation work.

However, as with the Inferred category, it is likely that a significant

proportion of this will eventually be classified as indicated or better. An

additional 10Moz, currently remain as Soviet classified P1 until further

drilling and sampling is carried out to allow the conversion to JORC

classification.

WAI has given the preliminary observations to KazakhGold in the attached letter*

in which they also state:

"The preliminary analysis of the asset base has shown the company to have a

world class asset which through proper management will be continuously upgraded

and should yield long term benefit to the company."

It is KazakhGold's strategy to aggressively continue its exploration and

evaluation programmes to upgrade resources to reserves with the aim of

continuing to provide the gold ounces for mining to meet its focused objective

to become a one million oz per annum gold company.

Operating Results

The Group's three operating mines in northern Kazakhstan Aksu, Bestobe and

Zholymbet produced a total of 33,910 ounces during the first quarter of 2007.

This compares with 33,624 ounces produced in the first quarter of 2006.

The recent announcement on appointment of a new senior management team is

expected to yield substantial production growth in the medium and long term.

The new management team has committed to presenting its operational growth and

development and modernisation plans to shareholders in mid-2007. It is expected

that this plan will form the basis for delivering substantial production growth.

Corporate activity

In addition to the substantial acquisitions at the end of 2006, namely the

purchase of the Azkhal, Boldykol and Vasilevski gold deposits and the five new

exploration licences, the company recently announced that it had agreed in

principle to acquire certain assets from Oxus Gold plc including:-

1. 100% of Norox Mining Company Limited, which owns 66.67% of Talas Gold

Mining Company in Kyrgyzstan. The Oxus Group has spent approximately US$63

million on the Jerooy gold project to date, including on the construction

of a processing plant which is approximately 80% complete, and associated

mining equipment. The Jerooy project contains 3.45 million ounces of gold.

Should KazakhGold obtain the rights to develop the project, it is

anticipated that production at an annual rate of 180,000 ounces could be

achieved in less than one year.

2. The remaining 50% of the issued share capital of Romaltyn Limited, which

operates a gold recovery plant in Romania and owns tailings stockpiles and

a number of gold exploration licences. The plant was built by Lycopodium

of Australia in order to treat 3 million tonnes of tailings per year. The

plant is expected to resume production in 2007.

3. Significant exploration assets in Turkey.

The period under review has been busy and challenging necessitating many

changes and intense corporate activity. Management believes that this effort

will result in KazakhGold becoming a world class gold mining company staffed by

seasoned professionals.

Exploration

Drilling work has focused on the key production deposits of the Company, to

ensure mine expansion. During the first quarter, 21,800m of core drilling were

completed, representing 26% of the planned total of 83,500m for the year. At

Aksu 10,300m of 48,500m were drilled, at Bestobe 5,000m of 15,000m and at

Zholymbet 6,500m of 20,000m.

In addition, 1,000m of drilling and trenching have been completed at Kaskabulak

and Akzhal as part of the preliminary exploration programmes that have been

established for the additional nine exploration areas.

Directors and Management

During the period, Kanat Assaubayev was appointed the Executive Chairman of the

Group and Darryl Norton joined the board as an Executive Director and Joint

Managing Director. In addition, Dr Stephen Westhead and Mr Geoff McLoghlin have

been appointed as Group Chief Geologist and Group Chief Metallurgist

respectively.

*Please click on the following link:

http://www.mining-investor.com/stex/wardell%20armstrong%20letter.pdf

Further Information:

Aidar Assaubayev Ron Marshman/John Greenhalgh

Kazakhgold City of London PR Limited

+73272509264 +442076285518

http://www.kazakhgold.com/KazakhGold Share Price

This information is provided by RNS

The company news service from the London Stock Exchange

END

QRFIFMITMMTTBMR

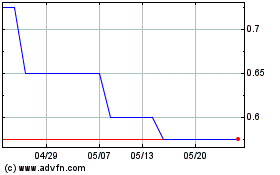

Kazera Global (LSE:KZG)

過去 株価チャート

から 6 2024 まで 7 2024

Kazera Global (LSE:KZG)

過去 株価チャート

から 7 2023 まで 7 2024