TIDMHPAC

RNS Number : 5183A

Hermes Pacific Investments PLC

26 September 2022

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

26 September 2022

HERMES PACIFIC INVESTMENTS PLC

(the "Company")

Final results for the year ended 31 March 2022

Hermes Pacific Investments Plc (AIM: HPAC) today reports its

financial results for the year ended 31 March 2022 ("Period" or

"Year")

Chairman's statement

I am pleased to report the results of Hermes Pacific Investments

Plc for the year ended 31 March 2022. During the Year, the Company

had no revenues as it does not have any operating business and the

Company made a loss of GBP105,000, which is marginally lower than

the loss of GBP106,000 reported for the previous financial year. We

continued our focus to minimise our costs whilst we looked for

opportunities to deploy our cash. At the financial year end the

Company had net assets of GBP3,486,000 (FY21: GBP3,554,000). During

the Period we adopted a new investment policy focused principally,

but not exclusively in the property sector and we are pleased that

post the Period end we identified a suitable opportunity and

purchased a two-bedroom leasehold flat and a single garage in

Westcliff-on-sea, Southend-on-Sea.

Review of the Company's activities

The Company is an investing company and has previously made some

investments in line with its investing policy in companies involved

in financial activities within the emerging market sector. These

investments have performed in line with management's expectations.

We are in a good position from a balance sheet perspective and our

cash balance as at 31 March 2022 stood at GBP3.284 million (FY21:

GBP3.395 million) . During the Year we have continued to evaluate

possible suitable opportunities to deploy our cash resources but

did not identify any transaction that met our criteria. However, as

mentioned above, we are delighted to have completed on the purchase

of a two-bedroom leasehold flat and a single garage in

Westcliff-on-sea, Southend-on-Sea post the Period end. Our total

comprehensive loss for the year was GBP68,000 compared to a loss of

GBP55,000 for the previous financial year. There was a gain of

GBP37,000 on investments held by the Company.

During the Period no further investments were made. A new

investment policy, focused principally, but not exclusively in the

property sector, was adopted by the Company following shareholder

approval on 14 December 2021. Further details of the new investment

policy adopted during the Period are set out below. .

New investing policy

The Company's new investing policy is to invest principally, but

not exclusively in the property sector within Europe and the Middle

East ("New Investment Policy"). Accordingly, the New Investing

Policy is as follows:-

The investments to be made by the Company may be either quoted

or unquoted; in debt and/or in equity instruments, may be in

companies, partnerships, joint ventures; or direct interests in

property or property projects (either residential or commercial

property). The Company's equity interest in a proposed investment

may range from a minority position to 100 per cent. ownership.

The Directors believe there are opportunities to invest in and

acquire commercial and/or residential properties where the

properties may be undervalued and/or suitable for redevelopment to

enhance capital value.

The Company will identify and assess potential properties and

where it believes further investigation is required, and subject to

assessment of potential risk, intends to appoint appropriately

qualified advisers to assist. Where further investigation is

required, the Company intends to carry out a comprehensive and

thorough investment review process in which all material aspects of

any potential property investment will be subject to due

diligence.

The Company's financial resources may be invested in a small

number of properties or investments or potentially in just one

investment which may be deemed to be a reverse takeover of the

Company under the AIM Rules. Where this is the case, it is intended

to mitigate the risk by undertaking an appropriate due diligence

process. Any transaction constituting a reverse takeover under the

AIM Rules would require Shareholders' approval. The possibility of

building a broader portfolio of properties has not, however, been

excluded. The Company may also continue to review and investigate

non-property related investments as it has done to date.

The Company's investments may take the form of equity, debt or

convertible instruments. Investments may be made in all types of

assets falling within the remit of the New Investing Policy and

there will be no investment restrictions. Proposed investments may

be made in either quoted or unquoted companies and structured as a

direct acquisition, joint venture or as a direct interest in a

project or property. The Directors may consider it appropriate to

take an equity interest in any proposed investment which may range

from a minority position to 100 per cent ownership. The Company may

be either an active investor or passive investor. Where the Company

is an active investor, it may seek representation on the board of

investee companies.

Post Period end highlights

The Company has purchased a two-bedroom leasehold flat and a

single garage in Westcliff-on-sea, Southend-on-Sea as announced on

19 May 2022. The purchase price of GBP594,907 has been funded from

the Company's existing cash resources. This flat has been now been

rented out on assured shorthold tenancy agreement.

Haresh Kanabar

Chairman

26 September 2022

Contacts

Hermes Pacific Investments Plc www.hermespacificinvestments.com

Haresh Kanabar, Non-Executive Chairman Tel: +44 (0) 207 290

3340

WH Ireland Limited ( Nominated Adviser www.whirelandcb.com

& Broker)

Mike Coe/ Sarah Mather Tel: +44 (0) 207 220

1666

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEARED 31 MARCH

2022

Year ended Year ended

31 March 31 March

Note 2022 2021

GBP'000 GBP '000

Continuing operations

Revenue - -

Cost of sales - -

g ross profit - -

Other operating income - -

Administrative expenses 3 (111) (114)

Operating loss (111) (114)

Finance income 6 8

Finance costs - -

Loss on ordinary activities

before tax (105) (106)

Tax expense 7 - -

L oss for the year from continuing

activities (105) (106)

Discontinued operations

Loss for the year from discontinued - -

operations

L oss for the year (105) (106)

Other comprehensive income

Gain/(losses) arising in the

year on investments

37 51

Total comprehensive loss for

the year (68) (55)

Basic and diluted loss per share

From continuing operations 8 (4.5)p (4.5)p

STATEMENT OF FINANCIAL POSITION AS AT 31 MARCH 2022

As at As at

31 March 31 March

2022 2021

Notes GBP'000 GBP'000

ASSETS

Non-current assets

Investments 9 211 173

211 173

Current assets

Trade and other receivables 11 10 9

Cash and cash equivalents 10 3,284 3,395

3,294 3,404

LIABILITIES

Current liabilities

Trade and other payables 12 (19) (23)

(19) (23)

Net current assets 3,275 3,381

NET ASSETS 3,486 3,554

SHAREHOLDERS' EQUITY

Issued share capital 13 3,576 3,576

Share premium account 5,781 5,781

Share based payments reserve 139 139

Fair value reserve 38 1

Retained earnings (6,048) (5,943)

TOTAL EQUITY 3,486 3,554

The financial statements were approved and authorised for issue

by the board of directors on 26 September 2022 and signed on its

behalf by:

Haresh Kanabar

Director

Company number: 05239281

CASH FLOW STATEMENT for the YEAR ended 31 March 2022

Note Year ended Year ended

31 March 31 March

2022 2021

GBP'000 GBP'000

Cash flows from operating activities 15 (117) (119)

Cash flows from investing activities

Acquisition of investments - -

Income from disposal of subsidiary - -

undertakings

Investment income 6 8

Net cash (used in)/from investing

activities 6 8

Cash flows from financing activities

Proceeds of share issues -

Other operating activities

Net cash from financing activities - -

(Decrease)/increase in cash and

cash equivalents (111) (111)

Cash and cash equivalents at start

of period 10 3,395 3,506

Cash and cash equivalents at end

of period 10 3,284 3,395

STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 31 MARCH 2022

Share Share Retained Revaluation Total

Ordinary Deferred premium based earnings reserve

share share payments

capital capital reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2020 2,333 1,243 5,781 139 (5,837) (50) 3,609

Total comprehensive

loss/profit for the

period - - - - (106) 51 (55)

At 1 April 2021 2,333 1,243 5,781 139 (5,943) 1 3,554

Total comprehensive

loss for the

period - - - - (105) 37 (68)

At 31 March 2022 2,333 1,243 5,781 139 (6,048) 38 3,486

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEARED 31 MARCH

2022

1. General information

Hermes Pacific Investments Plc is a company incorporated

in the United Kingdom under the Companies Act 2006. The

nature of the company's operations and its principal activities

are set out in the Directors' Report on page 4.

Statement of compliance

The Group financial statements were prepared in accordance with

UK adopted international accounting standards and with the requirements

of the Companies Act 2006.

At the date of approval of these financial statements, various

Standards and Interpretations affecting the Company, which have

not been applied in these financial statements, were in issue,

but not yet effective. The Directors have considered these new

standards and interpretations and do not expect them to have

a material impact on the company.

2. Accounting policies

The following accounting policies have been applied consistently

in dealing with items which are considered material in relation to

the company's financial statements.

Going concern

The financial statements have been prepared on a going concern

basis as, after making appropriate enquiries, the Directors have a

reasonable expectation that the company has adequate resources to

continue in operational existence for the foreseeable future at the

time of approving the financial statements.

Critical accounting estimates and judgments

The preparation of financial statements in conformity with UK

adopted international accounting standards requires management to

make judgements, estimates and assumptions that affect the

application of the company's accounting policies with respect to

the carrying amounts of assets and liabilities at the date of the

financial statements and the reported amounts of income and

expenses during the reporting year. The judgements, estimates and

associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, including current and expected economic conditions.

Although these judgements, estimates and associated assumptions are

based on management's best knowledge of current events and

circumstances, the actual results may differ. Estimates and

underlying assumptions are reviewed on an on-going basis. Revisions

to accounting estimates are recognised in the year in which the

estimate is revised and in any future years affected.

Management have not made any material estimates or judgements

that may result in a significant risk of causing a material

adjustment to the carrying amounts of assets and liabilities within

the next financial year.

Deferred taxation

Deferred taxation is provided in full using the liability method

on temporary differences between the tax bases of assets and

liabilities and their carrying amounts in the consolidated

financial statements. Deferred tax is determined using tax rates

that have been enacted or substantially enacted by the balance

sheet date and are expected to apply when the related deferred tax

asset is realised, or the deferred tax liability is settled.

Deferred tax assets are recognised to the extent that it is

probable that future taxable profit will be available against which

the temporary differences can be utilised.

Cash and cash equivalents

Cash and cash equivalents include cash in hand, deposits held at

call with banks, other short term highly liquid funds with original

maturities of three months or less and bank overdrafts.

Investments

The company carries its investments at fair value. Gains and

losses are either recorded in profit or loss or other comprehensive

income. For investments in equity instruments that are not held for

trading, this will depend on whether the company has made an

irrevocable election at the time of initial recognition to account

for the equity investment at fair value through other comprehensive

income.

Financial instruments

Financial assets and liabilities are recognised in the balance

sheet when the company becomes party to the contractual provisions

of the instrument.

Trade and other receivables

Trade receivables are measured at cost less any provision

necessary when there is objective evidence that the company will

not be able to collect all amounts due.

Trade and other payables

Trade and other payables are not interest bearing and are

measured at original invoice amount.

3. Operating loss

Year ended Year ended

31 March 31 March

2022 2021

GBP'000 GBP'000

The operating loss is stated after

charging the following, included

in administrative expenses:

Staff costs 34 43

Other admin costs 77 71

111 114

4. Auditors' remuneration

Year ended Year ended

31 March 31 March

2022 2021

GBP'000 GBP'000

Audit fees:

- statutory audit of the accounts 12 12

12 12

5. Directors' emoluments

Year ended Year ended

31 March 31 March

2022 2021

GBP'000 GBP'000

Emoluments for qualifying services:

H Kanabar 22 22

J Berry (resigned) 0 9

J Morton 12 12

34 43

6. Employees and staff costs

The company has no employees. Staff costs comprises payments

made in respect of services provided by the directors.

7. Taxation

Year ended Year ended

31 March 31 March

2022 2021

GBP'000 GBP'000

Continuing operations:

Current tax charge - -

Adjustment in respect of prior

years - -

Current tax credit - -

Factors affecting the tax charge

for the period

Loss from continuing operations

before taxation (105) (106)

Loss from continuing operations

before taxation multiplied by standard

rate of corporation tax of 19%

(2021: 19%) (20) (20)

Effects of:

Temporary timing differences - -

Non deductible expenses - -

Depreciation in excess of capital

allowances - -

Unutilised tax losses 20 20

Current tax charge - -

The company has approximately GBP4.1m (2021: GBP4m) of trading

losses to carry forward and offset against future trading

profits

8. Loss per share

Year ended Year ended

31 March 31 March

2022 2021

Basic

Loss from continuing activities

(GBP'000) (105) (106)

(105) (106)

Number of shares 2,333,295 2,333,295

Basic loss per share (p)

From continuing operations (4.5)p (4.5)p

(4.5)p (4.5)p

9. Investments

Investments

GBP'000

Cost or valuation

Brought forward 173

Fair value movement 38

At 31 March 2022 211

The directors have elected to hold the investments at fair value

through OCI as it is their intention to hold these for the long

term

10. Cash and cash equivalents

2022 2021

GBP'000 GBP'000

Cash at bank and in hand 3,284 3,395

3,284 3,395

11. Trade and other receivables

2022 2021

GBP'000 GBP'000

Other receivables 10 9

10 9

12. Trade and other payables

2022 2021

GBP'000 GBP'000

Trade payables 3 8

Accruals and deferred income 16 15

19 23

13. Share capital

2022 2021

GBP'000 GBP'000

Issued and fully paid

2,333,295 ordinary shares of 100p each 2,333 2,333

13,079,850 deferred shares of 9.5p each 1,243 1,243

3,576 3,576

All ordinary shares rank equally in respect of shareholders'

rights.

The deferred shares have no voting and dividend rights. On

winding up of the company, they will be entitled to the nominal

value only after all ordinary shareholders receive the nominal

value of their shares plus GBP10m per share.

As at 31 March 2022 and 31 March 2021 the authorised share

capital was 3,500,000 ordinary shares of 100p and 200,000,000

deferred shares of 9.5p.

14. Financial Instruments

Financial risk management

The company's activities expose the company to a number of risks

including credit risk, interest rate risk and liquidity risk. The

Board manages these risks through a risk management programme. The

fair value of the company's assets and liabilities at 31 March 2022

are not materially different from their book value.

2022 2021

GBP'000 GBP'000

Financial assets at fair value

through other comprehensive income 211 173

211 173

The fair value measured is categorised within level 1 of the

fair value hierarchy.

Financial assets at amortised cost 2022 2021

GBP'000 GBP'000

Loan and receivables:

Trade and other receivables 10 9

Cash and cash equivalents 3,284 3,395

3,294 3,404

Financial liabilities at amortised

cost 2022 2021

GBP'000 GBP'000

Trade and other payables 19 23

19 23

Credit risk

The company monitors credit risk on an on-going basis and

manages risk by concentrating on trading and placing bank deposits

with reliable counterparties. The company has no significant

concentration of credit risk associated with trading

counterparties. Credit risk predominantly arises from cash and cash

equivalents.

Interest rate risk

The company has interest bearing assets. Interest bearing assets

comprise cash balances which earn interest at a variable rate. The

financial liabilities in the current year are all non-interest

bearing. The company has not entered into derivatives transactions

and has not traded in financial instruments during the period under

review. The entire company's debt is non-interest bearing there

would be no effect on the company if interest rates changed.

Liquidity risk

The company seeks to manage liquidity risk by ensuring

sufficient liquidity is available to meet foreseeable needs and to

invest cash assets safely and profitably. All cash and cash

equivalents are immediately accessible.

Price risk

The company's exposure to equity securities price risk arises

from investments held by the company and classified in the

statement of financial position either as at fair value through

other comprehensive income or at fair value through profit or loss.

The risk is managed by regular reviews of the portfolio of

investments held to ensure that exposure to price movements is

within acceptable limits.

The maturity dates of the company's financial instruments are

shown below and are based on the period outstanding at the balance

sheet date up to the contractual maturity date.

Between Between

Less 6 months 1 and

than and 1 5 years Total

6 months year

GBP'000 GBP'000 GBP'000 GBP'000

2022

Financial Assets

Variable interest rate

instruments 3,284 - - 3,284

Non-interest bearing - 10 - 10

3,284 10 - 3,294

Financial Liabilities

Non-interest bearing 19 - - 19

19 - - 19

Between Between

Less 6 months 1 and

than and 1 5 years Total

6 months year

GBP'000 GBP'000 GBP'000 GBP'000

2021

Financial Assets

Variable interest rate

instruments 3,395 - - 3,395

Non-interest bearing - 9 - 9

3,395 9 - 3,404

Financial Liabilities

Non-interest bearing 23 - - 23

23 - - 23

15. Cash flows from operating activities

Year ended Year ended

31 March 31 March

2022 2021

GBP'000 GBP'000

Operating loss (111) (114)

Depreciation of property, plant and - -

equipment

Operating cash flows before movements

in working capital (111) (114)

(Increase)/Decrease in trade and (1) -

other receivables

(Decrease)/Increase in trade and

other payables (5) (5)

Cash flows from operating activities (117) (119)

16. Related party transactions

Key Management Personnel and Director Transactions

A number of key management personnel, or their related parties,

hold positions in other entities that result in them having control

or significant influence over the financial and operating policies

of these entities.

A number of these entities transacted with the company during

the year. The terms and conditions of these transactions with key

management personnel and their related parties were no more

favourable than those available, or which might reasonably be

expected to be available, on similar transactions to non-key

management personnel related entities on an arm's length basis.

The aggregate value of transactions related to key management

personnel and entities over which they have control or significant

influence was GBP33,600 (2021: GBP42,800).

During the year, the company used the services of Poonam &

Roshni Limited totalling GBP21,600 (2021: GBP21,600). H Kanabar is

a director of both companies. No balance was outstanding at the

year end (2021: Nil).

During the year the company used the services of Thirty Acre

Stables totalling GBP12,000 (2021: GBP12,000). J Morton is the

owner of that business. No balance was outstanding at the year end

(2021: Nil).

The compensation of key management is as disclosed in the

directors' emoluments note.

17. Events after the end of the reporting period

Subsequent to the reporting date, the company purchased an

investment property for GBP594,907.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UOANRUVUKUAR

(END) Dow Jones Newswires

September 26, 2022 02:00 ET (06:00 GMT)

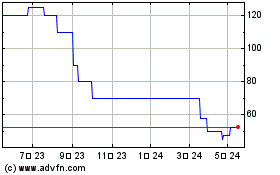

Hermes Pacific Investments (LSE:HPAC)

過去 株価チャート

から 12 2024 まで 1 2025

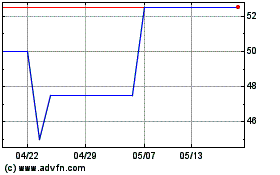

Hermes Pacific Investments (LSE:HPAC)

過去 株価チャート

から 1 2024 まで 1 2025