Massive Ethereum Whale Transfer Threatens To End ETH Rally, Here’s Why

2023年10月26日 - 4:00AM

NEWSBTC

In a recent development, Ethereum’s latest resurgence (up over 12%

in the last seven days) could be threatened by the actions of an

Ethereum whale who could potentially end the token’s rally and

further cause it to decline. Ethereum Whale Moves 30,710 ETH

In a post shared on the X (formerly Twitter) platform, a

crypto-related account with the username ‘EmberCN’ noted that a

particular Ethereum whale who had withdrawn a total of 42,311 ETH

from the crypto exchange Binance since September 20 had just

transferred 30,710 ETH (out of the withdrawn funds) back to

Binance. Related Reading: Pro-XRP Legal Expert Shares

Expectations If SEC Wins Appeal Against Ripple The account further

mentioned that the average ETH price at which this whale had

accumulated these tokens is about $1,667, which instantly shows

that the whale is currently in profit and could be looking to

realize some of their gains by selling the transferred tokens on

Binance. However, the crypto community will be more concerned

with how a potential sell-off could negatively impact the market.

It would add to the selling pressure on the asset, which could

cause a decline, especially if there is no buying pressure to match

it. Some might be more inclined to believe that this amount

of ETH may not matter in the grand scheme of things, considering

that it was recently reported that Ethereum’s ‘Billionaires’

control one-third of the token’s circulating supply. This category

of persons is those who hold 1 million ETH and above. It is

also worth mentioning that on-chain data shows that the Ethereum

whale has, since the transfer of the 30,710 ETH, gone on to

transfer the tokens to another Binance wallet, which has spread the

ETH across different wallets. Another Busy ETH Whale In a

post shared on its X platform, the analytics platform Scopescan

revealed that the 1inch investment fund had sold 4,685 stETH

(staked Ethereum on the Lido platform) for $8.54 million at an

average price of $1,823. In the process, they realized an estimated

profit of $1.28 million as these stETH were said to be bought on

October 13 at the average price of $1,550. Related Reading: Bitcoin

Spot ETF Approval: Why Price Could Be Set For 300% Surge The move

may not come as a surprise to some as the investment fund, which

has close ties to the DEX aggregator 1Inch, has been actively

trading Ethereum since the beginning of the year. During that

period, it bought a cumulative total of 17,000 ETH and then went on

to take some profits by liquidating 11,000 ETH at $1,906 for $21

million, making a profit of about $3.7 million in the process.

These whale movements may have had an impact on Ethereum’s price as

the token is, at the time of writing, trading at around $1,770,

down over 2% in the last 24 hours, according to data from

CoinMarketCap. ETH price picks up steam | Source: ETHUSD on

Tradingview.com Featured image from Nairametrics, chart from

Tradingview.com

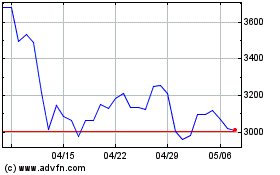

stETH (COIN:STETHUSD)

過去 株価チャート

から 11 2024 まで 12 2024

stETH (COIN:STETHUSD)

過去 株価チャート

から 12 2023 まで 12 2024