ETH Price Watch: Impact On Price As Traders Ditch Bitcoin On Derivatives Market

2023年10月20日 - 12:00AM

NEWSBTC

Ether (ETH), the second-largest cryptocurrency by market

capitalization, has been on a downward trajectory for the past

three months. Despite a brief fake-out rally, ETH has struggled to

regain its footing in the crypto market. The recent rally, though

short-lived, has brought about interesting developments in the

derivatives market. While Bitcoin’s open interest (OI) witnessed a

significant drop, Ethereum saw an increase in its OI. Open

interest, often abbreviated as OI, is a crucial metric in the world

of cryptocurrency derivatives. It represents the total value of

outstanding contracts in the market. In simpler terms, it measures

the amount of money traders have invested in futures or options

contracts for a specific cryptocurrency. ETH’s OI Garners More

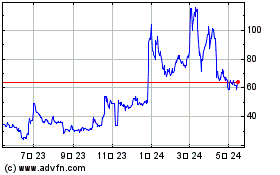

Interest As of October, the crypto derivatives market has depicted

an intriguing scenario. Bitcoin’s OI has been hovering around $6

billion, while Ethereum’s stands at $2.8 billion. Although ETH has

not surpassed BTC in terms of open interest, it has certainly

garnered more attention and interest. Bitcoin and Ethereum Open

Interest. Source: FXStreet A recent fake rally in Bitcoin’s price,

triggered by false reports of an approved spot Bitcoin ETF, had a

substantial impact on the cryptocurrency market. Bitcoin’s Open

Interest (OI) declined by more than $270 million, decreasing to

$5.7 billion as investors reacted to the misleading information. On

the other hand, Ethereum’s OI increased by over $93 million,

reaching $2.8 billion during the same period, highlighting its

resilience in the face of market volatility. These events

underscore the cryptocurrency market’s sensitivity to news and

rumors, emphasizing the importance of accurate information in this

space. Furthermore, the contrasting trajectories of Bitcoin and

Ethereum’s OI showcase Ethereum’s ability to attract renewed

investor interest and maintain stability, solidifying its position

as a prominent and enduring cryptocurrency in the market. Related

Reading: Bitcoin SV Climbs 22% – A Close Look At The Factors Behind

The Surge ETH market cap currently at $187 billion. Chart:

TradingView.com Potential Price Impact And ETH Current Status At

the time of writing, the CoinGecko price for Ethereum is $1,548.

It’s noteworthy that ETH has experienced a 1.9% dip in the past 24

hours and a 0.6% loss over the past week. Analyzing the daily price

chart, Ethereum’s price action is characterized by a rising wedge

formation. This formation serves as a key determinant of ETH’s

short-term trajectory. As long as the trendlines defining this

pattern remain intact, there’s potential for the coin to serve as a

dynamic support zone for buyers during market corrections. Related

Reading: Dogecoin Next Move: Will $0.055 Launch A Recovery Phase?

However, a more pessimistic scenario looms in the event of a

breakdown below the lower boundary of this wedge, which could

signal the onset of a major correction for Ethereum. (This site’s

content should not be construed as investment advice. Investing

involves risk. When you invest, your capital is subject to risk).

Featured image from

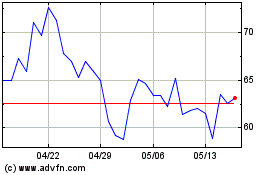

Bitcoin SV (COIN:BSVUSD)

過去 株価チャート

から 10 2024 まで 11 2024

Bitcoin SV (COIN:BSVUSD)

過去 株価チャート

から 11 2023 まで 11 2024