TIDMHFI

28 April 2023

Hydrogen Future Industries PLC

("Hydrogen Future Industries", the "Company" or the "Group")

Interim Results for the Six-Month Period Ended 31 January 2023

Hydrogen Future Industries (AQSE:HFI), a developer of a proprietary wind-based

green hydrogen production system, presents its unaudited interim results for

the six-month period ended 31 January 2023.

Highlights

* Acquisition of a suite of international patents which are relevant to the

systems being developed by HFI

+ Significantly enhanced IP around HFI's wind-based hydrogen production

system

+ Potential wider commercial applications for patents beyond HFI's

systems - potential for early cash flow generation

* Commenced prototype testing of the wind element of HFI's hydrogen

production system 1 metre diameter prototype in Montana, USA

+ First phase 20-hour live test successfully completed, confirming

aerodynamics align to wind direction, with no distinguishing noise from

rotor blades, and no fouling of blades with cowling

+ Second phase testing in variable weather and temperature conditions

completed successfully in wind speeds as high as 58 MPH

+ Third phase of performance analysis - the final phase of testing for

the 1 metre diameter wind turbine - will commence in May 2023. This

phase will use enhancements gained from previous tests and record

energy output over a three-month period

* Investment in, and collaboration with, Tower Green Holdings Limited

("Tower"), a developer of hydrogen production and distribution facilities

which is establishing multipurpose hydrogen hubs in the southwest of

England to provide energy storage and hydrogen as a fuel

+ HFI's system to be implemented as Tower's preferred green hydrogen

production technology

Daniel Maling, Non-Executive Chairman, commented:

"We expect 2023 to continue as an exciting year, particularly as we begin next

month to measure the energy output from our prototype turbine in Montana, USA.

We look forward to updating shareholders on our development progress in this

hugely exciting subset of the energy sector."

Enquiries:

Hydrogen Future Industries plc

Daniel Maling, Chairman +44 (0)20 3475 6834

David Ormerod, Executive Director

Vigo Consulting (Investor Relations)

Ben Simons +44 (0) 20 7390 0230

Peter Jacob

Cairn Financial Advisers LLP (AQSE

Corporate Adviser)

Ludovico Lazzaretti +44 (0) 20 72130 880

Liam Murray

Peterhouse Capital Limited (Broker)

Duncan Vasey +44 (0) 20 7469 0930

About Hydrogen Future Industries

Hydrogen Future Industries was established to invest in projects and companies

focused on the Hydrogen Economy. We are developing a proprietary wind-based

hydrogen production system, incorporating hydrogen compression and storage.

Through this technology, we aim to significantly reduce the cost of hydrogen

production from renewable sources and provide on-demand energy storage in the

form of hydrogen at a fraction of the cost of lithium-ion battery storage.

Visit our website: www.hydrogenfutureindustries.com

Follow us on social media:

LinkedIn: @Hydrogen Future Industries

Twitter: @HydrogenFI

Inside Information

This announcement contains inside information for the purposes of the UK Market

Abuse Regulation and the Directors of the Company accept responsibility for the

contents of this announcement.

Caution Regarding Forward Looking Statements

Certain statements made in this announcement are forward-looking statements.

These forward-looking statements are not historical facts but rather are based

on the Company's current expectations, estimates, and projections about its

industry; its beliefs; and assumptions. Words such as 'anticipates,' 'expects,'

'intends,' 'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These statements are not a

guarantee of future performance and are subject to known and unknown risks,

uncertainties, and other factors, some of which are beyond the Company's

control, are difficult to predict, and could cause actual results to differ

materially from those expressed or forecasted in the forward-looking

statements. The Company cautions security holders and prospective security

holders not to place undue reliance on these forward-looking statements, which

reflect the view of the Company only as of the date of this announcement. The

forward-looking statements made in this announcement relate only to events as

of the date on which the statements are made. The Company will not undertake

any obligation to release publicly any revisions or updates to these

forward-looking statements to reflect events, circumstances, or unanticipated

events occurring after the date of this announcement except as required by law

or by any appropriate regulatory authority.

Chairman's Statement

Introduction

I am pleased to present the unaudited interim results for the six-month period

ended 31 January 2023. During the period we have significantly strengthened the

intellectual property around our green hydrogen production system, commenced

prototype testing, and broadened our investment exposure to cover downstream

hydrogen production and distribution facilities.

Review of activity

On 5 October 2022, we announced the acquisition by our joint venture subsidiary

HFI IP Holdings Limited of a suite of international patents which are relevant

to the system being developed by the Company. This acquisition significantly

enhanced the intellectual property around HFI's wind-based hydrogen production

system. The patents cover a range of works including ducted wind turbine rotor

configurations; a dynamic telescopic tower to optimise wind farm energy

production and reduce maintenance cost; a variable hydraulic drive and

electro-magnetic clutch to increase efficiency and lower the cost of energy

production; and the conversion of stored energy to green hydrogen.

The patents acquired were granted to HW Power Limited in respect of work

undertaken by Timothy Blake between 2015 and 2018, prior to him joining HFI as

Chief Executive Officer of HFI Energy Systems Limited, the Company's wholly

owned product development subsidiary. Given the considerable efficiency gains

we believe our turbine will offer compared to existing open rotor wind turbines

in use today, the commercial applications for our patents may not be limited to

hydrogen and could be of value in the wider wind energy generation sector.

Accordingly, we will in due course be exploring wider commercial applications

for the patents beyond HFI's systems, potentially as an avenue for early cash

flow generation.

On 1 November 2022, HFI announced the commencement of prototype testing of the

wind element of the Company's hydrogen production system 1 metre diameter

prototype in Montana, USA. A key element of the prototype is its proprietary

wind turbine, which has been designed with notably distinct features which

allow the turbines to be more efficient than current open rotor turbines due to

modified aerodynamics, with cowling directing air flow across the rotor blades

to create a multiple factor increase in wind speed. The cowling also directs

the flow of wind out and away from the rear of the turbine, reducing the

potential for still air to block the flow through the turbines. We believe the

increased efficiency of the turbine could in turn increase the efficiency and

ultimately lower the cost of hydrogen production.

The prototype is being tested in an area selected for its consistent wind

speeds and regulatory support for wind turbine development and wind farm

placement. HFI has a local development facility where the turbines are

fabricated and mounted onto towers for testing in local wind speeds. The power

output from the turbines will be compared to predicted results. The cowling and

rotor blades are a product of aerodynamic development and have been 3D printed

on site.

The first stage of the outdoor test programme - a 20-hour live test - has been

successfully completed, confirming the aerodynamics align to the wind direction

as planned, there is no distinguishing noise from the rotor blades, and there

is no fouling of the blades with the cowling.

The next phase of testing - variable weather and temperature conditions - was

successfully undertaken between February and April 2023, in temperatures that

dropped below -20o C and in wind speeds up to 58 MPH. The test was undertaken

to see how the wind turbine would react to extreme cold temperatures and

consistent high wind speeds. The wind turbine completed the test without any

issues.

A third and final phase is expected to begin in May 2023 of an enhanced version

of the 1 metre diameter wind turbine. The upgraded wind turbine will be used to

measure the energy output over an 8 to 12-week period before work commences on

a larger diameter commercial wind turbine. The data gained from the performance

of the wind turbine will be compared to the wind tunnel results and used in the

design of the larger diameter wind turbines.

On 16 January 2023, we announced an investment in, and collaboration with,

Tower Green Holdings Limited, a developer of hydrogen production and

distribution facilities which is establishing multipurpose hydrogen hubs in the

southwest of England to provide energy storage and hydrogen as a fuel. Under

the agreement, HFI's system will be implemented as Tower's preferred green

hydrogen production technology.

HFI made an initial investment of £100,000 in Tower for a 20% equity stake, £

50,000 of which was paid in cash and £50,000 was settled by the issue of

500,000 new ordinary shares in HFI at a price of 10p per share. In addition,

HFI has the right to invest a further £50,000 in Tower upon Tower signing an

agreement to collaborate with certain specific project partners for an

additional 10% equity stake in Tower.

Our system aims to produce affordable green hydrogen and so is well placed to

support companies like Tower as they develop downstream infrastructure and

partnerships to get hydrogen into vehicles and support the decarbonisation of

transport. Through this agreement, not only are we gaining early investment

exposure to the massive growth opportunity in hydrogen refuelling which is

analogous to the rollout of EV charging infrastructure over recent years, we

are also supporting Tower's ambition to become a vertically integrated green

hydrogen producer and distributor in the UK.

Financial Review

Financial highlights for the Group for the six-month period ended 31 January

2023 are stated below:

* Cash and cash equivalents at period end were £736,065 (31 January 2022: £

1.907m)

* Loss before taxation for the period was £710,344 (includes £175,685

(non-cash) share based payments)

* Net cash outflow for the period was £641,300

* The Group held net assets at period end of £1.342m

The Group has invested significantly in research and development in the period

which accounts for a significant portion of the loss incurred. As prototype

testing progresses through the next phases, the Group will look to capitalise

this expenditure once it satisfies the necessary requirements laid out in "IAS

38 - Intangible Assets." The remaining loss in the period relates to general

administrative expenses of running the Group and be further viewed at Note 7.

The Company continues to carefully manage its working capital position.

Outlook

We expect 2023 to continue as an exciting year, particularly as we begin next

month to measure the energy output from our prototype turbine in Montana, USA.

We look forward to updating shareholders on our development progress in this

hugely exciting subset of the energy sector.

Daniel Maling

Non-Executive Chairman

28 April 2023

HYDROGEN FUTURE INDUSTRIES PLC - CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

STATEMENT OF COMPREHENSIVE INCOME

FOR THE 6 MONTH PERIODED 31 JANUARY 2023

Unaudited Unaudited

Period ended Period ended

31 January 31 January

2023 2022

Notes £'000 £'000

Continuing operations

Administrative expenses 7 (710) (274)

Operating loss (710) (274)

Finance income - -

Loss before taxation (710) (274)

Income tax 8 - -

Loss for the period from continuing (710) (274)

operations

Other comprehensive income 1 -

Total comprehensive loss attributable to (709) (274)

equity holders of the Group

Basic & dilutive earnings per ordinary share 9 (2.22) (2.29)

(pence)

The notes form an integral part of the unaudited condensed consolidated interim

financial statements.

Unaudited Unaudited Audited

As at As at As at

31 January 31 January 31 July

2023 2022 2022

Notes £'000 £'000 £'000

NON-CURRENT ASSETS

Investments 10 50 114 -

Right of use assets 22 - 22

Fixed assets 28 - 18

Intangibles 492 - -

TOTAL NON-CURRENT ASSETS 592 114 40

CURRENT ASSETS

Cash and cash equivalents 736 1,907 1,383

Trade & other receivables 40 36 210

TOTAL CURRENT ASSETS 776 1,943 1,593

TOTAL ASSETS 1,368 2,057 1,633

NON-CURRENT LIABILITIES

Lease liability 5 - 5

TOTAL NON-CURRENT LIABILITIES 5 - 5

CURRENT LIABILITIES

Trade and other payables 8 102 82

Lease liability 13 - 17

TOTAL CURRENT LIABILITIES 21 102 99

TOTAL LIABILITIES 26 102 104

NET ASSETS 1,342 1,955 1,529

EQUITY

Share capital 11 333 298 298

Share premium 11 2,211 1,900 1,900

Share based payment reserves 12 207 31 31

Foreign exchange merger reserve 1 - -

Retained earnings (1,410) (274) (700)

TOTAL EQUITY 1,342 1,955 1,529

HYDROGEN FUTURE INDUSTRIES PLC - CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

STATEMENT OF FINANCIAL POSITION

AS AT 31 JANUARY 2023

*Non-controlling interest of £49 not stated above as it is not material to the

financial statements

The notes form an integral part of the unaudited condensed consolidated interim

financial statements.

HYDROGEN FUTURE INDUSTRIES PLC - CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

STATEMENT OF CHANGES IN EQUITY

FOR THE 6 MONTH PERIODED 31 JANUARY 2023

Share Share Share Foreign Retained Total

capital premium based exchange earnings equity

payment merger

reserve reserve

£'000 £'000 £'000 £'000 £'000 £'000

Loss for period - - - - (274) (274)

Total comprehensive income for year - - - - (274) (274)

Transactions with owners in own

capacity

Ordinary Shares issued in the 298 2,007 - - - 2,305

period

Broker Warrants Issued - - 31 - - 31

Share Issue Costs - (107) - - - (107)

Transactions with owners in own 298 1,900 31 - - 2,229

capacity

Balance at 31 January 2022 298 1,900 31 - (274) 1,955

Loss for period - - - - (426) (426)

Total comprehensive income for year - - - - (426) (426)

Transactions with owners in own - - - - - -

capacity

Balance at 31 July 2022 298 1,900 31 - (700) 1,529

Loss for period - - - - (710) (710)

Other comprehensive income - - - 1 - 1

Total comprehensive income for year - - - 1 (710) (709)

Transactions with owners in own

capacity

Ordinary Shares issued in the 35 311 - - - 346

period

Advisor warrants issued - - 13 - - 13

Employee options issued - - 163 - - 163

Transactions with owners in own 35 311 176 - - 522

capacity

Balance at 31 January 2023 333 2,211 207 1 (1,410) 1,342

HYDROGEN FUTURE INDUSTRIES PLC - CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

STATEMENT OF CASHFLOW

FOR THE 6 MONTH PERIODED 31 JANUARY 2023

Period ended Period ended

31 January 2023 31 January 2022

Note £'000 £'000

Cash flow from operating activities

Loss for the financial year (710) (274)

Adjustments for:

Share based payment reserves 176 10

Foreign exchange movements 1 -

Depreciation & amortization 5 -

Changes in working capital:

Decrease / (increase) in trade and other 54 (39)

receivables

Increase / (decrease) in trade and other (74) 53

payables

Net cash outflow from operating activities (548) (250)

Cash flows from investing activities

Purchase of property, plant and equipment (39) -

Investment in TG Holdings Ltd 10 (50) (114)

Net cash outflow from investing activities (89) (114)

Cash flows from financing activities

Proceeds from Issue of Shares - 2,305

Share Issue Costs - (34)

Payment of lease liabilities (4) -

Net cash outflow from financing activities (4) 2,271

Net increase in cash and cash equivalents (641) 1,907

Cash and cash equivalents at beginning of the 1,383 -

period

Foreign exchange impact on cash balance (6) -

Cash and cash equivalents at end of the 736 1,907

period

The notes form an integral part of the unaudited condensed consolidated interim

financial statements.

HYDROGEN FUTURE INDUSTRIES PLC - CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL INFORMATION

FOR THE 6 MONTH PERIODED 31 JANUARY 2023

1General information

Hydrogen Future Industries Plc ("the Company") was incorporated on 13 July 2021

in England and Wales with Registered Number 13508782 under the Companies Act

2006.

The address of its registered office is Eccleston Yards, 25 Eccleston Place,

London SW1W 9NF, United Kingdom.

The principal activity of the Company and its subsidiaries collectively

referred to as "the Group" is to seek suitable investment opportunities in the

natural resources sector with a particular focus on the hydrogen industry.

The Company commenced trading on the Aquis Stock Exchange ("AQSE") Growth

Market on 1 December 2021. The unaudited condensed consolidated interim

financial statements ("interim financial statements") present the consolidated

results of the Group.

2Accounting policies

IAS 8 requires that the directors shall use their judgement in developing and

applying accounting policies that result in information which is relevant to

the economic decision-making needs of users, that are reliable, free from bias,

prudent, complete and represent faithfully the financial position, financial

performance and cash flows of the entity.

3Basis of preparation

The unaudited condensed consolidated interim financial statements ("interim

financial statements") have been prepared in accordance with the requirements

of the AQSE rules and international accounting standards in conformity with the

requirements of the companies act 2006 and the companies act 2006 applicable to

companies reporting under UK-adopted international accounting standards

("IFRS").

The interim financial statements have been prepared in accordance with IAS 34

"interim financial statements". The interim financial statements do not include

all disclosures that would otherwise be required in a complete set of financial

statements but have been prepared in accordance with the existing accounting

policies of the company.

The interim financial statements for the 6 month period from 1 August 2022 to

31 January 2023 are unaudited. Comparatives have been provided for the

comparable period ending 31 January 2022.

The interim financial statements have been prepared using the measurement bases

specified by IFRS for each type of asset, liability, income and expense.

The interim financial statements do not constitute statutory accounts within

the meaning of section 434 of the companies act 2006. The accounting policies

adopted are consistent with those applied in the Company's last audited annual

financial statements ending 31 July 2022 and can be viewed on the Company's

website (https://hydrogenfutureindustries.com/).

The interim financial statements are presented in Great British Pounds sterling

("£") unless otherwise stated, which is the Group's functional and

presentational currency. The Directors have decided to only present

consolidated interim financial statements and not parent level financial

statements as they believe consolidated statements alone present an accurate

depiction of the Group's financial performance and position.

The performance of the Group is not affected by seasonal factors and the risk

factors applicable to the Group have not changed materially since the

publication of the annual report and financial statements for the period ending

31 July 2022.

4Going concern

The directors have made an assessment of the Group's ability to continue as a

going concern and are satisfied that the Group has adequate resources to

continue in operational existence for the foreseeable future. The Group's

auditors included a material uncertainty related to going concern in the last

annual report based on the ability of the Group to source additional funding in

the 12 months from signoff of the annual report in December 2022. The Directors

are confident in the ability of the Group to satisfy this condition and hence

continue to adopt the going concern basis in preparing these interim financial

statements.

5Accounting policies

The same accounting policies, presentation and methods of computation have been

followed in these interim financial statements as were applied in the

preparation of the Group's annual financial report for the period ended 31 July

2022, except for the impact of the adoption of the standards and

interpretations described below and new accounting policies adopted as a result

of changes in the Company.

At the date of approval of these financial statements, the following standards

and interpretations which have not been applied in these financial statements

were in issue but not yet effective (and in some cases have not yet been

adopted by the UK):

Standard Impact on initial application Effective date

Annual Improvements 2018-2020 Cycle 1 January 2023

IAS 1 Classification of liabilities 1 January 2023

Current or Non-current

IAS 8 Accounting estimates 1 January 2023

IAS 12 Deferred tax arising from a 1 January 2023

single transaction

6Critical accounting estimates and judgments

In preparing the unaudited interim consolidated financial statements, the

directors have to make judgments on how to apply the Group's accounting

policies and make estimates about the future. Estimates and judgements are

continuously evaluated based on historical experiences and other factors,

including expectations of future events that are believed to be reasonable

under the circumstances. In the future, actual experience may deviate from

these estimates and assumptions.

The key assumptions concerning the future and other key sources of estimation

uncertainty at the reporting date that have a significant risk of causing a

material adjustment to the carrying amounts of assets and liabilities within

the next financial year, are described below:

Share Based Payments

The Group has made share based payments during the period that required

valuation under applicable accounting standards. The Directors have chosen to

value these warrants and options using Black Scholes method with inputs that

can be viewed at Note 12.

Research and development expenditure

The Group, primarily through its US based subsidiary is well advanced in the

development of a 1m Wind Turbine Prototype. At the end of the Group's last

annual report development was still at a stage where it was not considered

appropriate to capitalise expenditure related to the project. As of the signing

of this report data is being collected that will likely confirm the efficiency

advantages of the turbine over existing designs. Once this data is collected

the Directors will have sufficient confidence in the commercial potential of

the project and would be more assured of timings as to when economic benefits

would flow to the Group. As a result the Directors have made the judgement not

to capitalise expenditure related to the prototype in the period ending 31

January 2023 however will review at each period end going forward with the look

to capitalise expenditure as soon as practicable.

7Administrative expenses

Period ended Period ended

31 January 31 January

2023 2022

£'000 £'000

Directors' fees (54) (18)

Salaries and wages* (92) -

Professional fees (114) (182)

Contractors* (113) -

Insurance (17) (34)

Other administrative expenses (144) (30)

Share based payments (176) (10)

(710) (274)

*During the period the Group has invested in the development of wind turbine

technology and has utilised the services of contractors and employees to assist

with this. Once possible the Group will look to capitalise this expenditure as

it is directly attributable to the development of future intangible assets as

alluded to in Note 6.

8Income tax

Income tax can be reconciled to the loss in the Statement of Comprehensive

Income as follows:

Period ended Period ended

31 January 2023 31 January 2022

£'000

Loss before taxation (710) (274)

Tax at the UK corporation tax rate of (135) (52)

19%

Adjustment for items disallowable for (33) -

tax

Tax losses on which no deferred tax 102 52

asset has been recognised

- -

The Group has total carried forward losses of £1,234k. The taxed value of the

unrecognised deferred tax asset is £235k and these losses do not expire. No

deferred tax asset in respect of tax losses have been recognised in the

accounts because there is currently insufficient evidence of the timing of

suitable future taxable profits against which they can be recovered.

On 15 March 2023 it was announced that from 1 April 2023 the UK corporation tax

rate would increase from 19% to 25% for profits over £250,000. Profits made

under the £250,000 threshold will continue to be taxed at a rate of 19%. The

Company will continue to calculate the effective tax rate at 19%.

9Earnings per Ordinary Share

Period ended Period ended

31 January 31 January

2023 2022

Loss attributable to shareholders of HFI - £'000 (710) (274)

Weighted number of ordinary shares in issue 32,043,443 11,955,198

Basic & dilutive earnings per share from continuing (2.22) (2.29)

operations - pence

There is no difference between the diluted loss per share and the basic loss

per share presented. Share options and warrants could potentially dilute basic

earnings per share in the future but were not included in the calculation of

diluted earnings per share as they are anti-dilutive for the period presented.

10Investments

Period ended Period ended Period ended

31 January 31 January 31 July

2023 2022 2022

£'000 £'000 £'000

Investment - Tower Green Holdings Ltd 50 - -

Investment - LGT Hydrogen Ltd - 114 -

Total 50 114 -

On 16 January 2023, the Group announced an agreement with Tower Green Holdings

Limited to purchase 4,167 shares to assist in the development of green hydrogen

technologies. Following this investment, HFI owns 20% of Tower Green Holdings.

Subsidiaries

Name Holding Business Country of Registered Address

Activity Incorporation

HFI Energy 100% Research & England & Wales Eccleston Yards, 25

Systems Ltd development Eccleston Place, London

SW1W 9NF

HFI Energy 100% Research & United States 16 Nugget Court,

Systems US Inc development of America Whitehall, MT 59759

HFI IP Holdings 51% IP holding England & Wales Eccleston Yards, 25

Ltd company Eccleston Place, London

SW1W 9NF

HFI Development 100% Research & England & Wales Eccleston Yards, 25

Ltd development Eccleston Place, London

SW1W 9NF

HFI Consulting 100% Licensing England & Wales Eccleston Yards, 25

Limited entity Eccleston Place, London

SW1W 9NF

11Share capital & share premium

Ordinary Share Share Total

shares capital premium

# £'000 £'000 £'000

At 31 July 2022 29,800,000 298 1,901 2,200

Issue of ordinary shares 3,450,000 35 310 345

At 31 January 2023 33,250,000 333 2,211 2,545

On 5 October 2022 the Company issued 3,450,000 ordinary shares of £0.01 at a

subscription price of £0.10 as consideration for the acquisition of patents.

12Share based payment reserve

Total

£'000

As at 31 July 2022 31

Warrants issued 1 13

Employee options issued 2 163

At 31 January 2023 207

1On 5 October 2022, the Group issued 1,625,000 warrants to HW Power Limited as

part of the consideration for the transfers of IP Patents to the Group. All

options are exercisable at the price of £0.12 per ordinary share and are

exercisable, either in whole or part, for a period of 3 years from the date of

issue.

2 On 4 November 2022, the Group issued 6,000,000 employee options to the

directors of the Company, the director of the subsidiary and one consultant.

All options vested immediately apart from 1,500,000 options issued to the

director of the subsidiary which vest of the satisfaction of various

performance conditions. All options are exercisable at the price of £0.10 per

ordinary share and are exercisable, either in whole or part, for a period of

five years from the date of issue.

The estimated fair values of options which fall under IFRS 2, and the inputs

used in the Black-Scholes pricing model to calculate those fair values are as

follows:

Number of Share Exercise Expected Expected Risk free Expected

Date of grant options price price volatility life rate dividends

5 Oct 2022 1,625,000 £0.05 £0.12 60.00% 3 3% 0.00%

4 Nov 2022 6,000,000 £0.068 £0.10 60.00% 5 3% 0.00%

Warrants

As at 31 January 2023

Weighted average Number of warrants

exercise price

Brought forward at 31 July 2022 5p

8,050,000

Granted in period 12p

1,625,000

Vested in period 12p

1,625,000

Outstanding at 31 January 2023 6.3p

9,675,000

Exercisable at 31 January 2023 6.3p

9,675,000

The weighted average time to expiry of the warrants as at 31 January 2023 is

2.12 years.

Options

As at 31 January 2023

Weighted average Number of options

exercise price

Brought forward at 31 July 2022

-

Granted in period 10p 6,000,000

Vested in period 10p 4,500,000

Outstanding at 31 January 2023 10p 6,000,000

Exercisable at 31 January 2023 10p 4,500,000

The weighted average time to expiry of the options as at 31 January 2023 is

2.95 years.

13Related party transactions

Directors remuneration

During the period the Directors of the Company received the following

remuneration as Directors fees:

* David Ormerod: £24,000

* Daniel Maling: £18,000

* Fungai Ndoro: £12,000

During the period the Directors also were issued with the following options in

the Company:

* David Ormerod: 1,000,000

* Daniel Maling: 1,000,000

* Fungai Ndoro: 500,000

Service Agreements

Orana Corporate LLP, of which director Daniel Maling is a partner, has a

service agreement with the Company for the provision of accounting and company

secretarial services. In the period, Orana Corporate LLP received £25,353 for

these services from the Company.

14Ultimate controlling party

As at 31 January 2023, there was no ultimate controlling party of the Company.

15Events subsequent to period end

There are no events subsequent to period end that require disclosure.

16Approval of the financial statements

The interim financial statements were approved by the board of directors on 28

April 2023.

END

(END) Dow Jones Newswires

April 28, 2023 11:32 ET (15:32 GMT)

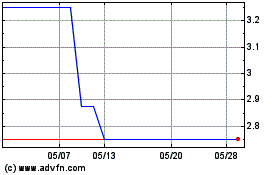

Hydrogen Future Industries (AQSE:HFI)

過去 株価チャート

から 5 2024 まで 6 2024

Hydrogen Future Industries (AQSE:HFI)

過去 株価チャート

から 6 2023 まで 6 2024