TIDMDIS

RNS Number : 7144C

Distil PLC

13 October 2022

Distil plc

("Distil", the "Company" or the "Group")

Interim Results for the six months ended 30 September 2022

Distil plc (AIM:DIS), owner of premium drinks brands RedLeg

Spiced Rum, Blackwoods Gin and Vodka, TRØVE Botanical Vodka and

Blavod Black Vodka, announces its unaudited interim results for the

six months ended 30 September 2022.

Operational highlights:

-- Major move from UK Distributor to a new business model

-- Relationship with major UK retail customers taken under direct control

-- Significant reduction in UK market stock cover associated

with removal of distributor

-- Commercial Director appointed to manage major retail and

exports to deliver ambitious growth plans

-- Appointment of leading distributor to service the UK hospitality sector

-- RedLeg TV advertisement developed and tested in two key regions

-- Major listing for RedLeg Tropical with leading pub group

-- New export market opened in Scandinavia

-- Blackwoods Gin & Vodka Distillery and visitor centre at

the Ardgowan site on track to open Spring 2023

Financial highlights:

-- Turnover decreased by 68% to GBP0.46 million (2021: GBP1.44 million)

-- Gross profit decreased by 74% to GBP210k (2021: GBP794k)

-- Volumes (litres) decreased by 72%

-- Investment in brand marketing and promotion decreased by 6%

to GBP376k (2021: GBP398k)

-- Administrative costs increased by 29% to GBP436k (*2021: GBP338k)

-- Adjusted** Operating loss of GBP602k (2021: GBP58k profit)

-- Loss before tax of GBP555k (2021: GBP45k loss)

-- Cash reserves*** at period end of GBP0.95 million (2021:

GBP4.22 million (GBP1.02 million excluding funds raised for, and

applied to, Ardgowan investment))

* Administrative costs for the prior period adjusted to remove

one-off transaction costs associated with the Ardgowan

investment.

** Operating loss for the prior period adjusted for one-off

transaction costs associated with the Ardgowan investment and for

both periods for share-based payment expense.

*** Prior period cash reserves include proceeds from the

fundraising completed in August 2021 amounting to GBP3.20 million

(before expenses), of which GBP3 million was invested in Ardgowan

by way of a convertible loan.

Don Goulding, Executive Chairman, commenting on these results

said:

"The first six months of this financial year have seen major

changes to our business model and the creation of a stronger

platform for accelerated future growth.

The key change year-on-year is our decision to take direct

control of relationships with our major UK retail customers, and to

move away from our previous distributor, Hi-Spirits, managing our

entire UK trade. From mid-September we transitioned to a hybrid

model, which sees direct sales to our largest retail customers

supported by a new, highly effective distributor, Marussia

Beverages Group, covering hospitality, wholesale and other sectors

where we are currently underdeveloped and have an opportunity for

new growth.

To support this significant development, we appointed a

Commercial Director to navigate the restructure and create new

relationships with our major customers, broaden our on-trade

distribution, and advance our international export network. The

strengthening of our commercial operation will also support our

drive for new product development.

While the remodel has seen a one-off hit to the half year

figures as we transition, we are confident that this move will put

Distil in a stronger position from which to accelerate future

growth"

Executive Chairman's Statement

We are grateful to our UK distributor for helping us build our

distribution platform especially in the off trade but, after

several years with our chosen partner, we decided it was the right

time to create a hybrid distribution platform which would

facilitate the next phase of accelerated brand development and

growth. We subsequently took direct control of relationships with

our largest retail stockists in late September. This was made

possible by the appointment of our Commercial Director who joined

us in June and played an important role in selection of, and

transition to, the right partner to broaden our list of stockists

in the on-trade, online and premium retail. We subsequently began

our distribution partnership with Marussia Beverages Group in

September, and early signs are most encouraging.

This new business model has led to an associated reduction of

stock in trade with little or no 'pipeline' replenishment into the

UK distributor for almost four months as we worked through a

contractual notice period and existing warehouse inventories were

depleted. This has caused a sizeably negative hit to sales out from

Distil, however there has been no real effect on actual consumer

sales.

H1 also saw the launch of the first TV advertising campaign for

RedLeg Spiced Rum in collaboration with ITV Adventures. The

campaign, valued at over GBP500,000, ran on linear channels in two

targeted regions and nationally across ITV Video-On-Demand

services. Focused around bringing the RedLeg crab logo to life, the

creative was named Ad of the Week in a leading trade publication

and has already begun to deliver positive results for the brand.

The Company views this initial test as the first step towards a

robust above-the-line plan to accelerate brand growth.

Our priority remains settling our brands into the new

distribution platform and restoring the momentum previously enjoyed

with accelerated future growth.

Operations

Our operations team has continued to work well by keeping

average year-on-year cost increases, per case, down to single digit

figures despite increased energy costs, general inflationary

pressures, and staff shortages throughout the supply chain, storage

and freight. This has been managed through sourcing new suppliers

and procurement consolidation.

We anticipate continued cost pressure in the short to

medium-term and will maintain our efforts to mitigate price

inflation.

Sustainability is increasingly becoming an important purchasing

consideration for both consumers and trade customers alike. Over

the past six months, our team has been working closely with

suppliers at all stages of the chain in order to reduce the

environmental impact of our brands. This includes sourcing the

latest technologies and materials for closures, and exploring new

sustainable substrates with our label suppliers. Sustainability

will continue to be a key focus across our brands moving

forward.

Ardgowan Distillery Project, Blackwoods distillery and visitor

centre

Site clearance work began earlier in the year as planned and the

building for Blackwoods Gin & Vodka distillery and visitor

experience is now taking shape, with an anticipated opening in

Spring 2023. Photos are available on the Distil website.

Good progress is also being made by the Ardgowan team on its

whisky distillery, which remains on-track for a scheduled 2024

opening.

The Ardgowan Distillery project ambition is to become the most

CO 2 efficient distillery in the Scotch Whisky industry, and

Blackwoods will play a key role on site.

The option remains for Distil to invest a further GBP2m into the

Ardgowan project and the team is working closely with Ardgowan to

move this forward.

Results versus same period last year

Total revenues fell 68% to GBP0.46 million against the prior

period, with UK sales adversely impacted by the removal of

inventory from the distributor supply chain as we transitioned away

from our UK distributor and to direct sales during Q2. The one-off

negative impact on H1 sales of this change amounted to GBP0.67

million inventories depletions and GBP0.3million reduced

promotional activity in the period leading to distributor contract

termination. The transition to direct sales was complete at the end

of September and we do not anticipate any further significant

impact on sales in the second half of the current financial year

attributable to the transition.

The Company sustained an operating loss (after adjusting for

share-based payment expense) of GBP602k (2021: GBP58k profit after

adjusting for share-based payment expense and one-off transaction

costs associated with the Ardgowan investment).

Cash reserves stood at GBP0.95 million at the end of the period

compared to GBP4.22 million at the end of the prior period, which

included proceeds of GBP3.20 million (before expenses) from the

fundraising completed in August 2021, of which GBP3 million was

invested in Ardgowan by way of a convertible loan .

Outlook

The past six months have seen one-off impacts to the business.

However, we are seeking to return to sales growth in seasonally

stronger H2 and continue that growth into the next financial year

and beyond as our new business model delivers additional stockists,

new markets, and our marketing focus delivers strong campaigns and

new products.

Rebuilding distribution across our brands is a key priority, and

we have seen encouraging early results, having recently added new

on-trade listings, including a major pub group, as well as new

export markets, both of which will come through from October

onwards.

The spirits market continues to perform well in the UK, with

value +14% vs 3 years ago (Data: WSTA). The rum category in

particular is showing good growth, reaching GBP1bn in sales and

having overtaken whisky in the UK on trade in the first half of

this year. RedLeg Spiced Rum is positioned in line with consumer

needs, and our new partnership with Marussia Beverages UK will

ensure we are well placed to benefit from market trends.

In addition to the appointment of a Commercial Director, we have

subsequently appointed a new Marketing Director and a Head of

Finance & Operations which will further strengthen our team and

broaden our capabilities.

The current political and economic uncertainties are likely to

see consumers shopping for true value in both on and off trade

outlets, especially over the peak Christmas trading period and

through Spring next year. Our brands are well positioned in this

regard, and we aim to maintain a strong promotional support

programme across all trade sectors. We anticipate full year

performance for the year ending 31 March 2023 to be in line with

current market expectations.

For further information please contact:

Distil plc

Don Goulding Executive Chairman Tel: +44 203 283 4007

Shaun Claydon, Finance Director

----------------------

SPARK Advisory Partners

Limited (NOMAD)

----------------------

Neil Baldwin Tel +44 203 368 3550

Mark Brady

----------------------

Turner Pope Investments

(TPI) Limited (Broker)

----------------------

Andy Thacker / James Pope Tel +44 20 3657 0050

----------------------

Distil plc - Half Year Results

Consolidated comprehensive interim

income statement

----------- ----------- ----------

Six months Six months Year

ended 30 ended 30 ended

September September 31 March

2022 2021 2022

Un-audited Un-audited Audited

GBP'000 GBP'000 GBP'000

Revenue 460 1,435 2,942

Cost of sales (250) (641) (1,313)

----------- ----------- ----------

Gross profit 210 794 1,629

Administrative expenses:

Advertising and promotional costs (376) (398) (890)

Other administrative expenses (436) (410) (812)

Share based payment expense (30) (30) (59)

Total administrative expenses (842) (838) (1,761)

Operating loss (632) (44) (132)

Finance income 77 - 37

Finance expense - (1) -

Loss before tax from continuing operations (555) (45) (95)

Income tax - 65 269

----------- ----------- ----------

(Loss)/profit for the period (555) 20 174

----------- ----------- ----------

(Loss)/profit per share:

From continuing operations

Basic (pence per share) (0.08) 0.01 0.03

Diluted (pence per share) (0.08) 0.01 0.02

Consolidated interim statement of As at As at As at

financial position 30 September 30 September 31 March

2022 2021 2022

Un-audited Un-audited Audited

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment 159 167 167

Intangible fixed assets 1,613 1,602 1,606

Financial assets 3,038 3,000 3,000

Deferred tax assets 445 241 445

-------------- -------------- ----------

Total non-current assets 5,255 5,010 5,218

Current assets

Inventories 793 542 637

Trade and other receivables 586 674 687

Cash and cash equivalents 948 4,215 1,562

-------------- -------------- ----------

Total current assets 2,327 5,431 2,886

-------------- -------------- ----------

Total assets 7,582 10,441 8,104

-------------- -------------- ----------

LIABILITIES

Current liabilities

Trade and other payables 410 512 407

Financial liabilities 150 3,000 150

Total current liabilities 560 3,512 557

Total liabilities 560 3,512 557

-------------- -------------- ----------

Net assets 7,022 6,929 7,547

-------------- -------------- ----------

EQUITY

Equity attributable to equity holders

of the parent

Share capital 1,474 1,308 1,474

Share premium 6,211 5,964 6,211

Share based payment reserve 228 147 198

Accumulated losses (891) (490) (336)

-------------- -------------- ----------

Total equity 7,022 6,929 7,547

-------------- -------------- ----------

Consolidated interim cash flow statement

----------- ----------- ---------------

Six months Six months Year ended

ended 30 ended 30 31 March

September September 2022

2022 2021

Un-audited Un-audited Audited

Cashflows from operating activities GBP'000 GBP'000 GBP'000

Loss before tax (555) (45) (95)

Adjustments for non-cash/non-operating

items:

Finance income (77) - (37)

Depreciation 8 8 16

Share based payment expense 30 30 59

Expenses settled by shares - - 15

(594) (7) (42)

Movements in working capital

(Increase)/decrease in inventories (156) 11 (84)

Decrease/(increase) in trade receivables 101 (65) (78)

Increase in trade payables 3 154 54

----------- ----------- -----------

Cash (used in)/generated by operations (52) 100 (108)

Net cash (used in)/generated by operating

activities (646) 93 (150)

Cashflows from investing activities

Purchase of property plant & equipment - (8) (16)

Expenditure relating to the acquisition (7) (4) (8)

and registration of licenses and trademarks

Payment on issue of convertible loan notes - - (2,850)

----------- ----------- -----------

Net cash used in investing activities (7) (12) (2,874)

Cashflows from financing activities

Proceeds from issue of shares - 3,072 3,492

Interest received on convertible loans 38 - 32

Net cash generated by financing activities 38 3,072 3,524

Net (decrease)/increase in cash and cash

equivalents (615) 3,153 500

Cash & cash equivalents at the beginning

of the period 1,563 1,062 1,062

Cash & cash equivalents at the end of

the period 948 4,215 1,562

----------- ----------- -----------

Notes to the interim accounts:

1. Basis of preparation

This interim consolidated financial information for the six

months ended 30 September 2022 has been prepared in accordance with

AIM rule 18, 'Half yearly reports and accounts'. This interim

consolidated financial information is not the group's statutory

financial statements within the meaning of Section 434 of the

Companies Act 2006 (and information as required by section 435 of

the Companies Act 2006) and should be read in conjunction with the

annual financial statements for the year ended 31 March 2022, which

have been prepared under UK-adopted International Accounting

Standards (IFRS) and have been delivered to the Register of

Companies. The auditors have reported on those accounts; their

report was unqualified, did not include references to any matters

to which drew attention by way of emphasis of matter without

qualifying their report and did not contain any statements under

Section 498 (2) or (3) of the Companies Act 2006.

The interim consolidated financial information for the six

months ended 30 September 2022 is unaudited. In the opinion of the

Directors, the interim consolidated financial information presents

fairly the financial position, and results from operations and cash

flows for the period. Comparative numbers for the six months ended

30 September 2021 are also unaudited.

3. Availability

Copies of the interim report will be available from the Distil's

registered office at 201 Temple Chambers, 3-7 Temple Avenue, EC4Y

0DT and also on www.distil.uk.com .

4. Approval of interim report

This interim report was approved by the board on 12 October

2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR MTBPTMTTBBBT

(END) Dow Jones Newswires

October 13, 2022 02:00 ET (06:00 GMT)

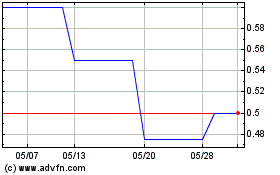

Distil (AQSE:DIS.GB)

過去 株価チャート

から 10 2024 まで 11 2024

Distil (AQSE:DIS.GB)

過去 株価チャート

から 11 2023 まで 11 2024