Friedman Industries, Incorporated (NYSE American: FRD) today

announced its results of operations for the third fiscal quarter

ended December 31, 2023.

December 31, 2023 Quarter

Highlights:

- Sales of

approximately $116.0 million

- Earnings

from operations of approximately $6.2 million

- Net

earnings of approximately $1.2 million

- 11%

increase in sales volume over prior year quarter

volume

- Working

capital balance at quarter-end of approximately $116.3

million

“We experienced higher hot-rolled coil (“HRC”)

pricing during the third quarter which increased our physical

margins, particularly during the second half of the quarter,” said

Michael J. Taylor, President and Chief Executive Officer. “Our

gross margin percentage increased to 9.0% for the third quarter

compared to 4.5% for the preceding second quarter. The rise in HRC

price brought a corresponding increase in HRC futures pricing,

which caused the improved physical margin to be partially offset by

our downside hedging protection. The market value of our inventory

increased substantially during the third quarter and we expect to

realize this value appreciation during our fourth quarter. We are

also pleased to see increased sales volume compared to prior year

periods and expect this trend to continue as we work toward our

goal of maximizing facility utilization,” Taylor concluded.

For the quarter ended December 31, 2023 (the

“2023 quarter”), the Company recorded net earnings of approximately

$1.2 million ($0.16 diluted earnings per share) on sales of

approximately $116.0 million compared to net earnings of

approximately $1.4 million ($0.19 diluted earnings per share) on

sales of approximately $111.9 million for the quarter ended

December 31, 2022 (the “2022 quarter”).

The table below provides our unaudited

statements of operations for the three- and nine-month periods

ended December 31, 2023 and 2022:

| SUMMARY OF

OPERATIONS (unaudited) |

| (In thousands,

except for per share data) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Nine Months Ended December 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

|

Net Sales |

$ |

115,973 |

|

|

$ |

111,860 |

|

|

$ |

384,019 |

|

|

$ |

423,356 |

|

| |

|

|

|

|

|

|

|

| Cost of

products sold |

|

105,531 |

|

|

|

105,730 |

|

|

|

351,427 |

|

|

|

393,876 |

|

| Selling,

general and administrative expenses |

|

4,269 |

|

|

|

4,701 |

|

|

|

15,007 |

|

|

|

15,662 |

|

| |

|

|

|

|

|

|

|

| Earnings

from operations |

|

6,173 |

|

|

|

1,429 |

|

|

|

17,585 |

|

|

|

13,818 |

|

| |

|

|

|

|

|

|

|

| Gain (loss)

on economic hedges of risk |

|

(4,126 |

) |

|

|

822 |

|

|

|

706 |

|

|

|

7,326 |

|

| Interest

expense |

|

(790 |

) |

|

|

(448 |

) |

|

|

(2,135 |

) |

|

|

(1,498 |

) |

| Other

income |

|

1 |

|

|

|

4 |

|

|

|

17 |

|

|

|

24 |

|

| |

|

|

|

|

|

|

|

| Earnings

before income taxes |

|

1,258 |

|

|

|

1,807 |

|

|

|

16,173 |

|

|

|

19,670 |

|

| |

|

|

|

|

|

|

|

| Income tax

expense |

|

74 |

|

|

|

431 |

|

|

|

3,786 |

|

|

|

4,639 |

|

| |

|

|

|

|

|

|

|

| Net

earnings |

$ |

1,184 |

|

|

$ |

1,376 |

|

|

$ |

12,387 |

|

|

$ |

15,031 |

|

| |

|

|

|

|

|

|

|

| Net earnings

per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.16 |

|

|

$ |

0.19 |

|

|

$ |

1.69 |

|

|

$ |

2.06 |

|

|

Diluted |

$ |

0.16 |

|

|

$ |

0.19 |

|

|

$ |

1.69 |

|

|

$ |

2.06 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The table below provides summarized unaudited

balance sheets as of December 31, 2023 and March 31, 2023:

|

SUMMARIZED BALANCE SHEETS (unaudited) |

|

(In thousands) |

| |

|

|

|

|

|

| |

December 31, 2023 |

|

March 31, 2023 |

| ASSETS: |

|

|

|

|

|

| Current

Assets |

170,897 |

|

|

143,656 |

|

| Noncurrent

Assets |

58,058 |

|

|

55,656 |

|

| Total

Assets |

228,955 |

|

|

199,312 |

|

| |

|

|

|

|

|

| LIABILITIES

AND STOCKHOLDERS' EQUITY: |

|

|

|

|

|

| Current

Liabilities |

54,601 |

|

|

45,088 |

|

| Noncurrent

Liabilities |

51,611 |

|

|

38,792 |

|

| Total

Liabilities |

106,212 |

|

|

83,880 |

|

| |

|

|

|

|

|

| Total

Stockholders' Equity |

122,743 |

|

|

115,432 |

|

| |

|

|

|

|

|

| Total

Liabilities and Stockholders' Equity |

228,955 |

|

|

199,312 |

|

| |

|

|

|

|

|

FLAT-ROLL SEGMENT OPERATIONS (previously

referred to as the “coil segment”)

Flat-roll product segment sales for the

2023 quarter totaled approximately

$106.4 million compared to approximately

$100.2 million for the 2022 quarter. The flat-roll

segment had sales volume of approximately 110,000 tons from

inventory and another 22,000 tons of toll processing for the 2023

quarter compared to approximately 106,000 tons from inventory and

13,000 tons of toll processing for the 2022 quarter. The growth in

sales volume was primarily related to the increased production at

the Company's Sinton, TX facility which commenced

operations in October 2022. The average per ton selling price

related to inventory tons sold increased from approximately

$949 per ton in the 2022 quarter to approximately

$960 per ton in the 2023 quarter. Flat-roll segment

operations recorded operating profits of approximately

$8.7 million and $3.3 million for the 2023 quarter

and 2022 quarter, respectively.

TUBULAR SEGMENT OPERATIONS

Tubular product segment sales for the 2023

quarter totaled approximately $9.5 million compared to

approximately $11.6 million for the 2022 quarter. Sales

decreased due to a decrease in the average

selling price per ton, partially offset by an

increase in the volume sold. The average per ton selling

price decreased from approximately $1,648 per ton in the 2022

quarter to approximately $1,164 per ton in the 2023 quarter.

Tons sold increased from approximately 7,000 tons in the 2022

quarter to approximately 8,000 tons in the 2023

quarter. The tubular segment recorded an operating

loss of approximately $0.1 million for the 2023 quarter

compared to operating profit of approximately

$0.7 million for the 2022 quarter.

HEDGING ACTIVITIES

We utilize HRC futures to manage price risk on

unsold inventory and longer-term fixed price sales agreements. We

typically account for our hedging activities under mark-to-market

(“MTM”) accounting treatment and all hedging decisions are intended

to protect the value of our inventory and produce more consistent

financial results over price cycles. With MTM accounting treatment

it is possible that hedging related gains or losses might be

recognized in a different fiscal quarter than the corresponding

improvement or contraction in our physical margins. For the third

quarter, we recognized a loss on hedging activities of

approximately $4.1 million. Of this amount, $3.0 million was

associated with realized closed positions and $1.1 million was

associated with unrealized open positions. We experienced an

inflection point in steel prices during the third quarter with both

HRC price and the futures prices increasing. This resulted in our

physical margins improving in the second half of the quarter with

this margin improvement being partially offset by hedging losses.

We expect to recognize the appreciation in our inventory value

through increased physical margins on fourth quarter sales.

OUTLOOK

The Company expects to conclude fiscal year 2024

with a strong fourth quarter characterized by solid margins

associated with a substantial increase in HRC price entering the

fourth quarter. Sales volume for the fourth quarter of fiscal 2024

is expected to be slightly higher than the third quarter

volume.

ABOUT FRIEDMAN INDUSTRIES

Friedman Industries, Incorporated (“Company”),

headquartered in Longview, Texas, is a manufacturer and processor

of steel products with operating plants in Hickman, Arkansas;

Decatur, Alabama; East Chicago, Indiana; Granite City, Illinois;

Sinton, Texas and Lone Star, Texas. The Company has two reportable

segments: flat-roll products and tubular products. The flat-roll

product segment consists of the operations in Hickman, Decatur,

East Chicago, Granite City and Sinton where the Company processes

hot-rolled steel coils. The Hickman, East Chicago and Granite City

facilities operate temper mills and corrective leveling

cut-to-length lines. The Sinton and Decatur facilities operate

stretcher leveler cut-to-length lines. The Sinton facility is a

newly constructed facility with operations commencing in October

2022. The East Chicago and Granite City facilities were acquired

from Plateplus, Inc. on April 30, 2022. The tubular product segment

consists of the operations in Lone Star where the Company

manufactures electric resistance welded pipe and distributes pipe

through its Texas Tubular Products division.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

and Section 21E of the Exchange Act, and such statements involve

risk and uncertainty. Forward-looking statements include those

preceded by, followed by or including the words “will,” “expect,”

“intended,” “anticipated,” “believe,” “project,” “forecast,”

“propose,” “plan,” “estimate,” “enable,” and similar expressions,

including, for example, statements about our business strategy, our

industry, our future profitability, growth in the industry sectors

we serve, our expectations, beliefs, plans, strategies, objectives,

prospects and assumptions, future production capacity, product

quality and estimates and projections of future activity and trends

in the oil and natural gas industry. These forward-looking

statements may include, but are not limited to, everything under

the header “Outlook” above, including sales volumes, margins,

hedging results, and potential price increases, expectations as to

financial results during the Company’s upcoming fiscal quarters,

future changes in the Company’s financial condition or results of

operations, future production capacity, product quality and

proposed expansion plans. Forward-looking statements may be made by

management orally or in writing including, but not limited to, this

news release.

Forward-looking statements are not guarantees of

future performance. These statements are based on management’s

expectations that involve a number of business risks and

uncertainties, any of which could cause actual results to differ

materially from those expressed in or implied by the

forward-looking statements. Although forward-looking statements

reflect our current beliefs, reliance should not be placed on

forward-looking statements because they involve known and unknown

risks, uncertainties and other factors, which may cause our actual

results, performance or achievements to differ materially from

anticipated future results, performance or achievements expressed

or implied by such forward-looking statements.

Actual results and trends in the future may

differ materially depending on a variety of factors including, but

not limited to, changes in the demand for and prices of the

Company’s products, changes in government policy regarding steel,

changes in the demand for steel and steel products in general and

the Company’s success in executing its internal operating plans,

changes in and availability of raw materials, our ability to

satisfy our take or pay obligations under certain supply

agreements, unplanned shutdowns of our production facilities due to

equipment failures or other issues, increased competition from

alternative materials and risks concerning innovation, new

technologies, products and increasing customer requirements.

Accordingly, undue reliance should not be placed on our

forward-looking statements. Such risks and uncertainty are also

addressed in our Management’s Discussion and Analysis of Financial

Condition and Results of Operations and other sections of the

Company’s filings with the U.S. Securities and Exchange Commission

(the “SEC”) under the Securities Act of 1933, as amended, and the

Securities Exchange Act of 1934, as amended (the “Exchange Act”),

including the Company’s Annual Report on Form 10-K and its other

Quarterly Reports on Form 10-Q. We undertake no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events, changed circumstances

or otherwise, except to the extent law requires.

For further information, please refer to the

Company's Form 10-Q as filed with the SEC on February 14, 2024 or

contact Alex LaRue, Chief Financial Officer – Secretary and

Treasurer, at (903)758-3431.

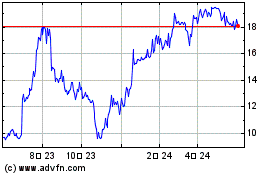

Friedman Industries (AMEX:FRD)

過去 株価チャート

から 11 2024 まで 12 2024

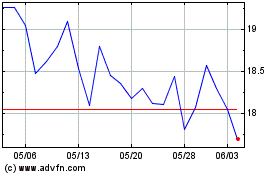

Friedman Industries (AMEX:FRD)

過去 株価チャート

から 12 2023 まで 12 2024