|

Registration

Statement No. 333-275898

Filed Pursuant to Rule 424(b)(2) |

| |

| |

|

|

|

Pricing Supplement

Pricing Supplement dated November 4, 2024 to the Prospectus

dated December 20, 2023, the Prospectus Supplement dated December 20, 2023 and the Product Supplement No. 1A dated May 16, 2024 |

|

$13,250,000

Redeemable Fixed Rate Notes,

Due November 6, 2034

Royal Bank of Canada |

| |

|

|

Royal Bank

of Canada is offering the Redeemable Fixed Rate Notes (the “Notes”) described below.

| · | The Notes will accrue interest at the rate of 5.00% per annum, payable semiannually. |

| · | We may redeem the Notes in whole, but not in part, as described under “Key Terms” below. |

| · | Any payments on the Notes are subject to our credit risk. |

| · | The Notes will not be listed on any securities exchange. |

| · | The Notes are bail-inable notes (as defined in the accompanying prospectus supplement) and are subject

to conversion in whole or in part—by means of a transaction or series of transactions and in one or more steps—into common

shares of Royal Bank of Canada or any of its affiliates under subsection 39.2(2.3) of the Canada Deposit Insurance Corporation Act (the

“CDIC Act”) and to variation or extinguishment in consequence, and subject to the application of the laws of the Province

of Ontario and the federal laws of Canada applicable therein in respect of the operation of the CDIC Act with respect to the Notes. |

CUSIP: 78014RTD2

Investing in the Notes involves a number of

risks. See “Selected Risk Considerations” beginning on page P-4 of this pricing supplement and “Risk Factors”

in the accompanying prospectus, prospectus supplement and product supplement.

None of the Securities and Exchange Commission

(the “SEC”), any state securities commission or any other regulatory body has approved or disapproved of the Notes or passed

upon the adequacy or accuracy of this pricing supplement. Any representation to the contrary is a criminal offense. The Notes will not

constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation or any other Canadian

or U.S. governmental agency or instrumentality.

| |

Per Note |

Total |

| Price to public(1) |

100.00% |

$13,250,000 |

| Underwriting discounts and commissions(1) |

1.46% |

$193,450 |

| Proceeds to Royal Bank of Canada |

98.54% |

$13,056,550 |

(1) RBC Capital Markets, LLC will purchase

the Notes from us on the Issue Date at purchase prices between $985.00 and $1,000.00 per $1,000 principal amount of Notes, and will pay

all or a portion of its underwriting discount of up to $15.00 per $1,000 principal amount of Notes to certain selected broker-dealers

as a selling concession. Certain dealers who purchase the Notes for sale to certain fee-based advisory accounts and/or eligible institutional

investors may forgo some or all of their selling concessions, fees or commissions. The public offering price for investors purchasing

the Notes in these accounts and/or for an eligible institutional investor may be as low as $985.00 per $1,000 principal amount of Notes.

See “Supplemental Plan of Distribution (Conflicts of Interest)” below.

RBC Capital Markets, LLC

| |

|

| |

Redeemable Fixed Rate Notes |

KEY TERMS

The information in this “Key Terms”

section is qualified by any more detailed information set forth in this pricing supplement and in the accompanying prospectus, prospectus

supplement and product supplement.

| Issuer: |

Royal Bank of Canada |

| Underwriter: |

RBC Capital Markets, LLC (“RBCCM”) |

| Minimum Investment: |

$1,000 and minimum denominations of $1,000 in excess thereof |

| Pricing Date: |

November 4, 2024 |

| Issue Date: |

November 6, 2024 |

| Maturity Date:* |

November 6, 2034 |

| Interest Rate: |

5.00% per annum |

| Interest Payment Dates:* |

Semiannually, on the 6th calendar day of May and November of each year, beginning on May 6, 2025 and ending on the Maturity Date. If an Interest Payment Date is not a business day, interest will be paid on the next business day, without adjustment, and no additional interest will be paid in respect of the postponement. |

| Redemption: |

The Notes are redeemable at our option, in whole, but not in part, on any Call Date upon 10 business days’ prior written notice. If we redeem the Notes, we will pay you the principal amount, together with the applicable interest payment, on the relevant Call Date. No further payments will be made on the Notes. |

| Call Dates:* |

The Interest Payment Date scheduled to occur on November 6, 2027 and each Interest Payment Date thereafter |

| Day Count Convention: |

30 / 360 |

| Canadian Bail-in Powers Acknowledgment: |

The Notes are bail-inable notes. See “Agreement with Respect to the Exercise of Canadian Bail-in Powers” below. |

| Calculation Agent: |

RBCCM |

* Subject to postponement. See “General Terms of the Notes—Postponement

of a Payment Date” in the accompanying product supplement.

| P-2 | RBC Capital Markets, LLC |

| | |

| | Redeemable Fixed Rate Notes |

ADDITIONAL TERMS OF YOUR NOTES

You should read this pricing supplement together

with the prospectus dated December 20, 2023, as supplemented by the prospectus supplement dated December 20, 2023, relating to our Senior

Global Medium-Term Notes, Series J, of which the Notes are a part, and the product supplement no. 1A dated May 16, 2024. This pricing

supplement, together with these documents, contains the terms of the Notes and supersedes all other prior or contemporaneous oral statements

as well as any other written materials, including preliminary or indicative pricing terms, correspondence, trade ideas, structures for

implementation, sample structures, fact sheets, brochures or other educational materials of ours.

We have not authorized anyone to provide any

information or to make any representations other than those contained or incorporated by reference in this pricing supplement and the

documents listed below. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that

others may give you. These documents are an offer to sell only the Notes offered hereby, but only under circumstances and in jurisdictions

where it is lawful to do so. The information contained in each such document is current only as of its date.

If the information in this pricing supplement

differs from the information contained in the documents listed below, you should rely on the information in this pricing supplement.

You should carefully consider, among other things,

the matters set forth in “Selected Risk Considerations” in this pricing supplement and “Risk Factors” in the documents

listed below, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal,

tax, accounting and other advisers before you invest in the Notes.

You may access these documents on the SEC website

at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| · | Prospectus dated December 20, 2023: |

https://www.sec.gov/Archives/edgar/data/1000275/000119312523299520/d645671d424b3.htm

| · | Prospectus Supplement dated December 20, 2023: |

https://www.sec.gov/Archives/edgar/data/1000275/000119312523299523/d638227d424b3.htm

| · | Product Supplement No. 1A dated May 16, 2024: |

https://www.sec.gov/Archives/edgar/data/1000275/000095010324006777/dp211286_424b2-ps1a.htm

Our Central Index Key, or CIK, on the SEC website

is 1000275. As used in this pricing supplement, “Royal Bank of Canada,” the “Bank,” “we,” “our”

and “us” mean only Royal Bank of Canada.

| P-3 | RBC Capital Markets, LLC |

| | |

| | Redeemable Fixed Rate Notes |

SELECTED RISK CONSIDERATIONS

The Notes involve risks not associated with

an investment in ordinary fixed rate notes. We urge you to consult your investment, legal, tax, accounting and other advisers before you

invest in the Notes. Some of the risks that apply to an investment in the Notes are summarized below, but we urge you to read also the

“Risk Factors” sections of the accompanying prospectus, prospectus supplement and product supplement. You should not purchase

the Notes unless you understand and can bear the risks of investing in the Notes.

| · | The Notes Are Subject to the Risk of an Early Redemption — We have the option to redeem the

Notes on the Call Dates set forth above. It is more likely that we will redeem the Notes prior to the Maturity Date to the extent that

the interest payable on the Notes is greater than the interest that would be payable on our other instruments of a comparable maturity,

terms and credit rating trading in the market. If the Notes are redeemed prior to the Maturity Date, you may have to re-invest the proceeds

in a lower rate environment, and you will not receive any further payments on the Notes. |

| · | Notes with a Longer Term May Be Riskier than Notes with a Shorter Term — By purchasing a

note with a longer tenor, you are more exposed to fluctuations in interest rates than if you purchased a security with a shorter tenor.

The value of a longer-dated note tends to be more sensitive to rising interest rates than the value of a shorter-dated note. If interest

rates rise, the value of a longer-dated note will typically fall faster than the value of a shorter-dated note. You should only purchase

the Notes if you are comfortable with owning a security with a longer tenor. |

| · | Payments on the Notes Are Subject to Our Credit Risk, and Market Perceptions about Our Creditworthiness

May Adversely Affect the Market Value of the Notes — The Notes are our senior unsecured debt securities, and your receipt of

any amounts due on the Notes is dependent upon our ability to pay our obligations as they come due. If we were to default on our payment

obligations, you may not receive any amounts owed to you under the Notes and you could lose your entire investment. In addition, any negative

changes in market perceptions about our creditworthiness may adversely affect the market value of the Notes. |

| P-4 | RBC Capital Markets, LLC |

| | |

| | Redeemable Fixed Rate Notes |

AGREEMENT WITH RESPECT TO THE

EXERCISE OF CANADIAN BAIL-IN POWERS

By its acquisition of the Notes, each holder

or beneficial owner is deemed to (i) agree to be bound, in respect of that Note, by the CDIC Act, including the conversion of that Note,

in whole or in part—by means of a transaction or series of transactions and in one or more steps—into common shares of the

Bank or any of its affiliates under subsection 39.2(2.3) of the CDIC Act and the variation or extinguishment of that Note in consequence,

and by the application of the laws of the Province of Ontario and the federal laws of Canada applicable therein in respect of the operation

of the CDIC Act with respect to that Note; (ii) attorn and submit to the jurisdiction of the courts in the Province of Ontario with respect

to the CDIC Act and those laws; and (iii) acknowledge and agree that the terms referred to in paragraphs (i) and (ii), above, are binding

on that holder or beneficial owner despite any provisions in the indenture or that Note, any other law that governs that Note and any

other agreement, arrangement or understanding between that holder or beneficial owner and the Bank with respect to that Note.

Holders and beneficial owners of any Note will

have no further rights in respect of that Note to the extent that Note is converted in a bail-in conversion, other than those provided

under the bail-in regime, and by its acquisition of an interest in any Note, each holder or beneficial owner of that Note is deemed to

irrevocably consent to the converted portion of the principal amount of that Note and any accrued and unpaid interest thereon being deemed

paid in full by the Bank by the issuance of common shares of the Bank (or, if applicable, any of its affiliates) upon the occurrence of

a bail-in conversion, which bail-in conversion will occur without any further action on the part of that holder or beneficial owner or

the trustee; provided that, for the avoidance of doubt, this consent will not limit or otherwise affect any rights that holders or beneficial

owners may have under the bail-in regime.

See “Description of Notes We May Offer―Special

Provisions Related to Bail-inable Notes” in the accompanying prospectus supplement for a description of provisions applicable to

the Notes as a result of Canadian bail-in powers.

UNITED STATES FEDERAL INCOME

TAX CONSIDERATIONS

You should review carefully the section in the

accompanying product supplement entitled “United States Federal Income Tax Considerations,” focusing particularly on the section

entitled “—Tax Consequences to U.S. Holders—Notes Treated as Debt Instruments—General.” The following discussion,

when read in combination with “United States Federal Income Tax Considerations” in the accompanying product supplement, constitutes

the full opinion of our counsel, Davis Polk & Wardwell LLP, regarding the material U.S. federal income tax consequences of owning

and disposing of the Notes. This discussion assumes that you purchased the Notes for cash in the original issuance at the stated issue

price and does not address other circumstances specific to you. In the opinion of our counsel, which is based on representations provided

by us, it is reasonable to treat the Notes for U.S. federal income tax purposes as debt instruments that are issued without original issue

discount. You should consult your tax adviser regarding the U.S. federal income tax consequences of an investment in the Notes in your

particular circumstances, as well as tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

SUPPLEMENTAL PLAN OF DISTRIBUTION

(CONFLICTS OF INTEREST)

After the initial offering of the Notes, the

public offering price of the Notes may change.

RBCCM or another of its affiliates or agents

may use this pricing supplement in the initial sale of the Notes. In addition, RBCCM or another of our affiliates may use this pricing

supplement in a market-making transaction in the Notes after their initial sale. Unless we or our agent informs the purchaser otherwise

in the confirmation of sale, this pricing supplement is being used in a market-making transaction.

For additional information about the settlement

cycle of the Notes, see “Plan of Distribution” in the accompanying prospectus. For additional information as to the relationship

between us and RBCCM, see the section “Plan of Distribution—Conflicts of Interest” in the accompanying prospectus.

| P-5 | RBC Capital Markets, LLC |

| | |

| | Redeemable Fixed Rate Notes |

VALIDITY OF THE NOTES

In the opinion of Norton Rose Fulbright Canada

LLP, as Canadian counsel to the Bank, the issue and sale of the Notes has been duly authorized by all necessary corporate action of the

Bank in conformity with the indenture, and when the Notes have been duly executed, authenticated and issued in accordance with the indenture

and delivered against payment therefor, the Notes will be validly issued and, to the extent validity of the Notes is a matter governed

by the laws of the Province of Ontario or Québec, or the federal laws of Canada applicable therein, will be valid obligations of

the Bank, subject to the following limitations: (i) the enforceability of the indenture may be limited by the Canada Deposit Insurance

Corporation Act (Canada), the Winding-up and Restructuring Act (Canada) and bankruptcy, insolvency, reorganization, receivership, moratorium,

arrangement or winding-up laws or other similar laws of general application affecting the enforcement of creditors’ rights generally;

(ii) the enforceability of the indenture is subject to general equitable principles, including the principle that the availability of

equitable remedies, such as specific performance and injunction, may only be granted at the discretion of a court of competent jurisdiction;

(iii) under applicable limitations statutes generally, including that the enforceability of the indenture will be subject to the limitations

contained in the Limitations Act, 2002 (Ontario), and such counsel expresses no opinion as to whether a court may find any provision of

the indenture to be unenforceable as an attempt to vary or exclude a limitation period under such applicable limitations statutes; (iv)

rights to indemnity and contribution under the Notes or the indenture which may be limited by applicable law; and (v) courts in Canada

are precluded from giving a judgment in any currency other than the lawful money of Canada and such judgment may be based on a rate of

exchange in existence on a day other than the day of payment, as prescribed by the Currency Act (Canada). This opinion is given as of

the date hereof and is limited to the laws of the Provinces of Ontario and Québec and the federal laws of Canada applicable therein.

In addition, this opinion is subject to customary assumptions about the trustee’s authorization, execution and delivery of the indenture

and the genuineness of signatures and to such counsel’s reliance on the Bank and other sources as to certain factual matters, all

as stated in the opinion letter of such counsel dated December 20, 2023, which has been filed as Exhibit 5.3 to the Bank’s Form

6-K filed with the SEC dated December 20, 2023.

In the opinion of Davis Polk & Wardwell

LLP, as special United States products counsel to the Bank, when the Notes offered by this pricing supplement have been issued by the

Bank pursuant to the indenture, the trustee has made, in accordance with the indenture, the appropriate notation to the master note evidencing

such Notes (the “master note”), and such Notes have been delivered against payment as contemplated herein, such Notes will

be valid and binding obligations of the Bank, enforceable in accordance with their terms, subject to applicable bankruptcy, insolvency

and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable principles of general applicability

(including, without limitation, concepts of good faith, fair dealing and the lack of bad faith) and possible judicial or regulatory actions

or applications giving effect to governmental actions or foreign laws affecting creditors’ rights, provided that such counsel

expresses no opinion as to (i) the enforceability of any waiver of rights under any usury or stay law or (ii) the effect of fraudulent

conveyance, fraudulent transfer or similar provision of applicable law on the conclusions expressed above. This opinion is given as of

the date hereof and is limited to the laws of the State of New York. Insofar as the foregoing opinion involves matters governed by the

laws of the Provinces of Ontario and Québec and the federal laws of Canada, you have received, and we understand that you are relying

upon, the opinion of Norton Rose Fulbright Canada LLP, Canadian counsel for the Bank, set forth above. In addition, this opinion is subject

to customary assumptions about the trustee’s authorization, execution and delivery of the indenture and the authentication of the

master note and the validity, binding nature and enforceability of the indenture with respect to the trustee, all as stated in the opinion

of Davis Polk & Wardwell LLP dated May 16, 2024, which has been filed as an exhibit to the Bank’s Form 6-K filed with the SEC

on May 16, 2024.

| P-6 | RBC Capital Markets, LLC |

424B2

EX-FILING FEES

0001000275

333-275898

0001000275

2024-11-05

2024-11-05

iso4217:USD

xbrli:pure

xbrli:shares

Ex-Filing Fees

CALCULATION OF FILING FEE TABLES

F-3

ROYAL BANK OF CANADA

Narrative Disclosure

The maximum aggregate offering price of the securities to which the prospectus relates is $13,250,000. The

prospectus is a final prospectus for the related offering(s).

v3.24.3

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_RegnFileNb |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FnlPrspctsFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NrrtvMaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

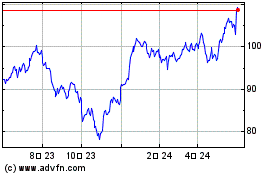

Royal Bank of Canada (NYSE:RY)

過去 株価チャート

から 10 2024 まで 11 2024

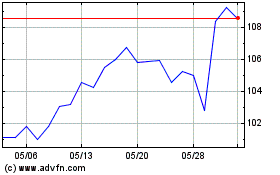

Royal Bank of Canada (NYSE:RY)

過去 株価チャート

から 11 2023 まで 11 2024