U.S. Dollar Firms Ahead Of U.S. Core PCE Inflation Data

2024年6月28日 - 2:43PM

RTTF2

The U.S. dollar strengthened against other major currencies in

the early European session on Friday, as traders eagerly await the

release of closely watched U.S. inflation data later in the day

that may shed additional clues on the interest-rate outlook.

The Commerce Department's report on personal income and spending

for May includes readings on inflation said to be preferred by the

Federal Reserve.

Analysts expect a modest slowdown in the annual rate of consumer

price growth to 2.6 percent last month from 2.8 percent, driven by

falling gas prices and more deflation in consumer goods.

That's the lowest reading since March 2021 but remains above the

Fed's 2 percent target.

Federal Reserve Bank of Atlanta President Raphael Bostic said

Thursday he continues to expect one interest rate cut this year in

the fourth quarter as inflation shows progress. His projection

echoes that of the Federal Open Market Committee.

Investors may also react to the Biden-Trump Presidential debate

and weigh political uncertainty risks, heading into France's

landmark legislative elections due over the weekend.

The first U.S. Presidential debate between President Joe Biden

and former President Donald Trump has ended, with both the leaders

trading fiery barbs at each other over several issues such as the

state of the economy, border, foreign policy, abortion and national

security.

Opinion polls suggest victory for the far right in the first

phase of the two-stage French parliamentary elections, but

predicting the outcome of final vote on July 7 is less clear-cut,

given the complexity of France's voting system.

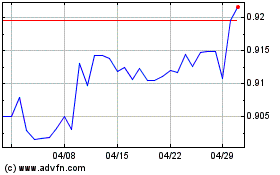

In the European trading today, the U.S. dollar rose to a 38-year

high of 161.28 against the yen, nearly a 4-week high of 0.9001

against the Swiss franc and a 10-day high of 1.3735 against the

Canadian dollar, from early lows of 160.65, 0.8985 and 1.3697,

respectively. If the greenback extends its uptrend, it is likely to

find resistance around 162.00 against the yen, 0.93 against the

franc and 1.39 against the loonie.

Against the euro and the pound, the greenback edged up to 1.0684

and 1.2622 from early lows of 1.0711 and 1.2650, respectively. The

greenback may test resistance near 1.05 against the euro and 1.24

against the pound.

Looking ahead, Canada GDP data for April, U.S. Core PCE price

index for May, personal income and spending data for May, U.S.

Chicago PMI for June, U.S. University of Michigan's consumer

sentiment index for June and U.S. weekly Baker Hughes oil rig count

data are slated for release in the New York session.

US Dollar vs CHF (FX:USDCHF)

FXチャート

から 10 2024 まで 11 2024

US Dollar vs CHF (FX:USDCHF)

FXチャート

から 11 2023 まで 11 2024