0000002178FALSE00000021782024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 8, 2024

ADAMS RESOURCES & ENERGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 1-7908 | 74-1753147 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | |

| 17 South Briar Hollow Lane, Suite 100, Houston, Texas | 77027 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (713) 881-3600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.10 par value | | AE | | NYSE American LLC |

| | | | | | | | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | Emerging growth company | ☐ |

| | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 2.02 Results of Operations and Financial Condition.

On May 8, 2024, Adams Resources & Energy, Inc., a Delaware corporation (the “Company”), issued a press release announcing financial results for the quarter ended March 31, 2024. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is hereby incorporated herein by reference.

The information provided in this Item 2.02 (including the press release attached as Exhibit 99.1) shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be incorporated by reference in any filing made by the Company pursuant to the Securities Act of 1933, as amended, except to the extent that such filing incorporates by reference any or all of such information by express reference thereto.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| 99.1 | |

| |

| 104 | Cover Page Interactive Data File — the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | ADAMS RESOURCES & ENERGY, INC. |

| | | |

| | | |

| | | |

| Date: | May 8, 2024 | By: | /s/ Tracy E. Ohmart |

| | | Tracy E. Ohmart |

| | | Chief Financial Officer |

| | | (Principal Financial Officer and |

| | | Principal Accounting Officer) |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Adams Resources & Energy, Inc. Announces First Quarter

2024 Results and Declares Quarterly Dividend

Houston, Texas (Wednesday, May 8, 2024) -- Adams Resources & Energy, Inc. (NYSE AMERICAN: AE) (“Adams” or the “Company”), a company engaged in marketing, transportation, logistics and repurposing of crude oil, refined products and dry bulk materials, today announced operational and financial results for the quarter ended March 31, 2024. The Company also declared a quarterly cash dividend of $0.24 per common share.

First Quarter 2024 Financial Summary

•Total revenue of $661.1 million, versus $650.2 million for the first quarter of 2023.

•Net loss for the quarter improved $1.5 million year over year to ($0.5) million, or ($0.19) per common share.

•EBITDA for the quarter improved $1.6 million year over year to $6.0 million, versus $4.4 million for the first quarter of 2023. Both net loss and EBITDA include $1.8 million of inventory liquidation gains for the first quarter of 2024 versus $1.0 million of inventory valuation losses for the first quarter of 2023.

•Cash and cash equivalents were $36.6 million as of March 31, 2024, versus $33.3 million at December 31, 2023.

•Liquidity of $83.6 million at March 31, 2024, versus $80.3 million at December 31, 2023.

•Paid dividends of $0.24 per share.

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is a non-generally accepted accounting principle (“non-GAAP”) financial measure that is defined and reconciled to net (losses) earnings in the financial tables later in this release.

“We are encouraged by the multiple signs of progress experienced across our business this quarter, especially on the margin side, as we continue to respond to the ongoing macroeconomic headwinds,” said Kevin Roycraft, President & CEO of Adams. “We increased volumes and strengthened our margins within our oil segments and are optimistic these trends can continue throughout the year. We are also beginning to see signs of recovery in the chemical transport markets which could lead to a reversal of rate decreases from last year. We

believe we are well-positioned to benefit when the economy improves, and confident in our ability to deliver long-term value to our shareholders.”

Additional Operational Highlights

•In the first quarter, Adams’ crude oil marketing subsidiary, GulfMark Energy, Inc. (“GulfMark”), marketed 64,634 barrels per day (“bpd”) of crude oil during the first quarter of 2024, compared to 94,030 bpd during the first quarter of 2023 and 73,381 bpd during the fourth quarter of 2023. The decrease in volumes was largely driven by GulfMark’s exit from the Red River trucking operations in the fourth quarter of 2023.

•The collective fleet of Service Transport Company (“Service Transport”), Adams’ liquid chemicals, pressurized gases, asphalt and dry bulk transportation subsidiary, traveled 6.29 million miles during the first quarter of 2024, versus 6.55 million miles during the first quarter of 2023 and 6.13 million miles during the fourth quarter of 2023.

•Adams’ crude oil pipeline and storage segment, which includes the Victoria Express Pipeline System, throughput was 11,256 bpd for the first quarter of 2024, compared to 10,088 bpd for the first quarter of 2023 and 9,377 bpd for the fourth quarter of 2023, and terminalling volumes were 11,544 bpd for the first quarter of 2024, compared to 10,395 bpd in the first quarter of 2023, and 9,589 bpd for the fourth quarter of 2023.

•Adams’ remained solidly positioned with 329,287 barrels of crude oil inventory at March 31, 2024, compared to 267,731 barrels at December 31, 2023.

Capital Investments and Dividends

During the first quarter of 2024, the Company had capital expenditures of $6.2 million primarily for the purchase of seventeen tractors, thirteen trailers and other various equipment. In addition, Adams paid dividends of $0.7 million, or $0.24 per common share.

As part of Adams’ on-going capital allocation strategy, the Board of Directors declared a quarterly cash dividend for the first quarter of 2024 of $0.24 per common share, payable on June 28, 2024, to shareholders of record as of June 14, 2024.

Use of Non-GAAP Financial Measures

To supplement the Company’s financial statements presented in accordance with generally accepted accounting principles in the United States (“GAAP”), this press release and accompanying schedules include the non-GAAP financial measure of earnings before interest, taxes, depreciation and amortization (EBITDA). The accompanying schedules provide a reconciliation of EBITDA to net earnings (losses), its most directly comparable financial measure calculated and presented in accordance with GAAP. The Company defines EBITDA as net earnings (or losses) before interest income or expense, income tax and depreciation and amortization expense. Company management believes this measure is a useful indicator of the financial performance of our business and uses this measurement as an aid in monitoring the Company’s ongoing financial performance from quarter to quarter and year to year on a regular basis and for benchmarking against peer companies. Management also believes that EBITDA is useful to investors as it is a measure commonly used by other companies in our industry and

provides a comparison for investors for the Company’s performance relative to its competitors. Our non-GAAP financial measure should not be considered as an alternative to net income or any other measure of financial performance calculated and presented in accordance with GAAP. Adams’ non-GAAP financial measure may not be comparable to similarly titled measures of other companies because they may not calculate such measures in the same manner as Adams does.

Conference Call

The Company will host a conference call to discuss its first quarter results on Thursday, May 9, 2024 at 9:00 a.m. ET (8:00 a.m. CT). To participate in the live conference call, dial 1-844-413-3976 (Toll-Free) within the U.S., or 1-412-317-1802 (Toll-Required) outside the U.S., or log into the webcast, available on Adams’ investor relations website at adamsresources.com/investor-relations. A replay will also be available on the Company’s website or by dialing 1-877-344-7529 (Toll-Free) within the U.S., or 1-412-317-0088 (Toll-Required) outside the U.S. and entering code 2340534.

About Adams Resources & Energy, Inc.

Adams Resources & Energy, Inc. is engaged in crude oil marketing, transportation, terminalling and storage, tank truck transportation of liquid chemicals and dry bulk, interstate bulk transportation logistics of crude oil, condensate, fuels, oils and other petroleum products and recycling and repurposing of off-specification fuels, lubricants, crude oil and other chemicals through its subsidiaries, GulfMark Energy, Inc., Service Transport Company, Victoria Express Pipeline, LLC, GulfMark Terminals, LLC, Firebird Bulk Carriers, Inc. and Phoenix Oil, Inc. For more information, visit www.adamsresources.com.

Cautionary Statement Regarding Forward-Looking Statements

This news release contains forward-looking statements. Forward-looking statements relate to future events and anticipated results of operations, business strategies, capital deployment plans and other aspects of our operations or operating results as well as future industry developments and economic conditions. In many cases you can identify forward-looking statements by terminology such as “anticipate,” “intend,” “plan,” “project,” “estimate,” “continue,” “potential,” “should,” “could,” “may,” “will,” “objective,” “guidance,” “outlook,” “effort,” “expect,” “believe,” “predict,” “budget,” “projection,” “goal,” “forecast,” “target” or similar words. Statements may be forward looking even in the absence of these particular words. Where, in any forward-looking statement, the Company expresses an expectation or belief as to future results or conditions, such expectation or belief is expressed in good faith and believed to have a reasonable basis. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, and any other risk factors included in Adams’ reports filed with the Securities and Exchange Commission. However, there can be no assurance that such expectation or belief will result or be achieved. Unless legally required, Adams undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Company Contact

Tracy E. Ohmart

EVP, Chief Financial Officer

tohmart@adamsresources.com

(713) 881-3609

Investor Relations Contact

John Beisler or Steven Hooser

Three Part Advisors

(817) 310-8776

ADAMS RESOURCES & ENERGY, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | March 31, | | |

| | 2024 | | 2023 | | | | |

| Revenues: | | | | | | | | |

| Marketing | | $ | 623,824 | | | $ | 608,476 | | | | | |

| Transportation | | 23,231 | | | 26,445 | | | | | |

| Pipeline and storage | | 4 | | | — | | | | | |

| Logistics and repurposing | | 13,991 | | | 15,241 | | | | | |

| Total revenues | | 661,050 | | | 650,162 | | | | | |

| | | | | | | | |

| Costs and expenses: | | | | | | | | |

| Marketing | | 615,591 | | | 604,494 | | | | | |

| Transportation | | 20,150 | | | 22,413 | | | | | |

| Pipeline and storage | | 697 | | | 938 | | | | | |

| Logistics and repurposing | | 13,837 | | | 13,125 | | | | | |

| General and administrative | | 4,781 | | | 4,772 | | | | | |

| Depreciation and amortization | | 6,355 | | | 7,050 | | | | | |

| Total costs and expenses | | 661,411 | | | 652,792 | | | | | |

| | | | | | | | |

| Operating losses | | (361) | | | (2,630) | | | | | |

| | | | | | | | |

| Other income (expense): | | | | | | | | |

| Interest and other income | | 561 | | | 204 | | | | | |

| Interest expense | | (793) | | | (696) | | | | | |

| Total other income (expense), net | | (232) | | | (492) | | | | | |

| | | | | | | | |

| Losses before income taxes | | (593) | | | (3,122) | | | | | |

| Income tax benefit | | 95 | | | 1,123 | | | | | |

| | | | | | | | |

| Net losses | | $ | (498) | | | $ | (1,999) | | | | | |

| | | | | | | | |

| Losses per share: | | | | | | | | |

| Basic net losses per common share | | $ | (0.19) | | | $ | (0.79) | | | | | |

| Diluted net losses per common share | | $ | (0.19) | | | $ | (0.79) | | | | | |

| | | | | | | | |

| Dividends per common share | | $ | 0.24 | | | $ | 0.24 | | | | | |

| | | | | | | | |

ADAMS RESOURCES & ENERGY, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

| | | | | | | | | | | | | | |

| | March 31, | | December 31, |

| | 2024 | | 2023 |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 36,603 | | | $ | 33,256 | |

| Restricted cash | | 11,664 | | | 11,990 | |

| Accounts receivable, net of allowance for credit losses | | 185,296 | | | 164,295 | |

| | | | |

| Inventory | | 27,326 | | | 19,827 | |

| | | | |

| | | | |

| Prepayments and other current assets | | 2,538 | | | 3,103 | |

| Total current assets | | 263,427 | | | 232,471 | |

| | | | |

| Property and equipment, net | | 104,659 | | | 105,065 | |

| Operating lease right-of-use assets, net | | 5,385 | | | 5,832 | |

| Intangible assets, net | | 7,563 | | | 7,985 | |

| Goodwill | | 6,673 | | | 6,673 | |

| Other assets | | 3,124 | | | 3,308 | |

| Total assets | | $ | 390,831 | | | $ | 361,334 | |

| | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 219,421 | | | $ | 183,102 | |

| | | | |

| | | | |

| Current portion of finance lease obligations | | 6,251 | | | 6,206 | |

| Current portion of operating lease liabilities | | 2,508 | | | 2,829 | |

| Current portion of long-term debt | | 2,500 | | | 2,500 | |

| Other current liabilities | | 15,492 | | | 16,150 | |

| Total current liabilities | | 246,172 | | | 210,787 | |

| Other long-term liabilities: | | | | |

| Long-term debt | | 16,750 | | | 19,375 | |

| Asset retirement obligations | | 2,529 | | | 2,514 | |

| Finance lease obligations | | 18,087 | | | 19,685 | |

| Operating lease liabilities | | 2,883 | | | 3,006 | |

| Deferred taxes and other liabilities | | 12,756 | | | 13,251 | |

| Total liabilities | | 299,177 | | | 268,618 | |

| | | | |

| Commitments and contingencies | | | | |

| | | | |

| Shareholders’ equity | | 91,654 | | | 92,716 | |

| Total liabilities and shareholders’ equity | | $ | 390,831 | | | $ | 361,334 | |

ADAMS RESOURCES & ENERGY, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 31, | | |

| 2024 | | 2023 | | | | |

| Operating activities: | | | | | | | |

| Net losses | $ | (498) | | | $ | (1,999) | | | | | |

| Adjustments to reconcile net losses to net cash | | | | | | | |

| provided by operating activities: | | | | | | | |

| Depreciation and amortization | 6,355 | | | 7,050 | | | | | |

| Gains on sales of property | (337) | | | (31) | | | | | |

| Provision for credit losses | (23) | | | (3) | | | | | |

| Stock-based compensation expense | 307 | | | 283 | | | | | |

| | | | | | | |

| Deferred income taxes | (504) | | | (1,424) | | | | | |

| Net change in fair value contracts | — | | | (487) | | | | | |

| Changes in assets and liabilities: | | | | | | | |

| Accounts receivable | (20,978) | | | 30,916 | | | | | |

| Accounts receivable/payable, affiliates | — | | | (31) | | | | | |

| Inventories | (7,499) | | | 4,644 | | | | | |

| | | | | | | |

| Prepayments and other current assets | 565 | | | 90 | | | | | |

| Accounts payable | 36,291 | | | (12,653) | | | | | |

| Accrued liabilities | (599) | | | (2,514) | | | | | |

| Other | (17) | | | (134) | | | | | |

| Net cash provided by operating activities | 13,063 | | | 23,707 | | | | | |

| | | | | | | |

| Investing activities: | | | | | | | |

| Property and equipment additions | (6,152) | | | (1,900) | | | | | |

| | | | | | | |

| Proceeds from property sales | 962 | | | 441 | | | | | |

| | | | | | | |

| Net cash used in investing activities | (5,190) | | | (1,459) | | | | | |

| | | | | | | |

| Financing activities: | | | | | | | |

| Borrowings under Credit Agreement | — | | | 18,000 | | | | | |

| Repayments under Credit Agreement | (2,625) | | | (18,625) | | | | | |

| Principal repayments of finance lease obligations | (1,553) | | | (1,576) | | | | | |

| | | | | | | |

| Net proceeds from sale of equity | — | | | 549 | | | | | |

| | | | | | | |

| Dividends paid on common stock | (674) | | | (681) | | | | | |

| Net cash used in financing activities | (4,852) | | | (2,333) | | | | | |

| | | | | | | |

Increase in cash and cash equivalents, including

restricted cash | 3,021 | | | 19,915 | | | | | |

Cash and cash equivalents, including restricted cash,

at beginning of period | 45,246 | | | 31,067 | | | | | |

Cash and cash equivalents, including restricted cash,

at end of period | $ | 48,267 | | | $ | 50,982 | | | | | |

ADAMS RESOURCES & ENERGY, INC. AND SUBSIDIARIES

NON-GAAP RECONCILIATION

(In thousands)

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | March 31, | | |

| | 2024 | | 2023 | | | | |

| Reconciliation of EBITDA to Net (Losses) Earnings: | | | | |

| Net losses | | $ | (498) | | | $ | (1,999) | | | | | |

| Add (subtract): | | | | | | | | |

| Interest income | | (561) | | | (204) | | | | | |

| Interest expense | | 793 | | | 696 | | | | | |

| Income tax benefit | | (95) | | | (1,123) | | | | | |

| Depreciation and amortization | | 6,355 | | | 7,050 | | | | | |

| EBITDA | | $ | 5,994 | | | $ | 4,420 | | | | | |

###

v3.24.1.u1

Cover Page

|

May 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 08, 2024

|

| Entity Registrant Name |

ADAMS RESOURCES & ENERGY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-7908

|

| Entity Tax Identification Number |

74-1753147

|

| Entity Address, Address Line One |

17 South Briar Hollow Lane

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77027

|

| City Area Code |

713

|

| Local Phone Number |

881-3600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.10 par value

|

| Trading Symbol |

AE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000002178

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

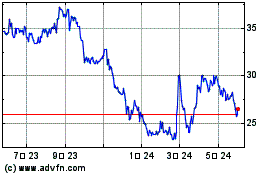

Adams Resources and Energy (AMEX:AE)

過去 株価チャート

から 4 2024 まで 5 2024

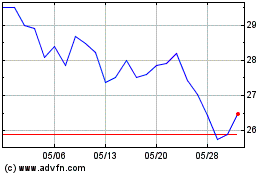

Adams Resources and Energy (AMEX:AE)

過去 株価チャート

から 5 2023 まで 5 2024