UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

| | | | | |

| [X] | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

| | | | | |

| [_] | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to _____________

Commission file number 1-14106

| | | | | |

| A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: |

DaVita Retirement Savings Plan

| | | | | |

| B. | Name of issuer of the securities held pursuant to the Plan and the address of its principal executive office: |

DaVita Inc.

2000 16th Street

Denver, Colorado 80202

DAVITA RETIREMENT SAVINGS PLAN

Table of Contents

| | | | | |

| Page |

| |

| Financial Statements: | |

| |

| |

| |

| Supplemental Schedules: | |

| |

| |

| |

Report of Independent Registered Public Accounting Firm

To the Plan Administrator and Plan Participants of

DaVita Retirement Savings Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the DaVita Retirement Savings Plan (the Plan) as of December 31, 2023 and 2022, the related statement of changes in net assets available for benefits for the year ended December 31, 2023, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023 and 2022, and the changes in net assets available for benefits for the year ended December 31, 2023 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures to respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Opinion on the Supplemental Information

The supplemental information included in schedule H, line 4(i) – schedule of assets (held at end of year) as of December 31, 2023, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedule, we evaluated whether the supplemental information, including its form and content, is presented in conformity with Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Moss Adams LLP

Everett, Washington

June 14, 2024

We have served as the Plan’s auditor since 2022.

DAVITA RETIREMENT SAVINGS PLAN

Statements of Net Assets Available for Benefits

December 31, 2023 and 2022

(dollars in thousands)

| | | | | | | | | | | |

| 2023 | | 2022 |

| Assets: | | | |

| Cash and cash equivalents | $ | 268 | | | $ | 167 | |

| Investments at fair value | 3,131,239 | | 2,571,816 | |

| Receivables: | | | |

| Notes receivable from participants | 122,062 | | 111,660 | |

| Employer contributions | 75,590 | | 71,158 | |

| Participant contributions | 10,502 | | 9,871 | |

| Net assets available for benefits | $ | 3,339,661 | | | $ | 2,764,672 | |

See accompanying notes to financial statements.

DAVITA RETIREMENT SAVINGS PLAN

Statement of Changes in Net Assets Available for Benefits

Year Ended December 31, 2023

(dollars in thousands)

| | | | | |

| 2023 |

| Additions | |

| Investment income: | |

| Interest on investments | $ | 3,159 | |

| Dividends | 2,101 |

| Net appreciation in fair value of investments | 459,677 |

| Total investment income | 464,937 |

| Participant notes receivable interest | 6,610 |

| Contributions: | |

| Employer | 73,828 |

| Participant | 300,343 |

| Rollovers | 20,421 |

| Total additions | 866,139 |

| Deductions | |

| Benefit payments | 284,322 |

| Administration expenses | 6,828 |

| Total deductions | 291,150 |

| Net increase in net assets available for benefits | 574,989 |

| |

| Net assets available for benefits at beginning of year | 2,764,672 |

| Net assets available for benefits at end of year | $ | 3,339,661 | |

See accompanying notes to financial statements.

DAVITA RETIREMENT SAVINGS PLAN

Notes to the Financial Statements

December 31, 2023 and 2022

(dollars in thousands)

(1) Description of Plan

The following description of the DaVita Retirement Savings Plan (the Plan) provides only general information. Participants should refer to the Plan document for a more complete description of the Plan’s provisions. All capitalized terms used herein that are not defined, shall have the meaning given to them in the Plan.

(a) General

The Plan was established as a defined contribution plan for the benefit of employees of DaVita Inc. and its subsidiaries (the Company). Employees become eligible to participate immediately following the date of hire and attaining the age of 18 (however, a Participant must wait until the first of the month after attaining age 18 and completing 12 months of service before being eligible for the discretionary matching contribution). The Plan does not cover certain classes of individuals such as leased employees, independent contractors, nonresident aliens, residents of the Commonwealth of Puerto Rico, employees covered under a collective bargaining agreement or interns. The Plan is intended to qualify under Section 401(a) of the Internal Revenue Code of 1986, as amended (the Code), and is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA).

Auto Enrollment

All new employees of the Company, except employees from plans transferred into the Plan, are automatically enrolled in the Plan at a pre-tax deferral rate of six percent of Compensation upon meeting the eligibility requirements as described above.

Automatic Increase Contributions

Participants who are deferring at least 1% but no more than nine percent of Compensation per pay period will have their deferral rate increased annually by one percent each January 1st until their deferral rate reaches 10%. All eligible Participants receive a notice of the right to opt out of the escalation of Automatic Contributions before such increased contributions are made. If the Participant does not make an affirmative election on or before the deadline, the Participant’s deferral percentage in effect as of December 31st of the prior Plan Year will be increased as described above.

(b) Contributions

Participants may elect to contribute a maximum percentage of 75% of their Compensation, subject to the legal limit allowed by the Code, into any of the investment options offered by the Plan. Participants may elect to contribute Compensation on a pre-tax basis, an after-tax (Roth) basis or a combination of both. Participants may change their election prospectively at any time.

The Company and its subsidiaries have elected to make a discretionary matching contribution to the Plan for each eligible Participant in an amount equal to 50% of the Participant’s contributions, up to 6% of Compensation each pay period. However, if the Participant had a base salary of $120 and was in a position of director or above as of December 31 of the prior Plan Year, the maximum match for that Participant did not exceed $3.6. The matching contribution is calculated on a payroll by payroll basis, funded annually the following January and is only allocated to Participants who are employed on the last day of the Plan Year (unless the Participant died, became Totally and Permanently Disabled, or terminated on or after Normal Retirement Age). The Company’s discretionary matching contributions are invested in accordance with the Participant’s investment elections for Participant contributions.

Participants may direct their investments into the DaVita Stock Fund, certain collective investment trust (CIT) funds, certain registered investment company funds and a common commingled trust (CCT) fund as allowed under the Plan. The contributions of Participants who do not make elected investment options are automatically

DAVITA RETIREMENT SAVINGS PLAN

Notes to the Financial Statements

December 31, 2023 and 2022

(dollars in thousands)

invested into various JPMorgan SmartRetirement Blend funds, depending upon the age of the Participants. Participants cannot direct more than 20% of their contributions into the DaVita Stock Fund.

Participants may elect to change their contribution percentage at any time and may change their investment elections or transfer amounts between funds daily, subject to applicable restrictions set forth in the insider trading policy of the Company if such elections or transfers involve the DaVita Stock Fund. Participants who have attained the age of 50 before the close of the Plan Year are also eligible to make catch-up contributions in accordance with, and subject to, the legal limitations of the Code.

The Company may not elect to make discretionary contributions, except as part of the employer matching contributions discussed above.

Participants may transfer rollover contributions from other qualified plans into their Plan account subject to provisions under the Plan. Rollovers must be made in cash within the time limit specified by the Code.

(c) Participant Accounts

The Plan recordkeeper maintains an account for each Participant’s contributions, allocations of Company and its subsidiaries contributions if any, rollover contributions, investment earnings and losses and Plan expenses. Investment earnings and losses and Plan expenses are allocated to each account in the proportion that the account bears to the total of all Participants’ accounts. Participants’ accounts are valued on a daily basis based on the quoted market prices as reported by the investment funds, or the quoted market prices of the underlying securities.

(d) Vesting

Participants in the Plan will always be 100% vested in their section 401(k) contributions, and their rollover contributions and earnings thereon. Participants in the Plan prior to January 1, 2018 are 100% vested in employer matching contributions immediately, while Participants joining the Plan on or after January 1, 2018 vest in employer matching contributions 25% per year over a four year period. Employees become fully vested upon death, Total and Permanent Disability or Normal Retirement Age.

(e) Benefit Payments

Distributions from the Plan will be paid in the form of cash or if a Participant’s vested balance includes the DaVita Stock Fund, they may elect to receive a distribution of those shares. Participants may receive distributions either upon termination of service, by obtaining age 59½, incurring a financial hardship, or upon termination of the Plan. Rollover and after‑tax contributions may be withdrawn at any time. Employee deferral contributions may not be distributed unless the Participant has attained age 59½, incurs a financial hardship, terminates service or upon termination of the Plan. However, unless the Participant elects otherwise, distributions in cash will begin no later than sixty days after the close of the Plan Year, in which the latest following event occurs: a Participant reaches Normal Retirement Age, obtains ten years of participation in the Plan or terminates employment. Distributions are also required to begin by April of the calendar year following the calendar year in which the Participant attains age 72, or 70½ if the Participant attained the age of 70½ before January 1, 2020. The benefit to which a Participant is entitled is the benefit that can be provided from the Participant’s Vested Account.

Terminated Participants with Vested Account balances greater than $1 and less than $5 will have their account transferred to another qualified account unless they elect to have a rollover or lump sum payment. For termination of service with Vested Account benefits of $1 or less, a Participant may automatically receive the Vested Account interest in his or her account in a lump sum distribution unless a rollover is elected.

Distributions for financial hardship can only be made both on account of an immediate and heavy financial need, and be necessary to satisfy that need. Only the Participant’s tax deferred contributions, Roth contributions,

DAVITA RETIREMENT SAVINGS PLAN

Notes to the Financial Statements

December 31, 2023 and 2022

(dollars in thousands)

vested matching contributions and rollover contributions may be distributed for financial hardship. Earnings and Company discretionary contributions are not eligible for financial hardship distributions.

In the event of death of a Participant, the Participant’s Vested Account balance will be distributed to the Participant’s beneficiary as soon as reasonably practicable.

If a Participant ceases to make loan repayments and the Plan Administrator deems the Participant loan to be in default, the Participant loan balance is reduced, and a benefit payment is recorded (deemed distribution).

(f) Forfeitures

At December 31, 2023 and 2022, forfeited non-vested accounts totaled $1,083 and $1,562, respectively. These accounts may be used to reduce future employer contributions or pay Plan expenses. During 2023, forfeitures of $1,762 were used to reduce employer contributions.

(g) Notes Receivable From Participants

The Plan permits Participants to borrow a minimum of $1 from their Participant accounts. Subject to the Code and Plan limits, such notes receivable cannot exceed the lesser of 50% of the value of the Participant’s vested account, or $50, reduced for any prior notes receivable outstanding.

The notes receivable must be repaid generally within five years or within 10 years when the proceeds are used to purchase a principal residence of the Participant and bears a fixed interest rate at prime as stated in the Wall Street Journal on the last day of the month preceding the month in which the note receivable is made plus 1%. The interest rates on outstanding notes receivable ranged from 4.25% to 9.50% at December 31, 2023, with maturities through December 2033. Notes receivable are secured by the Participant's Vested Account.

(h) Plan Termination

Although it has not expressed the intent to do so, the Company has the right to terminate the Plan at any time subject to the provisions under ERISA. If the Plan is terminated, each Participant’s account balance will be fully vested and distributed in a timely manner.

(2) Summary of Significant Accounting Policies

(a) Basis of Accounting

The accompanying financial statements are prepared on the accrual basis of accounting, in accordance with accounting principles generally accepted in the United States of America.

(b) Income Recognition and Net Investment Income

Purchases and sales of securities are recorded on a trade‑date basis. Interest income is accrued when earned. Dividends are recorded on the ex‑dividend date. Net appreciation in fair value of investments includes the Plan's realized gains and losses on investments bought and sold during the year as well as the appreciation or depreciation on investments held at year-end.

(c) Investments

The Plan’s investments are stated at fair value. Investments in shares of registered investment company funds are reported at fair value based on quoted market prices (the net asset values) as reported by each investment fund. The fair values of the CCT and CIT funds are calculated as discussed below. The DaVita Stock Fund is valued at fair value based on its year‑end unit closing price from the New York Stock Exchange (composed of year‑end market price of underlying stock plus uninvested cash position).

DAVITA RETIREMENT SAVINGS PLAN

Notes to the Financial Statements

December 31, 2023 and 2022

(dollars in thousands)

The T. Rowe Price Stable Value Common Trust Fund (Stable Value Fund) is a CCT fund investing primarily in guaranteed investment contracts (GICs), bank investment contracts, synthetic GICs and/or separate account contracts. The target retirement date funds and certain other funds are invested in CCTs and CITs, respectively. These CCTs and CITs are priced daily using the net asset values as reported by each investment fund. Investments in CCT and CIT funds are recorded at fair value using the price at which Participants are able to transact under the terms of the Plan as measured and available for redemption on a daily basis by the CCT fund managers.

(d) Risks and Uncertainties

The Plan provides for various investment fund options, which in turn invest in a combination of stocks, bonds and other investment securities. Investment securities, in general, are exposed to various risks, such as interest rate, credit and overall market volatility risks. Due to the high level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and such changes could materially affect the amounts reported in the statements of net assets available for benefits.

(e) Receivables – Notes Receivable From Participants

Notes receivable from Participants are measured at their unpaid outstanding principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. Delinquent loans are recorded as distributions based on the terms of the Plan document.

(f) Receivables – Participant Contributions

Receivables from Participant contributions are stated at net realizable value, and represent deferrals of employees’ Compensation that have not yet been contributed to the Plan.

(g) Receivables – Employer Contributions

Receivables from employer contributions are stated at net realizable value, and represent employer matching contributions that have not yet been contributed to the Plan.

(h) Benefit Payments

Benefits are recorded when paid.

(i) Administrative Expenses and Investment Management Fees

All operational administrative costs of the Plan are deducted from Participants’ account balances except certain transaction costs associated with the recordkeeping of the DaVita Stock Fund, which are borne by the Company. Administrative costs include trustee fees, recordkeeping, Participant reporting costs, brokerage fees, Participant notes receivable costs, accounting and legal fees, commissions and transactions charges. Investment management fees are paid by each respective investment fund and are deducted in arriving at each fund’s overall net asset value. Fees deducted from Participant accounts are held within the Plan and invested in the Vanguard Federal Money Market Fund as a nonparticipant-directed investment until used to pay Plan administrative expenses.

(j) Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires Plan Management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

DAVITA RETIREMENT SAVINGS PLAN

Notes to the Financial Statements

December 31, 2023 and 2022

(dollars in thousands)

(3) Party‑in‑Interest Transactions

Voya Financial is the Trustee and recordkeeper for the Plan. Each fund within the Plan has its own investment manager. The transfer of assets, as well as the recordkeeping functions of the Plan qualify as party-in-interest transactions. Additionally, the Company provided personnel and administrative functions for the Plan at no charge to the Plan. The Plan also holds shares of the Company’s Common Stock, which qualifies as party-in-interest transactions under the provisions of ERISA. During the year ended December 31, 2023, the Plan made purchases of approximately $6,201 and sales of approximately $7,411 of the Company's Common Stock. State Street Corporation is the custodian of the shares held in the DaVita Stock Fund.

(4) Tax Status

The Plan is maintained on the Voya Retirement Insurance and Annuity Company Defined Contribution Pre-Approved Plan which used a Base Plan Document and Adoption Agreement, which has received favorable opinion letters from the Internal Revenue Service (IRS) that the form of the plan is acceptable for use by employers for the benefit of their employees under Code Section 401. On July 13, 2022, the Plan was restated to be maintained on the Pre-Approved Plan documents for which Voya received a favorable opinion letter on June 30, 2020. The Plan has subsequently been amended. Plan Management believes the Plan is designed and is currently being operated in compliance with the applicable requirements of Section 401(a) of the Code, and as a result, is exempt from federal income taxes under Section 501(a) of the Code.

U.S. generally accepted accounting principles require Plan Management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2023, there are no uncertain tax positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions. The Plan Administrator believes it is no longer subject to income tax examinations for years prior to 2020.

(6) Nonparticipant-directed investments

Information about the net assets and the significant components of the changes in net assets for the year ended December 31, 2023 relating to the nonparticipant-directed registered investments is as follows:

| | | | | |

| Vanguard Federal Money Market Fund |

| 2023 |

| Net assets, beginning of year | $ | 5,153 | |

| Change in net assets | |

| Dividends | 225 |

Transfers in — administration fees, forfeitures and other | 825 |

Disbursements — administration fees, forfeitures and other | (1,370) |

| Net assets, end of year | $ | 4,833 | |

(7) Fair Value Measurements

The Plan measures the fair value of its assets based upon certain valuation techniques that include observable or unobservable inputs and assumptions that market participants would use in pricing these assets under a fair value hierarchy. The fair value hierarchy prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to quoted prices in active markets (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

DAVITA RETIREMENT SAVINGS PLAN

Notes to the Financial Statements

December 31, 2023 and 2022

(dollars in thousands)

The following table summarizes the Plan’s assets measured at fair value on a recurring basis as of December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total | | Quoted prices in

active markets for

identical assets

(Level 1) | | Significant other

observable inputs

(Level 2) | | Significant

unobservable

inputs

(Level 3) |

| | | | | | | | |

Investments in Registered Investment

Company Funds | | $ | 53,780 | | | $ | 53,780 | | | $ | — | | | $ | — | |

| Investments in CCT and CIT Funds | | 3,037,078 | | | 2,913,562 | | | 123,516 | | | — | |

| DaVita Stock Fund | | 40,381 | | | 40,381 | | | — | | | — | |

| Total assets in fair value hierarchy | | $ | 3,131,239 | | | $ | 3,007,723 | | | $ | 123,516 | | | $ | — | |

The following table summarizes the Plan’s assets measured at fair value on a recurring basis as of December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total | | Quoted prices in

active markets for

identical assets

(Level 1) | | Significant other

observable inputs

(Level 2) | | Significant

unobservable

inputs

(Level 3) |

Investments in Registered Investment

Company Funds | | $ | 67,323 | | | $ | 67,323 | | | $ | — | | | $ | — | |

| Investments in CCT and CIT Funds | | 2,475,066 | | | 2,347,602 | | | 127,464 | | | — | |

| DaVita Stock Fund | | 29,427 | | | 29,427 | | | — | | | — | |

| Total assets in fair value hierarchy | | $ | 2,571,816 | | | $ | 2,444,352 | | | $ | 127,464 | | | $ | — | |

The investments in registered investment company funds are recorded at fair value based upon quoted market prices as reported by each investment fund.

Investments in CCT and CIT funds are recorded at fair value using the price at which Participants are able to transact under the terms of the Plan as measured and available for redemption on a daily basis by the CCT fund managers. For the Stable Value Fund, the Plan is required to provide 12 months' advance written notice to the trustee prior to redemption of trust units upon withdrawal from the fund. There are no restrictions related to the redemption notice period and there were no unfunded commitments at December 31, 2023. The Stable Value Fund is considered within Level 2 of the fair value hierarchy above. See (2)(c) under Summary of Significant Accounting Policies for further discussions.

DaVita Stock Fund is recorded at fair value based upon quoted market prices as reported by the New York Stock Exchange. See (2)(c) under Summary of Significant Accounting Policies for further discussion.

The methods used for determining fair value may not be reflective of the actual values that will be received upon settlement of the securities due to fluctuations in the market. However, Plan Management believes the methods used to measure the fair value of its assets are appropriate and are based upon relevant market factors such as quoted prices or observable market inputs. The use of different methods or assumptions could result in a different fair value measurement at the reporting date.

During 2023, the Plan transitioned one mutual fund from a registered investment company fund to a CCT fund. This fund was Jennison Small/Mid Cap Fund.

DAVITA RETIREMENT SAVINGS PLAN

Notes to the Financial Statements

December 31, 2023 and 2022

(dollars in thousands)

(8) Reconciliation of Plan Financial Statements to the Form 5500

The following is a reconciliation of the Plan financial statements to the Form 5500 for the years ended December 31, 2023 and 2022:

| | | | | | | | | | | |

| 2023 | | 2022 |

| Net assets available for benefits: | | | |

| Net assets available for benefits per Plan financial statements | $ | 3,339,661 | | | $ | 2,764,672 | |

| Deemed distributions | (13,441) | | | (12,285) | |

| Net assets available for benefits per Form 5500 | $ | 3,326,220 | | | $ | 2,752,387 | |

| | | | | |

| 2023 |

| Net income: | |

| Net decrease in net assets available for benefits per Plan financial statements | $ | 574,989 | |

| Deemed distributions | (1,156) | |

| Net Income per Form 5500 | $ | 573,833 | |

DAVITA RETIREMENT SAVINGS PLAN

Notes to the Financial Statements

December 31, 2023 and 2022

(dollars in thousands)

(9) Contingencies

On March 23, 2022 a putative class action (Teodosio et al. v. DaVita Inc. et al.) was filed in the U.S. District Court for the District of Colorado against the Company, the Company’s Board of Directors, the Plan Administrative Committee for the Company's 401(k) plan, and 30 “John Does.” The complaint alleges that the defendants breached their fiduciary duties under ERISA by charging excessive recordkeeping and administrative costs to Plan Participants. In January 2024, the parties agreed to settle the matter for $2,000 and filed papers with the court seeking its approval of the settlement. The court has not yet ruled on this motion.

(10) Subsequent Events

Plan Management evaluated for disclosure or recognition any subsequent events through June 14, 2024, the issuance date of the financial statements.

DAVITA RETIREMENT SAVINGS PLAN

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

December 31, 2023

(dollars in thousands)

| | | | | | | | | | | | | | |

| Identity of issuer, borrower, lessor, or similar party | | Description of investment | | Current value |

| Common Commingled Trust and Collective Investment Trust Funds: | | |

| T. Rowe Price | | T. Rowe Price Stable Value Common Trust Fund - Class Q | | $ | 123,516 | |

| T. Rowe Price | | T. Rowe Price Large-Cap Growth Trust (Class B) | | 95,473 | |

| JPMCB | | JPMCB SmartRetirement Passive Blend Income Fund CF-B | | 34,031 | |

| JPMCB | | JPMCB SmartRetirement Passive Blend 2020 Fund CF-B | | 91,383 | |

| JPMCB | | JPMCB SmartRetirement Passive Blend 2025 Fund CF-B | | 170,437 | |

| JPMCB | | JPMCB SmartRetirement Passive Blend 2030 Fund CF-B | | 231,615 | |

| JPMCB | | JPMCB SmartRetirement Passive Blend 2035 Fund CF-B | | 302,920 | |

| JPMCB | | JPMCB SmartRetirement Passive Blend 2040 Fund CF-B | | 274,754 | |

| JPMCB | | JPMCB SmartRetirement Passive Blend 2045 Fund CF-B | | 237,164 | |

| JPMCB | | JPMCB SmartRetirement Passive Blend 2050 Fund CF-B | | 219,564 | |

| JPMCB | | JPMCB SmartRetirement Passive Blend 2055 Fund CF-B | | 171,871 | |

| JPMCB | | JPMCB SmartRetirement Passive Blend 2060 Fund CF-B | | 60,229 | |

| JPMCB | | JPMCB SmartRetirement Passive Blend 2065 Fund - C Class | | 9,919 | |

| Prudential | | Jennison Small/Mid Cap Fund | | 20,688 | |

| MetWest | | MetWest Total Return Bond Fund | | 37,823 | |

| Vanguard | | Vanguard Total Bond Market Index Fund | | 208,741 | |

| Vanguard | | Vanguard Institutional Index Fund | | 372,369 | |

| Vanguard | | Vanguard Extended Market Index Institutional Fund | | 157,758 | |

| Vanguard | | Vanguard Total International Stock Index Fund | | 216,823 | |

| | | | |

| Registered Investment Company Funds: | | |

**Vanguard | | STIF Holding Fund-Vanguard Federal Money Market Fund | | 4,833 | |

Dodge and Cox | | Dodge & Cox Stock Fund | | 34,228 | |

American Funds | | American Funds EuroPacific Growth Fund | | 14,719 | |

| | | | |

| Common Stock: | | | | |

*DaVita Inc. | | DaVita Stock Fund | | 40,381 | |

| | | | |

| *Participant loans | | 4.25% – 9.50% maturing through December 2033 | | 122,062 | |

| | Total Investments | | $ | 3,253,301 | |

* Represents a party-in-interest.

** Nonparticipant directed investments. Costs of the nonparticipant directed investments approximate current value at December 31, 2023.

See accompanying report of independent registered public accounting firm.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | Consent of Moss Adams LLP Independent Registered Public Accounting Firm. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly

authorized.

| | | | | | | | | | | |

| | DAVITA RETIREMENT SAVINGS PLAN |

| | |

| | | |

| | BY: | | /s/ Nihar Shah |

| | | | Nihar Shah |

| | | | Designated Representative of the Plan |

| | | Administrator |

Date: June 14, 2024

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statements on Form S-8 (No. 333-158220, and No. 333-240022) of DaVita Inc. of our report dated June 14, 2024, relating to the financial statements and supplementary information of the DaVita Retirement Savings Plan, appearing in this Annual Report on Form 11-K of the Plan for the year ended December 31, 2023.

/s/ Moss Adams LLP

Everett, Washington

June 14, 2024

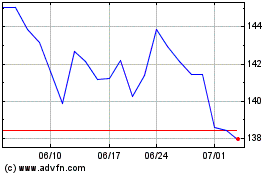

DaVita (NYSE:DVA)

過去 株価チャート

から 5 2024 まで 6 2024

DaVita (NYSE:DVA)

過去 株価チャート

から 6 2023 まで 6 2024