Yen Rises Amid BoJ's Rate Hike Speculation

2024年7月25日 - 12:46PM

RTTF2

The Japanese yen strengthened against other major currencies in

the Asian session on Thursday, as traders speculate that the Bank

of Japan is likely to raise its interest rate in the monetary

policy meeting due next week, to boost the currency.

The markets suspect the strength of the currency is due to the

Fx market intervention by the Japanese government authorities.

Traders await the outcome of the BoJ's policy meeting due on

July 31.

The Asian stock markets also traded lower, led by steep declines

for technology stocks, which mirrored their peers on the tech-heavy

Nasdaq, after a few big-name U.S. tech firms reported disappointing

quarterly numbers. Lingering concerns over slowing growth in the

world's second largest economy, China, also kept investors

nervous.

Traders also remained cautious ahead of the release of key U.S.

GDP and inflation data later in the week, which could have a

significant impact on the outlook for interest rates.

In economic new, data from the Bank of Japan showed that the

services producer prices in Japan were up 3.0 percent on year in

June, accelerating from the upwardly revised 2.7 percent increase

in May. On a monthly basis, producer prices were flat for a second

straight month.

In the Asian trading today, the yen rose to near 3-month highs

of 165.04 against the euro and 152.24 against the U.S. dollar, from

yesterday's closing quotes of 166.79 and 153.87, respectively. If

the yen extends its uptrend, it is likely to find resistance around

162.00 against the euro and 150.00 against the greenback.

Against the pound and the Swiss franc, the yen advanced to more

than a 2-month high of 196.27 and nearly a 2-month high of 172.33

from Wednesday's closing quotes of 198.60 and 173.83, respectively.

The yen is likely to find resistance around 193.00 against the

pound and 171.00 against the franc.

Looking ahead, Germany's Ifo business sentiment survey data for

July, European Central Bank's euro area monetary aggregates data

for June and the Confederation of British Industry's industrial

trends survey results for July are slated for release in the

European session.

In the New York session, Canada average weekly earnings data for

May, U.S. durable goods orders for June, GDP growth rate for the

second quarter, weekly jobless claims data, U.S. core PCE price

index for the second quarter and U.S. Kansas Fed manufacturing

index for July are slated for release.

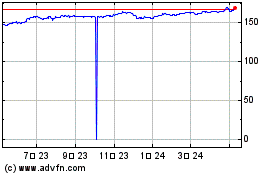

Euro vs Yen (FX:EURJPY)

FXチャート

から 6 2024 まで 7 2024

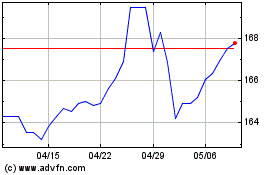

Euro vs Yen (FX:EURJPY)

FXチャート

から 7 2023 まで 7 2024