--12-312023Q20001355848false0.10P2Y0.1000013558482023-01-012023-06-3000013558482023-08-14xbrli:shares00013558482023-06-30iso4217:USD00013558482022-12-310001355848us-gaap:RelatedPartyMember2023-06-300001355848us-gaap:RelatedPartyMember2022-12-310001355848us-gaap:NonrelatedPartyMember2023-06-300001355848us-gaap:NonrelatedPartyMember2022-12-310001355848us-gaap:SeriesAPreferredStockMember2022-12-31iso4217:USDxbrli:shares0001355848us-gaap:SeriesAPreferredStockMember2023-06-300001355848us-gaap:SeriesBPreferredStockMember2023-06-300001355848us-gaap:SeriesBPreferredStockMember2022-12-310001355848toon:ProductionServicesMember2023-04-012023-06-300001355848toon:ProductionServicesMember2022-04-012022-06-300001355848toon:ProductionServicesMember2023-01-012023-06-300001355848toon:ProductionServicesMember2022-01-012022-06-300001355848toon:ContentDistributionMember2023-04-012023-06-300001355848toon:ContentDistributionMember2022-04-012022-06-300001355848toon:ContentDistributionMember2023-01-012023-06-300001355848toon:ContentDistributionMember2022-01-012022-06-300001355848toon:LicensingAndRoyaltiesMember2023-04-012023-06-300001355848toon:LicensingAndRoyaltiesMember2022-04-012022-06-300001355848toon:LicensingAndRoyaltiesMember2023-01-012023-06-300001355848toon:LicensingAndRoyaltiesMember2022-01-012022-06-300001355848toon:MediaAdvisoryAndAdvertisingServicesMember2023-04-012023-06-300001355848toon:MediaAdvisoryAndAdvertisingServicesMember2022-04-012022-06-300001355848toon:MediaAdvisoryAndAdvertisingServicesMember2023-01-012023-06-300001355848toon:MediaAdvisoryAndAdvertisingServicesMember2022-01-012022-06-3000013558482023-04-012023-06-3000013558482022-04-012022-06-3000013558482022-01-012022-06-300001355848us-gaap:CommonStockMember2022-12-310001355848us-gaap:PreferredStockMember2022-12-310001355848us-gaap:AdditionalPaidInCapitalMember2022-12-310001355848us-gaap:TreasuryStockCommonMember2022-12-310001355848us-gaap:RetainedEarningsMember2022-12-310001355848us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001355848us-gaap:NoncontrollingInterestMember2022-12-310001355848us-gaap:CommonStockMember2023-01-012023-03-310001355848us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001355848us-gaap:TreasuryStockCommonMember2023-01-012023-03-3100013558482023-01-012023-03-310001355848us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001355848us-gaap:RetainedEarningsMember2023-01-012023-03-310001355848us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001355848us-gaap:CommonStockMember2023-03-310001355848us-gaap:PreferredStockMember2023-03-310001355848us-gaap:AdditionalPaidInCapitalMember2023-03-310001355848us-gaap:TreasuryStockCommonMember2023-03-310001355848us-gaap:RetainedEarningsMember2023-03-310001355848us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001355848us-gaap:NoncontrollingInterestMember2023-03-3100013558482023-03-310001355848us-gaap:CommonStockMember2023-04-012023-06-300001355848us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001355848us-gaap:TreasuryStockCommonMember2023-04-012023-06-300001355848us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001355848us-gaap:RetainedEarningsMember2023-04-012023-06-300001355848us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001355848us-gaap:CommonStockMember2023-06-300001355848us-gaap:PreferredStockMember2023-06-300001355848us-gaap:AdditionalPaidInCapitalMember2023-06-300001355848us-gaap:TreasuryStockCommonMember2023-06-300001355848us-gaap:RetainedEarningsMember2023-06-300001355848us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001355848us-gaap:NoncontrollingInterestMember2023-06-300001355848us-gaap:CommonStockMember2021-12-310001355848us-gaap:PreferredStockMember2021-12-310001355848us-gaap:AdditionalPaidInCapitalMember2021-12-310001355848us-gaap:TreasuryStockCommonMember2021-12-310001355848us-gaap:RetainedEarningsMember2021-12-310001355848us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001355848us-gaap:NoncontrollingInterestMember2021-12-3100013558482021-12-310001355848us-gaap:CommonStockMember2022-01-012022-03-310001355848us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-3100013558482022-01-012022-03-310001355848us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001355848us-gaap:RetainedEarningsMember2022-01-012022-03-310001355848us-gaap:NoncontrollingInterestMember2022-01-012022-03-310001355848us-gaap:CommonStockMember2022-03-310001355848us-gaap:PreferredStockMember2022-03-310001355848us-gaap:AdditionalPaidInCapitalMember2022-03-310001355848us-gaap:TreasuryStockCommonMember2022-03-310001355848us-gaap:RetainedEarningsMember2022-03-310001355848us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001355848us-gaap:NoncontrollingInterestMember2022-03-3100013558482022-03-310001355848us-gaap:CommonStockMember2022-04-012022-06-300001355848us-gaap:PreferredStockMember2022-04-012022-06-300001355848us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001355848us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001355848us-gaap:NoncontrollingInterestMember2022-04-012022-06-300001355848us-gaap:RetainedEarningsMember2022-04-012022-06-300001355848us-gaap:CommonStockMember2022-06-300001355848us-gaap:PreferredStockMember2022-06-300001355848us-gaap:AdditionalPaidInCapitalMember2022-06-300001355848us-gaap:TreasuryStockCommonMember2022-06-300001355848us-gaap:RetainedEarningsMember2022-06-300001355848us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001355848us-gaap:NoncontrollingInterestMember2022-06-3000013558482022-06-300001355848toon:YFEMembertoon:YFEAcquisitionMember2023-01-012023-06-30toon:titletoon:episodetoon:territory0001355848toon:WowMember2023-01-012023-06-30toon:channel0001355848toon:BeaconMediaGroupMember2023-01-012023-06-30toon:company00013558482023-02-0500013558482023-02-060001355848us-gaap:WarrantMembertoon:A2021WarrantsMember2021-01-310001355848us-gaap:WarrantMembertoon:WarrantExerciseInducementOfferLettersMember2023-06-260001355848toon:SEGWarrantsMemberus-gaap:WarrantMember2023-06-2600013558482023-06-2500013558482023-06-260001355848us-gaap:WarrantMembertoon:A2021WarrantsMember2023-06-26xbrli:pure0001355848srt:ScenarioForecastMember2023-08-250001355848srt:ScenarioForecastMember2023-08-240001355848us-gaap:WarrantMembersrt:ScenarioForecastMembertoon:A2021WarrantsMember2023-08-2500013558482023-02-062023-02-060001355848toon:MarginLoanMember2023-01-012023-06-300001355848toon:FederalFundsRateMembertoon:MarginLoanMember2023-01-012023-06-300001355848toon:MarginLoanMember2023-06-300001355848toon:MarginLoanMember2022-12-310001355848srt:MedianMembertoon:MarginLoanMember2023-01-012023-06-300001355848srt:MedianMembertoon:MarginLoanMember2022-01-012022-12-310001355848toon:MarginLoanMember2023-04-012023-06-300001355848toon:MarginLoanMember2022-04-012022-06-300001355848toon:MarginLoanMember2022-01-012022-06-30iso4217:CADtoon:violation0001355848srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2023-01-012023-03-310001355848srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2023-03-31toon:segment0001355848toon:StanLeeUniverseMember2023-01-012023-06-300001355848us-gaap:ForeignExchangeContractMember2023-06-300001355848us-gaap:ForeignExchangeContractMember2023-04-012023-06-300001355848us-gaap:ForeignExchangeContractMember2023-01-012023-06-300001355848srt:MinimumMember2023-01-012023-06-300001355848srt:MaximumMember2023-01-012023-06-300001355848toon:AnimatedProductionsMembersrt:MinimumMember2023-01-012023-06-300001355848toon:AnimatedProductionsMembersrt:MaximumMember2023-01-012023-06-300001355848srt:MinimumMember2023-06-300001355848srt:MaximumMember2023-06-30toon:reportingUnit0001355848srt:MinimumMemberus-gaap:LicenseMember2023-01-012023-06-300001355848srt:MaximumMemberus-gaap:LicenseMember2023-01-012023-06-30toon:account0001355848us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembertoon:FourCustomersMember2023-04-012023-06-300001355848toon:ThreeCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-06-300001355848us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMembertoon:FourCustomersMember2023-01-012023-06-300001355848us-gaap:CustomerConcentrationRiskMembertoon:FiveCustomersMemberus-gaap:SalesRevenueNetMember2022-04-012022-06-300001355848us-gaap:CustomerConcentrationRiskMembertoon:FiveCustomersMemberus-gaap:SalesRevenueNetMember2022-01-012022-06-300001355848us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMembertoon:FourCustomersMember2022-01-012022-06-300001355848us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateBondSecuritiesMember2023-06-300001355848us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMember2023-06-300001355848us-gaap:CorporateBondSecuritiesMember2023-06-300001355848us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-06-300001355848us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2023-06-300001355848us-gaap:USTreasurySecuritiesMember2023-06-300001355848toon:USAgencyAndGovernmentSponsoredSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-06-300001355848toon:USAgencyAndGovernmentSponsoredSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-06-300001355848toon:USAgencyAndGovernmentSponsoredSecuritiesMember2023-06-300001355848us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryNotesSecuritiesMember2023-06-300001355848us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryNotesSecuritiesMember2023-06-300001355848us-gaap:USTreasuryNotesSecuritiesMember2023-06-300001355848us-gaap:FairValueInputsLevel1Member2023-06-300001355848us-gaap:FairValueInputsLevel2Member2023-06-300001355848toon:StanLeeUniverseMember2020-07-31toon:creation0001355848toon:StanLeeUniverseMember2023-06-300001355848toon:StanLeeUniverseMember2022-12-310001355848us-gaap:CommonStockMembertoon:YFEAcquisitionMember2023-06-300001355848toon:YFEAcquisitionMember2021-12-310001355848us-gaap:OtherNoncurrentAssetsMembertoon:YFEAcquisitionMember2023-06-300001355848toon:YFEAcquisitionMember2023-01-012023-06-300001355848toon:YFEAcquisitionMember2023-06-300001355848toon:YFEAcquisitionMember2022-12-310001355848us-gaap:CorporateBondSecuritiesMember2022-12-310001355848us-gaap:USTreasurySecuritiesMember2022-12-310001355848us-gaap:MortgageBackedSecuritiesMember2022-12-310001355848toon:USAgencyAndGovernmentSponsoredSecuritiesMember2022-12-310001355848us-gaap:USTreasuryNotesSecuritiesMember2022-12-310001355848us-gaap:AssetBackedSecuritiesMember2022-12-31toon:security0001355848us-gaap:FurnitureAndFixturesMember2023-06-300001355848us-gaap:FurnitureAndFixturesMember2022-12-310001355848us-gaap:ComputerEquipmentMember2023-06-300001355848us-gaap:ComputerEquipmentMember2022-12-310001355848us-gaap:LeaseholdImprovementsMember2023-06-300001355848us-gaap:LeaseholdImprovementsMember2022-12-310001355848us-gaap:SoftwareDevelopmentMember2023-06-300001355848us-gaap:SoftwareDevelopmentMember2022-12-310001355848toon:ProductionEquipmentMember2023-06-300001355848toon:ProductionEquipmentMember2022-12-310001355848toon:OfficeLeaseMember2023-06-300001355848toon:OfficeLeaseMember2022-12-310001355848toon:EquipmentLeaseMember2023-06-300001355848toon:EquipmentLeaseMember2022-12-3100013558482022-01-012022-12-310001355848us-gaap:CustomerRelationshipsMember2023-06-300001355848us-gaap:CustomerRelationshipsMember2022-12-310001355848toon:DigitalNetworksMember2023-06-300001355848toon:DigitalNetworksMember2022-12-310001355848us-gaap:TradeNamesMember2023-06-300001355848us-gaap:TradeNamesMember2022-12-310001355848toon:TechnologyMember2023-06-300001355848toon:TechnologyMember2022-12-310001355848us-gaap:OtherIntangibleAssetsMember2023-06-300001355848us-gaap:OtherIntangibleAssetsMember2022-12-310001355848toon:GBIAndAmebaMember2023-01-012023-03-310001355848toon:FrederatorMemberus-gaap:TradeNamesMember2023-01-012023-03-310001355848toon:WowMemberus-gaap:TradeNamesMember2023-01-012023-06-300001355848toon:ASquaredMembertoon:ContentProductionDistributionMember2013-12-310001355848toon:MediaAdvertisingServicesMembertoon:BeaconMediaGroupMember2021-03-310001355848toon:AmebaAndWowMember2022-01-012022-06-300001355848toon:AmebaMember2022-06-300001355848toon:WowMember2022-06-300001355848toon:MediaAdvertisingServicesMember2022-12-310001355848toon:ContentProductionDistributionMember2023-01-012023-03-310001355848toon:AmebaMember2023-01-012023-03-310001355848toon:ContentProductionDistributionMember2022-12-310001355848toon:ContentProductionDistributionMember2023-01-012023-06-300001355848toon:MediaAdvertisingServicesMember2023-01-012023-06-300001355848toon:ContentProductionDistributionMember2023-06-300001355848toon:MediaAdvertisingServicesMember2023-06-300001355848toon:RevolvingDemandFacilityMember2022-12-150001355848toon:RevolvingDemandFacilityMember2022-12-140001355848us-gaap:PrimeRateMembertoon:RevolvingDemandFacilityMember2023-01-012023-06-300001355848toon:SecuredOvernightFinancingRateMembertoon:RevolvingDemandFacilityMember2023-01-012023-06-300001355848toon:RevolvingDemandFacilityMember2023-06-300001355848toon:RevolvingDemandFacilityMember2022-12-310001355848toon:EquipmentLeaseLineMember2023-03-170001355848toon:EquipmentLeaseLineMember2023-03-160001355848srt:MinimumMembertoon:EquipmentLeaseLineMember2023-03-172023-03-170001355848srt:MaximumMembertoon:EquipmentLeaseLineMember2023-03-172023-03-170001355848srt:MinimumMembertoon:EquipmentLeaseLineMember2023-03-170001355848srt:MaximumMembertoon:EquipmentLeaseLineMember2023-03-170001355848toon:EquipmentLeaseLineMember2023-06-300001355848toon:EquipmentLeaseLineMember2022-12-310001355848toon:TreasuryRiskManagementFacilityMember2023-06-300001355848toon:TreasuryRiskManagementFacilityMember2023-01-012023-06-300001355848toon:TreasuryRiskManagementFacilityMember2022-12-310001355848us-gaap:PrimeRateMembersrt:MinimumMembertoon:ProductionFacilitiesMember2023-01-012023-06-300001355848us-gaap:PrimeRateMembersrt:MaximumMembertoon:ProductionFacilitiesMember2023-01-012023-06-300001355848toon:ProductionFacilitiesMember2023-06-300001355848toon:ProductionFacilitiesMember2022-12-310001355848toon:EquipmentLeaseFacilityMember2023-06-300001355848toon:EquipmentLeaseFacilityMember2022-12-310001355848us-gaap:CommonStockMember2023-01-012023-06-300001355848toon:LawyersMember2023-06-300001355848us-gaap:TreasuryStockCommonMember2023-01-012023-06-300001355848toon:A2015PlanMember2015-09-180001355848toon:A2020PlanMember2020-08-270001355848us-gaap:EmployeeStockOptionMember2022-12-310001355848us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001355848us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001355848us-gaap:EmployeeStockOptionMember2023-06-300001355848us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:EmployeeStockOptionMember2023-01-012023-06-300001355848us-gaap:EmployeeStockOptionMember2023-04-012023-06-300001355848us-gaap:EmployeeStockOptionMember2022-04-012022-06-300001355848us-gaap:EmployeeStockOptionMember2022-01-012022-06-300001355848us-gaap:RestrictedStockUnitsRSUMembersrt:DirectorMember2023-01-012023-06-300001355848us-gaap:RestrictedStockUnitsRSUMembersrt:DirectorMember2023-06-300001355848us-gaap:RestrictedStockUnitsRSUMember2022-12-310001355848us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001355848us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001355848us-gaap:RestrictedStockUnitsRSUMember2023-06-300001355848us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-012023-06-300001355848us-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300001355848us-gaap:RestrictedStockUnitsRSUMember2022-04-012022-06-300001355848us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001355848us-gaap:WarrantMember2022-12-310001355848us-gaap:WarrantMember2022-01-012022-12-310001355848us-gaap:WarrantMember2023-01-012023-06-300001355848us-gaap:WarrantMember2023-06-300001355848us-gaap:WarrantMember2023-02-160001355848us-gaap:WarrantMember2023-02-162023-02-160001355848toon:ExchangeWarrantsMemberus-gaap:WarrantMembersrt:ScenarioForecastMember2023-08-250001355848toon:SEGWarrantsMemberus-gaap:WarrantMember2023-06-262023-06-260001355848us-gaap:WarrantMembertoon:A2021WarrantsMember2023-06-262023-06-260001355848toon:WarrantsMemberus-gaap:WarrantMember2023-06-260001355848toon:WarrantsMemberus-gaap:WarrantMember2023-06-262023-06-260001355848toon:ExchangeWarrantsMemberus-gaap:WarrantMember2023-06-260001355848toon:WarrantsMemberus-gaap:WarrantMember2023-06-300001355848toon:WarrantsMemberus-gaap:WarrantMember2023-01-012023-06-300001355848toon:WarrantsMemberus-gaap:WarrantMember2023-04-012023-06-300001355848toon:ProductionFacilitiesLoansAndBankIndebtednessMember2023-04-012023-06-300001355848toon:ProductionFacilitiesLoansAndBankIndebtednessMember2023-01-012023-06-300001355848toon:ExchangeWarrantsMemberus-gaap:WarrantMember2023-06-300001355848us-gaap:WarrantMembertoon:A2021WarrantsMember2023-04-012023-06-300001355848toon:AmebaAndWowMember2023-04-012023-06-300001355848toon:AmebaAndWowMember2023-01-012023-06-300001355848toon:AmebaMember2023-06-300001355848toon:EmploymentAgreementsMember2023-06-300001355848toon:ConsultingContractsMember2023-06-300001355848us-gaap:DebtMember2023-06-300001355848toon:BeverlyHillsCAMember2019-01-30utr:sqft0001355848toon:BeverlyHillsCAMember2019-01-302019-01-300001355848toon:ChizCommAcquisitionMembertoon:TorontoOntarioMember2021-02-010001355848toon:ChizCommAcquisitionMembertoon:TorontoOntarioMember2021-02-012021-02-010001355848srt:MinimumMembertoon:ChizCommAcquisitionMembertoon:TorontoOntarioMember2021-02-010001355848srt:MaximumMembertoon:ChizCommAcquisitionMembertoon:TorontoOntarioMember2021-02-010001355848toon:LyndhurstNJMember2021-03-020001355848toon:LyndhurstNJMember2021-03-022021-03-020001355848toon:VancouverBCOfficeSpaceMembertoon:WowMember2022-04-060001355848toon:VancouverBCOfficeSpaceMembertoon:WowMember2022-04-062022-04-060001355848toon:WowMember2022-04-062022-04-06toon:parkingSpace0001355848toon:VancouverBCParkingMembertoon:WowMember2022-04-060001355848toon:VancouverBCParkingMembertoon:WowMember2022-04-062022-04-060001355848toon:WowMembersrt:MinimumMember2022-04-060001355848srt:MaximumMembertoon:WowMember2022-04-060001355848toon:WowMembersrt:MinimumMember2022-04-062022-04-060001355848srt:MaximumMembertoon:WowMember2022-04-062022-04-060001355848toon:WowMember2022-04-060001355848us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMembertoon:EmploymentAgreementsMember2020-12-072020-12-070001355848us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMembertoon:EmploymentAgreementsMember2023-01-012023-06-300001355848us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMembertoon:EmploymentAgreementsMember2022-01-012022-06-300001355848us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMembertoon:EmploymentAgreementsMember2022-04-012022-06-300001355848us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMembertoon:EmploymentAgreementsMember2023-04-012023-06-300001355848us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMembertoon:EmploymentAgreementsMember2023-06-300001355848us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMembertoon:EmploymentAgreementsMember2022-08-252022-08-250001355848us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMembertoon:WowMembertoon:EmploymentAgreementsMember2022-04-072022-04-070001355848us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMembertoon:WowMembertoon:EmploymentAgreementsMember2022-04-070001355848us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMembertoon:WowMembertoon:EmploymentAgreementsMember2022-01-012022-06-300001355848us-gaap:RelatedPartyMembersrt:ChiefExecutiveOfficerMembertoon:WowMembertoon:EmploymentAgreementsMember2023-01-012023-06-300001355848toon:MerchandisingAndLicensingAgreementMemberus-gaap:RelatedPartyMember2022-01-012022-06-300001355848toon:MerchandisingAndLicensingAgreementMemberus-gaap:RelatedPartyMember2023-01-012023-06-300001355848toon:PowMemberus-gaap:RelatedPartyMembertoon:LoanAgreementAndPromissoryNoteMember2021-09-300001355848toon:PowMemberus-gaap:RelatedPartyMembertoon:LoanAgreementAndPromissoryNoteMember2021-09-302021-09-300001355848toon:PowMemberus-gaap:RelatedPartyMembertoon:LoanAgreementAndPromissoryNoteMember2023-06-300001355848toon:PowMemberus-gaap:RelatedPartyMembertoon:LoanAgreementAndPromissoryNoteMember2022-12-310001355848toon:PowMemberus-gaap:RelatedPartyMembertoon:LoanAgreementAndPromissoryNoteMember2021-09-300001355848toon:YFEMemberus-gaap:RelatedPartyMembertoon:ShareholderLoanAgreementMember2022-07-19iso4217:EUR0001355848toon:YFEMemberus-gaap:RelatedPartyMembertoon:ShareholderLoanAgreementMember2022-07-192022-07-190001355848toon:YFEMemberus-gaap:RelatedPartyMembertoon:ShareholderLoanAgreementMember2023-06-300001355848toon:FMFilmAndMedienBeteiligungsGmbHMemberus-gaap:RelatedPartyMembertoon:IndependentContractorAgreementMember2021-12-012021-12-010001355848toon:FMFilmAndMedienBeteiligungsGmbHMemberus-gaap:RelatedPartyMemberus-gaap:RestrictedStockUnitsRSUMembertoon:IndependentContractorAgreementMember2021-12-012021-12-010001355848toon:FMFilmAndMedienBeteiligungsGmbHMemberus-gaap:RelatedPartyMemberus-gaap:RestrictedStockUnitsRSUMembertoon:IndependentContractorAgreementMember2021-12-01toon:interval0001355848toon:BeverlyHillsCAMemberus-gaap:RelatedPartyMembertoon:SubleaseAgreementMember2022-12-31toon:office0001355848toon:ContentProductionDistributionMember2023-04-012023-06-300001355848toon:ContentProductionDistributionMember2022-04-012022-06-300001355848toon:ContentProductionDistributionMember2022-01-012022-06-300001355848toon:MediaAdvertisingServicesMember2023-04-012023-06-300001355848toon:MediaAdvertisingServicesMember2022-04-012022-06-300001355848toon:MediaAdvertisingServicesMember2022-01-012022-06-300001355848country:US2023-04-012023-06-300001355848country:US2022-04-012022-06-300001355848country:US2023-01-012023-06-300001355848country:US2022-01-012022-06-300001355848country:CA2023-04-012023-06-300001355848country:CA2022-04-012022-06-300001355848country:CA2023-01-012023-06-300001355848country:CA2022-01-012022-06-300001355848country:GB2023-04-012023-06-300001355848country:GB2022-04-012022-06-300001355848country:GB2023-01-012023-06-300001355848country:GB2022-01-012022-06-300001355848toon:OtherCountriesMember2023-04-012023-06-300001355848toon:OtherCountriesMember2022-04-012022-06-300001355848toon:OtherCountriesMember2023-01-012023-06-300001355848toon:OtherCountriesMember2022-01-012022-06-300001355848us-gaap:SubsequentEventMembertoon:LyndhurstNJMember2023-08-02toon:installment0001355848us-gaap:SubsequentEventMembertoon:LyndhurstNJMember2023-08-022023-08-020001355848toon:LyndhurstNJMember2023-06-300001355848toon:LyndhurstNJMember2023-06-302023-06-300001355848toon:FurnitureFixturesAndLeaseholdImprovementsMembertoon:LyndhurstNJMember2023-06-300001355848us-gaap:SubsequentEventMember2023-07-012023-07-310001355848us-gaap:SubsequentEventMembertoon:MarginLoanMember2023-07-012023-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission file number: 000-54389

KARTOON STUDIOS, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Nevada | 20-4118216 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

190 N. Canon Drive, 4th FL

Beverly Hills, CA 90210

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: 310-273-4222

______________________________

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of Exchange where registered |

| Common Stock, par value $0.001 per share | TOON | The NYSE American |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

Large accelerated filer o | | Accelerated filer | o |

Non-accelerated filer x | | Smaller reporting company | x |

| | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of August 14, 2023, the registrant had 35,060,546 shares of common stock outstanding.

Kartoon Studios, Inc.

FORM 10-Q

For the Quarterly Period Ended June 30, 2023

Table of Contents

PART I- FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

Kartoon Studios, Inc.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share data)

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| (unaudited) | | |

| ASSETS | | | |

| Current Assets: | | | |

| Cash and Cash Equivalents | $ | 4,839 | | | $ | 7,432 | |

Investments in Marketable Securities (amortized cost of $53,113) | 49,498 | | | 83,706 | |

| Accounts Receivable, net | 8,328 | | | 15,558 | |

| Tax Credits Receivable, net | 25,093 | | | 26,255 | |

| Notes and Accounts Receivable from Related Party | 1,487 | | | 2,844 | |

| Other Receivable | 420 | | | 1,162 | |

| Prepaid Expenses and Other Assets | 1,946 | | | 2,568 | |

| Total Current Assets | 91,611 | | | 139,525 | |

| | | |

| Noncurrent Assets: | | | |

| Property and Equipment, net | 2,136 | | | 2,400 | |

| Operating Lease Right of Use Assets, net | 8,216 | | | 8,506 | |

| Finance Lease Right of Use Assets, net | 2,533 | | | 2,338 | |

| Film and Television Costs, net | 8,100 | | | 7,780 | |

| Investment in Your Family Entertainment AG | 19,969 | | | 16,247 | |

| Intangible Assets, net | 24,416 | | | 29,167 | |

| Goodwill | 20,852 | | | 31,807 | |

| Other Assets | 150 | | | 148 | |

| Total Assets | $ | 177,983 | | | $ | 237,918 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current Liabilities: | | | |

| Accounts Payable | $ | 6,236 | | | $ | 11,436 | |

| Participations Payable | 2,168 | | | 2,965 | |

| Accrued Expenses | 1,234 | | | 895 | |

| Accrued Salaries and Wages | 2,578 | | | 2,484 | |

| Deferred Revenue | 4,971 | | | 9,065 | |

| Margin Loan | 27,613 | | | 60,810 | |

| Production Facilities, net | 17,793 | | | 18,282 | |

| Bank Indebtedness | 4,755 | | | 1,741 | |

| Current Portion of Operating Lease Liability | 868 | | | 802 | |

| Current Portion of Finance Lease Liability | 1,635 | | | 1,623 | |

| Warrant Liability | 7,202 | | | 548 | |

| Due To Related Party | 55 | | | 2 | |

| Other Current Liabilities | 79 | | | 255 | |

| Total Current Liabilities | 77,187 | | | 110,908 | |

| | | |

| Noncurrent Liabilities: | | | |

| Deferred Revenue | 3,369 | | | 3,369 | |

| Operating Lease Liability, Net Current Portion | 7,763 | | | 8,095 | |

| Finance Lease Liability, Net Current Portion | 1,223 | | | 1,020 | |

| Deferred Tax Liability | – | | | 705 | |

| Other Noncurrent Liabilities | 928 | | | 952 | |

| Total Liabilities | 90,470 | | | 125,049 | |

| | | |

| Commitments and Contingencies (Note 19) | | | |

| | | |

| Stockholders’ Equity: | | | |

Preferred Stock Series A, $0.001 par value, 9,999,999 shares authorized, 0 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | – | | | – | |

Preferred Stock Series B, $0.001 par value, 1 share authorized, 1 share issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | – | | | – | |

Common Stock, $0.001 par value, 40,000,000 shares authorized, 35,054,573 and 31,918,552 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | 351 | | | 319 | |

| Additional Paid-in Capital | 773,377 | | | 762,418 | |

Treasury Stock at Cost, 48,498 and 42,633 shares of common stock as of June 30, 2023 and December 31, 2022, respectively | (305) | | | (290) | |

| Accumulated Deficit | (681,435) | | | (641,443) | |

| Accumulated Other Comprehensive Loss | (6,218) | | | (9,925) | |

| Total Kartoon Studios, Inc. Stockholders' Equity | 85,770 | | | 111,079 | |

| Non-Controlling Interests in Consolidated Subsidiaries | 1,743 | | | 1,790 | |

| Total Stockholders' Equity | 87,513 | | | 112,869 | |

| | | |

| Total Liabilities and Stockholders’ Equity | $ | 177,983 | | | $ | 237,918 | |

The accompanying notes are an integral part of these financial statements.

Kartoon Studios, Inc.

Condensed Consolidated Statements of Operations

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, 2023 | | June 30, 2022 | | June 30, 2023 | | June 30, 2022 |

| Revenues: | | | | | | | |

| Production Services | $ | 7,033 | | | $ | 10,018 | | | $ | 16,919 | | | 10,018 | |

| Content Distribution | 3,012 | | | 8,529 | | | 6,313 | | | 8,942 | |

| Licensing & Royalties | 103 | | | 2,495 | | | 149 | | | 2,536 | |

| Media Advisory & Advertising Services | 890 | | | 1,082 | | | 1,846 | | | 2,067 | |

| Total Revenues | 11,038 | | | 22,124 | | | 25,227 | | | 23,563 | |

| | | | | | | |

| Operating Expenses: | | | | | | | |

| Marketing and Sales | 1,690 | | | 972 | | | 1,935 | | | 1,132 | |

| Direct Operating Costs | 9,541 | | | 14,648 | | | 20,826 | | | 14,992 | |

| General and Administrative | 8,370 | | | 15,105 | | | 17,595 | | | 25,962 | |

| Impairment of Property and Equipment | – | | | — | | | 120 | | | — | |

| Impairment of Intangible Assets | – | | | – | | | 4,023 | | | – | |

| Impairment of Goodwill | – | | | – | | | 11,287 | | | – | |

| Total Operating Expenses | 19,601 | | | 30,725 | | | 55,786 | | | 42,086 | |

| | | | | | | |

| Loss from Operations | (8,563) | | | (8,601) | | | (30,559) | | | (18,523) | |

| | | | | | | |

| Interest Expense | (1,020) | | | (388) | | | (2,105) | | | (443) | |

| Other Income (Expense), Net | (6,368) | | | (3,161) | | | (8,080) | | | 2,256 | |

| Loss Before Income Tax Benefit | (15,951) | | | (12,150) | | | (40,744) | | | (16,710) | |

| | | | | | | |

| Income Tax Benefit | 705 | | | – | | | 705 | | | – | |

| | | | | | | |

| Net Loss | (15,246) | | | (12,150) | | | (40,039) | | | (16,710) | |

| | | | | | | |

| Net (Income) Loss Attributable to Non-Controlling Interests | 16 | | | (1,193) | | | 47 | | | (1,162) | |

| | | | | | | |

| Net Loss Attributable to Kartoon Studios, Inc. | $ | (15,230) | | | $ | (13,343) | | | $ | (39,992) | | | $ | (17,872) | |

| | | | | | | |

| Net Loss per Share (Basic) | $ | (0.47) | | | $ | (0.42) | | | $ | (1.24) | | | $ | (0.58) | |

| Net Loss per Share (Diluted) | $ | (0.47) | | | $ | (0.42) | | | $ | (1.24) | | | $ | (0.58) | |

| | | | | | | |

| Weighted Average Shares Outstanding (Basic) | 32,379,852 | | 31,551,991 | | 32,180,202 | | 30,968,201 |

| Weighted Average Shares Outstanding (Diluted) | 32,379,852 | | 31,551,991 | | 32,180,202 | | 30,968,201 |

The accompanying notes are an integral part of these financial statements.

Kartoon Studios, Inc.

Condensed Consolidated Statements of Comprehensive Loss

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, 2023 | | June 30, 2022 | | June 30, 2023 | | June 30, 2022 |

| Net Loss | $ | (15,246) | | | $ | (12,150) | | | $ | (40,039) | | | $ | (16,710) | |

| Change in Accumulated Other Comprehensive Income (Loss): | | | | | | | |

| Change in Unrealized Gain/(Losses) on Marketable Securities | (87) | | | (1,095) | | | 743 | | | (4,595) | |

| Realized Losses on Marketable Securities Reclassified from AOCI into Earnings | 720 | | | 44 | | | 2,257 | | | 123 | |

| Foreign Currency Translation Adjustments | 704 | | | (1,477) | | | 707 | | | (1,440) | |

| Total Change in Accumulated Other Comprehensive Loss | 1,337 | | | (2,528) | | | 3,707 | | | (5,912) | |

| Total Comprehensive Net Loss | $ | (13,909) | | | $ | (14,678) | | | $ | (36,332) | | | $ | (22,622) | |

| Net (Income) Loss Attributable to Non-Controlling Interests | 16 | | | (1,193) | | | 47 | | | (1,162) | |

| Total Comprehensive Net Loss Attributable to Kartoon Studios, Inc. | $ | (13,893) | | | $ | (15,871) | | | $ | (36,285) | | | $ | (23,784) | |

The accompanying notes are an integral part of these financial statements.

Kartoon Studios, Inc.

Condensed Consolidated Statements of Stockholders' Equity

(in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Preferred Stock | | Additional Paid-In Capital | | Treasury Stock | | Accumulated Deficit | | Accumulated Other Comprehensive Loss | | Non-Controlling Interest | | Total |

| Shares | | Amount | | Shares | | Amount | | | Shares | | Amount | | | | |

| Balance, December 31, 2022 | 31,918,552 | | 319 | | | 1 | | $ | – | | | $ | 762,418 | | | 42,633 | | | (290) | | | $ | (641,443) | | | $ | (9,925) | | | $ | 1,790 | | | $ | 112,869 | |

| | | | | | | | | | | | | | | | | | | | | |

| Issuance of Common Stock for Vested Restricted Stock Units, Net of Shares Withheld for Taxes | 78,088 | | 1 | | | – | | – | | | (1) | | | 3,700 | | (9) | | | – | | | – | | | – | | | (9) | |

| Fractional Shares Issued Upon Reverse Stock Split | 117,144 | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | |

| Share Based Compensation | – | | | – | | | – | | | – | | | 910 | | | – | | | – | | | – | | | – | | | – | | | 910 | |

| Realized Loss Reclassified from AOCI to Earnings, net change in Unrealized Loss | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | 2,367 | | | – | | | 2,367 | |

| Foreign Translation Adjustment | – | | | – | | | – | | | – | | | – | | | – | | | – | | | – | | | 3 | | | – | | | 3 | |

| Net Loss | – | | | – | | | – | | | – | | | – | | | – | | | – | | | (24,762) | | | – | | | (31) | | | (24,793) | |

| | | | | | | | | | | | | | | | | | | | | |

| Balance, March 31, 2023 | 32,113,784 | | $ | 320 | | | 1 | | $ | – | | | $ | 763,327 | | | 46,333 | | $ | (299) | | | $ | (666,205) | | | $ | (7,555) | | | $ | 1,759 | | | $ | 91,347 | |

| | | | | | | | | | | | | | | | | | | | | |

| Issuance of Common Stock for Services | 404,251 | | – | | | – | | – | | | 997 | | | – | | – | | | – | | | – | | | – | | | 997 | |

| Issuance of Common Stock for Vested Restricted Stock Units, Net of Shares Withheld for Taxes | 224,988 | | 29 | | | – | | – | | | (29) | | | 2,165 | | (6) | | | – | | | – | | | – | | | (6) | |

| Proceeds From Warrant Exchange, net | 2,311,550 | | 2 | | | – | | – | | | 4,854 | | | – | | – | | | – | | | – | | | – | | | 4,856 | |

| Warrant Inducement | – | | – | | | – | | – | | | 3,511 | | | – | | – | | | – | | | – | | | – | | | 3,511 | |

| Share Based Compensation | – | | – | | | – | | – | | | 717 | | | – | | – | | | – | | | – | | | – | | | 717 | |

| Realized Loss Reclassified from AOCI to Earnings, net change in Unrealized Loss | – | | – | | | – | | – | | | – | | | – | | – | | | – | | | 633 | | | – | | | 633 | |

| Foreign Translation Adjustment | – | | – | | | – | | – | | | – | | | – | | – | | | – | | | 704 | | | – | | | 704 | |

| Net Loss | – | | – | | | – | | – | | | – | | | – | | – | | | (15,230) | | | – | | | (16) | | | (15,246) | |

| | | | | | | | | | | | | | | | | | | | | |

| Balance, June 30, 2023 | 35,054,573 | | $ | 351 | | | 1 | | $ | — | | | $ | 773,377 | | | 48,498 | | $ | (305) | | | $ | (681,435) | | | $ | (6,218) | | | $ | 1,743 | | | $ | 87,513 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2021 | 30,337,914 | | 303 | | – | | – | | 739,495 | | – | | – | | (595,848) | | (1,221) | | 1,924 | | 144,653 |

| | | | | | | | | | | | | | | | | | | | | |

| Issuance of Common Stock for Services | 38,620 | | – | | – | | – | | 311 | | – | | – | | – | | – | | – | | 311 |

| Issuance of Common Stock for Vested Restricted Stock Units, Net of Shares Withheld for Taxes | 60,366 | | 1 | | – | | – | | (1) | | – | | – | | – | | – | | – | | – |

| Share Based Compensation | – | | – | | – | | – | | 4,491 | | – | | – | | – | | – | | – | | 4,491 |

| Unrealized Loss on Marketable Securities | – | | – | | – | | – | | – | | – | | – | | – | | (3,421) | | – | | (3,421) |

| Foreign Translation Adjustment | – | | – | | – | | – | | – | | – | | – | | – | | 37 | | – | | 37 |

| Net Loss | – | | – | | – | | – | | – | | – | | – | | (4,531) | | – | | (31) | | (4,562) |

| | | | | | | | | | | | | | | | | | | | | |

| Balance, March 31, 2022 | 30,436,900 | | $ | 304 | | | – | | $ | – | | | $ | 744,296 | | | – | | $ | – | | | $ | (600,379) | | | $ | (4,605) | | | $ | 1,893 | | | $ | 141,509 | |

| | | | | | | | | | | | | | | | | | | | | |

| Shares Issued for Wow Acquisition | 1,105,708 | | 11 | | 1 | | – | | 11,543 | | – | | – | | – | | – | | – | | 11,554 |

| Fair Value of Replacement Options Related to Wow Acquisition | – | | – | | – | | – | | 1,213 | | – | | – | | – | | – | | – | | 1,213 |

| Issuance of Common Stock for Services | 73,667 | | 1 | | – | | – | | 441 | | – | | – | | – | | – | | – | | 442 |

| Issuance of Common Stock for Vested Restricted Stock Units, Net of Shares Withheld for Taxes | 107,241 | | 1 | | – | | – | | (1) | | – | | – | | – | | – | | – | | – |

| Share Based Compensation | – | | – | | – | | – | | 4,245 | | – | | – | | – | | – | | – | | 4,245 |

| Unrealized Loss on Marketable Securities | – | | – | | – | | – | | – | | – | | – | | – | | (1,051) | | – | | (1,051) |

| Foreign Translation Adjustment | – | | – | | – | | – | | – | | – | | – | | – | | (1,477) | | – | | (1,477) |

| Distributions to Non-Controlling Interests | – | | – | | – | | – | | – | | – | | – | | – | | – | | (1,200) | | (1,200) |

| Net Loss | – | | – | | – | | – | | – | | – | | – | | (13,341) | | – | | 1,193 | | (12,148) |

| | | | | | | | | | | | | | | | | | | | | |

| Balance, June 30, 2022 | 31,723,516 | | $ | 317 | | | 1 | | $ | — | | | $ | 761,737 | | | – | | $ | — | | | $ | (613,720) | | | $ | (7,133) | | | $ | 1,886 | | | $ | 143,087 | |

The accompanying notes are an integral part of these financial statements.

Kartoon Studios, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

| | | | | | | | | | | |

| June 30, 2023 | | June 30, 2022 |

| Cash Flows from Operating Activities: | | | |

| Net Loss | $ | (40,039) | | | $ | (16,710) | |

| | | |

| Adjustments to Reconcile Net Loss to Net Cash Used in Operating Activities: | | | |

| Amortization of Film and Television Costs | 474 | | | 2,253 | |

| Depreciation and Amortization of Property, Equipment & Intangible Assets | 1,324 | | | 1,103 | |

| Amortization of Right of Use Asset | 1,486 | | | 700 | |

| Amortization of Premium on Marketable Securities | 322 | | | 545 | |

| Share Based Compensation Expense | 1,627 | | | 8,736 | |

| Impairment Loss of Intangible Assets | 4,023 | | | – | |

| Impairment of Goodwill | 11,287 | | | – | |

| Impairment of Property and Equipment | 120 | | | – | |

| Warrant Incentive Expense | 16,174 | | | – | |

| Deferred Income Taxes | (705) | | | – | |

| Marketing Expenses in Exchange for Stock | 1,195 | | | – | |

| Gain on Revaluation of Equity Investments in Your Family Entertainment AG | (3,427) | | | (2,901) | |

| Unrealized (Gain) Loss for Foreign Currency of Equity Investments in Your Family Entertainment AG | (295) | | | 1,296 | |

| Gain on Warrant Revaluation | (6,202) | | | (269) | |

| Realized Loss on Marketable Securities | 2,257 | | | 123 | |

| Stock Issued for Services | 997 | | | 312 | |

| Bad Debt Expense | 246 | | | 51 | |

| Other Non-Cash Items | (3) | | | – | |

| | | |

| Decrease (Increase) in Operating Assets: | | | |

| Accounts Receivable, net | 7,217 | | | 6,078 | |

| Other Receivable | 749 | | | 384 | |

| Tax Credits Earned (less capitalized) | (8,931) | | | (4,247) | |

| Tax Credits Received, net | 10,419 | | | 1,702 | |

| Film and Television Costs, net | (689) | | | (6,015) | |

| Prepaid Expenses and Other Assets | (563) | | | (469) | |

| | | |

| Increase (Decrease) in Operating Liabilities: | | | |

| Accounts Payable | (5,219) | | | (4,439) | |

| Accrued Salaries & Wages | 54 | | | 338 | |

| Accrued Expenses | 339 | | | (2,048) | |

| Accrued Production Costs | 473 | | | (1,438) | |

| Participations Payable | (813) | | | 1,283 | |

| Deferred Revenue | (4,216) | | | (3,455) | |

| Lease Liability | (297) | | | (352) | |

| Due To Related Party | 53 | | | (63) | |

| Other Liabilities | (24) | | | (42) | |

| Net Cash Used in Operating Activities | $ | (10,587) | | | $ | (17,544) | |

| | | |

| Cash Flows from Investing Activities: | | | |

| Cash Payment for Wow, net of Cash Acquired | – | | | (37,311) | |

| Cash Payment for Equity Investment in Your Family Entertainment | – | | | (9,540) | |

| Cash Payment for Ameba, net of Cash Acquired | – | | | (3,893) | |

| Repayments from/(Loans to) Related Party for Note Receivables | 1,357 | | | (128) | |

| Proceeds from Principal Collections on Marketable Securities | 460 | | | 4,420 | |

| Proceeds from Sales and Maturities of Marketable Securities | 34,169 | | | 5,536 | |

| Investment in Intangible Assets, net | – | | | (22) | |

| Purchase of Property & Equipment | (38) | | | (401) | |

| Net Cash Provided by (Used in) Investing Activities | 35,948 | | | (41,339) | |

| | | |

| Cash Flows from Financing Activities: | | | |

| Proceeds from Margin Loan | 8,582 | | | 58,980 | |

| Repayments of Margin Loan | (41,778) | | | (4,522) | |

| (Repayments of)/Proceeds from Production Facilities, net | (1,494) | | | 2,495 | |

| Proceeds from Bank Indebtedness, net | 2,931 | | | 1,291 | |

| Proceeds from Warrant Exchange, net | 5,299 | | | – | |

| Repayments of Notes Payable | – | | | (9) | |

| Principal Payments on Finance Lease Obligations | (1,216) | | | (442) | |

| Distributions to Non-Controlling Interest | – | | | (1,200) | |

| Shares Withheld for Taxes on Vested Restricted Shares | (15) | | | – | |

| Payment for Warrant Put Option Exercise | (250) | | | – | |

| Net Cash (Used in) Provided by Financing Activities | (27,941) | | | 56,593 | |

| | | |

| Effect of Exchange Rate Changes on Cash, Cash Equivalents and Restricted Cash | (13) | | | 46 | |

| | | |

| Net Decrease in Cash, Cash Equivalents and Restricted Cash | (2,593) | | | (2,244) | |

| Beginning Cash, Cash Equivalents and Restricted Cash | 7,432 | | | 10,060 | |

| Ending Cash, Cash Equivalents and Restricted Cash | $ | 4,839 | | | $ | 7,816 | |

| | | |

| Schedule of Non-Cash Financing and Investing Activities | | | |

| Leased Assets Obtained in Exchange for New Finance Lease Liabilities | $ | 1,216 | | | $ | – | |

| Warrants Issued for Services | $ | 443 | | | $ | – | |

| Shares Issued for Wow Acquisition | $ | – | | | $ | 11,554 | |

| Fair Value of Replacement Options Granted Related to Wow Acquisition | $ | – | | | $ | 1,213 | |

The accompanying notes are an integral part of these financial statements.

Kartoon Studios, Inc. And Subsidiaries

Notes to Condensed Consolidated Financial Statements

June 30, 2023

Note 1: Organization and Business

Organization and Nature of Business

Kartoon Studios, Inc. (formerly known as Genius Brands International, Inc.; “we,” “us,” “our,” or the “Company”) is a global content and brand management company that creates, produces, licenses, and broadcasts timeless and educational, multimedia animated content for children. Led by experienced industry personnel, the Company distributes its content primarily on streaming platforms and television and licenses properties for a broad range of consumer products based on the Company’s characters. The Company is a “work for hire” producer for many of the streaming outlets and animated content intellectual property (“IP”) holders. In the children’s media sector, the Company’s portfolio features “content with a purpose” for toddlers to tweens, providing enrichment as well as entertainment. With the exception of selected WOW Unlimited Media Inc. ("Wow") titles, the Company’s programs, along with licensed programs, are being broadcast in the United States on the Company’s wholly-owned advertisement supported video on demand (“AVOD”) service, its free ad supported TV (“FAST”) channels and subscription video on demand (“SVOD”) outlets, Kartoon Channel! and Ameba. These streaming services are available on Apple TV, Apple iOS, Android TV, Android mobile, Amazon Prime, Amazon Fire, Tubi, Roku, Comcast, Cox, Dish/Sling, Xumo, Pluto, Samsung Smart TVs, LG Smart TVs, as well as YouTube, among other platforms. The Company's in-house owned and produced animated shows include Stan Lee’s Superhero Kindergarten starring Arnold Schwarzenegger, Llama Llama starring Jennifer Garner, Rainbow Rangers, KC Pop Quiz and Shaq’s Garage starring Shaquille O’Neal. The Company’s library titles include the award-winning Baby Genius, adventure comedy Thomas Edison’s Secret Lab®, and Warren Buffett’s Secret Millionaires Club, created with and starring iconic investor Warren Buffett, Team Zenko Go!, Reboot, Bee & PuppyCat: Lazy in Space and Castlevania.

The Company also licenses its programs to other services worldwide, in addition to the operation of its own channels, including but not limited to Netflix, HBO Max, Paramount+, Nickelodeon, and satellite, cable and terrestrial broadcasters around the world.

Through the Company’s investments in Germany’s Your Family Entertainment (“YFE”), a publicly traded company on the Frankfurt Exchange (RTV-Frankfurt), it has gained access to one of the largest animation catalogues in Europe with over 50 titles consisting of over 1,600 episodes, and a global distribution network which currently covers over 60 territories worldwide.

Through the ownership of Wow, the Company has established an affiliate relationship with Mainframe Studios, which is one of the largest animation producers in the world. In addition, Wow owns Frederator Networks Inc. (“Frederator”) and its Channel Frederator Network, the largest animation focused multi-channel network on YouTube with over 2,500 channels.

The Company has rights to a select amount of valuable IP, including among them a controlling interest in Stan Lee Universe, LLC (“SLU”), through which it controls the name, likeness, signature, and all consumer product and IP rights to Stan Lee (the “Stan Lee Assets”).

The Company also owns Beacon Media Group (“Beacon”), the largest media buying service for children in North America. Beacon represents over 30 major toy companies, including Playmobile, Bandai Toys, Bazooka and Moose Toys.

In addition, the Company owns the Canadian company Ameba Inc. (“Ameba”), which distributes SVOD service for kids and has become the focal point of revenue growth for TOON Media Networks’ subscription offering.

The Company and its affiliates provide world class animation production studios a catalogue representing thousands of hours of premium global content for children, a broadcast system for delivering that content and an in-house consumer products licensing infrastructure to fully exploit the content.

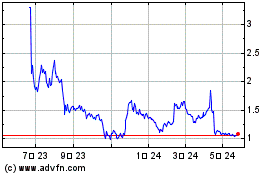

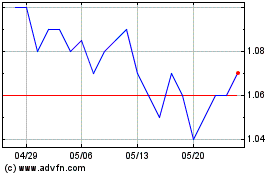

On June 23, 2023, the Company was renamed Kartoon Studios, Inc. On June 26, 2023, the Company transferred its listing to NYSE American LLC (“NYSE American”). In connection with listing on NYSE American, the Company

voluntarily delisted from the Nasdaq Capital Market (“Nasdaq”). The Company’s common stock began trading on NYSE American under the new symbol “TOON” on June 26, 2023.

Recent Developments

Common Stock

On February 6, 2023, the Company’s board of directors approved a 1-for-10 reverse stock split of the Company’s outstanding shares of common stock. The reverse stock split was effected on February 10, 2023 at 5:00 p.m. Eastern time. At the effective time, every 10 issued and outstanding shares of the Company’s common stock were converted into one share of common stock. Any fractional shares of common stock resulting from the reverse stock split were rounded up to the nearest whole post-split share and no shareholders received cash in lieu of fractional shares. The par value of each share of common stock remained unchanged. The reverse stock split proportionately reduced the number of shares of authorized common stock from 400,000,000 to 40,000,000 shares. The reverse stock split also applied to common stock issuable upon the exercise of the Company's outstanding warrants and stock options. The reverse stock split did not affect the authorized preferred stock of 10,000,000 shares. Unless noted, all references to shares of common stock and per share amounts contained in this Quarterly Report on Form 10-Q have been retroactively adjusted to reflect a 1-for-10 reverse stock split.

Exercise of 2021 Warrants and Issuance of New Warrants

On June 26, 2023, the Company entered into warrant exercise inducement offer letters (the “Letter Agreements”) with certain existing institutional and accredited investors pursuant to which such investors agreed to exercise for cash certain warrants issued by the Company in January 2021 (the “2021 Warrants”) to purchase 2,311,550 shares of common stock (the “Exercise”). To induce the Exercise by holders of the 2021 Warrants, the Company also amended the exercise price of the 2021 Warrants from $23.70 per share (as adjusted pursuant to a 1-for-10 reverse stock split of our outstanding shares of common stock effected on February 10, 2023) to $2.50 per share pursuant to the terms of the 2021 Warrants. In consideration for the Exercise, the exercising holders received warrants to purchase up to 4,623,100 shares of common stock, and The Special Equities Group, LLC, a division of Dawson James Securities, which acted as the warrant solicitation agent for the Exercise, received a warrant to purchase up to 161,809 shares of common stock (collectively, the “Warrants”). Prior to closing of the Exercise, the Company had 32,755,748 shares of common stock outstanding. Following the repricing of the 2021 Warrants, certain 2021 Warrants were exercised for an aggregate of 2,311,550 shares, resulting in 35,067,298 outstanding shares. Therefore, the issuance of 4,784,909 shares of common stock upon exercise of the Warrants would have constituted an excess of 19.99% of the outstanding shares of common stock of the Company (determined as of the date of, and without regard for, the issuance of the Warrants and the shares issued upon exercise of the repriced 2021 Warrants). The Warrants will be exercisable at any time at a price per share of $2.50 upon approval by the Company’s shareholders of (a) a proposal to approve an amendment to the articles of incorporation to increase the authorized shares of common stock from 40,000,000 shares to 190,000,000 shares with a corresponding increase in the total number of authorized shares of capital stock of the Company from 50,000,000 shares to 200,000,000 shares (the “Share Increase Proposal”) and (b) approve, in accordance with 713(A) of the NYSE American Company Guide, the issuance of more than 19.99% of the Company’s outstanding common stock upon the exercise of the Warrants (the “Warrant Exercise Proposal” and together with the Share Increase Proposal, the “Proposals”). The Company is holding its annual shareholder meeting on August 25, 2023, at which the Company will seek the shareholders approval of the Proposals. The Warrants have a term of exercise of five years from the date of Shareholder Approvals. Pursuant to the Letter Agreements, the Company filed a registration statement on Form S-3 covering the resale of the shares of common stock issuable upon the exercise of the Warrants on July 26, 2023, which registration statement is currently pending with the Securities and Exchange Commission (“SEC”).

Liquidity

As of June 30, 2023, the Company had cash and cash equivalents of $4.8 million, which decreased by $2.6 million as compared to December 31, 2022. The decrease was primarily due to cash used in financing activities of $27.9 million, primarily due to repayment of the margin loan, net proceeds, offset by the cash received from the warrant exchange and $10.6 million used in operating activities. The cash used was offset by cash provided by sales and maturities of marketable securities of $34.2 million.

As of June 30, 2023, the Company held available-for-sale marketable securities with a fair value of $49.5 million, which decreased by $34.2 million as compared to December 31, 2022 due to sales and maturities during the six months

ended June 30, 2023. The available-for-sale securities consist principally of corporate and government debt securities and are also available as a source of liquidity.

The Company borrowed an additional $8.6 million from its investment margin account during the six months ended June 30, 2023 and repaid $41.8 million primarily with cash received from sales and maturities of marketable securities. During the six months ended June 30, 2023, the borrowed amounts were primarily used for operational costs. The interest rates for the borrowings fluctuate based on the Federal Funds Rate plus 0.65%. The weighted average interest rates were 0.67% and 1.66% on average margin loan balances of $44.2 million and $27.1 million as of June 30, 2023 and December 31, 2022, respectively. The Company incurred interest expense on the loan of $0.6 million and $0.2 million during the three months ended June 30, 2023 and June 30, 2022, respectively. The Company incurred interest expense on the loan of $1.3 million and $0.2 million during the six months ended June 30, 2023 and June 30, 2022, respectively. The investment margin account borrowings do not mature but are collateralized by the marketable securities held by the same custodian and the custodian can issue a margin call at any time, effecting a payable on demand loan. Due to the call option, the margin loan is recorded as a current liability on the Company’s condensed consolidated balance sheets. As of June 30, 2023 and December 31, 2022, the Company’s margin loan balances were $27.6 million and $60.8 million, respectively.

The Company is subject to financial and customary affirmative and negative non-financial covenants on the revolving demand facility, revolving equipment lease line and treasury risk management facility that have an aggregate total outstanding balance of $6.7 million USD ($8.9 million CAD). The Company was in technical violation of two financial covenants requiring a minimum fixed charge ratio and a maximum senior funded debt to EBITDA ratio as of June 30, 2023. The Company has continued to make its regular principal and interest payments in a timely basis since the effective borrowing date.

The revolving demand facility and the treasury risk management facility can be called at anytime by the lender as per the original terms of the facilities. The risk of the lender demanding repayment can be deemed greater due to the breach of covenants, however, at the time the financial statements were available for issuance, the lender has not provided the Company with a formal notification of a covenant breach.

Historically, the Company has incurred net losses. For the three months ended June 30, 2023 and June 30, 2022, the Company reported net losses of $15.2 million and $13.3 million, respectively. For the six months ended June 30, 2023 and June 30, 2022, the Company reported net losses of $40.0 million and $17.9 million, respectively. The Company reported net cash used in operating activities of $10.6 million and $17.5 million for the six months ended June 30, 2023 and June 30, 2022, respectively. As of June 30, 2023, the Company had an accumulated deficit of $681.4 million and total stockholders’ equity of $87.5 million. As of June 30, 2023, the Company had current assets of $91.6 million, including cash and cash equivalents of $4.8 million and marketable securities of $49.5 million, and current liabilities of $77.2 million. The Company had working capital of $14.4 million as of June 30, 2023, compared to working capital of $28.6 million as of December 31, 2022.

Note 2: Summary of Significant Accounting Policies

Basis of Presentation

The accompanying condensed consolidated financial statements have been prepared in conformity with U.S. Generally Accepted Accounting Principles (“GAAP”).

The accompanying condensed consolidated financial statements include, in the opinion of management, all adjustments (consisting of normal recurring adjustments and reclassifications) necessary to state fairly the Condensed Consolidated Balance Sheets, Statements of Operations, Statements of Comprehensive Loss, Statements of Stockholders’ Equity, and Statements of Cash Flows for all periods presented.

Certain prior period amounts have been reclassified for consistency with the current period presentation. These reclassifications had no effect on the reported results of operations.

Out-of-Period Adjustment

The Company identified an error in the Company’s condensed consolidated statement of operations and comprehensive loss for the three months ended March 31, 2023 and balance sheet for the period ended March 31, 2023. The Company’s deferred tax liability, and net loss for the period ended March 31, 2023, are overstated by $705,000. In accordance with Staff Accounting Bulletin (“SAB”) No. 99, “Materiality,” and SAB No. 108, “Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements,” The Company believes

that the impact of the error was not material to the financial statements for the three months ended March 31, 2023, based on an evaluation of both quantitative and qualitative factors. As a result, the Company determined that correcting the prior period financial statements for such an immaterial error would not require the Form 10-Q for the three months ended March 31, 2023 to be amended. The Company has elected to record an out-of-period adjustment and record the amount in the condensed consolidated balance sheet as of June 30, 2023, the condensed consolidated statement of operations and comprehensive loss for the three and six months ended June 30, 2023, the condensed consolidated statement of cash flow for the six months ended June 30, 2023 and the condensed consolidated statements of stockholders’ equity for the three months ended June 30, 2023. The Company does not believe recording the amount in the condensed consolidated statement of operations and comprehensive loss for the three months ended June 30, 2023 has a material impact on the Company’s results of operations.

Segments

The Company determines its operating segments on the same basis that it assesses performance and makes operating decisions. The Company principally operates in two distinct business segments: the Content Production & Distribution Segment, which produces and distributes children’s content, and the Media Advisory & Advertising Services Segment, which provides media and advertising services. These segments are reflective of how the Company’s Chief Operating Decision Maker (“CODM”) reviews operating results for the purposes of allocating resources and assessing performance. The Company has identified its Chief Executive Officer as the CODM. The segments are organized around the products and services provided to customers and represent the Company’s reportable segments.

The accounting policies for each segment are the same as for the Company as a whole. Refer to Note 21 for additional information.

Principles of Consolidation and Basis of Presentation

The Company’s condensed consolidated financial statements include the accounts of Kartoon Studios, Inc. and its wholly-owned subsidiaries. The Company consolidates all majority-owned subsidiaries and variable interest entities where the Company has been determined to be the primary beneficiary. The interests in a variable interest entity which the Company does not control are recorded as non-controlling interests. Non-consolidated investments are accounted for using the equity method or the fair value option and recorded at fair value with changes recognized within Other Income (Expense), Net on the condensed consolidated statements of operations and comprehensive income (loss). All significant intercompany accounts and transactions have been eliminated upon consolidation.

Business Combinations

The Company accounts for transactions that are classified as business combinations in accordance with the Financial Accounting Standards Boards’ (“FASB”) Accounting Standards Codification (“ASC”) 805, Business Combinations (“ASC 805”). Once a business is acquired, the Company allocates the fair value of the purchase consideration to the tangible assets, liabilities, and intangible assets acquired based on their estimated fair values. The excess of the fair value of purchase consideration over the fair values of these identifiable assets and liabilities is recorded as goodwill. As required, preliminary fair values are determined upon acquisition, with the final determination of the fair values being completed within the one-year measurement period from the date of acquisition. The valuation of acquired assets and assumed liabilities requires significant judgment and estimates, especially with respect to intangible assets. The valuation of intangible assets requires that the Company use valuation techniques such as the income approach. The income approach includes the use of a discounted cash flow model, which includes discounted cash flow scenarios and requires significant estimates such as future expected revenue, expenses, capital expenditures and other costs, and discount rates. The Company estimates the fair value based upon assumptions that management believes to be reasonable, but are inherently uncertain and unpredictable and, as a result, actual results may differ from estimates. Estimates associated with the accounting for acquisitions may change as additional information becomes available regarding the assets acquired and liabilities assumed. Acquisition-related expenses and any related restructuring costs are recognized separately from the business combination and are expensed as incurred.

Variable Interest Entities

The Company holds an interest in Stan Lee University, LLC (“SLU”), an entity that is considered a variable interest entity (“VIE”). The variable interest relates to 50% ownership in the entity that is comprised of the Stan Lee Assets

and that requires additional financial support from the Company to continue operations. The Company is considered the primary beneficiary and is required to consolidate the VIE.

In evaluating whether the Company has the power to direct the activities of a VIE that most significantly impact its economic performance, the Company considers the purpose for which the VIE was created, the importance of each of the activities in which it is engaged and the Company’s decision-making role, if any, in those activities that significantly determine the entity’s economic performance as compared to other economic interest holders. This evaluation requires consideration of all facts and circumstances relevant to decision-making that affects the entity’s future performance and the exercise of professional judgment in deciding which decision-making rights are most important.

In determining whether the Company has the right to receive benefits or the obligation to absorb losses that could potentially be significant to the VIE, the Company evaluates all of its economic interests in the entity, regardless of form (debt, equity, management and servicing fees, and other contractual arrangements). This evaluation considers all relevant factors of the entity’s design, including: the entity’s capital structure, contractual rights to earnings (losses), subordination of the Company’s interests relative to those of other investors, contingent payments, as well as other contractual arrangements that have the potential to be economically significant. The evaluation of each of these factors in reaching a conclusion about the potential significance of the Company’s economic interests is a matter that requires the exercise of professional judgment. The Company continuously assesses whether it is the primary beneficiary of a variable interest entity as changes to existing relationships or future transactions may result in the Company consolidating its collaborators or partners.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

Foreign Currency

The Company considers the U.S. dollar (“USD”) to be its functional currency for its United States and certain Canadian based operations. The Canadian dollar (“CAD”) is the functional currency of Wow, a wholly-owned subsidiary of the Company. Accordingly, the financial information is translated from CAD to USD for inclusion in the Company’s condensed consolidated financial statements. Revenue and expenses are translated at average exchange rates prevailing during the period, and assets and liabilities are translated at exchange rates in effect at the balance sheet date. Resulting translation adjustments are included as a component of Accumulated Other Comprehensive Income (Loss), net in stockholders’ equity.

Foreign exchange transaction gains and losses are included in Other Income (Expense), Net on the condensed consolidated statements of operations.

Foreign Currency Forward Contracts

The Company’s wholly-owned subsidiary, Wow, is exposed to fluctuations in various foreign currencies against its functional currency, the Canadian dollar. Wow uses foreign currency derivatives, specifically foreign currency forward contracts (“FX forwards”), to manage its exposure to fluctuations in the CAD-USD exchange rates. FX forwards involve fixing the foreign currency exchange rate for delivery of a specified amount of foreign currency on a specified date. The FX forwards are typically settled in CAD for their fair value at or close to their settlement date. The Company does not currently designate any of the FX forwards under hedge accounting and therefore reflects changes in fair value as unrealized gains or losses immediately in earnings as part of the revenue generated from the transactions hedged. The Company does not hold or use these instruments for speculative or trading purposes.

Per FASB ASC 815-10-45, Derivatives and Hedging, the Company has elected an accounting policy to offset the fair value amounts recognized for eligible forward contract derivative instruments. Therefore, the Company presents the asset or liability position of the FX forwards that are with the same counterparty net as either an asset or liability in its condensed consolidated balance sheets.

As of June 30, 2023, the gross amounts of FX forwards in an asset and liability position subject to a master netting arrangement were $17.7 million and $17.7 million, respectively, resulting in an asset recorded within Prepaid Expenses and Other Assets on the condensed consolidated balance sheet. The change in fair value of $0.1 million and $0.2 million for the

three and six months ended June 30, 2023, respectively, was recorded as an unrealized gain within Production Services Revenue on the condensed consolidated statement of operations. The Company did not hold FX forwards prior to the Wow Acquisition.

Cash and Cash Equivalents

The Company considers all highly liquid debt instruments with initial maturities of three months or less to be cash equivalents. As of June 30, 2023 and December 31, 2022, the Company had cash and cash equivalents of $4.8 million and $7.4 million, respectively, that at times could exceed FDIC or CDIC limits.

Allowance for Doubtful Accounts

Accounts receivables are presented on the condensed consolidated balance sheets, net of estimated uncollectible amounts. The carrying amounts of trade accounts receivable and unbilled accounts receivable represent the maximum credit risk exposure of these assets. On a quarterly basis, in accordance with FASB ASC 326, Measurement of Credit Losses on Financial Instruments (“ASC 326”), the Company evaluates the collectability of outstanding accounts receivable balances to determine an allowance for doubtful accounts that reflects its best estimate of the lifetime expected credit losses. The allowance for credit loss is based on an assessment of past events, current economic conditions, and forecasts of future events. Individual uncollectible accounts are written off against the allowance when collection of the individual accounts appears doubtful. As of June 30, 2023 and December 31, 2022, the Company recorded an allowance for doubtful accounts of $112,250 and $65,421, respectively.

The Company limits its exposure to this credit risk through a credit approval process and credit monitoring procedures. In addition, Wow’s contracts with customers usually require upfront and milestone payments throughout the production process. The Company’s customer base is mainly comprised of major Canadian, American, and worldwide studios, distributors, broadcasters, toy companies and AVOD and SVOD platforms that have been customers for several years.

Tax Credits Receivable

The Canadian federal government and certain provincial governments in Canada provide programs that are designed to assist film and television production in the form of refundable tax credits or other incentives.

Estimated amounts receivable in respect of refundable tax credits are recorded as an offset to the related production operating cost, or to investment in film and television costs when the conditions for eligibility of production assistance based on the government’s criteria are met, the qualifying expenditures are made and there is reasonable assurance of realization. Determination of when and if the conditions of eligibility have been met is based on management’s judgment, and the amount recognized is based on management’s estimates of qualifying expenditures. The ultimate collection of previously recorded estimates is subject to ordinary course audits from the CRA and provincial agencies. Changes in administrative policies by the CRA or subsequent review of eligibility documentation may impact the collectability of these estimates. The Company continuously reviews the results of these audits to determine if any circumstances arise that in management’s judgment would result in a previously recognized amount to be considered no longer collectible.

The Company classifies the tax credits receivable as current based on their normal operating cycle. Government assistance, in the form of refundable tax credits, is relied upon as a key component of production financing. These amounts are claimed from the CRA through the submission of income tax returns and can take up to 18 to 24 months from the date of the first tax credit dollar being earned to being received. As this financing is fundamental to the Company’s ability to produce animated productions and generate revenue in the normal course of business, the normal operating cycle for such assets is considered to be a 12 to 24-month period, or the time it takes for the CRA to assess and refund the tax credits earned.

As of June 30, 2023 and December 31, 2022, $25.1 million and $26.3 million in current tax credit receivables related to Wow’s film and television productions were recorded, net of $0.4 million and $0.2 million recorded as an allowance for doubtful accounts, respectively.

Marketable Debt Securities

The Company purchases high quality, investment grade securities from diverse issuers. Management determines the appropriate classification of securities at the time of purchase and reevaluates such designation as of each balance sheet

date. Currently, the Company classifies its investments in marketable securities as available-for-sale (“AFS”) and records these investments at fair value. The securities are available to support current operations and, accordingly, the Company classifies the investments as current assets without regard to their contractual maturity.

Unrealized gains or losses on available-for-sale securities for which the Company expects to fully recover the amortized cost basis are recognized in Accumulated Other Comprehensive Income (Loss), a component of stockholders’ equity. Gains and losses as a result of sales of securities are reclassified from previously unrealized gains and losses on AFS securities in Accumulated Other Comprehensive Income (Loss) to Other Income (Expense), Net, in the condensed consolidated statements of operations.

On a quarterly basis, the Company reviews its AFS securities to assess declines in fair value for credit losses. For each AFS security with an amortized cost that exceeds its fair value, the Company first determines if it intends to sell or is more-likely-than-not required to sell the debt security before the expected recovery of its amortized cost. If it intends to sell or will more-likely-than-not be required to sell the security, the Company recognizes the impairment as a credit loss in the condensed consolidated statements of operations by writing down the security’s amortized cost to its fair value. For AFS securities that do not meet the aforementioned criteria, the Company evaluates whether the decline in fair value has resulted from credit losses or other factors. In making this assessment, management considers the extent to which fair value is less than amortized cost, any changes to the rating of the security by a rating agency, and adverse conditions specifically related to the security, among other factors. If this assessment indicates that a credit loss exists, the present value of cash flows expected to be collected from the security are compared to the amortized cost basis of the security. If the present value of cash flows expected to be collected is less than the amortized cost basis, a credit loss exists and an allowance for credit losses is recorded for the credit loss. The portion of the decline in fair value that is due to factors other than a credit loss is recognized in Accumulated Other Comprehensive Income (Loss) as an unrealized loss.

The Company reports accrued interest receivable separately from the AFS securities and has elected not to measure an allowance for credit losses for accrued interest receivables. Uncollectible accrued interest is written off when the Company determines that no additional interest payments will be received. Classified within Other Receivables on the condensed consolidated balance sheets, approximately $0.2 million and $0.3 million in interest income were receivable as of June 30, 2023 and December 31, 2022, respectively.

Interest earned on investment securities is reported in interest income, net of applicable adjustments for accretion of discounts and amortization of premiums accounted for over the life of the security or, in the case of callable securities, through the first call date, using the level yield method, with no prepayment anticipated.

Equity-Method Investments

When the Company does not have a controlling financial interest in an entity but can exert significant influence over the entity’s operating and financial policies, the investment is accounted for either (i) under the equity method of accounting or (ii) at fair value by electing the fair value option available under U.S. GAAP. Significant influence generally exists when the firm owns 20% to 50% of the entity’s common stock or in-substance common stock.

In general, the Company accounts for investments acquired at fair value. See Note 4 for further information about the Company’s investment in YFE’s equity securities accounted for under the fair value option.

Property and Equipment