FALSE000153743500015374352024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): May 9, 2024

TECOGEN INC. (OTCQX: TGEN)

(Exact Name of Registrant as Specified in Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| | | | | | | | |

| 001-36103 | | 04-3536131 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | |

| 76 Treble Cove Road |

North Billerica, Massachusetts 01862 |

| (Address of Principal Executive Offices and Zip Code) |

|

| 45 First Avenue |

| Waltham, MA 02451 |

| (Former Address of Principal Executive Offices and Zip Code) |

(781) 466-6400

(Registrant's telephone number, including area code)

Securities registered or to be registered pursuant to Section 12(b) of the Act. | | | | | | | | |

| Title of each class | Trading Symbol | Name of exchange on which registered |

| | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On May 8, 2024, the registrant issued a press release with earnings commentary and supplemental information for the three months ended March 31, 2024. The press release is furnished as Exhibit 99.01 to this Current Report on Form 8-K.

The information in this Item 2.02 and Exhibit 99.01 to this Current Report on Form 8-K shall shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 7.01. Regulation FD Disclosure.

On May 9, 2024, the registrant will present the attached slides online in connection with an earnings conference call. The slides are being furnished as Exhibit 99.02 to this Current Report on Form 8-K.

The information in this Item 7.01 and Exhibit 99.02 to this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibits relating to Items 2.02 and 7.01 shall be deemed to be furnished, and not filed:

| | | | | |

| Exhibit | Description |

| 99.01 | |

| 99.02 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized. | | | | | | | | |

|

| | |

| TECOGEN INC. |

| |

| | By: /s/ Abinand Rangesh |

| May 9, 2024 | | Abinand Rangesh, Chief Executive Officer |

Tecogen Announces First Quarter 2024 Results

Revenues of $6.2 million - 15% QoQ increase

NORTH BILLERICA, Mass., May 8, 2024 - Tecogen Inc. (OTCQX:TGEN), a leading manufacturer of clean energy products, reported revenues of $6.2 million and net loss of $1.1 million for the quarter ended March 31, 2024 compared to revenues of $5.4 million, and a net loss of $1.5 million in 2023. We generated $0.2 million in cash from operations during the quarter and ended the quarter with a cash balance of $1.5 million.

“In Q1 2024 had record service revenue of $4m, a 28% increase from the same period last year. We also had positive cash flow from operations. Our total revenue was also up 15% QoQ. Our cash position at the end of Q1 was $1.5m and we haven't drawn further into our line of credit. During the call I will update investors on our factory move, the service agreements we acquired in Q1 and our new marketing efforts," commented Abinand Rangesh, Tecogen's Chief Executive Officer.

Key Takeaways

Net Loss and Earnings Per Share

•Net loss in Q1 2024 was $1.1 million compared to a net loss of $1.5 million in Q1 2023, a decrease of $0.4 million, due to increased revenue and gross profit for our Products and Services segments, partially offset by increased operating expenses.

•EPS was $(0.04)/share and $(0.06)/share in Q1 2024 and Q1 2023, respectively.

Loss from Operations

•Loss from operations for the three months ended March 31, 2024 was $1.0 million compared to a loss from operations of $1.4 million for the same period in 2023, a decrease of $0.4 million,primarily due to increased revenue and gross profit for our Products and Services segments, partially offset by increased operating expenses.

Revenues

•Revenues for the quarter ended March 31, 2024 were $6.2 million compared to $5.4 million for the same period in 2023, a 15.0% increase.

◦Product revenue was $1.5 million in Q1 2024 compared to $1.7 million in the same period in 2023, a decrease of 12.8%, due to decreased sales of chiller units.

◦Services revenue was $4.0 million in Q1 2024 compared to $3.1 million in the same period in 2023, an increase of 28.0%, primarily due to the addition of $0.8 million in revenue from the acquired Aegis maintenance contracts.

◦Energy Production revenue was $680 thousand in Q1 2024 compared to $534 thousand in the same period in 2023, an increase of 27.5% due to increased run hours.

Gross Profit

•Gross profit for the first quarter of 2024 was $2.6 million compared to $2.1 million in the first quarter of 2023. Gross margin increased to 41.6% in the first quarter compared to 38.9% for the same period in 2023. The increase in gross profit margin was driven by increased service contract revenues.

Operating Expenses

•Operating expenses increased by 2.4% to $3.6 million for the first quarter of 2024 compared to $3.5 million in the same period in 2023, due primarily to duplicate rent costs, during the transition to our new facility in Q1 2024.

Adjusted EBITDA(1) was negative $0.9 million for the first quarter of 2024 compared to negative $1.3 million for the first quarter of 2023. (Adjusted EBITDA is defined as net income or loss attributable to Tecogen, adjusted for interest, income taxes, depreciation and amortization, stock-based compensation expense, unrealized gain or loss on investment securities, goodwill impairment charges and other non-cash non-recurring charges or gains including abandonment of intangible assets and the extinguishment of debt. See the table following the Condensed Consolidated Statements of Operations for a reconciliation from net income (loss) to Adjusted EBITDA, as well as important disclosures about the company's use of Adjusted EBITDA).

Conference Call Scheduled for May 9, 2024, at 9:30 am ET

Tecogen will host a conference call on May 9, 2024 to discuss the first quarter results beginning at 9:30 am eastern time. To listen to the call please dial (888) 428-7458 within the U.S. and Canada, or (862) 298-0702 from other international locations. Participants should ask to be joined to the Tecogen First Quarter 2024 earnings call. Please begin dialing 10 minutes before the scheduled starting time. The earnings press release will be available on the Company website at www.Tecogen.com in the "News and Events" section under "About Us." The earnings conference call will be webcast live. To view the associated slides, register for and listen to the webcast, go to https://ir.tecogen.com/ir-calendar. Following the call, the recording will be archived for 14 days.

The earnings conference call will be recorded and available for playback one hour after the end of the call. To listen to the playback, dial (877) 660-6853 within the U.S. and Canada, or (201) 612-7415 from other international locations and use Conference Call ID#: 13672659.

About Tecogen

Tecogen Inc. designs, manufactures, sells, installs, and maintains high efficiency, ultra-clean, cogeneration products including engine-driven combined heat and power, air conditioning systems, and high-efficiency water heaters for residential, commercial, recreational and industrial use. The company provides cost effective, environmentally friendly and reliable products for energy production that nearly eliminate criteria pollutants and significantly reduce a customer’s carbon footprint.

In business for over 35 years, Tecogen has shipped more than 3,200 units, supported by an established network of engineering, sales, and service personnel across the United States. For more information, please visit www.tecogen.com or contact us for a free Site Assessment.

Tecogen, InVerde e+, Tecochill, Tecopower, Tecofrost, Tecopack, and Ultera are registered trademarks of Tecogen Inc.

Forward Looking Statements

This press release and any accompanying documents, contain “forward-looking statements” which may describe strategies, goals, outlooks or other non-historical matters, or projected revenues, income, returns or other financial measures, that may include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "target," "potential," "will," "should," "could," "likely," or "may" and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements.

In addition to those factors described in our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and on our Form 8-K, under “Risk Factors”, among the factors that could cause actual results to differ materially from past and projected future results are the following: fluctuations in demand for our products and services, competing technological developments, issues relating to research and development, the availability of incentives, rebates, and tax benefits relating to our products and services, changes in the regulatory environment relating to our products and services, integration of acquired business operations, and the ability to obtain financing on favorable terms to fund existing operations and anticipated growth.

In addition to GAAP financial measures, this press release includes certain non-GAAP financial measures, including adjusted EBITDA which excludes certain expenses as described in the presentation. We use Adjusted EBITDA as an internal measure of business operating performance and believe that the presentation of non-GAAP financial measures provides a meaningful perspective of the underlying operating performance of our current business and enables investors to better understand and evaluate our historical and prospective operating performance by eliminating items that vary from period to period without correlation to our core operating performance and highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures.

Tecogen Media & Investor Relations Contact Information:

Abinand Rangesh

P: 781-466-6487

E: Abinand.Rangesh@tecogen.com

TECOGEN INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,510,435 | | | $ | 1,351,270 | |

| | | |

| Accounts receivable, net | 6,533,130 | | | 6,781,484 | |

| | | |

| Unbilled revenue | 1,258,532 | | | 1,258,532 | |

| Inventories, net | 10,021,002 | | | 10,553,419 | |

| | | |

| | | |

| Prepaid and other current assets | 409,573 | | | 360,639 | |

| Total current assets | 19,732,672 | | | 20,305,344 | |

| Long-term assets: | | | |

| Property, plant and equipment, net | 1,147,069 | | | 1,162,577 | |

| Right of use assets | 2,176,264 | | | 943,283 | |

| Intangible assets, net | 2,533,112 | | | 2,436,230 | |

| | | |

| Goodwill | 2,646,194 | | | 2,743,424 | |

| | | |

| | | |

| Other assets | 223,232 | | | 201,771 | |

| TOTAL ASSETS | $ | 28,458,543 | | | $ | 27,792,629 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Related party notes | $ | 511,905 | | | $ | 505,505 | |

| | | |

| | | |

| Accounts payable | 4,013,899 | | | 4,514,415 | |

| Accrued expenses | 2,682,656 | | | 2,504,629 | |

| Deferred revenue, current | 2,462,570 | | | 1,647,206 | |

| Lease obligations, current | 469,762 | | | 289,473 | |

| | | |

| Acquisition liabilities, current | 929,411 | | | 845,363 | |

| Unfavorable contract liability, current | 162,822 | | | 176,207 | |

| Total current liabilities | 11,233,025 | | | 10,482,798 | |

| | | |

| Long-term liabilities: | | | |

| | | |

| Deferred revenue, net of current portion | 345,427 | | | 369,611 | |

| Lease obligations, net of current portion | 1,725,276 | | | 683,307 | |

| Acquisition liabilities, net of current portion | 1,156,835 | | | 1,181,779 | |

| Unfavorable contract liability, net of current portion | 388,766 | | | 422,839 | |

| Total liabilities | 14,849,329 | | | 13,140,334 | |

| | | |

| | | |

| | | |

| | | |

| Stockholders’ equity: | | | |

| Tecogen Inc. shareholders’ equity: | | | |

| Common stock, $0.001 par value; 100,000,000 shares authorized; 24,850,261 issued and outstanding at March 31, 2024 and December 31, 2023 | 24,850 | | | 24,850 | |

| Additional paid-in capital | 57,645,937 | | | 57,601,402 | |

| | | |

| | | |

| Accumulated deficit | (43,984,623) | | | (42,879,656) | |

| Total Tecogen Inc. stockholders’ equity | 13,686,164 | | | 14,746,596 | |

| Non-controlling interest | (76,950) | | | (94,301) | |

| Total stockholders’ equity | 13,609,214 | | | 14,652,295 | |

| | | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 28,458,543 | | | $ | 27,792,629 | |

TECOGEN INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| | March 31, 2024 | | March 31, 2023 | | | | |

| Revenues | | | | | | | |

| Products | $ | 1,491,398 | | | $ | 1,710,136 | | | | | |

| Services | 4,014,310 | | | 3,136,173 | | | | | |

| Energy production | 680,389 | | | 533,509 | | | | | |

| Total revenues | 6,186,097 | | | 5,379,818 | | | | | |

| Cost of sales | | | | | | | |

| Products | 1,049,543 | | | 1,212,568 | | | | | |

| Services | 2,092,257 | | | 1,737,602 | | | | | |

| Energy production | 468,640 | | | 337,739 | | | | | |

| Total cost of sales | 3,610,440 | | | 3,287,909 | | | | | |

| Gross profit | 2,575,657 | | | 2,091,909 | | | | | |

| | | | | | | |

| Operating expenses | | | | | | | |

| General and administrative | 2,848,568 | | | 2,792,483 | | | | | |

| Selling | 529,669 | | | 520,070 | | | | | |

| Research and development | 254,696 | | | 229,102 | | | | | |

| Gain on disposition of assets | (7,391) | | | — | | | | | |

| | | | | | | |

| Total operating expenses | 3,625,542 | | | 3,541,655 | | | | | |

| Loss from operations | (1,049,885) | | | (1,449,746) | | | | | |

| | | | | | | |

| | | | | | | |

| Other income (expense) | | | | | | | |

| Other income (expense), net | (15,747) | | | 830 | | | | | |

| Interest expense | (18,670) | | | (415) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Unrealized gain on investment securities | 18,749 | | | — | | | | | |

| Total other income (expense), net | (15,668) | | | 415 | | | | | |

| Loss before income taxes | (1,065,553) | | | (1,449,331) | | | | | |

| Provision for state income taxes | 22,063 | | | 22,638 | | | | | |

| Consolidated net loss | (1,087,616) | | | (1,471,969) | | | | | |

| Income attributable to the non-controlling interest | (17,351) | | | (18,060) | | | | | |

| Net loss attributable to Tecogen Inc. | $ | (1,104,967) | | | $ | (1,490,029) | | | | | |

| | | | | | | |

| Net loss per share - basic | $ | (0.04) | | | $ | (0.06) | | | | | |

| Weighted average shares outstanding - basic | 24,850,261 | | | 24,850,261 | | | | | |

| Net loss per share - diluted | $ | (0.04) | | | $ | (0.06) | | | | | |

| Weighted average shares outstanding - diluted | 24,850,261 | | | 24,850,261 | | | | | |

| | | | | | | | | | | |

| | | |

| |

| | | |

| Three Months Ended |

| March 31, 2024 | | March 31, 2023 |

Non-GAAP financial disclosure (1) | | | |

| Net loss attributable to Tecogen Inc. | $ | (1,104,967) | | | $ | (1,490,029) | |

| Interest expense, net | 18,670 | | | 828 | |

| Income taxes | 22,063 | | | 22,638 | |

| Depreciation & amortization, net | 140,137 | | | 105,920 | |

| EBITDA | (924,097) | | | (1,360,643) | |

| | | |

| | | |

| | | |

| | | |

| Stock based compensation | 44,535 | | | 77,348 | |

| Unrealized gain on investment securities | (18,749) | | | — | |

| | | |

| Adjusted EBITDA | $ | (898,311) | | | $ | (1,283,295) | |

(1) Non-GAAP Financial Measures

In addition to reporting net income, a U.S. generally accepted accounting principle (“GAAP”) measure, this news release contains information about Adjusted EBITDA (net income (loss) attributable to Tecogen Inc adjusted for interest, income taxes, depreciation and amortization, stock-based compensation expense, unrealized gain or loss on investment securities, goodwill impairment charges and other non-cash non-recurring charges including abandonment of certain intangible assets and extinguishment of debt), which is a non-GAAP measure. The Company believes Adjusted EBITDA allows investors to view its performance in a manner similar to the methods used by management and provides additional insight into its operating results. Adjusted EBITDA is not calculated through the application of GAAP. Accordingly, it should not be considered as a substitute for the GAAP measure of net income and, therefore, should not be used in isolation of, but in conjunction with, the GAAP measure. The use of any non-GAAP measure may produce results that vary from the GAAP measure and may not be comparable to a similarly defined non-GAAP measure used by other companies.

TECOGEN INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| | | | | | | | | | | |

| Three Months Ended |

| March 31, 2024 | | March 31, 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Consolidated net loss | $ | (1,087,616) | | | (1,471,969) | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 140,137 | | | 105,920 | |

| Provision for credit losses | 14,258 | | | — | |

| | | |

| | | |

| Stock-based compensation | 44,535 | | | 77,348 | |

| | | |

| | | |

| Unrealized gain on investment securities | (18,749) | | | — | |

| Gain on disposition of assets | (7,391) | | | — | |

| | | |

| | | |

| Non-cash interest expense | 6,400 | | | — | |

| Changes in operating assets and liabilities | | | |

| (Increase) decrease in: | | | |

| Accounts receivable | 234,095 | | | (44,238) | |

| Employee retention credit | — | | | 667,121 | |

| Inventory | 532,418 | | | (1,380,052) | |

| | | |

| | | |

| Prepaid assets and other current assets | (48,933) | | | 136,170 | |

| Other assets | 194,283 | | | 161,931 | |

| Increase (decrease) in: | | | |

| Accounts payable | (500,516) | | | 905,509 | |

| Accrued expenses and other current liabilities | 167,789 | | | (143,923) | |

| Deferred revenue | 791,181 | | | 852,600 | |

| Other liabilities | (213,675) | | | (167,711) | |

| | | |

| Net cash provided by (used in) operating activities | 248,216 | | | (284,866) | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchases of property and equipment | (104,952) | | | — | |

| Proceeds from disposition of assets | 33,013 | | | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net cash used in investing activities | (71,939) | | | — | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Finance lease principal payments | (17,112) | | | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by financing activities | (17,112) | | | (17,112) | |

| Net increase in cash and cash equivalents | 159,165 | | | (284,866) | |

| Cash and cash equivalents, beginning of the period | $ | 1,351,270 | | | 1,913,969 | |

| Cash and cash equivalents, end of the period | $ | 1,510,435 | | | $ | 1,629,103 | |

| | | |

| Supplemental disclosures of cash flows information: | | | |

| Cash paid for interest | $ | 11,855 | | | $ | — | |

| Cash paid for taxes | $ | 425 | | | $ | 22,638 | |

| | | |

| Non-cash investing activities | | | |

| Aegis Contract and Related Asset Acquisition: | | | |

| Contingent consideration | $ | 92,409 | | | $ | — | |

OTCQX: TGEN Q1 2024 EARNINGS CALL MAY 9, 2024 1

MANAGEMENT Abinand Rangesh – CEO Robert Panora – COO & President Roger Deschenes – CAO Jack Whiting – General Counsel & Secretary 2

SAFE HARBOR STATEMENT This presentation and accompanying documents contain “forward-looking statements” which may describe strategies, goals, outlooks or other non- historical matters, or projected revenues, Income, returns or other financial measures, that may include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "target," "potential," "will," "should," "could," "likely," or "may" and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements. In addition to those factors described in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q under “Risk Factors”, among the factors that could cause actual results to differ materially from past and projected future results are the following: fluctuations in demand for our products and services, competing technological developments, issues relating to research and development, the availability of incentives, rebates, and tax benefits relating to our products and services, changes in the regulatory environment relating to our products and services, integration of acquired business operations, and the ability to obtain financing on favorable terms to fund existing operations and anticipated growth. In addition to GAAP financial measures, this presentation includes certain non-GAAP financial measures, including adjusted EBITDA which excludes certain expenses as described in the presentation. We use Adjusted EBITDA as an internal measure of business operating performance and believe that the presentation of non-GAAP financial measures provides a meaningful perspective of the underlying operating performance of our current business and enables investors to better understand and evaluate our historical and prospective operating performance by eliminating items that vary from period to period without correlation to our core operating performance and highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures. 3

AGENDA Key Takeaways Q1 2024 • Factory Move • Service Agreement Acquisitions • Marketing 1Q 2024 Results Summary Q&A 4

FACTORY MOVE 5 Offices Moved into 76 Treble Cove Road Manufacturing All material is moved in Factory floor fit out in progress Test cells to be completed in Q2 Significant cost savings using our own labor Disruption Limited production in Q2 Back to full production Q3

SERVICE AGREEMENT ACQUISITIONS 6 83 agreements acquired in 2024 16 agreements in Feb with 36 coming online later this year 31 agreements on May 1 Revenue Impact Expect $700k additional impact in 2024 Expect >$1m additional impact in 2025 Expect further 50 units under agreement in next 3 months

MARKETING 7 Google and LinkedIn Ads Streamlined website with case studies and applications Tecogen.com/applications/generator Tecogen.com/markets/brewery-glycol-chiller Online Marketing is now generating qualified leads at the similar cost per lead as trade shows

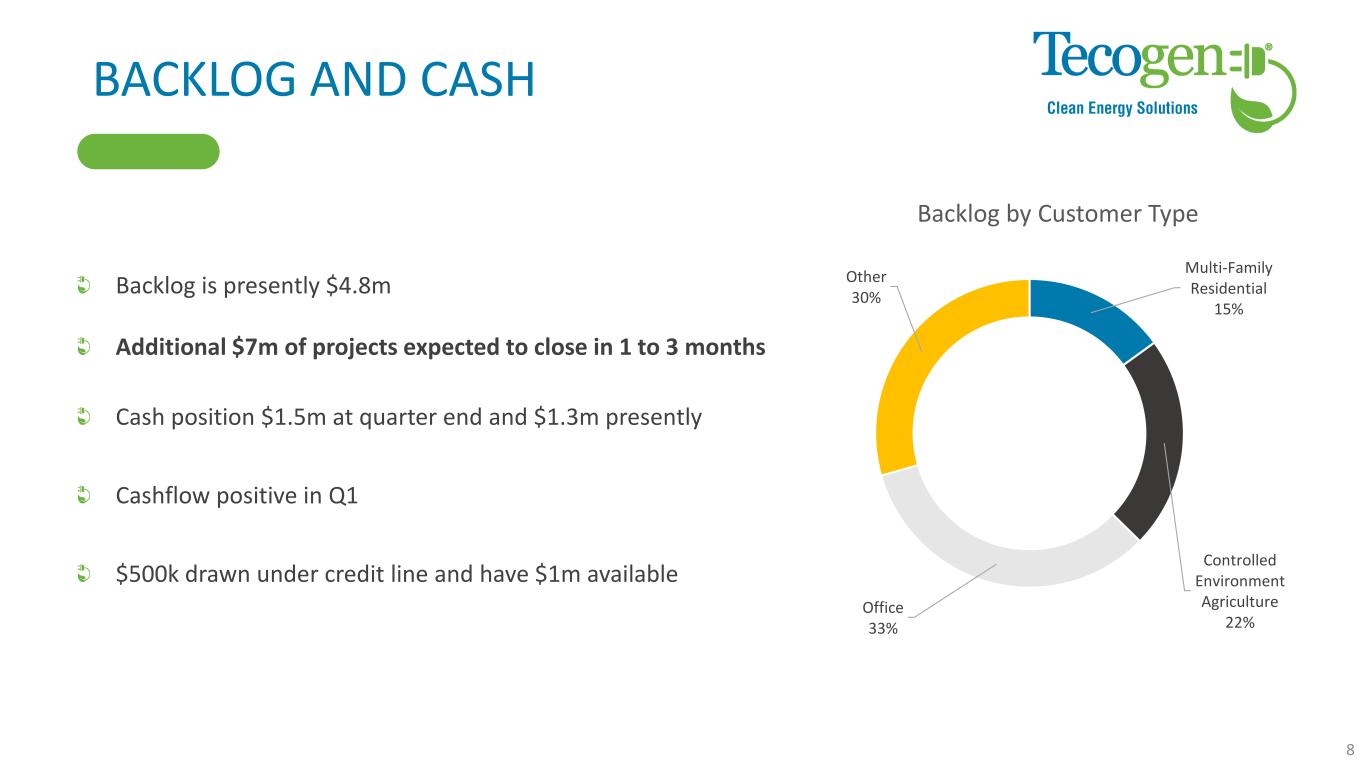

BACKLOG AND CASH Backlog is presently $4.8m Additional $7m of projects expected to close in 1 to 3 months Cash position $1.5m at quarter end and $1.3m presently Cashflow positive in Q1 $500k drawn under credit line and have $1m available Multi-Family Residential 15% Controlled Environment Agriculture 22% Office 33% Other 30% Backlog by Customer Type 8

REVENUE SEGMENTS We service most purchased Tecogen equipment in operation through long term maintenance agreements through 11 service centers in North America and perform certain equipment installation work. SERVICES CLEAN, GREEN POWER, COOLING AND HEAT Sales of combined heat and power, and clean cooling systems to building owners. Key market segments include multifamily residential, health care and indoor cultivation. PRODUCT SALES We sell electrical energy and thermal energy produced by our equipment onsite at customer facilities. ENERGY SALES 9

1Q 2024 RESULTS Key Points • Revenue = $6.18 million up 15% • Net loss of $0.04/share • Net loss $1.1m • Opex $3.62m (2.5% increase) • Includes double rent • Includes one off testing costs for air- cooled chiller • Gross Margin up 2% • Cash and equivalents balance of $1.5 million 10 $ in thousands 1Q'24 1Q'23 QoQ Change % Revenue Products $ 1,491 $ 1,710 $ (219) Services 4,014 3,136 878 Energy Production 680 534 147 Total Revenue 6,186 5,380 806 15.0% Gross Profit Products 1,050 498 552 Services 2,092 1,399 694 Energy Production 469 196 273 Total Gross Profit 2,576 2,092 484 23.1% Gross Margin: % Products 30% 29% 1% Services 48% 45% 3% Energy Production 31% 37% -6% Total Gross Margin 42% 39% 3% Operating Expenses General & administrative 2,849 2,792 56 Selling 530 520 10 Research and development 255 229 26 Gain on disposition of assets (7) - (7) Total operating expenses 3,626 3,542 84 2.4% Operating loss (1,050) (1,450) 400 -27.6% Net loss $ (1,105) $ (1,490) $ 385 -25.8%

1Q 2024 ADJUSTED EBITDA RECONCILIATION EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization • EBITDA and adjusted EBITDA loss was $924k and $898k respectively EBITDA Non-cash adjustments • Stock based compensation • Unrealized and realized (gain) loss on investment securities • Non-recurring charges *Adjusted EBITDA is defined as net Income (loss) attributable to Tecogen Inc, adjusted for interest, depreciation and amortization, stock-based compensation expense, unrealized loss on investment securities, non-cash abandonment of intangible assets, goodwill impairment and other non-recurring charges or gains including abandonment of certain intangible assets and extinguishment of debt 11 Non-GAAP financial disclosure (in thousands) 2024 2023 Net loss attributable to Tecogen Inc. (1,105)$ (1,490)$ Interest expense, net 19 - Income tax expense 22 23 Depreciation & amortization, net 140 106 EBITDA (924) (1,361) Stock based compensation 45 77 Unrealized gain on marketable securities (19) - Adjusted EBITDA* (898)$ (1,284)$ Quarter Ended, March 31

1Q 24 PERFORMANCE BY SEGMENT Product revenue decreased 13% QoQ • Gross margin flat • Product mix meant lower gross margin Service revenue increased 28% QoQ • Still working through product improvements to increase margin • Price increases for some products Energy Production revenue increased 28% QoQ Gross Margin 42% 12 1Q Revenues ($ thousands) 2024 2023 QoQ Change % Revenues Cogeneration 774$ 544$ 42% Chiller 657 1,069 -39% Engineered accessories 60 97 -38% Total Product Revenues 1,491 1,710 -13% Services Revenues 4,014 3,136 28% Energy Production 680 534 27% Total Revenues 6,186 5,380 15% Cost of Sales Products 1,050 1,212 -13% Services 2,092 1,738 20% Energy Production 469 338 39% Total Cost of Sales 3,610 3,288 10% Gross Profit 2,576$ 2,092$ 23% Gross Margin Products 30% 29% Services 48% 45% Energy Production 31% 37% Overall 42% 39% QTD Gross Margin 2024 2023 Target Overall 42% 39% >40%

Factory Move Finish fit out and get production back by Q3 Service – Foundation of the business Keep expanding the service fleet Expect 20% growth YoY Marketing Get the current projects in development closed Double the number and size of leads YoY SUMMARY AND Q&A Company Information Tecogen, Inc 76 Treble Cove Road, Building 1 North Billerica, MA 01862 www.Tecogen.com Contact information Abinand Rangesh, CEO 781.466.6487 Abinand.rangesh@Tecogen.com 13

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Tecogen (QX) (USOTC:TGEN)

過去 株価チャート

から 4 2024 まで 5 2024

Tecogen (QX) (USOTC:TGEN)

過去 株価チャート

から 5 2023 まで 5 2024