Bitcoin Miner Selloff Is Calming Down: Green Sign For Rally To Continue?

2024年10月4日 - 5:00PM

NEWSBTC

On-chain data shows the Bitcoin miner exchange inflows have been

dropping recently, a sign that may be bullish for the asset’s

price. Bitcoin Miner Exchange Inflow Has Been Declining Recently As

explained by CryptoQuant author Axel Adler Jr in a new post on X,

miners have gradually been reducing their exchange inflows

recently. “Exchange inflows” here naturally refer to transactions

heading to wallets attached to centralized exchanges from

self-custodial addresses. In the context of the current topic, the

exchange inflows made by miner-related wallets specifically are of

interest. Generally, the main reason why miners transfer to these

platforms is for selling, so large exchange inflows from them can

be a sign that these chain validators are participating in a

selloff. Related Reading: Dogecoin Crossover That Led To 90% &

180% Rallies Could Soon Form Again Miners have constant running

costs in the form of electricity bills, so selling from them is a

regular occurrence, as without it, they can’t keep their operations

going. This regular selling is usually of a scale readily absorbed

by the market, so there may be no visible negative effect on the

asset’s price. Large and sustained exchange inflows, though, can be

something to note, as they may imply unusual selling pressure from

this group. Here is the chart shared by the analyst that shows the

trend in the 30-day moving average (MA) Bitcoin miner exchange

inflows over the history of the cryptocurrency: As the above graph

shows, the 30-day MA of the Bitcoin miner exchange inflows had

plunged to pretty low in the first few months of the year but then

underwent a sharp reversal. The reason for this increase could be

that the fourth Halving occurred in April. Halvings are periodic

events about every four years that permanently cut the BTC block

subsidy in half. In the chart, the analyst has also attached the

data for the coin issuance on the network (colored in blue). From

this metric, the effect of the Halving is apparent, as miners can

suddenly only mint about half as many coins after each of these

events as before them. Related Reading: Shiba Inu Leads Whale

Frenzy: Large SHIB Transfers See Massive 360% Spike Miners make

their income through two main sources, the transaction fees and the

block subsidy, but most of the contribution generally comes from

the latter. Thus, the miners depend on the block subsidy to make

their income. After the latest Halving, the miners naturally came

under immense pressure because their revenue took a drastic hit.

The exchange inflow trend would suggest that these chain validators

had decided to sell off their reserves in response to this income

squeeze. The high inflows from the Bitcoin miners had continued for

a while, but the 30-day MA of their exchange inflow has recently

reversed, a potential sign that this cohort is finally pulling back

on their selling. If this starts a sustained trend, then the

cryptocurrency’s price might benefit from it. BTC Price Bitcoin has

retraced much of its recent recovery during the last few days, as

its price is now down to $60,300. Featured image from Dall-E,

CryptoQuant.com, chart from TradingView.com

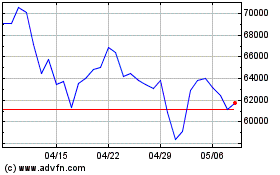

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 10 2024 まで 11 2024

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 11 2023 まで 11 2024