General Electric, AT&T Investors Reject CEO Pay Plans

2021年5月5日 - 2:23AM

Dow Jones News

By Thomas Gryta and Drew FitzGerald

Shareholders at General Electric Co. and AT&T Inc. rejected

the companies' executive compensation plans in nonbinding votes,

the latest blue-chip companies to be rebuked by investors over how

they paid leaders during the pandemic.

Nearly 58% of GE shares were voted against the board's

compensation practices, according to an initial tally announced at

the GE meeting Tuesday. Less than half of shares cast at AT&T's

annual meeting on Friday supported the telecom and media giant's

compensation plans, the company said. Neither company has disclosed

full tallies yet.

The two widely held stocks join a growing list of big U.S.

companies that have failed to garner shareholder support for their

executive compensation plans this year. Such advisory votes are

nonbinding and rarely fail to win overwhelming shareholder support.

But some institutional investors have used them this year to also

voice their displeasure with Starbucks Corp. and Walgreens Boots

Alliance Inc., among others.

Executives at both GE and AT&T received special stock awards

in 2020 that made them among the highest-paid business leaders last

year, a difficult period when the pandemic disrupted business,

tested managers and cost millions of Americans their jobs. The

median CEO received compensation of $13.7 million in 2020,

according to a Wall Street Journal analysis in April.

Larry Culp, GE's chairman and CEO, received compensation valued

by the company at $73.2 million, according to securities filings.

Over the summer, the GE board revised the CEO's contract, extending

it until 2024 and awarding him the special stock grant that was

valued at more than $100 million at the end of 2020. Mr. Culp

voluntarily gave up his salary after Covid-19 struck and also

declined his cash bonus. His salary for the year was $653,409.

The GE vote came after a campaign opposing the compensation vote

with proxy advisers Glass Lewis & Co. and Institutional

Shareholder Services recommending investors withhold their

support.

At Tuesday's meeting, lead GE director Tom Horton answered

questions about the compensation change and defended the board's

decision. At the beginning of the pandemic, it became evident that

GE's turnaround would take longer than initially planned, Mr.

Horton said, and the board moved to secure Mr. Culp's leadership

through 2024.

At the time, the board viewed the move as an extension, he said,

but also discussed how the new stock grant might be viewed as a

repricing of his performance-based goals.

"The board believed it was in GE's best interest and our

responsibility as the board to secure Larry so he can continue to

drive GE's transformation," Mr. Horton said. "If the maximum number

of shares are earned in 2024, it will mean all shareholders will

have benefited."

In its report, Glass Lewis criticized the targets and incentives

in the contract extension. "The revised award provides Mr. Culp

with the same amount of compensation in dollars for creating less

shareholder value" than his original employment agreement, the

report said.

A spokeswoman for the GE board said it would take the vote into

consideration as it evaluates its compensation program.

At AT&T, CEO John Stankey and WarnerMedia division chief

Jason Kilar collected compensation valued at $21 million and $52.2

million, respectively, during their first year on the job. Much of

Mr. Kilar's package reflected stock awards that would pay out over

several years.

Randall Stephenson, who served as AT&T chief executive until

the end of June, when Mr. Stankey took over, and was replaced as

chairman this past January, had compensation valued at $29.2

million.

AT&T said its compensation program aims to attract and keep

executive talent, though it has also relied on shareholder feedback

to draft its pay plans. "As we further engage with our owners on

this important topic, the Board will carefully consider today's

advisory vote to ensure that our approach to compensation continues

to reflect these principles," AT&T Chairman William Kennard

said in a statement.

The Dallas-based company said about 49% of shareholders voted to

approve its executive compensation but didn't disclose other

details about the vote.

Theo Francis contributed to this article.

Write to Thomas Gryta at thomas.gryta@wsj.com and Drew

FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

May 04, 2021 13:08 ET (17:08 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

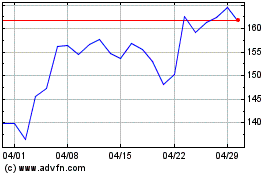

GE Aerospace (NYSE:GE)

過去 株価チャート

から 3 2024 まで 4 2024

GE Aerospace (NYSE:GE)

過去 株価チャート

から 4 2023 まで 4 2024