Canadian Dollar Appreciates On Higher Oil Prices

2021年4月16日 - 1:56PM

RTTF2

The Canadian dollar firmed against its major counterparts in the

early European session on Friday, following a rally in oil prices

as strong China and U.S. data spurred optimism about the recovery

from the pandemic.

Crude for June delivery rose $0.20 to $67.13 per barrel.

Official data showed that China's gross domestic product

expanded 18.3 percent year-on-year in the first quarter of

2021.

That was shy of estimates for a jump of 19.0 percent but was up

sharply from the 6.5 percent growth in the fourth quarter of

2020.

Industrial production was up an annual 14.1 percent in March -

missing forecasts for a gain of 17.2 percent and slowing from the

35.1 percent growth in February.

Retail sales skyrocketed 34.2 percent year-on-year in the month,

exceeding expectations for a gain of 28.0 percent and up from 33.8

percent in the previous month.

Fixed asset investment jumped an annual 25.8 percent, beating

forecasts for 25.0 percent while the jobless rate fell to 5.3

percent from 5.5 percent in February.

Better-than-expected U.S. retail sales data and a drop in

first-time claims for unemployment benefits backed hopes for a

strong economic recovery.

Oil prices were supported by improved oil demand outlook, as the

International Energy Agency raised its world oil demand estimate

for 2021.

The loonie reversed from an early 8-day low of 86.56 against the

yen, rising to 87.05. The loonie is seen finding resistance around

the 88.00 mark.

The loonie edged up to 1.2514 against the greenback, after a

fall to 1.2559 at 9:00 pm ET. Next key resistance for the loonie is

likely seen around the 1.21 level.

The loonie reached as high as 0.9677 against the aussie,

following a low of 0.9728 seen at the commencement of today's

deals. If the loonie extends rise, 0.95 is possibly seen as its

next resistance level.

After falling to a 2-day low of 1.5020 at 6:45 pm ET, the loonie

rose to 1.4973 against the euro. The next possible resistance for

the loonie is seen around the 1.48 level.

Looking ahead, Eurozone CPI for March and trade data for

February are scheduled for release in the European session.

At 8:15 am ET, Canada housing starts for March will be

published.

Canada wholesale sales for February and U.S. housing starts and

building permits for March, as well as University of Michigan's

preliminary U.S. consumer sentiment index for April are due out in

the New York session.

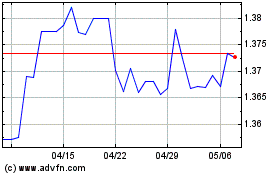

US Dollar vs CAD (FX:USDCAD)

FXチャート

から 3 2024 まで 4 2024

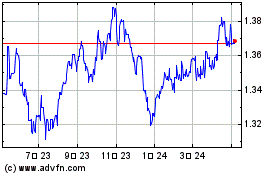

US Dollar vs CAD (FX:USDCAD)

FXチャート

から 4 2023 まで 4 2024