U.S. Dollar Spikes Up Amid Tight Race Between Trump And Biden

2020年11月4日 - 11:59AM

RTTF2

The U.S. dollar appreciated against its major counterparts in

the Asian session on Wednesday, as results from the U.S.

Presidential election showed a tight race between Donald Trump and

his Democratic rival Joe Biden in many battleground states.

Biden is currently leading the contest with 224 electoral votes,

while Trump has secured 213.

Trump won the crucial states of Ohio, Texas and Florida and is

leading in Georgia.

Hopes of a clean Democratic victory are diminishing, as Trump is

performing much better than predictions.

The final result may be delayed as mail in ballots have to be

counted.

ADP's private sector jobs report for October is due later in the

day.

The U.S. economy is expected to have added 650,000 jobs during

the month, following a gain of 749,000 jobs in September.

The greenback climbed to 1.2934 against the pound, from near a

2-week low of 1.3140 set at 7 pm ET. If the greenback rises

further, 1.28 is seen as its next resistance level.

After falling to a 1-week low of 1.1771 at 7 pm ET, the

greenback firmed to a 3-1/2-month high of 1.1603 versus the euro.

Further rally may take the greenback to a resistance around the

1.15 area.

The greenback was up against the franc, at a 2-high of 0.9196.

This followed a 6-day low of 0.9090 registered at 7 pm ET. The

greenback is likely to target resistance around the 0.94 level.

The greenback approached 105.35 against the yen, its biggest

level since October 21, and marked a 0.9 percent rise from a 5-day

low of 104.37 seen at 7 pm ET. On the upside, 108.00 is possibly

seen as its next resistance level.

Data from the Bank of Japan showed that Japan monetary base

surged 16.3 percent on year in October - coming in at 601.284

trillion yen.

That follows the 14.3 percent jump in September.

The greenback jumped to 2-day highs of 1.3279 against the loonie

and 0.6614 against the kiwi, recovering from a 2-week low of 1.3096

and a 1-1/2-month low of 0.6744, respectively seen in previous

deals. The next possible resistance for the greenback is seen

around 1.35 against the loonie and 0.645 against the kiwi.

The U.S. reached as high as 0.7049 against the aussie,

rebounding from more than a 3-week low of 0.7221 hit at 7:10 pm ET.

Next key resistance for the greenback is possibly located near the

0.68 level.

Data from the Australian Bureau of Statistics showed that

Australia retail sales fell a seasonally adjusted 1.1 percent on

month in September - coming in at A$29.157 billion.

That beat forecasts for a decline of 1.5 percent following the

4.0 percent drop in August.

Looking ahead, PMI reports from major European economies and

Eurozone PPI for September are due in the European session.

At 8:15 am ET, ADP private sector employment data for October is

scheduled for release.

U.S. and Canadian trade data for September, ISM

non-manufacturing composite index and Markit's U.S. final services

PMI for October are set for release in the New York session.

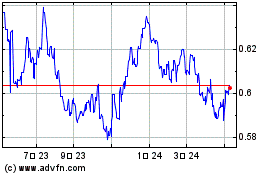

NZD vs US Dollar (FX:NZDUSD)

FXチャート

から 3 2024 まで 4 2024

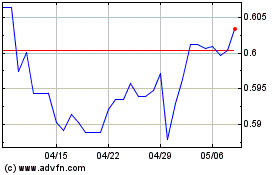

NZD vs US Dollar (FX:NZDUSD)

FXチャート

から 4 2023 まで 4 2024