Euro Advances After Strong Eurozone PMI Data

2020年11月2日 - 4:18PM

RTTF2

The euro firmed against its most major rivals in the European

session on Monday, as strong manufacturing data from Eurozone

triggered hopes of an economic rebound from the coronavirus

pandemic.

Final survey results from IHS Markit showed that the euro area

manufacturing sector gained further strength in October driven by

acceleration in production and new orders.

The manufacturing Purchasing Managers' Index rose to 54.8 in

October from 53.7 in September. The flash score was 54.4. A reading

above 50 indicates expansion in the sector.

Sentiment was further underpinned by better-than-expected China

data.

The manufacturing sector in China continued to expand in

October, and at a faster rate, the latest survey from Caixin

revealed with a manufacturing PMI score of 53.6, up from 53.0 in

September.

The euro rose to 122.15 against the yen and 1.0689 against the

franc, from its early low of 121.70 and a 3-1/2-month low of

1.0667, respectively. The currency may possibly challenge

resistance around 124.00 against the yen and 1.10 against the

franc.

After falling to a 5-week low of 1.1622 at 3:30 am ET, the euro

bounced off to 1.1651 against the greenback. The euro is poised to

locate resistance around the 1.20 level.

In contrast, the euro eased off from an early high of 0.9049

against the pound, with the pair trading at 0.9017. Should the euro

slides further, 0.88 is possibly seen as its next support

level.

Final survey results from IHS Markit showed that the UK

manufacturing sector continued to expand in October but the upturn

showed signs of losing impetus as the initial boost to growth from

the economy reopening faded and job losses accelerated.

The IHS Markit/Chartered Institute of Procurement & Supply

factory Purchasing Managers' Index fell to 53.7 in October from

54.1 in the previous month. The flash score was 53.3. A score above

50 indicates expansion.

The euro pulled back to 1.6550 against the aussie and 1.7568

versus the kiwi, from its early highs of 1.6641 and 1.7663,

respectively. The euro is seen finding support around 1.60 against

the aussie and 1.70 versus the kiwi.

The EUR/CAD pair hit 1.5486, setting a 2-week low. The next

possible support for the currency is seen around the 1.52

level.

Looking ahead, U.S. ISM manufacturing PMI for October and

construction spending for September are set for release in the New

York session.

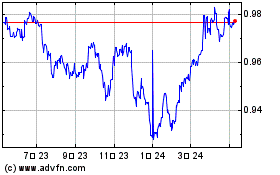

Euro vs CHF (FX:EURCHF)

FXチャート

から 3 2024 まで 4 2024

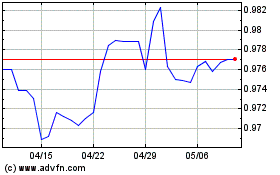

Euro vs CHF (FX:EURCHF)

FXチャート

から 4 2023 まで 4 2024