By Alexander Osipovich

Technology from the bitcoin world is coming to the

trillion-dollar plumbing that underpins the U.S. stock market.

Last week, the Securities and Exchange Commission gave the green

light to a pilot project in which blockchain -- the technology

behind cryptocurrencies -- will be used to settle trades in stocks

like General Electric Co. and AT&T Inc. Paxos, the blockchain

startup leading the project, hopes to construct a faster and

cheaper way to process stock trades, ultimately reducing costs for

Wall Street banks and investors alike.

The project will be limited to a tiny slice of the U.S. stock

market and there is no guarantee that it will succeed. Still, it

could eventually bring change to the world of clearing and

settlement, which has evolved slowly since the current system was

created in the 1970s.

Settlement is the delivery of securities from sellers to buyers,

while clearing is the process of handling trades from when they are

initially agreed upon to when they are settled. Today, the standard

time it takes to settle a stock trade is two business days -- which

is why investors must typically wait several days to get cash from

their brokers when they sell shares. Paxos's initiative is aimed at

settling trades at the end of the day in which they are agreed

upon, or even sooner.

For decades, an organization called the Depository Trust &

Clearing Corp. has had a monopoly on the clearing and settling of

equities trades in the U.S. Owned by a financial-industry

consortium, DTCC traces its roots to a 1970s effort to eliminate

paper stock certificates and replace them with electronic records.

Last year, it cleared an average of $1.3 trillion in stock trades

each day.

Now, DTCC is about to face something new: competition. On Oct.

28, the SEC issued a letter that lets Paxos set up an experimental

settlement service for stock trades. Paxos, whose other businesses

include a cryptocurrency exchange, expects to launch the service by

the end of the year. Credit Suisse Group AG and Société Générale SA

have said they would use it and Paxos hopes to bring more banks on

board.

The appeal to banks is that a faster, more efficient settlement

service could reduce costs in their stock-trading businesses, an

area where profit margins have shrunk in recent years due to

competition and declining fees.

"There has been so much innovation in the way trading happens

over the past 20 years, with people trading in microseconds, but

there hasn't really been innovation in clearing or settlement,"

Paxos Chief Executive Charles Cascarilla said in an interview.

DTCC says it welcomes the competition. "That kind of innovation

is helpful for the industry," said Michael McClain, the head of its

equities clearing and settlement business. DTCC says it has

modernized its processes, studied blockchain technology and shifted

the U.S. stock market from three-day to two-day settlement in

2017.

That two-day delay comes with various costs. Banks collectively

set aside tens of billions of dollars in capital to cover the risk

that firms elsewhere in DTCC's network will fail before the trades

settle.

There are also separate systems at each big bank, as well as at

DTCC itself, that track what different market participants are

expected to pay or deliver at settlement time. Bankers say this is

inefficient and results in errors when systems disagree with each

other.

"We are constantly reconciling that data," said Jeffrey Rosen, a

New York-based managing director at Société Générale. "That is

hugely expensive. While we've built tools to do it efficiently, it

would be better not to do it."

Paxos's goal is to eliminate these redundant systems by creating

a unified record of trading obligations using blockchain

technology. A blockchain is essentially a database with many copies

distributed across the internet that constantly communicate with

each other to ensure the data doesn't get garbled or hacked.

With cryptocurrencies, the blockchain records who holds how many

coins at any time and it supports the transfer of coins from one

person to another. Similarly, Paxos's planned blockchain would let

banks exchange digital representations of cash and securities to

settle trades with each other.

It would also allow settlement in less than two days. Paxos

plans to give participating banks the option of next-day or

same-day settlement, or perhaps even to settle trades multiple

times a day, Mr. Cascarilla said.

The SEC has put significant limits on Paxos's experiment. Only

about 140 of the most actively traded, least volatile stocks, like

Exxon Mobil Corp. and Bank of America Corp., are eligible for the

project. The number of trades Paxos can settle will also be capped

at 1% of average daily trading volume of those stocks, according to

the SEC's letter.

Moreover, the electronic records that officially record stock

ownership won't leave DTCC but will instead be housed in Paxos's

account at DTCC. So while Paxos's blockchain is recording transfers

of stocks between the participating banks, the stocks will stay

within the existing system -- a measure that will limit disruptions

to the market's plumbing.

Still, proponents say the project offers a blueprint for a

next-generation approach to clearing and settlement.

"There's an enormous amount of capital trapped in the system to

make sure clearing can take place," said Eric Noll, the former CEO

of brokerage Convergex and an adviser to Paxos. "The day you can

clear a trade instantaneously, or near instantaneously, the need

for that capital to be tied up goes away. That should ultimately

lead to lower costs for investors."

To receive our Markets newsletter every morning in your inbox,

click here.

Write to Alexander Osipovich at

alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

November 07, 2019 08:14 ET (13:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

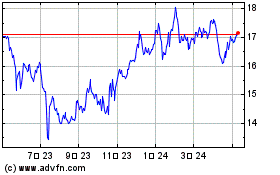

AT&T (NYSE:T)

過去 株価チャート

から 3 2024 まで 4 2024

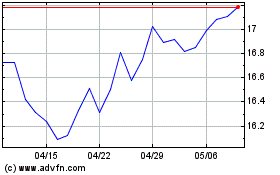

AT&T (NYSE:T)

過去 株価チャート

から 4 2023 まで 4 2024