By William Watts and Chris Matthews, MarketWatch

Qualcomm shares slump in heavy premarket trade

Stock-index futures pointed to a flat start for Wall Street

Thursday, a day after equities sank in apparent response to Federal

Reserve Chairman Jerome Powell's failure to affirm market

expectations the next move in rates would be a cut.

The flow of corporate earnings also continues as investors also

look ahead to economic data, including April jobs figures due on

Friday.

What are major indexes doing?

Dow Jones Industrial Average futures fell 10 points, or less

than 0.1%, to 26,380, while S&P 500 futures gained 1.65 points,

or less than 0.1%, to 2,924.75. Nasdaq-100 futures were up 12.5

points, or 0.2%, to 7,769.

What's driving the market?

Stocks turned lower on Wednesday, with the S&P 500 falling

22.10 points, or 0.8%, to close at 2,923.73 for its biggest one-day

drop since March 22. The Dow fell 162.77 points, or 0.6%, to end at

26,430.14, while the Nasdaq Composite fell 45.75 points, or 0.6%,

to finish at 8,049.64.

The turn lower by equities on Wednesday came after Powell, in a

news conference, described below-target inflation readings as

"transitory"

(http://www.marketwatch.com/story/fed-sticks-with-patient-policy-notes-weaker-core-inflation-2019-05-01)

and gave no indication the central bank is in a hurry to cut

interest rates.

Powell's position appeared to disappoint investors. Fed funds

futures had reflected -- just before Powell's news conference -- a

more than 60% chance that the Fed's cut rates before year-end, as

of Thursday morning, that probability had fallen to 49.9%,

according to CME Group.

Read:Economist Mohamed El-Erian: When central banks don't

understand the markets, watch out

(http://www.marketwatch.com/story/when-central-banks-dont-understand-the-markets-watch-out-warns-economist-mohamed-el-erian-2019-05-02)

U.S.-China trade talks are again getting the attention of market

participants, after Politico

(https://www.politico.com/story/2019/05/01/us-china-deal-tariffs-1400007)

and CNBC reported that the two sides are nearing a deal, with an

announcement possible as soon as next Friday

(https://www.cnbc.com/2019/05/01/trump-news-us-china-trade-deal-possible-by-next-friday.html).

The Wall Street Journal, however, reported Wednesday evening

(https://www.wsj.com/articles/u-s-china-conclude-productive-trade-talks-but-sticking-points-remain-11556718515)

that sticking points remain, including U.S. objections to Chinese

subsidies to domestic businesses.

Read:Powell's press conference draws rave reviews for simplicity

of Fed's message

(http://www.marketwatch.com/story/powells-press-conference-draws-rave-reviews-for-simplicity-of-the-feds-message-2019-05-01)

What stocks are in focus?

First-quarter corporate results continue to flood in.

Shares of chip maker Qualcomm Inc. (QCOM) fell 1.6% in premarket

trade, despite the company topping estimates

(http://www.marketwatch.com/story/qualcomm-stock-slides-after-earnings-apple-settlement-to-add-nearly-5-billion-2019-05-01)

for the quarter in a Wednesday evening earnings release.

Opinion:Apple deal doesn't solve Qualcomm's problems

(http://www.marketwatch.com/story/apple-deal-doesnt-solve-qualcomms-problems-2019-05-01)

(http://www.marketwatch.com/story/apple-deal-doesnt-solve-qualcomms-problems-2019-05-01)Shares

of Dow Inc. (DOW) may be in focus after reporting first-quarter net

sales that fell 10% from a year ago but remained above the

consensus forecast

(http://www.marketwatch.com/story/dow-revenue-falls-less-than-expected-sees-discrete-headwinds-in-second-quarter-2019-05-02).

3M Co. (MMM) announced Thursday a deal to buy privately held

wound-care company Acelity Inc. in a deal valued at $6.7 billion

(http://www.marketwatch.com/story/3m-to-buy-acelity-in-a-67-billion-deal-including-debt-2019-05-02),

including debt.

Shares of Under Armour Inc. (UAA) rallied 5.7% in premarket

trade, after the athletic brand reported earnings and revenue that

beat expectations and raised full-year guidance.

Shares of DowDuPont Inc. (DWDP) fell 0.5% before the bell

Thursday, after the chemical giant reported falling profits and

sales numbers

(http://www.marketwatch.com/story/dowdupont-profit-matches-views-sales-fall-short-2019-05-02)

that fell short of Wall Street expectations.

Caterpillar Inc. (CAT) said Thursday that it would raise its

quarterly cash dividend

(http://www.marketwatch.com/story/caterpillar-to-raise-quarterly-dividend-by-20-as-part-of-plan-to-return-cash-to-investors-2019-05-02)

by 20% to $1.03 per shares. The stock rose 0.8% in premarket

trade.

Shares of Square Inc. (SQ) were down 4.3% in off-hours trade

after the company reported Wednesday evening

(http://www.marketwatch.com/story/square-stock-falls-after-outlook-volume-come-up-short-2019-05-01)

that payment volume in the first quarter fell short of analysts

estimates, even as the company surpassed earnings and revenue

forecasts.

Wayfair Inc. (W) stock tumbled 4.6% in premarket trade, after

the online home furnishings retailer reported a wider-than-expected

first-quarter loss

(http://www.marketwatch.com/story/wafairs-stock-falls-after-losses-widen-more-than-expected-2019-05-02),

while revenue came in just above forecasts.

Shares of Dunkin' Brands Inc. (DNKN) rallied 4.7% before the

bell Thursday, after the chain restaurant company reported

same-store sales growth

(http://www.marketwatch.com/story/dunkin-brands-shares-up-25-premarket-as-earnings-top-estimates-2019-05-02)

that easily beat Wall Street forecasts.

Shares of Avon Products, Inc. (AVP) retreated 3.2% in premarket

action after the beauty-products firm reported widening losses

(http://www.marketwatch.com/story/avon-adjusted-profit-beats-estimates-as-revenue-falls-short-2019-05-02)

in the first-quarter and revenue that fell short of analysts

forecasts.

What are analysts saying?

"Central bankers always describe inflation, whether it be rising

or falling as 'transitory,' and it was never a realistic

probability that the Fed would open the door to the prospect of

rate cuts when wage growth is above 3% and yesterday's ADP payrolls

report for April added another 275,000 new jobs," said Michael

Hewson, chief market analyst at CMC Markets UK, in a note. "This

suggests that whatever one thinks of the U.S. labor market it is

nowhere near as tight as some might suggest."

What's on the economic calendar?

Traders will turn their attention Thursday to reports on weekly

jobless claims, productivity growth and unit labor costs, due at

8:30 a.m. Eastern Time, which will give clues to the state of the

labor market, and whether rising, but still moderate, wage

inflation can continue to grow with limited impact on corporate

profit margins.

Productivity growth indicates that companies are producing more

goods and services per worker hour, which can enable companies to

offer higher pay without accepting lower profits.

Economists polled by MarketWatch expect new applications for

unemployment insurance to fall from to 215,0000 in the week ended

April 27, from 230,000 the week prior, while they predict labor

force productivity to grow at 3.7% in the first quarter, and for

unit labor costs to fall by 0.2%.

At 10 a.m., The Commerce Department will release data on factory

orders for the month of March, with economists expecting to see a

1.7% increase.

(END) Dow Jones Newswires

May 02, 2019 08:28 ET (12:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

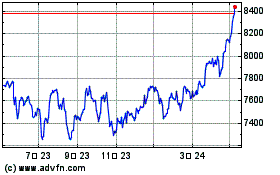

FTSE 100

指数チャート

から 3 2024 まで 4 2024

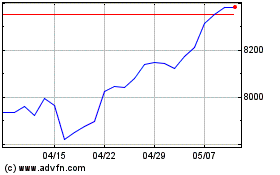

FTSE 100

指数チャート

から 4 2023 まで 4 2024