Crypto Market Rebounds But No Major Recovery in Sight: Factors and Trends

2018年12月5日 - 7:12PM

ADVFN Crypto NewsWire

Throughout the past 24 hours, the crypto market has slightly

rebounded by around $3 billion, from $123 billion to $125

billion.

Bitcoin (BTC) has avoided a potential decline to the

low region of $3,600, as it stabilized at around $3,850. It reached

its daily low at $3,800 but rebounded by a small margin.

Other major cryptocurrencies apart from Bitcoin have recorded

fairly large losses against the U.S. dollar throughout the past two

days. Ethereum (ETH), Stellar (XLM), and Bitcoin Cash (BCH) demonstrated losses in the range of

1.5 to 8 percent on the day.

Since November 29, within seven days, the Bitcoin Cash price has dropped from $200 to $142, by

more than 29 percent. While the asset did not experience a large

single-day drop, it continued to lose its value against both

Bitcoin and the U.S. dollar over the past week.

What is Happening to Bitcoin?

Subsequent to achieving a new yearly low at $3,456 on

November 25, the Bitcoin price has struggled to show

any sign of a major short-term reversal or a corrective rally.

A cryptocurrency technical analyst known as “The Crypto Dog”

stated that a clearly defined range between $3,500 and $4,500 range

has been established by the dominant cryptocurrency, and the

probability of the asset maintaining that range has increased.

The analyst emphasized that currently, bears remain in control

of the market, explaining:

“Following the November sell off into the low $3,000s, BTC has

now carved out a clearly defined range between $3,500 and $4,500. A

consolidation event following a strong move is more likely to

result in a continuation than reversal. That means currently the

bears are in control.”

Based on the oversold conditions of major cryptocurrency assets

in the global market and the exhaustion the market has shown

throughout November, the analyst added that the market could be

going through the final stage of the bear market.

“It is my opinion that Bitcoin is in the final stages of this

bear market. I expect the price to range between an absolute low of

$2000 to an absolute high of $6,200 (more likely, $3000-5400) for a

substantial period of time,” the analyst said cautiously, saying

that a several-month-long accumulation period will likely follow

the bottom.

Companies Struggling

Many companies in the cryptocurrency sector have started to

downsize and adjust to market conditions. Even ConsenSys, the largest software development company in

the blockchain sector, has announced its plans to realign its

long-term strategy and vision to focus on delivering real products

and results.

“ConsenSys 2.0 requires us to evaluate our endeavors more

rigorously. We will seek to run leaner projects because often

better decisions are made in a context of more constrained

resources. Scarcity sharpens the senses and forces discernment in

decision making. Lush plentitude, while perhaps a noble goal in

many circumstances, should be hard won; otherwise it leads to

complacency and dull-wittedness.”

If an increasing number of companies move beyond hype to

focusing on the development of real products that can garner stable

user bases, it could provide a strong foundation to support the

next wave of crypto.

Source:

CCN

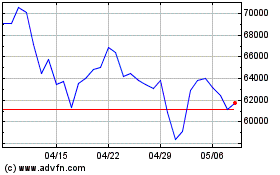

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 3 2024 まで 4 2024

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 4 2023 まで 4 2024