Dollar Mixed After U.S. Consumer Inflation

2018年11月14日 - 6:50PM

RTTF2

The U.S. dollar came in mixed against its major counterparts in

the European session on Wednesday, after a report showed that U.S.

consumer prices increased in line with economist expectations for

October.

Data from the Labor Department showed that U.S. consumer price

index rose by 0.3 percent in October after inching up by 0.1

percent in September. Economists had expected prices to climb by

0.3 percent.

Excluding food and energy prices, core consumer prices edged up

by 0.2 percent in October after creeping up by 0.1 percent in

September. The uptick in core prices also matched expectations.

The annual rate of consumer price growth accelerated to 2.5

percent in October from 2.3 percent in September, while the annual

rate of core consumer price growth slowed to 2.1 percent from 2.2

percent.

Sentiment dampened as weak GDP data from Japan and Germany

spurred concerns about sluggish global economic growth.

Mixed data out of China, the steepest drop in oil prices in more

than three years and lingering concerns surrounding Italy also

weighed on sentiment.

The currency was lower against its major counterparts in the

Asian session, barring the yen.

The greenback retreated to 1.2984 against the pound, from a high

of 1.2886 hit at 6:15 am ET. The greenback is poised to find

support around the 1.31 level.

Data from the Office for National Statistics showed that U.K.

inflation remained unchanged in October, defying expectations for a

modest increase.

The consumer price index rose 2.4 percent year-on-year, same as

in September. Economists had expected a modest acceleration in the

inflation figure to 2.5 percent.

The greenback fell back to 1.1311 against the euro, just few

pips short of a 4-day low of 1.1321 set at 6:00 pm ET. The

greenback is likely to challenge support around the 1.15 level.

Preliminary figures from the Federal Statistical Office showed

that Germany's economy contracted at a faster-than-expected pace in

the third quarter.

Gross domestic product declined a seasonally and

calendar-adjusted 0.2 percent in the three months to September,

after expanding 0.5 percent in the second quarter. Economists had

forecast a 0.1 percent drop.

The greenback eased back to 1.0080 against the franc, pulling

away from a high of 1.0104 touched at 5:45 am ET. The currency had

set a 4-day low of 1.0058 at 7:00 pm ET. The next possible support

for the greenback is seen around the 0.99 level.

The greenback was trading higher at 113.97 against the yen, up

from a low of 113.76 touched at 6:00 pm ET. The greenback is seen

finding resistance around the 115.00 mark.

At 10:00 am ET, Federal Reserve Governor Randal Quarles will

testify on banking supervision and regulation before the House

Financial Services Committee in Washington DC.

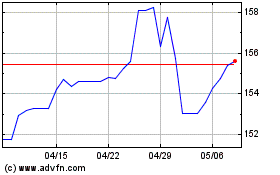

US Dollar vs Yen (FX:USDJPY)

FXチャート

から 3 2024 まで 4 2024

US Dollar vs Yen (FX:USDJPY)

FXチャート

から 4 2023 まで 4 2024