Capitalising crypto

2018年11月7日 - 9:48PM

ADVFN Crypto NewsWire

The Swiss Financial Market Supervisory Authority (FINMA) is,

according to this story from swissinfo.ch,

advising banks and dealers that crypto-assets should be assigned a

flat risk-weighting of 800 per cent.

We got in touch with FINMA, which said:

“We are working at

international level in the Basel Committee on the development of an

international standard.”

It added that it will “look again at this calibration when an

international consensus is reached in Basel”.

Risk-weightings are co-ordinated by the Basel Committee, an

international forum for central banks, which is set to meet in late

November. They are used to calculate the amount of capital a bank

needs in relation to the composition of its assets.

Some assets, such as sovereign debt, have a zero risk-weight,

meaning they theoretically (and controversially) require no capital

at all. Assets that are perceived to be riskier have higher risk

weightings.

The logic behind all this is that regulators want banks with

greater exposure to risky assets to have higher levels of capital

(in other words, less “leverage”, effectively), so they are greater

able to withstand losses.

800 per cent sounds high, because it is high (swissinfo.ch cites

a letter, rather than any official position). But there are higher

exposures already built into existing regulations. Some equity

tranches of securitisations, for example, have risk weightings of

1250 per cent in Europe, though these are not directly comparable

kinds of assets.

A spokesperson for FINMA said:

FINMA has chosen a

conservative approach in this area due to

the comparatively high volatilities of the underlying

assets. It should be noted, however, that certain countries are

taking an even more conservative approach.

The Swiss regulator has also, according to the report, said that

cryptocurrencies cannot count towards a bank's liquidity ratio — a

separate regulation which is designed to ensure banks have enough

liquid assets, from cash to treasuries to covered bonds. This is

one way of thinking about what constitutes money, which is part of

the whole crypto debate.

This risk-weighting approach is often subject to claims that the

weightings diverge from reality, or are used to technocratically

mediate certain policy goals. For example, some might argue that

generous risk-weights on mortgages reinforce the social norm of

highly leveraged home ownership. Others say excessive risk-weights

on securitisations have crippled the industry over the past decade.

And so on. Expect more of these from the crypto community.

There are two (non-mutually exclusive) interpretations of the

application of risk-weightings. It might consolidate the view that

cryptocurrencies are dangerously risky. Perhaps more importantly,

it signals a further degree of integration into the underlying

plumbing of finance.

Source:

Financial Times

By:

Thomas Hale

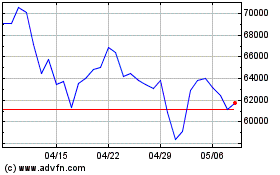

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 3 2024 まで 4 2024

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 4 2023 まで 4 2024