EUROPE MARKETS: Europe Stocks Back In The Green, Boosted By Major Oil Companies

2018年9月25日 - 11:29PM

Dow Jones News

By Barbara Kollmeyer, MarketWatch

Next jumps on earnings, BMW weighs on auto makers after profit

warning

Europe's main stock gauge returned to the black on Tuesday,

after a weaker start to the week as major oil companies climbed on

an extended run for crude prices and investors looked ahead to the

start of the Federal Open Market Committee meeting.

What are markets doing?

The Stoxx Europe 600 was up 0.4% to 383.83, after a six-session

win streak came to a halt with a loss of 0.6% on Monday

(http://www.marketwatch.com/story/european-stocks-rise-led-by-surge-for-biotech-galapagos-2018-09-12).

Germany's DAX 30 added 0.3% to 12,384.18, while France's CAC 40

gained 0.2% to 5,487.76. The U.K.'s FTSE 100 rose 0.5% to

7,493.81.

The euro firmed up to $1.1761

(http://www.marketwatch.com/story/us-dollar-struggles-for-direction-ahead-of-fed-rate-hike-2018-09-25)

versus $1.1749 late Monday, while the pound traded at $1.3163, up

from $1.3119 late Monday.

What is driving the market?

A big driver for Europe was Brent oil which extended four-year

highs

(http://www.marketwatch.com/story/brent-oil-extends-climb-to-4-year-high-while-us-crude-set-for-longest-streak-of-gains-in-2-months-2018-09-25)

from Monday. Looming U.S. sanctions on Iran have been a support for

prices, while over the weekend, major oil producers showed no sign

of boosting production, despite pressure from U.S. President Donald

Trump.

Need to know:All this bullishness over oil may be headed over a

cliff

(http://www.marketwatch.com/story/why-100-oil-may-be-bad-news-for-the-bulls-analyst-2018-09-25)

There was some optimism surrounding the Italian budget proposal,

due to be presented by the country's government this week. There

had been concerns that the budget could spark tensions between its

politicians and the European Union

(http://www.marketwatch.com/story/what-the-market-will-watch-for-in-italys-crucial-budget-proposal-in-the-coming-week-2018-09-21).

And that could be a risk factor for the euro, which got knocked

down from a session high of $1.1775 after European Central Bank

chief economist Peter Praet played down Monday's euro-moving

comments from ECB President Mario Draghi. The euro rose Monday

after Draghi said underlying eurozone inflation should

strengthen.

Otherwise, investors were largely focused on a two-day Federal

Reserve meeting that concludes Thursday. The Fed is expected to

deliver a 25-basis-point interest rate increase.

Read:10-year Treasury yield rises above 3.10% ahead of Fed

decision

(http://www.marketwatch.com/story/10-year-treasury-yield-rises-above-310-ahead-of-fed-decision-2018-09-25)

What are strategists saying?

Among the oil gainers, BP PLC (BP.LN) "(BP.LN) shot up 2.3%,

Total SA (TOT) (TOT) rose 1.5% and Royal Dutch Shell PLC

(RDSA.LN)(RDSA.LN) rose 2%.

Next PLC (NXT.LN) shot up nearly 10%, a top gainer for the Stoxx

Europe 600 as the retailer posted a healthy profit rise and

better-than-expected sales in August

(http://www.marketwatch.com/story/next-lifts-full-year-profit-guidance-2018-09-25).

On the other end, BMW AG (BMW.XE) slumped 5% and was a top

decliner as the German auto maker cut its profit view, blaming new

testing regulations in Europe and trade worries.

(http://www.marketwatch.com/story/bmw-cuts-profit-view-as-regulations-trade-bite-2018-09-25)

(http://www.marketwatch.com/story/bmw-cuts-profit-view-as-regulations-trade-bite-2018-09-25)BMW's

losses weighed on other German auto makers, with Daimler AG

(DAI.XE) down 1.8% and Volkswagen AG (VOW.XE) off over 4%.

(END) Dow Jones Newswires

September 25, 2018 10:14 ET (14:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

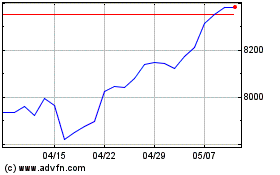

FTSE 100

指数チャート

から 3 2024 まで 4 2024

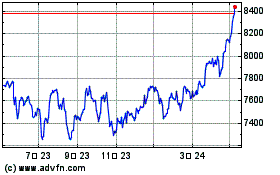

FTSE 100

指数チャート

から 4 2023 まで 4 2024