EUROPE MARKETS: Deal News Lifts Sky, Randgold, But Trade Worries Weigh On Europe's Stock Index

2018年9月24日 - 9:21PM

Dow Jones News

By Barbara Kollmeyer, MarketWatch

Pound climbs on Brexit developments

European stocks fell across the board on Monday, with banks and

mining stocks leading the downdraft as trade worries resumed.

Meanwhile, deal news for Sky PLC and Randgold Resources Ltd. made

those the top stock gainers among Stoxx Europe 600 benchmark.

What are markets doing?

The Stoxx Europe 600 slipped 0.3% to 383.30, after Friday's gain

of 0.4%

(http://www.marketwatch.com/story/europe-stocks-poised-for-best-week-since-july-lifted-by-global-rally-2018-09-21).

Last week was also the best weekly gain since March for the

pan-European gauge, which rose 1.7%.

Germany's DAX 30 fell 0.4% to 20,558.67, while France's CAC 40

slipped 0.2% to 5,480.89 and the U.K.'s FTSE 100 slipped 0.2% to

7,471.62.

The euro was changing hands at $1.1748, virtually unchanged from

late Friday in New York, while the pound strengthened to $1.3111

from $1.3080.

Need to know: Time to load up on gold? 'Do the math'

(http://www.marketwatch.com/story/time-to-load-up-on-gold-do-the-math-2018-09-24)

What is driving the market?

Last week was a strong one, but not just for Europe as China

stocks logged their best week in over two years and the Dow Jones

Industrial Average posted its biggest weekly percentage gain

(http://www.marketwatch.com/story/dow-set-for-best-week-since-july-as-stock-futures-imply-deeper-push-into-record-territory-2018-09-21)

since July. A grind higher for markets over the past several weeks

has come against upbeat U.S. economic data that have allowed

investors to ignore intensifying trade tensions.

Read:Perma-bear Albert Edwards warns stocks have 'drunk the

Kool-Aid' as recession looms

(http://www.marketwatch.com/story/perma-bear-albert-edwards-warns-stocks-are-drunk-on-kool-aid-as-recession-looms-2018-09-22)

But on Monday, the latter was back in the headlines as U.S.

tariffs of 10% on $200 billion of Chinese goods kicked in, to which

China has retaliated with taxes of on $60 billion worth of U.S.

imports. Potentially kicking off a fresh war of words, China

accused the U.S. of "trade bullyism"

(http://www.marketwatch.com/story/china-accuses-us-of-trade-bullyism-as-200-billion-in-tariffs-kick-in-2018-09-24)

and trying to intimidate it and other countries via tariffs in a

policy paper published through the state news agency Xinhua.

The pound rose after U.K. Brexit Secretary Dominic Raab

dismissed the idea that Prime Minister Theresa May may call a

general election in the autumn to salvage her Brexit plan that was

rejected by European Union leaders at a summit next week. He said

negotiations would go on for her plan in an interview on Sunday,

according to reports

(https://www.theguardian.com/politics/2018/sep/23/dominic-raab-rules-out-snap-general-election-to-save-mays-brexit-plan).

The pound was pressured late last week as May spoke of a

"no-deal" Brexit. Investors will also be watching the Conservative

Party conference this week for Brexit-related comments.

On the data front, the Ifo business climate index showed that

German business sentiment slipped in September.

Stock movers

Sky PLC (SKY.LN) surged 8.7% for the Stoxx Europe's top gainer

after U.S.-based Comcast Corp. (CMCSA) said it would pay 17.28

pounds ($22.60 a share) for Europe's biggest pay-TV group. Comcast

beat back a combined Walt Disney Co. and 21st Century Fox bid in a

blind auction on Saturday

(https://www.wsj.com/articles/comcasts-sky-high-bid-to-go-global-1537708890?mod=searchresults&page=1&pos=5).

Randgold Resources Ltd. (RRS.LN) (RRS.LN) climbed 5.8% after

announcing an all-share merger deal

(http://www.marketwatch.com/story/randgold-barrick-gold-to-create-183b-company-2018-09-24)

with Canada-based Barrick Gold Corp. (ABX.T) (ABX.T) to create an

$18.3-billion gold-mining giant.

Climbing crude prices underpinned oil stocks, which was the

leading sector in Europe for Monday. Total SA (TOT)(TOT) also

getting a lift, up 1.4%, after reporting a major gas find offshore

U.K

(http://www.marketwatch.com/story/total-makes-major-gas-find-offshore-uk-2018-09-24).

BP PLC (BP.LN) (BP.LN) rising over 1% and Lundin Petroleum AB

(LUPE.SK) up over 3%.

What are strategists saying?

"This is just the latest in a series of U.S. takeovers for U.K.

companies, with the devaluation in sterling helping drive bargain

basement shopping for U.K. firms," said Joshua Mahony, market

analyst at IG, in a note to clients, referencing the Sky/Comcast

tie-up. " Despite fears over the impact of Brexit, there is clearly

sufficient confidence in U.K. firms to grab a bargain as seen with

the purchase of Costa coffee by Coca-Cola."

"No fewer than 10 of the firms who were part of the FTSE 100 at

the start of the year have since been acquired, received a bid,

been involved in a merger, proposed a demerger or made a huge

acquisition. The past year to be this busy was 2007," said Russ

Mould, AJ Bell Investment Director, in a note to clients.

"The fact that the pros are buying gold and the punters are

selling it is interesting--and could suggest that Barrick and

Randgold Resources are positioning themselves for an upturn in gold

by getting leaner and meaner, even if skeptics of the deal will

argue it is a defensive measure prompted by necessity and lean

times for their main product," he added.

(END) Dow Jones Newswires

September 24, 2018 08:06 ET (12:06 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

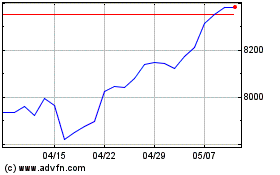

FTSE 100

指数チャート

から 3 2024 まで 4 2024

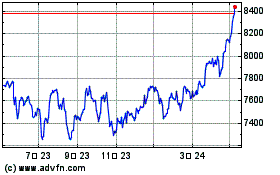

FTSE 100

指数チャート

から 4 2023 まで 4 2024