Euro Lower As Eurozone Private Sector Growth Slows As Estimated

The euro was lower against its major counterparts in the

European session on Friday, after a data showed that euro area

private sector growth eased in July, ceding most of the momentum

gained in the prior survey month.

Data from IHS Markit showed that the composite output index fell

to 54.3 in July, in line with flash estimate, from 54.9 in

June.

The services Purchasing Managers' Index dropped to 54.2 from

55.2 in June. The flash score was 54.4.

Germany's final composite PMI came in at 55.0, up from 54.8 in

June but below the flash 55.2. At the same time, the services PMI

declined to 54.1 from 54.5 a month ago. The flash reading was

54.4.

Meanwhile, data from Eurostat showed that Eurozone retail sales

increased for the second straight month in June.

Retail sales grew at a steady pace of 0.3 percent on month in

June driven by food sales. Sales were expected to climb 0.4

percent.

Investors looked ahead to the release of the U.S. jobs data for

July later in the day, with economists expecting employment to

increase by 190,000 jobs in the month. The jobless rate is expected

to edge down to 3.9 percent.

The currency held steady against its major counterparts in the

Asian session.

The euro weakened to 1.1562 against the greenback, its lowest

since June 29. Next key support for the euro is likely seen around

the 1.14 level.

The single currency slipped to a weekly low of 129.21 against

the yen, while touching 1.1519 against the franc, which was its

lowest since June 28. The euro is seen finding support around

128.00 against the yen and 1.14 against the franc.

The 19-nation currency retreated to 0.8896 against the British

pound, from a high of 0.8919 touched at 3:30 am ET. The next likely

support for the euro is seen around the 0.88 level.

Survey data from IHS Markit showed that British service sector

growth eased more-than-expected in July to the weakest level in

three months.

The IHS Markit/Chartered Institute of Procurement & Supply

Purchasing Managers' Index dropped to 53.5 in July from 55.1 in

June. The index was forecast to drop to 54.7.

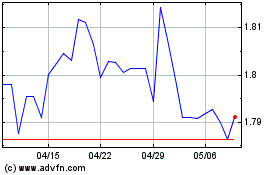

The euro weakened to 1.7179 against the kiwi, from a 10-day high

of 1.7228 hit at 3:30 am ET. On the downside, 1.70 is possibly seen

as the next support level for the euro.

The common currency slipped to more than a 2-month low of 1.5066

against the loonie, after rising to 1.5094 at 5:30 pm ET. If the

euro falls further, 1.49 is likely seen as its next support

level.

The euro fell back to 1.5723 against the aussie, heading to

pierce a weekly low of 1.5720 hit at 9:30 pm ET. The euro is likely

to challenge support around the 1.55 level.

Looking ahead, U.S. jobs data and ISM non-manufacturing

composite PMI for July and trade data for June, as well as Canadian

trade data for the same month are scheduled for release in the New

York session.

Euro vs NZD (FX:EURNZD)

FXチャート

から 3 2024 まで 4 2024

Euro vs NZD (FX:EURNZD)

FXチャート

から 4 2023 まで 4 2024