EUROPE MARKETS: European Stocks Run Into The Red As Wall Street Sets Course For Pullback

2018年2月13日 - 7:27PM

Dow Jones News

By Carla Mozee, MarketWatch

Advances for miners, travel companies fail to lift Stoxx 600 out

of the red

European stocks fell Tuesday, as advances for mining and travel

shares weren't enough to guide the market toward a second

consecutive win.

How markets are moving

The Stoxx Europe 600 index shed 0.1% to 372.62, with the telecom

and technology groups losing the most. But the basic materials and

consumer services sectors were moving higher. On Monday, the

benchmark climbed 1.2%

(http://www.marketwatch.com/story/european-stocks-bounce-back-after-biggest-weekly-drop-in-a-year-2018-02-12),

the first win in three sessions.

Germany's DAX 30 index fell 0.3% to 12,245.82, and France's CAC

40 index slipped 0.1% to 5,132.10. The U.K.'s FTSE 100 was up 0.2%

to 7,191.24.

The euro bought $1.2326, up from $1.2393 late Monday in New

York.

What's driving the market

The volatility that's been shoving major stocks markets into

correction territory was creeping back into the European markets,

indicating that investors are still wrestling with concerns about

rising inflation and higher bond yields.

U.S. stocks climbed Monday, but that was followed up in Asia

with Japan's Nikkei Average falling while Hong Kong stocks surged

1.3%. Ahead of Wall Street's open on Tuesday

(http://www.marketwatch.com/story/third-straight-win-for-us-stocks-in-doubt-as-dow-futures-tumble-more-than-100-points-2018-02-13),

U.S. stocks were pulling back, with Dow futures dropping nearly 100

points.

But gains for metals prices such as copper and gold helped lift

up shares of European-listed mining companies. Metals prices

denominated in dollars found strength on the back of a softening in

the U.S. dollar

(http://www.marketwatch.com/story/dollar-slides-vs-yen-as-investors-weigh-up-recent-stock-gains-2018-02-13)

.

What strategists are saying

"European markets are failing to follow through on yesterday's

bounce and a decent performance overnight in Asia," said Neil

Wilson, senior market analyst at ETX Capital, in a note. "A lack of

volume yesterday on Wall Street suggests there is not a huge amount

of interest in this recovery just yet and may be a signal that this

is not a reversal in a secondary downtrend."

Stock movers

TUI AG climbed 3% after the vacation services company posted a

narrower net loss of 99.6 million euros ($112.7 million) for the

first quarter and backed its full-year guidance

(http://www.marketwatch.com/story/tui-narrows-net-loss-backs-2019-guidance-2018-02-13)

In the mining group, Anglo American PLC (AAL.LN) rose 1.4% and

Glencore PLC (GLEN.LN) moved up 1%.

Kering SA shares (KER.FR) fell 1.2% even as the French parent of

luxury goods maker Gucci posted net profit for 2017 that more than

doubled from a year earlier,

(http://www.marketwatch.com/story/kering-profit-lifted-by-gucci-yves-saint-laurent-2018-02-13)

to 1.79 billion euros ($2.20 billion).

Economic data

In the U.K., a reading on January inflation showed annual

inflation remained at 3% in January, compared with estimated

reading of 2.9%. Inflation is well above the Bank of England's

target of 2%.

Read:A U.K. rate rise in May? Analysts digest hawkish surprise

from BOE

(http://www.marketwatch.com/story/a-uk-rate-rise-in-may-analysts-digest-hawkish-surprise-from-boe-2018-02-08)

(END) Dow Jones Newswires

February 13, 2018 05:12 ET (10:12 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

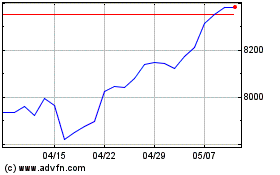

FTSE 100

指数チャート

から 3 2024 まで 4 2024

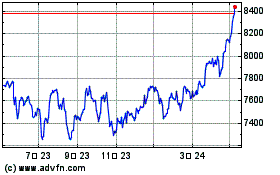

FTSE 100

指数チャート

から 4 2023 まで 4 2024