Eurozone Private Sector Logs Fastest Growth In Nearly 12 Years

2018年1月24日 - 4:30PM

RTTF2

Eurozone private sector activity expanded at the fastest pace in

nearly 12 years in January driven by an acceleration in the service

sector, flash data from IHS Markit showed Wednesday.

The composite output index rose unexpectedly to 58.6 from 58.1

in December. The expected reading was 57.9. This was the highest

since June 2006.

An acceleration of service sector growth to the fastest since

August 2007 was partly countered by a slowdown in manufacturing

output growth.

The services Purchasing Managers' Index came in at 57.6, up from

56.6 in December. The reading was expected to fall to 56.4 in

January.

By contrast, the factory PMI declined to 59.6 from 60.6 in

December, while it was forecast to ease to 60.3.

The acceleration of growth pushes the survey data into territory

consistent with the economy expanding at a super-strong quarterly

rate approaching 1 percent, Chris Williamson, chief business

economist at IHS Markit said.

Data showed that activity was buoyed by a further marked and

broad-based increase in new business. January's inflows of new

orders were the second-largest since July 2007, reflecting a

further improvement in demand for both goods and services.

Companies grew more optimistic about the outlook for the year

ahead in January, with business expectations reviving to an

eight-month high.

Amid strong growth of new orders and improved confidence about

the outlook, companies expanded their workforce numbers to the

greatest extent since September 2000.

Meanwhile, price pressures intensified during January, in part

reflecting improved pricing power as demand outpaced supply, as

well as rising oil prices.

Average input costs and selling prices both logged the biggest

monthly increases since April 2011, with rates of inflation

accelerating in both manufacturing and services.

By country, growth in Germany came in only slightly weaker than

December's peak and in France, the composite PMI ticked higher,

albeit down on November's peak.

Germany's composite output index dropped slightly to 58.8 from

December's 80-month high of 58.9. The expected reading was

58.5.

The quickest growth of services businesses activity since March

2011 was offset by a slower, but still-strong, increase in goods

production.

Germany's services PMI climbed unexpectedly to 57.0 from 55.8 a

month ago. Economists had forecast the indicator to fall to

55.5.

On the other hand, the factory PMI fell to 61.2 from 63.3 in

December. The score was also below the consensus of 63.0.

France's private sector growth was driven by services activity.

The composite output index came in at 59.7 in January. The score

was broadly unchanged from the prior survey period and only just

shy of November's six-and-a-half year peak of 60.3. The expected

score was 59.2.

The services PMI rose unexpectedly to 59.3 from 59.1 in

December. Economists had forecast the index to fall to 58.9.

Meanwhile, the factory PMI fell more-than-expected to 58.1 from

58.8 in December. The reading was seen at 58.6.

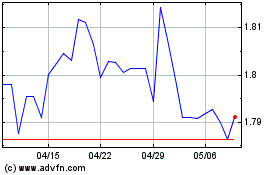

Euro vs NZD (FX:EURNZD)

FXチャート

から 3 2024 まで 4 2024

Euro vs NZD (FX:EURNZD)

FXチャート

から 4 2023 まで 4 2024