Japanese Yen Higher As Treasury Yields Surge On Fed Rate Hike Hopes

2022年1月19日 - 12:13PM

RTTF2

The Japanese yen firmed against its major counterparts in the

Asian session on Wednesday amid safe-haven status, as tech shares

slipped following a jump in treasury yields as investors worried

about an aggressive tightening of monetary policy to combat

inflation.

The benchmark yield on the 10-year treasury note touched a

2-year high of 1.88 percent.

Investors are preparing for four Fed rate hikes this year,

starting from March.

There is growing speculation that the Fed will deliver more than

a 25 basis-point rate hike in March.

The yen touched a 5-day high of 124.70 against the franc and a

fresh 2-week high of 155.40 against the pound, up from its prior

lows of 125.11 and 156.08, respectively. The currency is likely to

locate resistance around 122.00 against the franc and 154.00

against the pound.

Reversing from its previous lows of 114.79 against the

greenback, 129.99 against the euro and 82.54 against the aussie,

the yen moved up to a 2-day high of 114.21, more than 3-week high

of 129.39 and a 4-week high of 82.08, respectively. The yen is seen

finding resistance around 112.00 against the greenback, 126.00

against the euro and 80.00 against the aussie.

The yen rebounded to 91.28 against the loonie and 77.51 against

the kiwi, following its early lows of 91.84 and 77.81,

respectively. If the yen rises again, it may test resistance around

90.00 against the loonie and 76.00 against the kiwi.

Looking ahead, Eurozone current account and construction output

for November are due in the European session.

Canada CPI for December and wholesale sales for November and

U.S. building permits and housing starts for December are set for

release in the New York session.

Bank of England Governor Andrew Bailey will testify along with

Deputy Governor Jon Cunliffe on the Financial Stability Report

before the Treasury Select Committee in London at 9:15 am ET.

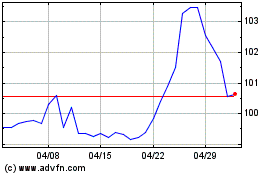

AUD vs Yen (FX:AUDJPY)

FXチャート

から 3 2024 まで 4 2024

AUD vs Yen (FX:AUDJPY)

FXチャート

から 4 2023 まで 4 2024