0001854964false00018549642023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

November 9, 2023

Date of Report (date of earliest event reported)

___________________________________

NewLake Capital Partners, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Maryland (State or other jurisdiction of incorporation or organization) | 000-56327 (Commission File Number) | 83-4400045 (I.R.S. Employer Identification Number) |

50 Locust Avenue, First Floor New Canaan, CT 06840 |

(Address of principal executive offices and zip code) |

(203) 594-1402 |

(Registrant's telephone number, including area code) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| N/A | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§ 230.405 of this chapter) or Rule 12b-2 Exchange Act. Emerging growth company

(§240.12b-2 of this chapter). ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition.

On November 9, 2023, NewLake Capital Partners, Inc. (the "Company") issued a press release announcing its financial results for the third quarter ended September 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 to this Form 8-K.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 furnished pursuant to Item 9.01, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities under that section. Furthermore, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 furnished pursuant to Item 9.01, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended (the "Securities Act") or the Exchange Act.

Item 7.01 Regulation FD Disclosure

The Company has posted an updated investor presentation to its website, www.newlake.com. A copy of the slide presentation is attached as Exhibit 99.2 hereto and incorporated herein by reference. The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2 furnished pursuant to Item 9.01, shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities under that section. Furthermore, the information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2 furnished pursuant to Item 9.01, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act or the Exchange Act.

Item 9.01 - Financial Statements and Exhibits

(d) The following exhibits are being filed herewith:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 9th day of November, 2023.

| | | | | |

| NewLake Capital Partners, Inc |

| |

By: | /s/ Lisa Meyer |

Name: | Lisa Meyer |

Title: | Chief Financial Officer, Treasurer and Secretary |

Exhibit 99-1

NewLake Capital Partners Reports Third Quarter 2023 Financial Results

Third Quarter 2023 Revenue Totaled $11.5 Million

Third Quarter 2023 Net Income Attributable to Common Stockholders Totaled $6.0 Million, Funds from Operations Totaled $9.6 Million, and Adjusted Funds from Operations Totaled $10.1 Million

The Company Repurchased 608,152 Shares of Common Stock During the Third Quarter 2023. Bringing Total Shares Repurchased to 713,831 for the First Nine Months of 2023

Conference Call and Webcast Scheduled for November 9, 2023, at 11 a.m. Eastern Time

New Canaan, CT, November 09, 2023 /GLOBE NEWSWIRE/ — NewLake Capital Partners, Inc. (OCTQX: NLCP) (the “Company” or “NewLake”), a leading provider of real estate capital to state-licensed cannabis operators, today announced its financial results for the third quarter ended September 30, 2023.

Anthony Coniglio, President and Chief Executive Officer, said, “Our financial results quarter-over-quarter were consistent and in line with our expectations. Through the first nine months of 2023, we have maintained our quarterly dividend of $0.39 per share and repurchased 713,831 shares in the open market. Our team has worked hard to create value for shareholders by executing on our share repurchase program, amending our lease with Revolutionary Clinics and working with a tenant to dispose of a Massachusetts property at our original cost.”

Third Quarter 2023 Financial Highlights

Quarter-over-quarter revenue, net income, Funds from Operations (“FFO”), and Adjusted Funds from Operations (“AFFO”) were relatively flat. As a result, presented below are only the third quarter financial highlights.

◦Revenue totaled $11.5 million.

◦Net income attributable to common stockholders totaled $6.0 million.

◦FFO(1) totaled $9.6 million.

◦AFFO(1) totaled $10.1 million.

◦Cash and cash equivalents as of September 30, 2023, were $31.1 million, with $20.2 million committed to fund Tenant Improvements (“TIs”).

Comparison to the third quarter ended September 30, 2022:

Quarterly-year-over year financial results were impacted by the non-payment of contractual rent from one tenant in 2023.

◦Revenue totaled $11.5 million as compared to $12.1 million, a decrease of 4.9% year-over-year.

◦Net income attributable to common stockholders totaled $6.0 million, as compared to $6.5 million.

◦FFO totaled $9.6 million, as compared to $10.3 million, a decrease of 6.0% year-over-year.

◦AFFO totaled $10.1 million compared to $10.6 million, a decrease of 5.1% year-over-year.

Nine Months Ended September 30, 2023 Financial Highlights

Comparison to the nine months ended September 30, 2022:

◦Revenue totaled $34.3 million as compared to $32.8 million, an increase of 4.7% year-over-year.

◦Net income attributable to common stockholders totaled $17.6 million, as compared to $15.3 million.

◦FFO totaled $28.6 million, as compared to $24.7 million, an increase of 15.8% year-over-year.

◦AFFO totaled $29.9 million compared to $27.8 million, an increase of 7.7% year-over-year.

Third Quarter 2023 Operational Highlights and Recent Developments

◦For the three months ended September 30, 2023, the Company acquired, pursuant to its repurchase program, 608,152 shares of its common stock at an average price, including commissions, of $13.02.

◦Declared a third quarter dividend of $0.39 per common share, equivalent to an annualized dividend of $1.56 per common share, paid on October 13, 2023 to stockholders of record on the close of business on September 29, 2023.

◦For the three months ended September 30, 2023, the Company funded approximately $2.6 million of TIs across three properties.

◦In October 2023, the Company entered into a lease amendment and forbearance agreement with Revolutionary Clinics for the Company’s cultivation facility in Massachusetts.

◦In October 2023, the Company closed on the sale of its cultivation facility located in Palmer, Massachusetts.

_________________________________________________________________________________

(1) FFO and AFFO is presented on a dilutive basis.

Investment Activity

The following tables present the Company's investment activity for nine months ended September 30, 2023 (dollars in thousands).

Acquisitions

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Tenant | | Market | | Site Type | | Closing Date | | Acquisitions | |

| Bloom Medicinal | | Missouri | | Cultivation | | March 3, 2023 | | $ | 350 | | (1) |

Total | | | | | | | | $ | 350 | | |

| | | | | | | | | |

(1) The Company exercised its option to purchase the adjacent parcel of land to expand its cultivation facility in Missouri and has committed to fund $16.2 million for the expansion. | |

Tenant Improvements Funded

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tenant | | Market | | Site Type | | Closing Date | | TI Funded | | Unfunded Commitments | |

| Mint | | Arizona | | Cultivation | | June 24, 2021 | | $ | 2,366 | | | $ | 5,703 | | |

| Organic Remedies | | Missouri | | Cultivation | | December 20, 2021 | | 282 | | | — | | |

| Bloom Medicinal | | Missouri | | Cultivation | | April 1, 2022 | | 2,961 | | | 13,722 | | |

| Ayr Wellness, Inc. | | Pennsylvania | | Cultivation | | June 30, 2022 | | — | | | 750 | | |

Total | | $ | 5,609 | | | $ | 20,175 | | |

| | | | | | | | | | | |

| |

Financing Activity

Revolving Credit Facility

As of September 30, 2023, the Company had approximately $1.0 million in borrowings under the Revolving Credit Facility and $89.0 million in funds available to be drawn, subject to sufficient collateral in the borrowing base. The facility bears a fixed rate of 5.65% for the first three years and thereafter a variable rate based upon the greater of (a) the Prime Rate quoted in the Wall Street Journal (Western Edition) (“Base Rate”) plus an applicable margin of 1.0% or (b) 4.75%.

The facility is subject to certain liquidity and operating covenants and includes customary representations and warranties, affirmative and negative covenants, and events of default. As of September 30, 2023, the Company is compliant with the covenants in the facility.

Seller Financing

In January 2023, the Company made its annual principal payment of $1.0 million. The loan’s outstanding principal balance as of September 30, 2023 was $1.0 million. The loan bears interest at a rate of 4.00% per annum with annual principal payments. The remaining principal payment of $1.0 million is due in January 2024.

Stock Repurchase Program

On September 15, 2023, the board of directors authorized an amendment to the stock repurchase program for the repurchase of up to an additional $10.0 million of the Company’s outstanding common stock and extended the program through December 31, 2024. For the nine months ended September 30, 2023, pursuant to the repurchase

plan, the Company acquired 713,831 shares of common stock at an average price, including commissions, of $12.96, totaling approximately $9.3 million. The remaining availability under the program as of September 30, 2023, was approximately $10.7 million.

Dividend

On September 15, 2023, the Company declared a third quarter 2023 cash dividend of $0.39 per share of common stock, equivalent to an annualized dividend of $1.56 per share of common stock. The dividend was paid on October 13, 2023, to stockholders of record at the close of business on September 29, 2023 and represents an AFFO payout ratio of 81.6%.

Recent Developments

Leases

Revolutionary Clinics

In October 2023, the Company entered into a lease amendment and forbearance agreement (the “Agreements”) for its existing lease agreement with Revolutionary Clinics on its cultivation facility in Massachusetts, where Revolutionary Clinics is the sole tenant. Under the terms of the Agreements, the lease term was extended by five years. The Company received $480 thousand of unpaid rent and applied the remaining $315 thousand of security deposit; these amounts will be recognized as income in the fourth quarter of 2023. Additionally, the Company has received October and November contractual rent payments pursuant to the amended lease. The new reduced rental payments will represent approximately 6.1% of estimated fourth quarter portfolio contractual rental income. The rental payments may escalate as the tenant’s business achieves certain gross revenue metrics. Under the forbearance agreement, the Company provided forbearance for approximately $2.0 million of back rental income. Lastly, the Company received 9.95% of equity in Revolutionary Clinics in the form of warrants.

Calypso

Calypso did not make its weekly October rent payments. However, it has resumed its weekly rent payments in November. Calypso continues to work towards a sale of its business.

Disposition of Real Estate

In October 2023, the Company closed on the sale of its cultivation facility in Palmer, Massachusetts, for $2.0 million, which was leased to Mint. The Company's investment in the property was $1.9 million. Upon closing, Mint's lease agreement was terminated, and they paid a portion of the closing costs, resulting in a break-even sale of the property.

Outlook for 2023

NewLake Capital is reaffirming AFFO guidance for full year 2023 of $39.8 to $40.8 million, an increase of 4.1% over AFFO for the same period the prior year, assuming the midpoint of that range.

Conference Call and Webcast Details:

Management will host a conference call and webcast at 11:00 a.m. Eastern Time on November 9, 2023, to discuss its quarterly financial results and answer questions about the Company's operational and financial highlights for the third quarter ended September 30, 2023.

| | | | | |

Event: | NewLake Capital Partners Inc. Third Quarter 2023 Earnings Call |

Date: | Thursday, November 9, 2023 |

Time: | 11:00 a.m. Eastern Time |

| | | | | |

Live Call: | 1-877-407-3982 (U.S. Toll-Free) or +1-201-493-6780 (International) |

Webcast: | https://viavid.webcasts.com/starthere.jsp?ei=1638874&tp_key=b6e61aa824 |

For interested individuals unable to join the conference call, a dial-in replay of the call will be available until November 23, 2023, and can be accessed by dialing +1-844-512-2921 (U.S. Toll Free) or +1-412-317-6671 (International) and entering replay pin number: 13742020.

About NewLake Capital Partners, Inc.

NewLake Capital Partners, Inc. is an internally-managed real estate investment trust that provides real estate capital to state-licensed cannabis operators through sale-leaseback transactions and third-party purchases and funding for build-to-suit projects. NewLake owns a portfolio of 31 cultivation facilities and dispensaries that are leased to single tenants on a triple-net basis. For more information, please visit www.newlake.com.

Forward-Looking Statements

This press release contains “forward-looking statements.” Forward-looking statements can be identified by words like “may,” “will,” “likely,” “should,” “expect,” “anticipate,” “future,” “plan,” “believe,” “intend,” “goal,” “project,” “continue” and similar expressions. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs and expectations. Forward-looking statements are based on the Company’s current expectations and assumptions regarding capital market conditions, the Company’s business, the economy and other future conditions. All of our statements regarding anticipated growth in our funds from operations, adjusted funds from operations, anticipated market conditions, and results of operations are forward-looking statements. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. For a discussion of the risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law.

Use of Non-GAAP Financial Information

FFO and AFFO are supplemental non-GAAP financial measures used in the real estate industry to measure and compare the operating performance of real estate companies. A complete reconciliation containing adjustments from GAAP net income attributable to common stockholders to FFO and AFFO and definitions of terms are included at the end of this release.

--

Contact Information:

Lisa Meyer

Chief Financial Officer, Treasurer and Secretary

NewLake Capital Partners, Inc.

lmeyer@newlake.com

Investor Contact:

Valter Pinto, Managing Director

KCSA Strategic Communications

Valter@KCSA.com

PH: (212) 896-1254

Media Contact:

McKenna Miller

KCSA Strategic Communications

MMiller@KCSA.com

PH: (212) 896-1254

NEWLAKE CAPITAL PARTNERS, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share amounts)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| Assets: | (Unaudited) | | |

| Real Estate | | | |

| Land | $ | 21,397 | | | $ | 21,427 | |

| Building and Improvements | 382,087 | | | 378,047 | |

| Total Real Estate | 403,484 | | | 399,474 | |

| Less Accumulated Depreciation | (28,931) | | | (19,736) | |

| Net Real Estate | 374,553 | | | 379,738 | |

| Cash and Cash Equivalents | 31,065 | | | 45,192 | |

| In-Place Lease Intangible Assets, net | 20,275 | | | 21,765 | |

| Loan Receivable | 5,000 | | | 5,000 | |

| Property Held for Sale | 1,949 | | | — | |

| Other Assets | 2,300 | | | 2,554 | |

| Total Assets | $ | 435,142 | | | $ | 454,249 | |

| | | |

| Liabilities and Equity: | | | |

| | | |

| Liabilities: | | | |

| Accounts Payable and Accrued Expenses | $ | 1,000 | | | $ | 1,659 | |

| Revolving Credit Facility | 1,000 | | | 1,000 | |

| Loan Payable, net | 997 | | | 1,986 | |

| Dividends and Distributions Payable | 8,231 | | | 8,512 | |

| Security Deposits | 7,338 | | | 7,774 | |

| Rent Received in Advance | 907 | | | 1,375 | |

| Other Liabilities | 199 | | | 1,005 | |

| Total Liabilities | 19,672 | | | 23,311 | |

| | | |

| Commitments and Contingencies | | | |

| | | |

| Equity: | | | |

| | | |

| Preferred Stock, $0.01 Par Value, 100,000,000 Shares Authorized, 0 and 0 Shares Issued and Outstanding, Respectively | — | | | — | |

| Common Stock, $0.01 Par Value, 400,000,000 Shares Authorized, 20,694,363 and 21,408,194 Shares Issued and Outstanding, Respectively | 207 | | | 214 | |

| Additional Paid-In Capital | 447,531 | | | 455,822 | |

| Accumulated Deficit | (39,635) | | | (32,487) | |

| Total Stockholders' Equity | 408,103 | | | 423,549 | |

| | | |

| Noncontrolling Interests | 7,367 | | | 7,389 | |

| Total Equity | 415,470 | | | 430,938 | |

| | | |

| Total Liabilities and Equity | $ | 435,142 | | | $ | 454,249 | |

NEWLAKE CAPITAL PARTNERS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Rental Income | $ | 11,297 | | | $ | 11,595 | | | $ | 33,637 | | | $ | 30,217 | |

| Interest Income from Loans | 131 | | | 434 | | | 390 | | | 2,301 | |

| Fees and Reimbursables | 63 | | | 49 | | | 256 | | | 239 | |

| Total Revenue | 11,491 | | | 12,078 | | | 34,283 | | | 32,757 | |

| | | | | | | |

| Expenses: | | | | | | | |

| Depreciation and Amortization Expense | 3,568 | | | 3,630 | | | 10,698 | | | 9,113 | |

| General and Administrative Expenses: | | | | | | | |

| Compensation expense | 1,173 | | | 1,040 | | | 3,450 | | | 5,100 | |

| Professional fees | 300 | | | 279 | | | 986 | | | 1,486 | |

| Other general and administrative expenses | 467 | | | 419 | | | 1,537 | | | 1,387 | |

| Total general and administrative expenses | 1,940 | | | 1,738 | | | 5,973 | | | 7,973 | |

| Total Expenses | 5,508 | | | 5,368 | | | 16,671 | | | 17,086 | |

| | | | | | | |

| Loss on Sale of Real Estate | — | | | — | | | — | | | (60) | |

| | | | | | | |

| Income From Operations | 5,983 | | | 6,710 | | | 17,612 | | | 15,611 | |

| | | | | | | |

| Other Income (Expenses): | | | | | | | |

| Interest Income | 178 | | | 7 | | | 607 | | | 103 | |

| Interest Expense | (95) | | | (94) | | | (284) | | | (167) | |

| Total Other Income (Expense) | 83 | | | (87) | | | 323 | | | (64) | |

| | | | | | | |

| Net Income | 6,066 | | | 6,623 | | | 17,935 | | | 15,547 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net Income Attributable to Noncontrolling Interests | (108) | | | (113) | | | (312) | | | (262) | |

| | | | | | | |

| Net Income Attributable to Common Stockholders | $ | 5,958 | | | $ | 6,510 | | | $ | 17,623 | | | $ | 15,285 | |

| | | | | | | |

| Net Income Attributable to Common Stockholders Per Share - Basic | $ | 0.28 | | | $ | 0.30 | | | $ | 0.83 | | | $ | 0.71 | |

| | | | | | | |

| Net Income Attributable to Common Stockholders Per Share - Diluted | $ | 0.28 | | | $ | 0.30 | | | $ | 0.83 | | | $ | 0.71 | |

| | | | | | | |

| Weighted Average Shares of Common Stock Outstanding - Basic | 21,199,638 | | 21,428,905 | | 21,330,046 | | 21,417,149 |

| | | | | | | |

| Weighted Average Shares of Common Stock Outstanding - Diluted | 21,582,314 | | 21,802,487 | | 21,710,101 | | 21,815,763 |

Non-GAAP Financial Information

Funds From Operations

The Company calculates FFO in accordance with the current National Association of Real Estate Investment Trusts (“NAREIT”) definition. NAREIT currently defines FFO as follows: net income (loss) (computed in accordance with GAAP) excluding depreciation and amortization related to real estate, gains and losses from the sale of certain real estate assets, and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by an entity. Other REITs may not define FFO in accordance with the NAREIT definition or may interpret the current NAREIT definition differently and therefore the Company’s computation of FFO may not be comparable to such other REITs.

Adjusted Funds From Operations

The Company calculates AFFO by starting with FFO and adding back non-cash and certain non-recurring transactions, including non-cash components of compensation expense. Other REITs may not define AFFO in the same manner and therefore the Company’s calculation of AFFO may not be comparable to such other REITs. You should not consider FFO and AFFO to be alternatives to net income as a reliable measure of our operating performance; nor should you consider FFO and AFFO to be alternatives to cash flows from operating, investing or financing activities (as defined by GAAP) as measures of liquidity.

The table below is a reconciliation of net income attributable to common stockholders to FFO and AFFO for the three and three months ended September 30, 2023 and 2022 (in thousands, except share and per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Net Income Attributable to Common Stockholders | | $ | 5,958 | | | $ | 6,510 | | | $ | 17,623 | | | $ | 15,285 | |

| Net Income Attributable to Noncontrolling Interests | | 108 | | | 113 | | | 312 | | | 262 | |

| Net Income | | 6,066 | | | 6,623 | | | 17,935 | | | 15,547 | |

| | | | | | | | |

| Adjustments: | | | | | | | | |

| Real Estate Depreciation and Amortization | | 3,568 | | | 3,630 | | | 10,698 | | | 9,113 | |

| Loss on Sale of Real Estate | | — | | | — | | | — | | | 60 | |

FFO Attributable to Common Stockholders - Diluted (1) | | 9,634 | | | 10,253 | | | 28,633 | | | 24,720 | |

| Severance | | — | | | 25 | | | — | | | 1,752 | |

| Stock-Based Compensation | | 379 | | | 280 | | | 1,060 | | | 1,201 | |

| Non-cash Interest Expense | | 71 | | | 59 | | | 211 | | | 92 | |

| Amortization of Straight-line Rent Expense | | — | | | 6 | | | — | | | 12 | |

AFFO Attributable to Common Stockholders - Diluted | | $ | 10,084 | | | $ | 10,623 | | | $ | 29,904 | | | $ | 27,777 | |

| | | | | | | | |

| FFO per share – Diluted | | $ | 0.45 | | | $ | 0.47 | | | $ | 1.32 | | | $ | 1.13 | |

| | | | | | | | |

| AFFO per share – Diluted | | $ | 0.47 | | | $ | 0.49 | | | $ | 1.38 | | | $ | 1.27 | |

A Leading Provider of Real Estate Capital To State-Licensed Cannabis Operators November 09, 2023

newlake.comOTCQX: NLCP 2 Safe Harbor Statement This presentation has been prepared by the NewLake Capital Partners, Inc. (“we,” “us” or the “Company”) solely for informational purposes. This presentation and related discussion shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of securities. This presentation contains forward‐looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts, and are often indicated by words such as “anticipates,” estimates,” “expects,” “intends,” “plans,” “believes” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” “and “could.” Forward looking statements include, among others, statements relating to the Company’s future financial performance, business prospects and strategy, the use of proceeds from our initial public offering, future dividend payments, anticipated financial position, the Company’s acquisition pipeline, liquidity and capital needs and other similar matters. These statements are based on the Company’s current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. The Company’s actual results may differ materially from those expressed in, or implied by, the forward looking statements. The Company is providing the information contained herein as of the date of this presentation. Except as required by applicable law, the Company does not plan to update or revise any statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. Use of Non-GAAP Financial Information Adjusted Funds From Operations ("AFFO”) is a supplemental non-GAAP financial measure used in the real estate industry to measure and compare the operating performance of real estate companies. A complete reconciliation containing adjustments from GAAP net income attributable to common stockholders and participating securities to AFFO are included in the appendix to this presentation.

newlake.comOTCQX: NLCP 3 By The Numbers 100% Leased — All Triple-Net Leases Founded in 2019 — 2021 IPO ~$427 Million Deployed — Invested & Committed 81.6% AFFO Payout Ratio — Strong Dividend Coverage 32 (2) Properties — 12 States, 1.7 Million Square Feet 0.2x Debt To EBITDA — $89 Million Available Credit Facility 12.2% Wtd. Avg. Yield(3) — 2.6% Annual Rent Escalations Note: (1) Data as of September 30, 2023 (2) Does not reflect the sale of the Company’s Palmer Massachusetts property that occurred subsequent to September 30, 2023 (3) Calculated as if all rents were collected and does not reflect transactions that occurred subsequent to September 30, 2023 1.4% Annualized G&A Ratio — Low General and Administrative Expenses 14.2 Years Remaining Lease Term — Weighted Average 5.4% YoY Dividend Growth — For the 3 months ending September 30, 2023 vs. 2022

newlake.comOTCQX: NLCP 4 Experienced Management Team Anthony Coniglio Chief Executive Officer & President, Director Lisa Meyer Chief Financial Officer, Treasurer & Secretary Jarrett Annenberg Senior Vice President & Head of Investment Former CEO of Primary Capital Mortgage, a residential mortgage company 14 years at J.P. Morgan as an investment banker leading various businesses Public company director Former President & CFO of Western Asset Mortgage Capital Corporation, a NYSE- listed REIT Extensive experience providing financial leadership to various public and private entities in the real estate industry Co-Founder of a cannabis REIT leading its acquisition activities 10 years at CBRE in the Transactions and Advisory Services Group, one of the youngest SVPs in the U.S.

newlake.comOTCQX: NLCP 5 Experienced Board of Directors Gordon DuGan Chairman of the Board, Independent Director Alan Carr Independent Director Joyce Johnson Independent Director Co-Founder and Chairman of the Board of Blackbrook Capital Chairman of the Board of INDUS Realty Trust (Nasdaq: INDT) Former CEO of Gramercy Property Trust, a NYSE-listed triple-net lease REIT Former CEO of W.P. Carey & CO., a NYSE- listed triple-net lease REIT Director on several boards in diverse industries including Sears Holdings Corporation and Unit Corporation. Former Managing Director at Strategic Value Partners investing in various sectors in North America and Europe Chairman of Pacific Gate Capital Management, LLC, an investment firm Former Senior Managing Director and Partner of Relativity Capital, LLC and Managing Director of Cerberus Capital Management, L.P. Lead Independent Director at Ayr Wellness Experienced board member for 22 companies

newlake.comOTCQX: NLCP 6 Experienced Board of Directors Continued Peter Kadens Independent Director Peter Martay Independent Director David Weinstein Director Co-Founder and former CEO of Green Thumb Industries, Inc., one of the leading public cannabis companies Co-Founder and former CEO of SoCore Energy, one of the largest commercial solar companies in the U.S. Former Director of KushCo Holdings, Inc. (OTCQX: KSHB) and Choice Consolidation Corp., a SPAC targeting cannabis businesses CEO of Pangea Properties, a private apartment REIT that owns more than 13,000 apartments and has completed over $300 million in short term bridge loans on numerous property types across the U.S. Former banker at Bernstein Global Wealth Management, Glencoe Capital and Deutsche Bank CEO of NewLake from August 2020 – July 2022, Director Since 2019 Former CEO of MPG Office Trust, a NYSE-listed office REIT 10 years at Goldman Sachs as a real estate investment banker and investor 10 years at Belvedere Capital, a real estate investment firm

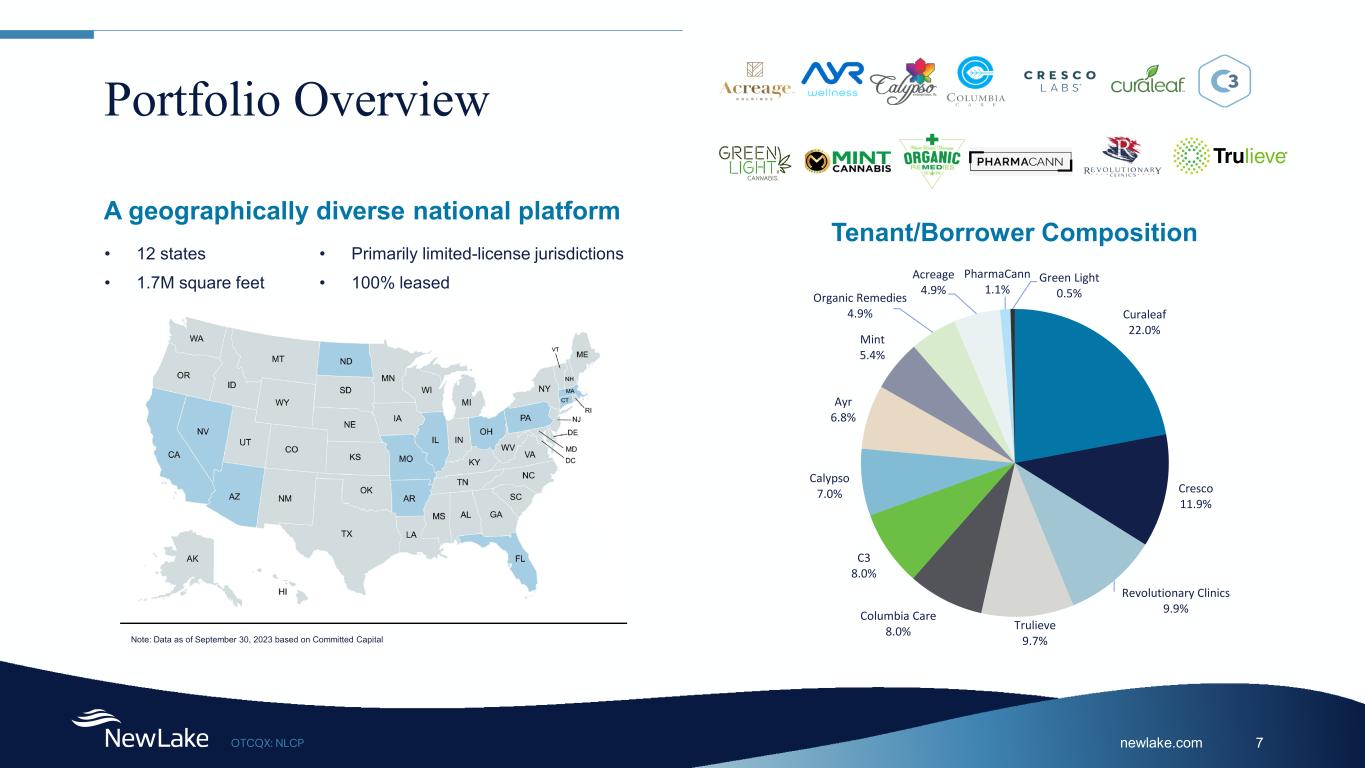

newlake.comOTCQX: NLCP 7 Portfolio Overview A geographically diverse national platform • 12 states • 1.7M square feet • Primarily limited-license jurisdictions • 100% leased Note: Data as of September 30, 2023 based on Committed Capital Curaleaf 22.0% Cresco 11.9% Revolutionary Clinics 9.9% Trulieve 9.7% Columbia Care 8.0% C3 8.0% Calypso 7.0% Ayr 6.8% Mint 5.4% Organic Remedies 4.9% Acreage 4.9% PharmaCann 1.1% Green Light 0.5% Tenant/Borrower Composition

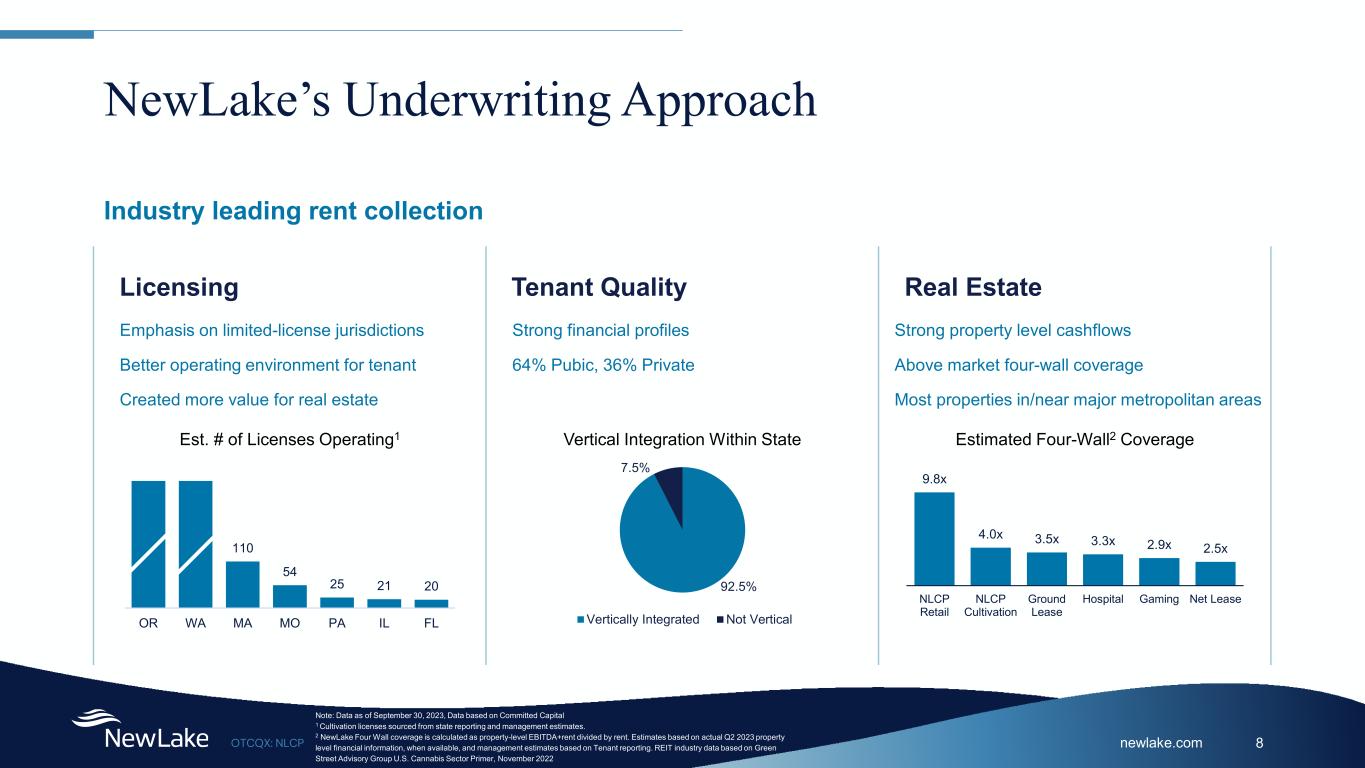

newlake.comOTCQX: NLCP 8 NewLake’s Underwriting Approach Licensing Tenant Quality Real Estate Industry leading rent collection Emphasis on limited-license jurisdictions Better operating environment for tenant Created more value for real estate Strong financial profiles 64% Pubic, 36% Private Strong property level cashflows Above market four-wall coverage Most properties in/near major metropolitan areas 110 54 25 21 20 OR WA MA MO PA IL FL 9.8x 4.0x 3.5x 3.3x 2.9x 2.5x NLCP Retail NLCP Cultivation Ground Lease Hospital Gaming Net Lease Est. # of Licenses Operating1 Estimated Four-Wall2 Coverage Note: Data as of September 30, 2023, Data based on Committed Capital 1 Cultivation licenses sourced from state reporting and management estimates. 2 NewLake Four Wall coverage is calculated as property-level EBITDA+rent divided by rent. Estimates based on actual Q2 2023 property level financial information, when available, and management estimates based on Tenant reporting. REIT industry data based on Green Street Advisory Group U.S. Cannabis Sector Primer, November 2022 92.5% 7.5% Vertically Integrated Not Vertical Vertical Integration Within State

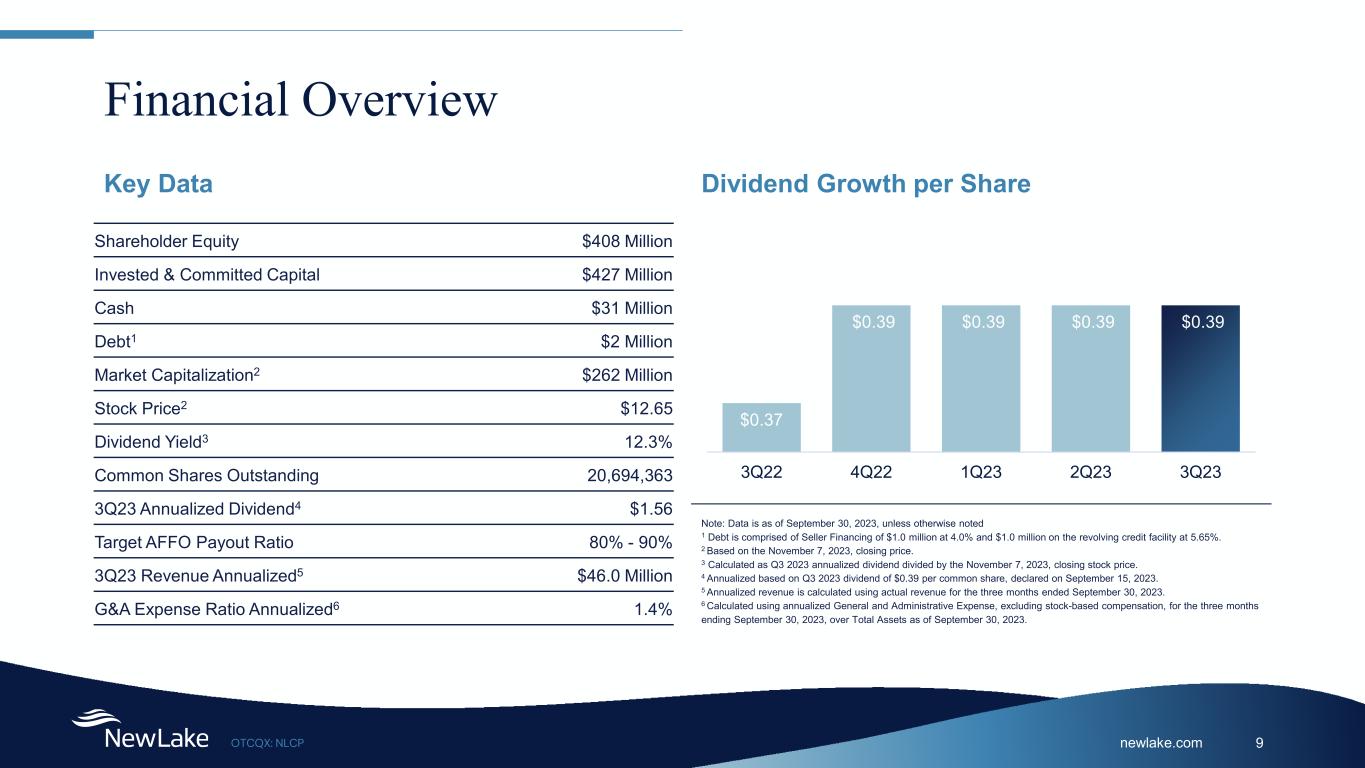

newlake.comOTCQX: NLCP 9 Financial Overview Shareholder Equity $408 Million Invested & Committed Capital $427 Million Cash $31 Million Debt1 $2 Million Market Capitalization2 $262 Million Stock Price2 $12.65 Dividend Yield3 12.3% Common Shares Outstanding 20,694,363 3Q23 Annualized Dividend4 $1.56 Target AFFO Payout Ratio 80% - 90% 3Q23 Revenue Annualized5 $46.0 Million G&A Expense Ratio Annualized6 1.4% Key Data Dividend Growth per Share $0.37 $0.39 $0.39 $0.39 $0.39 3Q22 4Q22 1Q23 2Q23 3Q23 Note: Data is as of September 30, 2023, unless otherwise noted 1 Debt is comprised of Seller Financing of $1.0 million at 4.0% and $1.0 million on the revolving credit facility at 5.65%. 2 Based on the November 7, 2023, closing price. 3 Calculated as Q3 2023 annualized dividend divided by the November 7, 2023, closing stock price. 4 Annualized based on Q3 2023 dividend of $0.39 per common share, declared on September 15, 2023. 5 Annualized revenue is calculated using actual revenue for the three months ended September 30, 2023. 6 Calculated using annualized General and Administrative Expense, excluding stock-based compensation, for the three months ending September 30, 2023, over Total Assets as of September 30, 2023.

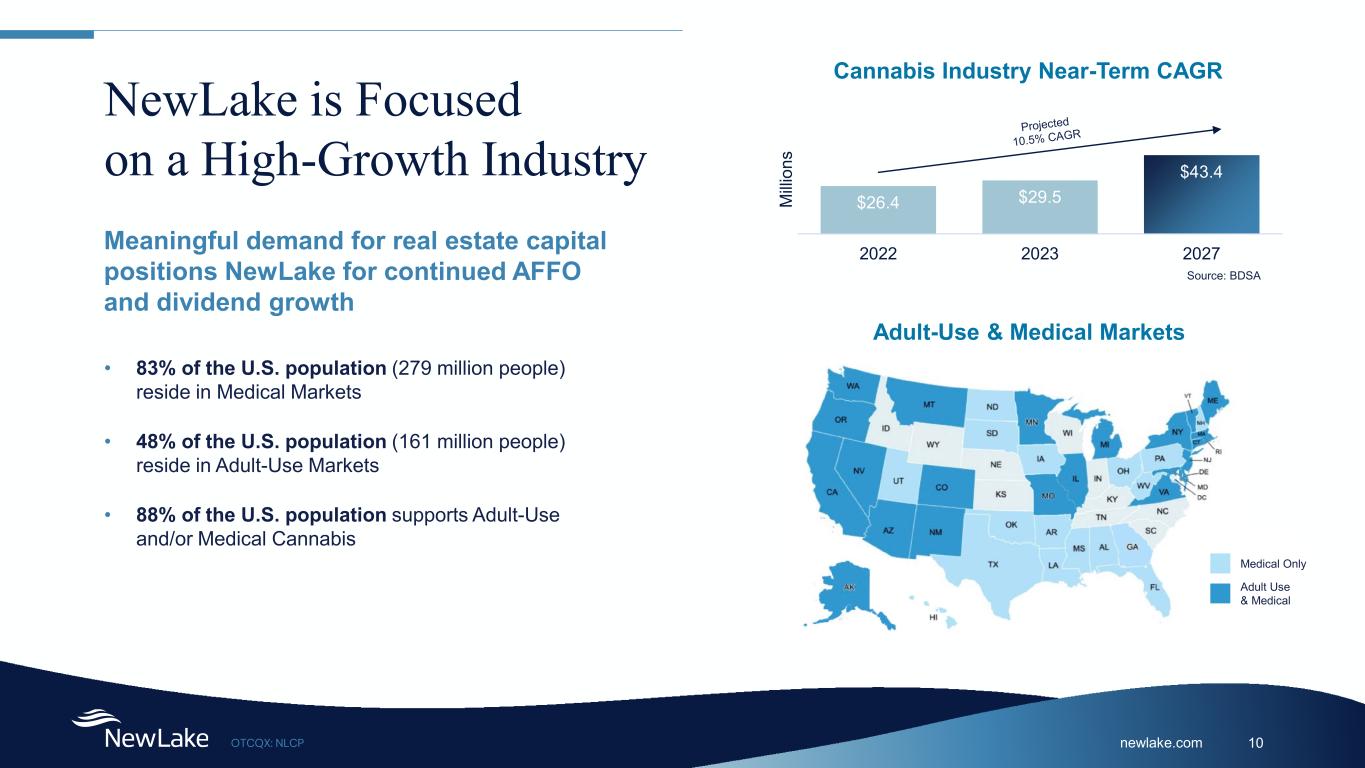

newlake.comOTCQX: NLCP 10 NewLake is Focused on a High-Growth Industry • 83% of the U.S. population (279 million people) reside in Medical Markets • 48% of the U.S. population (161 million people) reside in Adult-Use Markets • 88% of the U.S. population supports Adult-Use and/or Medical Cannabis Meaningful demand for real estate capital positions NewLake for continued AFFO and dividend growth $26.4 $29.5 $43.4 2022 2023 2027 M illi on s Cannabis Industry Near-Term CAGR Source: BDSA Adult-Use & Medical Markets Medical Only Adult Use & Medical

newlake.comOTCQX: NLCP 11 Investment Highlights Experienced Team Experienced team with a track record of strong corporate governance and delivering returns for investors Scale and Early Mover NewLake’s scale and early mover advantage positions the Company for long-term success Exceptional Portfolio High-quality portfolio with significant duration and above-market yields Financial Position Solid financial position with significant financial flexibility High-Growth Focus Focus on a high-growth industry with meaningful demand for real estate capital positions NewLake to continue growing AFFO and dividends

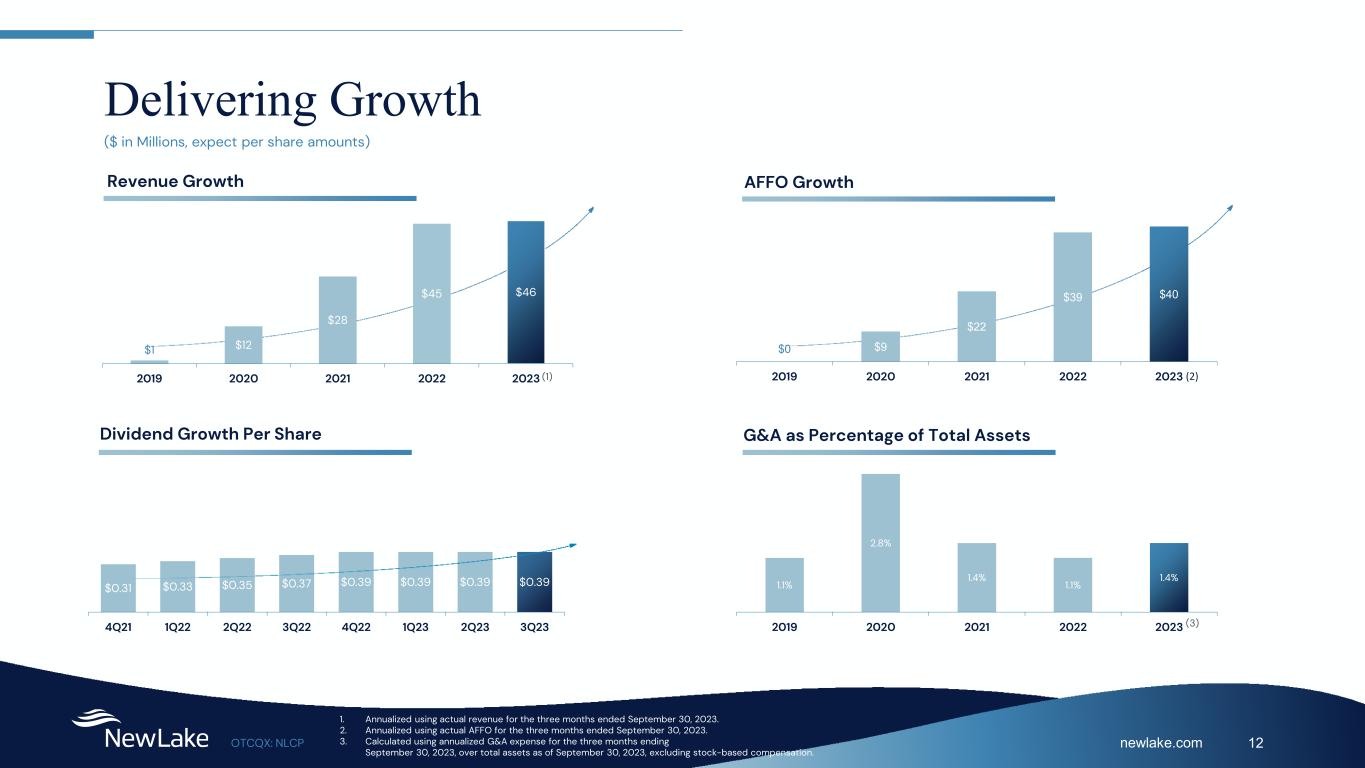

newlake.comOTCQX: NLCP 12 Delivering Growth 1.1% 2.8% 1.4% 1.1% 1.4% 2019 2020 2021 2022 2023 G&A as Percentage of Total Assets $0 $9 $22 $39 $40 2019 2020 2021 2022 2023 AFFO Growth $1 $12 $28 $45 $46 2019 2020 2021 2022 2023 Revenue Growth ($ in Millions, expect per share amounts) $0.31 $0.33 $0.35 $0.37 $0.39 $0.39 $0.39 $0.39 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 Dividend Growth Per Share (1) (3) 1. Annualized using actual revenue for the three months ended September 30, 2023. 2. Annualized using actual AFFO for the three months ended September 30, 2023. 3. Calculated using annualized G&A expense for the three months ending September 30, 2023, over total assets as of September 30, 2023, excluding stock-based compensation. (2)

Thank You Company Contact: Lisa Meyer CFO, Treasurer and Secretary Lmeyer@newlake.com Investor Relations Contact: Valter Pinto / Jack Perkins KCSA Strategic Communications NewLake@KCSA.com (212) 896-1254

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

NewLake Capital Partners (QX) (USOTC:NLCP)

過去 株価チャート

から 11 2024 まで 12 2024

NewLake Capital Partners (QX) (USOTC:NLCP)

過去 株価チャート

から 12 2023 まで 12 2024