(All amounts in US$ unless otherwise

specified)

VANCOUVER, Nov. 5, 2019 /CNW/ - Capstone Mining Corp.

("Capstone" or the "Company") (TSX:CS) announced its production and

financial results for the three and nine months ended September 30, 2019 ("Q3 2019"). Total copper

production from continuing operations for Q3 2019 totaled 39

million pounds of copper at consolidated C1 cash costs1

of $1.85 per pound. For full

financial and operational results, refer to Capstone's Q3 2019

Management's Discussion and Analysis and Unaudited Condensed

Interim Consolidated Financial Statements ("MD&A and Financial

Statements").

Q3 2019 HIGHLIGHTS AND SIGNIFICANT ITEMS

- Q3 2019 copper production of 39 million pounds

and C1 cash costs1 of $1.85 per payable pound produced. Copper sales

were lower at 31 million pounds due to timing of the last shipment

of the quarter at Pinto Valley.

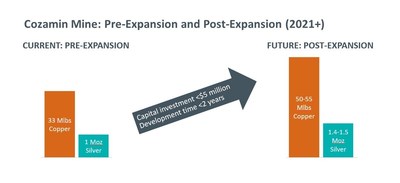

- Cozamin expansion project remains on track for the end of

2020 with the objective to debottleneck the mine with a one-way

ramp system. The project is now expected to increase production to

between 50 to 55 million pounds of copper and 1.4 to 1.5 million

ounces of silver.

- The Company achieved cost reductions of $25 million on its target of $25 million to $30

million in annualized savings.

-

- The Company has now removed $25

million of annualized costs out of the business with the

$12.5 million in savings at Pinto

Valley plus $3.5 million on new

revolver terms and improved cash management, $4 million from corporate administration and

$5 million from the disposition of

Minto.

- Pinto Valley delivered an additional $2.5 million in sustainable annualized cost

savings in Q3 2019, bringing the year-to-date total to $12.5 million. Pinto Valley is targeting to

achieve a total of $15 to

$20 million in annualized cost

savings.

- Q3 2019 net loss of $(10.7)

million (Q3 2018 - net income of $1.3 million), which was impacted by lower

realized copper prices and negative provisional pricing adjustments

in the quarter of $3.4 million, as

well as lower sales volumes due to the timing of shipments for

Pinto Valley concentrate and resulting build-up of concentrate

inventory. This resulted in a loss per share of $(0.03) for the quarter (Q3 2018 - $0.00).

- Q3 2019 adjusted net loss of $(8.7)

million (Q3 2018 – adjusted net income of $1.0 million) and adjusted loss per share of

$(0.02), (Q3 2018 – $0.00). Adjustments for 2019 relate to

inventory write-down and change in fair value on the Minto contingent receivable.

- 2019 production and C1 cash

costs1 guidance. Capstone expects to

achieve consolidated production guidance of 145-160 million pounds

and consolidated C1 cash costs1 guidance of

$1.80-$2.00 per payable pound produced.

- Capstone announced high grade copper and silver results drill

results at Cozamin, see news release dated November 5, 2019.

"Never have I been this excited about Capstone's future as both

Cozamin and Pinto Valley have clear organic growth strategies in

place and we are focused on execution to deliver increased

stakeholder benefits," said Darren

Pylot, President and CEO of Capstone. "Cozamin will leverage

incredible growth from expansionary capital of less than

$5 million, expanding copper and

silver production by 50% in 2021 and beyond. The continued

exploration success achieved by our team is a paradigm shift for an

already low cost and highly profitable mine. Cozamin has already

delivered over $400 million in

cumulative free cash flow for Capstone and it appears the best is

yet to come in the decade ahead of us."

Mr. Pylot continued, "As Pinto Valley's operating momentum

continues, we are concurrently focused on preparing the mine for

higher copper prices with low cost, quick payback improvements to

the mill, plus looking to expand the mine into a multi-generational

asset. We have identified optimal PV4 expansion scenarios to

capitalize on the roughly one billion tonnes of resources currently

not in reserves."

CORPORATE UPDATE

Cozamin: Expansion Update

During Q3 2019, development

work on the one-way ramp system continued and is on-track for

completion by the end of 2020. Concurrently, development of the

raisebore to improve ventilation is also on track for completion in

the first half of 2020. Once both development projects are

completed, Cozamin's annual production is now expected to increase

to between 50 and 55 million pounds of copper and 1.4 to 1.5

million ounces of silver. Expected production targets have

increased due to the results of the additional 103 drill holes, to

date, pointing to higher grades and thickness than in the current

reserve.

Cozamin: Mine Life Growth

During Q3 2019, Cozamin

acquired the Portree claimblock that laid within the Mala Noche

Footwall Zone ("MNFWZ") area. The claimblock is surrounded by high

grade Inferred Mineral Resources and provides access so we can now

continuously infill drill and eventually mine the Portree area as

well. A 2019/2020 infill drilling program was initiated earlier

this year to move Inferred Mineral Resources to the Mineral Reserve

category with the expectation of adding additional Mineral

Resources to support doubling the mine life and we are now

targeting to update both Mineral Resources and Mineral Reserves

before the end of 2020.

Cost Reduction Program

Capstone has achieved its cost

reduction target range of $25 million

to $30 million, using 2018 as a

baseline. The Company has now removed $25

million of costs out of the business with $12.5 million in savings at Pinto Valley plus

$3.5 million related to the new

revolver terms and improved cash management, lower corporate

administration costs ($4 million) and

holding cost savings due to the disposition of Minto ($5

million). A total of approximately $15 million to $20

million of savings is expected to come from Pinto Valley, of

which $12.5 million has been achieved

to date, primarily from manpower and contractor savings as a result

of the new collective bargaining agreement and improved power

pricing.

Pinto Valley Phase 4 Expansion Study

("PV4")

Preliminary work on the PV4 study continued in the

quarter to evaluate potential expansion scenarios to take advantage

of nearly one billion tonnes of Mineral Resources not currently

scheduled in the PV3 pit shell. For the remainder of 2019, PV4

study activities will be focused on further evaluating alternative

infrastructure options.

Pinto Valley: Crushing Plant Modernization

Pinto

Valley has identified small capital project to modernize the

crushing equipment and other front-end upgrades to improve mill

reliability and overall performance. The capital investment is

estimated to be approximately $10 to

$15 million, with double digit rate

of return. The return on investment is calculated based on

increasing throughput from current levels to targeted production

levels between 56,000 to 57,000 tonnes per day in 2021 and beyond,

and reduced maintenance and power costs. These capital costs are

subject to Board of Directors approval in the fourth quarter

2019.

Santo Domingo Project Progress

The Santo Domingo project is now "shovel-ready" as

Capstone has obtained all permits and approvals for the start of

construction from the Chilean authorities. During Q3 2019, work to

improve Santo Domingo's project

economics continued to advance and we are targeting to release an

updated NI 43-101 report early next year, which we expect will

include infrastructure sharing resulting in significantly reduced

capital cost estimate, increased gold recoveries and a preliminary

business case for producing battery-grade cobalt. The strategic

process, which was launched in early 2019, is on-going and is aimed

at evaluating alternatives regarding the project which may include

the sale of a majority portion of the project.

Management Appointment

In September 2019, Jerrold

Annett joined Capstone as Vice President, Strategy and

Capital Markets. Jerrold has 24 years of global mining and capital

markets experience, with the last three years providing strategic

direction and executive oversight for several junior exploration

and development companies. His mining career started at Teck

Resources and Falconbridge as a

metallurgist and within their commercial metals sales groups,

followed by 10 years in capital markets, most recently with

Scotiabank where he was Head of Mining Institutional Sales. He is a

professional Engineer and has a Bachelor of Applied Science in

Mining and Mineral Engineering from Queen's University in

Canada.

PRODUCTION RESULTS

Refer to Capstone's Q3 2019 MD&A and Financial Statements

for detailed operating results.

|

Q3

2019

|

Q3

2018

|

2019

YTD

|

2018

YTD

|

|

Copper production

(million pounds)

|

|

|

|

|

|

Pinto

Valley

|

29.9

|

31.3

|

91.6

|

86.1

|

|

Cozamin

|

9.1

|

9.6

|

26.5

|

26.8

|

|

Total from

continuing operations2

|

39.0

|

40.9

|

118.1

|

112.9

|

|

|

|

|

|

|

Copper

sales

|

|

|

|

|

|

Total from continuing

operations2 (million pounds)

|

31.2

|

41.5

|

112.1

|

108.4

|

|

Realized copper

price2 ($/lb.)

|

$2.52

|

$2.72

|

$2.68

|

$2.93

|

|

|

|

|

|

|

C1 cash

costs1 ($/lb.) produced

|

|

|

|

|

|

Pinto

Valley

|

2.13

|

2.15

|

1.97

|

2.23

|

|

Cozamin

|

0.94

|

0.87

|

0.90

|

0.76

|

|

Consolidated from

continuing operations2

|

1.85

|

1.85

|

1.73

|

1.88

|

|

2 The

Minto mine was placed on care and maintenance in Q4 2018 and was

considered a discontinued operation under IFRS 5 up until the date

of sale (June 3, 2019).

|

Consolidated:

For the nine months ended September 30, 2019, production from continuing

operations increased 5% and C1 cash costs1 decreased 8%

compared with 2018.

Q3 2019 realized price of $2.52 per pound was impacted by $3.4 million negative provisional pricing

adjustments recorded on previous quarter sales. 2019 year-to-date

realized copper price was $2.68 per

pound as compared to the LME average for the same period of

$2.74 per pound.

Pinto Valley Mine:

For the nine months ended

September 30, 2019, production

increased by 6% compared with 2018 while C1 cash costs1

decreased by 12%. Production increased primarily due to an increase

in copper grade (2019 year-to-date – 0.34% vs. 2018 year-to-date –

0.31%). C1 cash costs1 were $0.26/lb lower than 2018 as a result of the cost

reduction program initiated in 2019, as well as higher

production.

Cozamin Mine:

Copper production decreased by 0.5

million pounds in Q3 2019 vs. Q3 2018, primarily as a result of a

decrease in grade (Q3 2019 – 1.48% vs Q3 2018 – 1.70%) and slightly

lower recoveries which was partially offset by higher throughput

(3,204 tonnes per day vs 2,939 tonnes per day).

From a year-to-date perspective, copper production was

consistent year over year. The lower blended head grade (2019

– 1.49% vs. 2018 – 1.80%) was offset by significantly higher mill

throughput (2019 - 3,121 tonnes per day vs 2018 - 2,591 tonnes per

day).

C1 cash costs1 increased in Q3 2019 and 2019

year-to-date compared with the same period last year. This increase

was primarily driven by lower production and an increase in

development as the mine builds the areas available for longhole

stoping (building the prepared mineral inventory) to support

increased mining rates planned for 2021.

|

1 This is an alternative performance

measure; please see "Alternative Performance Measures" at the end

of this release.

|

CONFERENCE CALL AND WEBCAST DETAILS

Capstone will hold

a conference call on Wednesday, November 6,

2019, at 10:30 a.m. Eastern

time (7:30 a.m. Pacific time)

to discuss these results. The webcast presentation will also be

available at

https://capstonemining.com/investors/events-and-presentations/default.aspx.

|

Date:

|

Wednesday, November

6, 2019

|

|

Time:

|

10:30 am Eastern Time

(7:30 am Pacific Time)

|

|

Dial in:

|

North America:

1-888-390-0546, International: +416-764-8688

|

|

Webcast:

|

https://event.on24.com/wcc/r/2110021/22F1E92F94A522B0BF4CD321053FFFC3

|

|

Replay:

|

North America:

1-888-390-0541, International: +416-764-8677

|

|

Passcode:

|

447854#

|

The conference call replay will be available until November 13, 2019. Following the replay, an audio

file will be available on Capstone's website at

https://capstonemining.com/investors/events-and-presentations/default.aspx.

This release is not suitable on a standalone basis for readers

unfamiliar with Capstone and should be read in conjunction with the

Company's MD&A and Financial Statements for the three and nine

months ended September 30, 2019,

which are available on Capstone's website and on SEDAR, all of

which have been reviewed and approved by Capstone's Board of

Directors.

ABOUT CAPSTONE MINING CORP.

Capstone Mining Corp. is a

Canadian base metals mining company, focused on copper. We are

committed to the responsible development of our assets and the

environments in which we operate. Our two producing mines are the

Pinto Valley copper mine located in Arizona, US and the Cozamin copper-silver mine

in Zacatecas State, Mexico. In

addition, Capstone has the large scale 70% owned copper-iron

Santo Domingo development project

in Region III, Chile in

partnership with Korea Resources Corporation, as well as a

portfolio of exploration properties. Capstone's strategy is to

focus on the optimization of operations and assets in politically

stable, mining-friendly regions, centred in the Americas. Our

headquarters are in Vancouver,

Canada and we are listed on the Toronto Stock Exchange

(TSX). Further information is available at

www.capstonemining.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

INFORMATION

This document may contain "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995

(collectively, "forward-looking statements"). These forward-looking

statements are made as of the date of this document and the Company

does not intend, and does not assume any obligation, to update

these forward-looking statements, except as required under

applicable securities legislation.

Forward-looking statements relate to future events or future

performance and reflect our expectations or beliefs regarding

future events. Forward-looking statements include, but are not

limited to, statements with respect to the estimation of mineral

resources and mineral reserves, the realization of mineral reserve

estimates, the timing and amount of estimated future production,

costs of production and capital expenditures, the success of our

mining operations, the continuing success of mineral exploration,

Capstone's ability to fund future exploration activities,

environmental risks, unanticipated reclamation expenses and title

disputes. In certain cases, forward-looking statements can be

identified by the use of words such as "plans", "expects",

"budget", "scheduled", "estimates", "forecasts", "intends",

"anticipates", "believes" or variations of such words and phrases,

or statements that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved" or the negative of these terms or comparable terminology.

In this document certain forward-looking statements are identified

by words including "anticipated", "guidance", "plan", "expanding"

and "expected". By their very nature, forward-looking statements

involve known and unknown risks, uncertainties and other factors

that may cause our actual results, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Such factors include, amongst others, risks related to

inherent hazards associated with mining operations and closure of

mining projects, future prices of copper and other metals,

compliance with financial covenants, surety bonding, our ability to

raise capital, Capstone's ability to acquire properties for growth,

counterparty risks associated with sales of our metals, use of

financial derivative instruments and associated counterparty risks,

foreign currency exchange rate fluctuations, changes in general

economic conditions, accuracy of mineral resource and mineral

reserve estimates, operating in foreign jurisdictions with risk of

changes to governmental regulation, compliance with governmental

regulations, compliance with environmental laws and regulations,

reliance on approvals, licenses and permits from governmental

authorities, acting as Indemnitor for Minto Exploration Ltd.'s

surety bond obligations post divestiture, impact of climatic

conditions on our Pinto Valley and Cozamin operations,

aboriginal title claims and rights to consultation and

accommodation, land reclamation and mine closure obligations,

uncertainties and risks related to the potential development of the

Santo Domingo Project, increased operating and capital costs,

challenges to title to our mineral properties, maintaining ongoing

social license to operate, dependence on key management personnel,

potential conflicts of interest involving our directors and

officers, corruption and bribery, limitations inherent in our

insurance coverage, labour relations, increasing energy prices,

competition in the mining industry, risks associated with joint

venture partners, our ability to integrate new acquisitions into

our operations, cybersecurity threats, legal proceedings, and other

risks of the mining industry as well as those factors detailed from

time to time in the Company's interim and annual financial

statements and MD&A of those statements, all of which are filed

and available for review under the Company's profile on SEDAR at

www.sedar.com. Although the Company has attempted to identify

important factors that could cause our actual results, performance

or achievements to differ materially from those described in our

forward-looking statements, there may be other factors that cause

our results, performance or achievements not to be as anticipated,

estimated or intended. There can be no assurance that our

forward-looking statements will prove to be accurate, as our actual

results, performance or achievements could differ materially from

those anticipated in such statements. Accordingly, readers should

not place undue reliance on our forward-looking statements.

NATIONAL INSTRUMENT 43-101 COMPLIANCE

Unless otherwise

indicated, Capstone has prepared the technical information in this

MD&A ("Technical Information") based on information contained

in the technical reports, Annual Information Form and news releases

(collectively the "Disclosure Documents") available under Capstone

Mining Corp.'s company profile on SEDAR at www.sedar.com. Each

Disclosure Document was prepared by or under the supervision of a

qualified person (a "Qualified Person") as defined in National

Instrument 43-101 – Standards of Disclosure for Mineral

Projects of the Canadian Securities Administrators ("NI

43-101"). Readers are encouraged to review the full text of the

Disclosure Documents which qualifies the Technical Information.

Readers are advised that mineral resources that are not mineral

reserves do not have demonstrated economic viability. The

Disclosure Documents are each intended to be read as a whole, and

sections should not be read or relied upon out of context. The

Technical Information is subject to the assumptions and

qualifications contained in the Disclosure Documents.

The disclosure of Technical Information in this MD&A was

reviewed and approved by Brad

Mercer, P. Geol., Senior Vice President, Operations and

Exploration (Technical Information related to mineral exploration

activities and to mineral resources at Cozamin), Clay Craig, P.Eng, Superintendent Mine Technical

Services – Pinto Valley Mine (Technical information related to

mineral reserves and mineral resources at Pinto Valley),

Tucker Jensen, Senior Technical

Advisor – Cozamin Mine, P.Eng (Technical information related to

mineral reserves at Cozamin), all Qualified Persons under NI

43-101, and Albert Garcia III, PE, Vice President, Projects

(Technical Information related to project updates at Santo Domingo).

ALTERNATIVE PERFORMANCE MEASURES

The items marked

with a "1" are alternative performance measures and

readers should refer to Alternative Performance Measures in the

Company's Management's Discussion and Analysis for the three months

and nine months ended September 30,

2019 as filed on SEDAR and as available on the Company's

website.

CAUTIONARY NOTE TO UNITED

STATES INVESTORS

This news release contains

disclosure that has been prepared in accordance with the

requirements of Canadian securities laws, which differ from the

requirements of US securities laws. Without limiting the foregoing,

this news release may refer to technical reports that use the terms

"indicated" and "inferred" resources. US investors are cautioned

that, while such terms are recognized and required by Canadian

securities laws, the SEC does not recognize them. Under US

standards, mineralization may not be classified as a "reserve"

unless the determination has been made that the mineralization

could be economically and legally produced or extracted at the time

the reserve determination is made. US investors are cautioned not

to assume that all or any part of indicated resources will ever be

converted into reserves. US investors should also understand that

"inferred resources" have a great amount of uncertainty as to their

existence and as to whether they can be mined legally or

economically. It cannot be assumed that all or any part of

"inferred resources" will ever be upgraded to a higher category.

Therefore, US investors are also cautioned not to assume that all

or any part of inferred resources exist, or that they can be mined

legally or economically. Accordingly, information concerning

descriptions of mineralization and resources contained in this news

release may not be comparable to information made public by US

companies subject to the reporting and disclosure requirements of

the SEC.

View original content to download

multimedia:http://www.prnewswire.com/news-releases/capstone-q3-2019-results-near-term-organic-growth-300952346.html

View original content to download

multimedia:http://www.prnewswire.com/news-releases/capstone-q3-2019-results-near-term-organic-growth-300952346.html

SOURCE Capstone Mining Corp.