Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

2023年7月10日 - 11:58PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

Pursuant

to Rule 13a-16 or 15d-16

Under

the Securities Exchange Act of 1934

For

the month of July 2023

Commission

File Number: 001-35829

Vermilion

Energy Inc.

(Exact

name of registrant as specified in its charter)

3500,

520 – 3rd Avenue S.W., Calgary, Alberta T2P 0R3

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Exhibit

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

VERMILION

ENERGY INC.

| |

|

|

| By: |

|

/s/ Lars Glemser |

| Title: |

|

Lars Glemser, VP and Chief Financial Officer |

Date: July 10, 2023

Exhibit 99.1

Vermilion Energy Inc. Announces TSX Approval

for Renewal of Normal Course Issuer Bid

CALGARY, AB, July 10, 2023 /CNW/ - Vermilion Energy

Inc. ("Vermilion", "We", "Our", or the "Company") (TSX: VET) (NYSE: VET) is pleased to announce

that the Toronto Stock Exchange ("TSX") has approved the notice of Vermilion's intention to commence a normal course issuer

bid ("NCIB") through the facilities of the Toronto Stock Exchange ("TSX"), New York Stock Exchange and other alternative

trading platforms in Canada and USA.

The NCIB allows Vermilion to purchase up to 16,308,587

common shares, representing approximately 10% of its public float as at June 28, 2023, over a twelve month period commencing on July 12,

2023. The NCIB will expire no later than July 11, 2024. The total number of common shares Vermilion is permitted to purchase on the TSX

is subject to a daily purchase limit of 297,362 common shares, representing 25% of the average daily trading volume of 1,189,450 common

shares on the TSX calculated for the six-month period ended June 30, 2023; however, Vermilion may make one block purchase per calendar

week which exceeds the daily repurchase restrictions. Any common shares that are purchased under the NCIB will be cancelled upon their

purchase by Vermilion.

In connection with the NCIB, Vermilion will enter

an automatic purchase plan ("ASPP") with its designated broker to allow for purchases of its common shares during self-imposed

blackout periods. Such purchases would be at the discretion of the broker based on parameters provided by the Company prior to any self-imposed

blackout period or any period when it is in possession of material undisclosed information. The ASPP has been pre-cleared, as required

by the TSX. Outside of these blackout periods, common shares may be purchased under the NCIB in accordance with Management's discretion.

Vermilion has a long history of returning capital

to its shareholders as we have paid out over $40 per share in dividends since 2003. Our primary focus over the past three years has been

on debt reduction with the intention of increasing shareholder returns as debt levels decreased. In Q3 2022 we implemented an NCIB and

repurchased an aggregate 5,356,723 common shares at a weighted average price of $23.51 per share under this plan to June 28, 2023. These

repurchases were all made in open market transactions. The Company anticipates returning 25% to 30% of free cash flow(1) to

shareholders in 2023, depending on commodity prices, primarily through the base dividend and share repurchases. The majority of free cash

flow will continue to be allocated to debt reduction until we achieve our $1 billion net debt target, after which we plan to increase

our return of capital to shareholders. Share buybacks continue to screen as one of the most compelling options for returning capital to

shareholders as we believe our common shares are trading at a price that does not reflect the appropriate value of the company.

(1) Free cash flow is

a non-GAAP financial measure most directly comparable to cash flows from operating activities; it does not have a standardized meaning

under IFRS and therefore may not be comparable to similar measures presented by other issuers. Free cash flow is comprised of fund flows

from operations less drilling and development costs and exploration and evaluation costs. The measure is used to determine the funding

available for investing and financing activities including payment of dividends, repayment of long-term debt, reallocation into existing

business units and deployment into new ventures.

About Vermilion

Vermilion is an international energy producer that

seeks to create value through the acquisition, exploration, development and optimization of producing assets in North America, Europe

and Australia. Our business model emphasizes free cash flow generation and returning capital to investors when economically warranted,

augmented by value-adding acquisitions. Vermilion's operations are focused on the exploitation of light oil and liquids-rich natural

gas conventional and unconventional resource plays in North America and the exploration and development of conventional natural gas and

oil opportunities in Europe and Australia.

Vermilion's priorities are health and safety, the

environment, and profitability, in that order. Nothing is more important to us than the safety of the public and those who work with

us, and the protection of our natural surroundings. We have been recognized by leading ESG rating agencies for our transparency on

and management of key environmental, social and governance issues. In addition, we emphasize strategic community investment in each of

our operating areas.

Vermilion trades on the Toronto Stock Exchange and

the New York Stock Exchange under the symbol VET.

View original content to download multimedia:https://www.prnewswire.com/news-releases/vermilion-energy-inc-announces-tsx-approval-for-renewal-of-normal-course-issuer-bid-301872617.html

SOURCE Vermilion Energy Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2023/10/c2499.html

%CIK: 0001293135

For further information: Dion Hatcher, President & CEO; Lars

Glemser, Vice President & CFO; and/or Kyle Preston, Vice President, Investor Relations; TEL (403) 269-4884 | IR TOLL FREE 1-866-895-8101

| investor_relations@vermilionenergy.com | www.vermilionenergy.com

CO: Vermilion Energy Inc.

CNW 06:00e 10-JUL-23

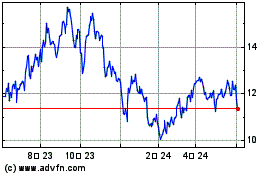

Vermilion Energy (NYSE:VET)

過去 株価チャート

から 10 2024 まで 11 2024

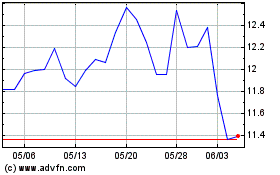

Vermilion Energy (NYSE:VET)

過去 株価チャート

から 11 2023 まで 11 2024