Delivers Record Quarterly Revenue of $61.1

Million, up 14% Year-over-Year Expands GAAP Gross Margin to 53% and

Non-GAAP Gross Margin to 58% Launched 36 SuperDove Satellites and

First Tanager Hyperspectral Satellite

Planet Labs PBC (NYSE: PL) (“Planet” or the “Company”), a

leading provider of daily data and insights about Earth, today

announced financial results for the period ended July 31, 2024.

“During the second quarter, we saw continued strength with

government customers, especially in the Defense & Intelligence

sector where revenue grew over 30% year-over-year and we saw

continued demand for our broad area monitoring solution paired with

AI,” said Will Marshall, Planet’s Co-Founder, Chief Executive

Officer and Chairperson. “We restructured the business towards an

industry-aligned operating model and improved overall operational

efficiency across the Company. We’re pleased with the gross margin

expansion and progress towards our profitability objectives that we

saw during the quarter, as well as the launch last month of 36

SuperDoves and Planet’s first hyperspectral satellite.”

Ashley Johnson, Planet’s President and Chief Financial Officer,

added, “Our results for the second quarter demonstrate continued

progress towards our target of achieving Adjusted EBITDA

profitability in Q4 of this fiscal year - an important milestone on

our journey to building a high margin, sustainable, cash flow

generating business. Our balance sheet remains strong with

approximately $249 million of cash, cash equivalents, and

short-term investments as of the end of the quarter, and we

continue to have no debt.”

Second Quarter of Fiscal 2025 Financial and Key Metric

Highlights:

- Second quarter revenue increased 14% year-over-year to a record

$61.1 million.

- Percent of Recurring Annual Contract Value (ACV) for the second

quarter was 96%.

- End of Period (EoP) Customer Count increased 7% year-over-year

to 1,012 customers.

- Second quarter gross margin was 53%, compared to 49% in the

second quarter of fiscal year 2024. Second quarter Non-GAAP Gross

Margin was 58%, compared to 52% in the second quarter of fiscal

year 2024.

- Second quarter net loss was ($38.7) million, compared to

($38.0) million in the second quarter of fiscal year 2024. Of the

net loss in the second quarter of fiscal 2025, ($10.5) million was

related to non-recurring charges in connection with the Company’s

headcount reduction during the quarter. Second quarter Adjusted

EBITDA loss was ($4.4) million, compared to a ($14.5) million loss

in the second quarter of fiscal year 2024.

- Ended the quarter with $249 million in cash, cash equivalents

and short-term investments.

Recent Business Highlights:

Growing Customer and Partner

Relationships

- NATO: Planet won an introductory contract with the North

Atlantic Treaty Organization (NATO) Communications &

Information Agency for the Alliance Persistent Surveillance from

Space program. Under the contract, NATO will have access to

Planet’s broad area monitoring and high resolution tasking

solutions to evaluate and perform detailed tracking and analysis of

foreign military activities, monitor infrastructure, and fill

intelligence gaps.

- International Defense Customer: Planet closed a

seven-figure deal with an international defense customer, which

includes an expansion of high resolution tasking imagery and a

pilot for PlanetScope data enhanced with AI capabilities from

partner SynMax for maritime domain awareness.

- Government of the Kingdom of Bahrain: Planet and the

Government of the Kingdom of Bahrain announced that the Kingdom is

using Planet data, enhanced by partner Aetosky’s AI capabilities,

to support smart city management and urban planning initiatives

across the country. The Kingdom shared that thus far this has led

to a significant increase in effectiveness of building permit

validation activities.

- International Government Agency: Planet won a

seven-figure expansion with an International Government Agency to

provide high resolution SkySat data.

- BASF Digital Farming GmbH: Planet expanded its contract

with long-time customer and global agricultural leader BASF, adding

Planet’s Field Boundary solution to support their xarvio® Digital

Farming Solutions platform. Xarvio is a digital agriculture

application that provides farmers and consultants with timely

agronomic advice, serving more than 100,000 customers in more than

seven countries.

- American Crystal Sugar Company: Planet announced a

renewal and expansion with American Crystal Sugar, led by Planet

partner SatAgro. SatAgro, a precision agriculture company, will use

Planet data to provide American Crystal Sugar with advanced sugar

beet monitoring in the northern United States, including solutions

such as harvest progression, yield prediction, and other insights

to inform crop management decisions.

New Technologies and

Products

- Recent Launch: On August 16, 2024, Planet’s first

hyperspectral satellite, Tanager-1, was launched into orbit onboard

a SpaceX launch vehicle, along with 36 Planet SuperDove satellites.

Planet has contacted Tanager-1 and the satellite is now in the

commissioning process. Tanager-1 is made possible by the Carbon

Mapper Coalition, a philanthropically-funded effort focused on

methane and CO2 super emission detection. All 36 SuperDoves have

been contacted as well, and the first satellite to achieve first

light did so in a record three days. Planet’s SuperDove

constellation remains the largest Earth imaging fleet in history

and the basis for Planet’s broad area monitoring solution.

- NVIDIA Jetson: During the quarter, Planet announced that

its upcoming Pelican-2 satellite is designed to incorporate

next-generation communication technology and NVIDIA’s Jetson

platform. With these advanced technologies, Planet plans to design

workflows that can significantly shorten the timeline to deliver

actionable insights to customers. The Pelican-2 satellite is

expected to provide improvements in image quality, spectral bands,

spatial resolution, and imaging capacity relative to its SkySat

predecessors.

Impact and ESG

- Disaster Response: As part of an ongoing partnership

with Microsoft’s AI for Good Lab, Planet provides imagery of

emergent disasters for use by rescue and aid operations,

researchers, and media organizations. Most recently, Planet

partnered with Microsoft’s AI for Good Lab and humanitarian aid

organizations to support a rapid disaster response and building

damage assessment to cover the impact of Hurricane Beryl on

Grenada. Beryl struck in late June to early July, causing dozens of

deaths and billions of dollars of damage according to current

estimates. It is notable for being the earliest-forming Category 5

Atlantic hurricane on record.

- Amazon Conservation: Mapping the Andean Amazon Project

released the first in a series of reports on forest carbon across

the Amazon. The researchers leveraged Planet’s deep data archive

and Forest Carbon Diligence product to estimate the total

aboveground forest carbon in the Amazon biome and understand how

much has been lost or gained over the past 10 years. This research

affirms that the Amazon remains a critical net carbon sink and can

be used to analyze which areas have a higher carbon density, which

could aid policy makers in allocating conservation resources. The

data can also be used as verification for carbon markets and their

customers, as operating high quality carbon markets requires

effective carbon sequestration measurement and validation

processes. Planet continues to have an active Education &

Research program across earth systems science fields, driving both

valuable research and use case validation.

Third Quarter Financial Outlook

For the third quarter of fiscal year 2025, ending October 31,

2024, Planet expects revenue to be in the range of approximately

$61 million to $64 million. Non-GAAP Gross Margin is expected to be

in the range of approximately 59% to 61%. Adjusted EBITDA loss is

expected to be in the range of approximately ($5) million and ($2)

million for the quarter. Capital Expenditures are expected to be in

the range of approximately $13 million and $16 million for the

quarter.

Planet has not reconciled its Non-GAAP financial outlook to the

most directly comparable GAAP measures because certain reconciling

items, such as stock-based compensation expenses and depreciation

and amortization are uncertain or out of Planet’s control and

cannot be reasonably predicted. The actual amount of these expenses

during the third quarter of fiscal year 2025 will have a

significant impact on Planet’s future GAAP financial results.

Accordingly, a reconciliation of Planet’s Non-GAAP outlook to the

most comparable GAAP measures is not available without unreasonable

efforts.

The foregoing forward-looking statements reflect Planet’s

expectations as of today's date. Given the number of risk factors,

uncertainties and assumptions discussed below, actual results may

differ materially.

Webcast and Conference Call Information

Planet will host a conference call at 5:00 p.m. ET / 2:00 p.m.

PT today, September 5, 2024. The webcast can be accessed at

www.planet.com/investors/. A replay will be available approximately

2 hours following the event. If you would prefer to register for

the conference call, please go to the following link:

https://www.netroadshow.com/events/login?show=7f21d0c6&confId=69577.

You will then receive your access details via email.

Additionally, a supplemental presentation has been made

available on Planet’s investor relations page.

About Planet Labs PBC

Planet is a leading provider of global, daily satellite imagery

and geospatial solutions. Planet is driven by a mission to image

the world every day, and make change visible, accessible and

actionable. Founded in 2010 by three NASA scientists, Planet

designs, builds, and operates the largest Earth observation fleet

of imaging satellites. Planet provides mission-critical data,

advanced insights, and software solutions to over 1,000 customers,

comprising the world’s leading agriculture, forestry, intelligence,

education and finance companies and government agencies, enabling

users to simply and effectively derive unique value from satellite

imagery. Planet is a public benefit corporation listed on the New

York Stock Exchange as PL. To learn more visit www.planet.com and

follow us on X (formerly Twitter) or tune in to HBO's 'Wild Wild

Space’.

Channels for Disclosure of Information

Planet intends to announce material information to the public

through a variety of means, including filings with the Securities

and Exchange Commission, press releases, public conference calls,

webcasts, the investor relations section of its website

(investors.planet.com) and its blog (planet.com/pulse) in order to

achieve broad, non-exclusionary distribution of information to the

public and for complying with its disclosure obligations under

Regulation FD. It is possible that the information Planet posts on

its blog could be deemed to be material information. As such,

Planet encourages investors, the media, and others to follow the

channels listed above and to review the information disclosed

through such channels.

Planet’s Use of Non-GAAP Financial Measures

This press release includes Non-GAAP Gross Profit, Non-GAAP

Gross Margin, certain Non-GAAP Expenses described further below,

Non-GAAP Loss from Operations, Non-GAAP Net Loss, Non-GAAP Net Loss

per Diluted Share, Adjusted EBITDA and Backlog, which are non-GAAP

measures the Company uses to supplement its results presented in

accordance with U.S. GAAP. The Company includes these non-GAAP

financial measures because they are used by management to evaluate

the Company’s core operating performance and trends and to make

strategic decisions regarding the allocation of capital and new

investments.

Non-GAAP Gross Profit and Non-GAAP Gross

Margin: The Company defines and calculates Non-GAAP Gross

Profit as gross profit adjusted for stock-based compensation,

amortization of acquired intangible assets classified as cost of

revenue, restructuring costs, and employee transaction bonuses in

connection with the Sinergise business combination. The Company

defines Non-GAAP Gross Margin as Non-GAAP Gross Profit divided by

revenue.

Non-GAAP Expenses: The Company

defines and calculates Non-GAAP cost of revenue, Non-GAAP research

and development expenses, Non-GAAP sales and marketing expenses,

and Non-GAAP general and administrative expenses as, in each case,

the corresponding U.S. GAAP financial measure (cost of revenue,

research and development expenses, sales and marketing expenses,

and general and administrative expenses) adjusted for stock-based

compensation, amortization of acquired intangible assets,

restructuring costs, and employee transaction bonuses in connection

with the Sinergise business combination, that are classified within

each of the corresponding U.S. GAAP financial measures.

Non-GAAP Loss from Operations: The

Company defines and calculates Non-GAAP Loss from Operations as

loss from operations adjusted for stock-based compensation,

amortization of acquired intangible assets, restructuring costs,

and employee transaction bonuses in connection with the Sinergise

business combination.

Non-GAAP Net Loss and Non-GAAP Net Loss

per Diluted Share: The Company defines and calculates

Non-GAAP Net Loss as net loss adjusted for stock-based

compensation, amortization of acquired intangible assets,

restructuring costs, and employee transaction bonuses in connection

with the Sinergise business combination, and the income tax effects

of the non-GAAP adjustments. The Company defines and calculates

Non-GAAP Net Loss per Diluted Share as Non-GAAP Net Loss divided by

diluted weighted-average common shares outstanding.

Adjusted EBITDA: The Company

defines and calculates Adjusted EBITDA as net income (loss) before

the impact of interest income and expense, income tax expense and

depreciation and amortization, and further adjusted for the

following items: stock-based compensation, change in fair value of

warrant liabilities, non-operating income and expenses such as

foreign currency exchange gain or loss, restructuring costs, and

employee transaction bonuses in connection with the Sinergise

business combination.

The Company presents Non-GAAP Gross Profit, Non-GAAP Gross

Margin, certain Non-GAAP Expenses described above, Non-GAAP Loss

from Operations, Non-GAAP Net Loss, Non-GAAP Net Loss per Diluted

Share and Adjusted EBITDA because the Company believes these

measures are frequently used by analysts, investors and other

interested parties to evaluate companies in Planet’s industry and

facilitates comparisons on a consistent basis across reporting

periods. Further, the Company believes these measures are helpful

in highlighting trends in its operating results because they

exclude items that are not indicative of the Company’s core

operating performance.

Backlog: The Company defines and

calculates Backlog as remaining performance obligations plus the

cancellable portion of the contract value for contracts that

provide the customer with a right to terminate for convenience

without incurring a substantive termination penalty and written

orders where funding has not been appropriated. Backlog does not

include unexercised contract options. Remaining performance

obligations represent the amount of contracted future revenue that

has not yet been recognized, which includes both deferred revenue

and non-cancelable contracted revenue that will be invoiced and

recognized in revenue in future periods. Remaining performance

obligations do not include contracts which provide the customer

with a right to terminate for convenience without incurring a

substantive termination penalty, written orders where funding has

not been appropriated and unexercised contract options.

An increasing and meaningful portion of the Company’s revenue is

generated from contracts with the U.S. government and other

government customers. Cancellation provisions, such as termination

for convenience clauses, are common in contracts with the U.S.

government and certain other government customers. The Company

presents Backlog because the portion of its customer contracts with

such cancellation provisions represents a meaningful amount of the

Company’s expected future revenues. Management uses backlog to more

effectively forecast the Company’s future business and results,

which supports decisions around capital allocation. It also helps

the Company identify future growth or operating trends that may not

otherwise be apparent. The Company also believes Backlog is useful

for investors in forecasting the Company’s future results and

understanding the growth of its business. Customer cancellation

provisions relating to termination for convenience clauses and

funding appropriation requirements are outside of the Company’s

control, and as a result, the Company may fail to realize the full

value of such contracts.

Non-GAAP financial measures have limitations as analytical tools

and should not be considered in isolation from, as a substitute

for, or superior to, measures of financial performance prepared in

accordance with U.S. GAAP. The non-GAAP financial measures

presented are not based on any standardized methodology prescribed

by U.S. GAAP and are not necessarily comparable to similarly-titled

measures presented by other companies, which may have different

definitions from the Company’s. Further, certain of the non-GAAP

financial measures presented exclude stock-based compensation

expenses, which has recently been, and will continue to be for the

foreseeable future, a significant recurring expense for the Company

and an important part of its compensation strategy.

Other Key Metrics

ACV and EoP ACV Book of Business:

In connection with the calculation of several of the key

operational and business metrics we utilize, the Company calculates

Annual Contract Value (“ACV”) for contracts of one year or greater

as the total amount of value that a customer has contracted to pay

for the most recent 12 month period for the contract, excluding

customers that are exclusively Sentinel Hub self-service paying

users. For short-term contracts (contracts less than 12 months),

ACV is equal to total contract value.

The Company also calculates EoP ACV Book of Business in

connection with the calculation of several of the key operational

and business metrics we utilize. The Company defines EoP ACV Book

of Business as the sum of the ACV of all contracts that are active

on the last day of the period pursuant to the effective dates and

end dates of such contracts, excluding customers that are

exclusively Sentinel Hub self-service paying users. Active

contracts exclude any contract that has been canceled, expired

prior to the last day of the period without renewing, or for any

other reason is not expected to generate revenue in the subsequent

period. For contracts ending on the last day of the period, the ACV

is either updated to reflect the ACV of the renewed contract or, if

the contract has not yet renewed or extended, the ACV is excluded

from the EoP ACV Book of Business. The Company does not annualize

short-term contracts in calculating its EoP ACV Book of Business.

The Company calculates the ACV of usage-based contracts based on

the committed contracted revenue or the revenue achieved on the

usage-based contract in the prior 12-month period.

Percent of Recurring ACV: Percent

of Recurring ACV is the portion of the total EoP ACV Book of

Business that is recurring in nature. The Company defines EoP ACV

Book of Business as the sum of the ACV of all contracts that are

active on the last day of the period pursuant to the effective

dates and end dates of such contracts, excluding customers that are

exclusively Sentinel Hub self-service paying users. The Company

defines Percent of Recurring ACV as the dollar value of all data

subscription contracts and the committed portion of usage-based

contracts (excluding customers that are exclusively Sentinel Hub

self-service paying users) divided by the total dollar value of all

contracts in our EoP ACV Book of Business. The Company believes

Percent of Recurring ACV is useful to investors to better

understand how much of the Company’s revenue is from customers that

have the potential to renew their contracts over multiple years

rather than being one-time in nature. The Company tracks Percent of

Recurring ACV to inform estimates for the future revenue growth

potential of our business and improve the predictability of our

financial results. There are no significant estimates underlying

management’s calculation of Percent of Recurring ACV, but

management applies judgment as to which customers have an active

contract at a period end for the purpose of determining EoP ACV

Book of Business, which is used as part of the calculation of

Percent of Recurring ACV.

EoP Customer Count: The Company

defines EoP Customer Count as the total count of all existing

customers at the end of the period excluding customers that are

exclusively Sentinel Hub self-service paying users. For EoP

Customer Count, the Company defines existing customers as customers

with an active contract with the Company at the end of the reported

period. For the purpose of this metric, the Company defines a

customer as a distinct entity that uses the Company’s data or

services. The Company sells directly to customers, as well as

indirectly through its partner network. If a partner does not

provide the end customer’s name, then the partner is reported as

the customer. Each customer, regardless of the number of active

opportunities with the Company, is counted only once. For example,

if a customer utilizes multiple products of Planet, the Company

only counts that customer once for purposes of EoP Customer Count.

A customer with multiple divisions, segments, or subsidiaries are

also counted as a single unique customer based on the parent

organization or parent account. For EoP Customer Count, the Company

does not include users that only utilize the Company’s self-service

Sentinel Hub web based ordering system, which the Company acquired

in August 2023, and which offers standard starter packages on a

monthly or annual basis. The Company believes excluding these users

from EoP Customer Count creates a more useful metric, as the

Company views the Sentinel Hub starter packages as entry points for

smaller accounts, leading to broader awareness of the Company’s

solutions throughout their networks and organizations. The Company

believes EoP Customer Count is a useful metric for investors and

management to track as it is an important indicator of the broader

adoption of the Company’s platform and is a measure of the

Company’s success in growing its market presence and penetration.

Management applies judgment as to which customers are deemed to

have an active contract in a period, as well as whether a customer

is a distinct entity that uses the Company’s data or services.

Capital Expenditures as a Percentage of

Revenue: The Company defines capital expenditures as

purchases of property and equipment plus capitalized internally

developed software development costs, which are included in our

statements of cash flows from investing activities. The Company

defines Capital Expenditures as a Percentage of Revenue as the

total amount of capital expenditures divided by total revenue in

the reported period. Capital Expenditures as a Percentage of

Revenue is a performance measure that we use to evaluate the

appropriate level of capital expenditures needed to support demand

for the Company’s data services and related revenue, and to provide

a comparable view of the Company’s performance relative to other

earth observation companies, which may invest significantly greater

amounts in their satellites to deliver their data to customers. The

Company uses an agile space systems strategy, which means we invest

in a larger number of significantly lower cost satellites and

software infrastructure to automate the management of the

satellites and to deliver the Company’s data to clients. As a

result of the Company’s strategy and business model, the Company’s

capital expenditures may be more similar to software companies with

large data center infrastructure costs. Therefore, the Company

believes it is important to look at the level of capital

expenditure investments relative to revenue when evaluating the

Company’s performance relative to other earth observation companies

or to other software and data companies with significant data

center infrastructure investment requirements. The Company believes

Capital Expenditures as a Percentage of Revenue is a useful metric

for investors because it provides visibility to the level of

capital expenditures required to operate the Company and the

Company’s relative capital efficiency.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements generally relate to future

events or Planet's future financial or operating performance. In

some cases, you can identify forward looking statements because

they contain words such as “expect,” “estimate,” “project,”

“budget,” “forecast,” “target,” “anticipate,” “intend,” “develop,”

“evolve,” “plan,” “seek,” “may,” “will,” “could,” “can,” “should,”

“would,” “believes,” “predicts,” “potential,” “strategy,”

“opportunity,” “aim,” “conviction,” “continue,” “positioned” or the

negative of these words or other similar terms or expressions that

concern Planet's expectations, strategy, priorities, plans or

intentions. Forward-looking statements in this release include, but

are not limited to, statements regarding Planet’s financial

guidance and outlook, Planet’s path to profitability (including on

an Adjusted EBITDA basis) and target for achieving Adjusted EBITDA

profitability, Planet’s expectations regarding future product

development and performance, and Planet’s expectations regarding

its strategies with respect to its markets and customers, including

trends in customer demand. Planet’s expectations and beliefs

regarding these matters may not materialize, and actual results in

future periods are subject to risks and uncertainties that could

cause actual results to differ materially from those projected,

including risks related to the macroeconomic environment and risks

regarding Planet’s ability to forecast Planet’s performance due to

Planet’s limited operating history. The forward-looking statements

contained in this release are also subject to other risks and

uncertainties, including those more fully described in Planet's

filings with the Securities and Exchange Commission (“SEC”),

including Planet’s Annual Report on Form 10-K and any subsequent

filings with the SEC Planet may make. All forward-looking

statements reflect Planet’s beliefs and assumptions only as of the

date of this press release. Planet undertakes no obligation to

update forward-looking statements to reflect future events or

circumstances, except as may be required by law. Planet’s results

for the quarter ended July 31, 2024, are not necessarily indicative

of its operating results for any future periods.

PLANET

CONDENSED CONSOLIDATED BALANCE

SHEETS (unaudited)

(In thousands)

July 31, 2024

January 31, 2024

Assets

Current assets

Cash and cash equivalents

$

148,288

$

83,866

Restricted cash and cash equivalents,

current

8,802

8,360

Short-term investments

101,102

215,041

Accounts receivable, net

43,926

43,320

Prepaid expenses and other current

assets

24,628

19,564

Total current assets

326,746

370,151

Property and equipment, net

113,227

113,429

Capitalized internal-use software, net

17,322

14,973

Goodwill

137,325

136,256

Intangible assets, net

30,405

32,448

Restricted cash and cash equivalents,

non-current

9,539

9,972

Operating lease right-of-use assets

21,703

22,339

Other non-current assets

2,084

2,429

Total assets

$

658,351

$

701,997

Liabilities and Stockholders’

Equity

Current liabilities

Accounts payable

$

2,392

$

2,601

Accrued and other current liabilities

56,839

44,779

Deferred revenue

64,523

72,327

Liability from early exercise of stock

options

7,171

8,964

Operating lease liabilities, current

8,755

7,978

Total current liabilities

139,680

136,649

Deferred revenue

11,969

5,293

Deferred hosting costs

7,963

7,101

Public and private placement warrant

liabilities

2,033

2,961

Operating lease liabilities,

non-current

15,218

16,952

Contingent consideration

2,491

5,885

Other non-current liabilities

5,750

9,138

Total liabilities

185,104

183,979

Stockholders’ equity

Common stock

28

28

Additional paid-in capital

1,619,738

1,596,201

Accumulated other comprehensive income

1,247

1,594

Accumulated deficit

(1,147,766

)

(1,079,805

)

Total stockholders’ equity

473,247

518,018

Total liabilities and stockholders’

equity

$

658,351

$

701,997

PLANET

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

(In thousands, except share and per share

amounts)

2024

2023

2024

2023

Revenue

$

61,092

$

53,761

$

121,532

$

106,464

Cost of revenue

28,782

27,469

57,539

52,025

Gross profit

32,310

26,292

63,993

54,439

Operating expenses

Research and development

27,250

26,741

52,839

54,927

Sales and marketing

23,733

22,310

45,218

45,435

General and administrative

20,904

20,521

40,084

42,049

Total operating expenses

71,887

69,572

138,141

142,411

Loss from operations

(39,577

)

(43,280

)

(74,148

)

(87,972

)

Interest income

2,771

3,802

5,878

8,308

Change in fair value of warrant

liabilities

(602

)

1,226

928

7,171

Other income (expense), net

(363

)

859

720

963

Total other income, net

1,806

5,887

7,526

16,442

Loss before provision for income taxes

(37,771

)

(37,393

)

(66,622

)

(71,530

)

Provision for income taxes

897

582

1,339

889

Net loss

$

(38,668

)

$

(37,975

)

$

(67,961

)

$

(72,419

)

Basic and diluted net loss per share

attributable to common stockholders

$

(0.13

)

$

(0.14

)

$

(0.23

)

$

(0.26

)

Basic and diluted weighted-average common

shares outstanding used in computing net loss per share

attributable to common stockholders

290,364,319

275,053,198

289,328,033

273,723,006

PLANET

CONDENSED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE LOSS (unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

(In thousands)

2024

2023

2024

2023

Net loss

$

(38,668

)

$

(37,975

)

$

(67,961

)

$

(72,419

)

Other comprehensive income (loss), net of

tax:

Foreign currency translation

adjustment

323

169

(211

)

124

Change in fair value of available-for-sale

securities

376

(515

)

(136

)

(1,059

)

Other comprehensive income (loss), net of

tax

699

(346

)

(347

)

(935

)

Comprehensive loss

$

(37,969

)

$

(38,321

)

$

(68,308

)

$

(73,354

)

PLANET

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (unaudited)

Six Months Ended July

31,

(In thousands)

2024

2023

Operating activities

Net loss

$

(67,961

)

$

(72,419

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation and amortization

26,248

22,408

Stock-based compensation, net of

capitalized cost

24,638

32,013

Change in fair value of warrant

liabilities

(928

)

(7,171

)

Change in fair value of contingent

consideration

1,924

(527

)

Other

(1,275

)

(2,747

)

Changes in operating assets and

liabilities

Accounts receivable

32

(1,588

)

Prepaid expenses and other assets

1,278

5,152

Accounts payable, accrued and other

liabilities

4,084

(17,164

)

Deferred revenue

(1,149

)

19,957

Deferred hosting costs

954

1,082

Net cash used in operating activities

(12,155

)

(21,004

)

Investing activities

Purchases of property and equipment

(25,061

)

(21,709

)

Capitalized internal-use software

(2,916

)

(1,998

)

Maturities of available-for-sale

securities

46,808

106,762

Sales of available-for-sale securities

150,211

990

Purchases of available-for-sale

securities

(81,656

)

(127,703

)

Business acquisition, net of cash

acquired

(1,068

)

—

Purchases of licensed imagery intangible

assets

(4,292

)

—

Other

(300

)

(644

)

Net cash provided by (used in) investing

activities

81,726

(44,302

)

Financing activities

Proceeds from the exercise of common stock

options

300

6,358

Shares repurchased for tax withholdings on

vesting of restricted stock units

(4,485

)

(4,753

)

Proceeds from employee stock purchase

plan

702

—

Payments of contingent consideration for

business acquisitions

(1,283

)

—

Other

(340

)

(15

)

Net cash provided by (used in) financing

activities

(5,106

)

1,590

Effect of exchange rate changes on cash

and cash equivalents, and restricted cash and cash equivalents

(34

)

155

Net increase (decrease) in cash and cash

equivalents, and restricted cash and cash equivalents

64,431

(63,561

)

Cash and cash equivalents, and restricted

cash and cash equivalents at the beginning of the period

102,198

188,076

Cash and cash equivalents, and

restricted cash and cash equivalents at the end of the

period

$

166,629

$

124,515

PLANET

RECONCILIATION OF NET LOSS TO

ADJUSTED EBITDA (unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

(in thousands)

2024

2023

2024

2023

Net loss

$

(38,668

)

$

(37,975

)

$

(67,961

)

$

(72,419

)

Interest income

(2,771

)

(3,802

)

(5,878

)

(8,308

)

Income tax provision

897

582

1,339

889

Depreciation and amortization

13,145

12,160

26,248

22,408

Change in fair value of warrant

liabilities

602

(1,226

)

(928

)

(7,171

)

Stock-based compensation

11,566

16,657

24,638

32,013

Restructuring costs

10,499

—

10,499

—

Other (income) expense, net

363

(859

)

(720

)

(963

)

Adjusted EBITDA

$

(4,367

)

$

(14,463

)

$

(12,763

)

$

(33,551

)

PLANET

RECONCILIATION OF U.S. GAAP TO

NON-GAAP FINANCIAL MEASURES (unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

(In thousands)

2024

2023

2024

2023

Reconciliation of cost of

revenue:

GAAP cost of revenue

$

28,782

$

27,469

$

57,539

$

52,025

Less: Stock-based compensation

942

1,063

1,818

1,968

Less: Amortization of acquired intangible

assets

750

439

1,539

878

Less: Restructuring costs

1,184

—

1,184

—

Non-GAAP cost of revenue

$

25,906

$

25,967

$

52,998

$

49,179

Reconciliation of gross profit:

GAAP gross profit

$

32,310

$

26,292

$

63,993

$

54,439

Add: Stock-based compensation

942

1,063

1,818

1,968

Add: Amortization of acquired intangible

assets

750

439

1,539

878

Add: Restructuring costs

1,184

—

1,184

—

Non-GAAP gross profit

$

35,186

$

27,794

$

68,534

$

57,285

GAAP gross margin

53

%

49

%

53

%

51

%

Non-GAAP gross margin

58

%

52

%

56

%

54

%

PLANET

RECONCILIATION OF U.S. GAAP TO

NON-GAAP FINANCIAL MEASURES (unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

(In thousands)

2024

2023

2024

2023

Reconciliation of operating

expenses:

GAAP research and development

$

27,250

$

26,741

$

52,839

$

54,927

Less: Stock-based compensation

2,663

6,929

7,826

12,899

Less: Amortization of acquired intangible

assets

—

—

—

—

Less: Restructuring costs

3,540

—

3,540

—

Non-GAAP research and development

$

21,047

$

19,812

$

41,473

$

42,028

GAAP sales and marketing

$

23,733

$

22,310

$

45,218

$

45,435

Less: Stock-based compensation

2,805

3,121

5,208

6,201

Less: Amortization of acquired intangible

assets

127

202

344

403

Less: Restructuring costs

4,433

—

4,433

—

Non-GAAP sales and marketing

$

16,368

$

18,987

$

35,233

$

38,831

GAAP general and administrative

$

20,904

$

20,521

$

40,084

$

42,049

Less: Stock-based compensation

5,156

5,544

9,786

10,945

Less: Amortization of acquired intangible

assets

36

80

115

161

Less: Restructuring costs

1,342

—

1,342

—

Non-GAAP general and administrative

$

14,370

$

14,897

$

28,841

$

30,943

Reconciliation of loss from

operations

GAAP loss from operations

$

(39,577

)

$

(43,280

)

$

(74,148

)

$

(87,972

)

Add: Stock-based compensation

11,566

16,657

24,638

32,013

Add: Amortization of acquired intangible

assets

913

721

1,998

1,442

Add: Restructuring costs

10,499

—

10,499

—

Non-GAAP loss from operations

$

(16,599

)

$

(25,902

)

$

(37,013

)

$

(54,517

)

PLANET

RECONCILIATION OF U.S. GAAP TO

NON-GAAP FINANCIAL MEASURES (unaudited)

Three Months Ended July

31,

Six Months Ended July

31,

(In thousands, except share and per share

amounts)

2024

2023

2024

2023

Reconciliation of net loss

GAAP net loss

$

(38,668

)

$

(37,975

)

$

(67,961

)

$

(72,419

)

Add: Stock-based compensation

11,566

16,657

24,638

32,013

Add: Amortization of acquired intangible

assets

913

721

1,998

1,442

Add: Restructuring costs

10,499

—

10,499

—

Income tax effect of non-GAAP

adjustments

(421

)

—

(421

)

—

Non-GAAP net loss

$

(16,111

)

$

(20,597

)

$

(31,247

)

$

(38,964

)

Reconciliation of net loss per share,

diluted

GAAP net loss

$

(38,668

)

$

(37,975

)

$

(67,961

)

$

(72,419

)

Non-GAAP net loss

$

(16,111

)

$

(20,597

)

$

(31,247

)

$

(38,964

)

GAAP net loss per share, basic and diluted

(1)

$

(0.13

)

$

(0.14

)

$

(0.23

)

$

(0.26

)

Add: Stock-based compensation

0.04

0.06

0.09

0.12

Add: Amortization of acquired intangible

assets

—

—

0.01

0.01

Add: Restructuring costs

0.04

—

0.04

—

Income tax effect of non-GAAP

adjustments

—

—

—

—

Non-GAAP net loss per share, diluted (2)

(3)

$

(0.06

)

$

(0.07

)

$

(0.11

)

$

(0.14

)

Weighted-average shares used in computing

GAAP net loss per share, basic and diluted (1)

290,364,319

275,053,198

289,328,033

273,723,006

Weighted-average shares used in computing

Non-GAAP net loss per share, diluted (1)

290,364,319

275,053,198

289,328,033

273,723,006

(1) Basic and diluted GAAP net loss per

share was the same for each period presented as the inclusion of

all potential Class A common stock and Class B common stock

outstanding would have been anti-dilutive.

(2) Non-GAAP net loss per share, diluted

is calculated using weighted-average shares, adjusted for dilutive

potential shares assumed outstanding during the period. No

adjustment was made to weighted-average shares for each period

presented as the inclusion of all potential Class A common stock

and Class B common stock outstanding would have been

anti-dilutive.

(3) Totals may not sum due to rounding.

Figures are calculated based upon the respective underlying

non-rounded data.

PLANET

RECONCILIATION OF U.S. GAAP TO

NON-GAAP FINANCIAL MEASURES (unaudited)

The table below reconciles Backlog to

remaining performance obligations for the periods indicated:

(in thousands)

July 31, 2024

January 31, 2024

Remaining performance obligations

$ 112,093

$ 132,571

Cancellable amount of contract value

101,407

109,821

Backlog

$ 213,500

$ 242,392

For remaining performance obligations as of July 31, 2024, the

Company expects to recognize approximately 78% over the next 12

months, approximately 97% over the next 24 months, and the

remainder thereafter. For Backlog as of July 31, 2024, the Company

expects to recognize approximately 65% over the next 12 months,

approximately 87% over the next 24 months, and the remainder

thereafter.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240905506462/en/

Investor Contact Chris Genualdi / Cleo Palmer-Poroner

Planet Labs PBC ir@planet.com

Press Contact Claire Bentley Dale Planet Labs PBC

comms@planet.com

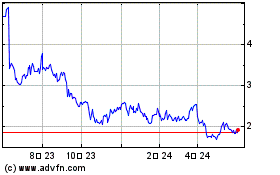

Planet Labs PBC (NYSE:PL)

過去 株価チャート

から 10 2024 まで 12 2024

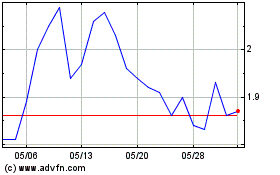

Planet Labs PBC (NYSE:PL)

過去 株価チャート

から 12 2023 まで 12 2024