Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

2023年11月29日 - 10:46PM

Edgar (US Regulatory)

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2023

Portfolio of Investments (Unaudited)

| Security

| Shares

| Value

|

| Aerospace & Defense — 1.7%

|

| Airbus SE(1)

|

| 58,150

| $ 7,783,289

|

| General Dynamics Corp.(1)

|

| 5,823

| 1,286,708

|

| L3Harris Technologies, Inc.(1)

|

| 6,745

| 1,174,439

|

| Northrop Grumman Corp.(1)

|

| 1,439

| 633,434

|

| RTX Corp.(1)

|

| 32,105

| 2,310,597

|

| Safran S.A.

|

| 10,087

| 1,580,725

|

| Textron, Inc.(1)

|

| 16,487

| 1,288,294

|

|

|

|

| $ 16,057,486

|

| Air Freight & Logistics — 0.4%

|

| Deutsche Post AG(1)

|

| 74,966

| $ 3,041,784

|

| Expeditors International of Washington, Inc.(1)

|

| 3,871

| 443,733

|

|

|

|

| $ 3,485,517

|

| Automobile Components — 0.5%

|

| Aptiv PLC(1)(2)

|

| 8,742

| $ 861,874

|

| Denso Corp.

|

| 187,200

| 3,003,788

|

| Yokohama Rubber Co., Ltd. (The)

|

| 52,300

| 1,088,394

|

|

|

|

| $ 4,954,056

|

| Automobiles — 3.5%

|

| Bayerische Motoren Werke AG

|

| 43,980

| $ 4,466,921

|

| Honda Motor Co., Ltd.

|

| 74,400

| 836,977

|

| Isuzu Motors, Ltd.

|

| 58,000

| 729,153

|

| Mazda Motor Corp.

|

| 26,000

| 295,217

|

| Mercedes-Benz Group AG(1)

|

| 53,889

| 3,750,498

|

| Stellantis NV

|

| 286,959

| 5,494,813

|

| Tesla, Inc.(1)(2)

|

| 63,578

| 15,908,487

|

| Toyota Motor Corp.

|

| 64,500

| 1,157,151

|

|

|

|

| $ 32,639,217

|

| Banks — 4.4%

|

| Bank of America Corp.(1)

|

| 50,000

| $ 1,369,000

|

| BNP Paribas S.A.(1)

|

| 94,000

| 5,977,110

|

| Citigroup, Inc.(1)

|

| 6,447

| 265,165

|

| Credit Agricole S.A.(1)

|

| 88,088

| 1,083,025

|

| Fifth Third Bancorp(1)

|

| 36,006

| 912,032

|

| HSBC Holdings PLC(1)

|

| 700,000

| 5,477,768

|

| Huntington Bancshares, Inc.(1)

|

| 87,053

| 905,351

|

| ING Groep NV(1)

|

| 331,336

| 4,367,031

|

| Intesa Sanpaolo SpA

|

| 2,042,702

| 5,231,803

|

| JPMorgan Chase & Co.(1)

|

| 44,825

| 6,500,522

|

| KBC Group NV

|

| 22,722

|

1,414,594

|

| Security

| Shares

| Value

|

| Banks (continued)

|

| KeyCorp(1)

|

| 74,715

| $ 803,933

|

| Lloyds Banking Group PLC

|

| 2,000,000

| 1,074,788

|

| NatWest Group PLC

|

| 464,285

| 1,328,113

|

| Nordea Bank Abp

|

| 90,000

| 988,055

|

| PNC Financial Services Group, Inc. (The)(1)

|

| 6,406

| 786,465

|

| Resona Holdings, Inc.

|

| 55,000

| 304,105

|

| Standard Chartered PLC

|

| 160,392

| 1,475,210

|

| Truist Financial Corp.(1)

|

| 21,845

| 624,985

|

|

|

|

| $ 40,889,055

|

| Beverages — 1.8%

|

| Asahi Group Holdings, Ltd.

|

| 14,400

| $ 537,906

|

| Coca-Cola Co. (The)(1)

|

| 28,606

| 1,601,364

|

| Constellation Brands, Inc., Class A(1)

|

| 28,994

| 7,287,062

|

| Heineken Holding NV

|

| 24,773

| 1,866,923

|

| Heineken NV

|

| 7,692

| 678,138

|

| Kirin Holdings Co., Ltd.

|

| 54,500

| 763,024

|

| PepsiCo, Inc.(1)

|

| 24,025

| 4,070,796

|

|

|

|

| $ 16,805,213

|

| Biotechnology — 1.5%

|

| AbbVie, Inc.(1)

|

| 26,528

| $ 3,954,264

|

| Amgen, Inc.(1)

|

| 16,600

| 4,461,416

|

| BioMarin Pharmaceutical, Inc.(1)(2)

|

| 9,584

| 847,992

|

| Gilead Sciences, Inc.(1)

|

| 65,372

| 4,898,978

|

|

|

|

| $ 14,162,650

|

| Broadline Retail — 3.5%

|

| Amazon.com, Inc.(1)(2)

|

| 224,714

| $ 28,565,644

|

| Next PLC(1)

|

| 41,584

| 3,688,152

|

| Prosus NV

|

| 18,666

| 550,013

|

|

|

|

| $ 32,803,809

|

| Building Products — 0.4%

|

| Daikin Industries, Ltd.

|

| 26,200

| $ 4,107,417

|

|

|

|

| $ 4,107,417

|

| Capital Markets — 1.4%

|

| 3i Group PLC

|

| 112,500

| $ 2,831,696

|

| CME Group, Inc.(1)

|

| 1,503

| 300,931

|

| Moody's Corp.(1)

|

| 9,981

| 3,155,693

|

| S&P Global, Inc.(1)

|

| 9,242

| 3,377,119

|

| St. James's Place PLC(1)

|

| 160,504

| 1,619,318

|

| UBS Group AG

|

| 90,256

| 2,223,203

|

|

|

|

| $ 13,507,960

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2023

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Chemicals — 2.3%

|

| Air Liquide S.A.

|

| 36,478

| $ 6,144,044

|

| Air Products and Chemicals, Inc.(1)

|

| 17,229

| 4,882,699

|

| BASF SE(1)

|

| 21,421

| 969,620

|

| Corteva, Inc.(1)

|

| 4,706

| 240,759

|

| Daicel Corp.(1)

|

| 50,400

| 421,638

|

| Dow, Inc.(1)

|

| 4,706

| 242,641

|

| Eastman Chemical Co.(1)

|

| 20,943

| 1,606,747

|

| Linde PLC(1)

|

| 2,800

| 1,041,759

|

| Mitsubishi Gas Chemical Co., Inc.

|

| 18,200

| 244,626

|

| Nitto Denko Corp.

|

| 22,800

| 1,495,119

|

| Shin-Etsu Chemical Co., Ltd.

|

| 109,000

| 3,165,975

|

| Sumitomo Chemical Co., Ltd.

|

| 10,700

| 29,103

|

| Toray Industries, Inc.

|

| 56,000

| 291,372

|

| Tosoh Corp.

|

| 85,900

| 1,101,332

|

|

|

|

| $ 21,877,434

|

| Commercial Services & Supplies — 0.3%

|

| SECOM Co., Ltd.

|

| 29,900

| $ 2,028,439

|

| Waste Management, Inc.(1)

|

| 3,330

| 507,625

|

|

|

|

| $ 2,536,064

|

| Communications Equipment — 1.2%

|

| Cisco Systems, Inc.(1)

|

| 194,533

| $ 10,458,094

|

| Nokia Oyj

|

| 200,000

| 752,014

|

|

|

|

| $ 11,210,108

|

| Construction & Engineering — 0.2%

|

| Ferrovial SE

|

| 59,598

| $ 1,821,135

|

|

|

|

| $ 1,821,135

|

| Construction Materials — 0.4%

|

| CRH PLC

|

| 62,332

| $ 3,436,622

|

|

|

|

| $ 3,436,622

|

| Consumer Finance — 0.4%

|

| American Express Co.(1)

|

| 22,280

| $ 3,323,953

|

| Navient Corp.(1)

|

| 28,416

| 489,324

|

|

|

|

| $ 3,813,277

|

| Consumer Staples Distribution & Retail — 1.1%

|

| Costco Wholesale Corp.(1)

|

| 8,600

| $ 4,858,656

|

| Koninklijke Ahold Delhaize NV

|

| 94,107

| 2,836,355

|

| Seven & i Holdings Co., Ltd.

|

| 33,700

|

1,319,361

|

| Security

| Shares

| Value

|

| Consumer Staples Distribution & Retail (continued)

|

| Target Corp.(1)

|

| 7,168

| $ 792,566

|

| Walmart, Inc.(1)

|

| 5,517

| 882,334

|

|

|

|

| $ 10,689,272

|

| Containers & Packaging — 0.2%

|

| Smurfit Kappa Group PLC

|

| 44,508

| $ 1,473,825

|

|

|

|

| $ 1,473,825

|

| Distributors — 0.2%

|

| LKQ Corp.(1)

|

| 34,009

| $ 1,683,786

|

|

|

|

| $ 1,683,786

|

| Diversified Telecommunication Services — 0.6%

|

| Deutsche Telekom AG(1)

|

| 244,879

| $ 5,136,776

|

| United Internet AG(3)

|

| 32,975

| 704,833

|

|

|

|

| $ 5,841,609

|

| Electric Utilities — 1.2%

|

| Acciona S.A.

|

| 8,786

| $ 1,118,940

|

| Chubu Electric Power Co., Inc.

|

| 31,500

| 400,991

|

| Edison International(1)

|

| 40,471

| 2,561,410

|

| Iberdrola S.A.(1)

|

| 633,684

| 7,087,406

|

| Tokyo Electric Power Co. Holdings, Inc.(2)

|

| 40,600

| 181,102

|

|

|

|

| $ 11,349,849

|

| Electrical Equipment — 0.9%

|

| ABB, Ltd.(1)

|

| 103,575

| $ 3,696,921

|

| Accelleron Industries AG

|

| 5,372

| 139,244

|

| Fujikura, Ltd.

|

| 69,000

| 554,463

|

| Legrand S.A.(1)

|

| 47,726

| 4,385,365

|

|

|

|

| $ 8,775,993

|

| Electronic Equipment, Instruments & Components — 1.1%

|

| Alps Alpine Co., Ltd.

|

| 82,200

| $ 712,610

|

| Citizen Watch Co., Ltd.

|

| 164,000

| 1,008,805

|

| Corning, Inc.(1)

|

| 7,504

| 228,647

|

| Halma PLC

|

| 50,000

| 1,178,036

|

| Kyocera Corp.

|

| 44,900

| 2,276,327

|

| Omron Corp.

|

| 12,000

| 534,017

|

| Taiyo Yuden Co., Ltd.

|

| 51,500

| 1,391,509

|

| TDK Corp.

|

| 79,900

| 2,953,924

|

|

|

|

| $ 10,283,875

|

| Entertainment — 1.6%

|

| Electronic Arts, Inc.(1)

|

| 30,496

| $ 3,671,718

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2023

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Entertainment (continued)

|

| Netflix, Inc.(1)(2)

|

| 21,340

| $ 8,057,984

|

| Nintendo Co., Ltd.

|

| 22,400

| 930,786

|

| Toho Co., Ltd.

|

| 14,100

| 481,030

|

| Walt Disney Co. (The)(1)(2)

|

| 20,692

| 1,677,087

|

|

|

|

| $ 14,818,605

|

| Financial Services — 1.7%

|

| Berkshire Hathaway, Inc., Class B(1)(2)

|

| 8,108

| $ 2,840,233

|

| Fidelity National Information Services, Inc.(1)

|

| 31,670

| 1,750,401

|

| M&G PLC

|

| 286,752

| 687,033

|

| Mastercard, Inc., Class A(1)

|

| 14,997

| 5,937,462

|

| ORIX Corp.

|

| 42,300

| 789,842

|

| PayPal Holdings, Inc.(1)(2)

|

| 33,387

| 1,951,804

|

| Visa, Inc., Class A(1)

|

| 7,797

| 1,793,388

|

|

|

|

| $ 15,750,163

|

| Food Products — 3.1%

|

| Kikkoman Corp.

|

| 3,300

| $ 172,962

|

| Mondelez International, Inc., Class A(1)

|

| 101,663

| 7,055,412

|

| Nestle S.A.(1)

|

| 180,310

| 20,410,370

|

| Nissin Foods Holdings Co., Ltd.

|

| 10,000

| 830,929

|

| Toyo Suisan Kaisha, Ltd.

|

| 5,000

| 196,084

|

|

|

|

| $ 28,665,757

|

| Gas Utilities — 0.1%

|

| Italgas SpA

|

| 35,014

| $ 179,140

|

| Snam SpA

|

| 152,501

| 715,576

|

|

|

|

| $ 894,716

|

| Ground Transportation — 0.6%

|

| Canadian Pacific Kansas City, Ltd.(1)

|

| 8,498

| $ 632,336

|

| Central Japan Railway Co.

|

| 17,000

| 413,406

|

| CSX Corp.(1)

|

| 117,095

| 3,600,671

|

| East Japan Railway Co.

|

| 5,700

| 326,193

|

| Keio Corp.

|

| 15,200

| 522,548

|

|

|

|

| $ 5,495,154

|

| Health Care Equipment & Supplies — 1.5%

|

| Abbott Laboratories(1)

|

| 68,052

| $ 6,590,836

|

| Boston Scientific Corp.(1)(2)

|

| 20,000

| 1,056,000

|

| DENTSPLY SIRONA, Inc.(1)

|

| 37,759

| 1,289,848

|

| EssilorLuxottica S.A.

|

| 5,248

| 912,867

|

| Olympus Corp.

|

| 31,100

|

403,786

|

| Security

| Shares

| Value

|

| Health Care Equipment & Supplies (continued)

|

| Teleflex, Inc.(1)

|

| 6,010

| $ 1,180,424

|

| Terumo Corp.

|

| 112,600

| 2,980,617

|

|

|

|

| $ 14,414,378

|

| Health Care Providers & Services — 1.5%

|

| McKesson Corp.(1)

|

| 7,905

| $ 3,437,489

|

| UnitedHealth Group, Inc.(1)

|

| 20,230

| 10,199,764

|

|

|

|

| $ 13,637,253

|

| Hotels, Restaurants & Leisure — 1.9%

|

| Amadeus IT Group S.A.

|

| 24,489

| $ 1,479,201

|

| Booking Holdings, Inc.(1)(2)

|

| 2,430

| 7,493,998

|

| Compass Group PLC

|

| 91,736

| 2,232,999

|

| Entain PLC

|

| 135,886

| 1,541,194

|

| Flutter Entertainment PLC(2)

|

| 6,119

| 995,600

|

| InterContinental Hotels Group PLC

|

| 9,889

| 731,334

|

| Yum! Brands, Inc.(1)

|

| 22,953

| 2,867,748

|

|

|

|

| $ 17,342,074

|

| Household Durables — 0.9%

|

| Casio Computer Co., Ltd.

|

| 63,200

| $ 529,299

|

| Nikon Corp.

|

| 35,000

| 368,616

|

| PulteGroup, Inc.(1)

|

| 70,920

| 5,251,626

|

| Sekisui Chemical Co., Ltd.

|

| 61,000

| 877,604

|

| Sony Group Corp.

|

| 11,000

| 899,531

|

|

|

|

| $ 7,926,676

|

| Household Products — 0.4%

|

| Clorox Co. (The)(1)

|

| 9,542

| $ 1,250,574

|

| Henkel AG & Co. KGaA, PFC Shares

|

| 8,309

| 591,680

|

| Procter & Gamble Co. (The)(1)

|

| 2,881

| 420,223

|

| Reckitt Benckiser Group PLC

|

| 20,566

| 1,450,329

|

|

|

|

| $ 3,712,806

|

| Industrial Conglomerates — 1.6%

|

| Honeywell International, Inc.(1)

|

| 19,811

| $ 3,659,884

|

| Nisshinbo Holdings, Inc.

|

| 82,000

| 609,383

|

| Siemens AG(1)

|

| 76,879

| 10,986,673

|

|

|

|

| $ 15,255,940

|

| Insurance — 3.0%

|

| Ageas S.A./NV

|

| 22,500

| $ 926,694

|

| Allianz SE(1)

|

| 55,814

| 13,282,399

|

| Allstate Corp. (The)(1)

|

| 14,109

| 1,571,884

|

| Chubb, Ltd.(1)

|

| 1,376

| 286,456

|

| Cincinnati Financial Corp.(1)

|

| 5,091

|

520,758

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2023

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Insurance (continued)

|

| Hannover Rueck SE

|

| 5,000

| $ 1,097,094

|

| Hartford Financial Services Group, Inc.(1)

|

| 14,283

| 1,012,807

|

| Legal & General Group PLC

|

| 250,000

| 674,583

|

| Lincoln National Corp.(1)

|

| 17,183

| 424,248

|

| Marsh & McLennan Cos., Inc.(1)

|

| 18,342

| 3,490,483

|

| MS&AD Insurance Group Holdings, Inc.

|

| 37,200

| 1,361,308

|

| Principal Financial Group, Inc.(1)

|

| 17,247

| 1,242,991

|

| Prudential PLC(1)

|

| 224,243

| 2,410,461

|

|

|

|

| $ 28,302,166

|

| Interactive Media & Services — 5.0%

|

| Alphabet, Inc., Class A(1)(2)

|

| 115,940

| $ 15,171,908

|

| Alphabet, Inc., Class C(1)(2)

|

| 113,763

| 14,999,652

|

| Meta Platforms, Inc., Class A(1)(2)

|

| 56,352

| 16,917,434

|

|

|

|

| $ 47,088,994

|

| IT Services — 0.6%

|

| Capgemini SE(1)

|

| 23,097

| $ 4,030,283

|

| NTT Data Group Corp.

|

| 62,200

| 832,320

|

| Obic Co., Ltd.

|

| 2,300

| 348,497

|

| Otsuka Corp.

|

| 15,600

| 660,012

|

|

|

|

| $ 5,871,112

|

| Leisure Products — 0.1%

|

| Hasbro, Inc.(1)

|

| 6,865

| $ 454,051

|

| Yamaha Corp.

|

| 25,600

| 699,178

|

|

|

|

| $ 1,153,229

|

| Life Sciences Tools & Services — 0.9%

|

| Revvity, Inc.(1)

|

| 6,547

| $ 724,753

|

| Thermo Fisher Scientific, Inc.(1)

|

| 14,903

| 7,543,451

|

|

|

|

| $ 8,268,204

|

| Machinery — 1.5%

|

| Daimler Truck Holding AG

|

| 13,462

| $ 466,112

|

| Dover Corp.(1)

|

| 7,424

| 1,035,722

|

| Ebara Corp.

|

| 25,500

| 1,193,067

|

| FANUC Corp.

|

| 112,135

| 2,916,342

|

| Kawasaki Heavy Industries, Ltd.

|

| 8,200

| 198,398

|

| Komatsu, Ltd.

|

| 29,200

| 787,557

|

| Makita Corp.

|

| 7,700

| 189,876

|

| Mitsui E&S Co. Ltd.

|

| 69,200

| 268,254

|

| Parker-Hannifin Corp.(1)

|

| 7,147

| 2,783,899

|

| SMC Corp.

|

| 1,500

| 672,393

|

| Snap-on, Inc.(1)

|

| 5,378

|

1,371,713

|

| Security

| Shares

| Value

|

| Machinery (continued)

|

| Stanley Black & Decker, Inc.(1)

|

| 23,555

| $ 1,968,727

|

| Toyota Industries Corp.

|

| 6,400

| 503,779

|

|

|

|

| $ 14,355,839

|

| Media — 0.5%

|

| Comcast Corp., Class A(1)

|

| 96,531

| $ 4,280,184

|

| Hakuhodo DY Holdings, Inc.

|

| 20,900

| 171,674

|

|

|

|

| $ 4,451,858

|

| Metals & Mining — 0.9%

|

| Glencore PLC

|

| 948,599

| $ 5,401,805

|

| Rio Tinto PLC(1)

|

| 54,826

| 3,442,659

|

|

|

|

| $ 8,844,464

|

| Multi-Utilities — 0.7%

|

| CMS Energy Corp.(1)

|

| 90,509

| $ 4,806,933

|

| NiSource, Inc.(1)

|

| 42,420

| 1,046,926

|

| Veolia Environnement S.A.

|

| 37,663

| 1,088,692

|

|

|

|

| $ 6,942,551

|

| Oil, Gas & Consumable Fuels — 3.9%

|

| APA Corp.(1)

|

| 25,465

| $ 1,046,611

|

| BP PLC

|

| 193,968

| 1,250,305

|

| Chevron Corp.(1)

|

| 33,237

| 5,604,423

|

| ConocoPhillips(1)

|

| 2,940

| 352,212

|

| Devon Energy Corp.(1)

|

| 11,014

| 525,368

|

| Idemitsu Kosan Co., Ltd.

|

| 6,200

| 142,136

|

| Marathon Petroleum Corp.(1)

|

| 27,916

| 4,224,807

|

| Phillips 66(1)

|

| 26,813

| 3,221,582

|

| Shell PLC(1)

|

| 253,138

| 8,023,010

|

| TotalEnergies SE(1)

|

| 181,770

| 11,951,254

|

|

|

|

| $ 36,341,708

|

| Personal Care Products — 1.0%

|

| Estee Lauder Cos., Inc. (The), Class A(1)

|

| 16,077

| $ 2,323,931

|

| Kao Corp.

|

| 28,554

| 1,058,354

|

| Unilever PLC

|

| 128,549

| 6,358,906

|

|

|

|

| $ 9,741,191

|

| Pharmaceuticals — 6.4%

|

| Astellas Pharma, Inc.

|

| 175,700

| $ 2,431,972

|

| AstraZeneca PLC(1)

|

| 56,549

| 7,627,579

|

| Bayer AG(1)

|

| 26,130

| 1,254,877

|

| Chugai Pharmaceutical Co., Ltd.

|

| 105,900

| 3,265,325

|

| Daiichi Sankyo Co., Ltd.

|

| 62,100

| 1,700,130

|

| Eisai Co., Ltd.

|

| 14,646

|

811,736

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2023

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Pharmaceuticals (continued)

|

| Eli Lilly & Co.(1)

|

| 13,232

| $ 7,107,304

|

| Johnson & Johnson(1)

|

| 13,558

| 2,111,659

|

| Merck & Co., Inc.(1)

|

| 25,250

| 2,599,488

|

| Novartis AG(1)

|

| 123,663

| 12,629,533

|

| Pfizer, Inc.(1)

|

| 14,458

| 479,572

|

| Roche Holding AG PC(1)

|

| 38,191

| 10,426,182

|

| Sanofi(1)

|

| 63,182

| 6,784,183

|

| UCB S.A.

|

| 9,177

| 751,681

|

|

|

|

| $ 59,981,221

|

| Professional Services — 0.9%

|

| Ceridian HCM Holding, Inc.(1)(2)

|

| 11,651

| $ 790,520

|

| Equifax, Inc.(1)

|

| 11,910

| 2,181,674

|

| Experian PLC

|

| 79,133

| 2,588,248

|

| Recruit Holdings Co., Ltd.

|

| 12,400

| 379,378

|

| Robert Half, Inc.(1)

|

| 26,747

| 1,960,020

|

| Wolters Kluwer NV

|

| 961

| 116,354

|

|

|

|

| $ 8,016,194

|

| Real Estate Management & Development — 0.5%

|

| CBRE Group, Inc., Class A(1)(2)

|

| 37,761

| $ 2,789,027

|

| Daito Trust Construction Co., Ltd.

|

| 5,500

| 579,335

|

| Heiwa Real Estate Co., Ltd.

|

| 26,700

| 710,246

|

| Sumitomo Realty & Development Co., Ltd.

|

| 13,600

| 353,077

|

|

|

|

| $ 4,431,685

|

| Residential REITs — 0.1%

|

| UNITE Group PLC (The)

|

| 75,723

| $ 825,537

|

|

|

|

| $ 825,537

|

| Semiconductors & Semiconductor Equipment — 9.3%

|

| Advantest Corp.

|

| 107,200

| $ 2,990,185

|

| Analog Devices, Inc.(1)

|

| 25,340

| 4,436,781

|

| ASML Holding NV(1)

|

| 25,161

| 14,813,539

|

| Enphase Energy, Inc.(1)(2)

|

| 4,000

| 480,600

|

| Infineon Technologies AG

|

| 85,739

| 2,839,739

|

| Intel Corp.(1)

|

| 163,942

| 5,828,138

|

| Lam Research Corp.(1)

|

| 864

| 541,529

|

| Marvell Technology, Inc.(1)

|

| 82,514

| 4,466,483

|

| Micron Technology, Inc.(1)

|

| 48,799

| 3,319,796

|

| NVIDIA Corp.(1)

|

| 32,241

| 14,024,512

|

| NXP Semiconductors NV(1)

|

| 40,985

| 8,193,721

|

| ON Semiconductor Corp.(1)(2)

|

| 30,000

| 2,788,500

|

| STMicroelectronics NV

|

| 35,000

|

1,509,307

|

| Security

| Shares

| Value

|

| Semiconductors & Semiconductor Equipment (continued)

|

| Texas Instruments, Inc.(1)

|

| 75,299

| $ 11,973,294

|

| Tokyo Electron, Ltd.

|

| 66,900

| 9,138,021

|

|

|

|

| $ 87,344,145

|

| Software — 7.3%

|

| Adobe, Inc.(1)(2)

|

| 19,153

| $ 9,766,115

|

| Crowdstrike Holdings, Inc., Class A(1)(2)

|

| 11,401

| 1,908,299

|

| Dassault Systemes SE

|

| 40,765

| 1,514,111

|

| Datadog, Inc., Class A(1)(2)

|

| 20,556

| 1,872,446

|

| Microsoft Corp.(1)

|

| 152,708

| 48,217,551

|

| Oracle Corp.(1)

|

| 34,518

| 3,656,147

|

| Sage Group PLC (The)

|

| 46,259

| 556,676

|

| Trend Micro, Inc.

|

| 14,897

| 563,901

|

|

|

|

| $ 68,055,246

|

| Specialized REITs — 0.3%

|

| American Tower Corp.(1)

|

| 17,793

| $ 2,926,059

|

|

|

|

| $ 2,926,059

|

| Specialty Retail — 2.1%

|

| Fast Retailing Co., Ltd.

|

| 56,700

| $ 12,350,123

|

| Fnac Darty S.A.

|

| 922

| 22,583

|

| Home Depot, Inc. (The)(1)

|

| 9,972

| 3,013,139

|

| Lowe's Cos., Inc.(1)

|

| 19,382

| 4,028,355

|

| USS Co., Ltd.

|

| 27,200

| 449,652

|

|

|

|

| $ 19,863,852

|

| Technology Hardware, Storage & Peripherals — 5.8%

|

| Apple, Inc.(1)

|

| 306,876

| $ 52,540,240

|

| Hewlett Packard Enterprise Co.(1)

|

| 64,216

| 1,115,432

|

| HP, Inc.(1)

|

| 26,241

| 674,394

|

|

|

|

| $ 54,330,066

|

| Textiles, Apparel & Luxury Goods — 2.7%

|

| Kering S.A.(1)

|

| 7,414

| $ 3,368,646

|

| LVMH Moet Hennessy Louis Vuitton SE(1)

|

| 24,802

| 18,721,304

|

| NIKE, Inc., Class B(1)

|

| 33,397

| 3,193,421

|

|

|

|

| $ 25,283,371

|

| Tobacco — 0.4%

|

| British American Tobacco PLC(1)

|

| 81,683

| $ 2,564,738

|

| Japan Tobacco, Inc.

|

| 34,000

| 782,274

|

|

|

|

| $ 3,347,012

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2023

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Trading Companies & Distributors — 0.7%

|

| Ferguson PLC

|

| 20,627

| $ 3,394,588

|

| Mitsubishi Corp.

|

| 21,400

| 1,019,717

|

| Sumitomo Corp.

|

| 96,700

| 1,929,930

|

|

|

|

| $ 6,344,235

|

| Transportation Infrastructure — 0.1%

|

| Aeroports de Paris S.A.

|

| 6,667

| $ 786,247

|

|

|

|

| $ 786,247

|

| Wireless Telecommunication Services — 1.0%

|

| KDDI Corp.

|

| 113,000

| $ 3,458,982

|

| SoftBank Group Corp.

|

| 114,496

| 4,823,202

|

| T-Mobile US, Inc.(1)(2)

|

| 5,440

| 761,872

|

|

|

|

| $ 9,044,056

|

Total Common Stocks

(identified cost $312,921,971)

|

|

| $934,058,993

|

| Short-Term Investments — 0.1%

|

| Security

| Shares

| Value

|

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio, Institutional

Class, 5.27%(4)

|

| 1,046,382

| $ 1,046,382

|

Total Short-Term Investments

(identified cost $1,046,382)

|

|

| $ 1,046,382

|

Total Investments — 99.9%

(identified cost $313,968,353)

|

|

| $935,105,375

|

Total Written Call Options — (0.2)%

(premiums received $7,906,866)

|

|

| $ (2,289,683)

|

| Other Assets, Less Liabilities — 0.3%

|

|

| $ 3,264,149

|

| Net Assets — 100.0%

|

|

| $936,079,841

|

| The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

|

| (1)

| Security (or a portion thereof) has been pledged as collateral for written options.

|

| (2)

| Non-income producing security.

|

| (3)

| Security exempt from registration under Regulation S of the Securities Act of 1933, as amended, which exempts from registration securities offered and sold outside

the United States. Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933, as

amended. At September 30, 2023, the aggregate value of these securities is $704,833 or 0.1% of the Fund's net assets.

|

| (4)

| May be deemed to be an affiliated investment company. The rate shown is the annualized seven-day yield as of September 30, 2023.

|

| Country Concentration of Portfolio

|

| Country

| Percentage of

Total Investments

| Value

|

| United States

| 55.7%

| $521,151,113

|

| Japan

| 11.1

| 104,006,792

|

| France

| 8.2

| 76,133,728

|

| United Kingdom

| 7.5

| 70,435,065

|

| Switzerland

| 5.3

| 49,811,909

|

| Germany

| 5.2

| 48,589,006

|

| Netherlands

| 3.9

| 36,752,516

|

| Spain

| 1.0

| 9,685,547

|

| Ireland

| 0.8

| 6,947,806

|

| Italy

| 0.7

| 6,126,519

|

| Belgium

| 0.3

| 3,092,969

|

| Finland

| 0.2

| 1,740,069

|

| Canada

| 0.1

| 632,336

|

| Total Investments

| 100.0%

| $935,105,375

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2023

Portfolio of Investments

(Unaudited) — continued

| Written Call Options (Exchange-Traded) — (0.2)%

|

|

|

|

|

|

|

|

| Description

| Number of

Contracts

| Notional

Amount

| Exercise

Price

| Expiration

Date

| Value

|

| Dow Jones Euro Stoxx 50 Index

| 1,050

| EUR

| 43,833,930

| EUR

| 4,300

| 10/6/23

| $ (33,905)

|

| Dow Jones Euro Stoxx 50 Index

| 1,050

| EUR

| 43,833,930

| EUR

| 4,400

| 10/13/23

| (19,633)

|

| Dow Jones Euro Stoxx 50 Index

| 1,030

| EUR

| 42,998,998

| EUR

| 4,300

| 10/20/23

| (175,460)

|

| Dow Jones Euro Stoxx 50 Index

| 1,050

| EUR

| 43,833,930

| EUR

| 4,300

| 10/27/23

| (267,537)

|

| FTSE 100 Index

| 770

| GBP

| 58,582,216

| GBP

| 7,875

| 10/20/23

| (140,164)

|

| NASDAQ 100 Index

| 11

| USD

| 16,186,764

| USD

| 15,800

| 10/2/23

| (28)

|

| NASDAQ 100 Index

| 11

| USD

| 16,186,764

| USD

| 15,700

| 10/4/23

| (330)

|

| NASDAQ 100 Index

| 11

| USD

| 16,186,764

| USD

| 15,650

| 10/6/23

| (1,155)

|

| NASDAQ 100 Index

| 11

| USD

| 16,186,764

| USD

| 15,600

| 10/9/23

| (2,393)

|

| NASDAQ 100 Index

| 11

| USD

| 16,186,764

| USD

| 15,600

| 10/11/23

| (5,225)

|

| NASDAQ 100 Index

| 11

| USD

| 16,186,764

| USD

| 15,600

| 10/13/23

| (9,570)

|

| NASDAQ 100 Index

| 11

| USD

| 16,186,764

| USD

| 15,500

| 10/16/23

| (19,360)

|

| NASDAQ 100 Index

| 11

| USD

| 16,186,764

| USD

| 15,500

| 10/18/23

| (26,455)

|

| NASDAQ 100 Index

| 12

| USD

| 17,658,288

| USD

| 15,050

| 10/20/23

| (162,480)

|

| NASDAQ 100 Index

| 11

| USD

| 16,186,764

| USD

| 15,000

| 10/23/23

| (185,460)

|

| NASDAQ 100 Index

| 11

| USD

| 16,186,764

| USD

| 14,900

| 10/25/23

| (256,630)

|

| NASDAQ 100 Index

| 11

| USD

| 16,186,764

| USD

| 15,150

| 10/27/23

| (176,165)

|

| Nikkei 225 Index

| 450

| JPY

| 14,335,929,000

| JPY

| 33,500

| 10/13/23

| (71,265)

|

| S&P 500 Index

| 57

| USD

| 24,441,885

| USD

| 4,560

| 10/2/23

| (143)

|

| S&P 500 Index

| 57

| USD

| 24,441,885

| USD

| 4,530

| 10/4/23

| (285)

|

| S&P 500 Index

| 56

| USD

| 24,013,080

| USD

| 4,525

| 10/6/23

| (420)

|

| S&P 500 Index

| 56

| USD

| 24,013,080

| USD

| 4,530

| 10/9/23

| (560)

|

| S&P 500 Index

| 57

| USD

| 24,441,885

| USD

| 4,525

| 10/11/23

| (1,425)

|

| S&P 500 Index

| 57

| USD

| 24,441,885

| USD

| 4,535

| 10/13/23

| (2,280)

|

| S&P 500 Index

| 57

| USD

| 24,441,885

| USD

| 4,510

| 10/16/23

| (6,412)

|

| S&P 500 Index

| 57

| USD

| 24,441,885

| USD

| 4,510

| 10/18/23

| (10,117)

|

| S&P 500 Index

| 57

| USD

| 24,441,885

| USD

| 4,400

| 10/20/23

| (116,280)

|

| S&P 500 Index

| 58

| USD

| 24,870,690

| USD

| 4,390

| 10/23/23

| (132,530)

|

| S&P 500 Index

| 57

| USD

| 24,441,885

| USD

| 4,360

| 10/25/23

| (230,850)

|

| S&P 500 Index

| 57

| USD

| 24,441,885

| USD

| 4,390

| 10/27/23

| (191,520)

|

| SMI Index

| 390

| CHF

| 42,757,650

| CHF

| 11,400

| 10/20/23

| (43,646)

|

| Total

|

|

|

|

|

|

| $(2,289,683)

|

| Abbreviations:

|

| PC

| – Participation Certificate

|

| PFC Shares

| – Preference Shares

|

| REITs

| – Real Estate Investment Trusts

|

| Currency Abbreviations:

|

| CHF

| – Swiss Franc

|

| EUR

| – Euro

|

| GBP

| – British Pound Sterling

|

| JPY

| – Japanese Yen

|

| USD

| – United States Dollar

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2023

Portfolio of Investments

(Unaudited) — continued

At September 30, 2023, the Fund had

sufficient cash and/or securities to cover commitments under open derivative contracts.

The Fund is subject to equity price

risk in the normal course of pursuing its investment objectives. The Fund writes index call options above the current value of the index to generate premium income. In writing index call options, the Fund in effect,

sells potential appreciation in the value of the applicable index above the exercise price in exchange for the option premium received. The Fund retains the risk of loss, minus the premium received, should the value

of the underlying index decline.

Affiliated Investments

At September 30, 2023, the value of

the Fund's investment in funds that may be deemed to be affiliated was $1,046,382, which represents 0.1% of the Fund's net assets. Transactions in such investments by the Fund for the fiscal year to date ended

September 30, 2023 were as follows:

| Name

| Value,

beginning

of period

| Purchases

| Sales

proceeds

| Net

realized

gain (loss)

| Change in

unrealized

appreciation

(depreciation)

| Value, end

of period

| Dividend

income

| Shares,

end of period

|

| Short-Term Investments

|

| Liquidity Fund, Institutional Class(1)

| $1,376,597

| $96,783,832

| $(97,114,047)

| $ —

| $ —

| $1,046,382

| $125,508

| 1,046,382

|

| (1)

| Represents investment in Morgan Stanley Institutional Liquidity Funds - Government Portfolio.

|

Fair Value Measurements

Under generally accepted accounting

principles for fair value measurements, a three-tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is

summarized in the three broad levels listed below.

| •

|

Level 1 – quoted prices in active markets for identical investments

|

| •

|

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

|

| •

| Level 3 – significant unobservable inputs (including a fund's own assumptions in determining the fair value of investments)

|

In cases where the inputs used to

measure fair value fall in different levels of the fair value hierarchy, the level disclosed is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs

or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

At September 30, 2023, the hierarchy

of inputs used in valuing the Fund’s investments and open derivative instruments, which are carried at value, were as follows:

| Asset Description

| Level 1

| Level 2

| Level 3

| Total

|

| Common Stocks:

|

|

|

|

|

| Communication Services

| $ 65,537,839

| $ 15,707,283

| $ —

| $ 81,245,122

|

| Consumer Discretionary

| 73,322,129

| 70,327,941

| —

| 143,650,070

|

| Consumer Staples

| 30,542,918

| 42,418,333

| —

| 72,961,251

|

| Energy

| 14,975,003

| 21,366,705

| —

| 36,341,708

|

| Financials

| 45,637,388

| 56,625,233

| —

| 102,262,621

|

| Health Care

| 58,483,238

| 51,980,468

| —

| 110,463,706

|

| Industrials

| 27,629,996

| 59,407,225

| —

| 87,037,221

|

| Information Technology

| 186,490,719

| 50,603,833

| —

| 237,094,552

|

| Materials

| 6,972,846

| 28,659,499

| —

| 35,632,345

|

| Real Estate

| 5,715,086

| 2,468,195

| —

| 8,183,281

|

| Utilities

| 8,415,269

| 10,771,847

| —

| 19,187,116

|

| Total Common Stocks

| $523,722,431

| $410,336,562*

| $ —

| $934,058,993

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2023

Portfolio of Investments

(Unaudited) — continued

| Asset Description (continued)

| Level 1

| Level 2

| Level 3

| Total

|

| Short-Term Investments

| $ 1,046,382

| $ —

| $ —

| $ 1,046,382

|

| Total Investments

| $524,768,813

| $410,336,562

| $ —

| $935,105,375

|

| Liability Description

|

|

|

|

|

| Written Call Options

| $ (1,538,073)

| $ (751,610)

| $ —

| $ (2,289,683)

|

| Total

| $ (1,538,073)

| $ (751,610)

| $ —

| $ (2,289,683)

|

| *

| Includes foreign equity securities whose values were adjusted to reflect market trading of comparable securities or other correlated instruments that occurred after the close of

trading in their applicable foreign markets.

|

For information on the Fund's policy

regarding the valuation of investments and other significant accounting policies, please refer to the Fund's most recent financial statements included in its semiannual or annual report to shareholders.

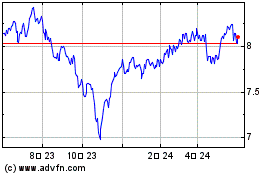

Eaton Vance Tax Managed ... (NYSE:ETW)

過去 株価チャート

から 11 2024 まで 12 2024

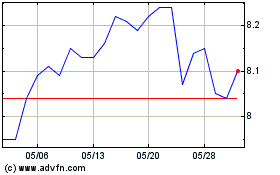

Eaton Vance Tax Managed ... (NYSE:ETW)

過去 株価チャート

から 12 2023 まで 12 2024