Russia-Ukraine Conflict and Inflation Will Continue to Weigh On S&P 500

2022年3月7日 - 2:54AM

Finscreener.org

The equity markets have fallen

for the fourth straight week as the S&P 500 is down 9.5%

from all-time highs. Comparatively, the NASDAQ and Dow Jones

indices have declined by 17% and 8.9% respectively from record

levels. Market analysts expect the markets to remain volatile in

the next week due to the ongoing conflict between Russia and

Ukraine as well as inflation numbers that will be published for

February this Thursday.

Russia

invaded Ukraine

10 days back, following which

several countries part of NATO imposed multiple sanctions on the

country. The S&P Dow Jones Indices also confirmed it will

remove all stocks listed in Russia from its benchmarks and will

declassify the country as an emerging market.

The New York Stock Exchange

paused trading in three Russian ETFs or exchange-traded funds. Due

to a sustained sell-off in Russian equity companies, the

iShares MSCI Russia ETF (AMEX:

ERUS) is down 81% in 2022.

Energy prices soar as inflation remains in

focus

The Russian invasion of Ukraine

has driven oil prices to multi-year highs. The U.S. Benchmark West

Texas Intermediate crude rose by 7% to $115 per barrel while prices

for the global standard Brent crude increased by 6% to

$118.

Comparatively, government bond

yields declined as investors reduced exposure to this asset class.

The 1-year Treasury yield stood at 1.73% and the plunge in interest

rates induced a sell-off in banking stocks.

Due to restrictions over air

space and the threat of rising costs amid high oil prices, shares

of travel companies such as United Airlines

(NASDAQ:

UAL), Delta Air Lines

(NYSE:

DAL), and American Airlines

(NASDAQ:

AAL) fell by 9%, 5.6%, and 7%

respectively.

Comparatively, higher commodity

prices allowed energy stocks to continue their momentum further in

the last week.

Berkshire Hathaway discloses a $5 billion stake in

Occidental Petroleum

During Berkshire

Hathaway’s (NYSE:

BRK.A)(NYSE:

BRK.B)

annual letter to shareholders,

Warren Buffett claimed he could not find an exciting enough company

to invest in at current prices. Instead, Berkshire focused on

improving shareholder wealth by focusing on stock repurchases and

buybacks.

However, an SEC filing on Friday

disclosed Berkshire owned 91.2 million shares of Occidental

Petroleum worth $5.1 billion. The stock surged by more than 17% on

Friday, following this news. Shares of Occidental Petroleum have

almost doubled in 2022, making it one of the top-performing stocks

part of the S&P 500.

Occidental Petroleum (NYSE:

OXY) recently reported a fourth consecutive record

for quarterly free cash flow generation which allowed it to

generate its highest-ever annual level of cash flows last year. It

continues to strengthen the balance sheet and repaid around $2.2

billion of debt in Q4 of 2021.

While the company ended 2021 with

a cash balance of $2.8 billion, it also repaid $6.7 billion of debt

in the last year.

Inflation will remain the focus

While the economic calendar is

relatively light for the upcoming week, investors will closely be

watching the consumer price index for the month of February.

Economists expect inflation to rise by 7.8% year over year compared

to the 7.5% rise in January, which was already the highest since

1982. The consumer price index or CPI includes food and energy

prices.

Investors are worried that rising

inflation will result in reduced consumer spending as well as the

possibility of multiple interest rate hikes. These factors will in

turn lead to higher borrowing costs, tepid top-line growth, and a

contraction in earnings for most enterprises.

Pfizer and Moderna expect to report $51 billion in

vaccine sales in 2022

The world’s largest vaccine

manufacturers Pfizer (NYSE: PFE)

and Moderna (NASDAQ: MRNA)

are expected to report

$51 billion in combined vaccine

sales in 2022. While Pfizer’s vaccine sales are expected to touch

$32 billion, Moderna is forecast to report $19 billion in sales.

These are minimum sales estimates and reflect the contracts already

signed by the two companies.

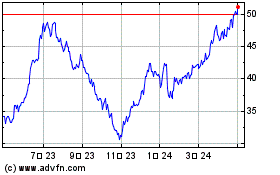

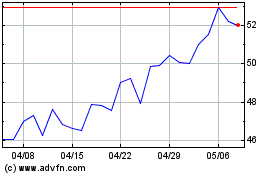

Delta Air Lines (NYSE:DAL)

過去 株価チャート

から 3 2024 まで 4 2024

Delta Air Lines (NYSE:DAL)

過去 株価チャート

から 4 2023 まで 4 2024