Apple Hospitality REIT Announces Monthly Distribution

2024年9月19日 - 10:00PM

ビジネスワイヤ(英語)

Apple Hospitality REIT, Inc. (NYSE: APLE) (the “Company” or

“Apple Hospitality”) today announced that its Board of Directors

declared a regular monthly cash distribution of $0.08 per common

share. The distribution is payable on October 15, 2024, to

shareholders of record as of September 30, 2024.

Based on the Company’s common stock closing price of $14.46 on

September 18, 2024, the annualized distribution of $0.96 per common

share represents an annual yield of approximately 6.6%.

About Apple Hospitality REIT,

Inc.

Apple Hospitality REIT, Inc. (NYSE: APLE) is a publicly traded

real estate investment trust (“REIT”) that owns one of the largest

and most diverse portfolios of upscale, rooms-focused hotels in the

United States. Apple Hospitality’s portfolio consists of 224 hotels

with more than 30,000 guest rooms located in 87 markets throughout

37 states and the District of Columbia. Concentrated with

industry-leading brands, the Company’s hotel portfolio consists of

100 Marriott-branded hotels, 119 Hilton-branded hotels and five

Hyatt-branded hotels. For more information, please visit

www.applehospitalityreit.com.

Forward-Looking Statements

Disclaimer

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements are typically identified by use

of statements that include phrases such as “may,” “believe,”

“expect,” “anticipate,” “intend,” “estimate,” “project,” “target,”

“goal,” “plan,” “should,” “will,” “predict,” “potential,”

“outlook,” “strategy,” and similar expressions that convey the

uncertainty of future events or outcomes. Such statements involve

known and unknown risks, uncertainties, and other factors which may

cause the actual results, performance, or achievements of the

Company to be materially different from future results, performance

or achievements expressed or implied by such forward-looking

statements.

Such factors include, but are not limited to, the ability of the

Company to effectively acquire and dispose of properties and

redeploy proceeds; the anticipated timing and frequency of

shareholder distributions; the ability of the Company to fund

capital obligations; the ability of the Company to successfully

integrate pending transactions and implement its operating

strategy; changes in general political, economic and competitive

conditions and specific market conditions (including the potential

effects of inflation or a recessionary environment); reduced

business and leisure travel due to geopolitical uncertainty,

including terrorism and acts of war; travel-related health

concerns, including widespread outbreaks of infectious or

contagious diseases in the U.S.; inclement weather conditions,

including natural disasters such as hurricanes, earthquakes and

wildfires; government shutdowns, airline strikes or equipment

failures or other disruptions; adverse changes in the real estate

and real estate capital markets; financing risks; changes in

interest rates; litigation risks; regulatory proceedings or

inquiries; and changes in laws or regulations or interpretations of

current laws and regulations that impact the Company’s business,

assets or classification as a REIT. Although the Company believes

that the assumptions underlying the forward-looking statements

contained herein are reasonable, any of the assumptions could be

inaccurate, and therefore there can be no assurance that such

statements included in this press release will prove to be

accurate. In light of the significant uncertainties inherent in the

forward-looking statements included herein, the inclusion of such

information should not be regarded as a representation by the

Company or any other person that the results or conditions

described in such statements or the objectives and plans of the

Company will be achieved. In addition, the Company’s qualification

as a REIT involves the application of highly technical and complex

provisions of the Internal Revenue Code of 1986, as amended.

Readers should carefully review the risk factors described in the

Company’s filings with the Securities and Exchange Commission,

including but not limited to those discussed in the section titled

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023. Any forward-looking statement

that the Company makes speaks only as of the date of this press

release. The Company undertakes no obligation to publicly update or

revise any forward-looking statements or cautionary factors, as a

result of new information, future events, or otherwise, except as

required by law.

For additional information or to receive press

releases by email, visit www.applehospitalityreit.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240918883540/en/

Apple Hospitality REIT, Inc. Kelly Clarke, Vice President,

Investor Relations 804‐727‐6321 kclarke@applereit.com

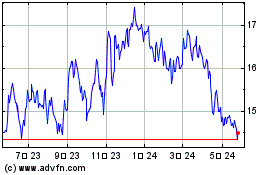

Apple Hospitality REIT (NYSE:APLE)

過去 株価チャート

から 10 2024 まで 11 2024

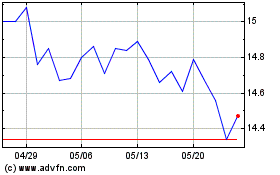

Apple Hospitality REIT (NYSE:APLE)

過去 株価チャート

から 11 2023 まで 11 2024