0000874501FALSE00008745012024-09-172024-09-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 17, 2024

| | |

| Ambac Financial Group, Inc. |

| (Exact name of Registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 1-10777 | | 13-3621676 |

| (State of incorporation) | | (Commission

file number) | | (I.R.S. employer

identification no.) |

| | | | | | | | | | | |

| One World Trade Center | New York | NY | 10007 |

| (Address of principal executive offices) |

| | | | | | | | | | | |

| (212) | 658-7470 | |

| (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

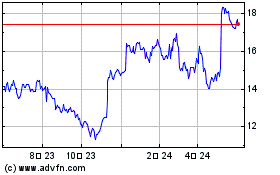

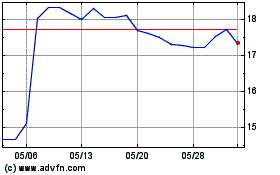

| Common stock, par value $0.01 per share | | AMBC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

| | | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to |

| Section 13(a) of the Exchange Act. | ☐ | |

Explanatory Note

On August 1, 2024, Ambac Financial Group, Inc. (the “Company”) completed its previously announced acquisition of Beat Capital Partners Limited (“Beat”) pursuant to a share purchase agreement (the “Beat Purchase Agreement”) by and among the Company, Cirrata V LLC, a Delaware limited liability company and an indirect wholly owned subsidiary of the Company (the “Purchaser”), certain sellers set forth therein (the “Sellers”) and Beat, pursuant to which, and upon the terms and subject to the conditions set forth therein, effective July 31, 2024, the Purchaser purchased from the Sellers approximately 60% of the entire issued share capital of Beat for total consideration of approximately $278 million, of which approximately $249 million was paid in cash and the remainder of which was satisfied through the issuance of 2,216,023 shares of Company Common Stock (the “Beat Transaction”). The Company made available the following information.

Item 9.01. Financial Statements and Exhibits

(a) Financial Statements of Business Acquired.

The unaudited condensed consolidated financial statements as of and for the six months ended June 30, 2024 and 2023, prepared in accordance with accounting principles, standards and practices generally accepted in the United Kingdom, together with a reconciliation to U.S. GAAP, and the notes related thereto, are filed as Exhibit 99.1 to this report and incorporated herein by reference.

(b) Pro Forma Financial Information.

The unaudited pro forma condensed combined financial information of the Company, which give effect to the Beat Transaction and the previously announced disposition of 100% of the common stock of Ambac Assurance Corporation, include the unaudited pro forma condensed combined balance sheet as of June 30, 2024 and the unaudited pro forma condensed combined statements of operations for the year ended December 31, 2023 and the six months ended June 30, 2024 and the notes related thereto, are filed as Exhibit 99.2 to this report and incorporated herein by reference.

(d) Exhibits. The following exhibit is filed as part of this Current Report on Form 8-K:

EXHIBIT INDEX

| | | | | | | | |

| Exhibit | | |

| Number | | Exhibit Description |

| 99.1 | | |

| 99.2 | | |

| 101.INS | | XBRL Instance Document - the instance document does not appear in the interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

| 101.SCH | | XBRL Taxonomy Extension Schema Document. |

| 101.CAL | | XBRL Taxonomy Extension Calculation Linkbase Document. |

| 101.LAB | | XBRL Taxonomy Extension Label Linkbase Document. |

| 101.PRE | | XBRL Taxonomy Extension Presentation Linkbase Document. |

| 101.DEF | | XBRL Taxonomy Extension Definition Linkbase Document. |

| 104 | | Cover Page Interactive Data File - The cover page interactive data file does not appear in the Interactive Data File because its XBRL tags or embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | Ambac Financial Group, Inc. |

| | | (Registrant) |

| | | | | |

| Dated: | September 17, 2024 | | By: | | /s/ William J. White |

| | | | | William J. White |

| | | | | First Vice President, Secretary and Assistant General Counsel |

Company registration number 10198821 (England and Wales)

BEAT CAPITAL PARTNERS LIMITED

UNAUDITED INTERIM REPORT AND CONDENSED CONSOLIDATED FINANCIAL STATEMENTS FOR THE SIX MONTH PERIODS ENDED 30 JUNE 2024 AND 30 JUNE 2023

COMPANY INFORMATION

Directors N Anand

M Cannan

J P Cavanagh

C Leblanc

E Lieskovska

A J T Milligan

R Smith

D Trick

Secretaries K Baker

H Marsden

S Naher

Company number 10198821

Registered office 5th Floor 6 Bevis Marks

London

EC3A 7BA

Auditor Ernst & Young LLP

25 Churchill Place Canary Wharf London

E14 5EY

Bankers Barclays Bank PLC One

Churchill Place London

E14 5HP

Solicitors RPC

Tower Bridge House St Katharine's Way London

E1W 1AA

CONTENTS

| | | | | |

| Page |

| Directors responsibilities statement | |

| |

| Group statement of comprehensive income | |

| |

| Group statement of financial position | 3-4 |

| |

| Group statement of changes in equity | |

| |

| Group statement of cash flows | |

| |

| Notes to the financial statements | 7-15 |

DIRECTORS' RESPONSIBILITIES STATEMENT

FOR THE SIX MONTH PERIODS ENDED 30 JUNE 2024 AND 30 JUNE 2023

The directors are responsible for preparing the Interim Report and the financial statements in accordance with applicable law and regulations.

Company law requires the directors to prepare financial statements for each financial year. Under that law the directors have elected to prepare the financial statements in accordance with United Kingdom Generally Accepted Accounting Practice (United Kingdom Accounting Standards and applicable law). Under company law the directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of the group and company, and of the profit or loss of the group for that period. In preparing these financial statements, the directors are required to:

•select suitable accounting policies and then apply them consistently;

•make judgements and accounting estimates that are reasonable and prudent;

•state whether applicable UK Accounting Standards have been followed, subject to any material departures disclosed and explained in the financial statements;

•prepare the financial statements on the going concern basis unless it is inappropriate to presume that the group and company will continue in business.

The directors are responsible for keeping adequate accounting records that are sufficient to show and explain the group’s and company’s transactions and disclose with reasonable accuracy at any time the financial position of the group and company and enable them to ensure that the financial statements comply with the Companies Act 2006. They are also responsible for safeguarding the assets of the group and company and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

BEAT CAPITAL PARTNERS LIMITED

UNAUDITED GROUP STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTH PERIODS ENDED 30 JUNE 2024 AND 30 JUNE 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Continuing | | Discontinued | | 30 June | | Continuing | | Discontinued | | 30 June |

| | operations | | operations | | 2024 | | operations | | operations | | 2023 |

| Notes | £'000 | | £'000 | | £'000 | | £'000 | | £'000 | | £'000 |

| Turnover |

| 26,355 | | | 4 | | 26,359 | | | 24,689 | | | 264 | | | 24,953 | |

Administrative expenses | | (20,568) | | | (70) | | (20,638) | | | (15,503) | | | (717) | | | (16,220) | |

Operating profit/(loss) |

| 5,787 | | | (66) | | 5,721 | | | 9,186 | | | (453) | | | 8,733 | |

| | | | | | | | | | | | |

Interest receivable and similar income |

| 502 | | | — | | 502 | | | 419 | | | 2 | | | 421 | |

Interest payable and similar expenses |

| (32) | | | — | | (32) | | | (111) | | | — | | | (111) | |

Exchange (losses)/gains | | (118) | | | — | | (118) | | | (1,525) | | | — | | | (1,525) | |

Profit/(loss) on disposal of operations | | — | | | — | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | |

Profit/(loss) before taxation | | 6,139 | | | (66) | | 6,073 | | | 7,969 | | | (451) | | | 7,518 | |

Tax on profit |

| (2,103) | | | — | | (2,103) | | | (2,080) | | | — | | | (2,080) | |

| | | | | | | | | | | | |

Profit after taxation | | 4,035 | | | (66) | | 3,970 | | | 5,890 | | | (451) | | | 5,438 | |

Other comprehensive income | | (286) | | | 41 | | (245) | | | 147 | | | 73 | | | 221 | |

| | | | | | | | | | | | |

Total comprehensive income for the year | | 3,750 | | | (25) | | 3,725 | | | 6,037 | | | (378) | | | 5,659 | |

Profit for the financial year is attributable to: - Owners of the parent company | | | | | | 2,565 | | | | | | | 3,585 | |

- Non-controlling interests | | | | | | 1,160 | | | | | | | 2,074 | |

| | | | | | | | | | | | |

| | | | | | 3,725 | | | | | | | 5,659 | |

| | | | | | | | | | | | |

BEAT CAPITAL PARTNERS LIMITED

UNAUDITED GROUP STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2024 AND AS AT 31 DECEMBER 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q2 2024 | | Q4 2023 |

| Notes | £'000 | | £'000 | | £'000 | | £'000 |

Fixed assets | | | | | | | | |

Intangible assets | 4 | | | 2,880 | | | | 2,565 |

Tangible assets | | | | 114 | | | | 169 |

| Investments | | | | 75 | | | | 75 |

| | | | 3,069 | | | | 2,809 |

Current assets | | | | | | | | |

| Debtors | | 4,425 | | | | 519 | | |

Prepayments and accrued income | | 32,533 | | | | 31,549 | | |

| Investments | | (471) | | | | 177 | | |

Cash and cash equivalents | | 31,567 | | | | 33,802 | | |

| | 68,054 | | | | 66,047 | | |

Creditors: amounts falling due within one year | | | | | | | | |

Taxation and social security | | 464 | | | | 349 | | |

Other creditors | | 5,272 | | | | 6,335 | | |

Deferred income | | 40,287 | | | | 37,601 | | |

| Accruals | | 3,774 | | | | 3,501 | | |

| | 49,797 | | | | 47,786 | | |

Net current assets | | | | 18,257 | | | | 18,261 |

| | | | | | | | |

Total assets less current liabilities | | | | 21,326 | | | | 21,070 |

| Provisions | | | | | | | | |

Deferred tax (asset)/liability | | (95) | | | | (21) | | |

| | | | 95 | | | | 21 |

Net assets | | | | 21,421 | | | | 21,091 |

| | | | | | | | |

Capital and reserves | | | | | | | | |

Called up share capital | | | | 2 | | | | 2 |

Share premium account | | | | 1,245 | | | | 1,245 |

Profit and loss reserves | | | | 20,174 | | | | 16,244 |

| | | | | | | | |

Equity attributable to owners of the parent company | | | | 20,034 | | | | 17,491 |

Non-controlling interests | | | | 1,387 | | | | 3,600 |

| | | | 21,421 | | | | 21,091 |

UNAUDITED GROUP STATEMENT OF FINANCIAL POSITION (CONTINUED)

AS AT 30 JUNE 2024 AND AS AT 31 DECEMBER 2023

The financial statements were approved by the board of directors and authorised for issue on 4 September 2024 and are signed on its behalf by:

J P Cavanagh

Director

Company registration number 10198821 (England and Wales)

BEAT CAPITAL PARTNERS LIMITED

UNAUDITED GROUP STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTH PERIODS ENDED 30 JUNE 2024 AND 30 JUNE 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Share capital | | Share premium account | | Profit and loss reserves | | Total controlling interest | | Non-controlling interest | | Total |

| Notes | £'000 | | £'000 | | £'000 | | £'000 | | £'000 | | £'000 |

| Balance at 1 January 2023 | | 2 | | | 1,223 | | | 18,515 | | | 19,739 | | | 2,848 | | | 22,587 | |

| Period ended 30 June 2023: | | | | | | | | | | | | |

| Profit for the period | | — | | | — | | | 3,585 | | | 3,585 | | | 2,074 | | | 5,660 | |

| Issue of share capital | | — | | | 31 | | | — | | | 31 | | | 38 | | | 68 | |

| Dividends | | — | | | — | | | — | | | — | | | (2,772) | | | (2,772) | |

| Effect of changes in non-controlling interests in existing subsidiaries | | — | | | — | | | 534 | | | 534 | | | (534) | | | — | |

| Balance at 30 June 2023 | | 2 | | |

1, 25 | | 22,634 | | | 23,890 | | | 1,651 | | | 25,541 | |

| | | | | | | | | | | | |

| Balance at 1 January 2024 Period ended 30 June 2024: | | 2 | | | 1,245 | | | 16,245 | | | 17,492 | | | 3,600 | | | 21,092 | |

| Profit for the period | | — | | | — | | | 1,805 | | | 1,805 | | | 1,920 | | | 3,725 | |

| Dividends | | — | | | — | | | — | | | — | | | (3,414) | | | (3,414) | |

| Effect of changes in non-controlling interests in existing subsidiaries | | | | | | 737 | | | 737 | | | (737) | | | — | |

| Subsidiary share buyback | | — | | | — | | | — | | | — | | | (30) | | | (30) | |

| Issue of share capital | | — | | | — | | | — | | | — | | | 49 | | | 49 | |

| Balance at 30 June 2024 | | 2 | | | 1,245 | | | 18,787 | | | 20,034 | | | 1,387 | | | 21,421 | |

BEAT CAPITAL PARTNERS LIMITED

UNAUDITED GROUP STATEMENT OF CASH FLOWS

FOR THE SIX MONTH PERIODS ENDED 30 JUNE 2024 AND 30 JUNE 2023

| | | | | | | | | | | | | | | | | |

| |

6 months 30 June 2024 |

6 months 30 June 2023 |

| Notes | £'000 | £'000 | £'000 | £'000 |

Cash flows from operating activities | | | | | |

Cash (absorbed by)/generated from operations | 7 | | (7,392) | | | (7,772) | |

Investing activities | | | | | |

Purchase of intangible assets | | (424) | | | (936) | | |

Purchase of tangible fixed assets | | — | | | — | | |

Interest received | | 503 | | | 420 | | |

Dividends received | | 8,397 | | | 8,721 | | |

Investment return | | (35) | | | (288) | | |

| | | | | |

Net cash generated from/(used in) investing activities | | | 8,441 | | | 7,917 | |

| | | | | |

Financing activities | | | | | |

Proceeds from issue of shares | | 35 | | | 260 | | |

Interest paid | | (18) | | | (110) | | |

Dividends paid to non-controlling interests | | (3,414) | | | (2,772) | | |

| | | | | |

Net cash used in financing activities | | | (3,397) | | | (2,622) | |

Net (decrease)/increase in cash and cash equivalents | | | (2,348) | | | (2,477) | |

Cash and cash equivalents at beginning of period | | | 33,802 | | | 40,054 | |

Effect of foreign exchange rates | | | 113 | | | (2,218) | |

| | | | | |

Cash and cash equivalents at end of year | | | 31,567 | | | 35,359 | |

| | | | | |

| | |

NOTES TO THE GROUP FINANCIAL STATEMENTS |

|

| FOR THE SIX MONTH PERIODS ENDED 30 JUNE 2024 AND 30 JUNE 2023 |

1Accounting policies

Company information

Beat Capital Partners Limited (“the company”) is a private limited company domiciled and incorporated in England and Wales. The registered office is 5th Floor 6 Bevis Marks, London, EC3A 7BA.

The group consists of Beat Capital Partners Limited and all of its subsidiaries.

1.1Basis of preparation

These financial statements have been prepared in accordance with FRS 102 “The Financial Reporting Standard applicable in the UK and Republic of Ireland” (“FRS 102”), The Financial Reporting Standard for interim reporting (“FRS 104”) and the requirements of the Companies Act 2006. The 2022 financial statements were prepared in accordance with FRS103 Insurance Contracts and the requirements of the Companies Act 2006.

The financial statements are prepared in sterling, which is the functional currency of the Company and Group. Monetary amounts in these financial statements are rounded to the nearest £'000.

The Group financial statements have been prepared under the historical cost convention. The principal accounting policies adopted are set out below.

The condensed consolidated financial statements should be read in conjunction with Beat Capital Partners Limited 2023 consolidated financial statements. The accounting policies are the same as those applied in the consolidated financial statements.

The company is a qualifying entity for the purposes of FRS 102, being a member of a group where the parent of that group prepares publicly available consolidated financial statements, including this company, which are intended to give a true and fair view of the assets, liabilities, financial position and profit or loss of the group. The company has therefore taken advantage of exemptions from the following disclosure requirements for parent company information presented within the consolidated financial statements:

▪Section 7 ‘Statement of Cash Flows’: Presentation of a statement of cash flow and related notes and disclosures;

▪Section 11 ‘Basic Financial Instruments’ and Section 12 ‘Other Financial Instrument Issues: Interest income/ expense and net gains/losses for financial instruments not measured at fair value; basis of determining fair values; details of collateral, loan defaults or breaches, details of hedges, hedging fair value changes recognised in profit or loss and in other comprehensive income;

▪Section 33 ‘Related Party Disclosures’: Compensation for key management personnel.

1.2Basis of consolidation

The consolidated group financial statements consist of the financial statements of the parent company Beat Capital Partners Limited together with all entities controlled by the parent company (its subsidiaries) and the group’s share of its interests in joint ventures and associates.

All financial statements are made up to 30 June 2024. Where necessary, adjustments are made to the financial statements of subsidiaries to bring the accounting policies used into line with those used by other members of the group.

All intra-group transactions, balances and unrealised gains on transactions between group companies are eliminated on consolidation. Unrealised losses are also eliminated unless the transaction provides evidence of an impairment of the asset transferred.

Subsidiaries are consolidated in the group’s financial statements from the date that control commences until the date that control ceases.

| | |

NOTES TO THE GROUP FINANCIAL STATEMENTS |

|

| FOR THE SIX MONTH PERIODS ENDED 30 JUNE 2024 AND 30 JUNE 2023 |

1 Accounting policies (Continued)

Entities in which the group holds an interest and which are jointly controlled by the group and one or more other venturers under a contractual arrangement are treated as joint ventures. Entities other than subsidiary undertakings or joint ventures, in which the group has a participating interest and over whose operating and financial policies the group exercises a significant influence, are treated as associates.

Investments in joint ventures and associates are carried in the group statement of financial position at cost plus post- acquisition changes in the group’s share of the net assets of the entity, less any impairment in value. The carrying values of investments in joint ventures and associates include acquired goodwill.

If the group’s share of losses in a joint venture or associate equals or exceeds its investment in the joint venture or associate, the group does not recognise further losses unless it has incurred obligations to do so or has made payments on behalf of the joint venture or associate.

Unrealised gains arising from transactions with joint ventures and associates are eliminated to the extent of the group’s interest in the entity.

The same accounting policies and methods of computation have been followed in the interim financial statements as compared with the annual financial statements for the year ended 31 December 2023.

1.3Going concern

At the time of approving the financial statements, the directors have a reasonable expectation that the group has adequate resources to continue in operational existence for the foreseeable future. Thus the directors continue to adopt the going concern basis of accounting in preparing the financial statements.

The Company and the Group have adequate resource to continue trading for the foreseeable future and the directors intend for it to do so. The Company has a bank overdraft facility of up to £4m to support liquidity, a facility with its shareholder of £6m to further support working capital and future investment. There has been no loan covenant breaches. Accordingly, the directors continue to adopt the going concern basis for accounting in preparing the Group Financial Statements.

1.4Discontinued operations

The group classifies operations as discontinued when a sale transaction has been agreed or in run-off for that operation and is a separate major line of business. The results arising from discontinued operations are included in the group consolidated statement of profit or loss and the split of discontinued operations from continuing operations is shown in the group consolidated statement of profit or loss. All other notes to the financial statements include amounts for continuing operations unless indicated otherwise.

| | |

NOTES TO THE GROUP FINANCIAL STATEMENTS |

|

| FOR THE SIX MONTH PERIODS ENDED 30 JUNE 2024 AND 30 JUNE 2023 |

2Judgements and key sources of estimation uncertainty

In the application of the group’s accounting policies, the directors are required to make judgements, estimates and assumptions about the carrying amount of assets and liabilities that are not readily apparent from other sources. The estimates and associated assumptions are based on historical experience and other factors that are considered to be relevant. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised where the revision affects only that period, or in the period of the revision and future periods where the revision affects both current and future periods.

Critical judgements

The following judgements (apart from those involving estimates) have had the most significant effect on amounts recognised in the financial statements.

Profit commission

The Group provides for profit commission receivable based on the financial performance of the related lines of business. The Group re-assesses the amount of profit commission receivable, on all underwriting years of account that have been open during the financial period, at each balance sheet date.

3Revenue

| | | | | | | | | | | |

Turnover analysed by type | 6 months 2024 £'000 | | 6 months 2023 £'000 |

Profit commission | — | | | — | |

Commissions receivable | 21,603 | | | 21,597 | |

Other income | 4,756 | | | 3,356 | |

| 26,359 | | | 24,953 | |

| | |

NOTES TO THE GROUP FINANCIAL STATEMENTS |

|

| FOR THE SIX MONTH PERIODS ENDED 30 JUNE 2024 AND 30 JUNE 2023 |

4 Intangible fixed assets

| | | | | |

| Group | Software |

Cost | £'000 |

At 31 December 2023 | 2,820 | |

| Additions | 425 | |

At 30 June 2024 | 3,245 | |

Amortisation and impairment At 1 January 2024 | 255 | |

Amortisation charged for the period | 110 | |

At 30 June 2024 | 365 | |

Carrying amount At 31 December 2023 | 2,565 | |

At 30 June 2024 | 2,880 | |

| | |

NOTES TO THE GROUP FINANCIAL STATEMENTS |

|

| FOR THE SIX MONTH PERIODS ENDED 30 JUNE 2024 AND 30 JUNE 2023 |

5 Related party transactions

Beat Capital Partners Limited, is registered in England and Wales at 5th Floor, 6 Bevis Marks, London, EC3A 7BA, United Kingdom. It is the ultimate parent company of the Group of companies as at 30 June 2024 and there is no controlling party over the Company. All transactions between group companies have taken place at arm’s length.

Transactions with Directors

Certain directors of the Company are also directors of other group companies. In all cases, transactions between the Company and other entities within the group are carried out on normal arm’s length commercial terms.

J Cavanagh, T Milligan and P Rayner are Lloyd’s Names and participate on Syndicate 4242 which the Group underwrite (re)insurance business on behalf of.

J Cavanagh is a non-Executive director of Hampden Capital Plc. They provide services to members of Syndicate 4242. All business is conducted on normal arm’s length commercial terms.

T Milligan and P Rayner are de minimis shareholders of Previse, a partner of Peterborough Agency Limited that the Company wholly owns. All business is conducted on normal arm’s length commercial terms.

P Rayner is a director of Cadenza Re Limited. They are an associated company of Beat Capital Partners Limited.

B Schnitzer and P Rayner are shareholders in, and B Schnitzer is a director of, Paraline Group Ltd which is a shareholder in the Company.

Transactions with Related Parties

On 28 March 2024 Beat Capital Partners Limited paid interest of £18k to Buffalo BCC Bidco Limited, a shareholder of the Company.

6 Cash (absorbed by)/generated from group operations

| | | | | | | | | | | |

| Q2 2024 | | Q2 2023 |

| £'000 | | £'000 |

| Total comprehensive income for the period | 3,725 | | | 5,660 | |

Adjustments for: | | | |

Corporation tax charge | 2,103 | | | 2,080 | |

Finance costs | 18 | | | 110 | |

Investment income | 231 | | | (694) | |

Other comprehensive income | 245 | | | (221) | |

| Interest receivable | (503) | | | (420) | |

Amortisation and impairment of intangible assets | 110 | | | 40 | |

| Commissions receivable in transit via restricted cash | 295 | | | 243 | |

| Introduction of client money funds | — | | | 1,337 | |

Depreciation and impairment of tangible fixed assets | 54 | | | 46 | |

Corporation tax paid | (3,052) | | | (1,947) | |

| Share of Lloyd’s member cash movement | — | | | 1,301 | |

Parent company dividends received | (8,397) | | | (8,721) | |

Movements in working capital: (Increase)/decrease in debtors | (4,134) | | | (1,560) | |

Increase/(decrease) in creditors | 1,913 | | | (5,026) | |

| ________ | | ________ |

Cash (absorbed by)/generated from operations | (7,392) | | | (7,772) | |

| | |

NOTES TO THE GROUP FINANCIAL STATEMENTS |

|

| FOR THE SIX MONTH PERIODS ENDED 30 JUNE 2024 AND 30 JUNE 2023 |

7 Discontinued Operations

The group has discontinued operations relating to Three areas, transactions relating to Beat CCM Nine Limited, Peterborough Agency Limited and Marcato Marine Insurance Services LLC. The results included in the group statement of comprehensive income above are shown by entity below:

| | | | | | | | | | | | | | |

| Period ended 30 June 2023 | Peterborough Agency Limited | Marcato Marine Insurance Services LLC | Beat CCM Nine Limited | Total |

| £’000 | £’000 | £’000 | £’000 |

| Turnover | 164 | 100 | - | 264 |

| Admin expenses | (45) | (672) | - | (717) |

| Profit/(loss) before taxation | 121 | (572) | - | (451) |

| Tax on profit/loss | - | - | - | - |

| Profit/(loss) after taxation | 121 | (573) | - | (451) |

| Other comprehensive income | - | 74 | - | 73 |

| Total comprehensive income | 121 | (499) | - | (378) |

| | | | |

| Period ended 30 June 2024 | Peterborough Agency Limited | Marcato Marine Insurance Services LLC | Beat CCM Nine Limited | Total |

| £’000 | £’000 | £’000 | £’000 |

| Turnover | 4 | - | - | 4 |

| Admin expenses | (21) | (49) | - | (70) |

| Profit/(loss) before taxation | (17) | (49) | - | (66) |

| Tax on profit/loss | - | - | - | - |

| Profit/(loss) after taxation | (17) | (49) | - | (66) |

| Other comprehensive income | - | 41 | - | 41 |

| Total comprehensive income | (17) | (8) | - | (25) |

8 Summary of significant differences between UK GAAP and US GAAP

The condensed consolidated financial statements of the Group have been prepared in accordance with generally accepted accounting practice in the United Kingdom (UK GAAP), which differ in certain significant respects from generally accepted accounting principles in the United States (US GAAP). A description of the differences and their effects on total comprehensive income and shareholders’ equity are set out below:

Description of differences between UK GAAP and US GAAP

a.Profit commission

This adjustment converts revenue from UK GAAP to US GAAP. Under UK GAAP, revenue is recognised to the extent that it is probable that the economic benefits will flow to the Group and the revenue can be reliably measured, regardless of when the payment is being made. Revenue is measured at the fair value of the consideration received or receivable, taking into account contractually defined terms of payment and excluding taxes or duty. Under US GAAP, revenue is recognised when or as performance obligations are satisfied by transferring of the service to the insureds, as the customer. Control either transfers over time or at a point in time, which affects when revenue is recorded. The difference in the timing of revenue recognition results in a £1,681k increase and £2,856k increase to accrued commissions for the six month periods ended 30 June 2024 and 30 June 2023 respectively, and an increase of £7,179k increase and £7,975k to consolidated shareholders’ equity for the six month periods ended 30 June 2024 and 30 June 2023, and affected the following line items in the financial statements:

| | | | | | | | | | | |

| 2024 | | 2023 |

| £'000 | | £'000 |

| | | |

| Net income: increase/(decrease) | 1,681 | | | 2,856 | |

| Admin expenses - salaries | 1,681 | | | 2,856 | |

| | | |

| Shareholders' equity: increase/(decrease) | 7,179 | | | 7,975 | |

| Creditors: Amounts falling due within one year | 7,179 | | | 7,975 | |

| | |

NOTES TO THE GROUP FINANCIAL STATEMENTS |

|

| FOR THE SIX MONTH PERIODS ENDED 30 JUNE 2024 AND 30 JUNE 2023 |

8 Summary of significant differences between UK GAAP and US GAAP (continued)

b.Bonus accrual

Under UK GAAP, the Group recognises bonuses once they are determined as the group operates a fully discretionary bonus scheme. Therefore, outside of non-discretionary bonuses, the bonus is recognised in April each year after the service year it relates to. Under US GAAP, bonuses are generally accrued throughout the year in the year of service. Bonuses have been adjusted for the six month periods ended 30 June 2024 and 30 June 2023 amounting to £1,310k and £231k for the six month periods ended 30 June 2024 and 30 June 2023 respectively. The following line items were adjusted for in the financial statements:

| | | | | | | | | | | |

| 2024 | | 2023 |

| £'000 | | £'000 |

| | | |

| Net income: increase/(decrease) | 1,310 | | | 231 | |

| Admin expenses - salaries | 1,310 | | | 231 | |

| | | |

| Shareholders' equity: increase/(decrease) | 1,303 | | | 1,303 | |

| Creditors: Amounts falling due within one year | 1,303 | | | 1,303 | |

c. Leases

Under UK GAAP, a lessee classifies a lease as either finance or operating. Finance leases are capitalised as assets, with the concurrent recognition of an obligation. Operating leases are treated as annual rental expenses on a straight-line basis taking into consideration rent free periods. The Group only has operating leases and was not required to capitalise lease balances.

Under US GAAP, a lessee classifies a lease as either finance or operating. All leases were classified as operating leases under US GAAP. A lease liability and right of use asset are recognised on the balance sheet. The lease liability is measured at the present value of lease payments that are not paid at commencement and discounted using the interest rate implicit in the lease, if that rate can be readily determined, otherwise using the incremental borrowing rate. The right-of-use asset is recognised on the balance sheet and is measured as the initial amount of the lease liability, plus any lease payments and initial direct costs incurred, minus any lease incentives received. Operating leases are typically expensed on a straight-line basis. The difference in the models resulted in a decrease of profit of £40k to consolidated shareholder’s equity in both six month periods ended 30 June 2023 and 2024. The following line items in the financial statements were adjusted:

| | | | | | | | | | | |

| 2024 | | 2023 |

| £'000 | | £'000 |

| | | |

| Net income: increase/(decrease) | — | | | — | |

| Admin expenses - rent | — | | | — | |

| | | |

| Shareholders' equity: increase/(decrease) | | | |

| Tangible fixed assets - right of use asset | 474 | | | 874 | |

| Creditors: Amounts falling due within one year | (514) | | | (914) | |

| (40) | | | (40) | |

| | |

NOTES TO THE GROUP FINANCIAL STATEMENTS |

|

| FOR THE SIX MONTH PERIODS ENDED 30 JUNE 2024 AND 30 JUNE 2023 |

8 Summary of significant differences between UK GAAP and US GAAP (continued)

d. Income taxes

The tax effects of the adjustments described above is calculated as an adjustment to consolidated total comprehensive income and shareholder’s equity.

e. Non-controlling interests

Non-controlling interests (NCI) is adjusted for each of the above listed significant adjustments.

Significant adjustments to consolidated total comprehensive income

The significant adjustments to total comprehensive income for the six month periods ended 30 June 2024 and 2023 which would be required if US GAAP had been applied, instead of UK GAAP in the consolidated financial statements are set out below.

| | | | | | | | | | | | | | |

| | 2024 | | 2023 |

| | £'000 | | £'000 |

| | | | |

| Total comprehensive income according to the consolidated | | | | |

| income statement prepared under UK GAAP | | 3,725 | | | 5,660 | |

| US GAAP adjustments - increase/(decrease) due to: | | | | |

| Profit Commission | a | 1,681 | | | 2,856 | |

| Bonus Accrual | b | 1,310 | | | 231 | |

| Leases | c | — | | | — | |

| Tax | d | (968) | | | (962) | |

| | 2,023 | | | 2,125 | |

| Total comprehensive income in accordance with U.S. GAAP | | 5,748 | | | 7,785 | |

| | | | |

| Non-controlling interest - US GAAP adjustments | e | 130 | | | 495 | |

| | | | |

| Profit for the financial year is attributable to: | | | | |

| -Owners of the parent company | | 4,459 | | | 5,216 | |

| -Non-0controlling interests | | 1,289 | | | 2,569 | |

| | 5,748 | | | 7,785 | |

| | |

NOTES TO THE GROUP FINANCIAL STATEMENTS |

|

| FOR THE SIX MONTH PERIODS ENDED 30 JUNE 2024 AND 30 JUNE 2023 |

8 Summary of significant differences between UK GAAP and US GAAP (continued)

Significant adjustments to consolidated shareholders equity

The significant adjustments to shareholders equity for the periods ended 30 June 2024 and 2023 which would be required if US GAAP had been applied, instead of UK GAAP in the consolidated financial statements are set out below.

| | | | | | | | | | | | | | |

| | 2024 | | 2023 |

| | £'000 | | £'000 |

| | | | |

| Shareholders equity according to the consolidated statement | | — | | | — | |

| of financial position prepared under UK GAAP | | 21,421 | | | 25,539 | |

| US GAAP adjustments - increase/(decrease) due to: | | | | |

| Profit Commission | a | 7,179 | | | 7,975 | |

| Bonus Accrual | b | 1,303 | | | 1,303 | |

| Leases | c | (40) | | | (40) | |

| Income taxes | d | (1,475) | | | (1,344) | |

| | 6,968 | | | 7,894 | |

| Shareholders equity in accordance with U.S. GAAP | | 28,389 | | | 33,433 | |

| | | | |

| Non-controlling interests (NCI) - US GAAP adjustments | e | 130 | | | 495 | |

| | | | |

| Equity attributable to owners of the parent company | | 26,871 | | | 31,286 | |

| Non-controlling interests | | 1,517 | | | 2,147 | |

| | 28,389 | | | 33,433 | |

Significant adjustments to consolidated statement of cash flows

No significant adjustments were required to the consolidated statement of cash flow if US GAAP had been applied instead of UK GAAP, with the exception of interest paid being classified as a financing activity under UK GAAP and as operating activity under US GAAP, amounting to £18k and £110k for the six month periods ended 30 June 2024 and 2023 respectively.

Exhibit 99.2

PRELIMINARY UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION

The following preliminary unaudited pro forma combined financial information gives effect to the following transactions by Ambac Financial Group, Inc (“Ambac”), collectively the “Transactions”:

•Ambac’s disposition of 100% of the common stock of Ambac Assurance Corporation (“AAC”) under the terms of a Stock Purchase Agreement dated June 4, 2024, with American Acorn Corporation (“Buyer”), a Delaware corporation owned by funds managed by Oaktree Capital Management, L.P., pursuant to which, subject to the conditions set forth therein, Ambac will sell all the issued and outstanding shares of common stock, par value $2.50 per share, of AAC to Buyer for aggregate consideration of $420 million in cash (the “AAC Transaction”). At the closing of the AAC Transaction, Ambac will issue to Buyer or its designee a warrant (the “Warrant”) exercisable for a number of shares of common stock, par value $0.01, of Ambac representing 9.9% of the fully diluted shares of Ambac’s common stock as of March 31, 2024, pro forma for the issuance of the Warrant (the “Warrant Shares”). The Warrant will have an exercise price per share of $18.50 with a six and a half-year term from the date of issuance and will be immediately exercisable.

•Ambac’s acquisition of 60% of Beat Capital Partners Limited and subsidiaries (“Beat”), effective July 31, 2024, for total consideration as of the closing date, of approximately $278 million, of which approximately $249 million was paid in cash and the remainder of which was satisfied through the issuance of 2,216,023 shares of common stock, par value $0.01 per share, of Ambac (“Ambac Common Stock”) to certain Sellers (the “Beat Transaction”).

The Transactions have been accounted for in the preliminary unaudited pro forma combined statement of operations (the “pro forma statement of operations”) for the six months ended June 30, 2024, and the year ended December 31, 2023, as if they had been completed on January 1, 2023. The preliminary unaudited pro forma combined balance sheet as of June 30, 2024, gives effect to the Transactions as if they occurred on June 30, 2024.

The following preliminary unaudited pro forma combined financial statements and related notes as of and for the six months ended June 30, 2024, and for the year ended December 31, 2023, have been derived from, and should be read in conjunction with, (i) the historical audited consolidated financial statements of Ambac and accompanying notes included in Ambac’s Annual Report on Form 10-K for the year ended December 31, 2023, (ii) the historical unaudited consolidated financial statements of Ambac and related notes included in Ambac’s Quarterly Report on Form 10-Q for the six months ended June 30, 2024, (iii) the historical audited combined financial statements of Beat and related notes for the year ended December 31, 2023, and (iv) the historical unaudited combined financial statements of Beat for the six months ended June 30, 2024.

In accordance with Article 11 of Regulation S-X, the preliminary unaudited pro forma combined financial statements were prepared for illustrative and informational purposes only and are not intended to represent what our results of operations or financial position would have been had the Transactions occurred on the dates noted above, nor what they will be for any future periods. The pro forma adjustments are based on available information and certain assumptions that management believes are factually supportable. In the opinion of our management, all adjustments necessary to present fairly the preliminary unaudited pro forma combined financial statements have been made. The preliminary unaudited pro forma combined financial statements do not include the realization of any cost savings from operating efficiencies or synergies that might result from the Transactions. Additionally, we anticipate that certain nonrecurring charges will be incurred in connection with the Transactions, the substantial majority of which consist of fees paid to investment bankers, legal counsel and other professional advisors. Any such charge could affect the future results of the post-acquisition company in the period in which such charges are incurred; however, these costs are not expected to be incurred in any period beyond twelve months from the closing date of the Transactions. Accordingly, the preliminary unaudited pro forma combined statement of operations for the year ended December 31, 2023, reflects the effects of these non-recurring charges, which are not included in the historical statements of operations of Ambac, AAC or Beat for the year ended December 31, 2023.

In connection with the Beat Transaction, the preliminary unaudited pro forma combined financial statements have been prepared using the acquisition method of accounting for business combinations under generally accepted accounting principles in the United State of America (“US GAAP”), in accordance with Accounting Standards Codifications (ASC) 805, Business

Combinations. Under the acquisition method of accounting, the purchase price is allocated to the underlying tangible and intangible assets acquired, liabilities assumed and noncontrolling interests based upon their estimated fair values as of the acquisition date, with any excess purchase price allocated to goodwill. Ambac has made a preliminary allocation of the purchase price as of the assumed acquisition date of June 30, 2024, using information currently available. We estimated the fair value of Beat’s assets, liabilities and noncontrolling interests based on reviews of Beat’s historical audited financial statements, discussions with Beat management and other due diligence procedures. The assumptions and estimates used to determine the preliminary purchase price allocation and fair value adjustments are described in the notes accompanying the preliminary unaudited pro forma combined financial statements. The final determination of the fair value of Beat’s assets, liabilities and noncontrolling interests will be based on the actual net tangible and intangible assets, liabilities and noncontrolling interests of Beat that existed as of the closing date of the acquisition (July 31, 2024). As a result, the unaudited pro forma purchase price adjustments related to the acquisition are preliminary and subject to further adjustments as additional information becomes available and as additional analyses are performed. The final valuation may be materially different than the estimated values assumed in the preliminary unaudited pro forma combined financial statements.

The preliminary unaudited pro forma combined financial statements contain certain reclassification adjustments to conform the historical Beat financial statement presentation to our financial statement presentation. For purposes of the preliminary unaudited pro forma combined financial statements presented below; it is assumed that we will fund the cash consideration with cash on hand and proceeds from the AAC Transaction.

In connection with Ambac’s disposition of 100% of AAC’s common stock, the preliminary unaudited pro forma combined financial statements have been prepared using the guidance in ASC 810, Consolidations. Under ASC 810, a parent shall deconsolidate a subsidiary as of the date the parent ceases to have a controlling financial interest in the subsidiary by recognizing a gain or loss in net income measured as the difference between the fair value of any consideration received and the carrying amount of the subsidiary’s assets and liabilities at the date of sale. Components of the gain/loss calculation are described in further detail in Note 1 to the preliminary unaudited pro forma combined financial statements. AAC has historically been managed and operated in the normal course with other Ambac businesses and has been identified as the Legacy Financial Guarantee Segment in Ambac’s SEC filings. Therefore, the accompanying adjustments to the combined financial statements have been derived from the accounting records of Ambac and are in accordance with US GAAP.

The indebtedness incurred to finance the Beat Transaction is included in the preliminary unaudited pro forma combined financial statements reflecting terms and rates Ambac has agreed to with the funding bank.

Ambac Financial Group, Inc. and Subsidiaries

Preliminary Unaudited Pro Forma Combined Balance Sheet

June 30, 2024

(Dollars in Millions, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Historical

Ambac

Consolidated | | Historical

Beat Business

As

Reclassified | | Deconsolidated

Accounting

Adjustments

relating to

AAC | | Acquisition

Accounting

Adjustments

relating to

Beat | | Other

Accounting

Adjustments | | Note | | Proforma

Ambac

Consolidated |

Assets | | | | | | | | | | | | | | |

Investments: | | | | | | | | | | | | | | |

Fixed maturity securities - available for sale, at fair value | | $ | 1,703 | | | $ | — | | | $ | (1,567) | | | $ | — | | | $ | — | | | | | $ | 136 | |

Fixed maturity securities - pledged as collateral, at fair value | | 25 | | | — | | | (25) | | | — | | | — | | | | | — | |

Fixed maturity securities - trading, at fair value | | 31 | | | — | | | (31) | | | — | | | — | | | | | — | |

Short-term investments, at fair value | | 314 | | | — | | | (105) | | | — | | | — | | | | | 209 | |

Other investments | | 558 | | | — | | | (526) | | | — | | | — | | | | | 32 | |

Total investments | | 2,632 | | | — | | | (2,254) | | | — | | | — | | | | | 377 | |

Cash and cash equivalents | | 35 | | | 40 | | | 410 | | | (249) | | | (27) | | | 4B | | 209 | |

Premium receivables | | 317 | | | — | | | (232) | | | — | | | — | | | | | 85 | |

Reinsurance recoverable on paid and unpaid losses | | 277 | | | — | | | (26) | | | — | | | — | | | | | 251 | |

Deferred ceded premium | | 232 | | | — | | | (85) | | | — | | | — | | | | | 147 | |

Deferred acquisition costs | | 12 | | | — | | | — | | | — | | | — | | | | | 12 | |

Subrogation recoverable | | 128 | | | — | | | (128) | | | — | | | — | | | | | — | |

Intangible assets, less accumulated amortization | | 285 | | | — | | | (226) | | | 275 | | | — | | | | | 334 | |

Goodwill | | 70 | | | — | | | — | | | 274 | | | — | | | | | 344 | |

Other assets | | 163 | | | 59 | | | (105) | | | — | | | 16 | | | 4C | | 133 | |

Variable interest entity - Fixed maturity securities, at fair value | | 2,101 | | | — | | | (2,101) | | | — | | | — | | | | | — | |

Variable interest entity - Restricted cash | | 62 | | | — | | | (62) | | | — | | | — | | | | | — | |

Variable interest entity - Loans, at fair value | | 1,567 | | | — | | | (1,567) | | | — | | | — | | | | | — | |

Variable interest entity - Derivative and other assets | | 303 | | | — | | | (303) | | | — | | | — | | | | | — | |

Total assets | | $ | 8,184 | | | $ | 99 | | | $ | (6,679) | | | $ | 301 | | | $ | (11) | | | | | $ | 1,894 | |

Liabilities and Stockholders’ Equity | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | |

Unearned premiums | | $ | 445 | | | $ | — | | | $ | (247) | | | $ | — | | | $ | — | | | | | $ | 198 | |

Losses and loss adjustment expense reserves | | 890 | | | — | | | (604) | | | — | | | — | | | | | 286 | |

Ceded premiums payable | | 140 | | | — | | | (58) | | | — | | | — | | | | | 82 | |

Deferred program fees and reinsurance commissions | | 7 | | | — | | | — | | | — | | | — | | | | | 7 | |

Long-term debt | | 515 | | | — | | | (515) | | | — | | | — | | | | | — | |

Accrued interest payable | | 500 | | | — | | | (500) | | | — | | | — | | | | | — | |

Other liabilities | | 203 | | | 63 | | | (137) | | | — | | | 20 | | | 4C | | 149 | |

Variable interest entity - Long-term debt | | 2,853 | | | — | | | (2,853) | | | — | | | — | | | | | — | |

Variable interest entity - Derivative liabilities | | 1,136 | | | — | | | (1,136) | | | — | | | — | | | | | — | |

Variable interest entity - Other liabilities | | 59 | | | — | | | (59) | | | — | | | — | | | | | — | |

Total liabilities | | 6,748 | | | 63 | | | (6,109) | | | — | | | 20 | | | | | 721 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Historical

Ambac

Consolidated | | Historical

Beat Business

As

Reclassified | | Deconsolidated

Accounting

Adjustments

relating to

AAC | | Acquisition

Accounting

Adjustments

relating to

Beat | | Other

Accounting

Adjustments | | Note | | Proforma

Ambac

Consolidated |

Redeemable noncontrolling interest | | 17 | | | — | | | — | | | 186 | | | — | | | | | 203 | |

Stockholders’ equity: | | | | | | | | | | | | | | |

Preferred stock | | — | | | — | | | — | | | — | | | — | | | | | — | |

Common stock | | — | | | — | | | — | | | — | | | — | | | | | — | |

Additional paid-in capital | | 295 | | | — | | | 16 | | | 29 | | | | | | | 340 | |

Accumulated other comprehensive income (loss) | | (175) | | | — | | | 168 | | | — | | | — | | | | | (7) | |

Retained earnings | | 1,265 | | | — | | | (703) | | | — | | | (30) | | | 4B/4C | | 532 | |

Parent company net investment | | — | | | 34 | | | — | | | (34) | | | — | | | | | — | |

Treasury stock, shares at cost | | (17) | | | — | | | — | | | — | | | — | | | | | (17) | |

Total Ambac Financial Group, Inc. stockholders’ equity | | 1,368 | | | 34 | | | (519) | | | (5) | | | (30) | | | | | 848 | |

Nonredeemable noncontrolling interest | | 51 | | | 2 | | | (51) | | | 119 | | | — | | | | | 121 | |

Total stockholders’ equity | | 1,419 | | | 36 | | | (570) | | | 115 | | | (30) | | | | | 969 | |

Total liabilities, redeemable noncontrolling interest and stockholders’ equity | | $ | 8,184 | | | $ | 99 | | | $ | (6,679) | | | $ | 301 | | | $ | (11) | | | | | $ | 1,894 | |

| | | | | | | | | | | | | | |

Ambac Financial Group, Inc. and Subsidiaries

Preliminary Unaudited Pro Forma Combined Statement of Operations

Year Ended December 31, 2023

(Dollars in Millions, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Historical

Ambac

Consolidated | | Historical

Beat Business

As

Reclassified | | Deconsolidated

Accounting

Adjustments

relating to

AAC | | | | Other

Accounting

Adjustments | | Note | | Proforma

Ambac

Consolidated |

Revenues | | | | | | | | | | | | | | |

Net premiums earned | | $ | 78 | | | $ | — | | | $ | (26) | | | | | $ | — | | | | | $ | 52 | |

Commission income | | 51 | | | 50 | | | — | | | | | — | | | | | 101 | |

Program fees | | 8 | | | — | | | — | | | | | — | | | | | 8 | |

Net investment income | | 140 | | | 1 | | | (127) | | | | | 6 | | | 4A | | 21 | |

Net investment gains (losses), including impairments | | (22) | | | — | | | 23 | | | | | — | | | | | 1 | |

Net gains (losses) on derivative contracts | | (1) | | | — | | | 1 | | | | | — | | | | | — | |

Other income | | 11 | | | 8 | | | (11) | | | | | — | | | | | 8 | |

Income (loss) on variable interest entities | | 3 | | | — | | | (3) | | | | | — | | | | | — | |

Total revenues | | 269 | | | 59 | | | (144) | | | | | 6 | | | | | 190 | |

Expenses | | | | | | | | | | | | | | |

Losses and loss adjustment expenses (benefit) | | (33) | | | — | | | 69 | | | | | — | | | | | 36 | |

Amortization of deferred acquisition costs, net | | 11 | | | — | | | — | | | | | — | | | | | 11 | |

Commission expense | | 29 | | | — | | | — | | | | | — | | | | | 29 | |

General and administrative expenses | | 156 | | | 43 | | | (108) | | | | | 28 | | | 4B/4C | | 119 | |

Intangible amortization | | 29 | | | — | | | (25) | | | | | 28 | | | 4D | | 32 | |

Interest expense | | 64 | | | — | | | (64) | | | | | 3 | | | 4B | | 3 | |

Loss on Disposal | | — | | | — | | | 663 | | | | | 21 | | | 4B/4C | | 684 | |

Total expenses | | 257 | | | 43 | | | 536 | | | | | 80 | | | | | 915 | |

Pre-tax income (loss) | | 12 | | | 16 | | | (680) | | | | | (73) | | | | | (724) | |

Provision (benefit) for income taxes | | 7 | | | 5 | | | (8) | | | | | — | | | | | 4 | |

Net income (loss) | | 5 | | | 11 | | | (672) | | | | | (73) | | | | | (728) | |

Less: net (gain) loss attributable to noncontrolling interest | | (1) | | | (5) | | | — | | | | | — | | | | | (6) | |

Net income (loss) attributable to common stockholders | | $ | 4 | | | $ | 6 | | | $ | (672) | | | | | $ | (73) | | | | | $ | (734) | |

| | | | | | | | | | | | | | |

Weighted average number of common shares outstanding: | | | | | | | | | | | | | | |

Basic | | 45,636,649 | | | 2,216,023 | | | | | | | | | | | 47,852,672 | |

Diluted | | 46,540,706 | | | 2,216,023 | | | | | | | | | | | 47,852,672 | |

Net income (loss) per share attributable to common stockholders: | | | | | | | | | | | | | | |

Basic | | $ | 0.18 | | | | | | | | | | | | | $ | (15.24) | |

Diluted | | $ | 0.18 | | | | | | | | | | | | | $ | (15.24) | |

Ambac Financial Group, Inc. and Subsidiaries

Preliminary Unaudited Pro Forma Combined Statement of Operations

Six Months Ended June 30, 2024

(Dollars in Millions, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Historical

Ambac

Consolidated | | Historical

Beat Business

As

Reclassified | | Deconsolidated

Accounting

Adjustments

relating to

AAC | | | | Other

Accounting

Adjustments | | Note | | Proforma

Ambac

Consolidated |

Revenues | | | | | | | | | | | | | | |

Net premiums earned | | $ | 66 | | | $ | — | | | $ | (13) | | | | | $ | — | | | | | $ | 53 | |

Commission income | | 31 | | | 29 | | | — | | | | | — | | | | | 60 | |

Program fees | | 6 | | | — | | | — | | | | | — | | | | | 6 | |

Net investment income | | 78 | | | 1 | | | (70) | | | | | 3 | | | 4A | | 11 | |

Net investment gains (losses), including impairments | | 4 | | | — | | | — | | | | | — | | | | | 4 | |

Net gains (losses) on derivative contracts | | 2 | | | — | | | (2) | | | | | — | | | | | — | |

Other income | | 18 | | | 5 | | | (19) | | | | | — | | | | | 4 | |

Income (loss) on variable interest entities | | 2 | | | — | | | (2) | | | | | — | | | | | — | |

Total revenues | | 207 | | | 34 | | | (107) | | | | | 3 | | | | | 138 | |

Expenses | | | | | | | | | | | | | | |

Losses and loss adjustment expenses (benefit) | | 16 | | | — | | | 26 | | | | | — | | | | | 42 | |

Amortization of deferred acquisition costs, net | | 10 | | | — | | | — | | | | | — | | | | | 10 | |

Commission expense | | 18 | | | — | | | — | | | | | — | | | | | 18 | |

General and administrative expenses | | 83 | | | 23 | | | (44) | | | | | (16) | | | 4B/4C | | 45 | |

Intangible amortization | | 21 | | | — | | | (18) | | | | | 14 | | | 4D | | 16 | |

Interest expense | | 32 | | | — | | | (32) | | | | | — | | | | | — | |

Total expenses | | 180 | | | 23 | | | (69) | | | | | (3) | | | | | 132 | |

Pre-tax income (loss) | | 27 | | | 11 | | | (38) | | | | | 6 | | | | | 6 | |

Provision (benefit) for income taxes | | 7 | | | 4 | | | (7) | | | | | | | | | 4 | |

Net income (loss) | | 20 | | | 7 | | | (31) | | | | | 6 | | | | | 2 | |

Less: net (gain) loss attributable to noncontrolling interest | | (1) | | | (2) | | | — | | | | | — | | | | | (3) | |

Net income (loss) attributable to common stockholders | | $ | 19 | | | $ | 6 | | | $ | (31) | | | | | $ | 6 | | | | | $ | — | |

| | | | | | | | | | | |

Weighted average number of common shares outstanding: | | | | | | | | | | | | | | |

Basic | | 46,019,145 | | | 2,216,023 | | | | | | | | | | | 48,235,168 | |

Diluted | | 46,568,862 | | | 2,216,023 | | | | | | | | | | | 48,235,168 | |

| | | | | | | | | | | |

Net income (loss) per share attributable to common stockholders: | | | | | | | | | | | | | | |

Basic | | $ | 0.42 | | | | | | | | | | | | | $ | 0.00 | |

Diluted | | $ | 0.41 | | | | | | | | | | | | | $ | 0.00 | |

NOTES TO PRELIMINARY UNAUDITED PRO FORMA COMBINED FINANCIAL STATEMENTS

(Dollar amounts in Millions, Except Share Amounts)

1. BASIS OF PRESENTATION

The preliminary unaudited pro forma combined financial statements have been derived from the historical consolidated financial statements of Ambac Financial Group, Inc (“Ambac”), Ambac Assurance Corporation (“AAC”) and Beat Capital Partners Limited (“Beat”) in accordance with generally accepted accounting principles in the United State of America (“US GAAP”) and are presented in U.S. dollars. As discussed in Note 5, certain of Beat’s historical amounts have been reclassified to conform to Ambac’s financial statement presentation, and pro forma adjustments have been made to reflect the Transactions and additional accounting adjustments.

The AAC Transaction (as defined below) is being accounted for as a deconsolidation of a subsidiary under ASC 810 Consolidations, which requires an entity to derecognize assets as of the date the parent ceases to have a controlling financial interest in that subsidiary. At the date of deconsolidation, the entity shall recognize a gain or loss in net income attributable to the parent, measured as the difference between (a) the aggregate of the (i) fair value of any consideration received; (ii) fair value of any retained noncontrolling investment in the former subsidiary at the date the subsidiary is deconsolidated; and (iii) carrying amount of any noncontrolling interest in the former subsidiary (including any accumulated other comprehensive income attributable to the noncontrolling interest) at the date the subsidiary is deconsolidated and (b) the carrying amount of the former subsidiary’s assets and liabilities.

The Beat Transaction (as defined below) is being accounted for as a business combination using the acquisition method of accounting under US GAAP, in accordance with the provisions of ASC 805, Business Combinations which requires assets acquired and liabilities assumed to be recorded at their acquisition date fair value. ASC 820, Fair Value Measurements, defines the term “fair value” as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.” Fair value measurements can be highly subjective, and it is possible the application of reasonable judgement could develop different assumptions resulting in a range of alternative estimates using the same facts and circumstances.

Ambac has not completed the detailed valuation studies necessary to determine the fair value of Beat’s assets acquired, the liabilities assumed, interests of noncontrolling shareholders and the related allocations of purchase price. Therefore, the allocation of the purchase price as reflected in the preliminary unaudited pro forma combined financial statements is based upon management’s preliminary estimates of the fair value of the assets acquired and liabilities assumed. We estimated the fair value of Beat’s assets and liabilities based on reviews of Beat’s historical audited financial statements, discussions with Beat management and other due diligence procedures. The final determination of the fair value of Beat’s assets and liabilities will be based on the actual net tangible and intangible assets, liabilities and noncontrolling interests of Beat that existed as of the closing date of the acquisition. As a result, the pro forma purchase price adjustments related to the acquisition are preliminary and subject to further adjustments as additional information becomes available and as additional analyses are performed. The final valuation may be materially different than the estimated values assumed in the preliminary unaudited pro forma combined financial statements.

The AAC Transaction and Beat Transaction (the “Transactions”) and the related transaction accounting adjustments are described in the accompanying notes to the preliminary unaudited pro forma combined financial statements. In accordance with Article 11 of Regulation S-X, the preliminary unaudited pro forma combined financial statements were prepared for illustrative and informational purposes only and are not intended to represent what our results of operations or financial position would have been had the Transactions occurred on the dates noted above, nor what they will be for any future periods. The pro forma adjustments are based on available information and certain assumptions that management believes are factually supportable. In the opinion of our management, all adjustments necessary to present fairly the preliminary unaudited pro forma combined financial statements have been made. The preliminary unaudited pro forma combined financial statements do not include the realization of any cost savings from operating efficiencies or synergies that might result from the Transactions. Additionally, we anticipate that certain nonrecurring charges will be incurred in connection with the Transactions, the substantial majority of which consist of fees paid to investment bankers, legal counsel and other professional advisors. Any such charge could affect the future results of Ambac in the period in which such charges are incurred; however, these costs are not expected to be incurred in any period beyond twelve months from the closing date of the Transactions. Accordingly, the preliminary unaudited pro forma combined statement of operations for the year ended December 31, 2023, reflects the effects of these non-recurring charges, which were not included in the historical statements of operations of Ambac, AAC and Beat for the year ended December 31, 2023.

NOTES TO PRELIMINARY UNAUDITED PRO FORMA COMBINED FINANCIAL STATEMENTS

(Dollar amounts in Millions, Except Share Amounts)

All amounts presented within these notes to the preliminary unaudited pro forma combined financial statements are in millions, except per share data and as otherwise expressly stated herein.

2 PRELIMINARY DECONSOLIDATION ACCOUNTING FOR AAC

On June 4, 2024, Ambac entered into a stock purchase agreement with American Acorn Corporation (“Buyer”), a Delaware corporation owned by funds managed by Oaktree Capital Management, L.P., pursuant to which and subject to the conditions set forth therein, Ambac will sell all of the issued and outstanding shares of common stock of AAC, a wholly-owned subsidiary of Ambac, to Buyer for aggregate consideration of $420 in cash (the “AAC Transaction”). Buyer will acquire complete common equity ownership of AAC and its wholly-owned subsidiary, Ambac Assurance UK Limited. In connection with and pursuant to the stock purchase agreement, Ambac has agreed to issue to Buyer a warrant exercisable for a number of shares of common stock, par value $0.01, of Ambac representing 9.9% of the fully diluted shares of Ambac’s common stock as of March 31, 2024, pro forma for the issuance of the Warrant. The Warrant will have an exercise price per share of $18.50 with a six and a half-year term from the date of issuance and will be immediately exercisable. Payment of the exercise price may be settled, at Ambac’s option, by way of a cash exercise or by net share settlement.

The AAC Transaction is subject to approval by Ambac shareholders and the Office of the Commissioner of Insurance of Wisconsin. There can be no assurance the AAC Transaction will close as expected or at all.

A loss on the AAC Transaction recorded in the preliminary unaudited pro forma combined statement of operations for the year ended December 31, 2023, is as follows:

| | | | | | | | |

Fair value of consideration received (cash less estimated fair value of warrants issued) | | $ | 404 | |

Carrying value of noncontrolling interests | | 51 | |

| | $ | 455 | |

Less: Carrying amount of AAC’s net assets (1) | | 880 | |

Less: Transaction expenses | | 17 | |

| | (442) | |

Reclassifications of Accumulated Other Comprehensive Income to earnings | | (242) | |

Total gain (loss) on disposal | | $ | (684) | |

| | |

(1) Adjusted by the impact of AAC operating leases that are being assumed by Ambac in connection with the AAC Transaction; refer to Note 4.C. for further details.

The impact of the sale of AAC on Total stockholders’ equity on the preliminary unaudited proforma combined balance sheet is $555.

The gain (loss) on the AAC Transaction is based upon financial information as included in the preliminary unaudited pro forma combined financial statements and changes to the financial position of AAC through to the closing date of the sale will impact these amounts. There can be no assurance that such changes will not be material.

NOTES TO PRELIMINARY UNAUDITED PRO FORMA COMBINED FINANCIAL STATEMENTS

(Dollar amounts in Millions, Except Share Amounts)

3. PRELIMINARY PURCHASE PRICE ALLOCATION FOR BEAT ACQUISITION

Effective July 31, 2024, the Company completed a transaction pursuant to a share purchase agreement (the “Beat Purchase Agreement”), by and among the Company, Cirrata V LLC, a Delaware limited liability company and an indirect wholly owned subsidiary of Ambac (the “Purchaser”), certain sellers set forth therein (the “Sellers”) and Beat, pursuant to which, and upon the terms and subject to the conditions set forth therein effective July 31, 2024, the Purchaser purchased from the Sellers approximately 60% of the entire issued share capital of Beat, for total consideration of approximately $278, of which approximately $249 was paid in cash and the remainder of which was satisfied through the issuance of Ambac Common Stock to certain Sellers (the “Beat Transaction”). Beat’s management team and Bain Capital Credit LP (“Bain” and, together with certain members of Beat’s management team, the “Rollover Shareholders”) each retained approximately 20% of Beat’s issued share capital immediately after closing. To reduce its exposure to appreciation of the British Pound Sterling (“GBP”) relative to the U.S. Dollar (“USD”), Ambac entered into a foreign exchange futures contract under which it agreed to purchase an amount of GBP sufficient to cover the cash portion of the purchase price of Beat along with estimated GBP denominated expenses at an exchange rate of 1.2662. We used this exchange rate to calculate the USD cash consideration in these preliminary unaudited pro forma combined financial statements, which may differ from the final financial statement presentation.

Ambac funded the cash portion of the consideration with a combination of available cash, $62 of funding from AAC and $150 of new indebtedness (the “Credit Facility”) maturing in 364 days funded by a global bank with an interest rate that approximates 10%. Funding received from AAC and the Credit Facility are required to be repaid upon closing of the sale of AAC. For purposes of this pro forma, both the acquisition of Beat and the sale of AAC are assumed to have occurred simultaneously and accordingly, such debt and related interest expenses are not included in the pro forma balance sheet or statement of operations, respectively. If the AAC sale does not occur within 364 days of funding of the Credit Facility or if the sale does not occur, Ambac will need to refinance such short-term debt with longer-term debt.

The preliminary purchase price allocation of Beat is subject to change due to several factors, including, but not limited to:

•Changes in the estimated fair value of identifiable intangible assets, primarily from distribution relationships. Distribution relationships are important because of the propensity of these parties to generate predictable, recurring future revenue for Beat. Such changes can result from our additional valuation analysis on relationship retention, changes in discount rates and other factors.

•Changes in the estimated fair value of noncontrolling interests held by Rollover Shareholders, which are subject to changes to ownership via put and call options, and the existing noncontrolling interests of Beat’s subsidiaries.

The table below represents a preliminary allocation of the estimated consideration to Beat’s identifiable and intangible assets to be acquired and liabilities to be assumed at June 30, 2024:

| | | | | | | | |

Total Consideration for Beat Acquisition | | $ | 278 | |

Cash and Cash Equivalents | | 40 | |

Intangible Assets | | 275 | |

Other Assets | | 59 | |

Total Assets | | 374 | |

Total Liabilities | | 63 | |

Noncontrolling interests | | 307 | |

Net Assets acquired | | 4 | |

Preliminary allocation to goodwill | | $ | 274 | |

4. PRO FORMA ADJUSTMENTS AND ASSUMPTIONS

A. The unaudited combined pro forma statement of operations assumes the AAC and Beat transactions were completed on January 1, 2023. Accordingly, this adjustment represents the investment income on such funds as if they were received / paid on January 1, 2023, at an effective yield of 5%.

B. Represents estimated costs related to the Transactions that include investment bankers, legal counsel and other professional fees. These costs are estimated at $17 for the AAC Transaction (included in the Loss on Disposal on the

NOTES TO PRELIMINARY UNAUDITED PRO FORMA COMBINED FINANCIAL STATEMENTS

(Dollar amounts in Millions, Except Share Amounts)

preliminary unaudited pro forma combined statement of operations) and $28 for the Beat Transaction ($25 included in general and administrative expenses and $3 included in interest expense on the preliminary unaudited pro forma combined statement of operations) and will not affect the combined statement of operations beyond 12 months after the closing date. During 2024, Ambac incurred total costs relating to the Transactions of $18 and accordingly operating expenses on the unaudited combined pro forma statement of operations for the six months ended June 30, 2024, has been reduced to eliminate these expenses considering they have been expensed in the unaudited combined pro forma statement of operations for the year ended December 31, 2023. The net estimated cost of $27 is reflected as an adjustment to cash and retained earnings within stockholders’ equity on the preliminary unaudited pro forma combined balance sheet.

C. In connection with the AAC Transaction and prior to closing, Ambac will be assuming two operating leases from AAC. This adjustment on the preliminary unaudited pro forma combined balance sheet represents the net of the Right of Use Asset ($16) and Lease Liability ($20) balances on June 30, 2024, with the net impact of $3 reflected in retained earnings within stockholders’ equity. The adjustment to the unaudited pro forma combined statement of operations for 2023 relates to (i) the net impact of the Right of Use Asset and Lease Liability of $3 (included in loss on disposal) and (ii) expenses related to these operating leases (included in general and administrative expenses). The adjustment to the unaudited pro forma combined statement of operations for 2024 relate to expenses for these operating leases.

D. As noted above in Note 3 Preliminary Purchase Price Allocation, the fair value of Beat’s identifiable intangible assets are estimated to be $277. This adjustment represents the amortization of this asset with an estimated amortization period of 10 years.

5. ADJUSTMENTS FROM UK GAAP TO US GAAP FOR BEAT ACQUISITION

The historical financial statements of Beat are prepared in accordance with UK GAAP and are adjusted to: (i) reconcile the financial statements to US GAAP, (ii) reflect reclassifications of Beat’s financial statements to conform to our financial statement presentation and (iii) translate the financial statements to U.S. dollars based on the historical exchange rates below.

| | | | | | | | |

| | GBP / USD |

June 30, 2024 exchange rate | | 1.26390 |

Year ended December 31, 2023, average exchange rate | | 1.24364 |

Six months ended June 30, 2024 average exchange rate | | 1.26527 |

As a result of the significant impact of the Balance Sheet from the proposed sale of AAC, Ambac will consider a more expanded presentation of other assets and other liabilities in future fillings.

NOTES TO PRELIMINARY UNAUDITED PRO FORMA COMBINED FINANCIAL STATEMENTS

(Dollar amounts in Millions, Except Share Amounts)

(a) The amounts below represent results as of June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beat (in GBP, in

UK GAAP) | | US GAAP

Adjustments(1) | | Reclassifications | | Historical Beat

Business as

Reclassified

(in GBP) | | Historical Beat

Business as

Reclassified

(in USD) |

ASSETS | | | | | | | | | | |

Cash and Cash Equivalents | | £ | 32 | | | £ | — | | | £ | — | | | £ | 32 | | | $ | 40 | |

Debtors | | 4 | | | (1) | | | (4) | | | — | | | — | |

Prepayments and accrued income | | 33 | | | 7 | | | (40) | | | — | | | — | |

Fixed Assets | | 3 | | | — | | | (3) | | | — | | | — | |

Other Assets | | — | | | — | | | 46 | | | 47 | | | 59 | |

Total Assets | | £ | 71 | | | £ | 7 | | | £ | — | | | £ | 78 | | | $ | 99 | |

LIABILITIES AND CAPITAL | | | | | | | | | | |

Other Creditors | | £ | 5 | | | £ | — | | | £ | (5) | | | £ | — | | | $ | — | |

Deferred Income | | 40 | | | — | | | (40) | | | — | | | — | |

Accruals | | 4 | | | (2) | | | (2) | | | — | | | — | |

Taxation and Social Security | | — | | | 1 | | | (2) | | | — | | | — | |

Other Liabilities | | — | | | 1 | | | 49 | | | 50 | | | 63 | |

Total Liabilities | | 50 | | | — | | | — | | | 50 | | | 63 | |

Shareholders Equity | | 20 | | | 7 | | | — | | | 27 | | | 34 | |

Non-redeemable NCI | | 1 | | | — | | | — | | | 1 | | | 2 | |

Total Capital | | 21 | | | 7 | | | — | | | 28 | | | 36 | |

Total Liabilities, NCI & Capital | | £ | 71 | | | £ | 7 | | | £ | — | | | £ | 78 | | | $ | 99 | |

(1) Reflects adjustments to reconcile UK GAAP per the footnotes to the financial statements of Beat, including (a) profit-sharing commissions, (b) bonus accruals, (c) leases and (d) the income tax impact of these adjustments.

(b) The amounts below represent results for the year ended December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beat (in GBP, in

UK GAAP) | | US GAAP

Adjustments(1) | | | | Reclassifications | | Historical Beat

Business as

Reclassified

(in GBP) | | Historical Beat

Business as

Reclassified

(in USD) |

Revenues | | | | | | | | | | | | |

Turnover | | £ | 47 | | | £ | — | | | | | £ | (47) | | | £ | — | | | $ | — | |

Commission income | | — | | | — | | | | | 40 | | | 40 | | | 50 | |

Net investment income | | 1 | | | — | | | | | — | | | 1 | | | 1 | |

Exchange (losses) gains | | (1) | | | — | | | | | 1 | | | — | | | — | |

Other comprehensive income | | 1 | | | — | | | | | (1) | | | — | | | — | |

Other income | | — | | | — | | | | | 6 | | | 7 | | | 8 | |

Total revenues | | 47 | | | 1 | | | | | — | | | 48 | | | 59 | |

Expenses | | | | | | | | | | | | |

General and administrative expenses | | 33 | | | 1 | | | | | — | | | 34 | | | 43 | |

Interest expense | | — | | | — | | | | | — | | | — | | | — | |

Total expenses | | 33 | | | 1 | | | | | — | | | 35 | | | 43 | |

Pre-tax income (loss) | | 14 | | | — | | | | | — | | | 13 | | | 16 | |